Good morning from Paul & Graham!

Podcast - guilt overcame me last night, so I recorded the weekend podcast here, summarising the previous week's SCVRs, and some macro thoughts. Sorry for it being late.

Hotel Chocolat (LON:HOTC) - as promised, I mystery shopped the Islington branch last week, and was left unimpressed with products, which strike me as ordinary, and over-priced -

Agenda

Paul’s Section:

Vianet (LON:VNET) [quick comment] (£18m) - Interim figures to 30 Sept 2022 look OK, with the hospitality sector returning to normal. Outlook for FY 3/2023 - confident in achieving market expectations. Cash position has worsened. Both inventories & receivables look a little high. Negative cashflow in H1, and note that it’s capitalising c.£2m p.a. into intangible assets (£1m in H1), which puts a question mark over the adjusted profit numbers (which seem to ignore amortisation of capitalised costs). Overall, I don’t think this is worth pursuing. No section below.

Victorian Plumbing (LON:VIC) (£221m) - I review the figures for FY 9/2022. It's beaten considerably reduced forecasts, but only if you're prepared to ignore the excessive share options cost. Great balance sheet, with a big net cash pile, so it's decided to start paying divis. I like the business, but not as much now that shares have risen 80% from recent lows, when we flagged it as a bargain here. So it might make sense to top slice, to lock in some of those profits maybe? It's not such an obvious bargain any more.

Hargreaves Services (LON:HSP) - I review below its in line with expectations update. What an interesting value share this is - super low PER, combined with a big dividend yield, and a strong balance sheet. Lots to like here, for value investors. Harwood Capital owning 28% is a good sign for valuation, but could introduce risk for small shareholders, if they try to whip the upside away, e.g. by pressuring mgt to de-list, or make a lowball offer, both of which Harwood have done before. Overall though, HSP shares look very interesting, and it gets a thumbs up from me.

Versarien (LON:VRS) [quick comment] - top faller of the day, down 34%. It’s got the begging bowl out again, raising only £1.85m at just 10p per share. See what I mean about avoiding any share that needs to raise cash from a position of weakness? It’s not enough either, as more cash is needed, with non-dilutive routes (grants, partnerships) also being explored - good luck with that. VRS has a terrible track record, and management strike me as rampy - lots of exciting announcements, but nothing that ever makes a profit! The tide has gone out for this type of share, so praying for a miracle is the only alternative to dumping the shares and moving on. [no section below]

Graham's Section:

Mercia Asset Management (LON:MERC) (£147m) - this fund manager and investor of its own capital reports good H1 results. The extraordinary gains of H1 last year have not been repeated, however the underlying operating profit measure is up by 6% and the investment portfolio generally appears to be doing well. I continue to find it strange that this stock trades so cheaply considering its fortress-like balance sheet, including a huge cash position, and its good track record. A small acquisition announced today also sounds like good news, bolstering its capabilities.

Solid State (LON:SOLI) (£157m) - a nice earnings upgrade from this manufacturing company. Its acquisition strategy is going well, with the integration underway of a US-based company that it acquired over the summer. Overall, I see more to like here than to dislike: the company has been making efforts to improve its gross margin, and its operating margin is rising. The overall quality of the business appears to be better than average for the manufacturing industry, and this is reflected in a premium valuation for the shares.

Saietta (LON:SED) (£76m) (-3.6%) [no section below] - this 2021 IPO “designs, engineers and manufactures complete light-duty and heavy-duty e-drive systems for electric vehicles”. FY March 2023 revenue forecasts were demolished in November, with the company saying that it was pursuing far larger systems contracts for the following year, instead of near-term revenues. Today’s interim results confirm H1 revenues of less than £1m and an operating loss of £10m. At least it has £22.7m of cash on its balance sheet, thanks to a placing in August, so it has a little bit of runway before it runs out of cash.

