Good morning! It's Paul here.

I've just about recovered from a fantastic weekend - in particular, participating in the UK Investor Show. I (perhaps foolishly!) agreed to be interviewed by Tom Winnifrith, in a "live bearcast". We didn't get off to a good start, as I had a brainstorm, and turned up at the wrong venue - a North London conference centre. Only to realise, with complete horror, that there was a room full of people, and a very angry Tom Winnifrith, waiting for me at the QE Centre, a couple of miles south of my actual location!

Anyway, I hopped on the tube, and arrived in time to be torn to shreds by Tom. Although I did manage to get some quite good points in, during the brief gaps when Tom paused his monologues to draw breath! Anyway, it was all a bit of fun, and I popped over (well, spent the next 2 hours in) the Westminster Arms, and had all sorts of interesting conversations with various readers of my articles here.

Then it was back over to the QE2 Centre, to do a main stage stint. If you had told me, when I was in the depths of despair, from 2008-2012, that in 2017 I would be on the main stage, interviewing Nigel Wray, I would have laughed at the implausibility of such a suggestion. Yet that's what happened, and the initial stage fright immediately dissipated, and it was a thoroughly enjoyable half hour.

The trick is to prepare really thoroughly in the days beforehand, and practice exactly what you want to say, and how to say it. Also, I telephoned both Nigel Wray & Paul Mumford, and ran through all the questions with them, so had a good idea what they wanted to say.

So I think I've finally cracked how to do public speaking, which for most people (certainly including me) is something which seems very daunting. However, the only way to overcome those worries, is to tackle it head on, by getting up & doing it. That involves accepting that at first, you'll be pretty rubbish at it, but that hopefully each subsequent time is an improvement.

Fulham Shore (LON:FUL)

Share price: 19p

No. shares: 571.4m

Market cap: £108.6m

(at the time of writing, I hold a long position in this share)

Trading update - for the year ended 26 Mar 2017.

This is a restaurant roll out, by experienced management. The main chain is called "Franco Manca", and is a pizza restaurant, with some nice original touches - e.g. blast cooked sourdough pizzas, premium ingredients imported from Italy, "no logo" craft beers at low prices, wine bottles refilled with tap water & mint leaves put on every table when you sit down, etc.

The point being that Franco Manca does actually have some good points of difference, as opposed to being just another "me too" pizza/pasta chain. This is important, as there seems to be over-capacity emerging in the restaurant sector, with so many roll outs occurring. Inevitably that means weaker formats could fall by the wayside.

Fulham Shore also operates its smaller The Real Greek chain, and is experimenting with some interesting new ideas, e.g. street stalls. Both chains make fairly decent operating profit margins at store level, which is absolutely key to determining whether a roll out will work, or not.

As we saw with Tasty (LON:TAST) last week (in which I have a long position), those that make mistakes with poor menus & poor site selection, or just don't offer good enough value for money, can start to go wrong - Tasty warned on profits a few days ago, which I reported on here.

So I was apprehensive about the next update from FUL - is a general slowdown occurring in the restaurant sector, or are Tasty's problems self-inflicted? It seems to be the latter, because FUL has updated positively;

The Board expects that Fulham Shore will report full year results in line with market expectations for the financial year to 26 March 2017.

Other details include;

- The company is to invest £100k in a seasonal branch in Sicily - via a franchisee. I've got mixed feelings about this, but it's not a huge amount of money.

- Rapid & ambitious roll out. 16 new sites opened in FY2017 - going from 29 to 45 sites in one year is a helluva challenge, but the company seems to have pulled it off.

- Pre-opening costs higher than anticipated, due to delays at one site, and 2 additional sites opening earlier, which had been intended for the new financial year. No big deal in my view.

- A further 15 new sites planned for the new financial year (ending 3/2018). Ambitious again, but the company seems to be able to cope with rapid expansion. It does increase risk though.

- Will these formats work outside London? As they are lower priced chains, I reckon they will. The company doesn't indicate any problems with regional site openings to date.

