Good morning, Roland and Graham with you today.

SThree (LON:STEM) Q&A: Graham is interviewing management at recruiter SThree at 10.20 this morning - if you have any questions you'd like him to ask management, please drop them in the comments below!

Update at 12.30: today's report is now finished, see you tomorrow!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

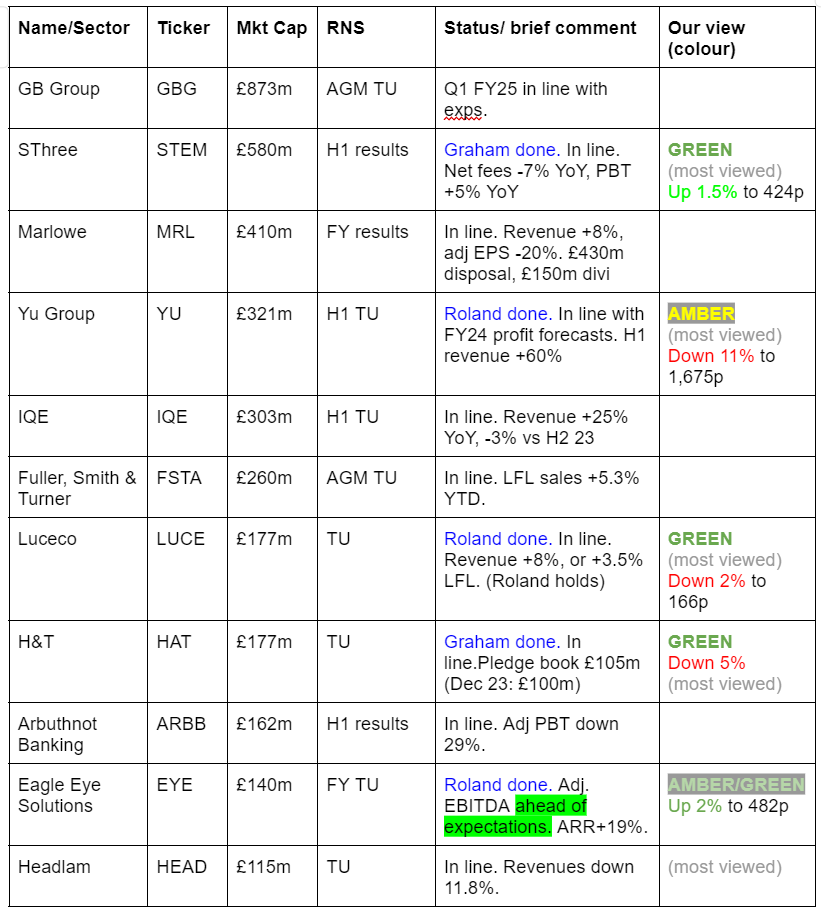

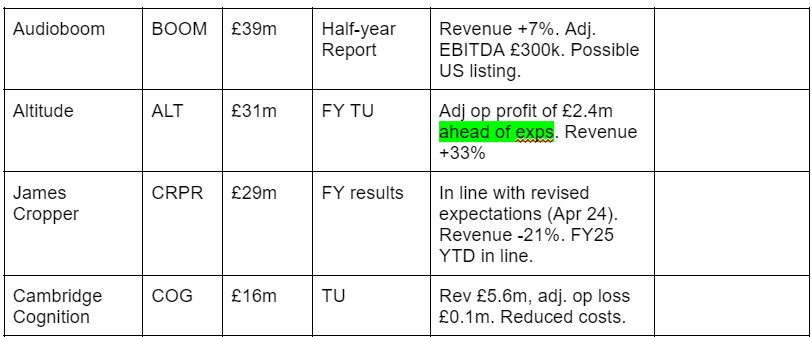

Companies Reporting

Summaries

Eagle Eye Solutions (LON:EYE) - up 2% to 482p (£141m) - FY trading update - Roland - AMBER/GREEN

FY24 adjusted EBITDA is ahead of expectations, despite revenue missing forecasts. Company says costs are well controlled. Mgt reports a number of contract wins late in FY24 and early in FY25. No specific guidance for FY25 yet. The shares aren't especially cheap, but I remain broadly positive ahead of September's results.

