Good evening/morning, it's Paul here.

Graham and I are both short of time this Tuesday (I have to go to London for a meeting, and Graham is doing a CEO interview). Therefore we've decided to pool our efforts here, writing a couple of sections each. I'll be reporting on results from MySale (LON:MYSL) (in which I have a long position) and am meeting management this Weds. So I'll report back on my impressions from that meeting.

I decided not to report on Bioventix (LON:BVXP) results yesterday, because it's specialised, and I don't have any sector knowledge. Suffice it to say though, that the company is amazingly profitable - PBT of £6.9m, on revenues of £8.0m, that's a net margin of 86%. Remarkable indeed. Although the share price actually fell 5% on the results. I think we're seeing quite a bit of nervousness in the market at the moment, and some people taking money off the table - particularly with highly-rated growth companies.

I note that Fevertree Drinks (LON:FEVR) peaked at 4000p under a month ago, and is now 2890p. This is despite there being no news from the company. Has the big momentum trade of recent years finally come to an end? Who knows. I'm certainly wary of over-paying for anything now - I think the market is starting to pay closer attention to valuation now.

Maybe equity valuations need to correct to more rational levels? Especially now that interest rates, and bond yields are rising, which usually pulls down equity valuations. Plus all the macro & political uncertainty of course, isn't good for confidence.

To get you started on Tuesday morning (I'm writing this on Monday evening), here is a reader request from yesterday;

XP Power (LON:XPP)

Share price: 3000p

No. shares: 19.2m

Market cap: £576m

XP Power, one of the world’s leading developers and manufacturers of critical power control components to the electronics industry, is today issuing a trading update for the quarter ended 30 September 2018.

- Order intake for the 9m to 30 Sep 2018 was up 8% on a LFL basis, and 11% higher including acquisitions (18% on a constant currency basis).

- Revenues for the 9m are up 18% (24% at constant currency)

- Trading is described as "robust"

- Inventories have been increased, to protect against components shortages

- Net debt rose slightly, to £49.3m at 30 Sep 2018

- Q3 divi of 19p, total so far this year is 52p. Stockopedia shows the forecast yield at 2.9% - OK but nothing special. Although the track record is good, with divis rising by 5-10% p.a.

Outlook - sounds OK;

The Group believes it is continuing to take market share as its portfolio of industry-leading power technology products is increasingly designed-in to new equipment by our target customers...

Order intake remains healthy, although the rate of growth has moderated slightly during the period.

Production volumes in China and Vietnam remain robust and we are encouraged by our design win pipeline and overall momentum across the business.

The Board anticipates the Group’s performance for the full year will be in line with its current expectations as outlined at the time of the Group’s interim results on 30 July 2018.

Looking at the chart, the interim results which were announced in late July 2018, seems to have triggered a correction in share price from c.£36, to now £30. A lot of shares have corrected in a similar way over this period.

