Good morning! It's Roland and Graham here with today's report.

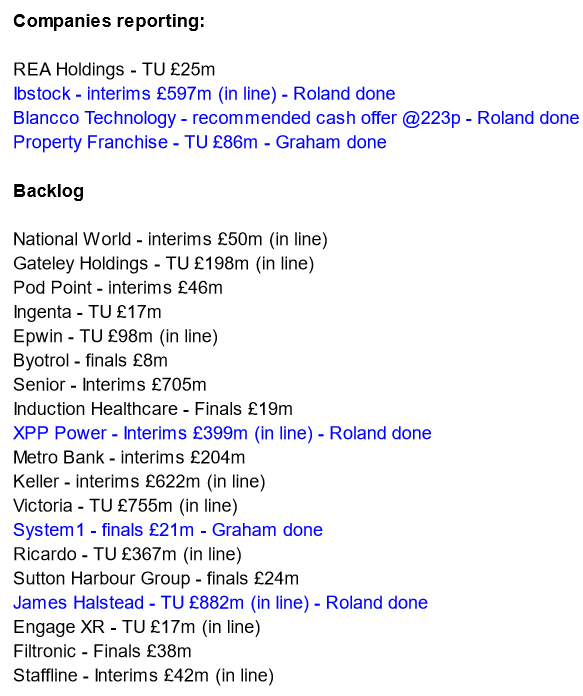

It's a quieter day for news, so we're hoping to cover some backlog items (see list below). Please feel free to highlight any interesting situations or movers in the comments!

Today's report is now finished (10.30).

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions

on them as possible candidates for further research if they interest

you. Our opinions will sometimes turn out to be right, and sometimes

wrong, because it's anybody's guess what direction market sentiment will

take & nobody can predict the future with certainty. We are

analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or

serious problems, so anyone looking at the share needs to be aware of

the high risk.

Summaries of main sections below

Property Franchise (LON:TPFG) - up 4% to 275.8p (£89m) - Half Year Trading Update - Graham - GREEN

An in line with expectations update from this property franchisor (the clue is in the name). Lettings revenue has risen thanks to more rental properties being managed at higher rents. I am a long-term fan of this business and I believe it offers excellent value at these levels.

System1 (LON:SYS1) - 177.5p (£22.5m) - Preliminary Results (in line) - Graham - AMBER

This “marketing decision-making platform” sees strong growth in platform revenues and is excited as it heads into FY 2024. Cash balance remains comfortable at nearly £6m. Existing management survived a shareholder vote. I’m neutral, waiting for meaningful profits.

Ibstock (LON:IBST) - up 5% to 160p (£618m) - Half-year results - Roland - AMBER/GREEN

The UK’s largest brick manufacturer says that trading remains in line with full-year expectations, but does inject a note of extra uncertainty into the outlook. Investment in modern new facilities continues. I can see some value here, despite macro risks.

XP Power (LON:XPP) - down 3% to 1,950p (£385m) - Half-year results - Roland - AMBER

This manufacturer of power controllers is going through a recovery process after a perfect storm of problems last year. I have some concerns about the risks posed by elevated debt. But on balance, I think the core attractions of the business are intact and the shares may offer value.

Quick comments (no sections below)

Blancco Technology (LON:BLTG) - 179p (pre-market) - recommended cash offer at 223p - Roland

Congratulations to holders of this data erasure software specialist, which has received a recommended cash offer of 223p per share - a premium of almost 25% to yesterday’s close and 45% above June’s lows. The buyer is Francisco Partners, a US private equity group.

This bid values the business at £175m, or roughly 22 times forecast earnings, for a business with an inconsistent record of profitability but recently improving momentum. I’m not especially familiar with Blancco, but it doesn’t seem an unreasonable offer to me. You can see Paul’s last comment here, when he took an AMBER view. If anyone has more insight into the business or the company’s market, then please let us know what you think in the comments.

James Halstead (LON:JHD) - 210p (unch) (£908m) - Trading update - GREEN - Roland

Just a quick comment on this excellent (in my opinion) family-controlled AIM firm, which specialises in high-quality vinyl flooring for non-residential purposes.

Halstead’s financial year ended on 30 June and Tuesday’s trading update confirmed that external conditions such as energy costs and shipping “greatly improved” in the latter part of the year.

Sales demand has been positive, “on the whole”, with increased demand in the UK, the Americas, Australia, Malaysia and New Zealand. Gross margins also improved, helped by a greater weighting towards commercial ranges, rather than heavy domestic.

The UK’s recent decision to join the CPTPP trade protocol will remove tariffs in many markets and is expected to be “good news” for the firm.

Stock levels have returned to more normal levels and cash balances have increased accordingly.