- HSBC borrowing facility expanded from £6.5m to £15.0m, to finance rapid expansion - so this roll out is not entirely self-funding. They're going faster, and increasing borrowings to do so.

Valuation - I'm struggling to get hold of the latest forecasts. It might be helpful if the company commissioned some research, to help investors better assess the prospects of the company. That might also help improve liquidity in this share, which is currently poor.

My opinion - I love good roll outs. The beauty is that bolting on each new site increases cashflow, thus creating a virtuous circle where expansion becomes self-funding. So providing nothing goes wrong, then investors can just sit back & watch the company grow considerably, with little to no further dilution.

When a format works, I also like the roll out to be done fairly aggressively, if management can handle that without making expensive mistakes on site selection. This seems to be one of the issues at Tasty (LON:TAST) for example.

I'm relaxed about FUL borrowing more from the bank, to part-finances rapid expansion, as long as trading remains robust. It would of course increase risk, if trading went badly wrong. Personally I don't see how a chain serving nicely done, large pizzas, from £4.95 each, is likely to suffer in a recession. The opposite could actually happen, as people might trade down from more expensive offerings?

Another key requirement for roll outs is experienced, and capable management. FUL gets a tick in that box.

Overall, FUL has good formats, which work well at individual site level (strong individual site profitability/EBITDA). I've read commentary that EBITDA is nonsense. In this sector, actually EBITDA is critical, and it's the most important measure for assessing performance. The reason being that it's all about cashflow, not profits. I could explain more, but don't have time now. Also it's a pointless discussion. You either understand that roll outs are all about cashflow, or you don't, and miss the point completely.

The ambition here is to get on with it, and build a national chain. That should see profits go through the roof over, say, the next 5 years. That's why I hold this share.

These bank facilites will enable Fulham Shore to gradually accelerate its opening programme and push for a nationwide presence throughout the UK.

Of course, the downside risk is that rapid expansion could lead to mistakes, and things going wrong, as has recently happened at Tasty (LON:TAST) . So roll outs are not without risk. Personally though, my assessment now is that FUL is one of the best roll outs on the UK market, based on currently available facts & figures. Of course, if the facts & figures change, then I reserve the right to change my mind in future. Views on shares should never be fixed. They can & should change when the facts change.

Keywords Studios (LON:KWS)

Share price: 694p (up 1.6% today, at 11:24)

No. shares: 54.4m

Market cap: £377.5m

Final accounts - for the year ended 31 Dec 2016.

Results today look in line with an update given on 8 Feb 2017, which I reported on here. Actually adjusted profit before tax is slightly above, at E14.9m, when E14.8m was indicated earlier. Always nice to put a cherry on top, with a slight beat against a previous update!

This group is highly acquisitive, and describes itself as an - "international technical services provider to the global video games industry"

The pace of acquisitions is the first thing that stands out with this company. It did an astonishing 8 acquisitions in 2016. I cannot understand how management could possibly do so many acquisitions, at the same time as running the business? So that's a bit of a worry. Although the bolt on acquisitions seem fairly small in total, just over E20m, as I noted in my previous report on this company. I wonder why the vendors are selling, if their businesses are doing so well?

Like-for-like ("LFL") revenue growth from existing businesses looks excellent, at +24%.

Cross-selling - someone at the UK Investor Show was briefing me on this company, and reckoned that the acquisitions are good, because it increases cross-selling opportunities. That's confirmed in the narrative today;

25% increase in clients using three or more services from 51 to 64

Current trading - looks fine;

Trading in the first two months of the year has been in line with the Board's expectations

Debt - more debt for more acquisitions. Looks fine, providing profitability remains strong;

Terms agreed for a revolving credit facility of up to €35m with Barclays Bank, which will provide further headroom for selective acquisitions

Diluted EPS - is 10.87 Euro cents. It's about £1 = E1.17 at the moment, so this translates to about 9.3p. Therefore at 694p per share, the PER is slightly under 75. Yikes!

Now of course, the statutory numbers are the most conservative version of profit, so we should also look at the adjusted EPS figures, to remove things like goodwill amortisation (which is fine by me, that's just a rather annoying book entry).

