Good afternoon, it's Paul here.

I'm terribly sorry, but we've had a break down of communications. I thought Graham was writing today's report, and he thought I was. We're very sorry about that. Not to worry, I'll put something together this evening. The stocks which have caught my eye for newsflow today are: ITQ, FDL, IGE, IGR, and RGD.

Interquest (LON:ITQ)

Share price: 41.5p (down 11.7% today)

No. shares: 38.7m

Market cap: £16.1m

Trading update - this is a recruitment company, specialising in the technology and financial services sector.

You might recall that the management of ITQ tried to buy the company on the cheap, at 42p. This was a bizarre situation, in that the one independent Director opposed the deal, as did many independent shareholders. The takeover offer is now closed, with the management's bidding vehicle (Chisbridge Ltd) holding 58.3% of the company. As it failed to reach 75%, the shares remain listed on AIM (for now).

That's the background, so what does today's trading update say then? This covers the 6 months to 30 Jun 2017. Key points;

- Net Fee Income (NFI) down 14% to £9.5m on a like-for-like basis (i.e. excluding an acquisition, which added another £1.7m in NFI)

- Operating profit (excluding amortisation) was down 19% to £1.3m

- Financial services sector is challenging, experiencing margin pressure

- Larger divisions are taking longer than expected to turnaround

Revised guidance is given;

...the Company expects that Net Fee Income will be materially affected and EBITA for the year to 31 December 2017, before taking into account approximately £0.5m of costs incurred in the failed defence of the bid by Chisbridge Limited, will be approximately £3.1m.

Unfortunately I can't find any broker updates today, so am not sure how this revised profit guidance compares with existing forecasts. So I've looked back at last year's results, to find the comparable figure, which seems to be £3.4m. So the 2017 result is expected to be about 9% lower than the prior year - not good, but hardly a disaster.

My opinion - I just don't trust management here, so for me it's uninvestable. The problem is that management tried to take it private on the cheap, but failed to secure enough acceptances. So it's now in limbo, with management in control, holding 58% of the company. What happens if they decide to de-list the shares? That would trigger a collapse in the share price probably.

Therefore this situation looks messy & unpredictable. Management seem interested in feathering their own nests - not just re the opportunistic takeover offer, but also have a look at the size of share-based payments.

I'm not surprised that the business is under-performing, as management would have been pre-occupied with the failed attempt to take the company private. To me, it doesn't really matter how cheap the shares look now, because I wouldn't invest in any company where management have tried to take it private. It's probably only a matter of time before they come back with another scheme to grab the upside for themselves.

Findel (LON:FDL)

Share price: 189.25p (up 13.3% today)

No. shares: 86.4m

Market cap: £163.5m

Trading statement - this is a home shopping company, offering extended credit to customers. It also has an educational supplies business.

Today's update (at the AGM) covers the 20 weeks to 18 Aug 2017. Things seem to be going well;

The Group has made a good start to the year, with both businesses trading in line with expectations.

Express Gifts, the Group's largest business, continues to see growth in customers and revenue in excess of 10% which provides a strong platform ahead of its peak trading period.

Findel Education has reported an improved performance in recent weeks, following a difficult start to the year, and is making good progress on the various pricing and cost initiatives designed to increase its profitability. The digital transformation of both businesses continues to progress well.

Checking the archive here, Graham flagged up some interesting points in his report here on 7 Apr 2017. In particular the departure of the FD, and also an issue with mis-sold insurance.

My opinion - I've never liked this company's business model. The problem is the enormous debtor book, where it sells products on extended payment terms. Bad debts are high, but are compensated for by high charges to customers that do pay up. So investors always have to be wary of the risk of a slew of bad debts, and exceptional write-offs, if the bad debt provisioning turns out to have been inadequate. That's exactly what happened in FY2017, when an additional bad debt provision of £35.2m was made.

There are worries that UK consumers may once again be getting over-borrowed. So I wouldn't particularly want to own a stock which operates in sub-prime credit space.

We've seen how doorstep lender Provident Financial (LON:PFG) has recently got into trouble. Although FDL is selling goods, rather than lending, it is similar in that it's extending credit to sub-prime people.

Its balance sheet is not good either. It's dominated by an enormous debtor book, and an even larger amount of bank debt. Net assets were only £16.7m at 31 Mar 2017. Write off intangibles, and NTAV is negative, at -£9.5m. I find that a worryingly weak balance sheet - basically the business is entirely dependent on the bank remaining supportive.

The StockRank is very low, at only 19. Although it is being skewed by what look like exceptional write-offs in 2017.

