Good evening.

Sorry I'm late today - was up at 5am, had done all my emails & Tweets, and was raring to go when the RNS started chucking out announcements at 7am, but within an hour was shivvering & coughing with a bug, so had to go back to bed.

Anyway, we don't like gaps in the sequence, so I'll catch up now.

NetDimensions Holdings (LON:NETD) - (at the time of writing, I hold a long position in this share) - a friend has pointed out this video with the CEO of Learning Technologies (LON:LTG) . In it he emphatically states that the Placing to raise the cash necessary to buy NETD has been done. Therefore any worries I had about whether it could raise the necessary funding seem to have been satisfied.

So it looks a done deal. I've not sold my shares yet, as a 5p discount to the 100p takeover price is too large, so I'll sit tight until the discount is only say 1p.

DX (Group) (LON:DX.)

Share price: 6.95p (down 61.4% today)

No. shares: 200.5m

Market cap: £13.9m

Trading update (profit warning) - this is the latest in a series of dire updates from this mail & parcels business. Key points today;

- Challenging conditions continuing

- Pressure on pricing

- Higher margin business failed to materialise

- Fixed cost nature of courier business is hurting profitability

- Problems integrating 5 sites into 1

On a more positive note,

- the lower margin logistics business has been winning new work, and

- "material new contracts are now being implemented and the Company's pipeline of new business opportunities is robust"

Put this all together then, and it's a nasty profits warning:

it now anticipates that profits for the year will be significantly below current market forecasts, with net debt consequently higher than expected.

Forget dividends too, probably forever;

...It has also taken the decision not to pay any dividends for the foreseeable future

A full review of the business is underway:

...and has commenced a wide-ranging review of the Company's operations with a view to driving revenues and improving its financial performance.

What's taken management so long? It's been obvious for some time that the business model here was completely broken. The reason is simple - a high fixed cost base, and declining customer revenues.

The core DX Exchange business used to be a massive cash cow, moving valuable parcels & letters around for solicitors, and similar. These days, they're using email instead, in many cases. So the reason for DX Exchange to exist has essentially gone away.

My opinion - I hope none of my readers go caught on this one. I foolishly caught the falling knife on the first big drop in Nov 2015, but it didn't take me long to realise that the problems at DX were structural, not temporary.

My report here on 21 Sep 2016 couldn't have been more stark, in warning that there probably wouldn't be any more divis, and that the company looked to be heading inevitably towards eventual insolvency.

This share is really now just a chip in a casino, for gamblers only. I think its business model is permanently broken. So the equity is probably worth nothing. Optimistic gamblers might hope that management can strip out enough cost to keep it afloat, but that's not a game I want to play. Why take the risk? Insolvency is a very real risk here, in my view.

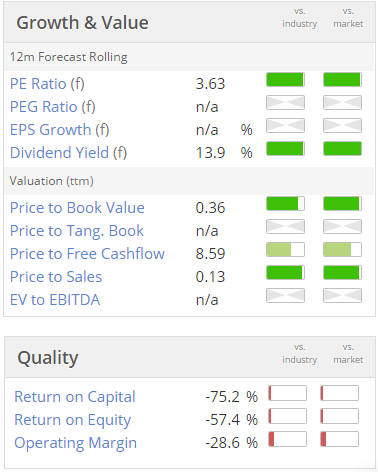

It's also a reminder that whenever you see a PER this low, and a divi yield this high (see below), then it's a massive red flag - it means the broker forecasts are badly wrong, and the market is anticipating serious problems ahead. The market is usually right, too.

I'm increasingly of the view that searching for the lowest PER, highest yielding companies, is a dangerous strategy which, more often that not, will land you in a mess. Fairpoint (LON:FRP) was a good recent example, and DX is another.

Speedy Hire (LON:SDY)

Share price: 51.25p (up 1.0% today)

No. shares: 523.5m

Market cap: £268.3m

Trading update - covering the financial year to date, ending 31 Mar 2017.