SThree (LON:STEM) - up 2.5% to 429p (£595m) - Half Year Results - Graham - GREEN

Expectations for FY24 remain in line despite ongoing difficult market conditions. Net fees are shrinking but the company has still managed to squeeze out an increase in profits, with some help from higher interest on its cash pile. There is still lots to like here in my view.

Yu (LON:YU.) - down 11% to 1,675p (£284m) - HY trading update - Roland - AMBER

Today’s half-year update from this energy supplier leaves expectations unchanged, but warns that mild weather resulted in lower consumption earlier this year. This weakness appears to have been offset by strong growth in new supply deals and good cash collection. I’m neutral, for now.

Luceco (LON:LUCE) (Roland holds) - down 2% to 166p (£265m) - HY trading update - Roland - GREEN

Like-for-like sales rose by 3.5% during the half-year and revenue was further lifted by acquisitions. Improve margins helped to lift operating profit by c.15%. Rising shipping costs are a possible risk, but I remain positive ahead of the half-year results.

H & T (LON:HAT) - down 5% to 386p (£166m) - Trading Update - Graham - GREEN

An in line update but it could be seen as a semi-profit warning as FY24 forecasts will be more difficult to hit, after a high rate of loan redemptions lasted longer than expected. Overall situation remains stable and as expected, so I’m happy maintaining my positive stance.

Graham's section

SThree (LON:STEM)

Up 2.5% to 429p (£595m) - Half Year Results - Graham - GREEN

As noted by Roland, I’ll be interviewing management here later this morning.

But before that, let’s get an overview of the H1 results from this international recruitment company.

Please note that I covered the relevant H1 trading update last month.

Today’s overview table:

Key points:

Like-for-like net fees down 7% (please note that “like-for-like” means using constant exchange rates).

Like-for-like operating profit +3%.

Interim dividend gets a small raise (+2%).

Net cash goes up to £90m from £72.4m.

Commentary: there is an “ongoing challenging backdrop”. As we’ve seen before, Life Sciences (down 16%) is the worst-performing sector, while Engineering (including Energy) is the best-performing sector.

Contract, as opposed to Permanent recruitment, now accounts for 84% of fees.

Order book is down 2% to £182m, which is still “sector-leading visibility with the equivalent of circa four months’ net fees”.

PBT up 5% helped by “tight cost control and the benefit of higher interest income”.

Outlook is in line for FY November 2024:

Contract extensions remain strong whilst new business activity continues to be subdued.

Whilst market conditions have remained challenging for longer than anticipated, performance for FY24 currently expected to be in line with market expectations.

Continued focus on investment and sequenced roll-out of the TIP [Technology Improvement Programme] across rest of the Group, strengthening the Group's position for long-term growth.

Graham’s view

I’ve read the CEO report here and see little reason for anyone to change their view on SThree. There is an interesting note on market share: they have an average share of 3% across their different geographies, with the highest being 6% in the Netherlands.

There are probably natural upper limits to what can be achieved in market share, as recruitment always tends to be a fragmented industry, but perhaps they can make a push towards 6% in a few more places?

I remain comfortable with this being my favourite recruitment stock - net fee growth vs. FY 2019 remains ahead of their peer group in all core geographies.

And the profit margin is large and healthy: they want an operating profit of over 21%, although they haven’t quite reached it yet (20%).

The enormous cash balance gives added comfort that they can afford to pay a helpful yield, but the dividend is well-covered by earnings too. The target dividend cover is 2.5x to 3x.

So again, I struggle to find any reasons not to like this stock. The focus on STEM contract recruitment has paid off in the form of several years of good profitability, and I share the company’s optimism for the future. The lack of growth in the short-term has been a disappointment, but SThree is not alone in having been affected by sluggish conditions in the recruitment industry.

On the income statement, I note that finance income increased in H1 2024 to £1.8m (from £0.7m). Without that increase, there wouldn’t have been any increase in pre-tax profits. But having so much cash on hand that your interest income becomes an important source of profits: that’s a nice problem to have!

H & T (LON:HAT)

Down 5% to 386p (£166m) - Trading Update - Graham - GREEN

We have a short H1 trading update from H&T today. Key message: trading is in line.

With the share price down 5%, and judging by reader comments today, investors were expecting a little better.

