Good afternoon, it's Paul here.

I woke up with a stinking cold, so am running late today. Therefore, this article will gradually take shape throughout this afternoon.

LoopUp (LON:LOOP)

Share price: 175p (up 8.4% today)

No. shares: 41.0m

Market cap: £71.8m

Trading update - this is a SaaS company, which provides conference calling software/telephony. It's an excellent product, which I have tried out myself. It allows a greater level of control, and enhanced features, compared with conventional conference calling systems.

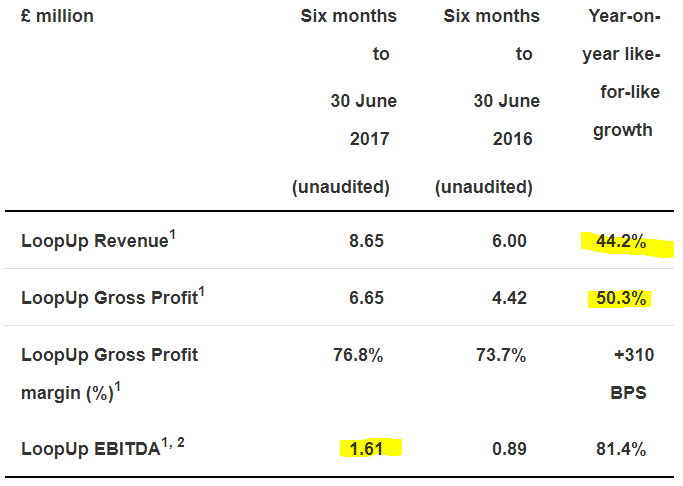

Today's update covers the 6 months to 30 Jun 2017. These are the highlights;

That's impressive stuff. Gross profit being up 50%, through organic growth, is really excellent, and justifies a premium rating for this share.

One complaint is that the company only presents EBITDA. That's annoying, because it now means that I have to check what development costs the company is capitalising, to arrive at a more meaningful view of profit. EBITDA is of interest, but it is absolutely not the only measure of profit that companies should give us. I very much dislike the current trend to steer investors towards EBITDA only.

Checking the accounts for y/e 31 Dec 2016, it turns out that EBITDA was £2.1m, yet operating profit was only £0.4m. So EBITDA certainly seems a misleading number here. The reconciling items were £246k in depreciation, and £1,419k in amortisation of intangibles.

In 2016, the company capitalised £3.2m into intangible assets. I've checked note 15 of the 2016 Annual Report, trying to find more detail on the intangible assets, but nothing more is given. So I can only presume that this is capitalised development spending.

Outlook - this also sounds positive;

"Looking ahead into the second half of 2017, we continue to see strong demand for the LoopUp product and we remain confident in our ability to deliver future growth."

The company seems to have settled at an organic top line growth rate of c.40% p.a.. Combine that with very high gross margins, and there is very powerful operational gearing here.

My opinion - this is a very nice company. I visited their Shoreditch HQ last year, and was really impressed. The people & the place had a real buzz to it. It's a young company, with a flat management structure, and a strong team spirit. All the employees I spoke to seemed very happy, and excited to be part of a rapidly growing company.

I panic sold my LoopUp shares, when news was announced that Amazon had launched its own conference calling product. However, to date, the Amazon "Chime" product seems to have had no adverse effect on LoopUp.

After strong trading announced today, I'm tempted to buy back into LOOP shares. It's rather illiquid though, and I recall it being difficult to buy and sell. There are lots of competitors in this space, so I do have some reservations that LoopUp might end up being surpassed by competing products at some point in the future. For now though, it seems to be carving out a successful niche.

MySale (LON:MYSL)

Share price: 113p (up 0.2% today)

No. shares: 151.3m

Market cap: £171.0m

Pre-close trading update - this is an online fashion business, specialising in "flash sales" - to allow brands to clear excess stock. It has a particular specialism is moving excess stock from the North, to the Southern hemisphere, thus enabling brands to continue selling out of season stock, but in a different market. I don't have the figures in front of me, but I recall that it does most of its business in Australia/New Zealand.

My most recent notes on the company are here on 1 Mar 2017. That article reports on the interim results to 31 Dec 2016, and a few snippets from my meeting with the Chairman & CFO.

