Morning all! Paul here.

Sosandar interview

Just to say, my interview with Sosandar (LON:SOS) management (in which I hold a long position) has been delayed until next week, due to delays from my side collating all the questions & planning the thing. Sorry about that. So there's a window for any late questions from you - please add any additional questions into the comments section below. Thanks.

Buying opportunities?

I've been mentioning for a while, how the recent market sell-off seems to have been fairly indiscriminate in nature. This has created (selectively) some smashing buying opportunities. Indeed, we're seeing strong rebounds in some shares recently, on reporting good news.

Some people like to imagine that the chart tells us everything about the company. Sometimes it does (e.g. if insiders are selling, due to a poor outlook), but sometimes it really doesn't, especially with small caps. All the chart is actually telling us, is a gauge of the current balance of investor sentiment. In a small cap that can be the actions of just a handful of people transacting in the marketplace. Everyone else is doing nothing - as the bulk of the shareholder base will not be transacting at all, most of the time. Institutions generally don't buy in the market for small caps, because there's inadequate liquidity. Buyers & sellers could be backed up, unable to trade in the size they want.

Put this together, and it means that, at times of high investor anxiety over macro factors, small cap prices can deviate considerably from what is logical. Therein lies our opportunity.

Here's a great example of what I'm talking about;

Water Intelligence (LON:WATR)

Share price: 396p (up 10.0% today, at 08:19)

No. shares: 15.23m

Market cap: £60.3m

January corporate transactions & technology update

Water Intelligence plc (AIM: WATR.L), a leading multinational provider of precision, minimally-invasive leak detection and remediation solutions for both potable and non-potable water is pleased to announce a series of corporate transactions that reinforce its growth trajectory for 2019 and beyond.

Several actions re franchises are mentioned. I like the bit I've bolded below;

These transactions underscore that American Leak Detection ("ALD") and UK-based Water Intelligence International ("WII") business lines are complementary and growth is accelerating.

New product launch - this sounds intriguing, I'd like to find out more about this, to assess the potential scale of the opportunity ;

Formal launch of ORCA municipal sewer product into the United States following trials at a UK water utility

Trading update - it sounds like they're not quite ready to put out FY 12/2018 figures, but give a positive steer;

A broader discussion will be set out in the next few weeks with a 2018 Trading Update that reinforces our previous strong guidance. The Company is currently closing its December franchisee royalty reporting on schedule.

Directorspeak - the Exec Chairman sounds very upbeat today. When management make very bullish comments, it's important to check back and verify their track record - i.e. what did they say in the past, and how did reality actually pan out? Serial over-optimists are best avoided. I don't know what the track record is like here, perhaps any readers who are more au fait with the company could comment on this?

Dr. Patrick DeSouza, Executive Chairman, commented: "We are off to a fast start in 2019. These transactions unlock significant shareholder value both from synergies and expansion into new offerings.

Water Intelligence is scaling operationally with multiple business lines and can execute such complementary transactions again and again going forward to reinforce sustainable growth - an objective that I have previously stated.

It is important to remember that given the size of the global water and infrastructure market that we are just at the beginning of creating significant shareholder value with a great company and brand. I look forward to updating the market on our 2018 results."

Bold words! Let's hope it pans out as well as Mr DeSouza suggests.

My opinion - the share price already factors in a lot of good news - the PER is very high, at 33.6 times 2019 forecast earnings. That leaves no room for disappointment. Investors clearly like, and believe, the growth story. A PE rating in the 30s is getting into territory where investors are pricing in above expectations earnings growth.

It would be good to find out more about the new sewer product. If that has potential to become a major, highly profitable product, then the current PER looking high doesn't matter.

Going back to my point in the intro, here's a chart which dropped in the broad market sell-off, but should not have done so. Well done to holders who ignored the market's background noise! How about this for a rebound;

This is a great example of how, in small, illquid shares, the chart can at times become completely detached from fundamental reality. Only traders dealing in the tiniest quantities, would have been able to sell, and buy back at the right times - and only then if they were lucky with regard to timing. Plus 2 lots of the wide bid:offer spread would make it hardly worthwhile.

This is why, if I'm absolutely certain about a company being a long-term winner, then I tend to just ignore the market price gyrations, and suffer the pain of any drawdowns.