Halstead shares don’t look obviously cheap, on c.22x forecast earnings, with a 3.8% yield. But this business has consistently generated c.30% ROCE in recent years and has a net cash balance I estimate at over £40m. I think it’s a quality firm that is likely to be a sound long-term investment.

Graham's section

Property Franchise (LON:TPFG)

Share price: 275.8p (+4%)

Market cap: £89m

This H1 update is in line with expectations.

The Property Franchise Group PLC, the UK's largest property franchisor, is pleased to provide an update on trading ahead of publishing its interim results on Tuesday 12 September 2023.

As with Foxtons (LON:FOXT), TPFG is able to rely on lettings revenues even when property sales-related revenues are struggling.

Or in TPFG’s words, lettings provides “a growing and highly resilient revenue stream”.

Some highlights:

Total revenue +1% to £13.2m

Royalty income from franchisees +3% to £7.7m, of which 61% was lettings-related (GN note: this is the very high-quality revenue received by TPFG).

The company moves into net cash £0.7m.

We don’t get information about profitability in this update, but if the company is tracking in line with expectations then we should be on course for c. £8.3m of net income and EPS around 26p (using StockReport data).

Ewemove - this hybrid offering “continued to perform well”, with royalty income up 15%, although the number of new territories sold wasn’t quite as many as last year. The hybrid estate agency model looks like it’s here to stay for the long-term. Ewemove now has nearly 200 territories covered.

CEO comment:

"We are pleased with our performance in the first half of 2023. The benefits of operating a focused franchise model with multiple income streams are reflected in these results, as we continue to demonstrate considerable resilience in the face of an uncertain macroeconomic backdrop. Whilst the Board expects the macro-economic uncertainty to continue, it is confident that trading remains in line with expectations for the full year."

Graham’s view

I rarely have anything negative to say about this company, and was positive about it the last time I looked at it in April. For me, it’s a prime example of a successful franchise company.

Since I last covered the stock in April, the only real change is that we have confirmation of a slowdown in revenue growth. Although that expectation was already baked into forecasts for this (today’s update is not a profit warning).

If you treat this stock as being truly “ex growth”, then you might think that the current valuation multiples are fair:

Personally, I don’t see it that way. I see it as a very high-quality business that’s currently in a quiet part of the cycle. I’m a former shareholder in this company and I’m open to the idea of buying back into it again at some point. The StockRank here is 95.

Even though the stock hasn’t moved far since 2021, its profits are up considerably since then: EPS was only 12p in 2021, versus 22.5p last year and 26p forecast this year. So in real terms this stock has been de-rated over the past couple of years:

System1 (LON:SYS1)

Share price: 177.5p

Market cap: £22.5m

When I covered this stock in April, shareholders were about to vote on whether or not to remove the Chairman and elect a new Executive Chairman (Stefan Barden, a 6% shareholder and former CEO of the company).

The resolutions were all defeated at a general meeting, but it was close: the failed resolutions received c. 40-43% of votes cast.

You can read the company’s detailed rebuttal to the arguments made in favour of the resolutions here.

This means that the company’s existing strategy continues.

And that brings us to yesterday’s full-year results for FY March 2023:

Revenue down 3% to £23.4m

Within this, “platform” revenue was up 40% to £17.4m (the other source of revenue, bespoke consultancy, is being allowed to decline)

Adjusted PBT £0.8m (prior year: £1m)

Net cash £5.7m

CEO comment:

"The business delivered a strong second half year and created momentum that has carried through into FY24 with profitable growth across our platform offering. We are relentlessly executing the plan outlined in the strategic review with a go-to-market strategy aimed at winning with the world's largest businesses; new product channels (digital and audio)

amplified by new partnerships, all spearheaded by a realigned executive team and John Kearon leading the charge on US growth."

John Kearon is the founder of Brainjuicer (now known as System1) and remains a 23% shareholder. On today’s Board, he is “Founder and President”.

The company argues that FY March 2023 was “a year of two halves”: H1 was all about “design and transition”, while H2 was about “relentless commercial execution”.

Financially, the company moved from year-on-year revenue decline in H1, to year-on-year revenue growth in H2.

Growth in “platform” revenue accelerated: from 34% in H1 to 45% in H2.

It’s worth mentioning that what the company calls “platform” revenue also includes “data-led consultancy”. A cynic might wonder if the quality of the revenue was improving all that much, if “bespoke consultancy” is being lost and then partially replaced with a different type of consultancy under a different name. The company would argue that the new category of consultancy work flows from its data-led ad testing service.

