Good morning! It's Paul here. Drat - just remembered that I didn't put up a placeholder article last night. I went to bed at 9:30pm, and my alarm to put up a placeholder article goes off at 10pm. Sorry about that.

Please note that Graham added some more sections to yesterday's report, which you might have missed. Here is the link to yesterday's report. I was particularly interested in the situation with disastrous toilet roll processor, Accrol Group (LON:ACRL) . What worries me is whether the placing is likely to go ahead at 50p? Since the share price has now fallen to 40p in the market, the key question is whether placees have signed anything binding to put in fresh equity at 50p? What's to stop placees pulling out, or demanding a reduced price? Normally with deeply discounted fundraisings, the share price stabilises a bit above the placing price. In this case though, the market price is now itself at a 20% discount to the originally deeply discounted placing price of 50p. It makes me wonder why the company/broker lifted the suspension on the shares? Surely it would have been better to leave the shares suspended, until the fundraising had been completed?

I was tempted to have a nibble at these shares yesterday, in the hope that the price would be pushed back above the 50p placing price. However, reading Graham's article on it yesterday, I decided to avoid Accrol. As Graham pointed out, the £18m placing doesn't seem to be enough to solve the company's financing issues. Plus, the fact that net debt will only be slightly reduced, implies that the company has been trading at enormous losses recently.

I think Accrol's business model just looks bad. In fact all these issues were flagged up in its admission document, which I reported on here, in Nov 2016. The company even flagged up that pulp reels were unusually cheap, due to over-supply (thus boosting Accrol's profits at the time it floated);

Parent Reel price volatility

The Group considers that, due to an oversupply of Parent Reels and pulp at present, Parent Reel prices are currently comparatively low.

However, if Parent Reel prices were to rise above the Group’s expectations and the Group was unable to offset such increases through cost savings or price increases, that could have a material adverse effect on the Group’s business, financial condition and results of operations.

(from May 2016 Admission Document)

So it seems to me that people who bought this share seem to have ignored the explicit risks set out in the admission document. Or maybe they didn't even read the admission document? Many people assume that fund managers do masses of research on companies that they invest in. Whilst some do, in my experience most don't. Investing millions of client money is often done on little more than a hunch, a lunch, or a phone call.

I can't urge people enough to read the Admission Document of all shares you purchase. There is a lot of detailed information in there. Often I find key information buried in the admission document, as was the case in Nov 2016, when I looked at Accrol's admission document. My conclusion then was that the company looked quite good (based on the historic numbers), but there were too many nasties, or potential nasties, in the admission document. I hope no readers here got caught on Accrol.

Another key question to always ask, is, "are profits sustainable?" I think that a lot of companies list on the stock market after they've had 2 or 3 bumper years. The owners know that level of profit is unsustainable, but stock market investors don't. Hence all too often an IPO will end up stuffing fund managers with an over-priced share, just before the problems start to surface.

To be fair, some IPOs do very well, but overall it really is a minefield in my opinion. Reading the admission document in full, is absolutely essential. They have to disclose everything, because if they don't, then the company & its Directors can be sued. So there will often be vital details buried in the admission document that investors need to be aware of. Skipping over the detail can often land investors in big trouble.

Accrol also seems to have a very bad track record on health & safety too. That's another reason why I wouldn't want to touch this share. I wouldn't be surprised if this company ends up going bust. It's sickening to see how the vendors pocketed a load of money from the IPO, and yet only 17 months later the company is fighting for its survival.

Empresaria (LON:EMR)

Share price: 102.5p (down 19.6% today)

No. shares: 49.0m

Market cap: £50.2m

Trading update (profit warning)

Empresaria (AIM: EMR), the international specialist staffing group, provides the market with an update on trading.

The company's year end is 31 Dec 2017.

The second half year adjusted profit before tax ("adjusted PBT") is expected to be ahead of both the first half and prior year. Although the Group is on track to deliver a record adjusted PBT for the full year, it is expected to be below current market expectations.

Note that this group has been acquisitive, so I would expect it to be trading ahead of last year.

What has caused this reduced performance?

- Lower margins in Germany, caused by legislative changes (which will also affect 2018 performance), and

- Soft market conditions in the Middle East.

Other points;

- Corrective action have been taken (presumably they mean cutting costs and/or changing management, at problem areas within the group?)

- Geographical & sector diversity of activities reduces the impact of problems in Germany & M.East

- Disposal of a non-core training business, will give rise to a £1m loss.

