Good morning!

It's Paul here.

I'm loving the positive energy we're generating this week - especially Robbie Burns' motivational message left in the comments section earlier this week! Nice one Robbie!

Quick initial review of RNS

(written from 7-8am, and not edited later - I'll try to stick to this format going forwards, as readers seem to like it. More detailed company sections are further down)

Zoo Digital (LON:ZOO)

Trading update - looks a poor performance for y/e 31 Mar 2019. Breakeven in H2 at EBITDA level.

It warned on profits in Jan 2019, so I'm not sure how much bad news is already in the price? Forecast looks to be a little above breakeven. Share price has already dropped more than 2/3rds since peak last summer.

Quite an interesting growth story that hit the buffers, so I'll take a closer look later.

Pendragon (LON:PDG)

Profit warning - poor Q1, due to lower margins & higher costs. Profits £10m lower than expected in Q1 - ouch. Strategic review being undertaken by new CEO & CFO.

Bad news, that's likely to have read-across for other car dealers too - expect a fall in share prices in this sector.

I'll take a closer look later.

Dart (LON:DTG)

Mid cap, so just a quick comment.

y/e 31 Mar 2019 - trading was slightly ahead of expectations. Leisure travel business doing well.

y/e 31 Mar 2020 - uncertain outlook. Pricing under pressure. Despite this, Board confident of meeting expectations.

An excellent business, in my opinion. Looks good value. Very high StockRank. Worth a closer look. Brexit concerns could be providing a buying opportunity perhaps? People won't stop going on holiday.

No further comments from me today on this one.

Dialight (LON:DIA)

AGM trading update - this industrial LED lighting group seems to be permanently trying to sort out operational problems.

Makes encouraging noises today, but says 2019 results to be "heavily weighted" towards H2. That makes it too risky for me.

I don't have enough information to take it any further today.

Universe (LON:UNG)

2018 results - small, but profitable, ex-growth EPoS software company. Hit by Conviviality insolvency. Despite that, 2018 results in line with Sept 2018 trading update. £0.9m operating profit. Acquisition in Apr 2019 to drive growth.

Doesn't interest me - too small, and illiquid. No organic growth since 2014. Why is it listed?

Carclo (LON:CAR)

Looks like another profit warning.

the profits for Wipac, and consequently the Group, falling below the Board's expectations for the year.

Eek, this looks worrisome - problems with bank covenant;

Group net debt at 31 March 2019 was in line with expectations, at slightly above the level at the half year. Given the ongoing discussions with customers referred to above, the net debt to EBITDA banking covenant test at 31 March 2019 was deferred by the bank for one month in advance of the year-end. The Group is financed through an overdraft facility and a £30m term loan maturing in March 2020, which will require refinancing in the coming months.

My opinion - this is uninvestable until finances sorted out. Looks very high risk.

