Good morning, it's Paul here!

Here's today's usual placeholder. I'm making an early start today, in order to cover today's news, and then circle back to finishing off yesterday's report, plus telling you about my meeting yesterday with management of Revolution Bars (LON:RBG) which went very well. There was so much to take in, that by the time I got home yesterday, I'd used up all my mental bandwidth for the day. That's the trouble with trying to write a report, and have meetings on the same day.

Taking a quick look at the day's top % movers (at 09:10) which fall within my remit;

Bilby (LON:BILB) - down 39% on a trading update - must be a profit warning, I'll look into that below

WH Ireland (LON:WHI) - down 29% to 45.5p on news of a discounted £5m placing

Swallowfield (LON:SWL) - down 13% on interim results - I'll take a closer look below

Looking at risers, the ones that interest me today are;

Netcall (LON:NET) - up 14% to 34.5p on interim results

SimplyBiz (LON:SBIZ) - up 6% to 192p on full year results. I've reported positively on this company before, so will review these results below

That's my initial to do list, so let's get cracking.

Bilby (LON:BILB)

Share price: 40p (down 39% today, at 09:42)

No. shares: 40.5m

Market cap: £16.2m

Bilby Plc, a leading gas heating, electrical and building services provider, announces the following trading update for year ending 31 March 2019.

Checking back through my notes here on 11 Dec 2018, this contracting group put out a mild profit warning.

Today it warns again, due to problems with various contracts. That's the Achilles Heel of contracting type businesses, and why I avoid this sector altogether now. The work tends to be low margin (due to competitive pressures), and sooner or later something awful seems to go wrong with contracts, leading to cost over-runs, disputes, etc.

Helpfully, the company does today quantify the likely outcome for the year;

As a result, P&R, through which the Company was undertaking both contracts, will now report a significant loss for the full year. Accordingly, the Board expects the trading losses and associated write offs at the division to lead to the Group reporting a positive EBITDA of between £2.0 to £3.0 million before non-underlying restructuring costs and losses associated with the termination of the contract for Ministry of Defence properties. Whilst the future of gas services within the P&R division is now being reviewed, it remains a core service for the rest of Group.

The other divisions of the Group continue to trade well and in line with management expectations for the current year.

My opinion - as you might have gathered, this share just doesn't interest me at all, at any price.

There's little in the way of balance sheet support - net tangible assets are positive, but small. Exceptional costs look likely to weaken the balance sheet when next reported, and there is some bank debt to take into account.

Mind you, looking at the long-term chart below, 40p was the level where it previously bottomed out, and staged a strong recovery. So if you are prepared to invest in this sector, it might be worth a closer look perhaps? Definitely not of interest to me though.

Swallowfield (LON:SWL)

Share price: 170p (down 13% today, at 10:13)

No. shares: 17.1m

Market cap: £29.1m

Swallowfield plc, a market leader in the development, formulation, and supply of personal care and beauty products, including its own portfolio of brands, announces its interim results for the 28 weeks ended 12 January 2019

I last reviewed this company here in Nov 2018, finding it apparently good value at 253p per share. The price is now down by a third since then - I wonder whether something has gone wrong, or if it's just been pulled down by the general, low liquidity, downward drift, which is affecting so many small caps right now?

These interim figures are poor. Underlying profit fell from £3.4m last time, to £1.63m this time - a drop of 52%. Reasons given are increased cost of materials, and weaker product mix.

Outlook comments indicate an improvement is expected in H2. This sounds more than just wishful thinking, as some reasons for optimism are given;

In our Manufacturing business, we expect a significant second half recovery given the visibility of the order book and as we benefit from the positive impact of pricing initiatives, product mix and cost base optimisation already implemented...

This is countered by cautious comments about market conditions;

There is clearly a considerable level of uncertainty in the current business environment and we expect consumer demand to remain subdued...

Balance sheet - looks reasonably solid. Note there is a £6.6m pension deficit.

Cashflow - favourable working capital movements have generated decent cashflow, which has mostly been used to reduce invoice discounting borrowings.

