Good morning!

Firstly, I've added a quick comment on an interesting announcement from a double-glazing company, which slipped through the net yesterday.

Safestyle UK (LON:SFE)

Share price: 47.9p (up19.8% yesterday, at market close)

No. shares: 82.8m

Market cap: £39.7m

This double-glazing company floated in Dec 2013, and for several years delivered good results, and rising divis. It all started to go wrong in July 2017. As you can see from the chart below, this is a great example of how it's often best to sell out (if you can) on the first sign of trouble.

The bad news seemed to come out in stages. I've just re-read mine & Graham's articles here in the archive, reporting on each profit warning. The red bars are clearly showing on the candlestick chart above, reflecting each time the company put out another profit warning.

It's interesting to see that in each case, Graham and I commented on how the company looked cheap after each profit warning. However, with earnings forecasts constantly falling, it turned out to be far from cheap. Thankfully we both remained fairly sceptical about the company, and managed to avoid getting caught out catching the falling knife.

It transpired that, apart from cost increases, the big problem seemed to be a new competitor which, I am told, poached staff from SafeStyle, and traded under the name SafeGlaze UK (also known as NIAMAC).

Safestyle launched legal action, described today as being;

... for alleged trade mark infringement, passing off, misuse of confidential information, malicious falsehood and various other matters.

A settlement has been reached, but no financial details are given;

In the settlement, NIAMAC has agreed that the existing court injunctions will be replaced by appropriate undertakings to the court. The settlement ensures that there will be no misuse of confidential information or misleading statements to customers. The settlement governs future relations between Safestyle UK and NIAMAC to prevent the possibility of any acts of intimidation or harassment of Safestyle UK representatives. In addition, SafeGlaze UK has agreed to change trading name and rebrand fully within an agreed period of time.

Further details of the settlement will remain confidential.

My opinion - this clearly seems to be a victory for SafeStyle, but I wonder how much of a difference it will make? SafeStyle will still have an aggressive competitor, just trading under a different name, and not allowed to play any alleged dirty tricks.

The information in the RNS really gives us nothing much to go on, in terms of how to value the shares. So I've had a look on Research Tree, and helpfully there are 2 broker updates, with a lot of useful information & views in them.

It seems to me that there should be some scope for SAFE to recover from its currently loss-making position - forecast operating profit for this year 12/2018 is negative, at £-3.0m.

Personally, I'm just not interested in investing in companies where profits have collapsed into losses, and the bull case is to hope for a turnaround. It seems to me very unlikely that SAFE could recover profits to its previous level. This seems a good example of where a business with no moat, was making too much profit, and that attracted aggressive competition.

Warning - I've looked at one broker's detailed forecasts today, and the previously strong balance sheet now looks worryingly weak. The cash pile has disappeared, and the broker's forecast cashflow statement shows an alarmingly bad forecast free cashflow for 2018 of £-12.0m.

The main problem on the cashflow statement seems to be £-6.0m in "exceptional cash costs". I've looked back to see what these costs might be, and the 11 July 2018 trading update has already explained this, as follows;

The Company expects to report non-recurring exceptional cash costs of c.£6m in the current financial year. These include, amongst other items, the previously-announced fine following the Health & Safety Executive investigation, the costs of the legal action against NIAMAC Developments Ltd and restructuring costs.

The company also said on 11 July 2018 that it has facilities available;

As a result of the loss of profits and exceptional costs in the current financial year, offset by working capital management, the Company expects to report a break-even cash balance at the year-end.

The business has put in place suitable borrowing facilities to ensure that it has access to appropriate funding, should it be needed, to cover these changed circumstances and any other contingency.

That sounds fine in a trading update, but I think the market may well get spooked by how bad the balance sheet now looks, after all these exceptional costs. For that reason, I am now thinking of this share in terms of it being uninvestable.

Interim results are out on 20 Sept 2018, so I wouldn't want to be holding this share on that date, when the stretched working capital position is revealed. Banks don't like lending money to loss-making companies, so this company might need to do a placing to prop up its finances later this year. High risk, in my assessment - based on the latest broker forecasts.