Here’s the company commentary:

Availability of small sum credit continues to be constrained generally for consumers and demand for our pawnbroking offer has been robust. Redemptions have taken a little longer to moderate than we anticipated, following the pickup of redemptions in Spring but they have moderated through June and into July.

The point about redemptions was raised in May when the company said:

Consistent with last year, redemptions in March and April were higher than average as customers chose to collect their items, often to wear them at religious and family celebrations. This is expected to reverse in the coming months.

So the company has been a little surprised by the pace of redemptions, though it adds that “all key pledge book metrics remain in line with redemptions”.

The pledge book is now £105m (end of June), vs. £101m at the end of Dec 2023.

Unfortunately, this isn’t a like-for-like comparison. H&T acquired a £6m book in February, discussed here.

So if you subtract the acquired book, we have a small decline during H1.

Retail sales, foreign currency revenues and gold purchasing for scrap gold margins are all performing as expected.

Graham’s view

I’ve been consistently positive on this one, most recently in May. This is a stock I’ve been a fan of long-term. But I acknowledge that the share price has struggled to gain traction in recent years (two-year chart):

Checking the estimates from Shore Capital, it looks like the company may now face a challenge to hit forecasts for 2024, due to the unexpectedly high redemptions during H1. They say that the pledge book growth needed in H2 for H&T to hit full-year forecasts (8%-9%) is “stretching but achievable”.

My own view is that even if the company doesn’t quite manage to hit forecasts, this uncertainty has already been priced in by the low valuation, with a PER of only about 7x:

It is a disappointment that the pledge book hasn’t maintained its momentum of course, but I’d also point out that this book is far larger than it was a few short years ago, even if you ignore the impact of the Maxcroft acquisition.

And despite an unexpectedly high rate of redemptions, the pledge book is unchanged vs. May 2024 when the AGM update was released.

Please note that the numbers released in these updates are the “capital value, excluding accrued interest and provisions”. These numbers are much smaller than the “net pledge book” figures in the annual reports, which includes accrued interest.

In conclusion, I still view this one as being quite unloved and deserving of a higher rating than the market is giving it. It qualifies for Ben Graham’s Deep Value Checklist according to Stockopedia, and it generates ROE/ROCE that is highly attractive compared to what you get from mainstream lenders.

I’m a broken clock when it comes to H&T, but I still like it!

Roland's section

Eagle Eye Solutions (LON:EYE)

+2% to 482p (£141m) - FY24 trading update - Roland [ahead] - AMBER/GREEN

“19% ARR growth and strong EBITDA performance, ahead of expectations”

Eagle Eye is a software business that enables companies to deliver personalised, real-time marketing to their customers. The company has an impressive-looking customer roster and says its loyalty personalisation platform delivers over 850m personalised offers each week.

Checking back in the archives, we last covered Eagle Eye in April when Paul commented on a promising-sounding contract win with Tesco Clubcard.

Today’s update covers the financial year ending 30 June 2024 and shows profits ahead of expectation, at least at adjusted EBITDA level. Let’s take a look.

Financial summary: today’s RNS is a trading update only, so we don’t get full details of profits or earnings, only revenue and adjusted EBITDA. Here’s the summary:

Strong annual recurring revenue (ARR) growth of 19% is encouraging, but the company says the proportion of its revenue generated from recurring charges actually fell slightly last year, to 79% (FY23: 80%). This is still an attractive figure, in my view, but I’d prefer to see it rising.

Group revenue growth of 11% to £47.7m also appears to be slightly below the consensus figure of £50m shown on Stockopedia. This is confirmed in an updated note from house broker Shore Capital this morning available on Research Tree – many thanks.

Despite this, strong cost control is said to have helped to lift the group’s EBITDA margin to 24% (FY23: 20%), resulting in a full-year adjusted EBITDA figure up 28% at £11.3m. That’s 5% ahead of Shore’s previous estimate of £10.8m.

Adjusted EBITDA isn’t my favourite measure of profit, as depreciation and amortisation charges can be real and significant costs for many businesses. However, today’s update confirms that Eagle Eye was cash generative over the last year, with net cash rising 12% to £10.4m. That’s a positive for me.