Forecasts - it can be difficult finding broker research for smaller companies. However, I've tracked down one broker note today (which is available to subscribers of Research Tree), which provides revised numbers - helpful, as I only had limited information from the RNS, so wasn't looking forward to working out my own estimates.

FY2017: PBT down 13%. Revised EPS is 12.2p. PER of 8.4

FY2018: PBT down 15%. Revised EPS is 12.4p. PER of 8.3

The PERs look quite attractive now, but bear in mind that Empresaria has grown by acquisition, so it has a weakish balance sheet, which looks top-heavy with intangible assets. If we eliminate intangibles, then the NTAV is negative, at -£8.0m. (taken from last reported balance sheet, at 30 Jun 2017)

I don't see the weak balance sheet as necessarily being a problem, providing profitability & cash generation remain resilient. Although bear in mind that the price for carrying debt, is that shareholders are only paid a measly dividend yield of about 1.1%. Also bear in mind that, should we face another banking crisis at any stage, then indebted companies are at higher risk of bank facilities being withdrawn, or made more expensive. Hence why generally I prefer companies with little to no debt.

My opinion - Empresaria seems to have been well-managed in recent years, and has a good track record.

The factors causing today's profit warning are outside the company's control, so they can't really be blamed. The issue in Germany seems to be that new legislation forces employers to treat temporary workers equally to permanent workers. That has reduced profit margins for agencies, and reduced demand for agency workers.

Overall, I think the market has re-priced this share sensibly, to reflect worsening conditions. So it gets a "probably priced about right" comment from me, after today's fall to 102.5p per share. Like many other shares, this one clearly had run up too far in the summer of exuberance we've just had, when it peaked at about 167p. That's the danger of following momentum - shares tend to overshoot, then correct sharply - we're seeing a lot of that at the moment.

I'm not really sure what the catalyst would be to drive this share back up again? For that reason I'll steer clear.

SRT Marine Systems (LON:SRT)

CEO interview - I made good use of my day off yesterday, to catch up with Simon Tucker at SRT Marine Systems. I was critical of the company's poor interim results, and perennial jam tomorrow promises, here on 14 Nov 2017. So it only seemed fair to give Mr Tucker a right of reply.

Please note that I do these interviews occasionally just for general interest only - I don't charge any fees now, as that compromises my independence. It's interesting to talk to CEO/FDs, and to submit questions crowd-sourced from SCVR readers. We only had a couple of questions from readers this time. Anyway, I hope people find it interesting - click on "CEO interview" above, in blue font, that's a link to the interview on my non-commercial, personal interest, free website QualitySmallCaps.co.uk

Focusrite (LON:TUNE)

Share price: 319p (up 5.5% today)

No. shares: 58.1m

Market cap: £185.3m

Final results - for the year ended 31 Aug 2017.

These numbers look very good. I won't go into all the detail, as you can read the RNS yourself, if interested.

A few key points;

Adjusted, diluted EPS up 29.8% to 14.8p. This seems to be a modest beat of consensus EPS shown on Stockopedia of 14.6p. Although you can never quite be sure that consensus is based on the same criteria as the reported numbers.

Forex movements have been favourable to revenue growth (and hence profitability) somewhat, so we mustn't expect such a high growth rate to necessarily repeat in future, e.g. note the comparisons of constant currency, versus reported currency below;

All regions grew. Regionally, the USA is the largest market in the music industry and the largest market for the Group's products. Revenue in the USA grew 30.9% (constant currency: 18%) to £28.0 million, Europe grew 11.4% (constant currency: 7%) to £25.2 million and the Rest of the World grew by 24.9% (constant currency: 13%) to £12.9 million.

The company is very open about this;

I am very pleased to report that FY17 has proved to be another successful year, exceeding our expectations for revenue, at £66.1million (+21.6%), profit and cash flow. The Company's products have continued to grow market share in our established and growth markets.

Revenue and profits have been boosted by the strengthening of the Euro and US Dollar but, even on a constant currency basis, the Company has enjoyed excellent growth.

Balance sheet - this is a very conservatively financed company, and its balance sheet is wonderful! Here are the usual stats that I focus on;

NAV: £32.9m

NTAV: £27.9m

Current ratio: 4.09 - very, very strong.

Net cash: £14.2m cash, no interest bearing debt.

There doesn't appear to be any pension fund.

The upshot of this, is that it provides safety for shareholders. If trading were to deteriorate, then obviously the share price would fall. However, shareholders don't have to worry about a situation like Accrol got itself into - I can't see that there would ever be a need for a discounted fundraising at Focusrite. So shareholders don't need to fear any solvency issues, nor worry about dilution. Plus the company has firepower to do acquisitions using its cash, which would increase earnings potentially. You often find such a conservative approach at companies which are still run by the original entrepreneur or family that set up the business, and it's a very positive thing in my view.