Adjusted basic EPS is much higher, at 20.59 Euro cents, and is up 61%. So clearly the valuation of this company partly hinges on strong growth (although remember that a lot is coming from acquisitions, so that has a one-off benefit). Also it partly hinges on the big difference between statutory & adjusted EPS.

So investors really need to be certain that you're comfortable with the adjustments to EPS, because they're big adjustments.

These adjustments are;

(before share option charges, amortisation of intangible assets, costs of acquisition and integration, and foreign currency movements)

...acquisition and integration expenses of €1.3m (2015: €1.1m), share option charges of €0.7m (2015: €0.4m), amortisation of intangibles of €1.6m (2015: €0.9m), and foreign currency loss of €1.7m (2015: loss of €0.5m).

Balance sheet - Net assets total E100.6m. As you would expect from a highly acquisitive group, this is becoming top heavy, with intangible assets.

Goodwill & other intangible assets total E55.5m, so take that off (to look at the most conservative view of the balance sheet - always worth doing) we get NTAV of E45.1m.

The rest of the balance sheet look fine to me, I can't see any particular funnies in there, or anything out-sized - debtors look about right for the size of business.

Cashflow - this is often more revealing than the P&L statement, and generally I think we should place more emphasis on analysing cashflow.

I don't see anything untoward here either. The net cash provided by operating activities, of E15.0m, is a huge increase on 2015's E3.4m. Although favourable working capital movements in 2016 of E3.2m are the reverse of a E3.2m adverse movement in 2015. So a E6.4m working capital improvement in 2016 vs 2015, reduces the increase in operating cashflow from E11.6m, to E5.2m. Still good, but we mustn't get carried away!

Pleasingly, there's no sign of aggressive accounting treatments that I've seen - e.g. no aggressive capitalisation of costs.

Basically the company has generated a lot of cash, and topped that up with some bank loans, to buy more bolt on subsidiaries.

Dividends - just a token amount really, but that's fine for a group with a growth strategy.

My opinion - I don't really have any opinion on the company's prospects or what the share price might do.

The main thing to point out, is that the stock is pretty expensive now, so the growth has to continue to justify that high rating. If you think that's likely, then everything's fine.

I was asked by a reader to run my slide rule over the accounts, which I've done, and it all looks clean to me - I don't see anything fishy, or suspect in there at all. Personally I would probably reverse out the adjustment of share-based payments, as that's remuneration, but it's not a huge amount. There's also some dilution from deferred consideration (in shares) for acquisitions, but that seems to have been accounted for in the diluted earnings numbers.

Overall - looks interesting, but quite pricey!

Utilitywise (LON:UTW)

Share price: 139p (down 11.6% today, at 16:17)

No. shares: 78.5m

Market cap: £109.1m

Interim results - for the 6 months to 31 Jan 2017.

The market clearly doesn't like today's figures and/or outlook, indeed the share price began falling sharply a few days before results day - funny that - it's almost as if someone knew that bad news was on the way.

This company is the utility cost management consultancy, with controversial accounting policies. I've written about it loads of times before here, please click here for the archive of my reports on it.

The key P&L numbers for the 6 months look like this;

- Revenues up 11% to £46.1m

- Adj profit before tax up 4% to £9.4m

- Adj fully diluted EPS flat at 9.6p

So for a company that talks a lot about growth, it's rather incongruous to see no increase in EPS.

However, overshadowing this, there seem to be 3 problem areas, as follows;

In order to further strengthen the Group's commercial prospects, the Board has taken the strategic decision to discontinue the practice of taking cash advances from suppliers,

as well as increasing the transparency of the balance sheet through a number of prior period restatements

and the non-cash impairment of our investment in t-Mac.

The decision to discontinue cash advances from suppliers and the prior period adjustments will have a one-off impact on net debt but puts the Group in a stronger position to achieve its future growth ambitions.