Main Sections

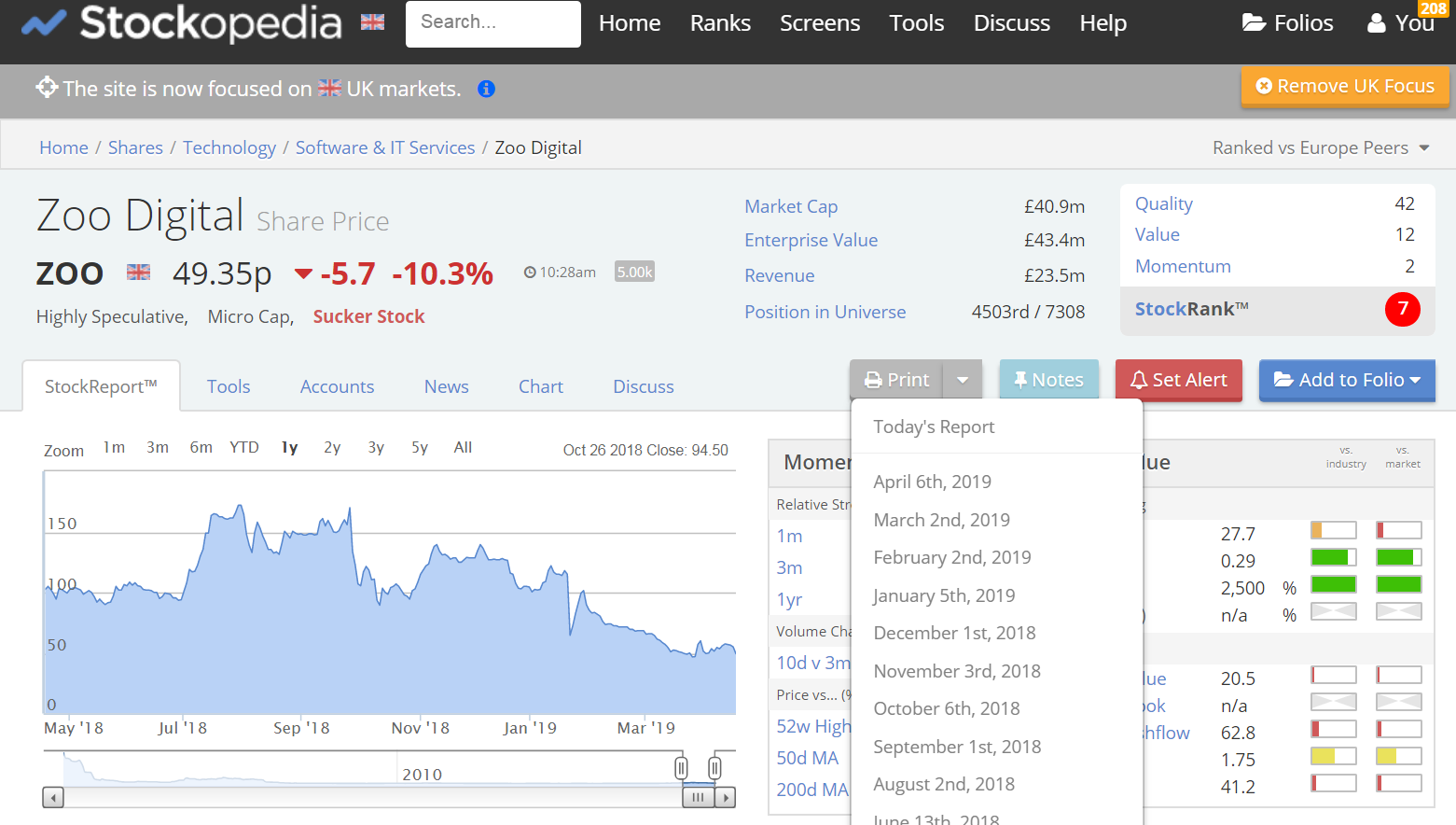

Zoo Digital (LON:ZOO)

Share price: 49.0p (down 11% today, at 10:49)

No. shares: 74.4m

Market cap: £36.5m

ZOO Digital Group plc, a world-leading provider of cloud-based localisation and digital distribution services to the global entertainment industry, today issues the following trading update in respect of the year ended 31 March 2019.

If my understanding is correct, ZOO provides services such as voice dubbing & subtitles, in various languages, such that films & TV programmes can be aired internationally. The bull case was that ZOO had important contracts with major companies, and that the market was growing fast, due to the popularity of Netflix, and other TV streaming services. ZOO also claimed competitive advantages from its offerings being cloud-based.

As you can see from the 2-year chart below, this is one of many growth companies where the valuation got (with hindsight) completely out of hand last year;

It's surprising how many growth stocks have an almost identical chart - as we've seen a big market de-rating of growth companies.

Stockopedia has a great feature, whereby you can look back at historical StockReports. This is particularly useful when reviewing companies which have gone wrong. Were there any warning signs? For anyone not aware, to access historic StockReports here, you click the "Print" button, and a drop down list of monthly StockReports appears, for you to click on the one you want, which then comes up in a pdf format, handy for printing;

Looking back to when ZOO shares were close to their peak, at 148.5p, in Sept 2018, what is striking is that ZOO was valued on 80.8 times forward earnings! At that time, the FY 03/2019 forecast was for $33.0m revenues, and $1.57m net profit.