Dividends - very small, at only 2.7p for the year - although this is up 38% on last year. Maybe the company is hoarding cash for acquisition(s)? If not, then they really should pay out the surplus cash in a special divi.

Stockopedia says - predictably high StockRank of 81, and categorised as a "High flyer".

Outlook -

Although competitive pressures remain strong, changes in technology and new customer requirements can emerge quickly, and macroeconomic and political factors affect our end customers and distributors alike, we remain committed to keeping abreast of these risks in order to continue to deliver strong growth.

Since the year end, revenue and cash have both grown further. We continue to see strong market acceptance across our expanding portfolio and our new product pipeline continues to grow. Our solid momentum has continued into the current year and we continue to look forward with confidence.

That sounds confident. However, I think it's worth noting that this company has to run to stand still - i.e. it has to continuously innovate, and launch new products, as old ones are copied by competitors & prices reduce.

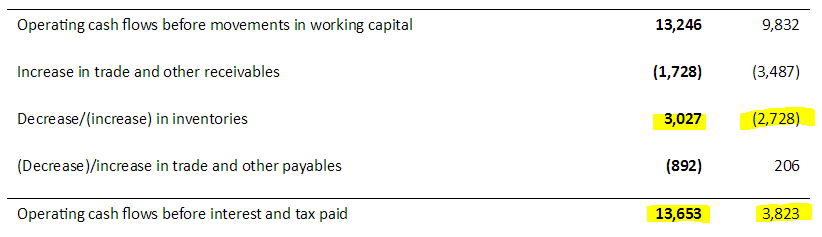

Cashflow statement - very interesting. This confirms what a lovely business this is. A couple of comments;

Intangible amortisation of £2.95m is now very close to capitalised development spend of £3.1m. So previous concerns that some investors had about profit being flattered are no longer valid. The cashflow is strong, and it's real!

Note from the cashflow statement excerpt below, how a big rise in inventories last year, has reversed this year. That's good to see, and it has caused a dramatic improvement in operating cash flows (before interest & tax paid) from £3.8m last year, to £13.65m this year;

My opinion - I like these numbers a lot!

I cannot foretell the future of course. So my opinion is purely based on the historic numbers, and the positive outlook statement, plus the strong balance sheet. On that basis, I think this share looks quite attractive.

If the company does say 15-18p EPS this year, which seems likely, then at 319p per share, the PER looks to be in the range of 17.7 to 21.3 . Those figures should be adjusted down, to take into account that there's a nice pile of surplus cash. So the valuation look pretty reasonable, for a decent growth company.

The downside risk is obviously if the company is unable to maintain decent growth.

Severfield (LON:SFR)

Share price: 72.5p (up 12.4% today)

No. shares: 299.6m

Market cap: £217.2m

Severfield plc, the market leading structural steel group, announces its results for the six month period ended 30 September 2017.

These results are a reader request. I'm very impressed with excellent figures, and a strong outlook statement. A few key numbers/comments;

- H1 revenues up 16% to £137.1m

- Underlying PBT up 59% to £12.9m

- Net cash of £31.4m

- Strong balance sheet, although the £20.2m pension deficit is unfortunate, but not a deal-breaker

- Good cashflow statement - this is a nicely cash generative business.

- Dividend yield c.4% looks good, and they're growing too.

- Order book & pipeline also strong

- Comfortably ahead of expectations outlook statement.

Shareholders must be delighted, this all sounds terrific!

Outlook -

The strong recent performance of the Group has continued in the first six months of the current financial year, with revenue and excellent profit growth supported by good cash generation. This, combined with ongoing operational improvements which continue to benefit margins and higher profits from certain project completions, means that the Group's performance for the year ending 31 March 2018 is now expected to be comfortably ahead of previous expectations.

In India, continued strong operational performance, the order book of £79m and the repayment of the high cost local debt during the period gives us confidence that the joint venture now has a solid foundation from which to deliver future profitable growth.

With a high quality order book of £245m and a strong UK pipeline of opportunities, the outlook for the Group remains very good. The underlying strength of the business and its performance in the first half of the financial year remains consistent with our continued progress towards delivering our 2020 strategic profit target of £26m.

My opinion - this is all sounds very positive. The valuation of the company looks cheap too.

