Good morning! It's Paul here. This should be a busy & interesting day, with lots of RNSs to report on, then the Budget from Philip Hammond around lunchtime. (12:20, according to the ITV listings)

Please note that I added lots more to yesterday's report, which now covers results or trading updates from;

Accrol, Empresaria, SRT Marine Systems (CEO interview), FocusRite, Severfield, XL Media, Jaywing, AO World.

All attention will be on the Budget today, which I think will be televised just after PMQs in Parliament. My broker reckons that some investors are worried that the Chancellor might tamper with AIM IHT relief - which he thinks has caused some selling in AIM shares recently. Let's hope that's not the case. EDIT - phew! All good.

Charity Investor Lunch - TOMORROW!

Stop press! Renowned small caps investor, David Stredder (aka Carmensfella) has just been on the phone, to alert me that there are a small number of spare places for a charity lunch in London tomorrow. David has organised this lunch to celebrate our own Ed Page-Croft's phenomenal achievement earlier this year, when he cycled from London to Paris in 24 hours.

So the aim of the lunch is for investors to meet up & chat about shares, over a nice lunch on a moored boat on the Thames. Between each course there will be some interesting speakers, including Clarke Carlisle, the footballer who has been very open about his battle with depression & addiction, and speaks very movingly about mental health issues.

On the shares front, I think David wants me, Leon Boros, and Lord Lee, to host tables of other investors. It should be great fun, with lots of interesting chats with other investors, plus the aim is for us to raise as much money as we can for the featured charities (minimum suggested donation £100 per person).

So if people would like to come along, please contact either David Stredder or Ed Page-Croft, using either a message through Stockopedia's messaging system, or David's Mello website has details on how to contact him.

Sorry it's such late notice, but a few places unexpectedly arose at the last minute. So I thought it would be good to throw it over to SCVR readers, just in case anyone is around tomorrow in London & fancies joining us.

Best Of The Best (LON:BOTB)

Share price: 280p (up 1.8% today)

No. shares: 10.1m

Market cap: £28.3m

(at the time of writing, I hold a long position in this share)

Best of the Best PLC, (LSE: BOTB) the principally online organiser of weekly competitions to win luxury cars...

The company has a 30 Apr year end. So today it is reporting on progress in H1 of FY 04/2018, i.e. May to Oct 2017. This sounds fine;

...is pleased to announce that trading for the six months ended 31 October 2017 has been solid, with revenues and profits before tax generated in line with management's expectations.

The Board is also pleased to report that revenues attributable to online sales continue to grow in accordance with the Company's stated strategy to move away from the reliance on physical sites at retail locations and airports.

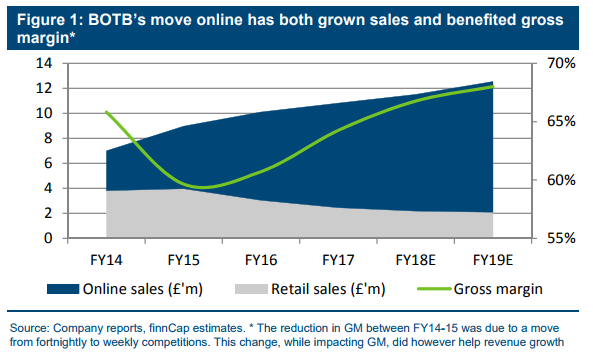

The second paragraph above is interesting, because the reduction in airport business (since airports want too much in rents) is masking the internet growth. FinnCap produced a useful graph demonstrating this point in a recent note - I hope they won't mind me reproducing it here, with thanks;