After the Jan 2019 profit warning, forecasts came down. Today the company reports it achieved $29.0m revenues, so $4m below the forecast back in Sept 2018. Not great, but hardly a disaster either. One contract lost accounted for half of this revenue miss, apparently.

Today's trading update says H2 was "around break-even", slightly worse than the $0.5m achieved in H1. These (annoyingly) are both quoted at the EBITDA level. Once you take into account depreciation, and amortisation of development spend, then it's modestly loss-making. It doesn't generate cash either, looking at the last cashflow statement.

So clearly investors were getting excited about future growth, rather than historic performance. That's fine, if the growth actually happens, but based on today's update, that growth just is not happening at the moment. Hence the big de-rating of the shares, to a forward PER now of 27.7 times - which looks more sensible than the bonkers 80.8 times forward PER last autumn.

Broker update - the house broker has put out a bullish note today, it's on Research Tree (which I use as my main source of broker updates), concluding;

... we strongly believe ZOO’s opportunity remains a case of “when” and not “if”, in an industry where even the modern OTT participants remain unexpectedly slow in adopting the opportunity from efficiencies in time and money from ZOO solutions in the cloud.

Balance sheet - I've checked back to the last reported balance sheet, and it's weak. This increases risk, if trading were to deteriorate.

NTAV is negative, at -$3.9m

There was $4.0m in long-term borrowings, plus another creditor of $4.67m called "Separable embedded derivative" - do any subscribers know what this pertains to?

Directors should be kicking themselves for not having taken advantage of last year's buoyant share price, to do a top-up placing to strengthen the balance sheet. That really was a cock-up. Companies should always mend the roof when the sun is shining. Especially a company like this that seems to have limited forward visibility, and is not cash generative yet.

This is what the company says today about cash;

The Group has been cash generative in the second half by focussing on strict working capital management, despite lower than anticipated profitability, such that the net cash balance of $1.8m at the year-end was double the amount at the half year stage with no debt other than the convertible loan notes. The business is therefore well-placed to grow organically during the forthcoming financial year.

Companies do tend to generate cash when revenues fall short, because receivables unwind, so there's not anything particularly impressive about this. As revenues rise, then cashflow is likely to turn negative again, at least to begin with, as receivables go back up again.

I think the "net cash" quoted above is incorrect. It's not net cash, it's gross cash, as the convertible loan notes are interest-bearing debt, so should have been included, to give a net debt of $2.2m position in reality.

Directorspeak - sounds realistic, and doesn't try to gloss over a disappointing year, which I like;

Stuart Green, Chief Executive commented,

"The financial outturn for 2019 is frustrating, having been impacted by market shifts and client disruption, but we are pleased that the business has grown and been cash generative.

We have been able to meet our investment and operational objectives which leave us well placed in markets globally where the requirement for premium media localisation clearly continues to increase.

"We believe demand for our cloud-based services is building, client adoption is accelerating and our recently launched ZOOstudio platform has been well received in the market. We are confident for the future."

Strange phrase to use, "we believe..." - it either is building, or it's not!

My opinion - this looks to me like a bull case that has had a wobble, but still might have some mileage in it. In the real world, smaller companies encounter bumps in the road, and progress is not linear. Visibility here looks limited, as the company seems to be subject to the vagaries of client contract decisions, some of which sound large, lumpy. Therefore, profit/losses look difficult to predict, making the share price volatile.

Based on performance to date (never having yet achieved a meaningful profit), I don't think this share is good value, even now after having dropped so much. However, this share is all about jam tomorrow. There seem to be positive industry trends, and ZOO looks to be in a good niche, at the right time. There must be loads of competitors though, in this space.

Therefore, this share could go either way. If it resumes revenue & profit growth, then the bulls could get excited again, and the share price could recover strongly.

