Good morning! It's Paul here.

Quarto Inc (LON:QRT)

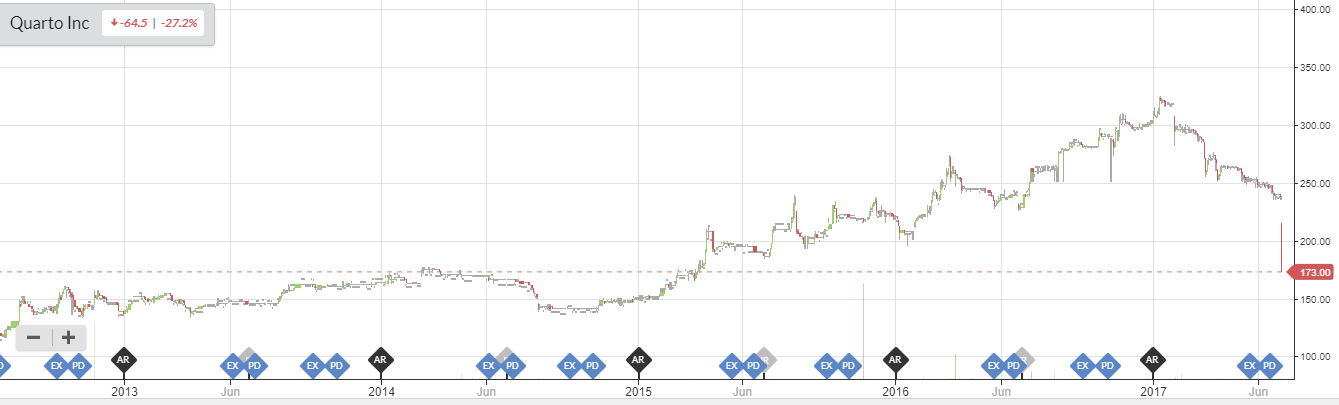

Share price: 176.6p (down 25.6% today)

No. shares: 19.7m

Market cap: £34.8m

Trading update (profit warning) - bad luck to shareholders here. This company is mainly an illustrated book publisher.

It says today that guidance given to the market has turned out to be too high. However, this explanation simply doesn't make sense to me;

Prior to entering the closed period, the Group has been reviewing guidance as given to the market. This process has revealed that the guidance currently in the market uses a publishing-only baseline for 2016 that does not reflect the benefit of $2.1m relating to the reduction in the amortisation of capitalised pre-publication costs - as explained in the FY2016 Results announcement on 31 March 2017 and in the Group's Annual Report. As a result, the baseline guidance for 2017 and beyond has been set too high.

Surely if the company didn't include the benefit of a $2.1m lower amortisation charge in its guidance, then the profit guidance would be too low, not too high? So the above paragraph doesn't make sense to me at all. Maybe I'm just being slow? (I am only half way through my first coffee of the day).

EDIT: a note from Liberum today explains it much better. They say that the baseline for forecasts was set too high, due to a one-off benefit in the prior year baseline figures.

Whatever the explanation given, the upshot is that profit guidance in the market is currently too high. So it's a profit warning. QRT joins RBG in a category of companies whose finance departments don't seem to be very good at forecasting.

As well as this apparent forecasting error, underlying trading conditions seem to be soft, causing under-performance in the year to date;

The Interim results will reflect the ongoing soft retail environment in the Group's domestic markets, resulting in a lower-than expected trading performance in the year to date - as well as a more pronounced second-half weighting, natural in a pure-play publishing business.

The Group expects its strong publishing programme, combined with the continuing resilience of its publishing portfolio and enduring backlist, to perform significantly better in the second half.

Investors should bear in mind that QRT normally has an extreme seasonal weighting for profitability in H2. I'm looking back at the last interim results, and practically all its profit is made in H2, with H1 only just above breakeven in both 2015 and 2016.

Therefore, i wonder if H1 in 2017 might even be loss-making?

If H2 does indeed perform strongly, as the company expects, then the full year results may not be too bad? It's not possible to tell from today's update, as there are no figures given.

Directorspeak - gives some hope that things might improve in future;

"This is a transitional year for Quarto as we refocus the Group on our core publishing business. As expected, we have seen a soft retail environment in the first half of the year in both our domestic markets which, combined with the disposal of our trading businesses earlier this year, means that our results will be even more second-half weighted than in previous years. "

"We are making good progress towards our strategic objectives and becoming more operationally agile to respond better to an ever-evolving market environment. We look forward to announcing the appointment of a new CFO in due course and to enjoying the full benefits of our new organisational structure and systems upgrade by year-end."

My opinion - this is not a share I hold personally, as my reservations about its accounts have held me back from buying any. Specifically, I'm not keen on the large amounts capitalised onto the balance sheet each year, for pre-production costs. Also, the business has too much debt for my liking.

Checking back on previous RNSs for disposals, it raised $7m from the disposal of Regent Publishing Services earlier this year, plus a small additional amount for another disposal. So that should have helped reduce bank debt somewhat.

How bad is today's announcement? We can't really tell from the RNS, unfortunately. So it would be a question of seeking out updated broker forecasts.

