Good morning!

Plenty to digest today.

Final list:

- Sosandar (LON:SOS)

- Science in Sport (LON:SIS)

- Innovaderma (LON:IDP)

- Strix (LON:KETL)

- United Carpets (LON:UCG)

- Seeing Machines (LON:SEE)

Sosandar (LON:SOS)

- Share price: 42p (+5%)

- No. of shares: 107 million

- Market cap: £45 million

This popular share is being watched and commented upon by plenty of analysts and investors. Today's statement is worth recording for the archives:

I am pleased to confirm that the momentum outlined in our Final Results Statement in July continued through the summer months, with significant progress across KPIs and without the need for extended discounted promotional activity. Autumn has begun well with further expansion of the product range and strong trading across all product categories.

Trading is in line with expectations. The company is happy with the PR impact it's making from celebrity promotions and is now getting a 7-day service from its partner Clipper Logistics (LON:CLG).

My view: there are no numbers given so nothing concrete to analyse. We just have the reassurance that KPIs (conversion rate, number of orders, etc.) are making "significant progress".

Sales are forecast this year (ending March 2019) at £3.9 million. In July, Paul suggested a range of £4 million - £5 million was realistic.

It's too early-stage for me, but I wish it well.

Science in Sport (LON:SIS)

- Share price: 70p (+0.4%)

- No. of shares: 68 million

- Market cap: £47 million

I've collected more than my fair share of useless knowledge about this sports nutrition business over the years.

The idea is that the company would turn profitable or at least breakeven at some point, and I would be able to nip in and buy the shares when they finally offered a lower-risk investment opportunity.

Today's H1 report wants to be that breakthrough point, but I don't know if I'm convinced.

H1 highlights (and lowlights):

- revenues +20% to £10 million.

- operating loss increases to £1.6 million (adjusted EBITDA).

- excluding USA/Italy/Australia, instead focusing on what SIS calls its "core business", EBITDA is positive for the first time at £0.3 million. Also excluding the launch of a Football business, EBITDA would have been £0.9 million.

- Cash of £10.7 million, down by c. £6 million compared to December 2017.

- Improved online sales offset a decline in sales through traditional retail channels

Outlook - revenue growth in line with expectations and the core business to be increasingly profitable at EBITDA level.

My view - I really want this company to succeed and turn into an exciting investment opportunity. Unfortunately, it's not ticking enough boxes for me.

Sales growth is good but not earth-shattering at 20%, and I suspect that it is largely propelled much by the company's aggressive marketing spend.

Cash burn remains high although most of it was driven by working capital requirements rather than losses.

Another cause of concern is the very large share-based payments. These are conveniently left out of the adjusted EBITDA figures but they are very significant at £800k in H1 and £1.6 million last year.

That works out to about 14% of gross profit in H1 (or 17% of gross profit in FY 2017) being spent on executive bonuses. I don't know what else to say except that it seems far too high!

So I'll continue to watch this passively, with no real interest in buying the shares yet.

Incidentally, this stock passes James Montier's Short-Selling Screen due to it having the "unholy trinity" of a weak F-Score, a high valuation relative to sales, and high asset growth.

Innovaderma (LON:IDP)

- Share price: 165p (-2%)

- No. of shares: 14 million

- Market cap: £24 million

Skinny Tan to be ranged in Boots UK

InnovaDerma (LSE: IDP), a UK developer of life sciences, beauty and personal care products, is pleased to announce its results for the year ended 30 June 2018.

We have covered this a good bit previously, so check out the archives for a look at the history.

It has been a volatile one, rising to 400p last year before collapsing to 100p this year. It has raised money along the way, including most recently in October 2017.

We had previously been warned about the reduction in profits for FY 2018 (ending June):

- Sales up 21% at constant FX to £10.7 million

- PBT falls to £670k (FY 2017: £1.03 million)

- Cash £1.9 million

Skinny Tan has become a general beauty brand, rather than only fake tan. It will be distributed at boots.com and in half of Boots' UK stores from next year. Including Superdrug, whose exclusivity agreement with Skinny Drug will expire, that means it will be available in 2,000 stores nationwide.

Roots haircare is also being developed through product extensions. It will soon be available in around 1500 stores (a combination of Boots, Superdrug and Tesco).