Cessation of cash advances from suppliers - this looks a big deal, and will result in a really nasty cash outflow in H2 of this year;

These amounts, along with associated VAT, will together lead to a one-off impact upon the Group's cash flow during the second half of FY17 of £16.4m with a resultant increase in the closing net debt of the Group at 31 July 2017 compared to the previously forecast position.

I don't like the look of that one bit. It's a dramatic increase in net debt, in the pipeline.

Prior period restatements - this is explained in note 10 to today's accounts. From what I can make out, there's negligible impact on profit or EPS.

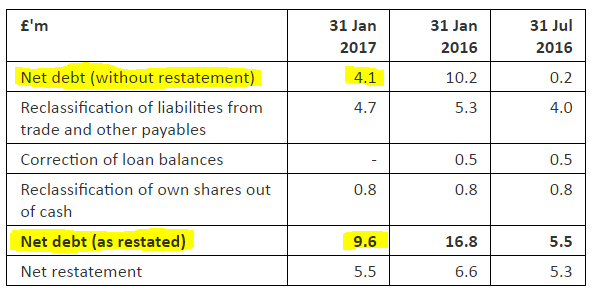

The main issue seems to be that some creditors were included in trade creditors, which should have been included within net debt. Therefore net debt, as restated, is higher than before, with this table showing the restatement;

Net debt of £9.6m as at 31 Jan 2017 looks reasonable. However, when you combine this with the £16.4m cash outflow in H2 expected above, then it looks like net debt would be heading for about £26m, less whatever other net cash inflow is generated in H2.

That looks to me as if it's likely to use up most of the available bank facilities - so headroom on the bank facility looks to be dramatically reducing in H2 of FY17 (i.e. now);

The activities of the Group are substantially funded by a £25m revolving credit facility (RCF) with a single lender, Royal Bank of Scotland plc. The RCF facility matures in April 2019. As at 31 January 2017, the undrawn committed facilities of the Group were £20.9m, net of cash and cash equivalents.

I wonder what the bank's view is, of accounting restatements, and the apparent decision to abandon supplier cash advances, and replace that with maxing out the bank facility?

Impairment of t-mac investment - this looks like a goodwill write-off for an acquisition made in 2015, as follows;

The near-term delays in certain revenues has caused the Group to recognise an impairment loss of £13.4m against its investment in t-Mac Technologies, which was acquired in 2015. That non-cash accounting loss has been recognised as an exceptional item within the Group's income statement in the current period

It's described as non-cash, but really that's not true, the way I look at things. If you look back to the announcement of the acquisition of t-mac just 2 years ago, in April 2015, it was paid for using cash borrowed from the bank, and issuing new shares, totalling £10m for the initial consideration.

Since today Utilitywise is writing off £13.4m, then presumably there might have been some additional consideration paid after the original £10m? That was real money, paid out by Utlilitywise, for what it now seems to be saying was a worthless acquisition. Shareholder value destruction, in other words.

Balance sheet - the biggest issue with this company's balance sheet still remains - namely the gigantic amount of revenue & hence profit which has been booked in advance of the cash being received. The other side of the double entry is shown within non-current assets, as a £33.9m asset, called accrued revenue.

This figure should turn into cash over several years, but it's a very aggressive accounting treatment, which I've never liked.

So a huge thumbs down, indeed a loud raspberry from me, for this balance sheet. I don't like it one bit, especially now net debt is set to soar in H2 of this year.

My opinion - what a mess! Multiple accounting issues, and net debt about to soar - it looks horrible to me, I wouldn't go near this share after this announcement.

The dividend yield is looking very attractive, at over 5%, after today's fall.

I see Geoff Thompson is stepping down from Exec Chairman to Non-Exec Chairman, in a separate announcement today. In this statement, he gushes;

...I firmly believe we are still only really scratching the surface in terms of the opportunities available to us

If that's the case, why did he bank squillions in personal share sales in 2012, 2013, and 2014? See the Stockopedia Director transactions page here. Sure there have been some hefty Director buys too, more recently, but these are still dwarfed by the massive sales previously. As the saying goes, follow the money! i.e. watch what Directors do, rather than what they say.

