Morning folks,

There are a few interesting bits of news out this Friday morning. Once I've covered them, I'll endeavour to make a few comments on things I skipped earlier in the week.

Before that, though, let me direct you to Paul Scott's catch-up report for last Friday. He has written an overview of retail stocks together with specific coverage of Card Factory (LON:CARD), Moss Bros (LON:MOSB) and Tasty (LON:TAST). So that's definitely worth a read - here's the link.

Onto today's report. Stocks which have caught my eye include:

- Numis (LON:NUM)

- Spaceandpeople (LON:SAL)

- Tandem (LON:TND)

And then stocks which were requested earlier in the week:

- Spectra Systems (LON:SPSY)

- Next Fifteen Communications (LON:NFC)

Tesla Inc (US:TSLA)

- Share price: $272 (-12% in after-hours trading)

- No. of shares: 171 million

- Market cap: $46.4 billion

Elon Musk Charged with Securities Fraud for Misleading Tweets

(Please note that I currently have a short position in TSLA.)

Not a small-cap, not even British, but I feel compelled to mention Tesla again.

Today was the day I finally opened a Tesla short, something I've been thinking about for some time.

The trigger was the news that the SEC has officially launched proceedings against Musk. If you follow the link above to the SEC's website, you can read the 23-page court filing at the US District Court.

It all relates back to Musk's tweets last month that he was thinking about taking Tesla private at a share price of $420, and that funding was secured.

When I saw those tweets, it was my opinion that he had probably committed market abuse. Even if it was true that funding was secured, tweeting the news during market hours without any sign of having taken legal advice would be a very strange thing to do.

Given that the "news" was released in such a manner, I suspected that any hypothetical deal was flimsy. Musk has been battling with the short-selling community for some time, and the tweet looked like it had been written with them in mind.

I've read this 23-page document and there are certain elements which I believe are damning for Musk's continued employment at Tesla and consequently for Tesla's share price.

These are the most damaging elements, in my view. They are quoted directly from the document, and I have added bold:

- According to Musk, he calculated the $420 price per share based on a 20% premium over that day’s closing share price because he thought 20% was a “standard premium” in going-private transactions. This calculation resulted in a price of $419, and Musk stated that he rounded the price up to $420 because he had recently learned about the number’s significance in marijuana culture and thought his girlfriend “would find it funny, which admittedly is not a great reason to pick a price.”

(GN Note: this means that $420 was nothing more than a random number chosen by Musk.)

- Musk’s statements that funding was “secured” and investor support was “confirmed” were false and misleading because, in reality, Musk had no “secured” or “confirmed” commitment from any source to provide any amount of funding. In addition, he had never even discussed taking Tesla private at a price of $420 per share with the Fund or any other potential investor.

(GN Note: the "Fund" referred to here is the Saudi sovereign wealth fund. According to the SEC, Musk had never discussed the $420 price or the specifics of a go-private deal with them or any other potential investor.)

- Nasdaq rules specify that listed companies such as Tesla must notify Nasdaq at least ten minutes prior to publicly releasing material information about corporate events like a proposed going-private action. Musk did not notify Nasdaq prior to publishing his August 7 tweets.

(GN Note: this is a basic violation of the rules.)

- ...the Commission respectfully requests that the Court enter a Final Judgment: ... V. Ordering that Defendant be prohibited from acting as an officer or director of any issuer that has a class of securities registered pursuant to Section 12 of the Exchange Act [15 U.S.C. § 78l] or that is required to file reports pursuant to Section 15(d) of the Exchange Act [15 U.S.C. § 78o(d)];...

This is the most dangerous part for Tesla. If the SEC gets its wish, then Musk will have to resign his position as CEO.

While he is not the founder of Tesla (that distinction goes to Martin Eberhard and Marc Tarpenning), the company as it exists today is bound up with his vision and charisma. Without him, it will be a much less interesting speculation for the many thousands of investors who have backed him.

And even If he wins the case, a jury trial in New York will be a distracting affair.

For these reasons I've sold the shares short, with an open-ended time horizon. If Musk successfully defends the case against SEC and if Tesla hits its financial targets of profitability and cash flow generation, then I will almost certainly be forced to exit the position at a loss.

On the other hand, if Musk is forced out and/or if Tesla continues to make losses and burn cash, then I expect the $46 billion valuation to be vulnerable.

Numis (LON:NUM)

- Share price: 350.5p (-6%)

- No. of shares: 106 million

- Market cap: £372 million

Numis Corporation Plc ("Numis"), a leading independent investment banking group, today issued a trading update relating to the year ending 30thSeptember 2018.

