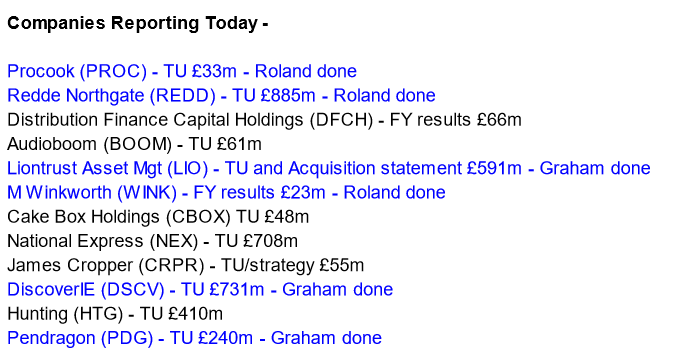

Good morning! It's Roland and Graham here with today's report.

Today's report is now finished (10.40). Have a good day!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Graham's section

Porvair (LON:PRV)

- Share price: 600p pre-market (-2% yesterday)

- Market cap: £278m

We had an AGM update from Porvair yesterday, “the specialist filtration, laboratory and environmental technology group”.

You can read more about what they do on their website. They have three divisions: “Aerospace & Industrial”, “Laboratory” and “Metal Melt Quality”.

Yesterday’s update was typically brief, as AGM updates often are:

In the four months ended March 2023, like-for-like constant currency revenue growth was 8%. Order lead times are shortening to more normal levels as supply chain disruption eases, notably in Laboratory and certain Industrial segments. The Group order book is however currently higher than in all previous years.

Not much to criticise here, as 8% like-for-like growth is likely enough to keep up with inflation, more or less.

I don’t think we ever quite got around to covering Porvair’s most recent full-year results, so here’s a brief overview of how the company performed.

It was a year of “unusually strong currency tailwinds”:

Revenue +18% to £173m, but only +13% at constant currencies.

Operating profit +25% to £19.8m

PBT +26% to £18.7m

The company spent only £4m on acquisitions in 2021, and only £1m on acquisitions in 2022, so these results are pretty close to being fully “organic”.

They finished the year with net cash of £18m.

CEO Ben Stocks flagged various reasons for caution in 2023:

"supply chain dislocation, while diminishing, requires vigilance; inflationary pressures continue; the wider economic picture is uncertain and there is a likelihood of currency headwinds"

Given the contents of the AGM update, the first four months of the year have perhaps not been too badly affected by these issues (although the impact of currencies has not been disclosed yet).

They don’t hedge against exchange rate risk, which is fine - I don’t think every company necessarily needs to hedge this risk.

I must say I like Porvair’s transparency around their long-term performance. Few companies want to analyse their 15-year performance in their annual results, but they do!

