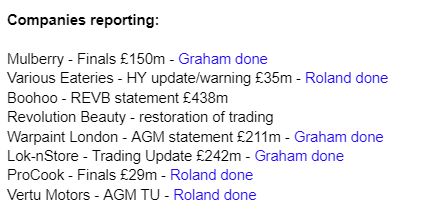

Good morning, it's Graham and Roland here with today's report. Paul is back tomorrow from his mini-break!

11.20am: today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

Quick comment

Revolution Beauty (LON:REVB) - there has been boardroom drama at Revolution Beauty, whose shares were unsuspended today and are up 56% at the time of typing this (market cap £92 million).

At yesterday's AGM, which REVB unsuccessfully attempted to adjourn, the company's largest shareholder Boohoo (LON:BOO) used its voting power to remove the CEO, the CFO and the Chair.

REVB was left with only one Director on its Board.

After the AGM, that Director then decided to reappoint all three individuals, who had just been booted out, to their former positions! And he also brought in two other NEDs.

Boohoo describes what happened as "self-serving" and an "abuse of process".

REVB says that the company needed to reappoint its Board members in order for the shares to be unsuspended, and has promised that it will allow a fresh vote in late July or early August.

Graham's view - this is hardly a controversial take, but I think that when shareholders vote against the re-election of directors, the remaining directors should not unilaterally reappoint those individuals!

Therefore, I think that the remaining director at REVB should have taken no action and should have allowed the shares to remain suspended. The restoration of trading is not the most important thing, and it could have happened at a later date. Respecting shareholder votes is far more important, in my view.

I also note that REVB has used the restoration to grant millions of options to the CEO, CFO and other members of the management team, diluting existing shareholders by 3.4%.

REVB says "the options awarded are fully vested, but shares will be subject to a 12-month holding period".

If I am reading this right, it means that the individuals receiving these options do not need to achieve anything further in order to reap the benefits of these option awards. They will have the right to cash out after 12 months.

Furthermore, these are nominal cost options, so there is not even a challenging hurdle that the share price needs to achieve.

The CEO gets 5.6 million nominal cost options (5.6 million shares are currently worth £1.9 million).

The CFO gets 2.8 million nominal cost options (2.8 million shares are currently worth nearly £1 million).

I am open to any counter-arguments, but this strikes me as disgraceful behaviour by a company, to grant such bonuses to directors who just lost a shareholder vote.

There is a long backstory at REVB but purely on the basis of today's news, I would give these shares the thumbs down. I would never want to invest in a company that behaved like this.

Summaries

Mulberry (LON:MUL) - up 3% to 260p (£156m) - Finals - Graham - GREEN

The performance of this luxury goods company remains something of a mixed bag. Revenues are doing ok, but profits for FY 2023 were only saved by closing an impaired London store. I continue to believe in the possible undervaluation of the stock.

PROCOOK (LON:PROC) - down 10% to 23p (£25m) - Finals - Roland - RED

Like-for-like sales at this cookware business fell by 10.7% last year and are down by 7.9% so far this year. Low margins and high fixed costs are making life difficult and the company has warned of going concern problems if trading continues to worsen. Too risky for me.

Warpaint London (LON:W7L) - up 1% to 277.25p (£213m) - AGM Statement - Graham - GREEN

This share has had a pleasant rise and cannot be considered a “value” share at this point, but it does still have nice earnings momentum. Today’s AGM statement reveals strong trading in recent months and an imminent expansion into Superdrug. I’ll stay positive.

Various Eateries (LON:VARE) - down 15% to 34p (£29m) - Interims/warning - Roland - RED

This restaurant chain has seen profit margins slump in the face of rising costs. H1 cash flow was heavily negative, while insider ownership and loan arrangements suggest delisting and refinancing risks, too. I think there are far better options available elsewhere in this sector.

Vertu Motors (LON:VTU) - down 1.5% to 68p (£239m) - AGM Statement - Roland - GREEN

A solid quarterly update from this car dealership group. New vehicle supply is said to be improving and Vertu’s profit margins have remained stable. Full-year results are expected to be in line with current forecasts. I think the shares look reasonably priced.

