Good morning!

It's been a tricky morning for me so far, as my computer is preoccupied with a Windows Update..

Fortunately, I've managed to commandeer a computer (temporarily) from someone else.

Let's see what's on the menu today:

- Frontier Developments (LON:FDEV) - trading statement

- McBride (LON:MCB) - trading update

- Cohort (LON:CHRT) - final results

- RM (LON:RM.) - interim results

Cheers,

Graham

Frontier Developments (LON:FDEV)

- Share price: 1485p (+9%)

- No. of shares: 38.7 million

- Market cap: £575 million

A super update from this video games publisher. Not only is it upgrading expectations again, but it has quantified these expectations with numbers (something that is suprisingly rare!)

The Board's expectations for the current financial year have increased as a result of the initial sales performance of Jurassic World Evolution. Although it's very early in terms of both Frontier's financial year and the life-cycle of Jurassic World Evolution, current Board projections indicate that Frontier could achieve total revenue for the year ending 31 May 2019 towards the upper end of the current market analyst range (of £58 million to £88 million).

Note how wide the range of analyst forecasts was: £58 million - £88 million. That indicates to me a great deal of uncertainty as to how the company might do.

If the company achieves toward the upper end of that range, I would expect a huge increase in the bottom line.

Gross margin is over 70% (the marginal cost of selling an additional video game is low) and the degree of operating leverage remains quite high. This means that additional sales should have a disproportionate impact on profitability.

This stock deserves a high rating, in my view. As I've said many times, I think there are larger and more diversified games publishers who are probably safer bets. But let's not take away from the achievements at Frontier.

Frontier is hoping to become more diversified over time. It currently has three franchises.

CEO comment:

We already have future franchises in different phases of internal development and we will continue to explore other models to accelerate our scale-up.

Activision Blizzard ($ATVI) is currently trading at a forward P/E ratio of 28x, and EV/EBITDA of 26x.

Prior to today's update, Frontier was trading at forecast P/E ratio of 38x, and EV/EBITDA of 37x.

Given the strength of today's update, I wonder if these valuation multiples could possibly reduce for Frontier? Or perhaps the trading momentum is more than fully offset by the share price increase.

I would like to own a video games publisher, as I think the economics of the industry are very favourable to investors.

One of the fund managers I follow, Nick Train, has been a long-term holder of Nintendo (TYO:7974). That's a good example of a stock with unique and precious intellectual property.

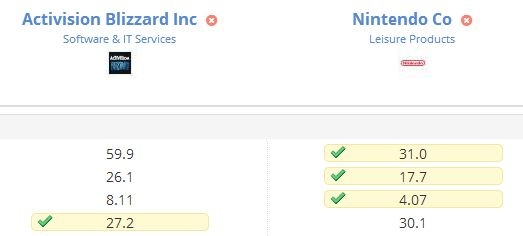

I've just run a quick comparison, and found that Nintendo might be offering decent value at the moment, relative to Activision:

(These metrics are trailing P/E ratio, EV/EBITDA, Price to Sales and Price to Cashflow.)

Given the strength of Frontier's momentum, it might be able to challenge these two giants on some of these metrics soon.

And when it is more diversified, e.g. with 5+ strong franchises, then it could feel safe enough for me to buy.

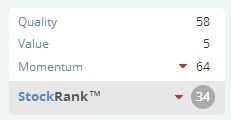

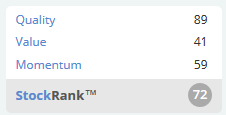

The StockRank summarises:

McBride (LON:MCB)

- Share price: 124p (-6%)

- No. of shares: 182.6 million

- Market cap: £226 million

McBride plc, the leading European manufacturer and supplier of Co-manufactured and Private Label products for the Household and Personal Care market, provides the following trading update for the twelve months ending 30 June 2018.

This is a double-bad update. It's a profit warning, and it fails to show the numbers.

Following weaker than expected sales levels in May and June 2018, the Group now expects full year adjusted Profit Before Tax to be marginally below the lower end of analyst expectations.

Personally, I can see a PBT forecast of £34 million, but I don't know what the lower end of expectations was.

Sales were weaker than expected in May. Strangely, the company also says that it has struggled with increased volumes, causing:

...higher distribution and warehousing costs and some short term inefficiencies at certain factories.

Perhaps this ia bit of indigestion arising from its acquisition last year?

My view

I've had a look at the archives to see what Paul was highlighting about this stock last year.

Apparently, it had guided shareholders to expect an H2 weighting at the very beginning of the financial year (ending June 2018).

Unfortunately, we have another instance of an H2 weighting failing to materialise properly, and are getting a profit warning instead.

Paul was cautious on the shares at 215p, citing the debt load, the fact that the company acts as a supplier to supermarkets, and the H2 weighting.

With the share price at 124p, the stock has sunk even further into "value" territory"

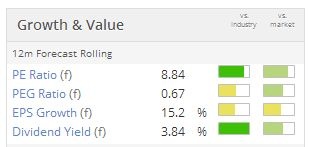

The dividend yield is now at level which would be material for many investors, and the P/E ratio is back in the single-digits.

If PBT turned out to be £30 million, for example (I don't know what the updated estimate will actually be), then at a 19% tax rate that is £24.3 million in net income.

It would feel uncomfortable owning shares in this - it's definitely a contrarian play. Either sales or margins (or both) are likely to remain under pressure. Owning shares in supermarket suppliers is never going to be entirely comfortable.