Personally, it doesn't interest me, as I don't know anything about this sector, so it would be nothing more than a punt for me to buy. If I can't work out the probability of the bull case playing out, then it's little more than guesswork trying to value the share. Good luck to holders though, as quite a few of my friends hold this one, so I hope they do well.

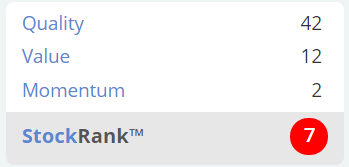

Stockopedia curls its lip at ZOO's figures, with a brutal "Sucker Stock" classification, and a dismal StockRank. It's fair to say though, that the Stockopedia algorithms are particularly sceptical about jam tomorrow shares (which is very useful I find, as a sense check);

The Altman score confirms my assessment, that the balance sheet is weak. Not necessarily a problem, but it certainly heightens risk;

ZOO qualifies for one Stockopedia screen - an Altman-based shorting screen. This is worth a look actually, as it flags up lots of companies with wobbly balance sheets here.

Pendragon (LON:PDG)

Share price: 22.8p (down 9% today, at 12:37)

No. shares: 1,396.9m

Market cap: £318.5m

Interim management statement - for Q1 2019

Car dealerships, including brands Stratstone, and Evans Halshaw.

I'm surprised the share price is only down 9% today, as to me this update seems poor.

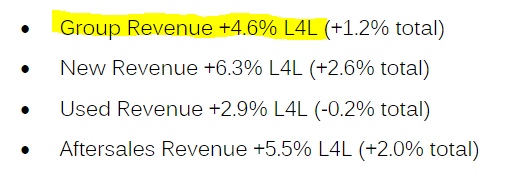

Revenues look fine, up on a like-for-like basis ("L4L" - i.e. stripping out the impact of branch openings & closures);

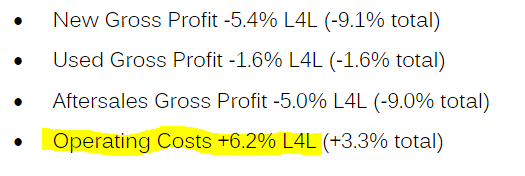

However, on the downside, gross profit from all 3 of its activities are down.

Operating costs are up sharply. That's a bad combination, as it's a two-pronged squeeze on the bottom line;

Impact on profitability - this looks quite serious to me, so why has the market almost shrugged it off, with just a 9% share price fall today?

This performance, combined with both a higher level of operating costs and increased losses within Car Store, arising from the ongoing development and maturation of the business (FY19 Q1: 34 stores, FY18 Q1: 26 stores), resulted in an underlying loss before tax of £2.8m.

This is around £10m lower than our expectations for the period, comprised of c.£7m from the net impact of higher revenue and lower margins, c.£2m of additional operating costs and c.£1m from the lower than expected Car Store performance.

That's a £10m profit shortfall, just in Q1! Current forecast consensus for 2019 on Stockopedia shows profit after tax of £36.5m. Therefore, if Q1's £10m shortfall is repeated throughout the rest of the year, then it would end up only a bit above breakeven. Maybe that is too simplistic on my part. Let's find out what brokers are saying.

I can't find any broker updates today, so this will remain a mystery for now.

Strategic review - is being undertaken by the new CEO & CFO. That sounds to me like closures, staff layoffs, and hence exceptional costs could be in the pipeline.

My opinion - this has turned me off the whole sector. Car dealers are all cheap, and often have great balance sheets with loads of freeholds. Declining new car sales were being offset by improved margins.

However, that seems to have turned on its head today for Pendragon - it's achieving lower margins across the board, in new, used, and aftersales. That really concerns me.

Other car dealers are probably facing the same pressures, so I'm now thinking in terms of giving the whole sector a wide berth. If profits are collapsing in the whole sector, then divis could also come under threat. Maybe they're not such good value after all?

That's me done for today, thanks for dropping by!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.