Good morning!

As you know, I like to keep an eye on mid to large cap retailers, as this gives a good feel for how consumer sentiment & spending are going, and sector trends. So here are some brief comments on Debenhams trading update today:

Debenhams (LON:DEB)

Share price: 43p (down 3.4% today)

No. shares: 1,227.8m

Market cap: £528.0m

(at the time of writing, I hold a short position in this share)

Trading update - I was expecting a lot worse actually, so these figures aren't too bad.

LFL sales in the last 15 weeks are down 0.9% (41 weeks: up 1.8%)

Costs are rising by 3% p.a. - this is the big problem for all UK retailers (DEB also has overseas operations) - that they're struggling to generate any LFL sales increases, hence rising costs are hitting the bottom line.

Outlook for the full year isn't too bad;

We currently anticipate that 2017 profit before tax will be within the range of market expectations. However, should current market volatility continue, the outcome could be towards the lower end of the current range.

Overall, not a disaster by any means.

So why have I shorted this share?

- Forex hedging is still protecting margins, but will unwind during 2018 (DEB has particularly long-dated forex hedging) - so gross margins likely to come under pressure.

- Low operating margin, and high operational gearing - so the company could swing into losses fairly easily in future.

- Dept stores are struggling big time in USA. They're starting to be seen as retail dinosaurs - so the same could happen here.

- Improving performance usually requires heavy capex - because refreshing huge, multi-floor stores is very expensive.

- Sentiment is against traditional retailers - just look at the charts. Investors seem mainly interested in chasing up e-commerce shares.

- The all-pervasive Amazon threat.

- DEB is stuck in long leases, that it can't get out of. That's not a problem if stores are profitable, but if they become loss-making, it is a problem that has killed many retailers before.

- Weak balance sheet.

Therefore, rightly or wrongly, I've come to the conclusion that it might be best to bet against the current share price. As to the future, my hunch is that DEB might eventually need to do a CVA, to get out of problem leases.

Shorting is dangerous of course, and not recommended. There's always a risk that some loonie with expensive paper (Amazon?!!) might come along and bid for it, at a huge premium. DEB's new CEO is ex-Amazon. Although it seems very unlikely that Amazon would bid for one of the old guard - its business model is based on crushing the old-style competition, not buying it.

It will be interesting to see how other retailers report on current sales, given the General Election result on 8 June 2017, which is bound to have had some impact on consumer confidence. Although in the past, consumers have tended to surprisingly resilient.

OK, on to some smaller caps, sticking with the retailers theme.

Carpetright (LON:CPR)

Share price: 195.4p (up 8.6% today)

No. shares: 67.9m

Market cap: £132.7m

Full year results - for the 52 weeks ended 29 Apr 2017.

This company is a carpet retailer, operating from 426 stores in the UK, and 138 stores in Europe.

The company last updated the market on 25 Apr 2017, which I reported on here. The reporting from CPR is excellent, with very clear guidance. So it's easy to check back, and see if the actual results tally with the guidance, and happily they do.

What is most striking from these results, is how what the company defines as underlying profit from the UK has fallen sharply (2017: £10.7m, down 40% on 2016: £17.8m). That's not good at all - the operating profit margin has fallen from 4.6% to only 2.8% - so becoming wafer thin.

European operations went the other way - underlying profit rose an impressive 128% from £2.5m to £5.7m. Obviously, exchange rates are a significant factor here.