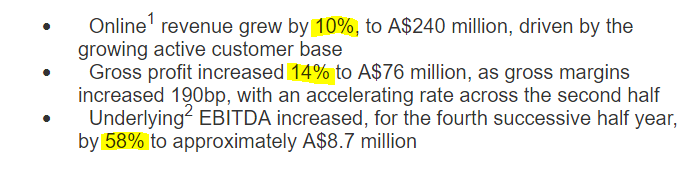

Here are the highlights published today, for the year ended 30 Jun 2017;

The top line growth isn't exciting enough, in my view, for an eCommerce business. It really should be delivering more than 10% growth.

Although note how a higher gross margin, and operational gearing, lead to a very impressive 58% growth in EBITDA. The trouble is, again, EBITDA is often a misleading number.

The wording above has confused me - I'm not sure whether the A$8.7m EBITDA figure is for H2, or for the full year? I'm assuming it is for the full year, but that could be wrong.

Development spend - the company capitalised $2.6m Aussie dollars into intangibles in H1 of this year. That number has been increasing, sequentially, half year on half year. So if we assume that the company capitalises say A$5.5m (my estimate) of development spend into intangibles for the full year (ending 30 Jun 2016), then that uses up a large part of the EBITDA. So the way I look at things, in cash accounting terms, this business is really only marginally profitable. That wouldn't matter too much if the growth was stellar, but it's not generating particularly impressive top line growth.

Outlook - this sounds reassuring, and top marks to the company for clearly stating what figures investors should expect to see for the new financial year which has just started. Why can't all companies do this?

Board confident in prospects for the current year, to 30 June 2018, with revenue growth of 15-20% anticipated and underlying EBITDA in line with market forecasts of A$11.5 - 11.8 million

So I would call that solid, rather than spectacular growth. Which does rather call into question whether the share price justifies a very high rating?

I recall from my meeting with management, earlier this year, that they emphasised their vision for the company becoming a broader portal for fashion eCommerce. This is mentioned again today;

''The momentum carried into FY18 is strong and we have a number of exciting strategic initiatives that will support the continued growth in revenue and profitability.

''Our new partnership with another global online retailer is an endorsement of the strength and quality of our international platform and demonstrates further progress in our strategy of working with global brands and retailers. ''

My opinion - I mentioned in my last report, back in Mar 2017, that I didn't see any immediate upside for this share, hence I decided to sell my personal position for the time being. Although it's possibly a share that I may revisit, if the growth rate accelerates in future. I left some in BMUS, more through inertia than anything else.

Overall then, an interesting company, which is high up on my watch list. Although I feel that the share price is probably up with events for now. There are probably better growth opportunities elsewhere for now.

It's interesting to note that the Stockopedia Style classifies this negatively, as a "falling star".

The StockRank is low, at only 27. Although it should be noted that highly rated growth companies often have a low stock rank, which subsequently improves, as results improve. Personally I use the StockRanks as a sanity check, to make me think twice before buying something which might be over-priced.

Quartix Holdings (LON:QTX)

Share price: 360p (down 6.1% today)

No. shares: 47.6m

Market cap: £171.4m

Directorate changes - the company has recruited a new COO. Also, its CFO of 10 years' standing is to step down "at some point in 2018". A CFO leaving is always worth scrutinising, as it can be a precursor of bad news to come, as we saw with RBG this year, for example.

However, in this case, the CEO's comments sound genuinely positive, and the relaxed timeframe of the CFO leaving seems to indicate that nothing is wrong. Also, I googled him, and his age is 59. That seems to be about the time when you can understand someone wanting to crank down a gear, and move to having a more relaxed portfolio of NED roles, rather than a full time CFO role.

So no particular worries over this.

Interim results - for the 6 months to 30 Jun 2017. I like the rapid reporting cycle, which suggests that strong financial reporting & controls are in place. Quartix is a provider of subscription based telematics services, for fleets of vehicles mainly.