Michelmersh Brick Holdings (LON:MBH)

Share price: 91.5p (up 5.8% today, at 09:05)

No. shares: 86.4m

Market cap: £79.1m

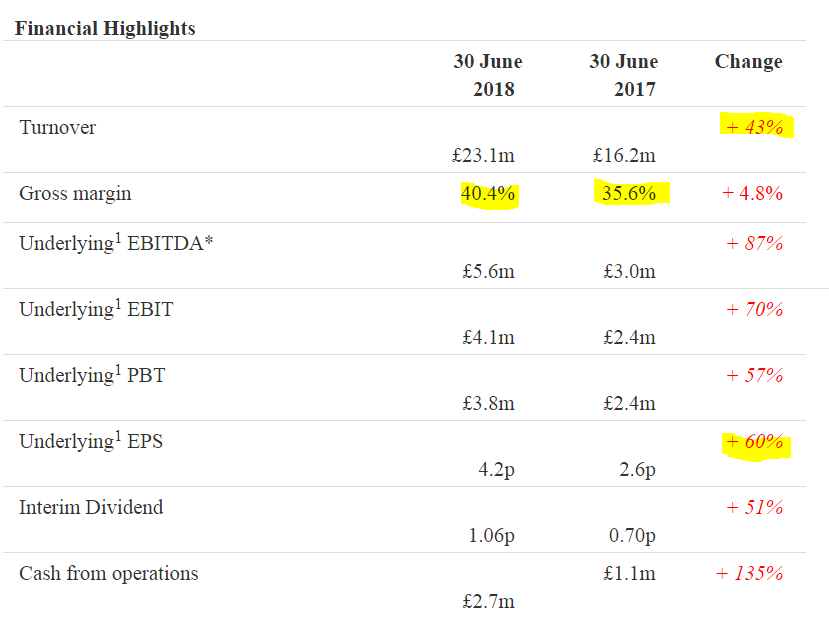

Michelmersh Brick Holdings Plc (AIM:MBH), the specialist brick manufacturer, is pleased to report its half year results for the six months ended 30 June 2018.

The highlights in this interim results statement certainly caught my eye, and look very good. Although it's always sensible to dig deeper into the actual numbers, because the highlights are often cherry-picked by the PR company, in order to present the most favourable view. I've made some expensive mistakes in the past, buying shares on great highlights, only to discover that reality was less rosy.

In this case, the only issue I would flag is footnote 1, indicating that £930k of costs were ignored for the purposes of "Underlying" profits. This relates to reorganisation costs in H1 of 2018. This figure is quite material, at almost 25% of Underlying PBT of £3.8m. I'm not saying there's anything wrong, but I do wonder how exceptional reorganisation costs are? Many companies are continually reorganising.

The last full year results also had exceptional items (relating to an acquisition) of about 25% of operating profit. It's not necessarily a problem, but it's always worthwhile to ask the question of just how reasonable the underlying figures at every company really are. Even if only to reassure yourself that everything is fine. Question everything, as the saying goes.

Where an acquisition has been made, it's useful to find out how much growth is organic, and how much acquired? Having a quick look back through the RNS, it seems that the acquisition of Carlton Main Brickworks Ltd was a material acquisition. Details are here. The net consideration (funded mainly from debt) was £31m, which is 39% of the current market cap - so literally a big deal.

Carlton has a very high EBITDA margin, so this acquisition is probably behind the large increase in the group's gross margin.

Given a large, mainly debt-funded acquisition has taken place, my next job is to check the health of the balance sheet.

Balance sheet - overall this looks OK to me. There's a fair bit of debt, but that's backed up with freehold property assets. I'm not aware of the market value of MBH's properties, but I do recall that in the past there was reckoned to be a good deal of hidden value on this balance sheet.

The Carlton acquisition brought with it land & buildings which were valued at £6.3m.

A few key balance sheet metrics;

Net assets: £60.1m (including intangible assets of £23.5m)

Net tangible assets: £36.6m - this is dominated by property, plant & equipment of £51.4m - so it's a capital-intensive business, as you would expect for a brick-maker - a lot of land & equipment is needed.

Current ratio: 2.09 - a healthy working capital position. Trade receivables & inventories look about right, when compared with revenues & cost of sales.

The long-term element of debt, of £18.0m does not seem excessive to me, given the asset-backing.

Overall then, this balance sheet gets a clean bill of health from me. That's when things are going well. The debt would be more of a concern if the economy goes into a recession, and/or the housing market crashes. That could then wipe out profits, and make the debt worrisome. We do have to remember that house building can be very cyclical.