Amino Technologies (LON:AMO)

Share price: 91.5p (down 15% today, at 09:28)

No. shares: 72.8m

Market cap: £66.6m

Final results (and 2019 mild profit warning)

Amino, the global provider of media and entertainment technology solutions to network operators, announces audited consolidated results for the year ended 30 November 2018.

Poor figures for 2018 are out today, but this is as expected. FinnCap says today in an update note, that the numbers are in line with the Oct 2018 profit warning (see chart below), and an update in Dec 2018.

I've double-checked to my notes on the profit warning, here on 8 Oct 2018, and the figures & comments are indeed very similar to what's in today's results announcement. Good thing I decided not to catch that falling knife, as the share price has fallen from 148p (down 30% on the day) on the morning of the Oct 2018 profit warning, down a further 38% from 148p to 91.5p today. Is it starting to get into interesting territory, valuation-wise? I think it's starting to look potentially interesting. Let's go through the figures.

Dividends - this is the main reason to take an interest in Amino. As they promised, the dividend has been raised 10% to 7.32p. That must be the small interim divi and the larger final divi combined. At 91.5p the yield is a delicious 8.0%. It's still covered by both adjusted and statutory earnings too.

Ability to pay divis is probably more important than the actual level of divis. In this case, Amino has plenty of cash - year end net cash is $20.3m, up 17%

Dividend policy;

The Board has recommended a full year dividend of 7.32 GBP pence per share, a 10% increase over the prior year. The Board also intends to continue this level of dividend for at least two years.

Put another way, anyone buying now, should get back about a quarter of their investment in divis, over the next 2 years and 3 months. That's an attractive proposition, especially for shares held in a tax-free wrapper such as SIPP or ISA.

Balance sheet - looks fine, even when you write off intangibles.

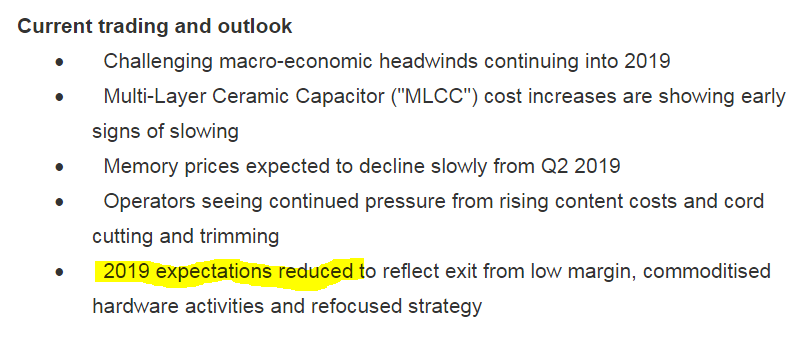

2019 profit warning - given that 2018 figures reported today are as expected, the 15% share price fall must be due to outlook comments being adverse.

Forecasts for 2019 have been reduced from consensus of $0.15, being flat on 2018, to a revised figure today of $0.129 for 2019, and a similar figure $0.13 for 2020 (source: house broker update note, out today)

That's a 14% drop in 2019 forecast earnings today, so the 15% fall in share price this morning makes sense. Although the big dividend yield is probably now supporting the share price - so I would guess that there might be only limited downside now, as income seekers become more attracted to the share. That's providing nothing else goes wrong, of course.

Cost savings - of $4.4m annualised have already been implemented. Additional $5.0m annualised savings identified.

Transformation programme - I cringe when that phrase is used, as it usually means things are going wrong, and a whole heap of exceptional costs need to be incurred.

To summarise;

- Exit from low margin hardware activities

- Focusing on software, added value services, and recurring revenues - organic, and by acquisition

- More cost savings, as mentioned above

- Simplified product portfolio

- Changes will be complete by April 2019

My opinion - I'm getting increasingly tempted by the very high dividend yield - which looks fairly safe, as it's covered by earnings, and cash in the bank.

Amino has a good track record of cash generation & decent divis.

My main worry, is that I know nothing about the sector it operates in. Therefore I could be attracted to a superficially cheap share, only to find out later that the company was withering away due to competitive pressures. With this is mind, it would be great to hear from any readers who are sector experts in Amino's space, to get a feel for how its products measure up versus the competition.