It says that it is “on track to ramp up UK-based and India production”, and “remains dedicated to securing several long-term, high volume OEM relationships globally”. A separate RNS today describes a series of agreements with “one of the largest OEM’s operating in the light duty mobility market in India”. £3.2m of revenue is mentioned, which strikes me as a small amount compared to the £32m of revenue baked into expectations for FY 2024. Having already slashed its forecasts for FY 2023, I wouldn’t be surprised to see the FY 2024 forecast getting slashed in due course. Given the very fast rate of cash burn and at a 2024 price/sales multiple in excess of 2x, based on a revenue forecast I don’t trust, these shares look overcooked to me even after they have already fallen by 70% year-to-date. [no section below]

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Victorian Plumbing (LON:VIC)

68p (pre market open)

Market cap £221m

Victorian Plumbing Group plc ('Victorian Plumbing', 'the Group'), the UK's leading online specialist bathroom retailer, announces its full year results for the year ended 30 September 2022 ('2022').

Results ahead of expectations, with H2 revenue growth as the Group demonstrates continued trading momentum and further market share gains, supported by a robust balance sheet

Board proposes maiden ordinary full year dividend of 1.1p and an additional special dividend of 1.7p

I flagged up here on 6 Oct that VIC shares looked cheap at 38p, and with a very healthy balance sheet supporting the downside risk nicely. They’re now up 79% in the last 2 months - not bad going.

Key numbers for FY 9/2022 -

Revenues £269.4m (flat vs LY)

Gross profit margin down, 45% (LY: 49%)

Overheads up 12% to £101.5m

Within that, marketing costs look enormous at £76.2m

Adj EBITDA halved to £19.5m

Statutory PBT shows £11.8m profit (down from £19.7m in the previous year, which had several distortions - boosted by the pandemic, but hurt by £9.4m IPO costs).

Adjusted operating profit strips out the one-offs, so is a good measure of underlying performance, and fell 57% from £37.1m LY, to £16.0m this time.

Balance sheet very healthy, with NTAV of £40.7m, including net cash of £45.5m. It's a capital-light business model, which I like.

Bank facility of £10m RCF is unused, and looks unnecessary.

Cashflow statement - looks very clean, with genuinely good cashflows.

Note 10 shows that £2.2m of internal salaries were capitalised into intangible assets as “computer software”

EPS - this is tricky, as the 3.9p adj EPS seems to ignore the substantial £3.9m cost of share-based payments, as you can see from the workings here -

I’d be inclined to work out EPS on the £9.2m unadjusted profit (i.e. including the share-based payments cost), which would re-work EPS to 2.9p, instead of 3.9p. This 2.9p EPS figure ties in with the “diluted earnings per share” figure just underneath the P&L, so this is the figure that I would be inclined to use for valuation purposes, not the higher adjusted number.

Dividends - it’s got surplus cash, so a policy of paying divis with a 3.0x to 3.5x cover is indicated, plus special divis with surplus cash. This results in a 1.1p full year divi, plus a 1.7p special divi. So 2.8p in total, an attractive 4.1% yield. Also, in my view it’s not even breaking into a sweat paying out that amount, so divis could increase without causing any financial strain. Hence I would see this as a potentially high yielding share in future.

Outlook - sounds positive -

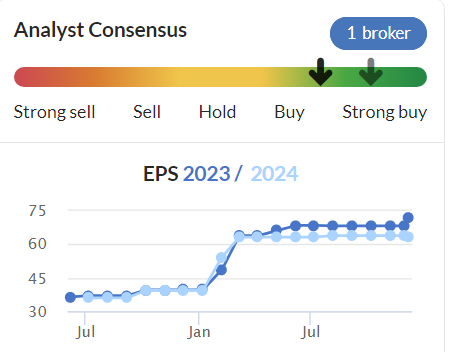

Broker updates - there’s nothing available to me unfortunately. Although the Stockopedia graph shows that forecasts have been considerably lowered (good, as it means less likely to hit a profit warning), and that FY 9/2023 is only expected to be modestly ahead of FY 9/2022, which sounds consistent with the positive outlook comments, suggesting it’s already ahead of the previous year’s numbers in this new financial year. So I think that looks OK.