The big worry is how sustainable this level of performance might be? There's no doubt that ultra low interest rates have stimulated something of a commercial property, and infrastructure boom. Although as the narrative states, this is expected to continue, with big Govt infrastructure projects in the pipeline.

I wouldn't normally consider investing in a structural steel company, due to its cyclicality. However the positive performance, and modest valuation, make this share look very tempting.

XLMedia (LON:XLM)

Share price: 189p (up 16.0% today)

No. shares: 204.4m

Market cap: £386.3m

Trading update - this is a performance marketing group - which generates leads for various clients, particularly in the online gambling sector.

The group has been issuing repeated good news this year, and serves up more of the same today;

Strong growth continues with trading ahead of expectations

XLMedia (AIM: XLM) is pleased to report that the Group has continued to trade strongly since the half year end and therefore expects adjusted EBITDA1 for the year ending 31 December 2017 to be materially ahead of expectations.

The Board further expects profit before tax to be ahead of expectations, albeit not to the same degree as adjusted EBITDA as a result of the effect of adverse currency exchange differences.

Since the half year end we have continued to see strong organic growth across the Group, particularly in the publishing division, which has led to us achieving better than expected direct margins in both segments. As well as the number of visitors to our websites increasing we have seen improved conversion rates and increased revenues from revenue share arrangements from users we referred to customers both this year and before.

That all sounds very good.

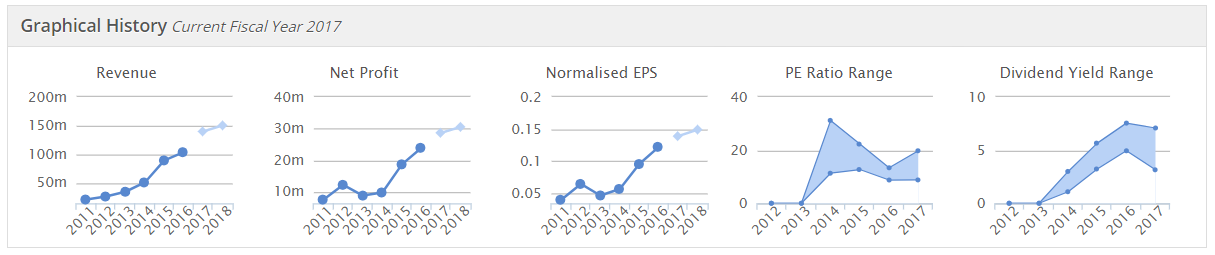

The company has now built up a superb track record;

As you can see - there's an excellent progression of profits, and also impressive dividends paid - so there's no doubt the cashflows are real.

Stockopedia likes it - a StockRank of 96, and "High flyer" classification.

It's difficult to argue with excellent figures, and a positive chart too;

Jaywing (LON:JWNG)

Share price: 26p (down 18.1% today)

No. shares: 86.9m

Market cap: £22.6m

Jaywing plc (AIM: JWNG) today announces its interim results for the six months ended 30 September 2017 ("H1").

The company does digital marketing.

I last looked at this company here in Jul 2014, and was underwhelmed by it then. In particular, its weak balance was a dealbreaker for me.

Nothing much seems to have changed. The balance sheet is still very weak, with too much debt. Also the trading performance in H1 looks quite poor.

If you ignore amortisation of goodwill & other intangibles (which is a perfectly valid approach in this sector), the it does make a profit at the EBITDA level. This was £1.45m in H1 this year, down from £2.13m last year in H1.

I see from the cashflow statement that debt increased due to payment of £2.5m in deferred consideration. Net debt was £8.1m, up considerable from £3.4m a year ago.

My opinion - I wouldn't want to be investing in a marketing company right now. As Jaywing says today;

"Since the election was called in the Spring we have seen consumer-led businesses in the UK grapple with difficult trading conditions. In common with previous periods where there has been a squeeze on consumer spending and more general economic uncertainty, their first action has been to cut costs, including marketing costs. Over the past months, we have experienced the impact of these market pressures in particular parts of our business, alongside every other agency.

Overall then, a highly indebted marketing group, with a weak balance sheet, seeing a downturn in business - that doesn't sound a very good investing proposition, does it? So I'll give this one a miss.

AO World (LON:AO.)

Share price: 112.75p (down 2.0% today)

No. shares: 458.8m

Market cap: £517.3m

Interim results - for the 6 months to 30 Sep 2017.

This is an online electrical retailer, operating mainly in the UK, but also building up a European presence.

H1 revenues up 13.3%. Note the geographic split though - UK is only up 7.4%, whilst much smaller Europe revenues are up 74.9%.