Outlook - some interesting comments here, of wider interest. So here's the whole section. In summary, it's in line with expectations, if you don't have time to read all this!

The Group has produced another positive trading performance whilst successfully completing both the integration of Carlton and the restructuring of the Michelmersh plant.

Industry statistics support the backdrop that demand for bricks remains strong, with imports filling shortfalls and industry brick stocks near historic lows.

Housebuilders remain confident in the near to medium term. The uncertainty around Brexit does not seem to have entered the activity pattern of housebuilding or the Repair, Maintenance and Improvement market, but remains an unknown that could affect the industry going forward.

Furthermore, two new key high value products were introduced in the first half of 2018 and these will begin to make a positive contribution in the latter part of 2018 and into 2019.

Looking ahead, production in the second half is traditionally lower than the first half due to planned maintenance shut downs.

The strong trading in the first six months also depleted plant stock levels due to high volumes outstripping output.

More widely, energy input prices that have risen over the recent months, are forecast to continue.

Despite this, with the benefits of the significant acquisition made last year, alongside the continued performance of our well invested works and future investment plans, the Board remains confident of delivering results for the full year in-line with market expectations.

An excellent outlook statement there - balanced, clearly explained, and giving us the key information we need.

Valuation - my task here is made much easier due to a Cenkos update note being available on Research Tree. It also contains some really useful valuation comparisons to larger peers Ibstock (LON:IBST) and Forterra (LON:FORT) .

The adjusted, fully diluted EPS forecast for calendar 2018 is 8.2p, with the same for 2019. This gives a PER of 11.2 - that looks about the right price to me, and is in line with its larger peers.

MBH makes higher margin, premium bricks, so arguably the shares should also trade at a premium? Being a smaller company, it also could have bigger % growth potential maybe? Set against that, personally I would rather invest in a more liquid share, so that I could exit rapidly in the event of some nasty macro events occurring.

My opinion - these numbers look good, but the growth in revenues and gross margin seems to have come from a big acquisition. Forecast profit from 2018 to 2019 is flat, so I think it's important not to get carried away with today's strong highlights, as the growth looks to be largely one-off, due to acquiring Carlton.

The balance sheet looks OK to me.

The valuation seems about right.

Forecast dividend yield looks alright at 3.7%

Overall it looks OK, but I can't see any particular reason to rush out and buy this share - especially at a time of macro uncertainty.

There could be an angle here for possible upside from surplus property, but I haven't got any information about that. Have any readers looked into the property assets? If so, please feel free to add a comment below.

With the share price having almost doubled from early 2017, and struggling to get through 100p, I do wonder if banking some profits might not be a bad idea at this stage? I'm nervous about anything housebuilding-related, because of the possible withdrawal of the Government's ridiculous "Help to Buy" scheme - which has just pushed prices up.

Utilitywise (LON:UTW)

Share price: 26.1p (down 7.5% today, at 10:53)

No. shares: 78.5m

Market cap: £20.5m

This company seems to be permanently in crisis. We've long been sceptical of it here at the SCVR. We cannot rely on the reported numbers, as the revenue recognition chops & changes to such an extent that I don't think anybody really knows if & how much its genuine profits are.

Today's is clearly another poor update, for the year ended 31 July 2018;

Order book delivery (is this revenues presumably?) down 16% to £55.6m

Closing order book down 17%

New auditors PWC are reviewing the revenue estimation policy - seriously! You couldn't make it up - this issue has been rumbling on for years now

Net debt of £17.5m, down 8% year-on-year

A few sweeteners, with some KPIs showing positives, but it reads to me like an attempt to polish the proverbial ****

My opinion - remains highly sceptical. The company seems to be trying to attract higher quality business, and sort out ongoing issues, but this hardly instils confidence;

The significant adverse impact on the business during the second half of FY18, as a result of the delay in announcement of the Group's results for the year ended 31 July 2017 ("FY17") and temporary suspension of the Company's shares from trading. The operational and commercial impact was greater and more far-reaching than the Board had expected...

That sounds like another profit warning, but we're left scratching our heads, as nothing specific is said today about profits vs market expectations. I'm not convinced by the explanation given. After all, temporary suspension of the shares, whilst the accountants work out what the profit figure is, really shouldn't affect the day-to-day operations of the business.

Overall, this just looks a lousy, badly-run business. I can't help wondering if the best course of action might be to just go into run-off, and collect in the long backlog of debtors over time?

