Good morning!

Many of you have probably already seen Paul's Part 1 report, which is at this link and covers Revolution Bars (LON:RBG) and Boohoo.Com (LON:BOO).

In this report, I'm planning to cover at least these four:

- Waterman (LON:WTM)

- Redde (LON:REDD)

- Avanti Communications (LON:AVN)

- Swallowfield (LON:SWL)

Cheers

Graham

Waterman (LON:WTM)

Share price: 78p (-5%)

No. shares: 30.8m

Market cap: £24m

I think shareholders are right to be a little bit disappointed with these results.

I've covered this share a couple of times recently, including the end-January trading update which announced that there had been a "positive interim trading period" and "revenue, profit and operating margin percentage generally in line with the prior year comparable period."

Strictly speaking, this is true: revenue is +1% against the comparative period, while PBT and the operating margin are unchanged (£1.8 million and 4.1%, respectively).

The problem is that (adjusted) operating profits in the UK fell by 37% (from £1.9 million to £1.2 million), being offset by growth in corresponding measurements for the overseas operations of Australia and Ireland (up to £0.9 million from £0.5 million).

But the profitable operation in Melbourne is only 51% owned by Waterman plc and so after you deduct minority interest, the EPS for Waterman shareholders ends up falling by 10%.

That's not a disaster but the UK is still 87% of revenue and being 100% owned by the plc it is the driver of EPS. So it's a worry to see it struggling a bit.

Dividend: the interim divi is increased by 33%, which is still well covered by earnings (note that Waterman pays equal-weighted interim and final dividends).

Outlook: "Measured optimism" beyond 2017, which is set to be a period of "consolidation":

The Board anticipates that the Group will continue to experience a stable trading outlook overall with revenue, profit and operating margin generally in line with the prior year.

Whilst trading conditions in the UK are expected to remain challenging, it is encouraging that Waterman continues to win exciting and varied projects across many sectors.

My opinion

I won't change my view on this. I continue to think this is investable around the current share price (it was 82.5p when I last covered it).

Cyclical ones like this are always tricky. I note that the UK Services and Infrastructure result was basically unchanged - nearly all of the weakness was in the UK Property segment where revenues fell by 11% but where operating profit more than halved!

I wouldn't have the confidence to bet on that segment but I can see that the shares are priced for a really good shareholder outcome should that segment pull through over the next couple of years.

Redde (LON:REDD)

Share price: 173p (-2%)

No. shares: 304m

Market cap: £526m

Some big growth numbers here following the full inclusion of Yorkshire-based insurance/claims management company FMG, which was acquired in late October 2015.

The key explanatory paragraphs:

Revenues were £227.1m (2015: £165.2m), an increase of £61.9m (37.5%). Revenues include an amount of £49.2m in respect of the fleet management activities of FMG which was acquired on 27 October 2015 and whose activities now include the Group's fleet management activities previously carried out by Total Accident Management. Combined sales of these merged businesses for the corresponding periods last year was £17.8m.

So if I've read that correctly, the additional contribution from RED/TAM is £31 million, or about half of the total increase in revenue.

Further:

The adjusted EBIT for the period was £19.8m (2015: £17.1m) which includes an amount of £3.1m in respect of the fleet management activities of FMG as described above (2015: £1.0m).

So adjusted EBIT is up by £2.7 million, of which £2.1 million is in relation to the increased FMG contribution.

Adjustments: Statutory PBT came in at £17.5 million, giving net income of £13.5 million.

I'm not entirely happy with the adjustments, because Redde (like many companies, to be fair) includes share-based payments as "exceptional". For the latest periods, these payments amounted to £1 million.

If share based payments were made in cash, nobody would describe them as exceptional - but the effect on shareholders would be about the same (although share payments do have the effect of aligning management with the share price, at least in the short term).

My opinion: I would need to do more research to analyse whether the FMG acquisition was a good use of capital. At first glance it appears to have worked out well.

Overall, however, I would be cautious about this share. Diluted EPS for the period is 4.5p, and yet the company has declared a 5p dividend.

Last year, the company made 8.3p in EPS, but paid out dividends of 9.65p.

While cash flow conversion looks good and the company has the balance sheet net cash to pay these dividends, I would still ultimately prioritise valuation (whether that's on the earnings multiple or something else) over the dividend attractions.

And on that score, the market cap of over half a billion pounds looks plenty full to me, for an outsourcing business which is anticipated to earn c. £30 million in net income this year.

