Good morning!

Today I intend reviewing the following;

Begbies Traynor (LON:BEG) - trading update

Redstoneconnect (LON:REDS) - trading update

Cambria Automobiles (LON:CAMB) - trading update

XLMedia (LON:XLM) - results

Lakehouse (LON:LAKE) - trading update & moving to AIM

The above is likely to take me most of the afternoon, so please refresh this page later for the full report.

Market & strategy update

The market's love affair with growth stocks continues unabated. Value investing hasn't worked very well at all for me, in the last 3 or 4 years. So I adapted my approach in 2015, and further again in 2016, to focus more on growth companies. Not speculative or blue sky rubbish, but proper growth companies - i.e. things that are already profitable (or close to it), and expanding fast, organically.

Specifically, I'm now focused quite tightly on these particular niches;

- High quality roll-outs at reasonable prices (e.g. Revolution Bars (LON:RBG) , Fulham Shore (LON:FUL) and Patisserie Holdings (LON:CAKE) - which I think are the best ones on the UK market currently, all 3 of which I hold personally)

- Internet-based businesses which are genuine disrupters of existing sectors, and have exponential organic growth potential (examples include Purplebricks (LON:PURP) , Gear4Music (G4M), MySale (LON:MYSL) , possibly Proactis Holdings (LON:PHD) might partially fall into this category, even little BOTB too - all of which I hold).

- Anything else which is demonstrating strong organic growth, and crucially is beating broker forecasts. I've set up a terrific Stockopedia screen to identify companies which are receiving broker forecast upgrades, and it's working very well. This is a really good way of identifying companies which are most likely to beat expectations at results time - i.e. ones which have already been guiding analysts upwards before results.

It's worked tremendously well, as you can see from my fantasy portfolio. which has risen over 137% since a recent low, in July 2016. Not bad in 8 months. I was discussing this the other day, with my stockbroker, and it's easy to get carried away in a roaring bull market like this. You can end up getting over-confident, and thinking that you're a genius, when actually practically everything is rising, and you just happen to be getting carried along in a big bull market.

Also, I'm haunted by what happened to me in 2007-9 - when a combination of hubris, plus gearing up on illiquid stocks, meant that my portfolio at the time completely collapsed. It's the gearing & illiquidity combined which is the killer when markets do turn bearish. Hence why I've decided to take my foot of the gas a bit, and reduce my gearing now, when the good times are still rolling. I won't be making those same mistakes again, that's for sure. Learning the hard way is sometimes a good thing, long term.

The trouble with hunting for low PER, high divi yield stocks (traditional value investing), is that all too often you end up buying rubbish, declining companies, which then disappoint against expectations, and cut their divis.

Begbies Traynor (LON:BEG)

Share price: 49.9p (up 0.8% today)

No. shares: 127.3m

Market cap: £63.5m

(at the time of writing, I hold a long position in this share)

Q3 trading update - this covers Nov, Dec, and Jan (since the company has an end-April year end). After a series of acquisitions, Begbies is now a combination of an insolvency practitioner business, and also property services companies. I had a fascinating discussion with Executive Chairman, Ric Traynor here, in Oct 2016.

Expectations are unchanged, so this is an in line update:

Our expectations for the year as a whole remain unchanged. We have seen an improvement in activity levels in our insolvency business in the third quarter, as anticipated at the time of our half year results which we reported in December 2016.

This leaves us well placed for a strong last quarter albeit our work in progress in both the insolvency and property services businesses includes a number of engagements with fees contingent upon completion prior to the year end.

The last sentence is a little worrying. Trouble is, no indication is given for how significant these contingent fees may be, and whether they are included within expectations or not. I hope this isn't preparing the ground for a possible future profit warning?

My opinion - trading has been fairly stable here for a while now, and the company has a good track record of paying decent divis.

I like the counter-cyclical nature of this business, so it should hopefully provide some portfolio protection against a downturn in the economy. Smaller retailers in particular are having a very rough time, and estate agencies is another problematic sector, where I can foresee a lot of companies failing. So it seems to me that there should be plenty of work to keep Begbies busy.

Redstoneconnect (LON:REDS)

Share price: 1.62p (up 10.2% today)

No. shares: 1,645.1m

Market cap: £26.7m

(at the time of writing, I hold a long position in this share)

Trading statement - for the year ended 31 Jan 2017.

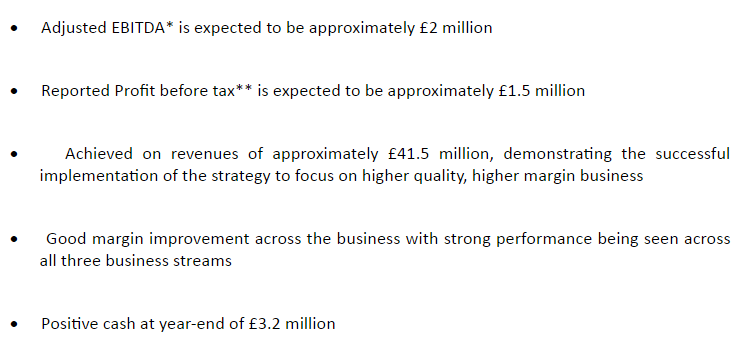

This looks to be a positive update;

The Board is delighted with the performance of the Group in the year with trading being materially ahead of market expectations...