Consensus forecasts on Stockopedia ahead of today showed earnings of 11.4p per share for the year just ended. Today’s Shore note suggests adjusted earnings of 14.2p per share for the FY24 year.

Shore’s 16.4p forecast for FY25 has been left unchanged pending further guidance with September’s results.

These forecasts price the stock on FY24 P/E of 35, falling 30 for FY25.

Trading update - recent contract wins: Eagle Eye seems to have secured a number of new contracts close to the year-end (my emphasis):

The Group exited the Year with strong ARR, up 19% year on year, with the majority of revenue from the wins in Q4 FY 2024 to be recognised from FY 2025 onwards

New international customers flagged up in today’s update include Central Retail Vietnam, Z Energy in New Zealand (a fuel/convenience retailer) and French retailers Picard Surgeles and Chronodrive.

Wins so far in the 24/25 financial year have included Waterstones in the UK and RONA in Canada (a DIY chain).

Outlook: the company says its new AI-based offerings are helping to provide the business with “increasing opportunities”.

Chief executive Tim Mason reports a “significant sales pipeline” to support further growth through FY25 into FY26. However, there is no specific new guidance in today’s update, which is less than two months into the new financial year.

I’d imagine a more detailed outlook statement will be provided when the group’s results are published on 18 September 2024.

Roland’s view

I’m encouraged by Eagle Eye’s improved margins and evidence of cash generation this year.

However, I’m wary of the group’s historically poor performance on statutory profitability. Historically, the group has reported an operating loss in four of the last six years:

Looking ahead, I think it’s possible this business could reach an inflection point in terms of profitability and margins.

Last year’s (FY23) accounts show an impressive gross margin of 95%. The incremental cost of delivering services appears to be minimal.

If Eagle Eye can control its broader operating costs, while maintaining strong revenue growth, the extra revenue could drop through rapidly to profits, resulting in improved margins.

A forward P/E of 30 isn’t obviously cheap, but I am inclined to remain positive here, given progress with new customer wins and improved margins.

I’m going to go AMBER/GREEN on Eagle Eye, ahead of the publication of the full-year results in September.

Yu (LON:YU.)

Down 11% to 1,675p - HY trading update - Roland - AMBER

This morning’s update from this fast-growing business energy supplier and meter installer/owner is said to be in line with expectations. But it’s met with a poor reception from investors. Yü stock is down by around 11% as I write. Let’s try and understand why.

Today’s update covers the six months ended 30 June 2024, so it includes the key winter trading period when electricity and gas usage is expected to be seasonally higher.

The company makes numerous mentions of mild Spring temperatures but has left full-year guidance unchanged:

On track to deliver EBITDA and EBIT margins and therefore profitability for FY24 in-line with current market expectations, against a backdrop of lower commodity pricing and the impact of the mild temperatures in H1 24.

H1 highlights: Yü flags up some strong growth metrics in today’s update, but does not provide any indication of the like-for-like impact on consumption volumes of this year’s mild winter/spring.

Half-year revenue up c.60% to approximately £310m (H123: £195m), “despite mild Spring temperatures reducing consumption”

Monthly average [energy supply] bookings at £46.9m (H1 23: £51.3m) reflecting lower commodity prices

35% increase in supplied meter points in H1 24, closing at 72,300 meters (FY23: 53,400), driving higher total volumes despite reduced per-customer consumption

As far as I can see, the story is that continued growth in the number of customers supplied is offsetting any fall in consumption caused by mild weather.

The other strand to the business is its smart meter installation, Yü Smart. This generated less than 1% of operating profit last year but is growing and has the potential to provide an annuity-like income over time (my emphasis):

Yü Smart continues to scale, with meter installations in the period up 125% on the same period in 2023 (H1 24: 9,000; H1 23: 4,000), leading to 13,100 cumulative meters financed, providing a £0.6m forward annualised, indexed annuity income. Engineering field force headcount increased to 101 (FY23: 50).

Cash position: Yü ended the half-year with £86.8m of net cash, benefiting from the return of cash collateral relating to hedging contracts and “consistent customer collections”. Perhaps this means bad debt levels have fallen slightly? A small change can have a big impact on profits in this business, perhaps helping to offset lower consumption.