Valuation - on a PER basis, and using the more conservative 2.9p EPS, at 68p per share currently, I make the PER 23 times - not cheap any more.

Using the company’s adjusted 3.9p EPS figure that comes down to a PER of 17x

If you want to push the boat out a little, then broker consensus for FY 9/2023 is 4.6p, giving a PER of 14.8 - still not particularly cheap. This was on a PER of about 10x last time I looked at it.

The cash pile is now just over 20% of the market cap, so useful asset backing there, and there is an argument for adjusting the PER downwards to strip out surplus cash.

Also there might now be some interest receivable, which on a £45m cash pile, could be quite useful, say £1m+?

My opinion - I think the c.80% rise in share price from the recent low, 2 months ago, is justified, but it now seems to me that the share price is probably up with events, so it might be worth top-slicing some of the profits?

Going forwards, it’s difficult to guess what profits it might generate in future. One angle I like on this share, is that several eCommerce companies have told us recently that online marketing costs are now reducing. Given that VIC spends a colossal amount on marketing, then even a relatively small fall in that cost could drop through nicely to the bottom line.

Overall, given all the uncertainties, if I held this share I’d be tempted to bank some or all of the recent 80% gain, and maybe let a smaller position run.

Note the shareholding structure is that it looks controlled by the Radcliffe family (holding c.59% amongst 3 people with that surname). Hence it would be worth checking how committed they are to remaining stock market listed? Note the gigantic, and shrewdly timed Director sells in 2021! There must be some de-listing risk, when they presumably have the cash to buy out minority shareholders, on unknown terms.

.

Hargreaves Services (LON:HSP)

347p (up 1% at 10:02)

Market cap £113m

Hargreaves Services plc (AIM: HSP), a diversified group delivering services to the industrial and property sectors, provides the following update on trading ahead of reporting its interim results for the six months ended 30 November 2022.

This is not the easiest of shares to understand, since it’s a mix of businesses in engineering & property development, which arose as legacy coal distribution activities wound down.

So I think a sum-of-the-parts type analysis & valuation makes sense, which takes too long for us to cover in these reports. However, the valuation metrics look such good value, that I want to flag it to readers as a value share that could be worth you investigating.

Today it says (my summary of main points) -

Strong H1, ahead of LY (both revenue & profit)

All 3 business segments have improved.

Contracts sound well-planned, with cost escalator clauses, or cost plus structures, hence higher costs are being passed on to customers, protecting profits.

German JV has uncertain outlook for H2 (but that's already baked into the forecasts)

Healthy cash position of £18.1m (up £4.3m in last 6m)

Leasing debt has increased £12.2m to £30.6m in last 6m, to service HS2 contract.

Most important point is -

The Board remains confident of delivering full year results in line with market expectations.

Broker update - many thanks to Singers, which provides a brief, but helpful update note today. It’s saying forecasts are prudent, with 71.7p adj EPS for FY 5/2023. That’s a PER of only 4.8 - so you would need to check how sustainable profits are, as such a low PER could be indicating to us that future profits might fall. I see that almost all the profit for FY 5/2022 came from the German JV, which had an exceptional year which may not be repeated.

Note that broker forecasts have been rising -

Dividends - HSP has been paying decent divis in the last couple of years, and 21p is expected for this year, giving an attractive yield of 6.1%

CEO results interview - I’ve not seen this before, a video actually embedded within an RNS, which you can click on & play the video as you read the announcement. What a great idea! More companies should do this, I really like a short video that draws out the main points, as it saves loads of time reading all the commentary.

Balance sheet - looks very strong, no concerns here. Note that Stockopedia shows a P/TBV of only 0.63

My opinion - this looks very interesting! I think some readers were discussing it not long ago, and I can see why. We’ve got an exceptionally low PER, a big dividend yield, plus a valuation which is well below tangible book value.