Given the scale of today's shortfall in order book, I think there's a risk this company could go bust, hence I regard it an uninvestable.

Seeing Machines (LON:SEE)

Share price: 6.65p (down 34.8% today, at 11:15)

No. shares: 2,253.4m

Market cap: £149.9m

Fleet business unit update (profit warning)

Everyone's worst nightmare - an intra-day profit warning.

I won't regurgitate the detail. Basically, previously announced problems are worse than expected, and;

... have led the Board to conclude that the Company's revenues for FY2019 will be materially below current market expectations.

The year end is June 2019, so this is quite early on in the current year.

I'm tempted to point out that SEE never seems to get anywhere near forecast revenues, so why is this a surprise?

Automotive sector - the above warning concerns the Fleet sector. However, this is not the main focus of the company, which is actually on the more exciting opportunities in the automotive sector, where a lot of work is going on with big car companies.

Some encouraging-sounding noises are made about that in today's update.

My opinion - this could be a buying opportunity, as today's profit warning is largely unrelated to the main opportunities the company has (in automotive). Obviously speculative, but that was the case already.

The market cap includes a lot of hope value, especially given rather poor execution to date. However, it does have a big market opportunity in the automotive sector, with legislation-driven requirement for more driver safety aids.

Some brief comments to finish off with today;

Cambria Automobiles (LON:CAMB) - another car dealer reporting in line with expectations performance (Vertu Motors (LON:VTU) did the same yesterday). Lots of detail is provided in today's update, concerning changes being made to the sites which it owns/operates.

Reduced new car demand has been partially offset with good used sales & aftersales.

The PER of 7 is attractively low for this share, and it owns plenty of freeholds too.

It mentions confusion over Government's mixed-messages on diesel cars. Notes some vehicle supply constraints.

Not really a sector I want to revisit at the moment, unless/until valuations become crazily cheap (e.g. sub-5 PER). There's too much uncertainty at the moment to justify paying any more than that, in my view.

Dillistone (LON:DSG) - too small and illiquid, so I dumped my small position in this a little while ago, no plans to revisit.

There is an update on the new Gated Talent offering. 1,000 CVs being uploaded per week doesn't strike me as very impressive, but it's a start.

Gattaca (LON:GATC) - is withdrawing from some overseas markets, which will incur £3m in costs, but release £7m in working capital, helping reduce net debt.

The company has disappointed once too often for me, so I have no plans to revisit this one.

McColl's Retail (LON:MCLS) - trading update says Q3 LFL sales down 0.9%.

Down is not good enough, since costs are rising.

Supply chain disruption.

No mention of how profits are vs market expectations.

It's just not a very good business, with a tiny profit margin and a weak balance sheet. I have no idea why anyone would want to invest in this company. I wouldn't rely on the high divi yield being maintained.

Johnson Service (LON:JSG) - interim results to 30 June 2018.

Surprisingly good actually, as I would have assumed that pressure on the hospitality sector might have hurt this provider of workwear. Apparently not.

Organic growth of 7.2% is impressive.

Full year results should be slightly ahead of market expectations - good stuff.

Pension deficit - note that recovery payments of £1.9m are payable in 2018, so a bit of a drain on cashflow.

Balance sheet - too much debt.

Looks fully valued to me.