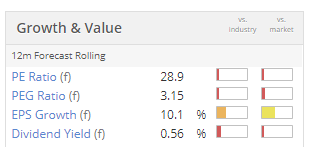

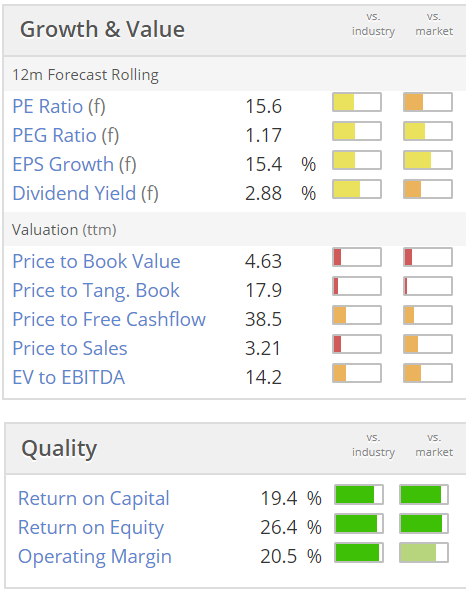

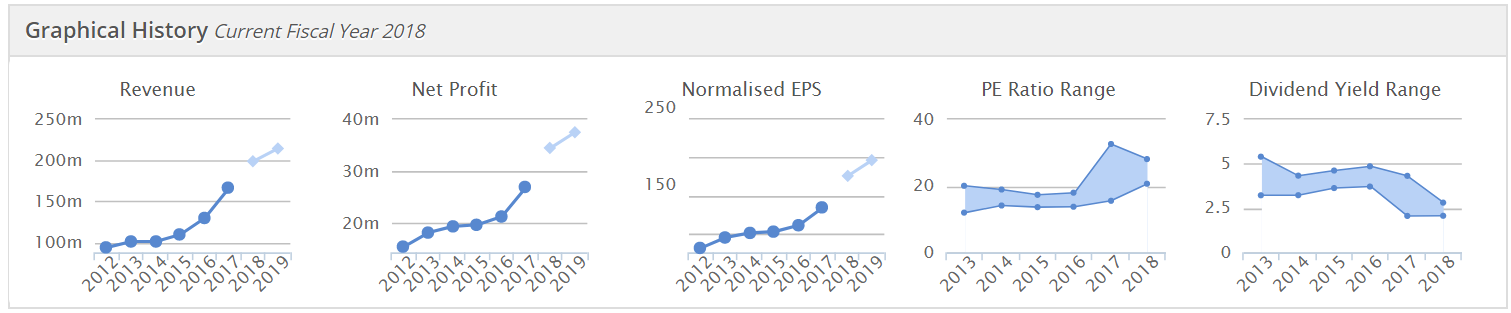

Valuation - looks undemanding, for a high quality company;

There's an update note from Edison out today, which gives a bit more colour on the weakening demand for some of XPP's products. Therefore, I'd say there's a risk that it might not achieve the 2019 forecasts.

My opinion - this company has a terrific track record, and seems to qualify as growth/quality at a reasonable price. So it could be worth a closer look. I think this might be a reasonably good entry point, perhaps, given the recent share price correction?

MySale (LON:MYSL)

Share price: 42p (down 15% today)

No. shares: 154.3m

Market cap: £64.8m

(at the time of writing, I hold a long position in this share)

Directorate change - the CFO has stepped down with immediate effect. That sounds like a firing, but the statement says he will remain with the group until the end of October, to do the handover, which sounds less worrying.

I'm generally not keen on sudden changes in CFO. I got caught out last year when the CFO of RBG resigned in strange circumstances, and it later turned out that the accounts department was a shambles, and that the forecasts had been wrongly calculated.

It doesn't necessarily mean there's a problem here with MYSL, but it increases risk. The initial share price movement this morning suggests to me that the CFO resignation has spooked some holders. Although the volumes traded are so small (about £70k at the time of writing) that price movements are pretty meaningless in the short term.

Preliminary results - for the year ended 30 Jun 2018.

MySale operates flash sale (i.e. clearance) websites, primarily in Aus/NZ. It has also more recently broadened the product offering enormously, to 1.2m product lines - the bulk of which are drop shipped, i.e. MYSL just acts as a middleman, but doesn't actually handle the physical stock. It has invested heavily in IT, the idea being that it will become a platform for brands to both clear surplus stock, but also as a pain-free way for brands to break into new markets. It has also recently launched OurPay, a proprietary instalment payments customer offering. Quite an interesting business model.