Lok'n Store (LON:LOK) - up 2% to 820p (£267m) - Trading update - Graham - AMBER

This self-storage business remains in an impressive growth trend with stores opening, under construction and in planning. I continue to view this as an excellent business but it’s arguably too expensive relative to NAV and the earnings multiple is also far from cheap at 27x.

Graham's Section

Mulberry (LON:MUL)

- Share price: 252p (pre-market)

- Market cap: £151m

I should try to keep these comments brief as this stock, despite a market cap of £150m, is not liquid: over 90% of it is owned by the Malaysian Ong family and by Frasers Group.

For more of the background, check out my comments from April.

Here are the highlights from today’s full-year results for the financial year ending April 1st, 2023:

Revenue +4% to £159m (this is ahead of the revenue estimate shown in the StockReport, £155m). Revenue has been boosted by Mulberry taking over some stores in Sweden and Australia that were previously run by franchisees.

The core UK and Asia Pacific regions are not doing as well as “international” markets.

Gross margin is still excellent at 71.2% (last year: 71.7%).

Underlying PBT of only £2.5m, after spending £4m on “SaaS costs and additional investment in the Group”. The net income estimate on the StockReport was better than this at £6m.

Current trading / outlook

Revenue in the first 12 weeks of the financial year is up 6%.

Retail revenue +15% (with the help of the newly acquired stores), offset by a possible decline in total franchise/wholesale revenue.

As of yesterday, Mulberry now has full ownership of Mulberry Japan Co. Limited.

Dividend cut: only a 1p final dividend (last year: 3p). The Chairman refers to “the external environment and ongoing sector headwinds”, but the harsh truth is that Mulberry used up £25m of cash during the year, and generated very little profit.

Speaking of which, let’s see where all the cash went!

Net cash outflow from investing activities: £14m (£3m on acquisitions, £7m on capex, £4m on intangible assets).

Then there were £10m on lease payments and £2m of dividends, offset by a small cash inflow from operating activities.

The company insists that all of the spending will help to underpin its future success, with new digital platforms, new back-office systems, new stores, etc.

Reported PBT: while some aspects of today’s numbers are disappointing, reported PBT was actually quite good at £13m. Mulberry gained £11m from the reversal of impairment charges, after it closed its store on London’s Bond Street.

Graham’s view

I’ve previously given this one the thumbs up, on the grounds that its price to sales multiple is simply too low at 1x, compared to other luxury brands. Burberry (LON:BRBY) (in which I have a long position) earns lower gross margins than Mulberry, but Burberry trades at a P/S multiple of 2.6x. Kering trades at 3x, and LVMH trades at 5x.

The one small problem that Mulberry has is that it doesn’t generate much profit (!). However, I continue to believe that this problem can be fixed at some point, either by Mulberry itself or by a larger competitor that takes it out and eliminates duplicate costs. I haven’t got a great deal of conviction and I don’t know when it will improve, but I’m going to leave my positive view here unchanged.

I’ve never owned these shares but if I had known back in 2012 or 2015 that they would be available at £2.50 in a few years, I’d have been very excited about the prospect of picking some up at this much lower level!

Warpaint London (LON:W7L)

- Share price: 277.25p (+1%)

- Market cap: £213m

This was a hot share at the recent Mello conference. Many investors must be sitting on nice gains after the recent run-up in the share price:

Today we have an AGM statement:

"The Group continues to trade strongly with sales for the six months to 30 June 2023 anticipated to be in excess of £36 million (six months to 30 June 2022: £25.2 million), with margins continuing to be robust and ahead of those achieved in 2022.

In further good news, the W7 brand is launching in “an initial 73 Superdrug stores” in September, and there are “active discussions” with other retailers.

Graham’s view

Damian Cannon presented this at the Mello BASH, and I also attended a presentation by the CEO. Based on what I heard then, I could think of few major issues with the investment thesis here. Yes, it’s a “copycat” business model, and it won’t ever have the prestige of other brands. But that won’t necessarily stop it from being an effective provider of core cosmetic products and cheap alternatives to the prestige brands.