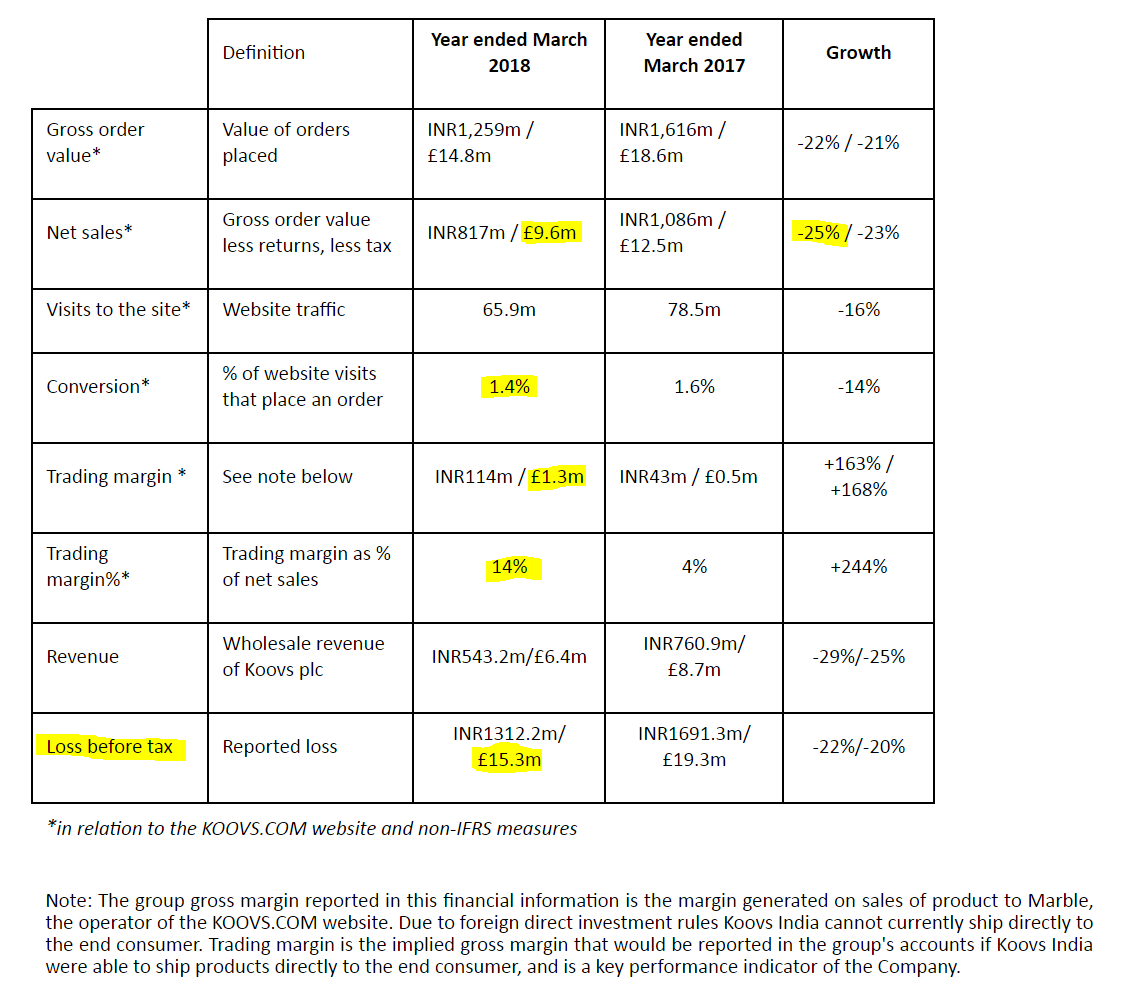

Koovs (LON:KOOV) - another year, another set of diabolical figures from this eCommerce fashion business, operating in India. It's been listed since Mar 2014, so there should have been some decent growth by now.

The figures announced today are for y/e 31 Mar 2018 - very late, mainly because the company has struggled once again to raise enough cash to keep going. A deal has been done to get advertising in India in return for a series of new share issues, which look like being highly dilutive.

Every year Koovs reports terrifically positive sounding narrative, prefacing diabolical actual numbers. This year's the same format. The way the numbers are reported is a bit complicated, because Koovs plc has to act as a wholesaler to Koovs.com, in order to circumvent Indian laws on foreign ownership - see the footnote to the table below, taken from today's results;

It's really not worth spending much time on this table, because however you look at it, the company's revenues are going down (lack of funding for marketing), and it generated a massive loss of £15.3m - considerably larger than website net sales of £9.6m.

Losses for early stage growth companies are acceptable if;

(a) Revenues are rising at triple-digit percentages year-on-year, and

(b) There is a strong gross margin (ideally 50%-ish) delivering great operational gearing.

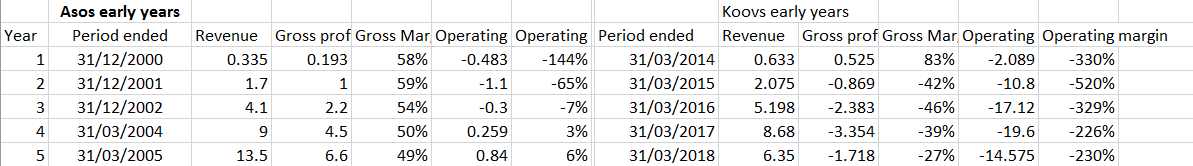

Neither is the case with Koovs - revenues are actually now falling, a lot, at -25% in local currency for the year. And its gross margin of only 14% is just pathetic, although an improvement on the prior year's laughable 4% gross margin.