There's a pension deficit too, requiring overpayments of £2.5m in FY2018. Note that these overpayments are scheduled to rise to £5.0m p.a. from FY2020 to FY2023.

Overall, I don't like it. There are too many messy things going on. Current trading may be good, but that's not enough to tempt me to overlook all the negatives. As you can see below, the share hasn't really gone anywhere over the last 2 years. Over this timeframe many other shares have gone through the roof. So there is an opportunity cost to holding an under-performing share like this.

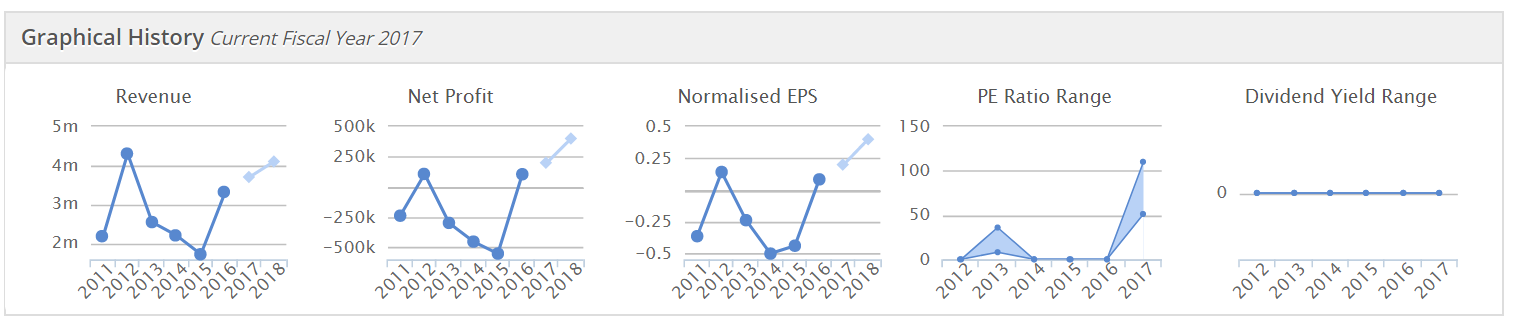

Image Scan Holdings (LON:IGE)

Share price: 8.25p (up 17.9% today)

No. shares: 135.6m

Market cap: £11.2m

(at the time of writing, I hold a long position in this share)

Trading update - this company describes itself as;

Image Scan, the AIM-listed specialist supplier of X-ray screening systems to the security and industrial inspection markets

I bought some shares in it recently, after a friend flagged up that new management seemed to be gaining traction in their turnaround plan. That's starting to look like a good call, as the company has today revised up its guidance for the year ending 30 Sep 2017;

Based on its current plans the Company anticipates that sales for the year to 30 September 2017 will be approximately £4.5m and that profit before tax will be approximately £250k.

Year-end sales at this level would leave the company with an orderbook in excess of £2m at the start of FY 2018.

In itself, a profit of £250k is not very exciting for an £11m market cap company. However, if this is the start of a strong growth trend, then things could potentially get more exciting.

Directorspeak is upbeat, and hints at possible out-perfomance against the above expectations, depending on delivery timeframes. I also like that the order book is strong.

Bill Mawer, Chairman and CEO of Image Scan, said: "I have been delighted by the response of our staff and our supply chain partners to the rapid increase in our order book. The manufacturing facility in Loughborough is busier than at any time since I joined the business.

While we still have some work to do to finalise delivery schedules with our customers, I am confident we should achieve at least this level of performance and will start the new year with a very healthy order book."

So what ever the company is doing, it seems to be working.

My opinion - this company looks potentially interesting. I'm not sure what is driving increased customer demand. Sometimes small companies like this can multi-bag if their products really start to take off. That's what I'm hoping might happen here, time will tell. Although I cannot claim to have done in-depth research, this one is a bit of a punt.

Have any readers looked into it? As always, reader views are welcomed in the comments section below.

A note of caution on IGE. It is a very small company, so the shares are illiquid. Therefore if something goes wrong, it could be difficult to impossible to exit. That's why I don't usually risk buying shares in such tiny companies. I made an exception in this case though.

Also, the company's history is distinctly lacklustre. Maybe its fortunes might have changed for the better now? Also, as you can see below from graph no.5, there are no divis. It's a difficult share to value, because there are so little historic profits. Therefore the valuation rests almost entirely on expectations for improved future performance.