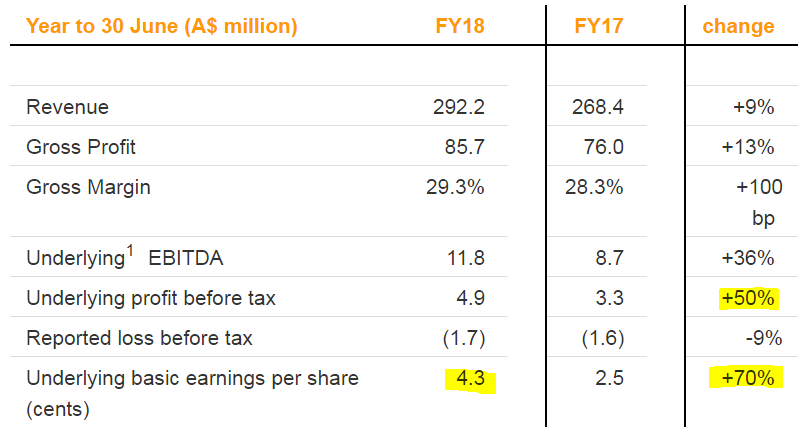

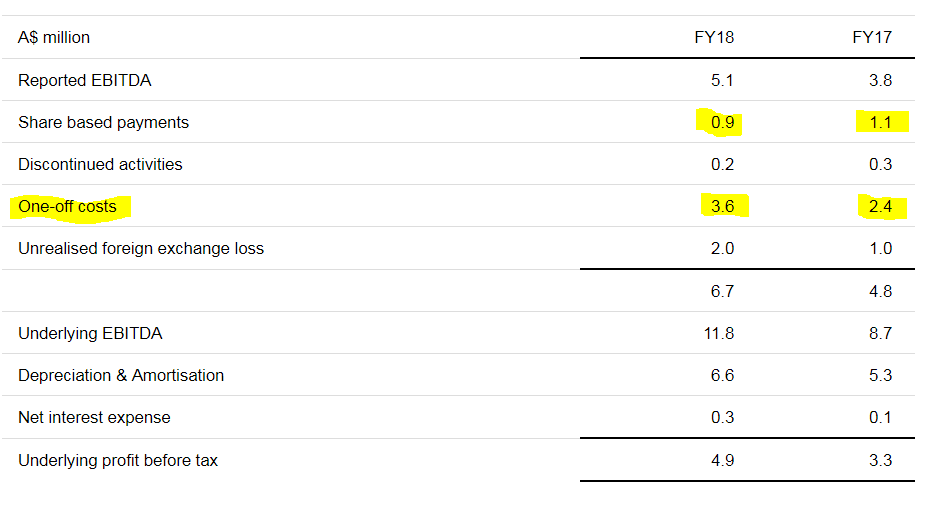

Headline numbers today look pretty impressive - note the strong growth in underlying profit;

The company reports in Aussie dollars. The exchange rate is currently £1 = A$1.85.

Are the adjustments to arrive at "underlying" figures reasonable? That depends on your point of view;

Given how weak the share price has been, I think it's taking the proverbial to be dishing out free shares to Directors & staff.

One-off costs are mainly related to an acquisition & an aborted acquisition. Fair enough - those are indeed one-offs.

Outlook - trading in line with expectations;

As a result, we expect revenues to be broadly level year on year, with growth in core online revenues offsetting this planned reduction in offline. We anticipate, however, that this, along with the full deployment of our technology platform, will bring significant cost efficiency gains and accretion in the underlying EBITDA margin.

While it is early in the current year, and our peak trading period lies ahead, trading to date has been in line with expectations and the board expects that underlying EBITDA for the year will be in line with market forecasts with an overall heavier second half weighting.

I feel that the share price has been weak here is partly due to the stalling of revenue growth. If you look at the eCommerce companies which are attracting the big PERs, they're the ones with rapid revenue growth. MYSL seems to be focusing more on improving its margins, but is struggling to generate meaningful top line growth.

Cost-cutting, and efficiency gains are mentioned in the narrative, which should benefit the FY 06/2019 profit figures.

Other points to note;

Marketing spend increased, but doesn't seem to be working very well, given that revenue growth is low;

The group made a planned investment into additional marketing with a 20% increase to 7.5% of revenue to support long term growth in the customer base.

That level of increased marketing should have delivered stronger growth, in my view.

Cost-cutting - I like this bit;

Having bedded in the new platform throughout the business during FY18 a comprehensive cost reduction programme commenced before the period end, the benefits of which will steadily increase across the FY19 financial year.

That should give the current year decent impetus. The level of IT development spend at MYSL strikes me as very high - with not a lot to show for it, in terms of revenue growth or profits.

Balance sheet - an amber flag here in terms of the big increase in receivables, up from A$16.95m a year ago, to A$29.9m. The narrative says this is a one-off, due to a large wholesale near the period end. That's fine, but I'll be checking to see that this does indeed unwind at the next year end balance sheet. The OurPay customer debtors have also increased overall receivables.

Critics of the company say that it has been burning cash. That's not actually true. It has invested in both some acquisitions, and increased own-buy inventories. That doesn't fit my definition of cash burn - which is cash that disappears through trading losses.

It has net debt of A$6.3m - not a distressed position, so I don't see any issue there.

My opinion - this strikes me as by far the cheapest eCommerce business on the UK market. However, the lacklustre growth in revenues is probably the reason that this share has failed to excite investors. Plus of course we're currently in very gloomy market conditions, with indiscriminate selling of small caps in evidence.

Underlying basic EPS of A$0.043 is 2.3p per share. So at 42p per share, that's a historic PER of 18.3. That strikes me as a very gloomy valuation for an eCommerce company - especially as the company is forecasting higher profits in FY 2019.

The opportunity with this share, is if the growth rate begins to accelerate. That could trigger a potentially big re-rating of the shares. That's the reason I'm holding. It seems a lot of business & potential, in an exciting sector, for just a £65m market cap.

The figures out today certainly don't justify anything like this extent of a share price fall. There again, if a company in a fancy sector disappoints on growth, then investors don't like it.

I'm off to London shortly, partly because I have a meeting with MYSL management tomorrow. So I'll read the results in more depth, and the broker updates this morning (on Research Tree), and report back to you later this week, with my impressions.

Right, that's me done for today. I will now hand over to Graham, who will be adding some more sections later today.