In its rebuttal to the resolutions put forward in April, this is what the company said (I’ve added the Bold):

In practice, we have found that ad testing is the best way to initiate a new relationship with a large business, because advertising is one of their largest and therefore most important annual investment. That's why Test Your Ad is the product we lead with, and then target to sell in Test Your Idea and Test Your Brand once we have won the relationship with the CMO and Head of Insight.

They also said:

We do not consider that Platform and creativity need to be mutually exclusive. We are selling predictions (product, feature) whilst at the same time selling the important benefit of creative confidence to our customers.

Outlook

FY March 2024 has started “promisingly”; the company is targeting revenue growth this year, has launched new “Test Your Ad” services for digital and audio ads, and the US commercial team is “making good progress”.

Canaccord Genuity made a slight upgrade to their FY 2024 adj. PBT estimate for the company yesterday, increasing it to £0.9m.

Net cash reduced from £8.7m to £5.7m during the year, so it’s still at a comfortable level.

A quick investigation of the cash flow statement shows me that the company spent £1.2m on “purchase of intangible assets” (last year, this was approximately zero). There is no mention of a change in accounting policy.

We always need to be careful when we find numbers like this. That £1.2m expense hasn’t shown up in P&L yet, but it will in future years, and it has already reduced the company’s cash pile.

Graham’s view

I remain unsure about this one. It has been years since meaningful profits were generated, although Covid was certainly an issue for some of those years:

As someone who’s looking for a high-grade investment, I was interested in the tech-focused alternative strategy put forward by the resolutions in April. The current strategy is a mix of data products and data-led consultancy, and hopefully it will work out.

However, the PBT forecast for the current year is still less than £1m. Maybe the company will generate meaningful profits in FY 2025?

I don’t think this is a bad company by any means, but as an investment I’m not sure that it offers investors enough to get excited about right now. At a £22m market cap, minus a deduction for the cash balance, I think you need a lot of faith in the management team to want to get involved. Personally, I’m neutral.

Roland's section

Ibstock (LON:IBST)

Share price: 157p (+3% at 08.10)

Market cap: £610m

Today’s interim results from this brickmaker are in line and reiterate unchanged full-year expectations.

That’s an interesting contrast to Ibstock’s smaller rival Forterra (LON:FORT), which recently warned on profits.

Let’s take a look at what Ibstock has to say.

H1 highlights: the company says performance during the first half was “resliient” and “marginally ahead of the Board’s expectations”.

However, it’s worth noting that these expectations had already been scaled back to reflect more subdued conditions in residential markets.

Ibstock’s half-year numbers show a big drop in profitability and a rise in debt levels:

H1 revenue down 14% to £223m reflecting “a significant reduction in sales volumes”

Pre-tax profit down 42% to £30m

- Operating margin: 14.4% (H1 2022: 19.7%)

Earnings per share down 43% to 5.7p

Adjusted earnings per share down by 20% to 9.0p

Interim dividend up 3% to 3.4p per share

Net debt up £53m to £89m (H1 2022: £36m)

The main difference between adjusted and reported earnings appears to be the £11m cost of arising from a “potential clay site closure”. £1.5m of this is said to be a cash cost.

The increase in net debt reflects two factors. The first is a £39.5m working capital outflow to rebuild “inventory depleted since the pandemic”.

The second reason for the rise in debt was continued expenditure on growth projects, with £32.7m spent during the period. Developments underway include new brick slip manufacturing capacity and the redevelopment of a plant that will produce “the UK's first externally verified carbon neutral brick”.

Ibstock is also closing an older, higher-cost factory.

My sums suggest working capital outflows and growth capex totalled £72m during the period, versus a £53m increase in debt. This suggests to me that Ibstock’s operating business still generated underlying free cash flow of £19m during the half year.

Ibstock is already the UK’s largest brick manufacturer. Management seem to be hoping that they can invest through the downcycle and emerge as a larger, stronger, market leader.

If Ibstock’s view on future demand is correct and the firm’s balance sheet can take the strain, this could be a winning strategy – this is a profitable business. Operating margins were 14% during the first half of the year and Ibstock’s track record shows that it’s capable of generating consistent double-digit returns on capital employed:

At present, management says that leverage is equivalent to 0.7x EBITDA, which does not appear concerning. However, it’s always worth remembering that this multiple can increase rapidly if EBITDA falls, even if net debt remains stable.

Outlook: today’s commentary leaves full-year expectations unchanged. However, management commentary does suggest some increased uncertainty to me:

While recent macroeconomic events have introduced greater uncertainty into the outlook, we remain confident in our ability to respond to market conditions and the Board's expectations for the full year are unchanged.

I can’t find any new broker notes today, but consensus forecasts on Stocko prior to today’s results suggested that Ibstock’s adjusted earnings would fall by 40% to 13.8p per share this year, before recovering to 15.3p per share in 2024.

