Happy new year!

News is very thin today, so I'm struggling to come up with ideas to discuss in today's report. I'm also learning to type "2019" in all of the places where I used to type "2018".

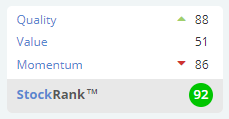

Several readers have requested a look at Spectra Systems (LON:SPSY), which I note has a StockRank of 92:

Spectra Systems (LON:SPSY)

- Share price: 119p (+13%)

- No. of shares: 45 million

- Market cap: £54 million ($68 million)

First Orders for TruBrand in China

This US-based company currently describes itself as:

a leader in machine-readable high speed banknote authentication, brand protection technologies, and gaming security software

It's based in Providence, Rhode Island (East Coast).

Today's announcement relates to orders from China for its TruBrand™ product. Nice to see robust trading between the US and China!

TruBrand enables the authentication of high-value products - such as cigarettes.

Today's order is from "Zhejiang Tobacco" which I understand is a reference to "China Tobacco Zhejiang Industrial Co.", one of the main provincial tobacco companies in China,

Unfortunately, Zhejiang Tobacco's own website is not working today - even when I use a proxy server based in Hangzhou.

Spectra reports that the order is for Zhejiang's Liquan Yundun Series, which I have identified is probably the Liqun Leisure Cloud, whose official price is 100 yuan for a small box.

Fake products are a fact of life in China. Official methods for checking the authenticity of cigarettes consist of looking at the stamping and printing on the box and cigarettes - this is the old-fashioned way. With Spectra's method, you take the human error out of it.

CEO comment:

We are optimistic that this first launch with one of the highest value cigarette brands in China will lead to the adoption of TruBrandTM across larger volume product lines, that could downstream result in over a billion units annually from this supplier alone."

This looks like a trial to me - Zhejiang will try out the product on between six and eight million packs of the Liqun Leisure Cloud. If it works then it will be continued and could be rolled out to other product lines.

Valuation

No numbers are given today in terms of revenue for the deal or potential future revenue from this business line in China. As has usually been the case, I am clutching at straws when it comes to valuing Spectra.

There are other companies who provide this sort of technology. It's hard for me to untangle whether or not Spectra's product stands out, though the fact that Spectra's idea has been patented stands in its favour.

The authentication test can be carried out with just a smartphone - that sounds like it could be an advantage versus rival products.

And remember that this is but one of Spectra's many products and services.

I was impressed by the company's H1 results, which we discussed in September. It generated H1 pre-tax profits of $3.4 million.

It also reported a cash pile of $12 million, leaving an enterprise value of $56 million.

So the valuation is not expensive, if momentum remains positive. And if TruBrand is a success, then I'm guessing that the shares will turn out to be a bargain at current levels.

So this might be worth a flutter, especially if I was building a diversified StockRank-based portfolio.

Fundamentally, though, Spectra is a bit of a black box for me - it has secretive clients and makes opaque deals in very faraway places (inevitable, given the industry it's in). So I wouldn't be brave enough to risk my own funds in it.

Last-minute announcements

There is often a flurry of last-minute announcements at the end of the year, as companies put off bad news as long as possible, in the hope that they will receive less attention.

One of my more recent quality filters is to check whether the companies I invest in are prompt with their results - there isn't any excuse for waiting until the last minute to tell shareholders how you are doing, and that's especially true for tiny companies.

Even when it's not a last-minute announcemnt, publishing results on New Year's Eve - a half-day when many people are away on holidays - seems like a strange thing to do.

Let's see if there are any companies on the naughty step this year:

- URU Metals (LON:URU) (market cap £1 million) - published its interims on New Year's Eve (the last possible day to comply with AIM rules).

This is a South African nickel exploration play. It owns $1.7 million worth of shares in Management Resource Solutions (LON:MRS), which seems to account for most of its tangible balance sheet equity. Not the sort of thing I would invest in, and bad form to publish interims on the last possible day.

Stockopedia computers also view the share with distaste, assigning a StockRank of 11.

- Catenae Innovation (LON:CTEA) (market cap £2 million) - published its final results on New Year's Eve.

Catenae made a loss of £1.1 million on sales of £157k in the period ending September 2018, and was running out of cash at the period-end. It subsequently raised £395k in cash, to keep the lights on.

It admits that it has an ongoing need for fundraising, and that there is a material uncertainty around its ability to continue as a going concern.

What does it do? Well, it has jumped on the blockchain bandwagon, providing blockchain-based proof of intellectual property and digital transactions.

Regular readers will know that I avoid everything related to crypto-currency like the plague. Stockopedia computers agree in this instance and give Catenae a StockRank of Zero.

Nothing else seems worth reporting on today, so I will leave it there. Expect fireworks from the RNS feed soon, though - we are about to enter retail reporting season! Christmas was probably not so merry for the retail industry.

All the best

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.