Good morning, it's Paul here.

Please note that yesterday's completed report is here, which includes my reviews of the results/trading updates from Tristel (LON:TSTL) , Tracsis (LON:TRCS) , and Synectics (LON:SNX) .

I see that shares in AA (LON:AA.) are down 30% today, on a big cut in the dividend. I'm kicking myself for not shorting this actually, as it has one of the worst balance sheets I've ever seen. I must do a screen for companies with terrible balance sheets & excessively high dividend yields. That would probably be a good starting point for finding good short positions. It's not something I do a lot of, but having a smattering of large cap shorts can be a nice shock absorber for market downturns. Shorting is high risk of course, and best avoided altogether for most people, in my opinion.

Bilby (LON:BILB)

Share price: 107p (up 12% today, at 09:29)

No. shares: 40.3m

Market cap: £43.1m

Bilby Plc (AIM: BILB.L) the holding company to P&R Installation Company Limited, Purdy Contracts Limited, Spokemead Maintenance Limited and DCB (Kent) Limited, a leading gas heating, electrical and building services provider...

The group's focus seems to be on providing housing-related maintenance services to Local Authorities and Housing Associations, in the South East.

Checking back through the archive, this group listed on AIM in March 2015. It's been a bit of a roller-coaster for shareholders, with a profit warning in 2016. The share bottomed out in April 2017 at 39p, and has since gone on to almost triple in price - an impressive turnaround.

The current financial year ends 31 March 2018.

We didn't cover its interim results to 30 September 2017, but looking through the figures here, they show a strong improvement in trading. Although I'm not keen on a rather weak balance sheet. NAV of £15.2m drops to only £0.3m NTAV once intangibles are stripped out. This is the problem with acquisitive groups - the balance sheets tend to become top-loaded with intangibles, relating to acquisitions, which can leave the financial structure weak & vulnerable to setbacks.

Today's update - key points;

- New contract wins.

- Existing customers extending scope of contracts - encouraging, as it suggests to me that the company's work is good.

- Tight focus on London & South East.

The result of this is;

As a result of these factors, the Board is pleased to advise that revenue and profitability for the year ending 31 March 2018 will be ahead of current market expectations.

That's great news, but what a pity the announcement didn't give some indication of how much ahead of expectations? Surely they could have said, say 5-10% ahead of expectations? (which is my guess). That would save so much time. Instead, I now have to search for revised broker guidance (since the broker will have been told what the percentage uplift should be). In this case, I can't find any updated broker research today, so we're in the dark somewhat. This is not really satisfactory - but it's a general problem with small caps, not just for Bilby.

I really do think that, post the information vacuum created by MiFID II, companies and their advisers need to raise their game, in terms of reporting more clearly to investors. We need clear guidance (even if it's a range of numbers, rather than one specific profit number), not general statements, otherwise we're left in the dark, and are relying to some extent on guesswork. If people are uncertain, then they're less likely to buy any share.

Valuation - the broker consensus EPS forecasts are currently (prior to upgrades from today's better than expected update) as follows;

3/2018 10.5p

3/2019 12.0p

Given that the company is now saying it should exceed the 10.5p EPS for the current year, then I suppose we're probably looking at between 11-12p? Let's take the mid-point of 11.5p, which gives a current year PER of 9.3 - which looks a modest valuation. Although companies in this sector rarely achieve high ratings, and of course lots of things have gone wrong lately, so this sector is very much out of favour. It's been a minefield for investors over the years actually.

If earnings continue to rise, then the PER would drop further in 3/2019 and subsequent years. You always have to bear in mind that another profit warning could appear, if as in the past, a major customer is lost. However, for the time being anyway, things seem to be going well.

Directorspeak - I like the bit about revenue visibility, which should reduce the risk of another profit warning;

"Our strong performance reflects the success of our core commitment to provide excellent customer service. This focus has driven the growth of our customer base and has given long-standing customers the confidence to increase the scope of work we do for them.

Pleasingly, this momentum enables significant long-term revenue visibility and gives the Board confidence that Bilby is well positioned for the years ahead."

My opinion - I like the look of this company. It seems to have the wind in its sails, and the valuation looks reasonable. The forecast dividend yield is c.3%, and that is well covered - almost 4 times actually.

On the downside, the sector is one of my least favourite. So many companies have come a cropper with contract problems. Having said that, the companies which go wrong are often sprawling groups, with poor management, not in full control of the empires that they have created. Whereas Bilby is smaller, and more focused, both in terms of its activities, and its geographies. I think that's probably the key to success in this sector - keeping things small, and niche, with strong management controls.

Overall, it's not for me, purely due to my anxiety about this sector. However, of the companies I've looked at in this area, Bilby is probably the best.

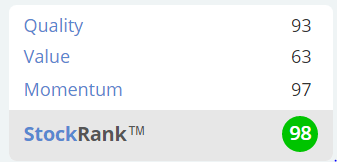

The Stockopedia algorithms like Bilby too, with a very high StockRank, and "Super Stock" style;

Lakehouse (LON:LAKE) is quite similar, but larger. That got itself into a terrible mess, but I've just had a look at its latest announcements, and things seem to be on the mend there. So if you like this sector, then it might be worth checking out Lakehouse too.

Hotel Chocolat (LON:HOTC)

Share price: 317.5p (down 1.6% at 10:31)

No. shares: 112.8m

Market cap: £358.1m

Hotel Chocolat Group plc, a premium British chocolatier and omni-channel retailer, today announces its interim results for the 26 weeks ended 31 December 2017.

I can't see any surprises in these numbers, as they look consistent with the last trading update, which I reported on here.

