Good morning, it's Paul here.

Conviviality (LON:CVR)

Share price: Suspended (at 101p)

No. shares: 183.3m

Market cap: £185.1m

(at the time of writing, unfortunately I hold a long position in this share)

Suspension of shares & further update

There is more disastrous news today for shareholders in this distributor of mainly alcoholic drinks. I bought some yesterday, unfortunately, after being reassured by a broker note saying that the situation re bank covenants was alright. In fairness, the broker can only report what the company tells him. So if the company doesn't know what's going on, then nor will the broker's analyst.

Director buys - the Directors genuinely didn't seem to know that trouble was brewing. This is evidenced by 5 Directors collectively spending about £583k buying shares at around 300p on 5 Feb 2018 - that's only just over 5 weeks ago. Since then the share price has dropped by two-thirds, and will probably drop considerably more when it returns from suspension.

The share has been "temporarily" suspended. An announcement came out at 09:55 today;

Further to the announcements made by Conviviality Plc on 8 March 2018 and 13 March 2018, the Company yesterday identified a payment due to HM Revenue & Customs of approximately 30.0 million which falls due for payment on 29 March 2018 and which has not been accrued for within its short term cash flow projections.

This has created a short term funding requirement.

What can I say? It's total incompetence. The finance department at CVR seems to have lost control of the budgeting process, and now cashflow management as well. Heads will need to roll - I think the CEO has to go, once this funding crisis has been resolved. The FD is relatively new, having joined CVR on 30 Oct 2017. In my view that is plenty of time to have got the budgeting & cashflow processes under proper control. So in my view, serious question marks hang over the new FD's competence too.

Trading could be adversely affected by this funding crisis;

The Company's announcement on 13 March 2018 confirmed an expected range of adjusted EBITDA of between 55.3 million and 56.4 million.

To the extent that the current situation creates operational difficulties, this may negatively impact the adjusted EBITDA range.

So clearly this funding crisis needs to be resolved quickly, before it does serious damage to the business. Obviously, customers will carry on buying product, because in the short term it doesn't matter to a customer if the vendor is in financial difficulties. The problem lies with suppliers. If trade credit insurance is withdrawn, then they may decide not to take on the credit risk themselves, and could refuse to send in any more goods to CVR. If that can't be resolved quickly, then CVR would run out of inventories, and that's it, the business is gone.

So time is very much of the essence, in this type of situation.

Banking covenants - the company is currently in compliance with its banking covenants;

The Company is currently in compliance with its banking covenants. The next covenant test date is 29 April 2018.

What are the bank covenants?

The Company is subject to two banking covenants

(i) for covenant debt (which excludes any amount drawn down under the Company's invoice discounting facility) to be less than 2.5 times the last 12 months adjusted EBITDA, and

(ii) adjusted EBITDA to be at least 4 times the net financial charge.

Current position - fully drawn

The Company is fully drawn under its term loans and revolving credit facility

The last Annual Report shows facilities (provided by a consortium of RBS, HSBC, and Barclays) as at 30 April 2017, as follows;

Term loan of £95.8m

Revolving credit facility (i.e. an overdraft) of £30m + £15m accordion facility

There is also a £130m receivables facility (i.e. invoice discounting) - let's ignore this for the moment, as it's outside the scope of the bank covenants (since it is secured on CVR's sales invoices)

The term loan will have had repayments made by CVR since 30 April 2017, of £1.25m on 31 May 2017, £6,361k on 29 Oct 2017, which will have reduced the term loan to £88.2m. There will also be interest charges of about 10.5 months to add to that, which is charged at LIBOR + 2.5%, so I make that roughly £2.4m, so by my rough calculations, the term loan probably currently stands at c.£90.6m. The next repayment is £6,631k, due on 29 April 2018, assuming that the banking arrangements are unchanged from the last Annual Report, where I got the above info.

Forecast debt - the company says this today;

... covenant net debt at 29 April 2018 is expected to be approximately 113.0 million (which excludes any amount drawn down under the Company's invoice discounting facility).