It would have been more helpful if the company has put a footnote in, precisely stating what they believe market expectations to be - as this is not always clear with smaller caps, and many private investors can't get hold of broker notes easily.

It does however give figures for actual performance for y/e 31 Jan 2017, which is very helpful, as follows;

Checking back through my previous reports here, to refresh my memory, the company issued a positive update here on 9 Jan 2017. It seems to be the case that, very often companies which start reporting positive news, carry on doing so.

Outlook comments today also sound positive;

Strong order book underpinning medium term growth expectations... Our sales pipeline appears strong and, combined with our solid recurring revenue stream, provides support and confidence in the outlook for the Company.

I'll wait to see what the full figures look like. They're due to be published on 25 April 2017.

My opinion - I took a modest opening size position in this company a little while ago, following a positive meeting with its relatively new CEO, and its FD.

I like the established relationships it has with big name clients. Innovative products & services sound intriguing. Overall, it's a company I look forward to getting to know better over time. I'm not yet confident enough to increase my existing position in the company, but might do if I like the results due to be announced on 25 April.

Cambria Automobiles (LON:CAMB)

Share price: 64.5p (up 2.4% today)

No. shares: 100.0m

Market cap: £64.5m

Trading update - I'm confused as to what period this update is covering. The last year end was 31 Aug 2016. Today's update says that it relates to the 5 months to 28 Feb 2017. Yet the financial year to date is surely 6 months to 28 Feb 2017? So anyway, it's either 5 or 6 months being reported today, it's not clear which.

It sounds as if this chain of car dealerships is trading well;

The Group has maintained its momentum from the strong results delivered in the last financial year and its trading performance in the first five months of the current financial year has been substantially ahead of the corresponding period in 2015/16, both on a total and like-for-like basis.

Used vehicle sales are doing well.

Aftersales has been hit by a fire at one site, but a business interruption insurance claim should rectify any financial impact there.

New car sales - this is the most striking bit of today's announcement. Sales are down heavily, but profit is actually up. This suggests to me that the manufacturers must be upping incentives & margins, in order to stop sales volumes dropping further;

Whilst new vehicle unit sales for the five months were down 2.9% (like-for-like down 11.1%), the gross profit per retail unit improved over the same period in the Group's like-for-like businesses and therefore the gross profit in this department improved.

That 11.1% LFL fall in unit sales is a huge figure. Yet it's not hurt their profits at all, by the looks of it, as manufacturers get more desperate to shift high volumes. This introduces an interesting angle on car dealership shares - in a tougher market, maybe they might even benefit from reduced sales, as margins improve? Whereas in the good times, with higher demand, manufacturers have more scope to squeeze the dealership profit margins?

Outlook - current trading sounds alright;

Heading into the important March trading period, the new car order book is building well and is in line with our expectations.

The full year outlook sounds alright too;

The Board continues to believe that there may be some pressure on new car volumes and margins in 2017 with the current macroeconomic uncertainty in the economy.

However, the Group's trading performance in the first five months indicates that it is trading in line with market expectations for the full year which the Board believes already reflect these uncertainties.

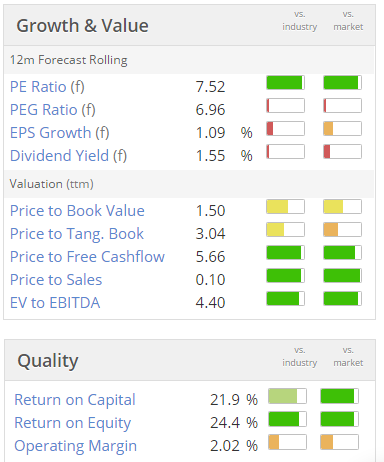

Valuation - as with a lot of the sector, valuation really does look cheap at the moment. Here are the Stockopedia graphics;

Bear in mind that forecasts have been revised down quite heavily already, so a low rating on lowered earnings forecasts suggests to me that the bad news (of economic uncertainty & reduced demand) is already in the price.

Directorspeak - the CEO sums things up quite nicely today;

"I am pleased with the Group's performance over the period and the robust trading momentum we have maintained from last year. As previously flagged, we expect to see some industry wide pressures on new car volumes in 2017, however we remain confident that our resilient business model and high margin used and aftersales revenue streams will offset these pressures.

We continue to be focused on integrating the businesses we have acquired and delivering on our targeted site investment strategy as we build on our competitive advantages over the year ahead."

My opinion - I've been saying for a while that used car sales & aftersales on new cars, is the high margin stuff where dealers make most of their money. Therefore the fall in new car sales isn't such a big deal as the stock market seems to think. This could provide an opportunity to buy shares in this sector at low valuations.