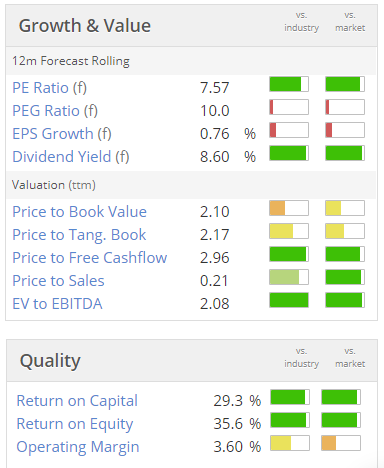

Valuation - if we look at the usual Stockopedia growth & value section, you can see that the quality scores are very high. The forward PER seems to have settled at around 20;

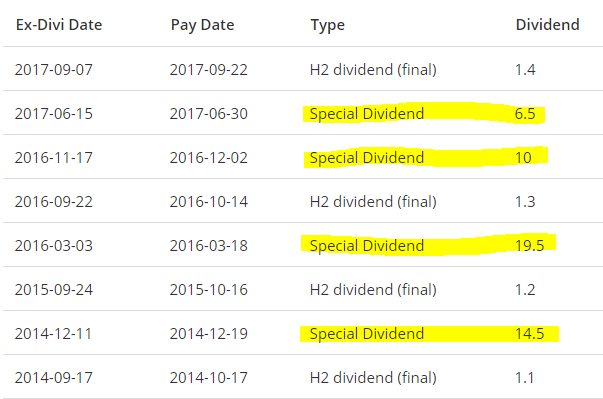

Dividends - note that the business has been very cash generative, and paid out surplus cash in a series of special divis. So this has certainly be a joyful share to hold over the last 3 or 4 years - with a terrific flow of divis, and decent capital appreciation too;

Dividend data can be found on Stockopedia under the "Accounts" tab on any company's StockReport. You will also find Director dealings there, plus tables of 6-years' worth of P&L, Balance Sheet, and Cashflow statements.

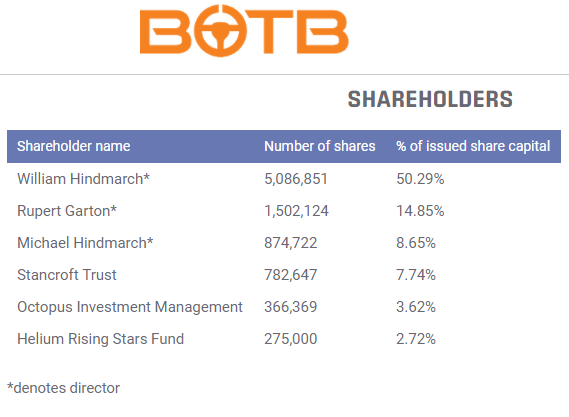

Liquidity (lack of) - this is a tightly held share, with management owning a majority stake;

In this type of situation, it is essential that you trust management, which I do. Directors remuneration is not excessive, and there don't seem to be many share options outstanding (although about 10% of the company was exercised in options last year).

Going back to liquidity, the free float is small. Holders seem to want to sit tight for the long term mainly, so it's difficult to get in & out of this share, which adds to price volatility.

As is often the case for micro & small caps, the quoted market prices that we see on our screens are often wrong. This is because the market is rigged against private investors. So the market makers publicly quote prices (currently 260p Bid, and 300 Offer) which we are able to see. However, our brokers see the real, hidden prices, which at the moment are: 265p Bid (for 2,500 shares), and 286.5p Offered (5k shares). This is a terrible system. However, it's important to know how things work, so that you're not automatically put off by an apparently very wide bid-offer spread. There are often better prices which are hidden from view. You can find out the real prices by putting in a dummy trade into an online dealing platform, or using a conventional telephone broker like I do, and just asking them to tell you the real prices.

My opinion - I'm a happy long-term holder of this share. In my view, the company's potential could be considerably more than the current value. I accept that, if you adopt a conventional valuation approach (mainly based on forward PER), then the current valuation is about right. Earnings growth is not forecast to be very strong, because the company is ploughing some profits back into marketing spend.