This seems to tie in with my estimates above of £45m RCF facility (including the accordion) + c. £90.6m term loan = £135.6m, less say 3 days receivables cash in transit of £23.1m, which I've estimated at about £7.7m per day - based on £2bn VAT-inclusive sales p.a., divided by 260 working days p.a.) = £112.5m - which is only £0.5m away from what the RNS says. So I've therefore sense-checked the company's £113m estimate of covenant debt as at 29 April 2018 as being correct. Actually, thinking about it, since those calculations are based on the group having already maxed out its covenant facilities, covenant debt can't go any higher! (unless they exceed their overdraft limit, which the bank would probably prevent, by rejecting BACS runs that would breach the limit.

Working backwards from the 2.5 times Net Debt: EBITDA covenant, and the maximum facilities less cash of £113m, this means that EBITDA would have to drop to below £45.2m to breach this covenant. The current estimate is about £56m, but if serious disruption to trade occurs due to the current funding crisis, then EBITDA could plunge, and trigger a breach of bank covenants later this year. So again, time is very much of the essence, they need to get the short-term funding crisis resolved in days, rather than weeks, in my view.

Invoice discounting facility - historically, CVR seems to have drawn down relatively little of this facility, which is perplexing. With a large trade receivables book (of £184.2m in last Annual Report - as at 30 April 2017), then surely CVR could relieve the pressure on its maxed-out, and relatively small overdraft, by drawing down more heavily on its £130m invoice discounting facility - which, crucially, lies outside the scope of the bank covenants, so is better (i.e. safer) debt to incur. Unfortunately, today's announcement does not state how much headroom the company has on that particular facility.

What happens next?

The Company has engaged PwC to assist it in its forthcoming discussions with HM Revenue & Customs and its key stakeholders including its lending banks, credit insurers, suppliers and other creditors, as well as to determine the potential impact of any resulting funding requirement on the Company's adjusted EBITDA expectation and compliance with its banking covenants.

Following preliminary advice received from PwC, whilst there can be no guarantee, the Board believes this short term funding requirement will be satisfactorily resolved.

To me this seems nonsensical - it's a sledgehammer to crack a nut. In this situation, what the CEO/Chairman should be doing, is ringing round its biggest Institutional shareholders, and do a quick discounted placing for £30m, to get them out of trouble.

If they were to offer say 60m new shares at 50p each, I'm sure there would be plenty of takers. Better still, do an accelerated book build, and get the whole thing sorted in a couple of days. If they do that, there wouldn't be any need to have further discussions with various stakeholders, the situation would have been quickly fixed.

My opinion - it's quite clear that this business has incompetent management, who need to be cleared out, once the current funding crisis is sorted.

The fundamental problem here is not the bank covenants. It's rather that the overdraft facility is too small for what the company needs in the short term, to make this £30m payment to HMRC. Therefore the quickest solution would be to persuade the bank to extend the overdraft by £30m, to give the company breathing space to raise some fresh equity, and to relax the covenants until the fundraising is done.

Of course, PwC will love to string out the whole process, as it means lucrative fees for them. It would be much better to send PwC packing, and instead get the house broker to do a very fast, underwritten discounted placing. Then once the financial position has been stabilised, the company could do another equity fundraising, with pre-emption rights, a Rights Issue, so that existing shareholders could also participate, and the balance sheet completely secured. (by the way, I don't charge for my advice to the company, unlike PwC).

EDIT: a friend has just messaged me, to make the excellent point that the bank (and potential equity investors) probably insisted on sending in PwC to review the books, before agreeing to extend further credit or new shares. I should have thought about that before criticising management for bringing in PwC. That was a rather daft oversight, since I've personally been in a situation where the bank insisted on the company calling in a firm of accountants to review the books. Banks also can use these reports as justification for withdrawing credit, if the investigating accountants paint a negative picture. End of edit

These are fundamentally sound businesses, in my opinion, and the amounts involved here are not huge. So this financial crisis really should be fairly straightforward to solve - if the company had competent management. The trouble is, they clearly don't have competent management.