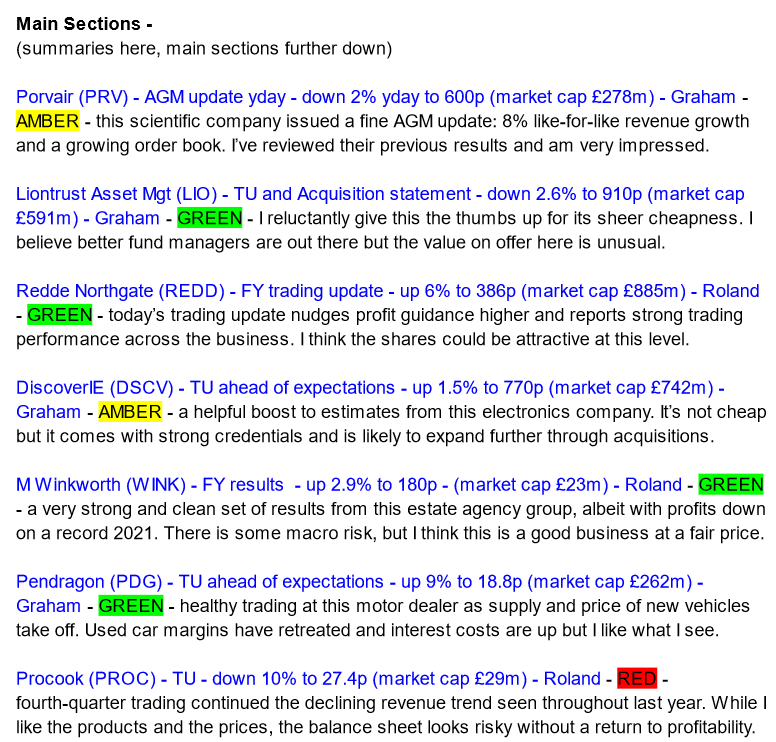

These columns help to summarise the sources and uses of cash over the last 5 years (left-hand side), 10 years (middle) and 15 years (right).

As you can see, the company has generated far more cash from operations than it has spent on capex and acquisitions. It’s true that investors can work this out for themselves without difficulty, but I take it as a positive sign that Porvair wants to highlight its long-term record.

Some comments on the long-term strategy:

Porvair's strategy and purpose has remained consistent for 18 years, a period that now encompasses two recessions and a pandemic. This longer-term growth record gives the Board confidence in the Group's capabilities and is the basis for capital allocation and planning decisions.

I’m actually very impressed by the strategy section: they mention that they “look for applications where product use is mandated and replacement demand is regular”, and that they “make new product development a core business activity”, building intellectual property where possible.

They also “aim to meet dividend and investment needs from free cash flow and modest borrowing facilities”. There has been no significant dilution here for a long time.

Pension: their defined benefit pension plan (closed to new members) has assets of £24.5m vs. liabilities of £34m. The annual deficit recovery payment is £2.1m.

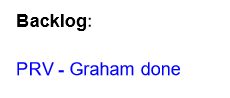

Graham's view

In the interests of time I’ll wrap this up here. I’m on the fence between Green and Amber. I think I’ll cautiously stick with Amber, because the market has rationally (in my opinion) awarded this company a higher-than-average valuation. It might still be worth paying up for these shares at this valuation, but at this rating you do need to have real conviction in its quality:

Liontrust Asset Management (LON:LIO)

- Share price: 910p (-2.6%)

- Market cap: £591m

I’ve written about this fund management group a few times over the past year. In particular, see here when I noted the very poor ValueRanks associated with many companies held by its “sustainable” funds, and here when I noted that the company’s AUM had fallen by much more than the headline numbers, if you excluded the impact of the acquisition it made.

We have two announcements to cover today.

First we have yesterday’s announcement: “Statement re press speculation”, regarding “a proposed acquisition of the entire issued share capital of GAM by Liontrust… with the intention of combining GAM's investment management business with Liontrust's investment management business… Liontrust confirms it has made an approach to the Board of GAM.”

GAM is another struggling fund manager, currently valued at just £84m in the Swiss market despite c. £67 billion in AUM as of Q3 2022:

GAM has been caught up in the Greensill scandal. From the Guardian last year:

A star fund manager who invested £1.5bn of his clients’ money in the scandal-hit Greensill Capital failed to report a dinner at Buckingham Palace, a £15,000 private jet trip to Sardinia, or secret fees and share options offered to his company by the since-collapsed lender, an investigation by the UK City regulator has revealed.

GAM is currently heavily loss-making and looks like it may be destined to merge with another company, whether that is Liontrust or someone else.

Liontrust is currently valued at almost 10x GAM’s market cap, despite having lower AUM. Whoever is going to buy GAM could find that they get a bargain - if they can convince clients to stop pulling their money out!

Trading update - Liontrust has also issued a trading update this morning. Key points:

Adjusted PBT to be ahead of market expectations for FY March 2023 and “not less than £86m”, thanks to “stronger than expected performance fee revenues” (£17m).

Net outflows of £4.8 billion for the year, of which £2 billion in Q4.

Most of the outflows were in retail funds rather than institutional accounts (in Q4 and in the year as a whole). I think it’s fair to say that retail flows tend to be more volatile and sentiment-driven.

Assets under management and advice finished the year at £31.4 billion, down 3.6% in Q4.