RM (LON:RM.)

Share price: 243p (up 6.6% today, at 11:34)

No. shares: 83.9m

Market cap: £203.9m

RM plc ("RM"), a leading supplier of technology and resources to the education sector, reports its final results for the year ended 30 November 2018.

Several readers have asked me to look at this, so suppose I ought to oblige. My last review of the company here was in May 2014, so arguably we're overdue an update! Graham reviewed its last interim results here in July 2018. He pointed out positive trading. Also that the company claims to have a strong balance sheet, which it doesn't (negative NTAV). It's surprising how often that is the case - hence why narrative claiming to have a strong balance sheet is an amber flag for me.

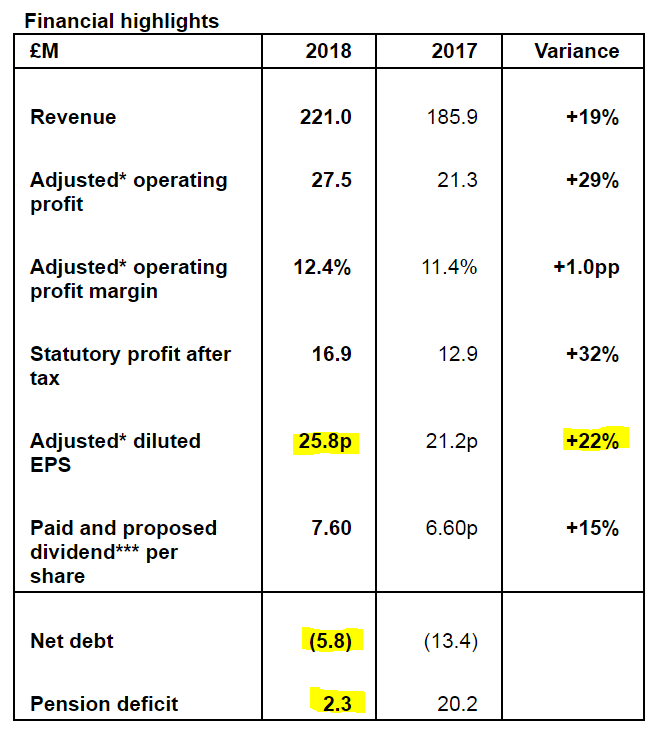

The highlights figures look great, as you can see below. Note that organic revenue growth was only 2%, with the bulk of the total 19% growth coming from an acquisition.

Also note from this table that net debt, and the pension deficit, are nicely down;

Valuation - based on today's 243p share price, and the adjusted EPS number highlighted above, the PER is only 9.4.

Dividends - up 15% on prior year, to 7.6p - yielding 3.1%

Outlook - it's difficult to ascertain much from this;

The RM Group has undergone substantial change in recent years. The newly consolidated RM Resources stands to benefit from distribution synergies to counteract anticipated price pressure as customers move increasingly online, RM Results is much invigorated both in UK and overseas, and RM Education, having dealt with substantial legacy issues, has developed its continuing businesses.

Notwithstanding macroeconomic uncertainties, the Group enters 2019 in a good position.

Pension deficit - has dropped considerably on an accounting basis, from £20.2m last year, to only £2.3m this year. Whilst good news, the cash contributions may not necessarily fall so much, as they're worked out differently. Cash contributions are hefty, at £4.6m p.a. presently. Agreement on the next triennial valuation (which will determine cash payments) is expected soon.

Remember that cash payments into pension schemes is money that would otherwise be paid out in divis. Hence probably why the divi yield here is only 3.1%.

Net cash/debt - year end net debt was only £5.8m, however it turns out this is not a typical figure. As we know, balance sheet cash/debt positions are often window-dressed to look better than reality at other times of the year.

RM is to be commended for addressing this point, and telling us the full truth;

The average net debt position during the year was £24.1m with the highest borrowing point being £32.8m.

I feel very strongly about this - all companies should be compelled to report the average & highest points of net debt throughout the year. These are key numbers that investors need to know, but are rarely reported. Top marks to RM & its advisers for being so transparent.

