Good morning, it's Paul here with Wednesday's SCVR.

Timings - I should have this finished or nearly finished by 1pm.

EDIT at 12:29 - I've covered most of the more important things for today. I'm taking a lunch break now, will finish off this article by 3pm.

EDIT at 15:46 - today's report is now finished.

More thoughts on China

If you're not interested, just skip this section.

Overnight, the US markets seemed to shrug off worries about the coronavirus. From what I can make out, the attitude seems to be that this crisis will get sorted out, like all previous crises, and it shouldn't affect America. I'm not sure that's sensible. As we're seeing on our TV news, some large Chinese cities are like ghost towns, as people prefer to stay indoors to minimise the risk of becoming infected with a potentially fatal illness - who can blame them?

As I see it, there are two problems for markets. One is potential panic - SARS apparently hit markets by something like 6% to 13%. Although it's difficult to isolate that from other bearish factors going on at the same time - as one reader pointed out, that was the same time as the second Gulf War was building up, which kicked off in Mar 2003. Casting my mind back, I think the build up to the Iraq War was more of a worry for investors than SARS. Also, SARS didn't spread like this new virus is doing now.

Restrictions on travel (especially aviation) in & out of China is bound to affect shares in airlines, cruise ships, etc. Also I note that $SBUX warned last night of an earnings hit from having to temporarily close over half its 4,292 Chinese stores. As the world's second-largest economy, events in China have more impact on the West than when it was a subsistence agricultural economy in the past.

What about supply chains being disrupted? Numerous companies in the UK and USA import parts and finished goods from China. How will production and transportation of those be impacted? How long for? Plus of course, the UK luxury goods are popular in China, so sales of those might fall.

Will markets look through this crisis, and see profit warnings connected with China as being a temporary blip? I'm not sure. In the UK, the market tends to mark down shares quite sharply, even if a profit warning is due to temporary factors. Although as we saw with Joules (LON:JOUL) profit warning recently, a temporary negative (over apparently a one-off internal blunder re managing its inventories) triggered a 30% plunge in price initially, about half of which was recovered quite quickly in subsequent days.

All in all, I'm cautious, and have decided not to open any new small cap positions until we have more clarity. Also, I've shorted the Hong Kong & US indices, as a general hedge. They don't particularly correlate to UK small caps, but the US does set the general direction of markets.

Are US markets expensive?

I've shorted the US market purely as a hedge against possible escalation of the problems globally, and because I think the US is in any case probably overdue a correction (everything feels too bullish).

My shorts on indices hardly ever work, so this comes with a giant, neon-flashing warning sign! As always, I'm just reporting on my opinions, not giving advice.

The problem with a geared small caps portfolio such as mine (or part of my portfolio anyway), is that you can't really move in & out of things. It's too expensive (bid-offer spread), and there's not usually enough liquidity to be able to buy & sell in reasonable size. Hence why, when I get nervous about macro stuff, then shorting an index gives me some comfort. That combined with gradually reducing some position sizes and gearing.

Anyway, I decided to do more digging on the US market overall recently. I'm lucky enough to have access to Stockopedia's international coverage, so find it easy to research US stocks because all the info I need is presented in a familiar format.