However, if you value the company's track record, brand, reputation (everyone knows it from airports), then you could see it as being potentially worth a lot more than £28.3m. I am hoping that at some point, we might get a big payday from an agreed sale of the business to a more aggressive owner, prepared to drive sales harder through increased marketing. It would make an ideal bolt-on acquisition for a bigger gaming group, or even a private equity owner.

In the meantime, the company pays out bumper special dividends whenever the cash pile mounts up. It's a smashing, capital light business model. Also the supercar competition is very well structured, and very enjoyable to play - I participate most weeks, and really enjoy it. Last week I was only about 8 pixels away from the winning co-ordinates (it's a spot the ball competition).

Overall then, this is a core long-term holding for me, that I think one day might surprise me with a profitable exit via a sale of the business.

Cambria Automobiles (LON:CAMB)

Share price: 63p (up 1.6% today)

No. shares: 100.0m

Market cap: £63.0m

Cambria, the franchised motor retailer, announces its audited preliminary results for the year to 31 August 2017.

I can't decide whether or not I like being told what to think about a results statement, in the title. However, this seems to be a growing trend, to give results or trading updates a heading, to add a bit of PR spin to things. In this case, today's RNS is given this title;

Solid results in Group's 11th year of trading, continued strategic progress

Car dealerships seem very out of favour with investors at the moment, for a variety of reasons. I think the sector looks potentially interesting value, given that the PERs are now very low, and that these groups often have strong balance sheets full of valuable freehold property.

A few key numbers;

Revenues up 4.9% to £644.3m

Underlying PBT up 6.6% to £11.3m

Whilst the profit increase looks quite respectable, given tough market conditions, I thought it would be useful to calculate the H2 vs H2 last year performance. The last interim results showed a 21.7% increase in underlying PBT to £5.6m (PY H1: £4.6m). If we deduct the H1 underlying profit from the full year underlying profit, this isolates the H2 performance, which is;

H2 this year: £5.7m underlying profit, vs. H2 last year: £6.0m.

Therefore profitability now appears to be declining, so it would make sense to assume this trend continues. Looking at the broker consensus, a fall in profitability for FY 08/2018 is already assumed, with a drop to 8.25p EPS forecast.

It looks as if the FY 08/2017 figures being reported today are an earnings beat against forecast, with actual 9.19p underlying EPS, against consensus of 8.75p shown on the StockReport. I've confirmed this by reading a broker note out this morning (there are 2 available on Research Tree), saying the EPS was 5% ahead of their target.

New car sales - this is very interesting indeed, and suggests that (so far anyway) Cambria (and maybe other companies too?) are coping well with considerably reduced new car sales volumes;

New vehicle revenue increased from £297.4m to £308.7m with total new vehicle sales volumes down 11.7%. Excluding the impact of the acquisitions and disposals, our new volumes reduced by 17% on a like-for-like basis. Gross profit increased by £2m (10.4%) in total but reduced by £0.2m on a like-for-like basis.

The reduced new vehicle volumes were offset by an improvement in the gross profit per unit sold which increased by 25.7%, a combination of like-for-like increase and strengthening mix from the JLR and Aston Martin businesses acquired as this product typically sells at higher price points.

Balance sheet - note the £41.9m of freehold property, a solid underpinning.

As with most car dealers, working capital is large, with credit from manufacturers being the big item in payables, and inventories being the big item in current assets.

There is £23.0m in cash, less £16.9m in interest bearing debt, so I make that net cash of £6.1m.

Trade payables of £142.5m dwarf the bank debt - so it's important to remember that there is a lot of other debt, provided by the car manufacturers. Given that P&L finance cost is only £576k for the year, it must be the case that the manufacturers' credit is interest-free.

Overall, this balance sheet looks OK to me.

My opinion - I wonder whether the investor gloom over car dealers might be overdone? I picked up some Pendragon (LON:PDG) after the recent plunge, and am quite tempted to pick up a few Cambria too - it looks good value.