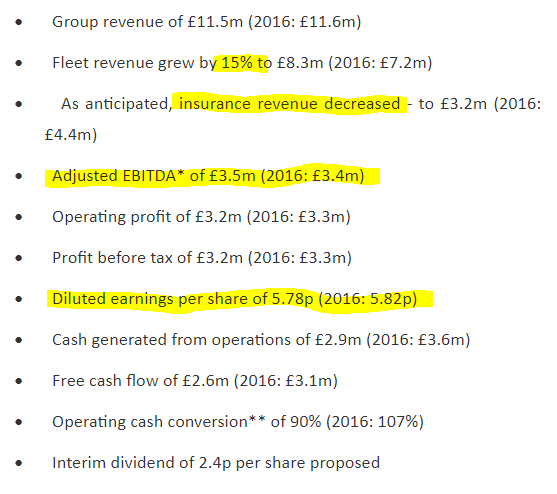

Here are the highlights from today's H1 results;

(apologies, I had some formatting problems with this section of the report, hopefully resolved now)

USA operations - small, but with interesting growth potential:

The Group continued to develop its operations successfully in the USA, taking its subscription base to 7,613 vehicles. This is 87% higher than it was 12 months ago (30 June 2016: 4,067).

During this time the Group has invested in the development of products to satisfy forthcoming legislation concerning the logging of driver hours. The initial release of the product is in use and receiving positive feedback from customers, and a full release of the main application is expected in the second half. Revenue increased by 76% to $0.7m (2016: $0.4m).

This is obviously quite small still, but could provide good upside in future, if business in the USA really takes off.

Dividends - the company says today that it intends distributing surplus cash as supplementary divis. That reinforces what a cash cow this business is.

Outlook - full year market expectations are confirmed in the Managing Director's comments near the start of the RNS;

...hence we remain on track to meet market profit expectations for the year as a whole".

The Chairman's statement includes this;

The Group has made a good start to the second half, in line with management's expectations. The high levels of recurring revenue and opportunities to grow in the UK, France and the USA in fleet combined with the reinstatement of some lost volume and improved pricing in the insurance business, underpin our confidence for the rest of the year and beyond. We will continue to use the financial strength of the business to invest in our core fleet operations.

That sounds reassuring.

Balance sheet - looks fine, I don't see any issues here. It had net cash of £4.8m at 30 Jun 2017.

Accounting policies seem conservative to me, which is good.

My opinion - overall, I like this company a lot. However, at the current price, it seems fully valued. I can't get away from the fact that, for whatever reason, profits are flat against last year. If I'm asked to pay a PER of 30-ish, then I would want strongly rising profits.

So for now, it's staying on my watch list. I'd be happy to buy some, but sub-300p is the sort of level where risk:reward would feel right for me. That said, a company with high margin, sticky recurring revenues, is likely to command a premium price. Plus, some investors may be happy to pay up, given the good growth in UK and overseas markets (e.g. France, and early-stage USA). So an interesting company, with great quality scores too.

It's getting late now, so I'll finish off with some quick comments;

Vertu Motors (LON:VTU)

AGM statement from this chain of car dealers. It says trading in Mar 2017 was strong, but softer in April, May, and June.

Reasons given are;

- linked to the Vehicle Excise Duty ("VED") increase in April (which pulled forward sales into March),

- the impact of sterling depreciation on new vehicle pricing and

- customer uncertainty regarding the General Election and the macroeconomic environment.

Overall though, the company seems to have managed things well;

Though market conditions have softened, I am pleased to confirm that your Company remains well positioned both operationally and financially. Accordingly, at this stage, the Board expects the Group's trading performance for the year ending 28 February 2018 to be in line with market expectations.

Investors often forget that car dealers make most of their profit from aftersales (servicing, and warranty work), and used car sales. So a downturn in new car registrations is not necessarily such a bad thing. Also the car manufacturers tend to increase incentives for dealers when demand is softer.

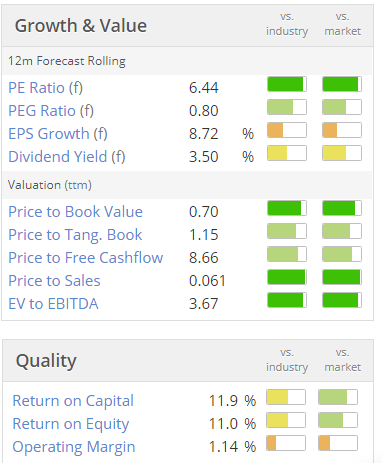

This share (and the whole sector) seem very out of favour with investors. Maybe there are worries about higher interest rates, and Brexit, still lingering? When the valuation of a solid company gets this cheap, I'm very tempted to buy;

Another point to consider, is that the move to electric vehicles could well put traditional dealers under pressure - since an electric vehicle has fewer moving parts, and requires less servicing. They might even be sold direct by manufacturers to the public, at some point?