Graham’s view

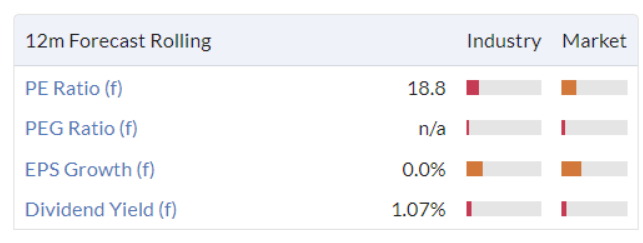

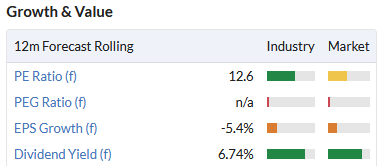

I’m going to reluctantly give Liontrust the thumbs up. It’s not one of my favourite fund management stocks, by a long way, but it is cheap, highly profitable and generates huge returns for shareholders:

The possible GAM acquisition offers a similar theme to Liontrust itself, although Liontrust’s brand is less weak than GAM’s. Buying additional AUM very cheaply is usually a good idea, because all you need is for at least some of the clients to have enough inertia to stay invested. So long as that happens, the economics of the deal should make good sense.

Discoverie (LON:DSCV)

- Share price: 770p (+1.5%)

- Market cap £742m

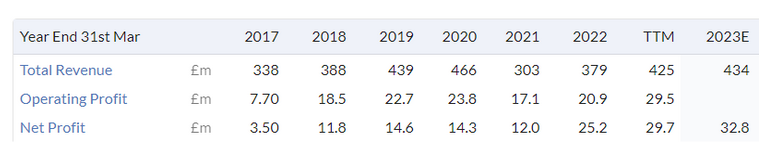

We don’t cover this one very often but maybe we should? It is “a leading international designer and manufacturer of customised electronics to industry”.

Financial track record looks strong:

Today we have a full-year trading update for FY March 2023. Full year underlying earnings are “ahead of the Board’s expectations”.

I have to pull out the broker note to find what these expectations were. finnCap have upgraded all of their estimates from FY 2023 to FY 2025, as follows:

Revenue estimates are boosted by over 1% for each of the three financial years.

PBT is boosted by 2.3% in FY 2023 and 1.3% in both FY 2024 and FY 2025.

So these aren’t huge upgrades by any means, but they don’t hurt!

The PBT estimates range from £44.8m in the year just finished, to £7.8m in FY 2025.

Let’s circle back and consider some of the features of the performance.

Revenues +8% organically, +5% from acquisitions and +3% from foreign exchange, so +16% in total (I like this simple method of presenting revenue growth!).

8% organic growth seems like the benchmark for what a good company is able to achieve in the current inflationary environment.

The order book has normalised “less than previously anticipated”, i.e. it has remained elevated. There is “good visibility” heading into FY 2024. Semiconductor availability issues are “mostly resolved”.

Net debt to adjusted EBITDA is currently 0.9x, which in most circumstances is considered to be a modest level. Indeed, DSCV’s target gearing range is 1.5x-2.0x! So they will certainly have the appetite to load up on more acquisitions. According to finnCap, net debt should currently be around £56m.

Graham’s view

My broad impressions of this company are positive. It is priced expensively at a P/E ratio of over 20x but that may be reasonable, given its strong performance history and its capacity for further growth through acquisitions. Worthy of further research, in my view.