I've had a look on Research Tree, and one broker has updated its forecasts, with a 25% reduction in 2017 EPS estimate, and a 17% in 2018. That means the 2017 EPS forecast has fallen from 49.9c to 37.5c (the company accounts are presented in US dollars). Convert that into sterling at £1 = $1.294, and we get EPS of 29p for calendar 2017. This works out at a 2017 PER of 6.1 .

I think a lot may hinge on what the company decides to do with its dividends. If H2 turns out well, then hopefully the generous divis would be maintained. The existing divis look well covered. Although the company has been juggling the need to reduce debt, with shareholders who expect divis. Reduced earnings for 2017 makes that juggling act more difficult.

Overall, if you like the company, and think this is just a temporary setback, then maybe this could be a good time to buy some more shares, at a discounted price? Personally, I'm not tempted, as I just can't get comfortable with its balance sheet.

As you can see from the chart below, all the gains since 2014 have now been given back.

XLMedia (LON:XLM) -

There's an impressive trading update today from this "performance marketing" group.

...trading update for the six months ended 30 June 2017, with the Group trading ahead of managements' expectations for the period.

The Group has continued to execute on its strategy of diversifying its revenue streams and has delivered strong organic growth across all business verticals within the Group.

That sounds very good.

The company still makes most of its profits from the gambling sector (it's drums up new business for clients, through websites & other marketing). Gambling is now 57% of revenues (down from 70% a year ago), due to diversification (from acquisitions). However, I would be interested to find out the proportion of profit that gambling generates.

There's a very confident outlook comment too;

...the Board remains extremely confident in the performance of the business.

My opinion - the figures look great - strong growth, highly profitable, cash-rich, nice divis.

I can't shake off my sense of unease about this company, but it keeps reporting positive trading. Although the modest forward PER of 11.9 suggests that the share is either a bargain, or the market shares my sense of unease about how sustainable profits are.

Stockopedia loves it, with a StockRank of 98, and a style of "super stock".

Staffline (LON:STAF)

There's a reassuring trading update, as usual, from this staffing & welfare to work group.

The key bit says;

...As a result, we are pleased to confirm that current trading is in line with market expectations and the Board remains confident of the Group's growth prospects with the "Burst the Billion" £1 billion revenue target still very much on track for the current year.

I really like that this company is private investor friendly. It is laying on its now usual results day presentation for private investors, details are below to book yourself in. It's an interesting meeting, management are open & happy to answer questions. It is usually accompanied with good quality sandwiches, and soft drinks only (probably best, for lunch time meetings);

A presentation for private and retail investors will also be held on Wednesday 26 July 2017, starting at 12.00pm at the offices of Buchanan, 107 Cheapside, EC2V 6DN.

Admittance is strictly limited to those who register their attendance in advance of the event. To register for the event, please contact Buchanan on 020 7466 5000 orstaffline@buchanan.uk.com.

The shares look reasonably priced to me, for a good quality growth company. Albeit in a sector that is generally cheap.

No doubt Guardian readers, requiring a strict diet of masochistic doom in their newsfeed, will be furious that the company is seeing no impact on demand, or supply, from Brexit;

The number of OnSites continues to grow. We are still seeing no change in demand following the EU Referendum Vote and the Group continues to source record numbers of workers to supply this demand.

Veltyco (LON:VLTY)

Thanks to Andrea34l, who pointed out this positive trading update, in the comments section below. I'm not familiar with this company, so can't add any personal comments on it. However, its trading update today sounds excellent;

"The Board of Veltyco is pleased to confirm that trading in the first six months of 2017 has been strong in all business verticals. The revenue and EBITDA for the period January to June 2017 are significantly ahead of market expectations. The Board has confidence in the continued success of the Group and of the business exceeding market expectations for 2017".

A quick skim of the StockReport reveals that this seems to be a company with high profit margins. It seems to operate in a similar space to XLMedia (LON:XLM) coincidentally - marketing for gambling companies. This is a dangerous sector however, as anything to do with digital marketing, can be subject to sudden problems, as we saw a while ago with ad-tech companies shares plummeting.

Any updates along those lines are well worth researching in more detail. So this one certainly looks worthy of a closer look. Reader comments welcomed on this, as I haven't got time to update myself, due to me having to down tools shortly for a long car journey.

As with XLM, the forward PER looks cheap. So providing earnings are sustainable, then it could be a good investment maybe? I'll come back to this one at a later date, when more time is available.

Johnson Service (LON:JSG)

There's a good update today from this (mainly) textiles hire group.

It says;

The Group has continued to trade very well in the first half with the results for the full financial year now expected to be slightly ahead of management expectations.

Whilst that's clearly positive, I'm not keen on this share because the company has taken on too much debt, in my opinion, in recent years, on an acquisition drive. Given that it operates in a cyclical sector, I don't think it's wise to rack up debt in buoyant times, leaving a weak balance sheet, which can cause problems in a downturn.

So personally, I think a degree of caution is needed with this share. It's risen a lot, and now looks fully, or even slightly over-priced, in my view.

That's all I can cover today, as I'll be on the road for the rest of the afternoon.

I'll reply to reader comments this evening, once I'm home.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.