Personally, I like companies with simple business models, and straightforward, transparent accounts. Why get involved in something like this? I think the accounts here are pretty ropey, and I'm not sure management are up to scratch either. With all these latest issues, I can't see any reason to get involved.

Next Fifteen Communications (LON:NFC)

Share price: 385.5p (down 3.6% today)

No. shares: 73.4m

Market cap: £283.0m

Final results - for the year ended 31 Jan 2017.

Checking the archive here, to refresh my memory, I last looked at this marketing group just after the Brexit vote, in late Jun 2016. I flagged up here that it looked set to be a beneficiary of sterling devaluation, and was trading well. The share price is up 65% since then, so am a bit annoyed I didn't buy any at the time. Never mind.

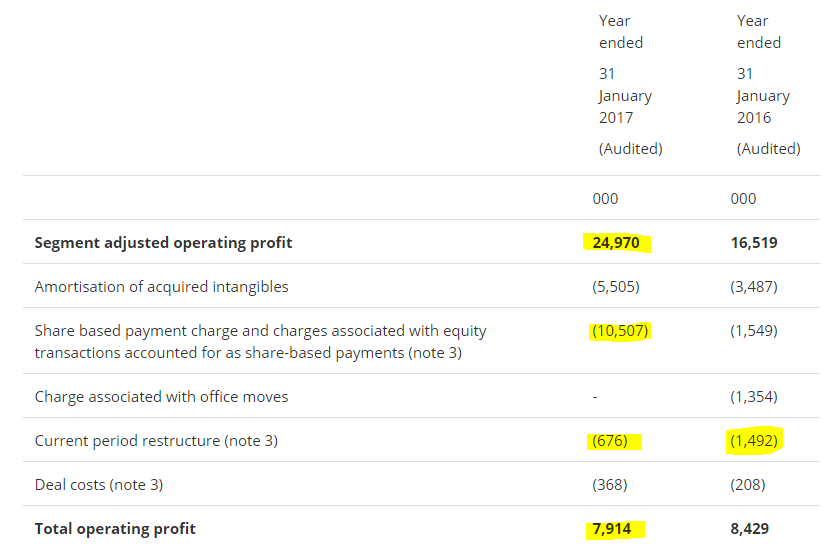

The headline figures given in a table, are adjusted numbers, so it's necessary to review whether the adjustments are reasonable or not. As you can see from the table below, taken from note 2 of today's accounts, the adjustments are huge;

Note 3 shows even bigger adjustments to profit before tax. This makes me uncomfortable, with such big figures involved.

There's a more detailed explanation of the enormous £10.5m share based payment charge, which says;

1 This charge relates to the acquisition of the 20% minority interest in Bourne whereby performance shares were issued as partial consideration, and transactions whereby a restricted grant of Brand equity was given to key management in Agent3 Limited, BYND Limited, MIG Global Limited, The Lexis Agency Limited, Twogether Creative Limited, BYND LLC, Vrge Strategies LLC and M Booth LLC (2016: Bite Communications Limited, Bite Communications LLC and The OutCast Agency LLC) at nil cost which holds value in the form of access to future profit distributions as well as any future sale value under the performance-related mechanism set out in the share sale agreement. This value is recognised as a one-off share-based payment in the income statement. It also includes charges associated with equity transactions accounted for as share based payments.

I haven't got a clue what that all means. Which is a problem, as it's a highly material number.

Also, restructuring costs in both years looks like it's becoming a habit. If so, why is it adjusted out?

Balance sheet - a very top-heavy balance sheet, with ever-growing intangibles. The NTAV is negative, at -£11.5m. There's a fair bit of debt too, especially when you include acquisition-related creditors.

Outlook - this sounds encouraging;

Looking ahead, the Group has made a good start to the new financial year with encouraging signs across our brands.

The Board is recommending the payment of a final dividend for the 12 months to 31 January 2017 of 3.75p per share, which would represent a total dividend of 5.25p for the year to 31 January 2017 which reflects an increase of 25% on the dividend in the prior year.

Although note that the dividend yield is fairly paltry at 1.4% - not surprising, given the weak balance sheet, and heavily adjusted profits.