The gross profit margin last year was 36.4% - not what you’d want to see from brands at the other end of the price spectrum, but still impressive for what are considered to be cheap products (e.g. lipstick for £3.95).

At December 2022, the company reported having cash of nearly £6m and no debt.

The shares themselves are a little pricey (ValueRank of only 18 and a PER of 18x). However, it has the tailwind of earnings momentum behind it and in the spirit of letting winners run, I’ll maintain a positive view on this for the time being.

Lok'n Store (LON:LOK)

- Share price: 820p (+2%)

- Market cap: £267m

This successful self-storage company issues a trading update. I most recently commented on it here.

The roll-out expansion continues:

A new store has just opened in Peterborough. £7.5m cost, 46,000 square feet.

Three further stores under construction or being fitted out. These will bring an extra 162,000 square feet of capacity.

Two other huge stores are in the planning phase.

Momentum remains good:

Our total secured pipeline of 10 new stores will result in the Group operating 52 stores when fully developed, increasing the owned store trading space by 37.7%.

Trading continues to be buoyant with H2 stores' revenue expected to be up c.10.5% year on year.

Graham’s view

I think this is an excellent business: founder-led (Chairman Andrew Jacobs owns 17%), conservatively geared, with a proven process, and operating in a niche with excellent secular growth.

Valuation remains a niggle for me: the shares are trading below “adjusted” NAV, but about 27% above my own calculation of “actual” NAV. For property-related businesses I do struggle to pay a premium to book value. Perhaps I’d make an exception for this one, but I’ll stick with a neutral view for now. Around 700p I would be more interested.

Roland's Section

PROCOOK (LON:PROC)

- Share price: 26p (pre-market)

- Market cap: £29m

Preliminary results for 52 weeks to 2 April 2023

In April, I looked at Procook’s year-end trading update and said that while I liked the products as a customer, the company’s financial situation looked somewhat uncertain to me.

Today’s results provide us with a chance to see more detail on the group’s financial performance last year and gain fresh insight on current trading.

Let’s start with a quick reminder of what a disastrous IPO this has been – the shares are down by c.85% from October 2021 listing price. If Procook can turnaround, this might be an interesting situation, but the market is clearly pricing in significant risk:

Financial summary: Procook’s full-year update in April guided for revenue of £62.3m, with profits at “approximately breakeven”, on an underlying basis.

Today’s results are in line with these numbers:

Revenue down 9.9% to £62.3m

Ecommerce like-for-like revenue down 11.0%

Retail (store) LFL revenue down 10.4%

Gross margin: 61.5% (FY22: 65.1%)

Underlying pre-tax loss: £0.2m

Reported pre-tax loss: £6.5m

Net debt exc. lease liabilities: £2.8m (FY22: £1.8m)

The big problem for Procook seems to be that the expected post-pandemic decline in ecommerce sales has not been offset by a corresponding increase in store sales.

The revenue decline has been made worse by the company’s decision to exit low-margin Amazon sales channels. But even if this is stripped out, sales still fell by 5% last year. That’s a big decline against a backdrop of c.10% inflation, implying a sizeable reduction in volumes.

Today’s reported loss includes £4.4m of impairment charges. £3.3m of impairment has been applied to the group’s stores, with the remaining £1.1m applied to head office/distribution sites. I guess this may reflect lower future expectations from ecommerce as well as in-store trading.

Cash flow/balance sheet: operating cash flow of £9.4m was converted into a free cash outflow of £0.5m last year. However, this result was boosted by a £5.2m reduction in inventories. I wouldn’t expect this to be repeated, as supply chain conditions are now normalising.

Net debt rose to £2.8m during the year (FY22: £1.8m), leaving borrowing headroom of £13.2m.

This may sound relatively comfortable, but it’s worth remembering that Procook also has £29m of lease liabilities that required payments of £4.4m last year.