The only way enterprise value makes sense, is by using the average cash/debt number, yet this is not usually available for most companies - which makes enterprise value based on year end cash/debt snapshots a very shaky concept in valuing companies.

Balance sheet - overall it's weak, with negative NTAV of -£8.7m.

However, given the group's strong profitability & cash generation, the balance sheet looks sustainable, and hence is not a concern.

My opinion - this looks rather interesting, I like it! Thank you to the readers who pointed me in the direction of this share. It certainly looks worthy of further research. From what I can see, it seems a modestly valued group, which is performing well.

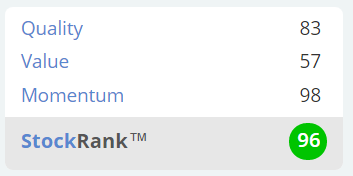

Stockopedia loves it, with a "Super Stock" classification, and a StockRank of 96. As we know, this is not infallible, but it is proven to move the chances of success in the right direction;

Note how the 2 year chart looks so similar to that of WATR above - a spurious sell-off in H2 of 2018, now completely reversed in a thundering recent rebound!

OnTheMarket (LON:OTMP)

Share price: 93p (up 0.5% today, at 16:28)

No. shares: 61.5m

Market cap: £57.2m

(at the time of writing, I hold a long position in this share)

This is a residential property portal, challenging the dominance of Rightmove & Zoopla. The point of difference is that it is part-owned by estate agents, who will therefore benefit if it succeeds.

Rapid growth is being achieved, by using free trials to entice agents to use it initially.

The company keeps putting out RNSs, saying how rapidly the number of agents is growing - hardly surprising, when the service is offered free of charge. These announcements don't seem to be impressing the stock market at all, as you can see from the chart below.

This is what it said today, which has put all of 0.5p on to the share price;

OnTheMarket plc, the agent-backed company which operates theOnTheMarket.com property portal, is pleased to announce that, as of 31 January 2019, it has listing agreements with UK estate and letting agents with more than 12,500 branches. This is an increase of more than 7,000 branches in just under a year since Admission to AIM in February 2018.

It remains to be seen whether the free trials will convert into paying customers.

As a punt, it looks interesting, in my view. Any sign of real commercial traction, and the lowly market cap could really zoom up. Whether or not that happens, who knows? The broker forecast, suggesting a sudden move from heavy losses into big profits, don't look realistic to me.

Carpetright (LON:CPR)

Share price: 19.75p (down 6.1% today)

No. shares: 303.8m

Market cap: £60.0m

Carpetright plc, Europe's leading specialist carpet and floor coverings retailer, today announces a trading update for the 13 week period to 26 January 2019.

In line with expectations

- Negative LFL sales in UK, but improving trend (no figures given, so probably pretty bad)

- Europe doing better, especially the Netherlands

- Cost savings of £19m oin track, per CVA

- Long-serving CFO is stepping down. Sounds amicable. New CFO lined up

Tapi - Carpetright is struggling particularly because its retired founder's son, set up a direct competitor, Tapi, which strikes me as being a bit off. Here's an interesting article on that subject.

This article indicated that Tapi is heavily loss-making, but that fact was swatted away by Tapi's management as expected startup losses. I'm having a rummage at Companies House, and note that Tapi has 25 active Directors, which seems odd. Maybe the strategy is to lock in key people with shareholdings & Directorships? Ah yes, note 6 of the 2017 accounts, says - "There are no key management personnel other than the directors".

The latest figures at Companies House for Tapi are for FY 12/2017, so a bit dated now (that's the trouble with private company accounts). However, this section in the commentary is rather revealing - clearly Tapi is eating a fair chunk of Carpetright's lunch, at high gross margins too;

So Carpetright can bellyache as much as it likes about weak consumer confidence - that's clearly not the problem - a new, national competitor is its main problem. There's also the issue of losing good staff to Tapi.

The fact that Tapi has founders with very deep pockets, made from their Carpetright shares, who can afford to run Tapi at a loss, is a big concern. Tapi reported revenues of £57.0m in 2017, generating a £10.9m loss before tax.

Tapi's operating lease expense (disclosed in note 4 of its 2017 accounts) looks extremely high, at £13.9m. That's over 24% of revenues. Could it be that Tapi may have made the same mistake as the pre-CVA Carpetright, in signing up for excessively rented stores?