My opinion - I don't like it. The adjustments to the accounts are massive, and the balance sheet look weak to me.

That said, if you do accept the adjusted figures, then EPS growth to 23.4p (up 38% - helped considerably by favourable forex) looks good. That gives a PER of 16.5, which looks a lot for a company in this sector.

If sterling does start recovering against the dollar, then of course that would be negative.

It seems to me that this share has had a great run, and risk:reward may no longer be quite as favourable as it was a year ago?

A few quick comments now to round off with:

Koovs (LON:KOOV) - let's enter the parallel universe of Indian online fashion. Koovs thinks everything is going great, despite selling clothes for less than it costs to have them made, and losing money hand over fist.

The share price has fallen 8.6% to 50.25p, valuing the company at about £90m - which is astonishing, considering its abject failure to demonstrate it has a viable business model. Remember this thing is burning cash heavily, and will need more, in the not-too-distant future.

In today's trading update, it focuses on top line growth;

Sales* up 87% to £18.6m (1.62Bn INR)

Note the asterisk, which says;

* Gross sales order value placed through the KOOVS.COM website including taxes. This does not represent the revenue of the Group.

Might it not be better to tell shareholders what the group's revenue actually is then? Apparently not.

International expansion - the company is expanding into other markets, in Asia-Pacific & the Middle East, through distribution agreements.

Gross margins - this seems to be saying that the gross margin is still negative, but expected to become positive in the new financial year just started (ending 3/2018):

The company continued to improve its gross margin position by improving intake margin and controlling the level of discounts given, and expects to generate positive gross margins in FY18.

To be clear, a positive gross margin means selling something for more than you paid for it - which is the basic starting point for any business, surely? Not to be doing that already is complete madness.

My opinion - I can't see any mention of the cash position, cash burn, or even profitability. So in what sense is this a trading update? It's not really. It's just a lot of PR.

This remains probably the worst eCommerce share that I've seen. Things could change of course, nothing is set in stone. If investors are prepared to continue funding the losses (which means more dilution for existing holders), then it could perhaps reach a tipping point where a viable business might emerge - if strong growth in sales can be achieved, and if a decently positive gross margin achieved.

There are far too many ifs in the above upside case for my liking. I cannot see the point in taking on so much risk by buying this share. It might eventually succeed, but the business model looks deeply flawed to me, as things stand at the moment.

Adept Telecom (LON:ADT) - the share price is up 12.6% today to 357.5p, so the market clearly likes its trading update today.

This bit sounds good (if you accept EBITDA as a performance measure - something that differs considerably between various sectors, in my view);

The Company is pleased to announce that it anticipates that underlying EBITDA will be around 26% ahead of the previous year (ahead of the market consensus expectation of an 18% rise year-on-year).

Turnover is expected to be approximately 16% ahead of the previous year and above market consensus expectation.

I imagine that's likely to trigger broker forecast increases.

Net debt of £15.8m is a bit (£1.3m) better than forecast.

Divis are up 19% Y-on-Y to 7.75p, but that's only a 2.2% yield, hardly worthy of dusting down the bunting, and getting out the stepladder.

My opinion - I'm not keen on this type of telecoms/IT company. The tech is moving so fast, that you can suddenly see existing business models become defunct, or at least withering away. Hence the valuations are not particularly high, for good reason.

For now Adept seems to be doing well, but how sustainable is that, longer term, I wonder? It's not for me.

Universe (LON:UNG) - results for 2016 are out today, and look OK. Note that the 20% increase in profit before tax is driven by a sharp fall in finance expenses. Operating profit was actually only flat against the prior year, at £2.0m.

The balance sheet looks alright to me. The Chairman sounds upbeat about new products & contract wins, albeit with timing delayed.

I've dabbled in this share before, and found it horribly illiquid, with a very wide spread. So for me that probably rules it out. It looks an OK company though, and it might be worth more research on what prospects are like for new products.

Flowtech Fluidpower (LON:FLO) - this is a good company, providing a wide range of spare parts of hydraulic equipment. It generates decent profit margins, and has been expanding through acquisition.