Seasonality - when reviewing interim numbers from Hotel Chocolat, the most important point is that this is a highly seasonal business - it makes all its profit in H1, and nothing in H2. When seasonality is that extreme, I feel that companies have a duty to say so, very clearly, in the highlights and the narrative. There doesn't seem to be any reference to this extreme seasonality in today's announcement. Indeed, there are not even any full year comparatives, which are usually included with interim results. This lack of clarity could mislead some investors (if they don't do their homework properly, so arguably caveat emptor). However, full disclosure of extreme seasonality is conspicuous by its absence, in this statement.

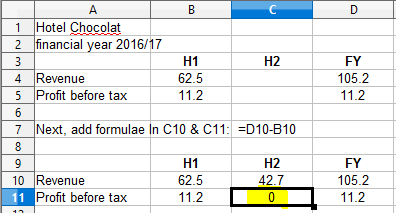

If in doubt, I tend to create an extremely simple, but useful spreadsheet, here's one I created today (see below), to check HOTC's seasonality between H1 & H2 revenues & profits. So I just key in the revenues & profit figures from the interim results, and the full year results. Then add a formula to deduct one from the other, to produce the H2 revenue & profit.

As you can see, all the profit was made in H1 last year;

Key points from today's interim results;

- H1 revenues up 14.7% to £71.7m, as previously indicated (rounded up to 15%)

- Profit before tax up 15.2% to £12.9m

- Diluted EPS 8.9p (last year H1 was 7.8p), up 14.1%

There doesn't seem to be any operational gearing in evidence - i.e. I would normally expect profit to rise at a faster percentage than revenues. Although this might perhaps be due to pre-opening losses on new shops? HOTC doesn't strip out those costs for separate disclosure, whereas some other companies do. This comment from management is relevant;

Both revenue and profit before tax for the period increased by 15%, with efficiencies offsetting known cost headwinds.

- Ten new shops opened, with the commentary sounding positive about these.

- New digital wholesale partners - encouraging results (this is Amazon & Ocado)

- Gross margin is excellent, at 67.9% (up from 66.8% last year)

Current trading - sounds alright;

"Recent trading, including the Valentine's period is in line with the Board's expectations and we continue to make good progress against our three key strategic objectives of opening more stores, improving our digital capability and increasing our production capacity."

The company certainly needs to improve its digital capability - as I flagged up last time in January 2018, the online TrustPilot reviews for HOTC are terrible - lots of unhappy customers.

Balance sheet - slightly unusual, but nothing concerning.

NAV is £39.5m, less intangibles gives NTAV of £37.0m.

Fixed assets (property, plant & equipment), is large, at £34.7m. Note that this includes £11.8m in freehold property, which is a big plus.

Immediately after Christmas, there is a big cash pile of £25m, but I would expect that to deplete in the spring.

Current assets were £40.6m, less current liabilities of £32.2m, gives a surplus on working capital of £8.4m. That's a current ratio of 1.26 - which is OK, but not especially good. Therefore, in calculating enterprise value, I would treat it as being roughly cash/debt neutral on average. If calculated on seasonal cash spikes (such as this balance sheet date, immediately after Christmas takings have been banked), enterprise value can be a dangerous concept.

There is also £6.6m in long-term liabilities, which looks fine in the context of this being a decently profitable and cash generative business.

As an aside, note that the company has innovative "chocolate bonds", where it borrowed funding, and repays interest in chocolate instead of cash - what a great idea!

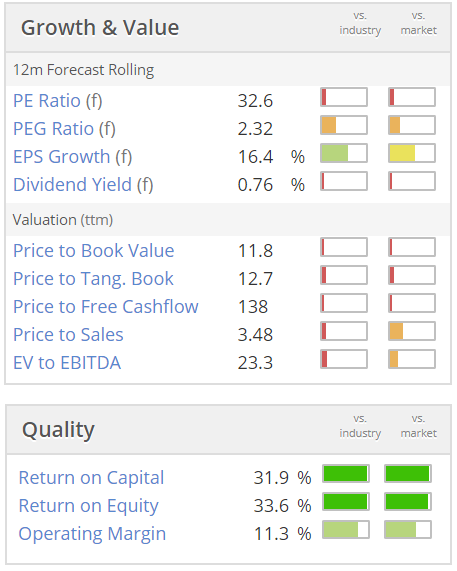

Valuation - this is the problem, as I've mentioned before. I think the valuation is just too high, given the fairly sedate rate of growth. Note that the PEG is high, at 2.32, indicating that the market could be over-paying for the growth;

My opinion - I remain of the view that this share looks significantly over-priced. Why pay up-front for years' worth of future growth? That doesn't make sense to me.

Growth is OK, but not exciting. Personally, I don't rate the product - it seems nothing special in terms of taste, but hideously expensive, for what it is. Therefore I question whether the fancy branding & packaging is enough to keep consumers engaged, long-term? For me, a large Cadbury's whole nut bar (only £1 in Sainsburys) is a tastier, and much cheaper option. Why pay more, unless it's as a gift?

The tea shops are altogether more interesting though. I haven't visited one yet, but intend to. Patisserie Holdings (LON:CAKE) shows that there are fabulous profit margins to be had from tea & cake shops. So perhaps the market is pricing-in a successful roll-out of HOTC's cafes?

Overall though, the price looks way too high. I might possibly take an interest if the share price were to roughly halve from the current price (from 317p now, to c.160p), which to me looks about the right price - i.e. a PER in the high teens, rather than over 30.

That's probably all I have time for today, as have to travel back home this afternoon. Although I'll review the reader comments this evening & respond to anything interesting!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.