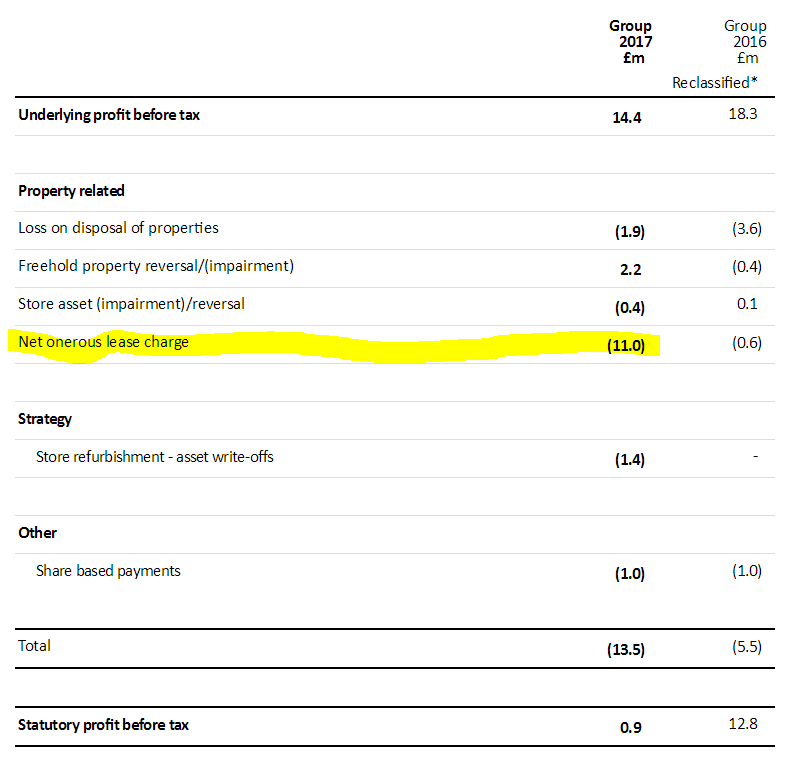

Statutory profit before tax is only £0.9m (versus £12.8m last year). Note that this is a lot lower than the underlying profit of £14.4m which the company encourages us to focus on. What makes up the £13.5m difference between underlying profit and statutory profit?

A friend (who is a senior, experienced retailer), pointed out to me this morning that there is a big clanger in these results. If we refer to Note 4, which gives a reconciliation from underlying profit, to statutory profit, we can see that the biggest item is at £11.0m onerous lease charge, see below;

The notes explain the £11.0m onerous lease provision as follows;

Following a strategic review of the store portfolio in February 2017, we have made a revised assessment of the onerous lease costs for loss-making stores. The net impact of these judgments is a net charge of £11.0m (2016: £0.6m).

This is a prudent approach, which auditors require - i.e. booking a provision for future losses, at under-performing stores.

However, there's a clear problem with this - the underlying numbers exclude losses from poorly performing stores! Yet those losses are real, cash losses which the business has to absorb in terms of cashflow. Sure, the provision might be spread over several years, but these are still real losses.

Therefore, the underlying profit is an unreliable way to value this business, in my opinion, for the above reason.

As a general point, if there is a big difference between underlying, and statutory profit, I think it's very important to investigate, and sense-check the reconciling items. They're often rather questionable, as in this case.

I could tell you that my portfolio is up 40% YTD, if I exclude my losses! The onerous lease provision for retailers is very similar conceptually. Hence underlying figures really do need to be scrutinised carefully.

LFL sales - the company says that its refurbished stores are achieving +6.8% LFL sales. That's to be expected - after all, there's no point in spending the capex to refurbish a store, unless it achieves a decent sales uplift.

This does suggest that the non-refurbished stores must be generating poor LFL sales, since the overall total LFL for the year was negative, at -0.5%. Although there was an improving trend, with H2 being +1.8%.

Current trading - LFL sales look reasonably good, at +2.0% in the 7 weeks to 17 June 2017. However, as this includes refurbished stores, it's not really a true like-for-like. I expect this number obscures the likelihood that mature (i.e. non-refurbished) stores are probably delivering negative LFLs.

Balance sheet - net assets are £78.0m. If we deduct £57.3m intangibles, then the NTAV is modest, at only £20.7m. That doesn't seem much of an asset base, for what is quite a sizeable business.

Note that there is £60.3m of freehold & long leasehold property within fixed assets, which is very appealing. These are in the books at a "combination of value-in-use and independent valuations", therefore there's not likely to be any hidden value (which can happen when companies value freeholds at cost, from many years ago).

Net debt was £9.8m, which is not significant, especially in view of the decent-sized property portfolio.

Capex is an issue, as the company is having to spend money refurbishing stores, just to stand still. It spent £17.4m on gross capex in the year.

There's a small pension deficit of £3.2m. It would be worth double-checking the Annual Report, to confirm this is not an iceberg deficit, if you're considering a purchase of the shares.

Creditors - it's very unusual to see £34.5m "trade and other payables" in non-current liabilities. Does anyone know what this represents?

Provisions of £17.5m in non-current liabilities is also mounting up - remember that will have to be settled with real cash that will be leaving the business in future.

All in all, I'm not terribly happy with this balance sheet. Overall though, the freehold property is probably enough to pacify me. If conditions get difficult in future, the company may have to run down some of its freehold property portfolio, to meet cash outflows, perhaps?

My opinion - this share looks quite good superficially. However, it's the type of share where, the more you dig into the numbers, the less impressive it looks.

There have been no divis paid since 2011 either, which isn't good. Although a small divi is forecast for the new year.