My opinion - as you can see from the figures, it's going nowhere fast, and burning through cash at an unsustainable rate.

The latest cobbled-together fundraising gives it a mixture of some cash, and free advertising in return for issuing lots of new shares. This means that, even if the growth does resume, existing shareholders are going to see dilution.

People like to punt on stories, rather than analysing the numbers. So the (now very tired) story that Koovs could become the Asos of India, is all very well - but the numbers say that it's a million miles away from

Of course, if sales & gross margins do start to shoot up, and costs drastically reduce, then this could yet become a successful business. I'm keeping an eye on it, because if the business does reach an inflection point where performance gathers momentum, then that would be the time to dive in and buy some shares.

Currently we're nowhere near such an inflection point, hence why, for me, the only logical stance is to consider Koovs uninvestable. If the facts change favourably in future, then I'll alter my stance on it. There are no emotions involved, it's just a question of crunching the numbers and forming a logical view based on those facts.

I've prepared a little table, showing the first 5 years results of ASOS (LON:ASC) , side by side with the first 5 years results from Koovs (LON:KOOV) . As you can see, they're like chalk & cheese. I'll try to put them into some graphs later, but am a bit rusty on Excel charts, and I absolutely hate the new version of Excel, as it's so complicated!

(source - accounts from Companies House)

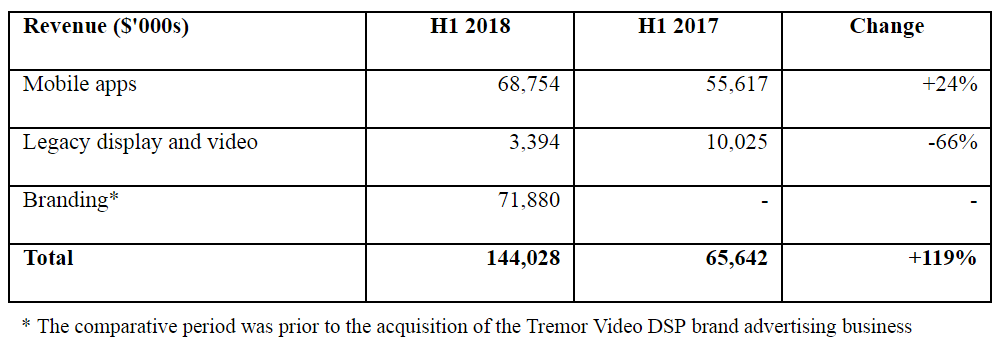

Taptica International (LON:TAP) -

Taptica (AIM: TAP), a global leader in advertising technologies for performance-based mobile marketing and brand advertising, announces its interim results for the six months ended 30 June 2018.

Headline growth looks stunning, but a table below shows that the growth has mainly come from the acquisition of a brand advertising business called Tremor Video DSP. It's good that the company is transparent in its presentation of the growth, using this table;

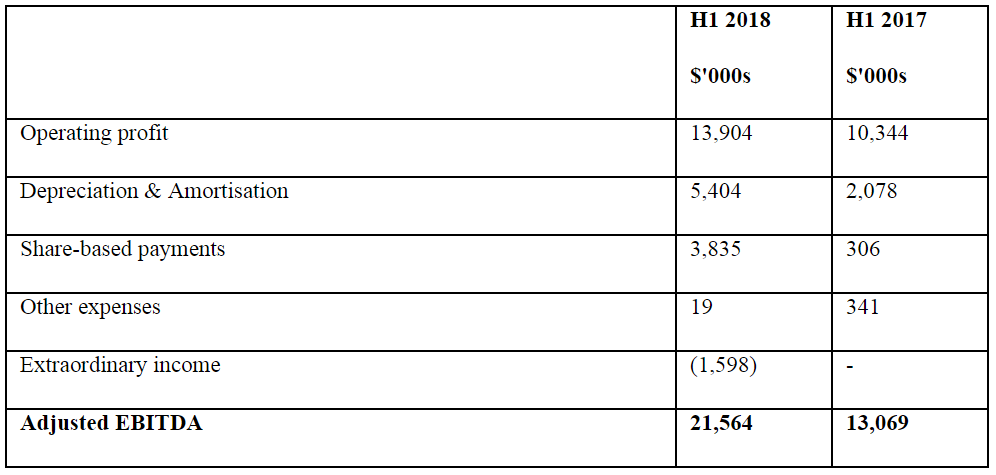

There's also a nice clear table below, reconciling operating profit to adjusted EBITDA;

Outlook - more detail is given, but this is the important bit;

As a result, the Board is confident of delivering significant year-on-year growth with EBITDA ahead of market expectations.