However, the company has a £33.2m annual ROC (Renewables Obligation Certificates) liability due in August.

Today’s update only includes guidance for “a significant net cash balance … at the end of 2024”, without being more specific.

However, I expect the cash figure to remain high, not least because I believe Yü needs strong liquidity to be able to manage commodity price hedging collateral requirements.

Share premium cancellation/dividends: the other notable update for shareholders is that Yü has now cancelled its share premium account, providing a further £12.3m in additional distributable reserves. This is expected to support increased distributions to shareholders, reflecting underlying cash generation.

Outlook: Yü’s statement on forward guidance seems carefully worded to me, again mentioning lower energy prices and mild temperatures:

“On track to deliver EBITDA and EBIT margins and therefore profitability for FY24 in-line with current market expectations, against a backdrop of lower commodity pricing and the impact of the mild temperatures in H1 24.”

The number of meter points supplied and the number of meters installed are both expected to continue rising, building in future revenue potential.

Sadly, the company has not included details of current market expectations for profits in today’s update. Stockopedia’s consensus earnings figure of 192p per share sits between unchanged estimates from brokers SPAngel (197.8p) and Panmure Liberum (185.9p) - many thanks to both.

Taking Stocko’s figure as a consensus estimate, the shares trading on a modest 8.8 times forecast earnings after today’s price drop.

Roland’s view

Yu shareholders have perhaps become used to the company beating expectations on a regular basis. Stockopedia’s broker analyst consensus chart shows multiple upgrades over the last 12 months:

This run of upgrades now seems to have come to an end, despite continued strong underlying growth.

In this review of last year’s results, Paul commented that he was unsure if elevated profit margins can be maintained. That’s very much my view, as well.

My reading of today’s update is that the company is banking on strong growth to offset weaker consumption and the impact of lower commodity prices.

I would argue that today’s update has (slightly) increased the chance of a slight downgrade at some point, depending on trading conditions over the remainder of the year.

I remain encouraged by the strong growth of this business, which appears to have a compelling offer for its target corporate customers and a solid balance sheet. However, this isn't a stock I'd want to pay a premium price for.

Pending the release of the half-year accounts, I’m going to leave our previous view unchanged at AMBER.

Luceco (LON:LUCE) (Roland holds)

Down 2% to 166p (£265m) - HY trading update - Roland - GREEN

Luceco performed strongly in the first half against a challenging market backdrop. The Group's diverse portfolio and channels have ensured that we continue to deliver progress, with adjusted operating profit up around 15% in H1 2024.

Shares in this supplier of wiring accessories, lighting, power products and EV chargers are down slightly this morning after the company warned of a significant recent increase in container shipping costs.

Luceco depends heavily on manufacturing in China, so is unavoidably exposed to shipping costs.

Apart from this possible risk to margins, trading for the half-year to 30 June appears to have been reasonable.

Half-year summary: Luceco’s revenue rose by 8% to c.£109m in H1, albeit only 3.5% of this was like-for-like.

The acquisition of D-Line in February is expected to add c.£15m of sales this year, so presumably contributed much of the remaining increase in H1 revenue.

Adjusted operating profit for the half year is expected to be up by c.15% to approximately £12.5m. This performance was aided by a 0.8% improvement in adjusted operating margin to c.11.5%.

Leverage remains comfortable at 1.2x EBITDA, providing the option for further acquisitive growth.

Outlook: Performance so far is said to be in line with market expectations for the full year.

Unfortunately, “key industry metrics remain weak”, but management is confident “growth in our core markets will return in the not too distant future”.

The update doesn’t include any guidance on market expectations, but Stockopedia’s data suggest full-year adjusted earnings of 11.9p per share, up 7% from the FY23 figure of 11.1p.

These estimates appear unchanged today and price the stock on 14 times FY24 forecast earnings.

Roland’s view

Today’s update seems broadly reassuring to me. The improvement in operating margins suggests to me that Luceco is performing well in areas it can control.

Higher shipping costs are not fully within the group’s control, but if these persist I imagine Luceco would attempt to push price rises through to customers to cover some of the extra expense.

We’ve been positive on Luceco here in recent months. Given the group’s strong history of growth, I am happy to maintain a GREEN view ahead of the half-year results in September.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.