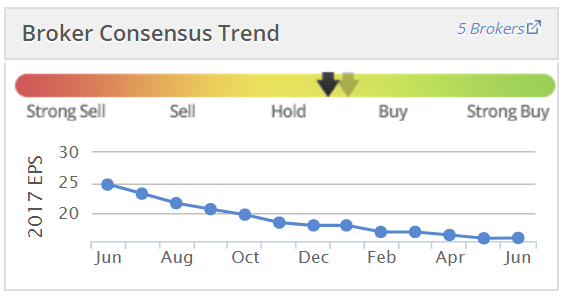

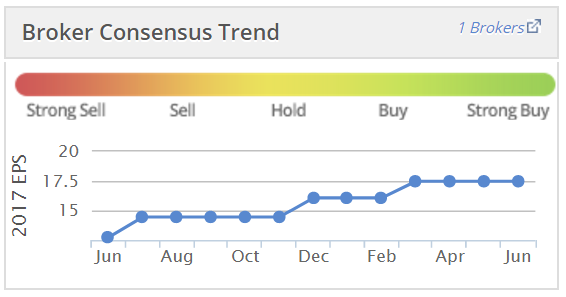

Look how brokers have been steadily revising down forecast EPS in the last year, which hardly seems to be a business in rude health, does it?

As you've probably gathered, I'm not keen to buy any shares in Carpetright, at the moment.

STOP PRESS! A grim update from serial disappointer NATURE (LON:NGR) has come out - to me, this is the type of announcement where I would instruct my broker to sell the lot, at whatever price he could get. This is the alarming part of the announcement;

As outlined in the final results announcement of 31 May 2017, the Board is closely monitoring the cash position of each of its entities. The Company continues to pursue opportunities but, in the absence of additional material contracts in the short term, the cash position of the Group will continue to deteriorate and it is expected that external financing may be required.

Therefore, as well as immediately implementing further reduction in operational cost as well as the Group overhead, the Board is also exploring opportunities to strengthen its balance sheet and the financial position of the Company."

Looks potentially terminal to me. Or at least this could entail significant dilution for existing shareholders. Why take the risk? It's not a good company - performance has been lousy since 2013, so why would anyone want to put fresh money in?

IG Design (LON:IGR)

Share price: 347.6p (up 1.5% today)

No. shares: 62.6m

Market cap: £217.6m

Preliminary results - for the year ended 31 Mar 2017.

The company describes itself as;

...one of the world's leading designers, innovators and manufacturers of celebration, gifting, stationery and creative play products

This might be simplified to: gift wrapping paper, and similar stuff.

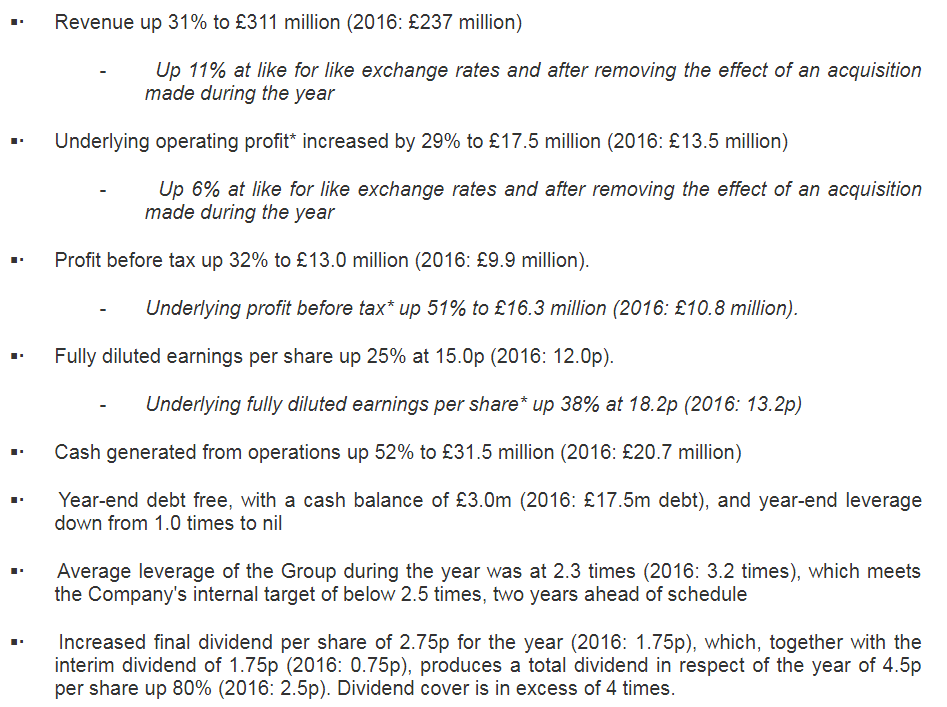

There's a lot of detail in the financial highlights, which I'll copy/paste below, to avoid having to re-type it. I particularly like the presentation - which clearly shows organic growth (11% vs total revenue growth of 31%). Although it can also get a bit confusing, to be given so many options for a profit figure!