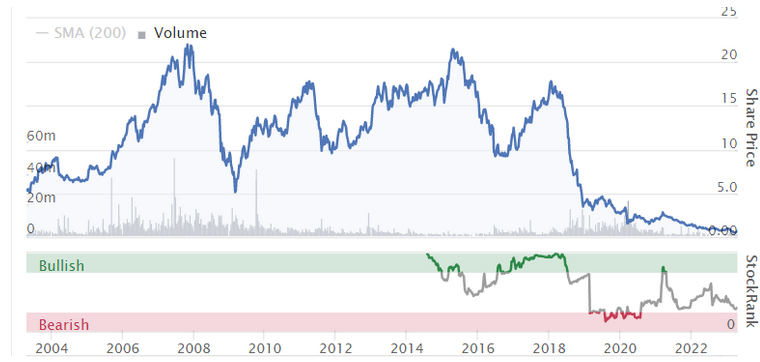

Pendragon (LON:PDG)

- Share price: 18.8p (+9%)

- Market cap: £262m

I last looked at this auto retailer in January when it said that trading was “slightly” ahead of expectations. The supply of new cars was improving, thereby allowing PDG’s volumes to improve.

Today we have an interim management statement for Q1 (January to March). It is ahead of expectations.

Key bullet points:

Like-for-like operating profit +32% to £37m

Interest costs up by £4.6m, an increase of over 50%

Underlying PBT for the quarter +23% to £23m

The rise in operating profit has easily cancelled out the rise in interest costs, allowing for that big 23% increase in underlying PBT.

New vehicle volumes were up 20% like-for-like, and gross profit per unit rose too, as manufacturers focused on higher margin models. As a result, gross profit on new vehicle sales rose 31% like-for-like.

The much healthier new car market did result in lower profits on used vehicles as the pressure in that sector has eased off to some extent.

Aftersales saw a 20% increase in like-for-like revenues.

Profits also grew at Pendragon’s software business Pinewood and its leasing business Pendragon Vehicle Management.

Outlook

The company thinks the used car market isn’t out of the woods yet:

There are encouraging signs of improvement in production and supply of new vehicles, although used vehicle supply is expected to remain tight for the foreseeable future. The Group remains mindful of the macro-economic headwinds including the potential for further interest rate rises and continued inflationary cost pressures, however as a result of the strong performance in Q1 it expects to comfortably outperform the Board's previous expectations for FY23.

Graham’s view

I’ve suggested before that this stock was only suitable for deep value aficionados who were comfortable taking on lots of economic risk.

But at the current level, and in the light of this trading update, I’m going to take a braver stance and give it the thumbs up.

Adjusted net debt (excluding leases and vehicle stocking loans) finished 2022 at only £23m which doesn’t strike me as a particularly scary number. Tangible net assets were £124m.

It’s likely that I’m missing something, but the company appears to be trading very robustly, so I just can’t see how this valuation makes sense right now.