For context, Ibstock generated adjusted earnings of 13.9p in 2021, so a repeat of this would not be a disaster.

The shares are up slightly as I write, pricing Ibstock on 11.5 times 2023 forecast earnings, with a 5.3% dividend yield.

Roland’s view

Ibstock floated on the London market in 2015, so the company hasn’t yet traded through a housing market downturn as a listed business.

My pick in this sector would be AIM-listed specialty firm Michelmersh Brick Holdings (LON:MBH) , which has a much longer track record as a plc and founder ownership.

However, I don’t see any major concerns with Ibstock and am encouraged by management’s ability to correctly guide expectations so far. Hopefully their view of H2 trading will not turn out to be over-optimistic (as happened at Forterra).

I think this is a decent enough business and I can see some potential value here. I’m going to take an AMBER/GREEN view, on the assumption that the housing downturn will be relatively short-lived.

However, I don’t know how accurate this assumption will turn out to be. If the downcycle becomes deeper or more protracted, Ibstock’s decision to draw down debt to fund growth capex could start to look much riskier.

This is very much a case of DYOR – I don’t think you can really take a view on housing-related stocks without also taking a macro view.

XP Power (LON:XPP)

Share price: 1,950p (-3% at 10.00)

Market cap: £385m

This is a backlog item from Tuesday, when this electronic power controller manufacturer published interim results.

XPP was a reliable performer (and a great investment) for many years, but it came off the rails last year.

Graham covered this story in August 2022 and more recently in January this year.

In short, the company lost an expensive legal case and suffered badly from last year’s supply chain problems.

My feeling is that the underlying qualities of the business probably remain intact, so I’m interested to see if there’s any evidence of this in this week’s results.

Half-year highlights: XPP’s results cover the six months to 30 June 2023 and show the benefits of supply chain conditions returning to normal, with revenue and profits sharply higher.

Revenue up 30% to £160.2m

Gross margin up 1.6% to 41.8%

Adjusted pre-tax profit up 14% to £15.8m

Adjusted Operating Margin: 13.6% (H1 2022: 12.1%)

Adjusted earnings per share up 13% to 59.1p

However, order intake has softened, as customers destock and market conditions become weaker in some sectors.

- Order intake: £115.6m (H1 2022: £193.1m)

- Order book at period end: c£.250m (December 2022: £308.4m)

XPP’s backlog of orders remains elevated as a result of last year’s supply chain problems. So weaker order intake is not yet a concern for me, as the order book provides visibility through to next year.

Net debt/cash flow: the loss of a lawsuit in the US last year left XPP with net debt of £151m at the end of 2022.

Net debt fell to £148m during the first half, thanks to a modest working capital inflow.

The company says that on a covenant basis, leverage fell from 2.7x EBITDA to 2.3x during the first half of the year. Management expects this to fall below 2x by the end of the current year.

Operating cash flow was quite strong in H1, at £27.5m. However, cash generation for debt repayment was held back by other commitments:

Spending of £8.8m on relocating its US design centres and constructing a new plant in Malaysia

Debt interest payments of £7.6m (H1 2022: £1.0m)

Dividends payments of £11.2m

Rising interest rates mean this is an unfortunate time to be saddled with an unexpected rise in debt. Interest costs accounted for one third of adjusted operating profit in H1.

However, as the order book continues to unwind, I’d expect further cash to be released from working capital, aiding debt reduction.

XPP remains committed to its investment programme and expects to spend c.£30m on growth capex this year to support future US growth and reduce manufacturing dependence on China.

The dividend has also been maintained. XPP has a long and impressive record of shareholder payouts, so it’s clear this is important to the firm. But I wonder if it could start to be a headwind to deleveraging:

Outlook: trading has “much improved” over the last 12 months and the company expects this to continue into the second half of the year, despite macroeconomic risks.

Full-year expectations are unchanged and management reiterate plans to reduce financial leverage below 2x by year end – a more comfortable level. If this isn’t achieved, I think there’s a risk that a dividend cut will be needed.

Consensus estimates price the stock on around 12x forecast earnings, with a 4.8% yield.

Roland’s view

XPP isn’t out of the woods yet in my view, due to its elevated leverage. But I don’t see anything in these results to suggest that the company’s core franchise has weakened.

The company can’t escape macro headwinds, especially weaker demand in the semiconductor industry.

However, investments to support US growth and a more diverse manufacturing base make sense to me. I am also a fan of preserving the dividend, if possible.

I think the shares are probably cheap enough at current levels and could perform well if XPP can continue to deliver on its guidance.

I’m going to go AMBER on this share due to the risk posed by higher debt levels and external market conditions. But my overall impression is broadly positive.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.