Also, I particularly like the disclosure given of average debt throughout the year. All companies should be compelled to do this, because year-end cash/debt figures are so often window-dressed, and can present a completely misleading impression of the typical values throughout the year. You need to be really careful when valuing companies using Enterprise Value, as this can be badly skewed & deliver the wrong result, if you use year end net debt figures (which are often at a seasonal low).

Having a quick read of the narrative alongside today's results, it all sounds very positive.

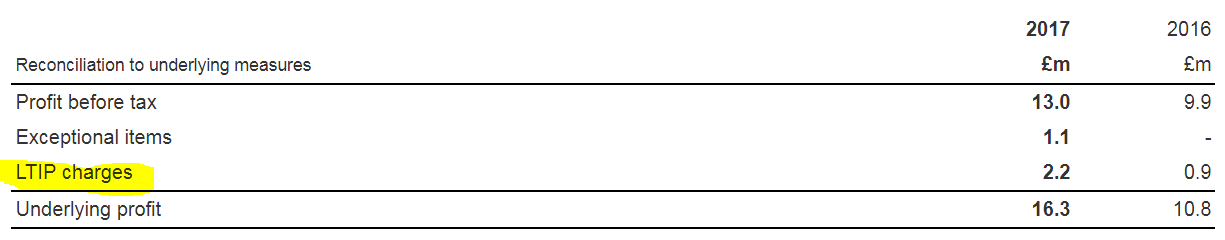

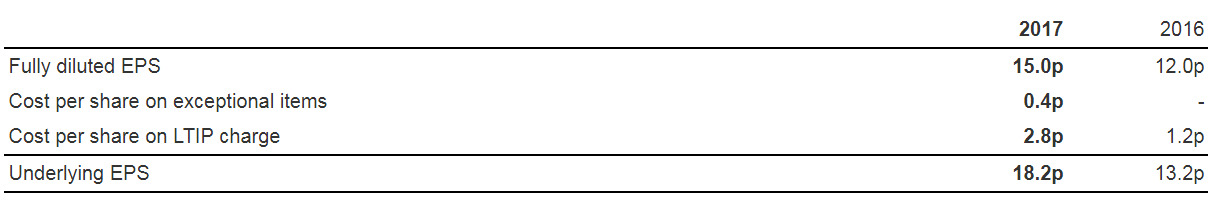

Underlying profit measures - the following reconciliation is provided;

As you can see, I've highlighted the LTIP charges, as that's a pretty material sum. This is a form of management remuneration, so to my mind it can't just be ignored. Although if you use the fully diluted EPS figures, then you're already allowing for potential dilution from share options.

I have to admit, I get a bit confused on this point, and really need to work through an example on paper to clarify things. Would you value the share on a multiple of the 15.0p fully diluted EPS, or the 18.2p underlying EPS figure below, and why?

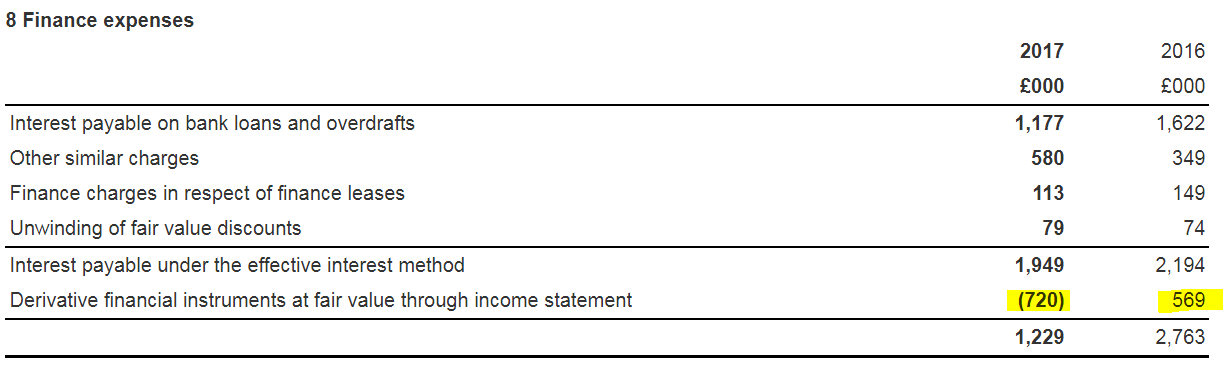

Finance expenses - profit has been boosted by a big fall in the finance expenses line, from £2,763k last year, down to £1,229k this year. That's a boost to profit of just over £1.5m - a very significant part of the reported profit increase.