I'm also impressed with the expansion, with 2 Bentley, and 1 McLaren dealerships opening in Jan 2018. It's far from easy to win those sort of franchises.

The wild card in this sector is the Government's changing stance on diesel cars. For years they have urged us to buy diesel, due to their fuel efficiency. Now we're being told not to buy them, due to particulates in the exhaust gases. This has caused considerable uncertainty & unease amongst new car buyers. I think this could be a bigger, temporary factor, than people think. Once Govt policy is more clear, then we could see demand for new cars increase, maybe? For this reason, I'm leaning towards maybe increasing my exposure to this sector.

Vertu Motors (LON:VTU) is another one that I'm considering, as it's P/NTAV is only just above 1.

SCS (LON:SCS)

Share price: 181p (up 3.7% today)

No. shares: 40.0m

Market cap: £72.4m

AGM statement (trading update) - the company has an end Jul 2018 financial year. So it's reporting today on the first 16 weeks of this financial year.

ScS, one of the UK's largest retailers of upholstered furniture and floorings

Surprisingly, given all the gloom about consumer spending, trading seems to be going quite well;

"The Board is pleased to report that the Group has made a good start to the financial year, with like-for-like order intake up 2.9% for the 16 weeks ended 18 November 2017, and two-year like-for-like orders up 8.0%.

I'm quite impressed by that.

The only negative is that trading from House of Fraser concessions (stores within a store) have fallen back from last year's strong growth.

Overall the company says;

Whilst it is still early in the current financial year, the Group continues to trade in line with our expectations. We believe the Group's increasing resilience and value proposition will enable us to manage the continued economic uncertainty and take advantage of opportunities."

Valuation - the PER and yield metrics look very cheap;

My opinion - it looks as if I was unduly negative on this share, when I last looked at it here on 9 Aug 2017. Judging by today's update, the company seems to have been a lot more resilient than I imagined. So it could be worth a a fresh look maybe?

Note that the Stockopedia computers love this one - a StockRank of 99, and "SuperStock" classification.

Van Elle Holdings (LON:VANL)

Share price: 82p (up 3.8% today)

No. shares: 80.0m

Market cap: £65.6m

There are 3 announcements today from this piling & ground engineering business.

EGM - the former Chairman of the business, Michael Ellis, has requisitioned a general meeting, apparently trying to take control of the company again himself. The company is fighting this, and caustically comments today;

The Board believes the Ellis Resolutions reflect the failure by Mr Ellis to accept that Van Elle is no longer his private family business and that the Ellis Resolutions serve to promote the interests of Mr. Ellis and his family, not necessarily to the benefit of the Company and its other Shareholders.

This type of EGM battle often results in some fascinating #####ing, as both sides air their dirty laundry in public. We saw cases of this not long ago, with Lakehouse (LON:LAKE) and Speedy Hire (LON:SDY) .

CEO resignation - this is blamed on a serious medical matter in his close family. He will continue until a replacement is found. So the resolution to sack him at the general meeting is now superfluous presumably.

Half year trading update - for the 6 months to 31 Oct 2017.

Helpfully, the company gives figures;

Overall trading in the first half of the financial year has been positive and the Board expects to report turnover of approximately £53m (H1 2016: £43.1m) with underlying profit before taxation increasing by approximately 15% (H1 2016: £4.7m).

Doing the maths, that seems to be saying that underlying H1 profit will be c.£5.4m (why didn't they just say that?)

Problems in one division sound as if they are being resolved.

Cashflow has been good.

Outlook comments strike me as a little hesitant, and there is an H2 weighting, which increases risk for investors;

The Group has a seasonal weighting towards a stronger second half and the Board expects this will be the case again in the current year. As the Group enters H2, enquiry levels are encouraging and the current order book as at November remains strong.

The Board continues to monitor market conditions closely and whilst mindful that the Group is subject to clients' decisions regarding contract call-off timing, its expectations for the full year remain unchanged.