Avanti Communications (LON:AVN)

Share price: 18p (-5%)

No. shares: 162m

Market cap: £29m

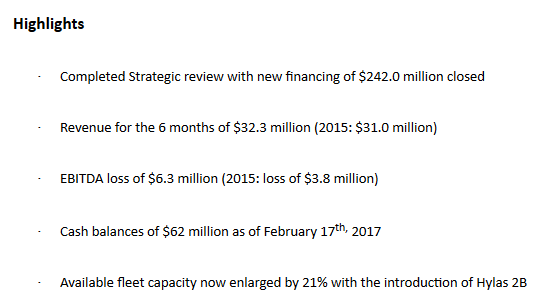

I wont dwell too long on this, as I think most investors at this stage have figured out that the shares will probably turn out to be worthless.

Losses

The loss for the half-year period rises to $63 million, not too far off the loss for the entire previous financial year.

Revenues increased slightly but cost of sale increased by about 50% against the corresponding period in the prior year. Trading was said to be slower than anticipated due to "the uncertainty associated with the Strategic Review".

My opinion

The balance sheet doesn't make any sense from a shareholder point of view. It looks to me as if there was $685 million in face value of high yield (10%) notes outstanding at year-end.

The interest bill on these is far bigger than anything Avanti could afford to pay out of profits in the short-term, and they mature in October2019.

It can't afford to pay the interest in cash, so instead it is going to issue it in the form of more 2019 notes. And it has somehow managed to raise more funds by issuing 2021 notes (it looks like these are at some combination of 10% and 15% yields).

The market cap tells the story - equity is now priced in the same way as an out of the money option on the value of the company. Indeed, I would be very surprised if existing equity holders were left with anything much at the end of the day. The way I see things playing out, it will be up to the bondholders to decide how much to offer them, for the sake of their cooperation.

Swallowfield (LON:SWL)

Share price: 340p (-3%)

No. shares: 16.9m

Market cap: £57m

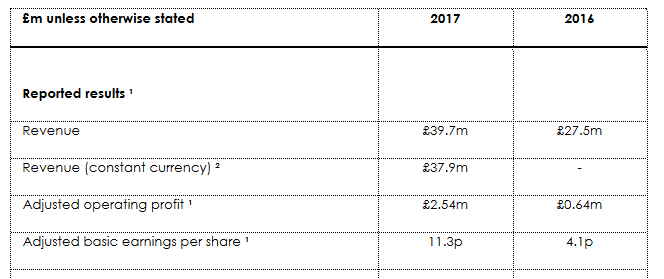

These shares have more than doubled in the past year as results have started picking up momentum, including the effects of an acquisition:

Strong revenue growth of +44% (+12% excluding The Brand Architekts acquisition) to £39.7m (2016: £27.5m), sterling weakness benefits the top-line with revenue growth on a constant currency basis of +38% and +7% respectively

So if you were to look at things in the most sceptical light, you'd say that excluding the GBP windfall and the acquisition, revenue growth was 7% (as opposed to 44% when you include both of them!)

Swallowfield designs and produces personal care/cosmetics products, both own-brand (25%) and third-party brands.

The value of getting it right in this industry is typically worth an above-average earnings multiple, and it looks as if the share price strength here reflects a growing belief that Swallowfield can successfully execute the strategy of running its own brands. That could massively improve margins from their historically uninspiring levels (it had a pre-exceptional operating margin of just 3.3% last year).

Outlook

It has an overall positive outlook, with the simple conclusion that it expects "further sales and profitability growth for the full year, as planned".

There is a note of caution for the 3rd party work and I wonder how material this might be:

In our Manufacturing business, the outlook is solid with a steady flow of new contract wins and launches. This needs to be balanced against the expected normalisation of volumes in the second half of this year and the first half of next year, having had the benefit of four major launches during calendar 2016, which will be hard to repeat and which have created strong comparators.

My opinion

Overall, I'd be quite positive on the outlook with this one.

Swallowfield paid £11 million last June for Brand Architekts, which had earned PBT of £2 million in the previous financial year. The rationale (see the related RNS) makes a lot of sense to me, so I'd be optimistic that these H1 results aren't just a fluke.

That being the case, I wouldn't see this share price and market cap as being wildly expensive, even with £5.5 million of debt on the balance sheet. I think there is good potential for these brands, along with the company's capabilities and economies of scale, to continue to develop over time.

Management appear similarly optimistic, more than doubling the interim dividend.

That might be it for me today, unless I discover some more time later this evening.

Thanks for reading!

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.