The company also announces a £3m share buyback today.

At this type of lowly valuation, I think Vertu is looking rather interesting. So I might grab a few, on a down day.

Joules (LON:JOUL)

Results for the 52 weeks to 28 May 2017 look very good. This is a retailer, eCommerce, and wholesaler of distinctive, "preppy" clothing and accessories. The product looks expensive to me, as I'm more of a Primark shopper.

Here are the highlights, which are impressive;

It seems to me that Joules is succeeding on multiple levels - it's a successful roll out of physical stores. Plus the business also seems to be doing well in concessions (stores within a store - e.g. I saw them in John Lewis at the weekend), and eCommerce is also doing well (At 34.8% of total sales, and up 29.4% on prior year). There are also international sales, at 11.5% of the total. That's a very attractive combination.

Outlook comments are generally positive, with the usual uncertainty about Brexit being mentioned, as you would expect;

We have seen good growth in the first few weeks of our new financial year and we have had positive early feedback on our Spring/Summer 2018 ranges from our wholesale customers.

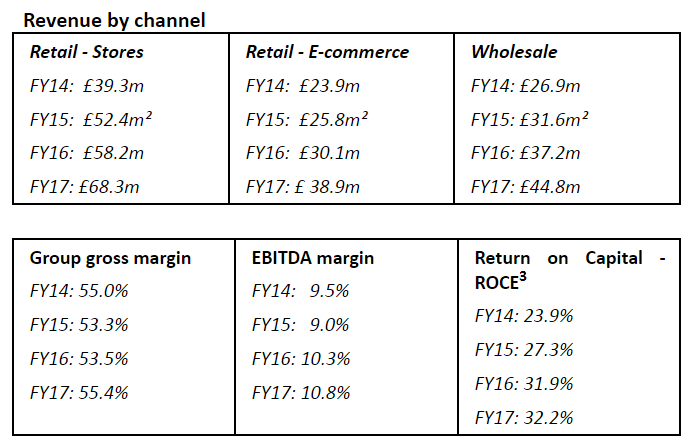

I really like this table presented today, which gives lots of useful information, and trends;

This is fantastic;

The average payback on new stores, opened for more than one year, remained at less than 12 months, and all continuing stores delivered a positive contribution.

Balance sheet - generally looks OK. Not particularly strong, but not weak either.

One item did jump out at me - namely that intangible assets rose from £5.9m to £9.5m in the year, which seems rather large. On doing more digging, notes 7 & 8 reveal that the company capitalised £5.3m of IT spending onto the balance sheet in 2016/17. The amortisation charge was a lot smaller, at £1.7m. Whilst this is a perfectly reasonable accounting treatment, I want to flag it up, as profit is being heavily boosted in this way.

Underlying profit of £10.1m would drop to £6.5m, if the IT spending had been expensed directly to the P&L, so this is a material issue.

Forecasts - the broker forecasts for the new year seem too conservative. So I think there is likely to be upside on the 10.4p EPS forecast from one broker for 5/2018. I'd say that something nearer to 12p EPS looks more feasible. If my guesstimate of 12p EPS this new year is right, then at 303.5p per share, the PER would be 25.3 - hardly a bargain, compared with say SuperGroup (LON:SGP) (in which I hold a long position).

On the broker forecast of 10.4p EPS, then the PER would be 29.2 - that's a very full valuation. Although the strong growth probably justifies it.

The share price seems to have stalled at around 300p, after a very good rise. I'm struggling to see much of an immediate catalyst to take it to an even higher valuation, any time soon.

My opinion - I like the business a lot, and the figures today are good.

However, I'm struggling to see much immediate upside on what seems a pretty full valuation.

There is also fashion risk to consider. Joules has a very distinctive, quite narrow look. So if that suddenly became unfashionable, then the company could be in trouble. I generally prefer fashion companies with a broader customer appeal.

I note that its polo shirts are reduced from £35 to £20-25 in the sale. That still seems extortionate to me - I get mine for £4 each in Primark, and they do the job.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.