Morning all,

A busy round of updates. This list is provisional:

- Somero Enterprises Inc (LON:SOM) - trading update

- Norcros (LON:NXR) - proposed acquisition and trading update

- 1pm (LON:OPM) - interim results

- Headlam (LON:HEAD) - trading update

- City of London Investment (LON:CLIG) - trading update

Somero Enterprises Inc (LON:SOM)

- Share price: 337.5p (+15%)

- No. of shares: 56 million

- Market cap: £190 million ($244 million)

Well done to holders, as Somero delivers that pleasant phrase: "ahead of expectations".

Key points:

- 2018 revenues and EBITDA "moderately ahead of market expectations". (EBITDA was expected to be $29 million)

- net cash "more significantly ahead of expectations" (it was expected to be $25 million)

- no change to dividend policy

The company is excited about its new product, the SkyScreed 25, which you can watch in operation at this link. It will be officially launched later this month.

A booming US construction industry is responsible for Somero's outperformance, as Europe, China and Latin America were all down by varying amounts.

My hunch that it will be impossible to penetrate China is unchanged after the company says its efforts there "have yet to gain full traction".

Outlook

Confident of more profitable growth in 2019.

My view

Stocko shows a forecast for net income of $21.4 million for 2018, rising to $22.7 million in 2019.

"Moderately ahead" - is that a 3%-5% beat? Perhaps 2018 net income was $22 - $22.5 million? And 2019 income could be $23 - $24 million?

Let's assume that the enterprise value is in the region of $210 million, after deducting an estimate for Somero's big cash pile.

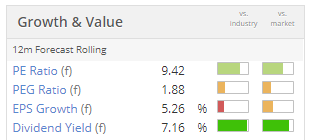

So I would put the cash-adjusted P/E ratio for 2019 at c. 9x. Stockopedia's 9.4x estimate for the rolling P/E ratio is possibly too high:

Whichever way you look at it, the company is cheap on conventional metrics and is a top performer when it comes to return on capital, operating margins, etc.

So it's difficult for me to argue against the view that the shares are still undervalued, and perhaps structurally undervalued due to their listing on AIM.

When I studied this company in some detail, I came to the view that it faced very little competition, at least in North America/Europe, and I believe that this is still the case. It offers the best machines and one of the very few options when it comes to achieving flat concrete floors. This explains its surprisingly high returns.

Congratulations to holders. I can't quite convince myself to buy shares in a small American company, so I will leave it to others to enjoy the ride.

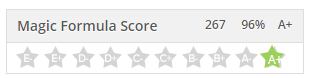

Worth noting that the StockRank is an excellent 88, and it has an A+ from the Magic Formula Score, i.e. high returns and low valuation.

Norcros (LON:NXR)

- Share price: 195.7p (+0.4%)

- No. of shares: 80 million

- Market cap: £157 million

Proposed Acquisition and Trading Update

Let's cover the first thing last: trading is in line with expectations. The bathroom/kitchen products group is experiencing a "challenging" environment, but expects to outperform its markets and deliver results in line with expectations.

Nothing wrong with that at all.

Separately, it is buying a South African plumbing materials company for up to £12 million. It made pre-tax profit of £1.9 million in FY 2018.

Acquisition Rationale: expand the bathroom portfolio with complementary products, reinforce the Group's overall position, and strengthen the subsidiary with Norcros' distribution channels, etc.

My view: Rather like Somero, I can see some strong arguments for investing in this company. It is cheap on a P/E basis (6x), is being managed well, and is executing its plans. It has some recognisable brands, e.g. Triton electric showers, and has an excellent track record of profitability (nearly always profitable).

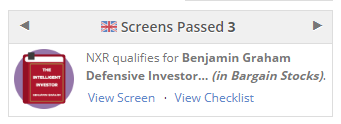

It also has a very strong StockRank of 86, and passes three of the Screens (in Bargain Stocks, Income Investing and Growth Investing).

Against that, you have to bear in mind the debt load (£53.5 million at September 2018), the pension liability (£29 million), the lack of organic growth, and the exposure to South Africa (one-third of revenues).

In conclusion, I'm inclined to think that these shares are priced about rght. For example, trailing EV/EBITDA is 6.5x according to Stocko. Its latest acquisition, excluding the earn-out, is at a trailing P/EBITDA rating of 5.2x. Norcros certainly deserves a higher rating than an undiversified subsidiary, but I would be surprised if it deserved a rating that was 50% - 100% higher.

1pm (LON:OPM)

- Share price: 46p (unch.)

- No. of shares: 87.6 million

- Market cap: £40 million

This SME lender is doing fine - all the financial metrics making positive progress. Revenue up 15%, EPS up 12%.

The only slight negative is that the bad debt provision has nudged up to 2% of the portfolio (1.8% a year ago).

60% of loans it originates are forwarded on to other lenders, with the rest being funded on its own balance sheet.

Organic growth has been the focus over the past six months. Acquisitions are a possibility in the next phase of growth.

Outlook is optimistic.

My view

There is no reference to return on equity (ROE) in today's results - it would be helpful to get a comment on how the company sees this metric evolving for them.

At its final results for FY 2018, it reported return on capital of 13.3%, up from 11.5%.

A note published by Hardman says that ROE was 13% in FY 2018, and forecasts the same again in FY 2019 and FY 2020.

That's quite a reasonable level for an SME lender, in my view. Being paid research, I presume these forecasts match with what the company itself expects to achieve.

The company's history of acquisitions muddies the calculation, however - goodwill is £28 million, i.e. more than half of balance sheet equity. Tangible equity is just £23 million.

My portfolio holding, PCF (LON:PCF), currently trades at nearly 2x tangible equity. 1pm (LON:OPM) is at a similar multiple at the current share price.