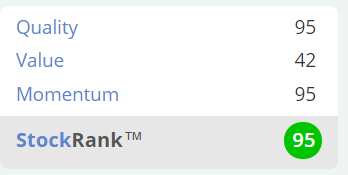

IG Design (LON:IGR)

Share price: 386p (up 0.7% today)

No. shares: 63.1m

Market cap: £243.6m

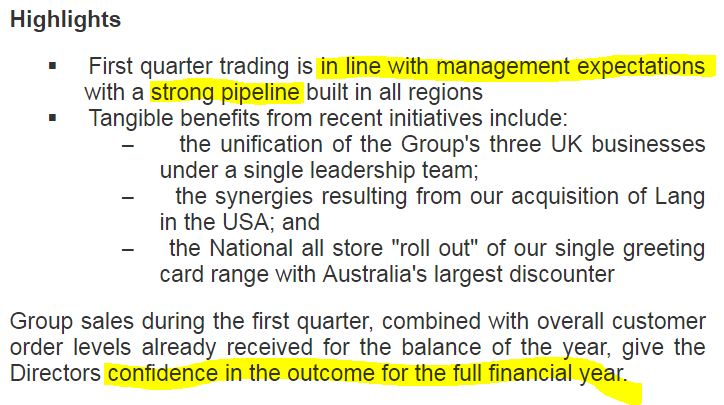

Trading update - this company makes gift wrapping paper, and other related products. It updates us today on how Q1, being the 3 months ended 30 Jun 2017. The company's next year end is 31 Mar 2018.

This looks reassuring;

There is a lot more detail given, describing progress within each geographical area. I won't regurgitate that here, you can read the RNS yourself, if you're interested.

Directorspeak sounds bullish;

"We are pleased with the progress made in the first quarter, particularly with regard to the various incremental growth initiatives highlighted at the Group's results.

Alongside this, our order book is yet again at record levels with strong momentum fueled by excellent product innovation and ever closer relationships across our broad customer base.

Organic growth opportunities exist in all regions, and our strong balance sheet is also providing the flexibility to continue to evaluate M&A opportunities."

Valuation - the shares aren't cheap, rated at 18.9 times consensus earnings of 20.3p EPS for this year (ending 3/2018). However, given that the company has an excellent track record of growth, and earnings upgrades, then I reckon the valuation looks reasonable.

My opinion - Its balance sheet looks OK, but isn't notably strong.

Overall, this looks like a very well managed business, delivering good growth. It sounds like there is more growth to come too. So I can see the bull case, for holding this share long term. I regret selling mine for a short term gain, some time ago, should've held on to them. Never mind. I might buy some if there's a dip at some point, e.g. on a general market wobble, so it's going back on my watch list.

Real Good Food (LON:RGD)

Share price: 25p (down 5.7% today)

No. shares: 78.4m

Market cap: £19.6m

Company update - this is a diversified food business. Shareholders here must be at the end of their tether. The company seems to be very problem-prone.

I reported here on 1 Aug 2017 about the latest profit warning. They've served up another one today! Here goes;

The Company announced on 1 August 2017 that it anticipated EBITDA for the year ended 31 March 2017 would be lower than market expectations at approximately £2.0m, subject to final audit.

Since the announcement of 1 August, a review has been undertaken, under the guidance of the Company's new Finance Director, which is now expected to lead to additional audit adjustments relating to inter-company trading and consolidation. As a result of these additional adjustments, the Board now expects EBITDA for the year ended 31 March 2017 to be in the region of £1.0m.

Why are they still finalising Mar 2017 results, 5 months later? There's clearly a lack of financial control at this company.

Banking covenants - this sounds ominous;

The Company's banking facility is subject to customary terms, conditions and covenants which are tested quarterly, with the next date at which the Company's banking covenants will be tested being 30 September 2017. The Board is in discussions with its bankers to vary certain conditions of this facility to reflect the Company's recent and anticipated trading.

Banks tend to be accommodating over this kind of thing, but they usually hike up the charges, to reflect increased risk. Also, there's always the risk that the bank could turn nasty. However, the following comments today do reassure somewhat;

In addition, the Board is pleased to announce that its major shareholders, NB Ingredients Ltd, Omnicane International Investors Ltd, and certain funds managed by Downing LLP have confirmed that they will, if required, provide additional funds to support the Company's working capital requirements.

Whilst that's a good thing, small shareholders could end up being diluted, if a fundraising has to be done in a hurry - it would probably be at a discount.

My opinion - I've never understood why this share would appeal to anyone. It seems a low margin collection of businesses, which are capital intensive, and where things seem to be constantly going wrong! Also it now has funding issues. Oh, and there's a pension deficit too, just for good measure.

I think it's best to steer clear of this share. Risk:reward looks poor to me.

OK, all done for today.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.