Unusually, the company has put out 2 separate RNSs, one for its 2016 results, and one for its Q1 trading update.

I don't have time to go through the figures now, but on a brief glance, the business seems to be doing pretty well. That's reflected in a share price up 9.3% today to 140p.

I've looked at this company before, and think it's good, and reasonably priced, so could well be worth a closer inspection.

Topps Tiles (LON:TPT) - the share price has taken a hit today, down 7.7% to 90p, on a rather lacklustre trading update.

H1 LFL sales were down 1.9% in H1, with a worsening trend (Q2 was down 4.1%). Thus some of last year's LFL decent sales growth has been given back.

Although costs seem to have been well controlled, mitigating the impact of weaker sales;

Lower sales growth over the first half will primarily be offset by reduced operating expenditure. Based on an improving trend across the second quarter and a prudent view of the second half, management expectations for full year profits are within the current range of analyst forecasts.

That's quite impressive. I wonder which costs they've been able to reduce, as there's not a lot of scope for retailers, other than cutting staffing levels & bonuses.

Top marks also, for the company helpfully including a note on what market expectations are. This is so useful, I really wish all companies & advisers would make sure this is done as standard practice. To be blunt, it's just laziness and/or arrogance, not to do what Topps, and increasingly lots of other companies are now doing to help provide investors with the information we need;

1 The current range of analyst expectations for underlying profit before tax for the year ended 30 September 2017 is £21.0m to £22.3m, with consensus at £21.8m.

My opinion - I do like this company, but I can't really see any reason to buy any other retailer, when the best quality one of them all, Next (LON:NXT) is so cheap (in which I hold a long position).

And finally, a reader has asked me to look at a blue sky stock reporting today:

Nanoco (LON:NANO) - interim results from this company today look grim. It's a blue sky stock - so a company which is developing some novel product, where everybody gets terribly excited about the potential, and chases the share price up to a high valuation.

The trouble is, practically all blue sky stocks in the UK seem to go wrong - either partially, or very often totally. So punting on shares of this type is an almost guaranteed way to lose money. That's why I don't do it any more. Although there can be big surges of excitement when individual stocks can multi-bag, which is why people like to try their hand at this type of gambling (it's not investing, let's face it).

This company seems to have some credibility - it mentions big name companies which seem to be interested in its product. However;

Although first half results are in line with the Board's expectation, sales have not yet materialised in the second half and we are therefore lowering our full year expectations

To put that into context, sales in H1 (the 6 months to 31 Jan 2017) were only £676k, and the operating loss was £6.4m.

Cash burn is high, and the bank balance is rapidly depleting. There was net cash of £8.3m at 31 Jan 2017, which had fallen from £14.5m just 6 months earlier. Therefore, it looks as if this company is likely to run out of cash before the end of 2017, if sales don't kick in, and/or if costs are not reduced.

This is the nightmare scenario for any blue sky stock - i.e. sales not occurring as hoped, and cash rapidly running out. Investors usually don't want to fund another placing, unless/until there's clear evidence of actual orders in the pipeline.

Often in this type of scenario, companies start issuing lots of bullish-sounding announcements about impending orders, in order to push the share price up, so they can get another placing away.

There's a going concern note with today's figures, which bulls should read carefully.

Outlook comments sound good, but remember that no commercial sales have begun yet;

Progress over the last six months has been transformative for the business. We now have active engagement with nine display OEMs working on 14 different programs and have developed the manufacturing capabilities through our own facilities and those being developed by our partners and supply chain to fulfil the demand. We look forward to our current activities generating our first commercial sales.

My opinion - how can I (or anyone else who is not closely involved with the product development plans) possibly assess whether this company is likely to succeed or not?

It's just a punt, not an investment. I wish the company well, and hope it succeeds, but it's not something I could possibly consider as an investment, as I have no way of knowing what the future holds for this company & its products.

Things always take longer, and cost more than planned. When cash is running out, that means more dilution looks inevitable, and can often be on very poor terms for existing holders.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.