Various details are given, with the conclusion being;

...the Board anticipates that adjusted profit before tax for the full year will be ahead of its previous expectations.

Hmmm. Since it's referring to full year expectations, this update should surely refer to market expectations, and not the Board's expectations? Also, the update should state what those expectations actually are. Give us a figure - or a range, for goodness sake. Plenty of companies do this now, so why has Speedy Hire withheld important information that investors need to make informed decisions?

Broker notes - to make sense of the above, I now have to dig out some broker notes. Since Speedy will have given more detailed information to the brokers, but withheld it from the rest of us.

I'm using Research Tree now, and it shows updates today from N+1 Singers, and Liberum - both of which put out decent quality research, in my experience.

Both brokers have upped their current year profit forecasts by 9-10%. So why didn't Speedy Hire just give us that ballpark figure in today's announcement. It's easy, here's the wording they could have used: we expect profit for the current financial year to be approximately 10% higher than existing market expectations (subject to audit adjustments).

Valuation - this is a turnaround situation, so earnings forecasts rise quite a lot in each of the next 2 years. This means that SDY is forecast to reach about 3.5p EPS by 2018/19. With the shares currently at 51.25p this means the 2018/19 fwd PER is 14.6 - so investors are being asked to pay up-front now, for a further 2 years' earnings recovery. Is that reasonable? Personally I don't particularly like paying up-front for recovery which may or may not happen.

My opinion - I can't get excited about this. The company somehow got into a mess, which hasn't to this day been fully explained. It's now sorting itself out, but as one of the brokers points out, it's still delivering profit margins well below the sector average.

There's plenty of good news in today's update, but the share price has barely moved - suggesting that recovery is now already priced-in.

Entu (UK) (LON:ENTU)

Share price: 23.25p (down 8.8% today)

No. shares: 65.6m

Market cap: £15.3m

Trading update - there are striking similarities between DX (Group) (LON:DX.) and Entu (UK) (LON:ENTU) . Both have been diabolical floats, both brought to the market by Zeus Capital. In both cases there was a deeply flawed business model, but the businesses were dressed up for sale with an attractive dividend yield being the hook to get Institutions on board. In both cases the shares prices have subsequently collapsed, and in both cases the dividends have now disappeared. Doesn't look good, does it?

Let's work our way through what Entu says today:

Further to the announcement of 28 October 2016, Entu confirms that its current EBITDA expectation, for the year ended 31 October 2016 ('FY 2016'), from continuing operations and before exceptional items, is expected to be within the range previously announced, at approximately £2.6 - 2.7 million.

That's hardly a surprise. 3 months after the year end, the company thinks trading for that year was about the same as they said at the year end. Note also that there are considerable adjustments to arrive at the positive EBITDA figure. Last time I went through the numbers, the company was loss-making after accounting for all costs (exceptionals of £1.9m, and losses from discontinued ops, etc).

Net cash at the year end was £0.8m.

Balance sheet write-offs are required, but some is non-cash (i.e. impairment of goodwill, etc);

As a result of the costs incurred to exit from these discontinued operations, the balance sheet review exercise and other non-recurring charges, the reported results for FY 2016 will contain further exceptional and discontinued items totalling approximately £6.8 million. A significant proportion of these items are non-cash in nature.

Accounting policies are also being tightened up;

The Group has also conducted a detailed review of its accounting policies to ensure they are in line with best practice and appropriate to the business going forward. This has resulted in the accounting for its Repairs and Renewals Service Agreements and finance commissions to be changed to reflect more appropriately the timing of revenue recognition as well as other adjustments to bring accounting policies in line across the Group. These adjustments are not expected to have a material impact on the FY 2016 result, but will result in a prior year adjustment of approximately £2.0 million.

In other words, historic reported profit was overstated by £2.0m.

The balance sheet now has negative net worth;

The aggregate effect of these actions, taken with the objective of providing the Group with a balance sheet to support future trading, is that net liabilities of the Group are expected to be in the region of £8.5 million, subject to finalisation of the Group's tax positon for the year. The losses are expected to be concentrated in the subsidiaries relating to the discontinued operations.