Roland's section

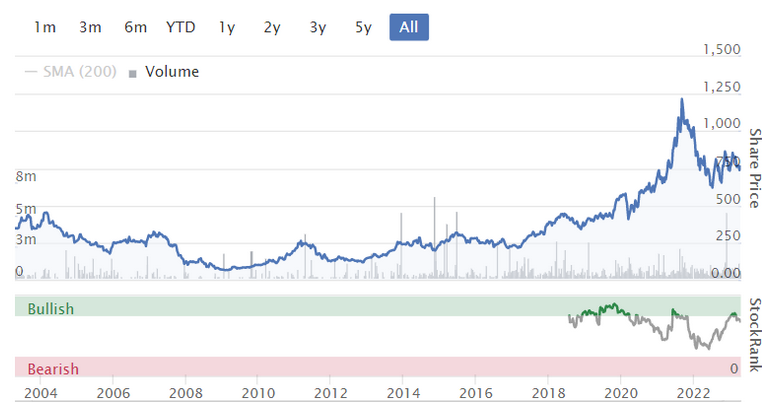

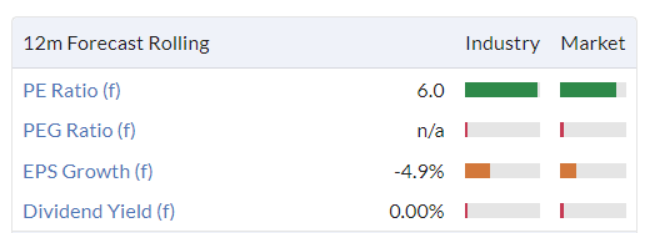

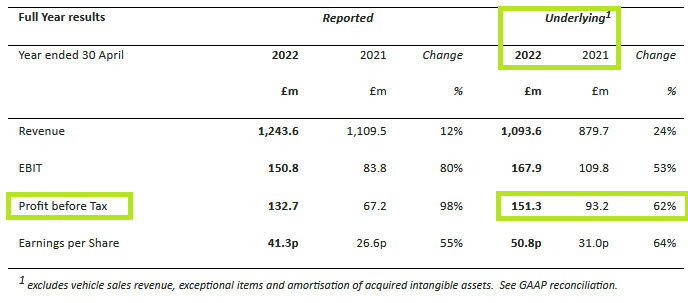

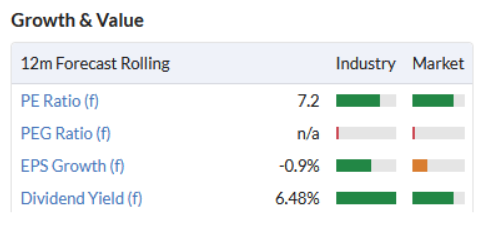

Redde Northgate (LON:REDD)

Share price: 364p (pre-market)

Market cap: £835m

Continued strong performance across the business, with FY23 adjusted PBT expected to be around the top end of consensus range

This FTSE 250 firm operates in the UK and Spain and is a “leading mobility solutions platform providing vehicles across the vehicle lifecycle”. At its core are the Northgate van hire business and the Redde claims management company, with a chain of workshops and Van Monster used van dealerships.

In addition to its core corporate van hire business, Redde’s clients include insurers such as Tesco (LON:TSCO) and Admiral (LON:ADM).

The company says that trading during the year ending 30 April 2023 has been ahead of expectations. Demand for both vehicle rental and accident management is said to be “strong and resilient”, including growth from major insurance contracts over the last 12 months.

Although supplies of new vans are starting to normalise, residual values have remained strong, supporting disposal profits.

As a result, the board now expects adjusted pre-tax profit for the full year to be “ahead of market consensus and around the top end of consensus range”.

Helpfully, the company includes its understanding of current consensus forecasts for us:

“Company-compiled consensus: adjusted PBT £155.2m, range £149.6m - £164.4m”

Today’s update suggests to me that we can expect an adjusted PBT figure of at least £160m for the current financial year.

How does this compare to last year?

Based on my estimate, it looks like the group may report an increase in adjusted pre-tax profit of 5%-8% for the 2023 financial year. That’s a slower rate of growth than last year, but that’s not surprising as market conditions continue to normalise.

Roland’s view

I have to admit that when Redde and Northgate combined, I was sceptical. But the resulting business has performed consistently well through some difficult markets. Today’s trading update appears to continue this trend.

I took a more detailed look at Redde Northgate in a piece in October 2022 – the shares are now trading at a slightly higher level, but still look quite attractively valued to me.

The main external risk I can see to the business is that the used van market will soften as new vehicle supplies improved. In a recession, this could combine with softer demand for rental vehicles.

The van rental side of the business generates the majority of profit, so a scenario like that could see profits fall materially.

So far, there’s no sign of such a slowdown. But today’s update didn’t include any comment on the year ahead, other than the following general remark from the CEO, Martin Ward:

“As we look forward, the Group is performing at record levels, there is more interest in our platform than ever before and we have a strong base from which to make strategic progress in the coming year.”

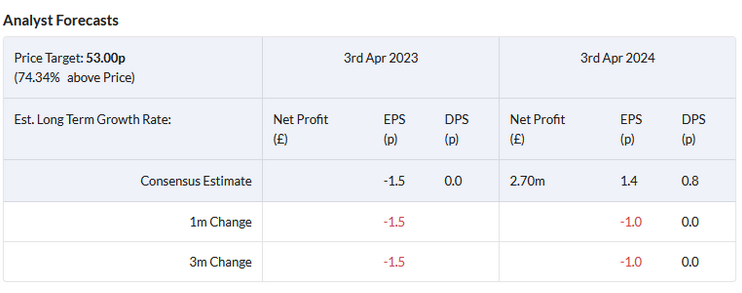

Prior to today, broker consensus for FY24 (prior to today) suggested a 2% fall in earnings next year:

I don’t know how the UK and Spanish economies will perform next year. But as things stand, Redde Northgate appears to be trading strongly. The group’s diversification into large-scale insurance contracts seems to be working well and looks to me like a sensible way to expand the business.