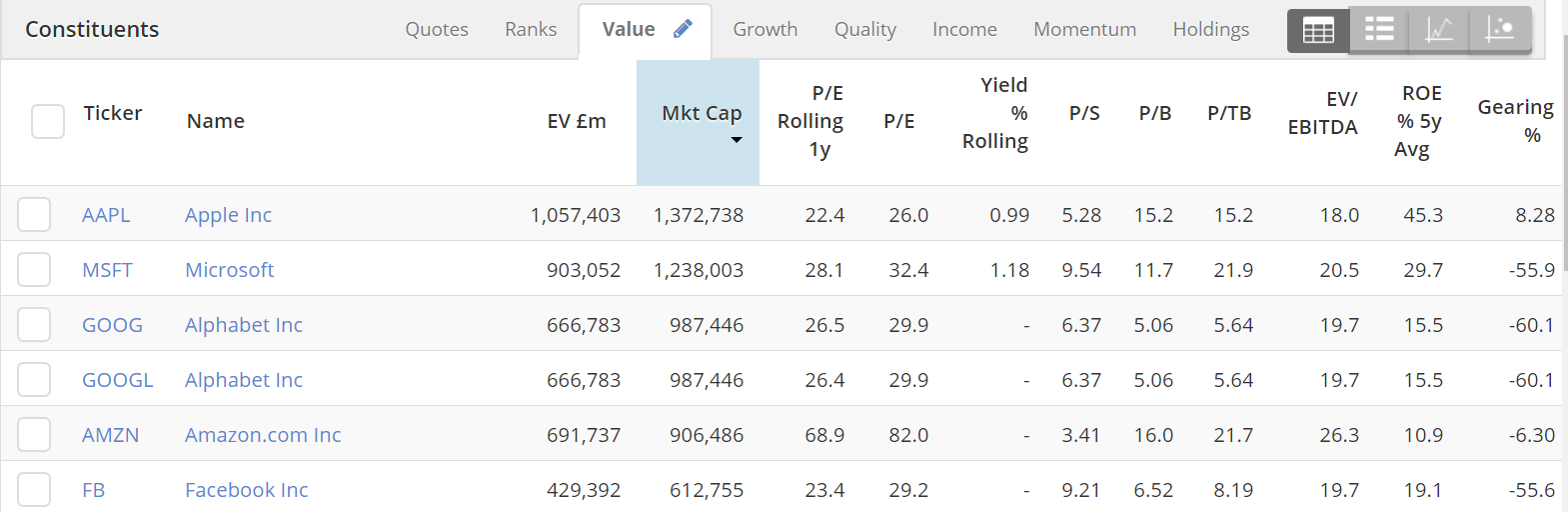

Sorting the S&P 500 in descending order of market cap (biggest first) reveals that the top 5 (ignoring Google being double-counted) most valuable shares are the tech behemoths (see below). Given their dominance, do the forward PERs in the 20s (apart from Amazon, at 68.9) really seem excessive? I don't think so. These outstanding companies with large moats justify high valuations, especially in such a low interest rate environment.

A PER of 25 is an earnings yield of 4.0% - much better than cash in the bank, or treasuries. When that 4% return is being mostly retained within the business, and re-invested on a ROCE of between 11.4% to 27.5% for these 5 companies, then that produces a great long-term return (assuming these companies are not undermined by competitors). Therefore a PER of 25 is not necessarily expensive at all, for a high quality business.

Lots of US stocks buy back their shares too. We've seen in the UK how transformative that can be over the long term, e.g. Next (LON:NXT) enhances its EPS every year with buybacks, and that has had a remarkable long-term benefit for shareholders.

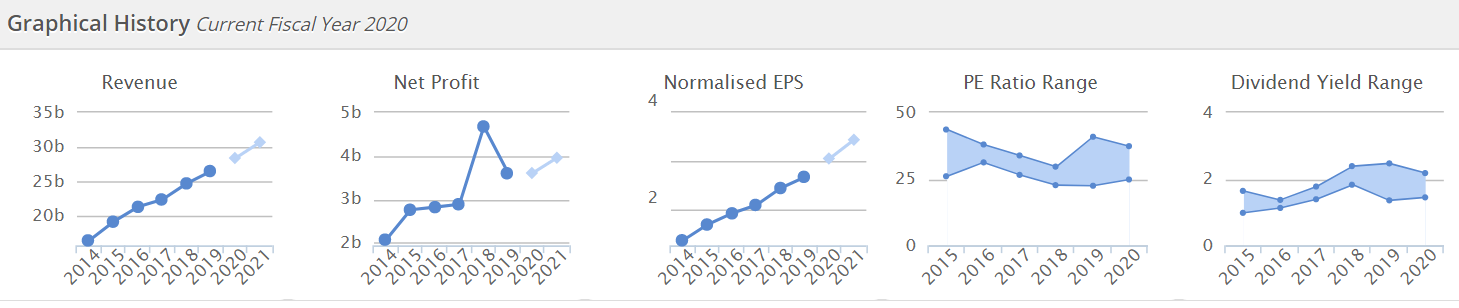

Going back to Starbucks, the StockReport shows avg no shares falling from 1,526m in 2014, to 1,181m now, a drop of nearly 23%. Look at how this has helped the EPS progression;

As you can see from graph no.4 above, the PER is always expensive, but justifiably so, as Starbucks is such a remarkable business & brand.