I'd rather take a conservative view and value it based on tangible equity - from that perspective, 1pm looks fairly priced. While its P/E multiple is undoubtedly very cheap at just 6x, that looks to me like a fair reflection of the balance sheet position.

By the way, I note rumours that Atom Bank is about to be snapped up by BBVA. I wonder if this could become a trend - challenger banks getting bought out by the big names.

Headlam (LON:HEAD)

- Share price: 394p (-1.5%)

- No. of shares: 84.6 million

- Market cap: £333 million

Let's take a quick look at the update from this floorcoverings distributor.

2018 is in line, after much concern that it would be a miss.

2019, on the other hand, is pointing lower. Reasons given:

- a changing revenue mix leading to lower margins

- higher distribution costs, administrative expenses

- efficiency initiatives being at an early stage

This seems like one of the better companies associated with floorcoverings. The description of the business on its own website is very clear. It provides a massive logistics operations, enabling suppliers and retailers to focus on their own core strengths.

It is preparing for Brexit by stocking up on additional inventory - sensible.

Headlam has net cash, good returns, and isn't spending too much on acquisitions. It's keeping things simple - I like simple!

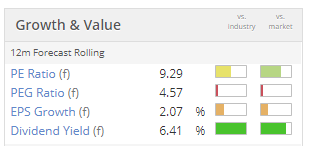

I'm leaning towards the view that this one is underpriced. Hopefully it can start to grow profits again by FY 2020:

City of London Investment (LON:CLIG)

- Share price: 361.65p (-4%)

- No. of shares: 26.7 million

- Market cap: £99 million

FUNDS UNDER MANAGEMENT - Trading Update

This investor in closed-end funds has seen a net outflow of $42 million over six months, and negative performance has contributed to a total reduction in funds under management (FuM) of some $480 million.

Key points:

- FuM is $4.6 billion at Dec 2018, versus $5.1 billion at June 2018.

- The primary strategy, Emerging Markets, outperformed, but the newer strategies all underperformed.

- On a positive note, CLIG has received notification of inflows worth $125 million to be funded over the next quarter

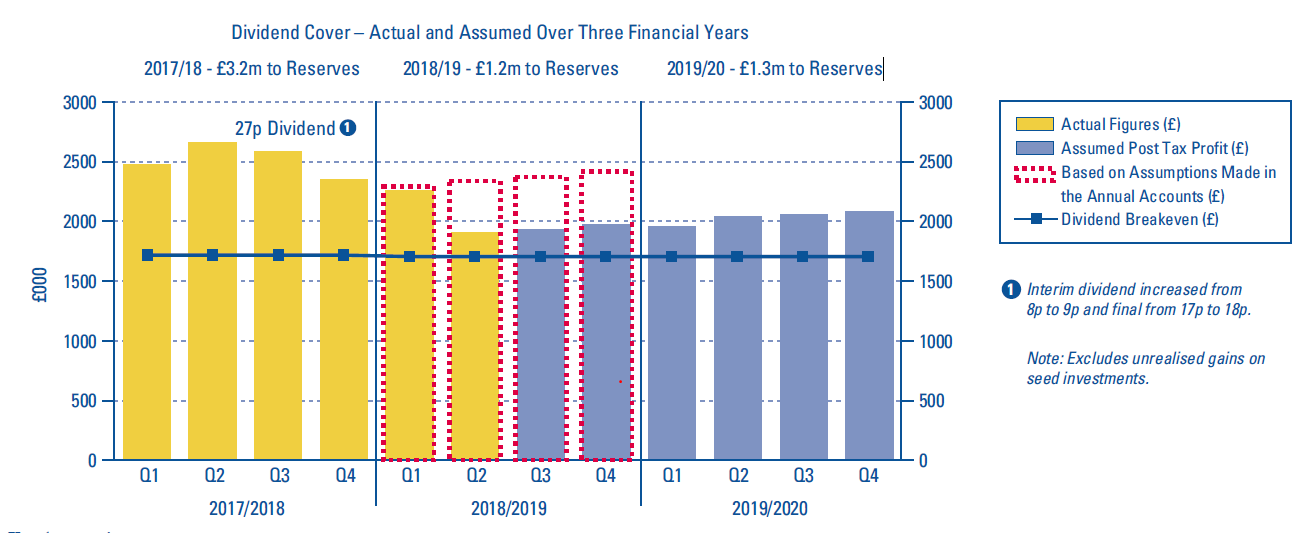

The update includes a link to the following picture, showing that the current dividend (plotted with squares) is worth almost as much as the company's entire net income:

The dividend yield is a stonking 8%.

I would think that prospects for long-term growth are probably still good - emerging market asset managers enjoy some nice tailwinds. Short-term developments have been a bit disappointing, and the share price reaction has left the stock with a ValueRank of 98. The Stocko system ranks this as a Super Stock.

So this is another fund management company that I am keenly interested in. I also think that Ashmore (LON:ASHM), Jupiter Fund Management (LON:JUP) and Schroders (LON:SDR) are worth a look.

Other stories in passing:

- City Pub (LON:CPC) - trading in line, acquisition.

- Works co uk (LON:WRKS) - gifts & stationary retailer trading in line, loss-making but plans to grow

- Van Elle Holdings (LON:VANL) - weaker margins in one divison and a revenue miss at another means full year performance significantly below expectations, shares down 25%. High StockRank, could be worth investigang.

- EKF Diagnostics Holdings (LON:EKF) - adjusted EBITDA ahead of expectations

- Actual Experience (LON:ACT) - early stage company, loss-making but confident. Sucker Stock.

That's it for today. It's hard to cover things in a lot of detail when there are so many updates - hope I provided a few ideas for you at least!

All the best

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.