Trading commentary: founder and CEO Daniel O’Neill is keen to emphasise that Procook’s offer is continuing to resonate with customers.

The number of active customers over the last 12 months rose by 1.8% to 991,000, while the 12-months repeat purchase rate was relatively stable, at 23.6%. However, new customer numbers were lower, at 692k (FY22: 723k).

I don’t think this is a bad result, operationally, given the conflicting pressures on consumer spending (and the return to holiday travel) after the pandemic.

Current trading: this doesn’t look good to me. Procook says that trading during the quarter to 26 June 2023 has been challenging, with revenue down by 7.9% on a LFL basis due to “the warm weather and soft homewares market in May and June”.

The company reckons its share of the market has remained flat, versus last year.

Outlook: there’s no clear financial guidance today, but the outlook sentiment strikes a very cautious note:

The outlook remains challenging and much is uncertain. While there are indications that inflationary pressures will ease over the months ahead, UK consumers have suffered a significant adverse impact on disposable incomes and discretionary spending power.

Consensus forecasts on Stockopedia suggest that revenue could rise by 10% to £68m this year, generating earnings of 2.4p per share. These forecasts seem optimistic to me. I suspect that they’ll be revised down (again) after today’s results, although I haven’t been able to find an updated broker note yet.

Going concern risk: in yesterday’s report I commented on how operational gearing had boosted profits at CML Microsystems. Procook’s declining revenue and substantial fixed cost base means the group is now suffering operating leverage in reverse.

It seems that this could lead to some uncertainty over the group’s going concern status, if trading worsens.

The company’s severe but plausible downside scenario modelled a further 5% LFL decline in revenue in addition to that seen already (YTD: -7.9% LFL). I don’t know how likely this is, but in this scenario the company believes it would breach the fixed charge covenant on its main borrowing facility.

Essentially, this means that the group’s EBITDA would not provide sufficient cover for its rent, lease and interest payments.

A breach might not stop the business operating normally, but it would require a covenant waiver from lender HSBC. In fact, today’s results reveal that HSBC has already relaxed the fixed charge covenant once, in May this year, to prevent a breach.

Roland’s view: I don’t know how Procook will perform over the remainder of this year. But I don’t see any obvious reasons why sales should suddenly improve, after such a weak start to the year.

I think there’s some risk that Procook will need to carry out a placing to strengthen its balance sheet. Existing shareholders could face significant dilution.

In addition, I think it may also be worth remembering that the founding O’Neill family control more than 65% of the stock. So there might be some risk that the business will be delisted and taken private if it needs refinancing.

On balance, my negative view remains unchanged from April. Even at the best of times, this is a low-margin business with fairly high fixed costs. This isn’t a good place to be right now and I can see some risk to equity holders.

Various Eateries (LON:VARE)

- Share price: 34p (-15% at 09.00)

- Market cap: £29m

Half-year results & trading update (profit warning)

“the Company anticipates that net EBITDA margins as a percentage of sales will be significantly lower than previously expected.”

Various Eateries operates 17 locations under the Coppa Club, Tavolino and Noci brands.

In August 2022, Paul commented that this chain of bars/eateries looked “unproven” and perhaps not very financially robust. Today’s half-year results and profit warning suggest he was probably right to be cautious.

Trading update/profit warning: the company says it has been prioritising sales over margins.

While full-year revenue is expected to be “broadly in line with market expectations”, EBITDA margins are now likely to be “significantly lower than previously expected”.

Management says that as a result of rising food, labour and variable costs, EBITDA margins for the full year to September 2023 are expected to be between 5% and 7%.

Various Eateries’ EBITDA margin was 8.6% last year, on an adjusted basis. So this represents a material worsening of profitability. While I understand the importance of trying to maintain price positioning in the market, I wonder if this approach is really sustainable.

For contrast, rival Loungers (LON:LGRS) reported an EBITDA margin of 15.8% for the half-year to October 2022 and recently confirmed trading in line with expectations.

For what it’s worth, Various Eateries says that the performance of new openings “has been encouraging”. New sites in prime locations at reduced rents continue to become available – but can the business really afford to be expanding? I’m not sure.