Adjusted EBITDA is going backwards - at minus -£6.3m in H1 this year, versus positive £1.5m in H1 last year. The problem seems to be that marketing spend to drive growth is outweighing the growth achieved.

Balance sheet - looks odd to me. The NAV is £80.9m. Stripping out intangibles, and NTAV is £66.0m - which looks a little light perhaps.

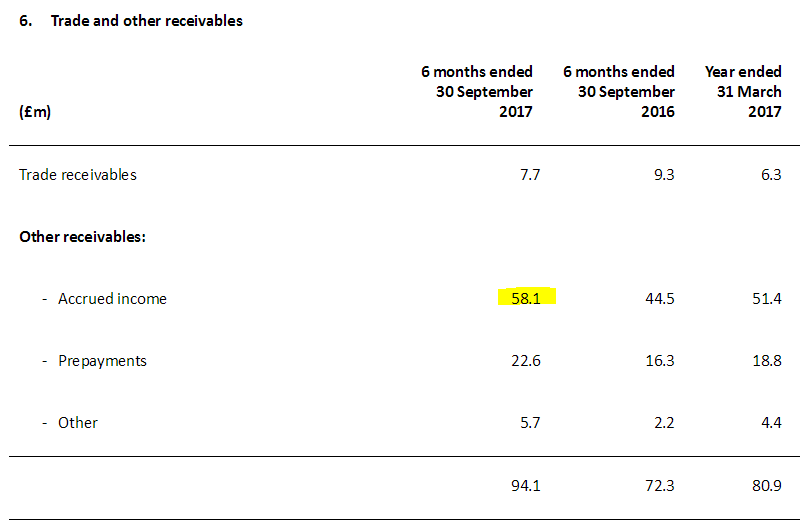

However, it's the stray debtors which jump out at me. Debtors within the fixed assets section (i.e. monies due in over 12 months) are a red flag to me. In this case, note 6 explains more. There is another £48.9m in receivables within current assets. This looks unusual to me - retailers normally have very little in the way of receivables, because customers buy goods in cash, not on credit, usually.

The big item is "accrued income", which I've highlights. If my understanding is correct, these are items which have been booked to revenues (and hence profit), but where the money has not yet been received.

Reading through the narrative, this accrued income appears to relate to commission on selling extended warranties;

UK trade and other receivables (both non-current and current) were £86.0m as at 30 September 2017 (2016: £68.9m) mainly reflecting an increase in accrued income in respect of commissions due on product protection plans as a result of the higher retail volumes.

UK trade and other payables increased to £152.0m (2016: £116.3m) reflecting increased trade and manufacturers continuing to extend credit on the higher volume of sales.

I'm very uneasy about the extent of the accrued income. This reminds me very much of Utilitywise (LON:UTW) - where the company was booking sales in advance of the monies being received. This inflated its profits, which turned out to be a can of worms, and eventually the accounting treatment was made more prudent.

It seems to me that AO's losses would be much greater than reported, if it more prudently accounted for these delayed receipts. Also, I wonder is there a risk of a mis-selling scandal here? Most of us realise that extended warranties are normally worthless. However, it's lucrative business if customers can be scared into worrying about the what-ifs, of products breaking down.

Some have argued that AO is really a loss-making online retailer, which acts as a vehicle to sell profitable extended warranties.

Note also the paragraph quoted above about trade payables. These look high to me, and it sounds like AO is at least partly funded by extended credit being offered by manufacturers.

My opinion - the closer I look at these numbers, the more negative I become. This share might be worth a new short position? AO seems to be struggling to generate strong (and profitable) growth - which is hardly surprising, considering that it's just selling products which are also offered online by numerous other companies. There's no product differentiation at all - people just shop around for the cheapest price. AO tries to differentiate itself with superior service, but that costs money - fine if the products are high margin, but the opposite is the case here. Low margin products, combined with more expensive service levels, just means trading losses.

So I think the business model here is weak, and fundamentally flawed. The trouble is, that Amazon is becoming the place people tend to visit, to get the best deals. We look up facts on Google, and we look up things to buy on Amazon - that's just the way things are going. I think online retailers that can succeed, are ones which have unique products, which you can't get anywhere else. That particularly applies to fashion. It doesn't apply to electrical goods.

To maintain a premium rating, I think AO needs to grow a lot faster, and show that it can achieve economies of scale. That just isn't happening at the moment. So this shares is one I would be more likely to short, than buy.

The long term chart says it all - way too much hype to start with. Then a gradual realisation from investors that the business model just isn't working;

(work in progress)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.