My opinion - I don't normally invest in contracting companies these days, as so often something goes wrong.

Having said that, this share is starting to look very cheap. With a reasonable trading update today, it could be worth a closer look. I'm starting to get tempted!

Creightons (LON:CRL)

Share price: 36.5p (down 7.6% today)

No. shares: 60.6m

Market cap: £22.1m

For the 6 months ended 30 Sep 2017, from this maker of personal care and beauty products.

To refresh my memory on the company, I've just re-read my report on the excellent results for y/e 31 Mar 2017. So has the strong performance continued into this year?

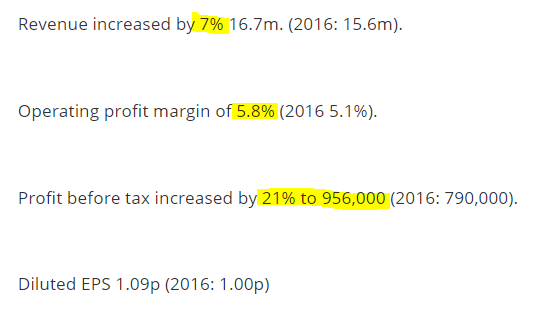

The highlights look solid, rather than spectacular;

Order growth is faster than revenue growth, suggesting that revenue growth in H2 might accelerate;

This has been achieved in conjunction with an order intake during the period which is 13.5% up on the same period last year.

Gross margin has improved from 41.0% to 42.1%, due to economies of scale, and supplier consolidation. Further margin improvements are being sought out through targeted capex.

Tax - note that historic tax losses have now been used up. So this is why the increase of 21% in PBT filters through to only a 9% increase in diluted EPS, to 1.09p. Double that, to annualise it, and the run rate of EPS looks to be 2.18p, giving a PER of 16.7 - that looks a fair valuation, if profits do continue increasing.

Balance sheet - looks strong.

NAV is £9.2m

NTAV is £8.5m

Current ratio is 1.96 - very good, indicating a well-financed company, with plenty of working capital.

Cashflow - is negative, due to big increases in receivables and inventories. Hopefully that's just because of increased production, although it's something we should keep an eye on. Indeed, the company says;

The main reason for the decrease in net cash on hand is the higher working capital requirement to support the sales growth during the period.

Outlook - it is customary to give a view on the full year outlook, with any company's interim results. However, unless I've overlooked it, I can't see any commentary on the outlook, or whether the company is trading in line with expectations or not. That's a surprising oversight. Perhaps the company could rectify this with future updates.

My opinion - I can't find any broker research on the company, bit it seems reasonable to expect full year EPS of double, or a bit more than double the interim figures. On that basis the PER seems to be about 16. That looks priced about right to me. If you think that the company has more growth potential, then the shares could be good value.