Half-year results: these numbers cover the 26 weeks to 2 April 2023 and provide additional context for today’s profit warning. We can see that while revenue is rising, all measures of profit have fallen sharply:

Revenue up 16% to £20.6m

Gross profit down 63% to £565m

Gross margin: 2.8% (H1 2022: 8.6%)

Adjusted EBITDA loss of £29k (H1 2022: +£1.7m)

Operating loss increased to £3.2m (H1 2022: £1.6m)

Net debt exc. lease liabilities increased to £9.8m (H1 2022: net cash of £1.9m)

My sums suggest the business suffered a cash outflow of £6.3m during the half-year reporting period. Presumably this is continuing into the second half of the year.

However, the H1 EBITDA loss seems to suggest that some improvement in profitability is expected over the summer period, in order to achieve the guided 5%-7% EBITDA margin.

Roland’s view: As with Procook, Various Eateries’ profitability looks challenging for the near future. The financial situation here is also complicated by a dominant shareholder and related-party loans.

I haven’t researched this business in any detail. But Various Eateries’ low margins suggest to me that some of its sites may be tied into expensive leases. Alternatively, perhaps the pricing power of its brands and locations are not as strong as some rival chains.

In addition to the risk of an equity placing, I would argue that there’s a risk this business could be taken private for refinancing, perhaps before being refloated or sold in more advantageous market conditions.

This isn’t something I would want to spend anymore time on. It looks high risk and speculative to me at present, so I’m going to stop there.

Vertu Motors (LON:VTU)

- Share price: 68p (-1.5% at 09.40)

- Market cap: £239m

“The Board anticipates that full year results for FY24 will be in line with current market expectations.”

Today’s update from this car dealership group seems fairly reassuring to me. Although management does comment on “uncertainty of consumer demand”, the remaining commentary is fairly positive and suggests industry supply conditions are improving.

Trading highlights: trading (adjusted operating) profit for the three months to 31 May has been “above prior year levels”, aided by the acquisition of the Helston Garages last year.

New car retail and Motability volumes up 10.8%

Like-for-like (LFL) new vehicle margins stable at 7.9% (8.0% last year)

Fleet and commercial volumes up 1.0%

Used vehicle LFL volumes down 5.9%, due to supply constraints

LFL gross profit per used unit sold stable at £1,648 (last year: £1,652)

Operating costs have risen slightly as a proportion of revenue due to energy, pay, IT, etc.

Updates from car dealership groups often provide interesting insight on market conditions across the sector.

Today’s update shares that SMMT (industry trade body) forecasts for the new vehicle registrations this year were increased by 2% to 1.83m in April, to reflect stronger fleet sales.

This is said to reflect a return to more normal supply conditions, with UK fleet and commercial vehicle registrations rising by 30.9%, especially in the rental sector.

Vertu isn’t a major supplier to the “low margin rental sectors”, so the group’s volumes lagged the wider UK market.

However, Vertu says that its new car retail and Motability volume growth of 10.8% compared favourably to a UK-wide figure of 8%. This implies Vertu has gained market share in this segment.

Outlook: the company strikes a positive tone:

“New vehicle supply continues to improve whilst constraints in used vehicle supply in the UK are likely to persist, helping to underpin used vehicle values and gross profit.”

However, higher interest rates and inflationary pressures may act as a headwind to consumer demand.

Results for the year to 28 February 2024 are expected to be in line with current expectations.

Stockopedia’s consensus forecasts suggest earnings of 9.9p per share, with a 2.5p dividend. That prices the stock on a P/E of 7, with a 3.6% yield:

Roland’s view: Vertu has plenty of freehold property and the shares continue to trade just above tangible net asset value.

However, I suspect that consumer demand could still be held back later this year by the impact of higher interest rates on both mortgages and car finance costs.

On balance, I think Vertu shares look reasonably valued at current levels, but perhaps not quite as cheap as they might seem.

However, given the strength of the balance sheet and the group’s current stable performance, I’m happy to go green on this one.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.