Good morning! It's Paul here.

Drat, I've just realised that I forgot to put up a placeholder article last night - apologies. There's no way I'll remember reliably in future, so I've just set up a reminder system on my phone.

Today is a very quiet day for small cap results & trading updates. We have 2 profit warnings though, so I'll start with those.

Here is the link to yesterday's report. I updated it in the evening, adding sections on Bloomsbury Publishing (LON:BMY) , Shoe Zone (LON:SHOE) , and Gear4Music results.

Lombard Risk Management (LON:LRM)

Share price: 7p (down 34.9% today)

No. shares: 400.6m

Market cap: £28.0m

Lombard Risk Management plc (AIM: LRM), the leading dedicated global provider of collateral management and regulatory reporting solutions, announces its interim results for the six months ended 30 September 2017.

I'm impressed with the prompt reporting (just 25 days after the half year end). The figures themselves though, can only be described as diabolical. I won't spend much time on this, as I've long been a bear on this share. Looking at the figures today, I'm seriously wondering whether the company might go bust.

A few key numbers;

First-half revenue of 12.7m (H1 2016: 15.2m), down 16.4% largely due to a temporary fall in services revenues and some delays in contract signings.

Negative EBITDA of £3.5m. Bear in mind that the company capitalises a ton of internal costs onto the balance sheet, so the cash loss is much worse than EBITDA.

Capitalised development spend of £2.7m.

Loss before tax of -£5.9m - remember this is just for H1 trading. This is a massive deterioration, from a loss of -£0.1m in H1 2016.

Cash - amazingly, the company has burned through pretty much all the c.£8m in fresh equity raised last summer. There's only £0.4m left. Although it also has (currently undrawn) borrowing facilities of £4.5m. Although if it continues burning cash so quickly, will the lender allow them to draw on those facilities? I'd be rather surprised if they do.

Outlook comments sound upbeat, but they always do. This company is a perennial jam tomorrow - always optimistic, but usually falling short. This is what they say today;

We recognise that this has been a challenging first half for Lombard Risk. A number of opportunities we had hoped to secure in the period remain in the pipeline as market distractions such as MiFID II caused companies to delay on committing to new projects.

This leaves us much to do in the second half, and converting our strong visible pipeline will be crucial in us meeting market forecasts.

However, with the size and quality of our pipeline at an all-time high, we remain confident this can be achieved.

During the period strong foundations have been put in place, with an improved salesforce, a new development centre in Birmingham, and a renewed effort to target new business as well as extant cross-selling opportunities. We believe this positions Lombard Risk well for the future and delivery of a strong second half will enable the Company to meet its stated objectives of being cash generative. We look forward to updating the market on progress during the second half of the financial year.

Balance sheet - looks terrible to me. I don't see how the company can survive much longer, without yet another equity fundraising. Will shareholders stump up more cash, yet again?

My opinion - these figures suggest to me that this company is in serious trouble. I think another equity fundraising is almost certain now. There are several big name institutions with discloseable stakes, who might be prepared to provide more cash, but on what terms?

Note that there was an open offer with the last fundraising, so one hopes that this is also included with any future fundraisings, to avoid diluting small shareholders.

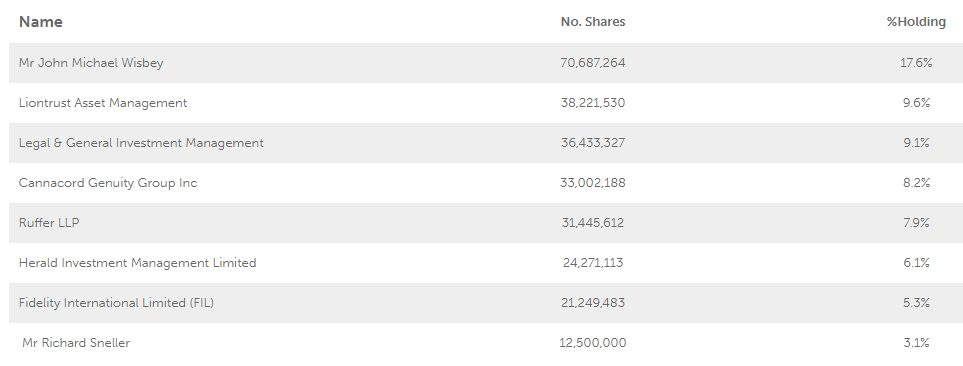

Overall, I think anyone holding this share, after seeing today's numbers, needs their head examining. Although of course, the problem with small caps, is that the market price is artificial - because big holders can't sell - there isn't enough market liquidity. So those guys in the list above don't have the option of selling. Smaller private investors can sell, which is a great advantage we have over small cap institutional investors. So to my mind, selling would be the only sensible option, given the scale of how bad today's interim results are.

There's a real risk of a 100% loss here, in my view. Is this a viable business? Based on today's figures, I would say no. Incidentally, I've tried to get a short position on this share today, but my broker can't find a borrow. Pity.

Defenx (LON:DFX)

Share price: 59p (down 39.5% today)

No. shares: 13.0m

Market cap: £7.7m

Trading update - this is a cyber-security company. I've not looked at it before, but will just have a quick look, as the market cap is now below our usual £10m size cutoff.