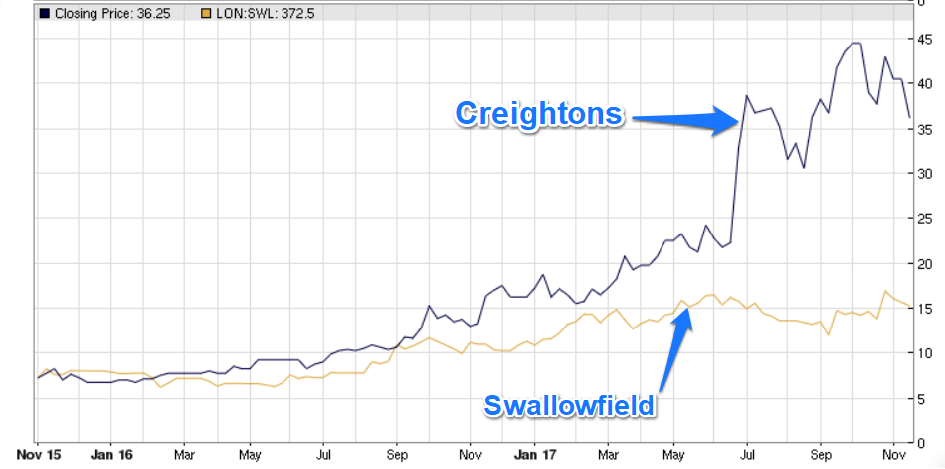

I'm a little wary of venturing down this low in market cap, as liquidity can become a problem. So because of that issue, personally I prefer larger competitor Swallowfield (LON:SWL) (in which I hold a long position) if I had to have something in this sector, which has also been performing well in recent years.

Of the two, Creightons has produced a much better return for shareholders in the last 2 years, as you can see from this chart comparison of the 2 shares;

QUIZ (LON:QUIZ)

Share price: 159p (unchanged at close, but up to 169p during the day)

No. shares: 124.2m

Market cap: £197.5m

Interim results - for the 6 months ended 30 Sep 2017.

This is a ladieswear retailer, selling value-priced special occasion wear in shops, online, and overseas. It is headquartered in Glasgow.

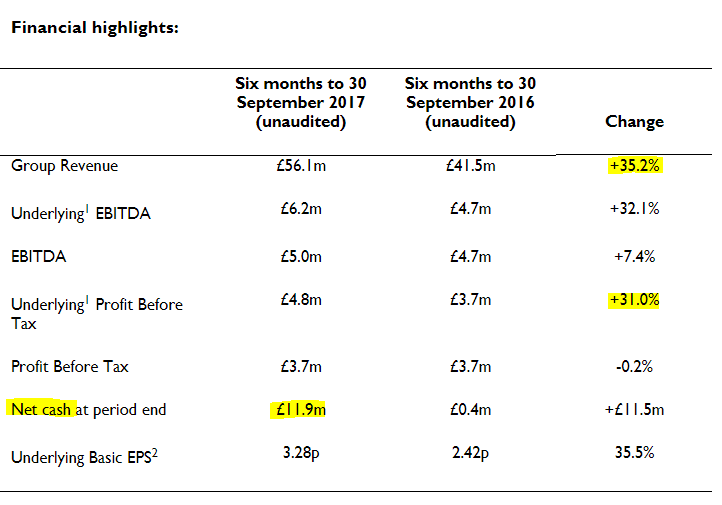

The highlights section from today's interim results looks good;

I'm happy with the "underlying" figures, since the main item adjusted for is the one-off £1.0m costs of the IPO.

Outlook - sounds confident;

Since the end of H1 2018 we have continued to trade well. Underlying sales, excluding non-recurring wholesale revenue in relation to Spain in the year ended 31 March 2017, in the seven weeks to 18 November 2017 are up 32.9% year on year, in line with our expectations, and are continuing to be driven by growth across all channels.

Our strong growth, supported by very positive customer feedback on our collections, is encouraging as we enter the important Christmas period and the Board remains confident of delivering further growth across all channels for the full year.

The company generates most of its revenues from physical stores. As it is opening new shops, then obviously its sales are increasing. It doesn't say anywhere what the like-for-like ("LFL") sales increase is. Without that key information, it's rather difficult to judge underlying performance.

Online revenues are growing very fast, at 204.6%, but are still quite small, at £13.8m for the half year. Such a high % growth rate won't be possible going forwards, but it's still very impressive. Whatever they're doing, clearly it's working, at driving up online sales rapidly.

Balance sheet - looks solid, and very clean, with no funnies.

It has net cash of £11.5m, and overall I can't see any issues here at all - it's a decent balance sheet, and the company is well-funded.

My opinion - I'm wavering a bit on this company. I met management at the time of the IPO, and was really impressed with them - experienced rag traders who learned their lessons the hard way (their original company went bust, so they're now much more careful about property leases). So I bought some in the IPO. However, doubts about valuation soon crept in, and I sold them. Maybe the IPO price was a little too high?