Employee costs (see note 5) of £13.2m in 2017 at Tapi also looks excessive. That's a massive 23% of revenues, which as any retailer will tell you, is far too high. That would include all wages though, including warehouse & head office, not just the stores.

The "other creditors" in note 12 are enormous at £17.7m, and are spread in tranches over 1-5 years. That suggests to me these might well be capital contributions from landlords, which have to be parked on the balance sheet and amortised. This suggests to me that Tapi might have signed leases with high rents, but huge cash bungs (reverse premiums), to fund its capex. That helps cashflow in the short term, but makes it difficult to trade profitably,, as rents are too high.

Overall then what do I make of Tapi's accounts? They look pretty awful to me. Maybe the Harris's have created a monster here, running at big losses, with apparently uneconomic rents & staff costs? The only logic I can see for doing this, is if they think they can run Carpetright into the ground, so that it goes bust, and Tapi gets all its business, which would then make Tapi profitable. That strikes me as a shabby way to behave. Most families that have made a fortune from a business would just retire to a warmer climate, and enjoy the fruits of their labour.

My opinion - I see CVAs as usually deferring the inevitable failure of declining companies. Carpetright probably fits into that bracket, for as long as Tapi can keep going, and eating its lunch.

I'm really glad I reviewed Tapi's accounts, as that has completely put me off investing in Carpetright (which wasn't high up on my list of priorities in the first place).

It seems to me we could see this as carpet wars - a grudge match, with two struggling companies slugging it out, until one of them goes bust. Tapi's founders have got the deeper pockets, so providing they're happy to keep pouring cash into loss-making Tapi, then ultimately they're the likely victor.

Therefore, to me CPR shares have to be viewed as currently uninvestable.

The wild card would be if Tapi's backers pull the plug on it. That would then make CPR look a lot more interesting.

Elektron Technology (LON:EKT)

Share price: 44p (unchanged today)

No. shares: 186.1m

Market cap: £81.9m

Elektron Technology plc, the global technology group, is pleased to provide updates on trading for the financial year ended 31 January 2019 (FY19) and a strategic update for the Group.

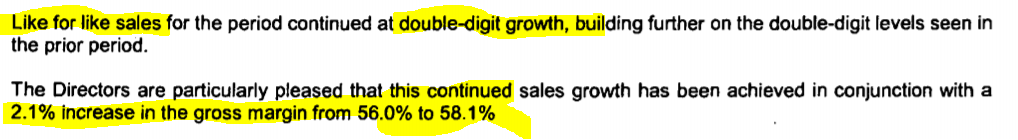

Group trading - this all sounds pretty solid;

The Board expects performance for the full year to be line with the upgraded market forecasts notified in the trading update on 1 November 2018.

Group revenue from continuing operations (on a like for like basis) for the full year is expected to be approximately £33.7m (unaudited) a 13% increase compared with £29.8m for FY18, building on the strong, double-digit growth of 11% in FY18 compared with the prior year.

Revenue in the second half of the year of £17.8m was substantially stronger than the first half (£15.9m) as a result of the conversion of Bulgin's strong H1 order book to sales revenue.

Cash - has risen from £5.2m a year ago, to £10.1m at 31 Jan 2019.

Order book - is bulgin' (sorry, couldn't resist that!);

Bulgin ended the period with both sales and orders significantly ahead of the prior year driven by the continued successful implementation of Bulgin's high margin product growth strategy, aided by operational gearing and in-house capacity improvements.

Bid approach - this made me sit upright and pay attention;

During the second half of the year, the Board received an unsolicited indicative offer for the Bulgin business at a substantial premium to the Group's current market capitalisation.

The Board engaged with the potential overseas buyer, incurring in the region of £200k of due diligence related costs. Following this extensive due diligence which confirmed the business's trading performance and prospects, the offeror decided not to proceed for its own strategic reasons.

Call me old fashioned, but if a bidder does due diligence, and then pulls out, then they've probably decided that the original approach was not such a good idea, for whatever reason.

Outlook - limited in timeframe, but positive;

The order book has continued strongly into the new financial year and Q1 sales are expected to set a new record.