Is the doom and gloom sufficiently priced in? I was going to provide a positive response to that question, but I've just checked the last-recorded level of net debt: £123 million.

That means the stock isn't really trading at a single-digit P/E ratio. When you take the net debt into account, we are back in double digits.

So I don't think it's offering an exceptional amount of value, to compensate for the weak performance.

Meanwhile, its Momentum Rank is merely 8/100.

The thing about momentum is that it tends to persist. In other words, things are likely to get worse before they get better.

There is a level where this would become an attractive value investment. I'm not convinced we are quite there yet.

Neither are the StockRanks:

Cohort (LON:CHRT)

- Share price: 357.5p (-2%)

- No. of shares: 41 million

- Market cap: £147 million

From its website:

Cohort is the parent company of four innovative, agile and responsive businesses providing a wide range of services and products for British, Portuguese and international customers in defence and related markets.

Results are ok, overall, and in line with expectations. Adjusted operating profit has reached its highest ever level. Though the order book closed 25% down compared to the prior year.

In the same way that a rising order book doesn't necessarily lead to an increase in sales (it depends on when the revenues are recognised), a falling order book doesn't necessarily spell disaster, either.

Cohort says there are "important order opportunities in 2018/2019", and it has a "reasonable underpinning" for sales this year, based on order activity since year-end and its pipeline of opportunities.

The results are very detailed, with lots of numbers around each of the four subsidiaries.

I need to try to understand what the subsidiaries do:

- EID - advanced high performance electronic equipment and systems primarily for the worldwide defence community.

MASS - trusted services and solutions that improve the security, efficiency and effectiveness of operations in government, industry and educational establishments.

- Marlborough Communications Ltd (MCL) - advanced electronic and surveillance technology

- Systems Engineering & Assessment Ltd (SEA) - electronic systems to the defence, transport and offshore energy markets

Outlook

In the outlook statement, the company reiterates some confidence that the sales outlook is not as bad as the order book reduction suggests:

Lower order intake in 2017/18 was substantially due to delays rather than losses or a lack of opportunities, and there is a larger than normal concentration of opportunities in 2018/19.

That seems reasonable. Business is always going to be lumpy for contract-driven businesses like this.

I like this snippet:

The responsibility of the Cohort Board is to manage our affairs so that our businesses prosper whatever the political and economic backdrop.

That's music to my ears: a Board taking responsibility for what happens, regardless of macro conditions. It's so common to see the opposite happening - macro conditions being used as an excuse to avoid responsibility.

I don't have the time to study all of Cohort's moving parts, however. And I have never taken much interest in the defence sector, reliant as it is on government contracts and lumpy orders.

Returns doesn't seem particularly strong at first glance, either:

Having said that, the company's overall metrics are encouraging, and its track record of profitability is quite good. And it passes the Stocko Neglected Firms Screen.

So if you happen to take an interest in defence, this stock does appear to be worth investigating further.

The StockRank is above average:

RM (LON:RM.)

- Share price: 236p (+5%)

- No. of shares: 83 million

- Market cap: £195 million

RM plc ("RM"), a leading supplier of technology and resources to the education sector, reports its interim results for the period ending 31 May 2018.

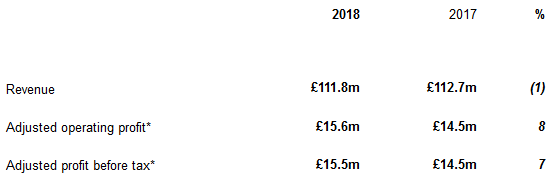

Some very strong growth rates reported by this educational businesses, boosted by an acquisition within its Resources division (providing physical resources to schools).

The Board is confident of "at least meeting full year expectations" - this means we will perhaps get an out-performance, against those expectations. The 5% share price gain today makes sense.

Drilling into it a little bit, the acquired business generated £24 million of revenue for the enlarged group. Revenue for the entire group increased by £23.6 million, so I think the pre-existing businesses were in aggregate flat or marginally lower.

Synergies of £4 million are being targeted - sounds good. Hopefully, this is one of those instances when an acquisition creates rather than destroys value.

The Statement of Comprehensive Income shows a £9.4 million gain (gross of tax) from re-measurement of the pension deficit.

That provides a helpful improvement to the shape of the balance sheet, and the company points out a couple of times in today's statement that its balance sheet is "strong".

I don't think the balance sheet is necessarily weak, but I do think I should point out that it has negative net tangible assets. There are net assets of £40 million, more than offset by more than £65 million of intangibles.

The company is financed by its customers and suppliers: there is a huge £50.6 million balance within payables, in current liabilities. This figure includes cash due to suppliers, services due to customers, and miscellaneous other items.

That's fine - I presume the company's business model supports this structure? It apparently enjoys very favourable terms of trade. I'd want to have a look into this and make sure I was happy with it and that it was unlikely to change for the worse, if I was considering buying these shares.

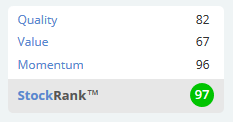

Despite excellent share price gains, RM continues to trade on a single-digit P/E ratio and offers a mighty StockRank:

So I do think this is worth looking into.

All done for today. I was distracted by a few technical-logistical issues - apologies.

Oh, good luck to England tonight vs. Colombia. I routinely check the odds before a big match like this, and the latest odds say that England are about 6/5 to win, with a draw being the next most likely outcome (followed by extra time). I hope we get winning goals in open play, rather than penalties!

Cheers,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.