This is complete gobbledegook! You don't write-off goodwill and other assets "to support future trading", you do it because the auditors have insisted on it!

Dividends - there won't be any more for the time being, by the looks of it;

In view of the above, the Board has determined that it is not appropriate to propose a final dividend in respect of the financial year ended 31 October 2016. The Board intends that Entu return to the dividend list as soon as possible. The Directors will assess the level of future dividends as the Group looks to strengthen its distributable reserves.

Current trading - note that the company only mentions revenues below, and not profit or EBITDA. It looks carefully worded to side-step giving a clear view on profit vs market expectations. The company has a capital-light business model, so it looks as if it should be able to continue trading, despite the weak balance sheet:

The Board confirms that revenues for the first 3 months of the current year are in line with management expectations.

It also confirms that it does not expect the balance sheet review to have a material impact on its expectations of profitability or cash generation in the current year.

My opinion - this company's track record is one of the worst I can recall ever witnessing. For that reason I don't believe anything the company says. Giving them the benefit of the doubt in the past has been a costly mistake.

The business model is just horrible. It has an incestuous buying relationship with sister company Epwin (LON:EPWN) and it looks to me as if Entu has probably been hung out to dry, with the profits instead accruing within Epwin's books.

Therefore, overall for me, this company is a dead duck, and I wouldn't buy its shares ever again, for any reason. It's just been a catalogue of disasters.

Hornby (LON:HRN) - another big disappointer in recent years. However today's update gives some more positive indications that the turnaround plan is working.

I particularly like that inventories & debt are both reducing;

At 31 December 2016 stocks were £11.2 million (2015: £15.5 million) and net debt was £2.7 million (2015: £6.4 million).

Current trading sounds reasonably good;

Underlying Christmas trading was healthy and we have enjoyed a solid January sales period. All sales channels have performed in line with or better than our expectations.

That's fine as far as it goes, but total sales are substantially down - due to rationalising the business. Total revenues is expected to be 20-25% down this financial year.

Its property in Margate is being sold for £2.25m, expected to complete at the end of Feb 2017, so that should eliminate most of the net debt, I presume.

What they call a transitional year is going to be loss-making;

As previously announced the current financial year is a period of transition as we reshape and streamline the business. This will result in full year revenue reducing significantly year on year and the Group will be loss-making during this transition year. However, we remain confident of meeting the Board's expectations.

My opinion - I'm looking for scaleable businesses, which can deliver growing profits, cashflows & divis. This looks to be more of a small, niche business, which has been stabilised after a period of mismanagement.

I could see this company getting back to being a modestly profitable company. Maybe it could resume divis in future (the last one was paid in 2012). Trouble is, how much upside is there in this share? It's valued at about £27m now. Could it get to £100m market cap? Very unlikely in my view.

We're in a market that is looking for innovation & growth. I just don't see there being much scope for that here. So there are possibly better opportunities with other shares. This looks a bit of a backwater, likely to go sideways. There's an opportunity cost to that, in a bull market.

Amino Technologies (LON:AMO) - just a quick mention, but what seem to be very good results out today. Also the outlook comments sound positive;

Amino enters 2017 with a strong order book and sales pipeline providing good visibility of revenue and profits for the first half. The Board expects the positive momentum gained in 2016 to continue and result in sustainable profitable growth in 2017.

The company has a history of paying good & growing divis.

I don't really understand the sector in which it operates, but as I mentioned here in Oct 2016, the share looks worthy of further research.

Walker Greenbank (LON:WGB) - there's an in line trading update out today.

The company was hit by flooding, and received substantial insurance payouts.

My main question is what has been done to mitigate future flooding, and will the insurance companies pay out quite so readily if the same thing happens again?

The valuation of this share (on a PER basis) has dropped quite a bit, so it might be worth a closer look. It used to be rated highly, on a PER of around 20, but that has now dropped to 13.8. So could be an opportunity maybe?

That's me done for today. I shall resume in the morning.

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.