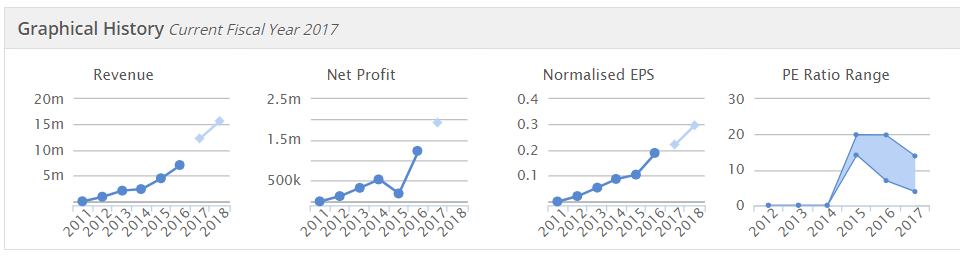

As you can see from the Stockopedia graphical history (always my first port of call when reviewing a new company), up until recently it looked like a nice little growth company;

I missed off the 5th chart, which is dividend history, as this company doesn't pay divis.

Profits were building nicely, but it's gone rather badly wrong recently, with the company today saying;

...These factors combined are expected to result in the financial results for the year to 31 December 2017 being materially below market forecasts and the Board currently expects to report a loss for the full year.

The Board is satisfied that Group's cash and available facilities in the region of 2.2 million are sufficient for its current requirements.

I don't like the use of the phrase "current requirements" when talking about cash. That possibly implies that more cash might be needed in the longer term, maybe?

My opinion - this is only based on a very quick skim of the figures. Today's profit warning seems to contain lots of things that have gone wrong, which might take some time to fix. For that reason I'm not tempted to catch this falling knife. I like profit warnings where something untoward has gone wrong, but can be swiftly rectified. Those situations can make nice buying opportunities. This looks a bit more complex, so I'll steer clear. Also something this small won't be liquid enough, so the danger is that you get stuck in the share, unable to exit. Why take that risk?

There are so many companies active in the cyber security field, that picking a winner would be very difficult. Also, I think the danger is that investors chase prices too high, just because it's a sexy sector at the moment.

Nexus Infrastructure (LON:NEXS)

Share price: 193p (up 0.8% today)

No. shares: 38.1m

Market cap: £73.5m

Trading update - this company's trading update was flagged up by andrea34l, in the comments section below. Gus1065 responded with a nice summary of the company, in comment no.9 below.

Nexus Infrastructure plc (AIM:NEXS), a leading provider of essential infrastructure services to the UK housebuilding and commercial sectors, announces a trading update ahead of its annual results for the financial year ended 30 September 2017 which will be announced on 9 January 2018.

I've not looked at this company before. It listed on AIM in Jul 2017. So the usual caution for new floats is probably a good idea.

Trading update - it's an in line update;

The Board expects the results for the Group for the year ended 30 September 2017 to be in line with its expectations.

The Board is encouraged by the level of growth in the Group's order book, which ended the year at 202.7m, a 25% year-on-year increase. This provides Nexus with good visibility for the year ahead.

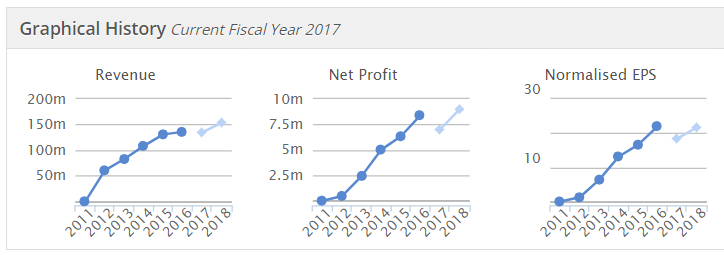

The Stockopedia graphs show a nice progression in revenue & profitability;

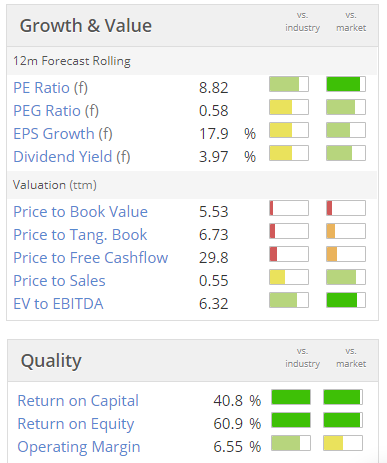

Looking at the usual Stockopedia growth & value graphics, the stand out numbers are the low PER, reasonable dividend yield, making this look apparently good value (although contractor type businesses don't usually command high valuation ratings);

Its AIM Admission document is here. I might review that later.

My opinion - at first glance, it seems quite good value.

I'll wait until the 09/2017 numbers are published, in Jan 2018, before taking the stock idea any further. It hasn't yet published any results post-IPO.

Generally I tend to avoid any contractor type businesses, as so many of them seem to go wrong. However, the attraction here is that the company seems to make decent profit margins - suggesting that it has some particular niche, and/or expertise. Also, I like its exposure to housebuilding, as there is such a clear need for more housing and Government seem to finally be waking up to this need, after decades of neglect. Also, I like that the order book is up 25%.

So it's going on to my watch list.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.