CAMB has, in common with a lot of its peers, a fairly decent balance sheet, and owns plenty of freehold property. So it should be financially stable.

This company seems to be well-run, and performing reasonably well. It depends what you think is likely to happen with any future UK-EU trading arrangements. Personally I believe that common sense is likely to prevail, and there probably won't be a lot of change. The UK is a huge net importer of goods, so any tariffs erected by the EU would harm themselves more than the UK. So it's very unlikely to happen in my view.

Electric cars is another issue. There again, the existing car manufacturers are developing hybrid & electric cars too. They still need servicing, and things will still go wrong with them. People will still want to inspect, and test drive competing models. So again, will there really be that much change to car dealership business models? Who knows, but I suspect not.

Overall then CAMB looks a decent company to me, on a lowly valuation.

XLMedia (LON:XLM)

Share price: 107p (up 0.9% today)

No. shares: 200.4m

Market cap: £214.4m

Final results - for year ended 31 Dec 2016.

These numbers look strong, e.g.

Revenues up 16% to $103.6m

Profit before tax up 28% to $31.0m (a very high profit margin of 29.9%)

The balance sheet looks strong to me, and the cashflow looks real.

Dividends are generous too.

So there's undoubtedly a lot to like in these numbers.

My reservation remains whether this business model is sustainable? The bulk of revenues (and hence presumably profit too) comes from running websites which direct new clients to online gambling companies. Clearly that is highly lucrative. The biggest region is Scandinavia, who are huge poker players. I wonder though, how long can such bumper profits be generated?

XLM seems to be diversifying into other ares of digital marketing, making acquisitions using the bumper profits & cash generated by the existing business. That makes a lot of sense, and is gradually building other income streams.

Outlook comments sound upbeat;

We have made a strong start to 2017 with sales across all products and verticals progressing well.

The integration of the recently acquired ClicksMob and Greedyrates businesses is on track and once completed, these acquisitions are expected to add significant value to the Group.

The Board therefore looks forward to another year of strong growth and is extremely confident of the medium term trading prospects of the Group.

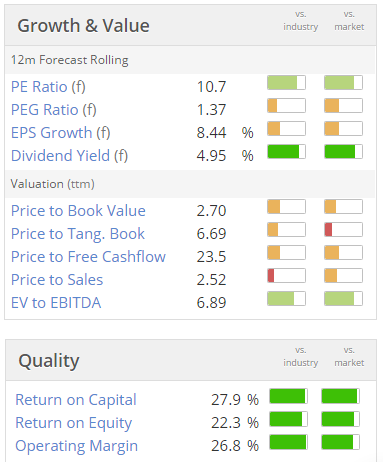

Valuation - the StockRank is outstanding, at 97, and the valuation graphics look excellent - it appears to be a high quality business, at a bargain price (although that clearly means the market shares some of my doubts about the business model);

My opinion - the numbers look great, but I'm not entirely convinced by the business model.

At some point later this year, I'm hoping to meet management, and dig a bit deeper.

Briefly, some comments on 2 announcements from

Lakehouse (LON:LAKE)

Trading update - lots of detail given about contract wins. Smart metering sounds like it's becoming important to the group.

It sounds like Bob Holt is doing a good job at turning around this problematic group;

Elsewhere the Group is performing to the Board's expectations as a result of the strategic initiatives implemented in each division and we expect a strong second half performance from the Group as previously indicated. We remain focused on restoring shareholder value by delivering against our organic growth strategy.

My opinion - it does look like Lakehouse is gradually turning a corner. However, I'm just not interested in companies in this sector. Margins are low, profit warnings are frequent, so why get involved? Pressure on local authority budgets can also mean contract losses & deferrals. There's lots of competition, and little pricing power. I cannot see any attractions at all to invest in this sector generally.

Move to AIM - in the past, such an announcement would have seen the share price drop heavily. However, despite its many failings, I think more companies and investors are seeing the benefit of listing on AIM. It gives companies more flexibility when making acquisitions, and a key advantage is that money is pouring into Inheritance Tax planning portfolios.

There are some very well managed IHT portfolio services, including my friends at Fundamental Asset Management, and also I've been impressed with the excellent performance & share selection process from the manager of Charles Stanley's IHT service. These guys really know what they're doing, but they can only invest portfolio monies into AIM shares.

Therefore, I think smaller companies are these days much more likely to attract investor interest if they list on AIM, rather than the main market.

I appreciate that opinions differ on this though. Some investors prefer the greater investor protection from a listing on the full market. I respect that view, but personally I think AIM is a more dynamic market for growth companies. They just need to put their house in order, in terms of attracting frauds & semi-frauds to AIM. Yet that should not obscure the fact that AIM also has hundreds of decent companies on it.

Well, I got there in the end, sorry this was so slow today.

Regards, Paul.

(usual disclaimer applies)

![58bef6402b8e9CAMB_brokers_2].PNG](https://images.stockopedia.com/user-images/node-174398-58bef6402b8e9CAMB_brokers_2%5D.PNG)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.