There’s also interesting upside from the Scottish land assets, since people want to either build wind farms, or run cables to wind farms over its land, which could generate decent income for HSP. Plus continuing profits from land disposals.

This has only been a quick review, but it gets a thumbs up from me.

I’ve just seen that Harwood Capital holds 28.2%! Is that good or bad, people ask me. Both! Is my usual answer. It shows there’s value in the share, but it could be that Harwood might try to snatch the upside away from small shareholders. That said, I’ve met HSP's 8% shareholder CEO, and he didn’t strike me as the type who would be pushed around even by a major shareholder. If the right deal came along though, then shareholders could do well from it. Delisting risk is a potential issue though, whenever Harwood have a big position. That said, HSP is financially strong, so there wouldn’t be any risk of dilution, so it’s probably fine. I like this share, it looks good.

Looks like the chart might be forming a base perhaps? Combined with very cheap fundamentals, I'd say that's attractive.

Although the StockRank system is looking distinctly unimpressed -

.

Graham’s Section:

Mercia Asset Management (LON:MERC)

Share price: 33.5p (+9%)

Market cap: £147m

This is a fund manager and an investor of its own capital in regional businesses (i.e. businesses outside of London and the South East). It argues that “London and the South East has a significant oversupply of capital creating high pre-money valuations.”

I last covered Mercia at the time of its full-year results back in July. At a share price of about 30p, my conclusion was that it looked quite cheap. As of last night’s close, it was still trading around this level.

Let’s get into these interim results for the period to September:

- Adj. operating profit +50% to £3.6m

This adjusted profit measure excludes many items. I think the point of it is to show Mercia’s profits from managing 3rd party funds and receiving interest, while excluding one-off gains such as unusual performance fees and capital gains on its own investments.

- PBT £7.4m (last year: £11m)

This is an unadjusted number straight from the income statement.

Compared to H1 last year, Mercia has incurred higher expenses and has seen a weaker improvement in the fair value of its investments.

- Net assets increase to £206m or 46.8p per share.

If we exclude goodwill and intangibles, net assets are £175m or 39.8p per share.

Total assets under management are up by a few percentage points to £979m. Within this, 3rd-party funds under management increased slightly to £773m.

During a period when most active managers have seen a reduction in AuM, this feels like a big achievement! Mercia enjoyed £54m of inflows, offset by net negative performance and some distributions to investors.

The reason for the lack of outflows is actually to do with the structure of their funds: “all the capital that we manage is in closed-end or evergreen structures, providing a stable source of long-term third-party capital which is not subject to redemptions.”

Cash - one quarter of AuM is in the form of “unrestricted cash available for investment”. So there is lots of flexibility to fund its companies through a recession.

On its own balance sheet, Mercia has £56m of cash and near-cash instruments. I guess this is why it feels confident to raise its interim dividend by 10%.

Direct investment portfolio - the estimated value of Mercia’s own portfolio increased by 10% over the six-month period, to £131.5m.

Acquisition - in a separate RNS, Mercia announces the acquisition of a lender to SMEs with £415m of funds under management. The acquired business makes loans of £2m+; these are bigger than the loans Mercia currently makes. Mercia will pay up to £9.5m for this.

Outlook

With our focus on SMEs within the UK, predominantly businesses in sectors with relatively modest capital needs, we and the funds we manage, are able to continue to support these businesses with additional capital as and when needed during these turbulent times. As almost all businesses in our portfolios are private businesses, our exposure to the public markets is limited. In addition, as a debt-free, cash-rich business, Mercia is well placed to capitalise on both corporate (as evidenced by our recent acquisition) and direct investment opportunities as we invest through the cycle.

My view

I continue to like this one. In plain English, it appears to be good at what it does: making investments in small regional businesses, and seeing a profitable exit. Its own portfolio is doing well, and its 3rd party funds appear to be doing well.

The gains of last year have not been repeated, but it’s in the nature of things that returns won’t be repeated every year.