Key points from this update:

- Revenue down in H2, so full-year core revenue will be up by only 3% against 2017 (H1 revenue had been 41% higher against 2017).

- Average fees lower and timing of deals affected revenues from Corporate Broking & Advisory.

- Headcount up 16% and staff costs up, so profits will be lower than last year. This is not quantified.

Readers have pointed out in the comments that the NUM share price was weak in the days prior to this announcement:

There was no news released over the previous two days to spark the sell-off. Weird!

My view on the update - not terribly helpful, since it doesn't reveal how much profits have fallen by.

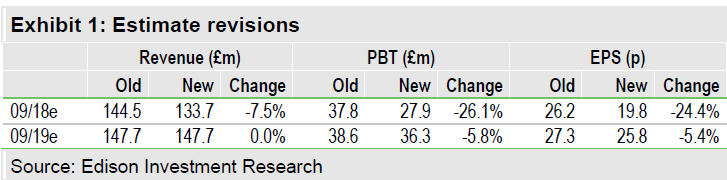

There is a free Edison note published on Research Tree today which leaves the dividend forecast unchanged but makes revisions to revenue, PBT and EPS forecasts:

Edison (which is paid by Numis to publish these notes) reckons that the increased headcount will help to spur growth in future periods and that the immediate pipeline/backlog will enable an improvement in FY 2019.

You can see this in the estimates I've copied above: the 2019 PBT forecast is reduced by 5.8% but is still much higher than the FY 2018 PBT forecast (the FY 2018 forecast is going to be quite accurate, because Edison will have been briefed by Numis about it!)

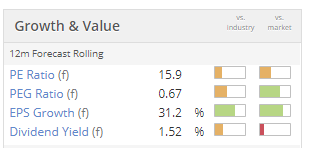

So the forward P/E multiple based on 2019 numbers is now around 13.6x.

That looks about right to me, perhaps a little full? Given how volatile earnings in this sector are, I don't believe that companies like Numis should ever trade at an aggressive earnings multiple (although I think Numis should trade at the top end of the sector).

Reviewing previous SCVR comments, I was positive on prospects back in 2017 when the price was trading within a 240p-280p range. At 350p, with a mixed outlook, I'm neutral.

Spaceandpeople (LON:SAL)

- Share price: 19.5p (-35%)

- No. of shares: 20 million

- Market cap: £4 million

SpaceandPeople (AIM:SAL), the retail, promotional and brand experience specialist which facilitates and manages the sale of promotional and retail merchandising space in shopping centres and other high footfall venues, announces interim results for the six months ended 30 June 2018.

This company warned earlier in the year that FY 2018 had gotten offer to a "slightly slower than expected start".

Indeed, today we learn:

- H1 revenues down 20%.

- H1 pre-tax loss, but a small pre-tax profit (£0.2 million) is forecast for the full year.

- most of the cash leaves the balance sheet as trade payables are reduced.

I remarked in March that the company offered "cheap earnings, a sound balance sheet and a nice dividend yield", and that it represented "Value" for people who simply wanted those quantitative features and didn't mind buying into a tiny nano-cap.

The StockRank today is 97, and the ValueRank is 98. So quantitatively it still looks ok (prior to today's update).

My own view is that it is too small to justify a stock market listing. It has been around for long enough to prove what it can do and that it is worthy of being listed, but it just hasn't achieved enough.

Tandem (LON:TND)

- Share price: 112.5p (-4%)

- No. of shares: 5 million

- Market cap: £6 million

I've been breaking the £10 million threshold a lot recently. Oh well! I'll keep these comments brief.

Tandem is the bike developer owning some classic old bike brands and other leisure products.

It has been listed for over 20 years and has generated scant shareholder value during all of that time.

In 2017, director remuneration added up to £800k (including bonuses), versus £200k paid out in dividends. The high level of director pay in comparison to the market capitalisation of the company and in comparison to dividends remains worthy of comment.

2017 was a good year for the business, however: net income exploded higher to £1.7 million. So it looked as if shareholders might be getting a good deal for their £800k expense.

Sadly, the company has fallen straight away back into losses after the collapse of major customer Toys 'R Us. The pre-tax loss is £350k.

Outlook - some hope that the poor fortune in H1 can be reversed:

There has been an improvement in performance since we made our AGM statement in June. Revenue for the 13 week period from 25 June to 23 September was approximately 10% ahead of the prior year period taking the 38 week period to 23 September to 16% behind the prior year period.

