Good morning, it's Paul here!

I only have a brief window to write a report today, as I'm off to Reading, for an investor lunch. The same group of us have been meeting up 4 or 5 times per year, since about 2002. It's great fun. Forming your own network of like-minded individuals, is an important part of investing, in my view. I've learned so much from successful investors, there is always some terrific insight, or a brilliant stock idea, that I take away from every investor lunch. Plus of course it's wonderful to knock back a G+T, and several glasses of wine, when I really should be working!

A few quick points first;

Yesterday's report

I wrote loads more shortish sections in the evening, so here is the compete report.

Contrary to what some muppet on advfn posted, I am not paid by page impressions, he just made that up. I just work better in the evenings, when the market is closed, and my brain is more agile, so sometimes I add more sections.

Non-specific anxiety

I read a very interesting article from a journalist who has given up drinking coffee. She said that drinking coffee, particularly in the morning, was causing her to feel generally anxious all day, for no particular reason. This struck a chord with me, as I feel exactly the same, and sometimes work myself up into such a lather, that the only option is to have a nap after lunch. Indeed, this is one of several reasons why I didn't suit the 9-5 routine, and gave up paid employment in 2002, at the age of 34. My version of 9-5 was to roll up between 11-noon, usually hungover, and then drive to Tesco's car park at 1pm for a nap in the car. The only reason I wasn't sacked was because my skill at controlling the cashflow made me indispensable.

So I'm going coffee-free this week, and am already feeling considerable benefits. So I recommend breaking the coffee addiction to readers. I also recommend working from home. Having a commute of about 3 seconds, to get from the bedroom to my office, is just so efficient. Although there are temptations from working at home, which I won't go into.

Keywords Studios (LON:KWS)

This company reported interims yesterday. I didn't get round to reporting on it, as I have no idea how to value the share. It looks overly expensive to me, and companies which make so many acquisitions, so quickly, often go wrong. The market cap is too large for here anyway, at c.£700m.

The reason I mention it now, is because my friends Tamzin & Tim, at PIworld, have published a video of the latest results presentation. Here is the link. PIWorld provide such a great service to investors, and it's free too. I hope more companies engage with them, and do videos of results presentations. It's a terrific way to engage with many private investors. After all, companies spend time giving results presentations to institutions & analysts, so they really should also do a presentation for private investors too. Many people are busy, so cannot attend meetings in person. Therefore video is the perfect solution. More of this please!

New £10 notes

I was thrilled to have my local cashpoint dispense the new £10 notes to me last night. I received 10 notes, brand new, and in sequential serial number order. If we have any notaphilist readers, perhaps you could advise whether I should frame these sequentially numbered notes, and put them proudly on display in my hallway? Trouble is, I'd constantly worry about some light-fingered visitor departing with my framed bank notes under their arm.

Talking of which, I found $180 hidden in a drawer whilst moving house recently, which was a lovely surprise. I'd hidden it, to prevent any light-fingered visitors from pinching it! Also, I found £500 in another drawer, which I'd also hidden, then forgotten about, which was the proceeds from selling my old car. It came in handy for paying the removal men.

So if I catch any visitors rummaging through my drawers, I'll know that they're read this report!

Character (LON:CCT)

I covered this in yesterday's report. The company put out an RNS at 4:45 saying that it had been affected by Toys R Us going into bankruptcy protection in the USA & Canada, but didn't know the financial impact yet.

As predicted, it's caused a 10% spike down in share price.

This to me is a category 1 profit warning - which I define as something that is temporary, and fixable. In such a situation, I will not sell my shares, and would actively consider averaging down, because the share price should recover in due course, once the issue is fixed.

Category 2 profit warnings are more serious, and I define as being some sort of structural problem, that will probably get worse. Also the extent of the problem is often not fully disclosed with this type of profit warning, so more profit warnings often follow. So I would always want to sell immediately if a category 2 profit warning is announced.

(incidentally, I only invented this categorisation last night, and initially numbered them the other way around. However, I decided to reverse the numbering system, to align it with hurricanes). A Category 3 profit warning would probably be that the company is in imminent danger of going bust.

EDIT: There's an update from Panmures, which is available on Research Tree this morning, which covers the Toys R Us issue. It doesn't look too bad, but might cause some disruption in the short term.

accesso Technology (LON:ACSO)

Share price: 1800p

No. shares: 26.3m

Market cap: £473.4m

Interim results - for the 6 months ended 30 Jun 2017.

This company used to be called Lo-Q, but changed its name because increasing amounts of business are in the USA, where the term "line" is used instead of "queue". It offers queuing & ticketing systems for theme parks, and similar venues.

The group has considerable seasonality to trading, so there's not a lot of point analysing the H1 figures. The outlook comments are more important.

For what it's worth, here are a few key number/points;

- Revenues up 17.4% to $46.6m

- Adjusted operating profit up 30.0% to $6.5m

- Net debt has almost doubled to $23.8m

Outlook - sounds in line;

The Group's performance during the first half has been strong, primarily driven by continued momentum in accessoPassport and some impressive wins across the remainder of the ticketing and guest management business.

Notwithstanding the lower than expected theme park attendance experienced in the first six months, the Board remains confident in the power of and demand for its products and in its outlook for the full year.

