This is the usual placeholder article, ready & waiting for your comments on RNSs from 7am.

Main article to follow.

Good morning it's Paul here.

I'm multi-tasking this week, being a NED for a small restaurant/pub chain in which I invested - setting budgets, KPIs, reviewing accounting procedures, etc. So my apologies, but the SCVRs will have to be a little briefer than usual.

Interquest (LON:ITQ)

I was asked the other day to nominate the small company which seems to worst treat its outside shareholders. Interquest was the obvious choice. Our archive here contains the details of shareholder value destruction by management who seem incompetent, and not to be trusted. They seem hell-bent on taking the company private by whatever means they can, after their lowball takeover bid was not accepted by enough shareholders to push it through. Then they sacked their NOMAD, and took so long to find another one that the shares were suspended.

Today's latest wheeze is that they're trying to dilute existing shareholders, presumably to make it easier for them to have another go at taking it private. Or it might be in order to raise monies for an acquisition possibly?

The purpose of the meeting is to extend the director's authority to allot shares from one third of the issued share capital of the Company as currently authorised pursuant to the Annual General Meeting held on 23 May 2017 to 75 per cent. of the current issued share capital of the Company.

The purpose of which is to authorise the directors so that they may have flexibility to issue shares in the case that these are required as part of any future acquisitions or other dealings.

Clearly the last thing outside shareholders would want, is to give authority to issue shares to Directors who have repeatedly acted against the interests of minority shareholders (something which can actually be challenged in court).

Anyway, it's an awful company, with awful Directors. I have little doubt that they will succeed with their grubby plans to take the company private. I've made a mental note never to invest in anything these people bring to the stock market in future. Leopards don't change their spots.

Trifast (LON:TRI)

Share price: 238.25p (down 3.9% today)

No. shares: 120.3m

Market cap: £286.6m

Interim results - for the 6 months to 30 Sep 2017.

This is a group of companies which make industrial fastenings.

On a very quick read through, these interim results seem solid & with positive outlook comments.

- Underlying PBT is up 9.7% to £10.9m

- Underlying diluted EPS is up 8.1% to 6.78p.

There doesn't seem to be any seasonality between H1 & H2, so it's easy enough estimate full year profit by doubling the H1 figure.

Outlook comments from the Chairman sound encouraging;

Our strong first half results, together with a robust balance sheet, good access to banking facilities and a proven track record of profitable investment, means the Group is in a great position to keep moving forward. The second half has started well and, with a robust pipeline in place, the Board remain confident of delivering its expectations for the current financial year.

As an international business with over 70% of our revenue being generated outside of the UK, and a very well-balanced geographical and sector spread, the Board remains confident we have the flexibility and foresight to continue to grow, while facing any challenges head on as and when they arise."

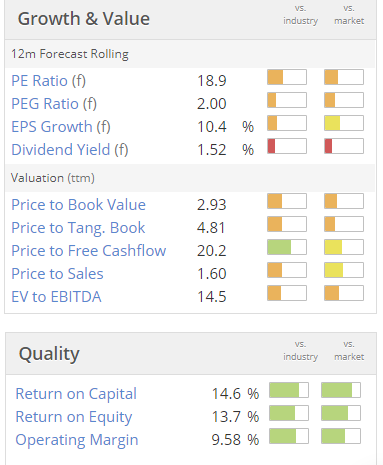

Valuation - the PER will have fallen slightly from last night's figures (below), due to the share price dropping 3.9% today, but are still in the same ballpark. The graphics below don't exactly scream "value" at me. Although in an expensive market, this is probably about the right valuation;

Balance sheet - looks good to me. There is a bit of debt, but that's plentifully covered by current assets such as inventories, and debtors.

I'm surprised that tangible fixed assets are only £18.4m - that seems low, for a manufacturer. That's a good thing though - the less capital required to generate decent profits, the better.

The working capital position is strong, and I can't see a pension deficit. So looks good.

I think the company has scope to increase borrowings, to make more acquisitions - which it has done in the past. So shareholders could see earnings continue to rise from further acquisitions.

My opinion - I've watched for several years whilst this company has consistently done well, and grown. So it has performed well, and I don't see any reason why that should stop, given that the world economy now seems to be in a good patch of synchronised growth.

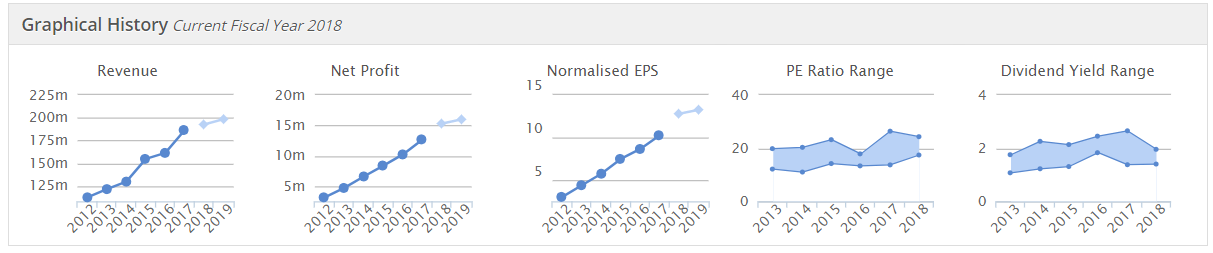

For me, the price is up with events, so I wouldn't be interested in buying any at this level. Given it excellent track record (see lovely graphs below), then a full price is probably justified. Providing nothing goes wrong in future, of course.