Anyway, I hope they manage to resolve matters quickly. Being a holder of the shares, since yesterday afternoon, I'm braced for a loss of at least 50% on the price I paid. Thankfully my position sizing rules mean that I never take large positions in companies with a lot of debt. So the likely losses here for me, even if it goes bust, which I think is unlikely, won't be disastrous.

Another solution to short term funding issues, is to get your credit controller on the phone to the biggest customers, and offer them a 1% discount early payment discount, to settle everything on the account early. So if say £50m in customer invoices could be paid more quickly, then that would buy some breathing space, at a relatively small cost of £0.5m.

I did wonder why the market reaction to the first profit warning was so severe. Now we know why - some of the sellers must have known that the problems were worse than originally announced. So that's another good reason to follow Stockopedia's profit warning guide, and sell on the first piece of bad news. I have printed it off, and will have another re-read of it, given that ignoring its conclusions is likely to cost me about the price of a medium sized car, in losses incurred in one day.

EDIT: Given that reporting accountants might take about 2 weeks to produce a report for the bank, then I can't see this share coming back from suspension any time soon - we're probably looking at either insolvency, or more likely a resumption of trading in the share, some time in April. The institutions won't want a total loss on their hands, and it's a viable business, so I'm fairly sure that an equity fundraising is likely to happen. Fingers crossed the various parties can sort this out - it looks fixable, in my view.

Another RNS has been issued this afternoon, saying that, very sensibly, CVR has cancelled its interim dividend, which was due to be paid this Friday, 16 March. This improves the cash position by £8.2m. Clearly this was both necessary, and very much the right thing to do.

End of edit

I've been rather pre-occupied with Conviviality (LON:CVR) today, so haven't had time to look at anything else. Let's review a few more things.

Somero Enterprises Inc (LON:SOM)

Share price: 372p (up 3.3% today, at 15:17)

No. shares: 56.24m

Market cap: £209.2m

(at the time of writing, I hold a long position in this share)

This company is a long-standing favourite of ours here at the SCVR. It's based in America, and sells laser-guided concrete screeding machines worldwide. It has little to no competition, therefore achieves high profit margins. There is an increasing need for perfectly flat concrete floors, due to warehouse automation. Therefore I feel that this company is in a potentially long-term growth market. Although note that selling capital equipment, it is very cyclical.

Note that this company reports in US dollars.

- Revenue up 8% to $85.6 million

- adjusted EBITDA 14% to $28 million

- Diluted adjusted earnings per share 31 US cents, up 15% on prior year (stock appear is showing 29 US cents forecast for 2017, so this looks like an earnings beat)

- In sterling this is 22.2p, giving a per of 16.9

- net cash of $19 million (down 6%)

- Dividends of 19.1 US cents paid, including a special divvy of 3.6 US cents which is 50% of adjusted earnings

Outlook comments – detail is given for the various regions, and all sounds positive. The summary concludes

The Board believes the Company has many meaningful growth opportunities in 2018 across its broad portfolio of markets and products and is confident that Somero is poised to deliver another year of profitable growth to shareholders in 2018.

My opinion – this is such a nice company, producing strong results every year. It has a very strong balance sheet, with net cash, and pays generous dividends.

I feel that some investors have perhaps been overly cautious about this company, because of the problems it had in 2008, in the great financial crisis, when a lot of orders dried up as you would expect. Business is bound to drop again when the next recession kicks in. However we have synchronised growth now in most major economies, so I imagine Somero is likely to continue doing well for some time to come.

The valuation still looks reasonable, especially when you strip out cash. So I cannot see any reason to sell any of my shares any time soon. For that reason I'm happy to continue holding for the foreseeable future.

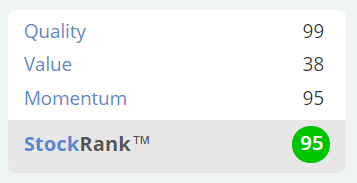

Stockopedia also likes the share, with a stock rank of 95.