The main cause of this is a favourable swing in the value of derivative instruments - that's a non-trading item, and is really just random. See note 8 below. So maybe the profit growth isn't quite as great as it initially seems?

Non-controlling interests - I just wish to flag up that the company doesn't own 100% of all subsidiaries. So part of the profit, and the net assets, belongs to minorities. The figure here is about 6.4% of group net profit, and 4.3% of net assets. These items are identified clearly on both the Consolidated Income Statement (what I still call the P&L), and on the Balance Sheet.

The good news is that these items are already taken into account in reported EPS, so it's safe to value the company on an EPS multiple. You would need to adjust for non-controlling interests if you rely on any multiples of the figures on the face of the P&L or the Balance Sheet. Again, I'm just flagging it, it's not a particular problem.

Balance sheet - overall, this looks OK. Some key numbers & ratios;

Net assets of £86.2m (excluding non-controlling interests).

NTAV of £52.5m, once we eliminate intangible assets, which are almost entirely goodwill that is not being amortised.

Working capital - the current ratio is satisfactory, at 1.38 - calculated as current assets of £83,063k, divided by current liabilities of £60,338k.

Note this important point from the "going concern" section of the Director's Report;

The Group relies on its banks for financial support and is confident that the facilities in place are sufficient to meet its needs for the foreseeable future (see note 1 to the financial statements). Accordingly the Directors continue to adopt the going concern basis in preparing the financial statements.

That's fine, but it's just something to be aware of.

Everything else looks OK, so I'm reasonably comfortable with this balance sheet.

Cashflow - there's a £1,271k boost to profits from the release of negative goodwill. Following it through to note 10, it's been put through exceptional items, so that's fine.

Cash generated from operations is outstandingly good at £31.5m this year, and £20.7m last year. This has been boosted by favourable working capital movements - mainly a big increase in trade payables (£37.5m this year, up from £27.2m last year).

I'm not sure whether this is a permanent gain in cashflow (e.g. from agreeing later payment terms with suppliers), or whether it's just swings & roundabouts? It does seem a large rise in payables though, which caused the bulk of the increase in cash generation which is fanfared in bullet point 5 of the financial highlights. Without this stretch is trade payables, cash generation would have been very similar to last year.

Dividends - are increased significantly in percentage terms, to 4.5p total for the year. However, this is a modest yield of 1.3%. However, the trajectory is clearly upwards, so shareholders should see further increases in divis in future.

My opinion - I've been impressed with this company's renaissance in recent years, under highly regarded new management. Indeed, I made a nice turn myself on the shares, but decided to bank the profits & move on a while ago (can't remember when).

The company has tended to out-perform against forecasts, with regular upgrades to earnings estimates, as you can see from the Stockopedia graph below;

I wouldn't be surprised to see the same pattern continue. With that in mind, if I still held this share, I'd probably be inclined to hang on to it, for further potential gains. The narrative sounds upbeat about the future, and management really has executed well so far.

Although do bear in mind that they got a nice boost this year from the finance charge dropping (driven by movement in derivatives), which may not boost next year's results, or could swing the other way.

I would have thought 20p+ adjusted EPS should be on the cards (geddit?!!) for this year, so at 356p currently, that means a PER of 17.8 or lower. That looks about right to me, with potential upside from estimates being revised upwards as the year progresses, maybe.

A few brief comments to finish off with.

Zoo Digital (LON:ZOO) - the market seems to like final results out today from this minnow, which provides subtitling services. The company has had financial difficulties in the past. However, things now seem to be coming together rather well.

Revenue is up an impressive 42% to $16.5m, and it's moved into a modest profit of $0.5m.

The balance sheet problems look to have been mostly resolved, and a refinancing was done post the 31 Mar 2017 year end. The pro forma balance sheet provided, looks quite sensible now.

Potential investors need to consider the impact of the remaining convertible loan, as that is some remaining dilution. Outlook comments sound upbeat - "current pipeline of work is considerably stronger than at the corresponding prior period".

Overall, this looks quite interesting. I held the stock previously, but chucked it out fairly recently, when I was nervous about the market overall & didn't want to be holding anything tiny & illiquid. That is looking like a mistake.

Note that this share is probably still quite high risk, because one client still provides 44% of total revenue. If you're prepared to accept the risks involved in something this small (under £10m mkt cap), then it could be worth a closer look. Things have greatly improved from where the company was a couple of years ago anyway.

Sorry, I've run out of steam for today, can't manage any more.

See you tomorrow.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.