My view - if the directors had any real interest in building shareholder value, they would have done it already.

According to the company's website, the members of the Board have been involved with Tandem or its predecessor companies since:

- 1989 (Chairman)

- 1990 (CEO)

- 2002 (Finance Director)

- 1999 (Commercial Director)

- 2010 (NED)

- 2010 (NED)

It doesn't get much more entrenched than this. Even the NEDs have been with the company for the best part of a decade.

I'd have no problem with these arrangements at a private company, but the track record suggests that public shareholders should stay well away.

Spectra Systems (LON:SPSY)

- Share price: 115p (-2%)

- No. of shares: 45.5 million

- Market cap: £52 million

Interim Results - Six Months ended 30 June 2018 (Monday)

This got skipped earlier in the week. Spectra is a US-based company that provides "advanced technology solutions for banknote and product authentication".

I covered it in a little bit of detail earlier in the year, ultimately putting it in the "too difficult" basket. Here's the link to that article.

Ok, let's review the latest interim highlights:

- revenue +11% to $7,950k

- adjusted EPS +30% to $7.8 cents

- cash generated from operations $4 million

- big cash pile and dividend increased 20%

It all sounds great on paper (or polymer).

Outlook - the company has a range of near-term and long-term opportunities, including penetration into Asia.

My view - I'm afraid I don't understand this industry, so I feel unable to offer much of a view as to the fair value of SPSY shares.

The company made a statement in January that I found rather confusing, but I mention it because it involved c. $14 million in payments being received over the 2018-2028 period.

Of this amount, $11.2 million (to the extent that it translates into earnings) should not be capitalised and used in earnings multiples, because it relates to royalty payments for a perpetual licensing agreement that won't be repeated.

So on that basis I think a conservative approach to the company's figures might be justified for the next few years.

Good luck to all holders. I really don't know what this one is worth.

Next Fifteen Communications (LON:NFC)

- Share price: 540p (-2%)

- No. of shares: 79 million

- Market cap: £427 million

Half-year Report (Tuesday)

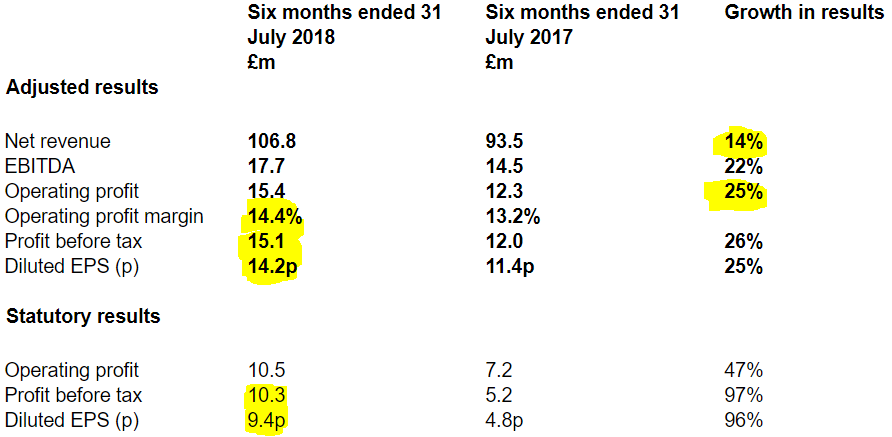

Next Fifteen Communications Group plc (“Next 15” or the “Group”), the digital communications group, today announces its interim results for the six months ended 31 July 2018.

I've never covered this one before. But let's quickly review these numbers for the benefit of readers who hold it.

I've highlighted some figures which jump out at me. Firstly, a 14% revenue increase translated to at 25% operating profit increase - excellent. Hints at some nice operating leverage.

We need to be careful about the use of adjusted figures, however. There are big differences between adjusted PBT and EPS versus actual PBT and EPS. The main item being adjusted is the amortisation of acquired intangibles, and then share-based charges.

Fortunately, the company provides us with a measure of organic revenue growth, excluding acquisitions, and this came in at 8.7%. Not bad.

Outlook - confident.

My view - it's not the type of thing I'd invest in, because I don't invest in creative/digital agencies and I don't invest in groups which grow via lots of acquisitions. Next Fifteen has negative tangible equity of minus £17 million thanks to the clump of intangibles on the balance sheet.

Apart from that, I haven't noticed anything particularly worrying about it so if you are comfortable with the sector then it could make for a fine opportunity.

All done for today and for the week!

You'll be in Paul's safe hands on Monday, while I take some time off from writing this report.

Best wishes

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.