A lot of small caps have seen considerable profit-taking in recent months, however Somero shares have remained strong. Remember that Somero also has upside from tax cuts in America, which is its largest market, and where it is headquartered.

What a lovely 2-year chart;

Empresaria (LON:EMR)

Share price: 88.2p (down 6.2% today, at market close)

No. shares: 49.0m

Market cap: £43.2m

This international specialist staffing group, reports its results for the year ended 31 Dec 2017.

Despite being a small cap, it has a good geographic spread of activities, which has proven helpful in these times of weaker sterling.

I've just watched a concise results presentation video, courtesy of our friends at PI World, which can be found here.

- Revenue rose 32% to £357.1 million – remember that this is mostly pass-through revenue, as with most staffing companies.

- Adjusted operating profit rose 18% to £11.6 million (13% growth at constant currency)

- Adjusted diluted earnings per share rose 11% to 12.5p - PER of 7.1

- Final dividend is up 15% to a very modest 1.32p – the company is focusing its cash flow mainly on financing acquisitions at the moment. Although note the potential for much bigger dividends longer term, once acquisitions cease.

A lot of the growth has come from acquisitions. There was little organic growth this year, due to Germany and the Middle East encountering specific problems.

Outlook - all a bit vague;

The Group has a strong platform from which to deliver the next phase of growth. The economic conditions are positive and whilst we maintain a cautious view on political risk, we see good opportunities to develop our Group further during the year ahead. We have a proven strategy and brands that have the potential to grow their profit.

The Group has a strong platform in place from which to launch the next phase of its growth and we see good opportunities to support the profitable growth of our brands in the year ahead."

Balance sheet – as with any acquisitive group, I like to check the balance sheet carefully, to ensure that financial stability has not been compromised. The importance of this is demonstrated today by Conviviality (LON:CVR) which has of course come spectacularly undone due to overdoing acquisitions, with an insufficient capital base.

Many companies fail to disclose their bank covenants to investors, which I think is very poor and should not be allowed. In contrast, Empresaria is refreshingly open, giving full disclosure;

As you can see, the group seems to have plenty of headroom on its banking covenants.

NAV: £48.9m

NTAV: -£5.2m - this is negative because the balance sheet is top-heavy with goodwill of £35.9 million and other intangible assets of £18.2 million. Not ideal, but not a major concern either, given that the group is decently profitable. Note that there are deferred tax liabilities of £4.1 million in long-term creditors, which probably relates to the intangible assets. This could be added back, arriving at adjusted NTAV of -£1.1m.

Working capital - current ratio is 0.97 – which looks rather weak to me. I prefer the current ratio to be 1.3 or more.

Cash flow statement - this looks very healthy, but one item jumps out at me as being high, namely income taxes paid. The group seems to have a high tax rate, presumably due to overseas operations being subject to higher taxes.

My opinion – this seems to be a well-run group, which has performed very well in recent years, fuelled by what seems to have been a series of sensible acquisitions.

My biggest difficulty in analysing the share is how to treat its bank debt. Net debt is modest, but gross debt is considerable, so which figure do we use? I can't really make my mind up unfortunately!

Small staffing companies are cheap at the moment. Only very modest earnings growth is forecast in 2018 and 2019 at Empresaria. So why would it deserve a premium rating?

Overall, I'm neutral on this share. It has some positive features, such as decent profits and cash flow, and it seems well-managed. However the balance sheet isn't great, and the divvy is small. The company says it expects debt to fall significantly in 2018, so the figures might be more to my liking in a years time.

I hadn't realised that the share price has halved from its peak in June 2017. Hmmm, given that it's only on a PER of just over 7, maybe this might be a reasonably good entry point?

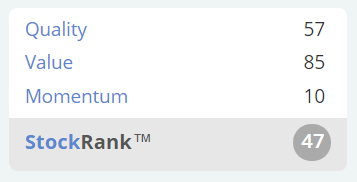

The StockRank nicely reflects that this is a value share, but momentum is very poor, for both share price and earnings forecasts.

I have to leave it there for today.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.