Since the initial price surge, the shares have drifted down by about a quarter from the peak. There again lots of growth companies have dropped by a similar amount in recent months. Quiz is now rated on about 20 times next year's earnings, which looks about right to me. The reality is that it's mainly a physical retailer, albeit one which is expanding nicely (and probably getting good rental deals on new sites, in current depressed High Street conditions). Bolted on to that is a successful, but small, eCommerce offering. Plenty of other physical retailers also have successful eCommerce offerings, yet are rated on a lower PER. So I'm not convinced that Quiz justifies a big premium rating. That would change if its online revenues really exploded upwards, and became the dominant part of the business - in which case, the share price would probably zoom upwards. So it's a share that I'll keep on the watch list for now.

It's only been listed since Jul 2017;

Gfinity (LON:GFIN)

Share price: 23.25p (up 1.1% today)

No. shares: 218.2m

Market cap: £50.7m

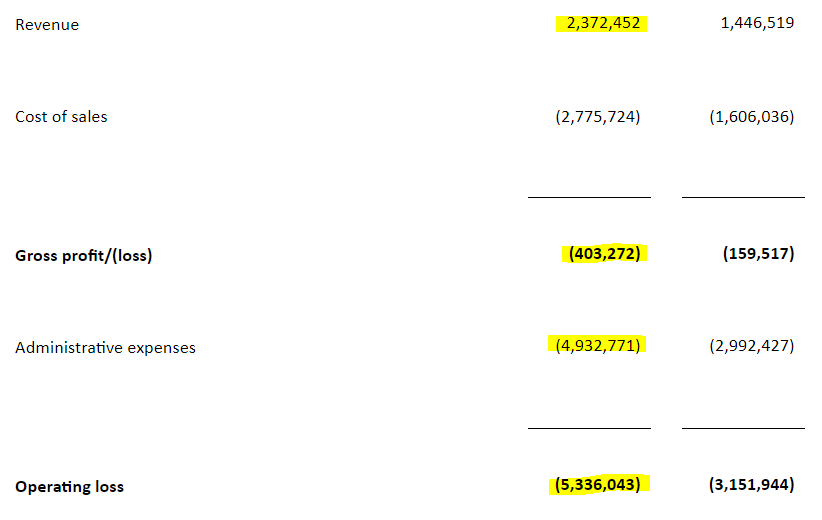

Gfinity plc, a leading international esports entertainment business, announces publication of its audited financial results for the year ended 30 June 2017.

It seems rather late to be reporting accounts for end June, when most companies reporting at the moment are doing 30 Sept figures. Late accounts are rarely good accounts, and that's certainly the case here - although management say they are in line with expectations. It's a heavily loss-making growth company, and these type of companies tend to make poor investments, in my experience - as they tend to need repeated fundraisings, causing nasty dilution.

As you can see from the P&L below, revenues have risen an impressive 64%. However, the gross margin is negative! So the company's selling things for less that the direct cost. Plus the £4.9m admin expenses look completely bloated, for such a small company.

If it's burning that much cash, then I hope it has plenty in the bank? The company seems to have raised £10m in fresh equity during the year, but only had £4.5m left at year end. Not to worry though, because investors stumped up another £7m post year end, at 27p. Investors included Nigel Wray. So clearly they must see potential here, to make them look beyond the losses.

My opinion - I'm only really able to review facts & figures here. I've not got a crystal ball, trying to guess what the future of eGaming might be, as it's a sector I know nothing about. So all I can really say, is that the figures look terrible. Therefore it doesn't interest me. I'd only be interested in looking at it once its business model is proven, and profitable. However, it might be of interest to investors who are happy to take a punt on a jam tomorrow company. Not many of that type of share actually works out as planned though. The area of eGaming does look interesting, and apparently is attracting large audiences. So who knows?!

All done for today, see you tomorrow!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.