My view on this stock remains positive, despite some macro risk. This business also scores very highly with the StockRanks, providing a useful sanity check for my view:

M Winkworth (LON:WINK)

Share price: 180p (+2% at 08.50)

Market cap: £22m

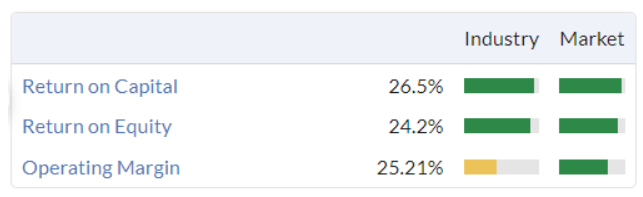

This family-controlled estate agency group is a little smaller than Property Franchise (LON:TPFG) (which we covered yesterday) but is another well-run and highly profitable franchise-based business, with a track record of growth:

Today’s final results appear to be pretty solid, albeit below record levels:

Financial performance in 2022 in line with management expectations but below the exceptional 2021 level. Revenues and pre-tax profits both markedly higher than 2019.

Financial highlights: the main numbers from today’s statement are indeed lower than last year, but they still suggest sparkling profitability and good cash generation:

Revenue: down 1.5% to £9.31m

Pre-tax profit: down 23% to £2.47m

Diluted earnings per share: down 22% to 15.2p

Dividend: 11p per share (2021: 9.3p per share + special dividend of 7.7p per share)

Year-end net cash: £5.25m (2021: £5.02m)

Free cash flow: £2.1m (2021: £1.9m)

Free cash flow per share: 16.6p (2021: 15.1p)

Operating margin: 26.5% (2021: 34.2%)

Return on capital employed: 35.2% (2021: 45.8%)

I can’t see anything to dislike here. Winkworth appears to have converted more than 100% of its earnings into free cash flow last year, supporting a very attractive 6% dividend yield.

Profitability is excellent and the group’s debt-free balance sheet contains enough cash to cover a full year of operating expenses.

In my view, the risks attached to this investment are more likely to be external than internal. Let’s see what the company has to say about conditions in the housing market.

Operational performance: like many estate agencies, Winkworth has increased its activity in the letting sector in recent years, to offset possible weakness in the sale market.

Today’s results show this shift continuing:

Total franchise network revenue: down 3% to £63.1m

Sales income down 12% to £34.3m

Lettings & Management up 11% to 28.7m

The end result is a 54:46 split between sales and lettings, compared to a 60:40 split in 2021.

Winkworth continued to expand last year, opening two new offices and supporting the expansion of existing franchisees in regional locations.

Housing Market commentary: Winkworth has a good insight into market conditions across London and many of the more affluent regions of southern England.

The company says that house prices peaked in August 2022, but there’s been a “predictable slowdown in activity” since the October budget, with “pricing being tested”. Early signs are said to suggest “a soft landing rather than significant weakness”.

London sales have performed more strongly than the regions, thanks to a return to office work and the resumption of international travel.

The rental market is said to have remained “incredibly strong” across all regions, due to a shortage of supply caused by many landlords exiting the market.

Outlook: the company says it expects UK transaction levels to return to historic average levels of around 1m per annum, below the boom levels of the last two years.

Average prices are expected to fall by around 5%, reflecting higher mortgage costs.

Rental continues to suffer “a severe shortage of supply”, especially in London. However, CEO Dominic Agace is hopeful that as finance costs recede slightly, some landlords may return to the market.

Despite short-term uncertainty, Agace believes the market could stabilise over the coming year and does not expect a hard landing:

“While the outcome for the current year is shrouded, now that mortgage rates have fallen from their peak and are settling at more historic norms of around 4%, we see a rebased market emerging. Rental prices are showing greater stability and we expect a further healthy contribution from our lettings and management business in 2023."