During the first half of the year the Group performed in line with the Board's expectations, completed an important acquisition and made significant progress in the ticketing side of the business.

The Group remains on track to achieve its aims in 2017, although as ever, full year performance remains second half weighted.

I don't see any problem with the H2-weighting comments, as that's entirely normal for this company, and is due to theme park attendance being higher in H2.

Balance sheet - looks very weak to me, and is far too reliant on bank debt.

NAV is £81.2m, but that's dominated by intangibles of £116.2m. So NTAV is negative, at -£35.0m, which rules it out for me. Debt is cheap & plentiful at the moment, but what happens if something goes wrong? There's no downside protection. So I'd prefer it if the company did say 10% dilution, to fix its balance sheet.

My opinion - this is undoubtedly a quality company, which dominates its niche, globally.

The issue is obviously valuation. Would you pay a forward PER of 40 for it?

Cello (LON:CLL)

Interims are out today, for this healthcare focussed marketing group.

The numbers look unremarkable. Headline profit before tax is up 8% to £4.6m for H1.

Outlook comments sound reassuring;

...The Board is therefore confident of meeting market expectations for the year and is pleased to increase the interim dividend."

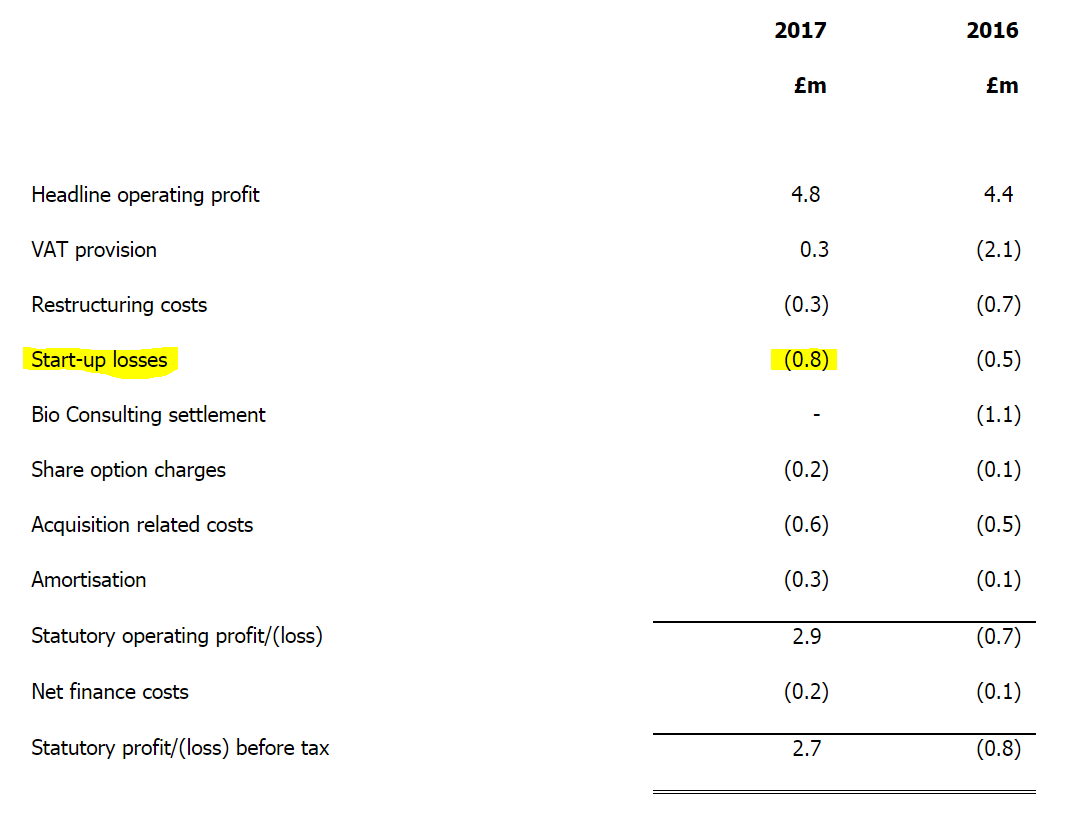

There are a lot of adjusting items, which makes me a bit nervous. Start-up losses is the most questionable one, in my view;

So there's little doubt that the figures have been buffed up, to give the highest possible gloss finish, as you would expect from a marketing company.

My opinion - I'm not keen on marketing companies, and rarely invest in them.

The forward PER of about 16 here looks much too expensive.

I see that both People's Operator (LON:TPOP) and Blur (LON:BLUR) report their interim figures today.

In both cases, the results are simply laughable - terrible business models, which are trying to stem their losses. Neither company is generating any growth, and both are heavily loss-making.

I'd be very surprised if either of these companies still exists in 12 months' time. It's remarkable how some investors are prepared to keep pouring money into companies which are very obviously not viable. I do wonder if that is more about fund managers protecting their own career & reputation, but staving off an insolvency long enough for them to find another job elsewhere?

Sorry this is rushed, I have to dash now.

There's a possibility that Graham might add another section or two, but I didn't give him enough notice, so he's already made other plans for today.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.