Afternoon all, it's Graham here picking up the baton with a few updates.

Cenkos Securities (LON:CNKS)

- Share price: 80p (+15%)

- No. of shares: 57 million

- Market cap: £45 million

I wouldn't wish this on anyone - they lose their job, and their company's share price rallies all day.

The outgoing CEO has had a long and illustrious career which you can still read in detail on the Cenkos website.

The departure sounds friendly, as the Board thank him for his hard work and contribution to the company.

There is no ignoring the fact that profits at Cenkos have at least temporarily collapsed (see my commentary last month).

In my own view. that's just something that goes with the territory for a mid-sized investment bank which is led by its corporate finance activities. Deals dry up from time to time, and there is nothing anyone can do about it.

After just a little over a year in the role, the Board evidently feel that performance could have been a little better.

As a reminder, Cenkos net assets were last reported at £26 million, of which cash is £21 million.

So the business has an anchor in terms of valuation: in my view, it is worth at least net assets, and probably a good bit more, given the company's excellent track record and franchise in the City.

It's not a share I would own because I'm more interested in finding potential compounders, and I don't think this is one of those. As a possible value investment, however, it could be worth a look.

As far as today's news is concerned, I don't have any particular reasons to think that the outgoing CEO did a bad job in the circumstances. Hopefully the Board have some clear ideas about who they are looking to replace him with.

Volvere (LON:VLE)

- Share price: 1100p (unch. today)

- No. of shares: 3.7 million

- Market cap: £41 million

Disposal of Impetus Automotive Limited

Please note that I currently hold VLE shares.

This announcement was super news for me, particularly as VLE was (and remains) my largest individual holding.

(I say "individual holding" because there is an ETF which I previously held in larger size.)

For background on Volvere, see my analysis of the interims last month.

The company has achieved an amazing sale price for Impetus, consultants to the automotive industry.

Volvere only had to put about £2 million into Volvere between the equity purchase and its working capital requirements.

It has now turned around and sold it for a staggering £31 million (subject to adjustments).

After the managers get their bonuses and after transaction costs, £23 million will be left. Taxes weren't mentioned in the announcement and the vehicle is not very tax-efficient, so I expect taxes will also be due. If there are any taxation experts who can express a view, that would be helpful.

Let's put the tax issue to one side for a minute. Volvere's cash was recorded at £20.4 million at June 2018. Adding £23 million gives us £43.4 million - as Paul already pointed out, this is more than the company's market cap.

On top of that we have a food manufacturing business (Shire Foods) thrown in "for free". I am optimistic that it is worth at least a few million pounds based on its freehold property alone, but it could be worth significantly more if its performance recovers.

I have a lot of exposure to this share - nearly 20% of my equity portfolio.

The thought hasn't crossed my mind that I should sell any, however. The reason I bought such a decent chunk in the first place was that I felt confident that the managers were cautious by nature and were aligned with shareholders, as they themselves own such a decent stake.

The only thing that has changed since then is I now additionally believe they are extremely skilled, having extended their record of superb NAV growth (it was already quite a long record when I joined the shareholder register in 2016).

Something I'd like to reiterate is the counter-cyclical nature of what they do. They have a particular specialism in finding distressed companies where there is the potential for recovery.

As they reminded investors during the interim results, there is the potential that Volvere could benefit from some economic distress, as it could increase deal flow and opportunities to pick up some bargains.

Whatever happens, I expect that the managers will want to do something with a war chest of £40 million+. And if they can't find acquisition targets, I would warmly welcome another share buyback.

YouGov (LON:YOU)

- Share price: 463p (-2%)

- No. of shares: 105 million

- Market cap: £488 million

YouGov continues to perform well.

The funny thing is that it goes to great efforts to show misleading adjusted figures, when there is really no need. The statutory numbers are excellent in their own right.

The unadjusted numbers are:

- revenues +9%

- operating profit +56%

- PBT +49%

- dividend +50%

It's a remarkably US-centric business now. The US was responsible for over 80% of adjusted operating profits.

Outlook - in line with expectations.

Strategy - the five year plan from 2014 to 2019 has been successfully executed, taking the company away from the traditional consulting model and instead to a "real-time data analytics model" - well done. The next five year plan is being designed.

My view - a high-performing share, I've not taken a closer interest because a) I was put off by its use of misleading adjusted numbers, and b) it has always seemed to be ahead of itself by a couple of years in terms of valuation.

The racy valuation is still in play. Indeed, Stocko algorithms give it a Value Rank of 6. I'm not willing to pay these sorts of multiples but the company has done better than I expected it to, so it deserves a mention.

That's us all done for today, thank you for dropping by!

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.