I don't mind the fact that the company had inventory issues with Roots, such that demand outstripped supply. While it doesn't reflect well on management's ability to forecast inventory requirements (a new CEO to manage this side of the business has been hired), it does hint at the idea that IDP's profit warnings have been "good" ones, i.e. growing pains.

The other brands have potential, too. However, I still don't really understand why the company wants to build a portfolio of life sciences products, rather than focusing on hair-care and skincare.

I don't see the rationale for such a small company having its fingers in so many pies at this stage. It is seeking to develop new devices or acquire complementary businesses for the life sciences division.

Outlook - trading is in line with expectations.

My view - this is another company I want to like. If it was focused on Roots and Skinny Tan and perhaps a few other cosmetics projects, I'd probably want to buy the shares. But I have no idea what the life sciences division is going to look like in a few years, or how much money the company might look to spend on acquiring and developing life sciences businesses, so it's not for me.

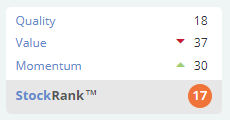

Perhaps harshly, the StockRanks don't like it at all and rate it as a Sucker Stock.

Strix (LON:KETL)

- Share price: 162.5p (-3%)

- No. of shares: 190 million

- Market cap: £309 million

Strix (AIM: KETL), the AIM listed global leader in the design, manufacture and supply of kettle safety controls and other complementary water temperature management components, is pleased to announce its unaudited interim results for the six months ended 30 June 2018.

This is a great business, listed since August 2017. It has what amounts to a monopoly (through IP rights) on an essential piece of kit found in kettles all over the world. Global market share is estimated at 38%.

The tricky bit is defending its IP in the developing world (especially in China, where the devices are made!) and getting regulators to impose standards which require safety controls.

It also has a growth opportunity in coffee that we mentioned recently in this report, and is active in baby formula milk and filter water preparation.

The outlook for the full year is in line with expectations.

Results:

- revenues +1.5% to £43 million

- adjusted PBT minus 1.9% due to finance costs

- net debt £38 million

Dividend - total dividend of 7p this year, 7.7p next year, and will then increase dividends in line with future growth in earnings.

My view - not much more to add except that I still really like this business and will hopefully get the chance to add it to my portfolio at some stage.

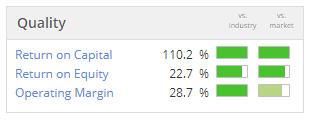

Its amazing quality metrics demonstrate the power of its intellectual property:

United Carpets (LON:UCG)

- Share price: 6.75p (-13%)

- No. of shares: 81 million

- Market cap: £5.5 million

(Please note that I currently own UCG shares.)

This is one of the very few remaining shares in my portfolio from that period when I was focused on "value" more than anything else.

The share price has gradually deteriorated during my holding period. The only consolation is that I have picked up more than 2p in dividends, softening the blow.

When today's announcement was released at 11:25am (why?), I immediately checked the bid, to see if I could get a satisfactory price for any shares. I couldn't, so I decided to continue holding.

The statement says that as a consequence of the warm weather and the World Cup, affecting UCG and the sector as a whole, like-for-like sales are down 1.9% and profits are significantly lower, due to increased marketing spend ("investment") and other costs.

Despite this, the Board is confident it will remain "cash generative, with no borrowings, and able to support its current dividend policy".

Net funds were last reported at £2.6 million and the annual dividend is running at 0.42p per share, for a yield of 6% at the latest share price according to Stocko.

So the share still has one or two "deep value" characteristics, notably the cash pile.

If I was constructing my portfolio from scratch, I probably wouldn't add this one. But I own too much of it to sell very easily. so I feel locked in, and in any case I'm quite stubborn when it comes to selling.

As the saying goes: experience is what you get when you don't get what you want.

Seeing Machines (LON:SEE)

- Share price: 6.75p (-1%)

- No. of shares: 2253 million

- Market cap: £152 million

This is another early-stage company. It makes driver monitoring systems for detecting drowsiness and distraction. I am out of time for today but wanted to mention it in passing as I know that some readers are interested in it.

Sales have doubled to A$30.7 million but expenses are huge, including A$20 million of R&D. So the pre-tax loss is A$36 million.

Outlook - "current expectation for FY 2019 revenue approximately in line with FY 2018".

It had cash at the end of June of A$42 million, enough to fund about a year of losses and investing at the rates seen in FY 2018.

It's "highly speculative" according to Stocko - I can only agree.

All done for today, cheers!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.