More acquisitions are in the pipeline, primarily funded from existing resources.

Balance sheet - looks very good, with plenty of cash.

Valuation - I haven't got a clue where to start with this, as I just don't understand this sector. Thankfully, FinnCap has issued an update today, available on Research Tree, giving a 14% upgrade to its calendar 2018 EPS forecast. This is now 49.4 US cents, which converts to 38.5p. Divide that into the current share price of 355p (up 2.9% today, at 16:22), and I make that a current year forecast PER of only 9.2 - that seems remarkably cheap, for a cash-rich company generating good results, and having earnings upgrades.

My opinion - this share has come up on my GARP screens before, and I've dabbled in it, making a nice little profit. Although I've never felt comfortable holding the share, because I just don't understand what it does, nor have I any idea how sustainable its profits are.

If profits are sustainable, and the overseas/AIM thing doesn't worry you, then it could be worth a closer look. This is a risky area though. In the past, AdTech shares have collapsed unexpectedly. Also, a similar sort of company, XLMedia (LON:XLM) which looked amazingly good on paper has fallen out of bed this year, halving in price. For these reasons, I'm very wary of going near TAP. However, for people braver than me, there could be a re-rating on the cards here, for a quick 20-30% gain, possibly, on the back of forecast increases today and putting the cash pile to work with more acquisitions?

It looks like a chart breakout too, with a nice base having formed in recent months. Still well below the peak back in Jan 2018. Hmmm, I'm quite tempted to have a nibble here, for a trade rather than an investment.

Dalata Hotel (LON:DAL)

Share price: 611.5p (down 3.4% today, at market close)

No. shares: 184.3m

Market cap: £1,127m

Dalata Hotel Group plc ("Dalata" or "the Group"), the largest hotel operator in Ireland with a growing presence in the United Kingdom, announces its results for the six months ended 30 June 2018.

This one is a reader request. Naughty readers, as the £1.1bn market cap is way over my usual upper limit, but by the time I realised that, I'd already done some work on it! So might as well write something about what looks quite an interesting share.

It operates under the Clayton and Maldron Hotels brands. I've had a quick look on its website, and on TripAdvisor, and they look decent quality mid-range, 4-star hotels. The reviews on TripAdvisor seem solid, but unspectacular, at 4/5, with most people apparently happy with their stays.

Reviewing the StockReport quickly, these points jump out at me;

- Strong growth in revenues & profits in recent years

- Very good profit margin

- Maiden dividend forecast for this year

- Low corporation tax charge - which makes sense as its hotels are mainly in Ireland

Balance sheet - this is my first port of call with hotels groups' accounts, as I can quickly eliminate anything that's too highly geared.

This balance sheet looks terrific! The company seems to own the freeholds, or long leases, of most of its hotels. I really like that, as it safeguards the balance sheet, and means that shareholders benefit from the long-term increase in property values.

Property, plant & equipment is E1,116m, of which E955m is land & buildings.

Net debt is only E276m, so that's a modest Loan To Value on the properties of only 29%. This strikes me as a very solid balance sheet, with scope to even take on a bit more debt without stretching things.

My opinion - I haven't got time to dig any deeper, as it's getting late now. However, my initial review of this company is favourable. It has more expansion in the pipeline, and it could be an interesting long-term share to hold. Worth a closer look.

How about this for a lovely chart - a steady up-trend, with little volatility. That rock-solid balance sheet certainly makes this a sleep soundly investment.

Severfield (LON:SFR) - a reader request for me to look at today's trading update.

There's not really anything to say - it's trading in line with expectations;

The Group's trading performance and financial position remains in line with management expectations and the outlook for the year ending 31 March 2019 remains unchanged...

Sorry I didn't get round to reporting on Filta, Codemasters, or Boku. I had a quick look at the announcements from them, but couldn't see anything of interest to me. Also, I've run out of mental bandwidth for today.

See you in the morning!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.