SRT Marine Systems (LON:SRT)

Share price: 34.5p (down 0.7% today)

No. shares: 127.7m

Market cap: £44.1m

Interim results - for the half year ended 30 Sep 2017.

These are poor results, but that had already been flagged to the market, hence why the share price is almost unchanged today.

Revenue of only £2.9m resulted in a -£1.75m operating loss before exceptionals.

There was a further exceptional charge of £1.5m due to a customer projects which has been "postponed". Again, this is nothing new - we had already been told about it before.

Balance sheet - I'm not keen on the company drawing down on a debt facility to fund development spend (and operating losses). It had drawn down £2.75m so far, although it has £2.1m cash too. So that's an inefficient way of doing things, in terms of interest costs. The borrowings come with quite a high interest rate too.

To my mind it would have made much more sense to do a big equity raise, whilst the share price is high (relative to historic performance).

Sales pipeline - the company always seems to dangle the carrot of big future contracts in front of investors, but to date there haven't been any sustainable profits. So the company's big challenge is to convert this promising pipeline into sustainable, growing profitability - which has been elusive to date.

I am pleased to report that we have seen significant activity across all our validated sales pipeline opportunities which have an aggregate total value of over £200m. Each is a large and complex project, where SRT is engaged directly with the end customer in conjunction with our local partners. Each have their own local planning challenges and therefore have required very involved and protracted discussions which has involved a considerable investment of sales and support resources by SRT over several years. Many are now at an advanced stage with four, two in the Middle East and two in Asia, with an aggregate value of £60 million, appearing to be in the final stages prior to contracting. Once contracted, the planned implementation period varies between 1 and 3 years, depending on which contract.

So this seems to be terribly close to glory.

My opinion - I'm not keen on companies which rely on large, unpredictable contracts. The delays that seem to come with the territory here (dealing with multiple Governmental bodies, etc), and that the product is pushed by Governments, rather than wanted by the end users, seem to have created a tough nut for SRT to crack.

Everyone wants the affable CEO to succeed here, so I hope he does. That's just not something I would want to punt on. I need more certainty in my investing decision-making, so it's not for me.

Escher Group (LON:ESCH)

Share price: 135p (down 22.9% today)

No. shares: 18.8m

Market cap: £25.4m

Trading update (profit warning) - this company calls itself (rather grandly, for a £25m mkt cap company);

...a world leading provider of outsourced, point of service software for use in the worldwide postal, retail and financial industries

As so often happens with software companies, it hasn't won the big contracts that it had hoped for;

...announces that the Group will not close the additional licence sales that it had expected in H2 2017 due to the postponement of major contracts.

Helpfully, the company quantifies the shortfall as follows;

As a result, Group revenues are now expected to be approximately US$18m for the year to 31 December 2017 with licence revenues, which have a high margin, materially lower than expectations.

Stockopedia shows a 2017 forecast of $22.1m revenues. So this is a $4.1m, or 18.6% revenue shortfall. Since it's high margin licence revenues which have fallen short, this will have a very big impact on the bottom line.

Helpfully, this is also quantified (at the almost meaningless EBITDA level anyway);

The adjusted EBITDA*, excluding exceptional items, is expected to be approximately US$2.7m for the year to 31 December 2017. As at 31 December 2017, the Group expects to have a neutral net debt/cash position.

My opinion - there's just not enough visibility of earnings, to enable me to accurately value this share. For that reason, it has to go in the too difficult tray.

Also, postal services worldwide must be seeing falling volumes, due to internet substitution. So investing in a company which serves a declining sector, doesn't appeal to me.

Carclo (LON:CAR)

Share price: 142.2p (up 1.0% today)

No. shares: 73.3m

Market cap: £104.2m

Interim results - for the 6 months to 30 Sep 2017.

This company calls itself, "the global manufacturing group", which is a bit too vague! Its biggest division is technical plastics, and LED technologies is its other significant division.

Of all the companies I looked at today, this one looks the most interesting as a potential investment.

Key points;

- Profits are down a little - underlying PBT of £4.55m in H1, versus £4.85m in the prior year H1

- Positive outlook for H2.

- In line with expectations for the full year.

- Substantial growth in the medium term - this bit looks interesting, so makes this share worthy of a closer look, in my opinion.

Balance sheet - has a fair bit of debt, and a pension deficit, so not great.

My opinion - definitely worth a closer look.

The forward PER looks low (only about 10), which combined with positive outlook comments, is usually a good sign that a share might be set to rise in future.

On the downside, I'm not keen on the balance sheet, which has debt & a pension deficit, which could well be the reason for the share looking superficially cheap.

Run out of time, sorry, I have to leave it there for today.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.