My main difficulty with Mercia is the complexity involved: there are a number of different layers to the business, and the company’s results statements always feel like a long and difficult read. And then there is the challenge of trying to understand the companies Mercia has invested in, which I have not even begun this morning.

But is it cheap? Oh yes - we’ve got a discount to tangible NAV, for a start. Then if we compare the market cap to funds under management, we find that Mercia is valued at 1.9% of AuM. But that doesn’t give it any credit for its cash pile, which is a significant % of the market cap, or for the fact that the entire company is being valued at less than the value of its balance sheet.

Also, I’ve not made any adjustment for the new acquisition, which has added another £400m in funds under management and looks like it gives Mercia the very useful and complementary new ability to make larger loans.

What have I missed? Or is this stock cheap simply because it’s quite complicated and obscure, and investors are pessimistic about the outlook for SMEs?

Mercia passes the following three bullish screens for Stockopedia:

Solid State (LON:SOLI)

Share price: £13.92 (+6%)

Market cap: £157m

Solid State is “the specialist value added component supplier and design-in manufacturer of computing, power, and communications products”. Here is its website.

In July, it raised £28m to help it to fund an acquisition of a US-based company, Custom Power. This deal has “provided a step change in the internationalisation and technical competencies of our enlarged Power offering”.

Some headlines from today’s interim results, with the outlook now ahead of expectations:

- Revenue +50.8% to £59.4m

- PBT +98% to £4.2m

- Adjusted PBT +60% to £5.2m

The other key number is that the order book has increased to £112.5m (from £85.5m six months previously).

It’s important to always look for organic growth in these circumstances and Solid State confirms that its “like-for-like constant currency organic revenue growth” is actually around 31%: not as high as the headline growth figure, but still very good!

Cash generation has fallen to almost nothing, due to “inventory investment” - a common refrain these days, especially in electronics.

Net debt increases to £16m mostly due to the acquisitions, with a sharp rise in deferred/contingent consideration.

Investor presentation - tomorrow (Wednesday) at 2pm. Here’s the link to register.

Chairman review - calling it “an excellent start to our financial year”, the Chairman confirms that the integration of Custom Power is underway and that more targets in the acquisition pipeline are being studied.

Outlook - the Chairman and the CEO each confirm that expectations for FY March 2023 have now been raised.

The Chairman’s words are worth quoting extensively:

Current order intake continues to be strong and trading since the Period end has been ahead of management expectations. Prospects for the remainder of the financial year are underpinned by the near-term open order book and the resilience and diversity of the Group.

Solid State has gained a competitive advantage from being proactive in managing the impacts of supply chain shortages, which continues to impact current trading. The business will need to be equally proactive in managing inventories and margin pressures against the weakening macro-economic environment in the UK. In the latter part of this financial year end and in to FY23/24 we anticipate seeing some supply chains start to improve. We have benefitted from strong current trading during Q3 23, meaning the Company now expects to be ahead of the current revenue and adjusted PBT consensus expectations for FY23.

My view

I’m not a specialist in this sector, but my impressions coming away from these results are positive:

- The operating profit margin has improved to between 7.5% and 9.3%, depending on how you measure it. Hopefully there is scope for further improvement as the company grows? It looks like it has never achieved a 10% operating margin (manufacturing margins tend to be modest)..

- The company puts great emphasis on its gross margins (around 32%) and has tried to improve them by selling its own brand products and focusing its efforts on higher-margin work. I always like to see own-brand products instead of distribution.

- While shareholders did suffer some dilution this year, the acquisition strategy has fortunately been managed without putting the company into extreme levels of debt.

The current debt load, including deferred and contingent consideration of £14.4m, will require some work to pay off, but an initial look suggests that it should be manageable.

The overall trajectory is positive:

One quibble is that I don’t see any mention of return on capital as a metric. I always like to see this used as a KPI and particularly in capital-intensive industries. Stockopedia calculates SOLI’s return on capital as above-average for the industry:

Overall, I see more to like here than to dislike. WIth a PER of 17x, before today’s earnings upgrade, the market agrees.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.