Dividends - interim divi has been raised 7.5% to 2.15p. If the (larger) full year divi is also increased by a similar amount, then the yield would be just under 4%.

The risk is that if H2 disappoints, then the final divi might be cut.

My opinion - I'm not keen on situations where a poor H1 is expected to be recouped in H2, as very often that fails to actually happen.

Whilst management sound fairly confident, I wouldn't want to hang my hat on this, in current market conditions;

... we are confident in a materially improved performance in the second half and believe results will be broadly in line with market expectations for the full year demonstrating profitable growth.

With the share price now depressed, the market has probably factored in further downside. However, we seem to be in a market where further disappointments (even if already priced in) trigger a further plunge in share prices. So why take the risk?

SimplyBiz (LON:SBIZ)

Share price: 184p (up 2% today, at 11:04)

No. shares: 76.5m

Market cap: £140.8m

SimplyBiz (AIM: SBIZ), the leading independent provider of compliance and business services to financial advisers and financial institutions in the UK, today announces its audited consolidated results for the twelve months ended 31 December 2018.

These figures look very good. Stockopedia is showing broker consensus of 10.5p normalised EPS for 2018. The actual EPS figure of 11.92p looks a comfortable beat. The PER of 15.4 looks reasonable. A year ago we would have considered that cheap, but in today's more bearish markets, it's probably about right.

There is a caveat though. Looking at the figures on a broker note today (available on Research Tree), the EPS beat is entirely down to a low tax charge. The commentary says this about tax;

The tax charge for the year includes the beneficial impact of research and development claims submitted in respect of FY17, offset by non-deductible expenses incurred during the IPO process.

At the adjusted PBT level, the 2018 results are actually in line with forecast of £10.0m. It's always worth checking the figures carefully.

Growth is both organic, and from acquisitions.

Dividends - are kicking in, with a final divi of 2.05p. The cash generative, capital-light nature of this business should see a good flow of future divis. Providing nothing goes wrong.

Finance costs - note that these relate to pre-IPO. Zeus has this dropping to zero in 2019 and beyond, as most debt was paid off with funds raised in the IPO. There is a £7.5m loan remaining on the balance sheet, which is more than offset by £13.3m of cash, giving net cash of £6.4m at 31 Dec 2018.

I spoke to the CFO some time ago, querying why the company has both a large cash balance, and simultaneously a bank loan. I can't remember exactly what he said, but one reason was to give plenty of headroom at the time of the IPO (in April 2018). There could also be seasonal fluctuations - i.e. balance sheet dates are often chosen to reflect seasonally favourable highs in cash.

Outlook - non-specific, but upbeat;

The Board strongly believes that SimplyBiz is well placed to continue to take advantage of the opportunities that arise within the markets it operates in, and that its strong business model positions it for continued growth to deliver a successful year ahead for the business, clients, staff, and Shareholders.

My opinion - as mentioned before, I like the look of this share. It has a lot of favourable characteristics;

- Sticky revenues, being recurring in nature, and spread over lots of clients

- A clear value proposition for customers (an affordable fee, to deal with very complex regulatory issues)

- High profit margins (although this can also be a problem, as it attracts competition)

- Rising divis

- Balance sheet looks adequate, given capital-light model

My main worry is that the business model might possibly prove too lucrative, and could lead to key staff peeling off and setting up their own competitor. That's the big risk with people businesses. So a key question to ask management here, is how they lock in key staff (hopefully with generous long-term share options schemes)?

The numbers look very good, so I continue to view this share favourably.

As you can see below, this share has recovered well from the indiscriminate small caps sell-off late last year;

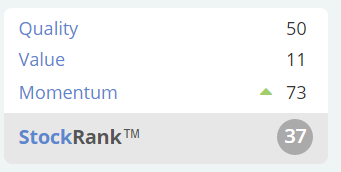

The StockRank system here doesn't like it. Although that is often the case with recently floated small caps. I think the Stockopedia computers like to see more track record.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.