Roland’s view

This appears to be a high quality business with strong fundamentals and a near-bulletproof balance sheet. The year-end net cash balance of £5m is enough to cover a year’s operating expenses and covers around 22% of the current market cap.

The main risk I can see is that the UK economy – and housing market – could suffer a deeper downturn than currently expected.

I’m not sure this risk is fully priced into Winkworth stock at the moment, as the group appears to have a fairly high proportion of fixed costs. This could result in significant operating leverage. In other words, a small decline in revenue (as seen last year) could lead to a more significant fall in profits.

However, while the short-term outlook may be uncertain, I think the quality characteristics and strong management of this business mean that the medium-term outlook is attractive.

On balance,I think the shares could be attractively valued at current levels for long-term investors.

PROCOOK (LON:PROC)

Share price: 27p (-10% at 10.00)

Market cap: £29m

Full year performance in line with expectations

This cookware firm has been a disastrous flotation. After a brief boom during the pandemic, sales have slumped. Back in December, Graham suggested this as a stock to avoid “with vigour”.

Has anything changed since then?

Guidance for this year is for “approximately breakeven” at an adjusted pre-tax profit level. In other words, a statutory loss is very likely.

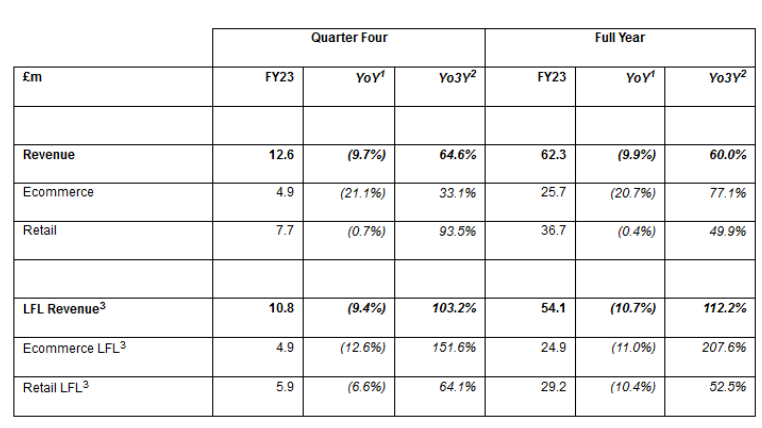

Broadly speaking, the decline in sales during the final quarter was consistent with the decline for the year as a whole. I’ve pasted in the chart from the RNS below, rather than trying to reproduce the numbers:

Trading update: We can see that both ecommerce and retail (store) revenue fell on a like-for-like basis last year.

The fall in ecommerce revenue is perhaps not surprising, given the impact of the pandemic on shopping habits. However, it’s clear that shoppers are simply buying less, not just switching from online to in-store purchases.

A decline in revenue in an inflationary environment suggests an even larger fall in sales volumes.

While total retail revenue is broadly flat, this includes sales from stores that were not open in the previous year.

We’ll have to hope that these stores are being opened at attractively low rental rates, in order that they can contribute to future profits when market conditions strengthen. The interim accounts showed £33m of lease liabilities, which seems quite material for a company that is struggling to breakeven:

Roland’s view

In fairness, ProCook’s total sales are still 60% higher than they were before the pandemic. I think it’s fair to say the group has expanded its franchise during this period. The question is whether this can be maintained, profitably.

I can see some positives here. ProCook is a family-led business that’s been in the same hands for 27 years. The founding O’Neill family remain the largest shareholders following the IPO, with more than 40% of the stock:

My impression is that the company’s products are quite good, too. I recently bought some new pans from ProCook and have been pleased with the quality – although they were heavily discounted.

I’ll watch the company’s progress with interest, but it’s too speculative for me to consider right now. Although bank debt was minimal at the half-year mark, this may since have increased.

If trading doesn’t improve, I think there’s some risk that equity holders could face dilution.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.