US-China trade tariffs sound like a good opportunity;

With Bulgin manufacturing predominantly in Tunisia, Bulgin is well placed to capitalise on the current 25% tariff for Chinese electronic component goods imported to the United States, Bulgin's largest market.

My opinion - this share looks quite good.

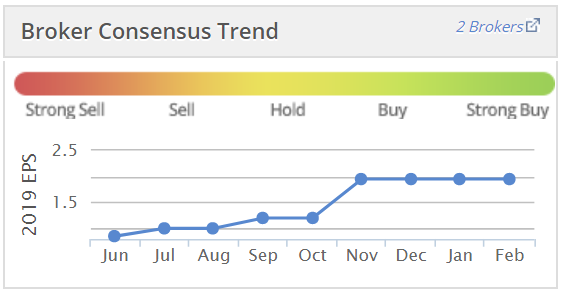

I see that broker forecasts have been steadily raised over the last year, which is a positive thing to look for;

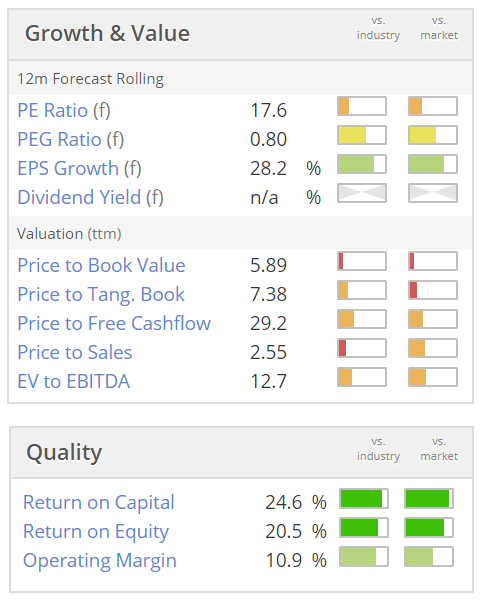

Valuation looks a bit toppy, for an electronics component manufacturer - not a sector that interests me anyway, and certainly not at an elevated price;

The big problem with this sector, is that there's a huge amount of competition. So companies which find a high margin niche, can end up seeing new entrants copying their products & selling them cheaper.

You can see from the 10 year chart below, that there seems to be a cycle, of product innovation, growing profits, then those products going into decline, as competition erodes the profits. I vaguely recall this happening about 14 or 15 years ago too, when I was offered some shares in a placing, to refinance the original group which had gone bust. My memory's a bit hazy on that, due to the passage of time.

There are no dividends from Elektron either, which is a problem for me. This type of business would only interest me if profits were sustainable, and it was on a low PER, and throwing off big divis. Good luck to holders, but it's not of any interest to me. Although the bid approach does sound intriguing! Maybe I'll keep half an eye on it.

A couple of quickies before I pop out for some dinner & a couple of pints.

Safestay (LON:SSTY) - nicely branded hostels. Says it traded positively in 2018, but only mentions EBITDA not profits, of £3.4m (barely higher than £3.2m in 2017).

Poised for European roll-out.

Says it will become "self-funding" when it reaches 20 sites (currently has 13).

To me, this just seems a lousy business model - requiring huge amounts of capital, to generate (so far) no return at all for investors. It has to repeatedly dilute investors, to continue expanding.

The upside case is if it gets really established as a brand, and occupancy levels rise from the current 75.6%.

Gama Aviation (LON:GMAA) - I last looked at this in Oct 2018 when it fell 20% to 121p on a profit warning. It's since plunged to only 67p - yet another one where selling at the first sign of trouble would have been wise. That's often the case, apart from when it's not.

Today's RNS is titled "Receipt of overpayments" - surely that's a good thing? So why is the share price down 23% today?

The reason is that this looks very bad;

Gama Aviation Plc today announces that it has identified the receipt of two overpayments, in error, from Gama Aviation LLC, its US Air associate. $5.75m and approximately $2m were received in June 2018 and December 2017 respectively and were reported in cash and trade creditors in the respective half and full year reporting periods. Both of these overpayments have been re-paid in full.

A strange coincidence that the cash balance got inflated just before two balance sheet dates, isn't it? By accident.

That's me done for today! See you tomorrow.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.