Long-term investors have cleaned up. Whoever said that elephants don't gallop was clearly wrong! They do in the USA. All of this does sometimes make me wonder if I'm wasting my time on UK small caps, and should instead focus on up & coming US stocks? That said, we only need to uncover the occasional nugget of gold in the UK market, to achieve very good overall results.

Maybe a concentrated UK small caps portfolio, combined with some US stocks might work well? Having better liquidity, and a much larger pool of high quality companies, does make the US market seem more attractive. I've dabbled in it before, but never seriously.

Here's the 10 year chart for Starbucks:

Overall then, whilst I feel we could see a correction in US markets, and they seem far too complacent about coronavirus, I certainly wouldn't bet against the US market for the long-term.

Recession risk is the big risk. We're overdue a recession, and maybe China could be the trigger? Who knows, it's all guesswork really.

The nightmare scenario for me, is that UK small caps drift down on nervousness about China, whilst US large caps storm upwards.

EDIT: I should add that, for long-term, ungeared investors, then none of this really matters. Indeed, falls in share prices for small caps provides a buying opportunity, both in terms of price, and availability of stock for things that can be nigh-on impossible to buy in any size in more normal market conditions.

My SIPP is such a long-term portfolio, and I'm not doing anything with the positions there - they're buy & hold (as reflected in BMUS).

End of Edit.

(sorry for all the typos in the first draft, think I've eliminated them now on an edit)

On to today's news. My initial list of things to look at is;

Gattaca (LON:GATC) - profit warning

Quixant (LON:QXT) - looks like a profit warning

Empresaria (LON:EMR) - same sector, trading update

plus trading updates from;

Pendragon (LON:PDG)

Renew Holdings (LON:RNWH)

SCS (LON:SCS)

Reporting on 5 companies is usually about right, in terms of time & energy.

Gattaca (LON:GATC)

Share price: 90p (down 14% today, at 08:56)

No. shares: 32.3m

Market cap: £29.1m

Trading update (profit warning)

This staffing/recruitment agency often comes up on value screens, but the reason it looks cheap is because it so often disappoints on earnings, turning out not to be cheap after all - that's the general danger with low PER shares. They're usually cheap for a reason. Moreover, turnaround talk from companies is also cheap, but usually doesn't work!

Whilst it is disappointing news, a profit warning, this announcement is perfect in how it is presented. Please would all the brokers & PRs who read these reports, take note - this is how all profit warnings should be presented, it's a model of clarity;

Following a review by the Board of the outlook for the business for its financial year ending 31 July 2020 ("FY20"), it now expects the Company's continuing underlying profit before tax to be approximately £6.0 million, which is below current market expectations*.

* Consensus expectations for underlying PBT are £10.0m.

That's it! Perfect. It tells us everything we need to know. None of this nonsense of having to interpret "broadly", "significantly", "materially", or "substantially", etc etc ad nauseam. Whilst at the same time feeding the house broker the actual figures, and then restricting access to the broker notes, to give an unfair advantage to some investors. That's the bad way to do things. Gattaca is showing the way to do things well.

A hat tip to Gattaca's advisers - Liberum, and Citigate Dewe Rogerson, who no doubt will have helped craft this excellent, model of clarity announcement.

Even though profit expectations have fallen 40% today, the share price is only down 16% at the time of writing (admittedly on low volume). That seems to show that, if the full facts are given, and quantified, then investors don't panic sell. Plus to a certain extent, the bad news was already in the price.

There's a lesson in that for all other companies & advisers who are still putting out opaque, overly complicated trading updates that all too often seem crafted to deceive, rather than inform. I would seriously urge companies to sack your PR advisers, if they are encouraging you to obscure bad news, in cleverly worded announcements. It doesn't work! Investors see through it, and punish the share price even more. Plus, all too often, such ill-advised PR nonsense actually repels investors, because they see the company as being dishonest and don't want to own the shares in future.

It's so refreshing from my point of view, having to plough through and unpick the real meaning of trading updates every weekday, for years now, to find one which is so simple, and so clear. Hence why I'm making such a big deal about this. All advisers need to print off Gattaca's announcement, and pin it to the wall, as a model for how to present trading updates to the market.

What's gone wrong? - a short & clear explanation is given, so a thumbs up here as well from me;

Gattaca experienced a challenging environment across the staffing market, driven by the economic and political climate in the UK for the first five months of FY20 (August to December 2019) which has resulted in net fee income 11% lower than the same period last year.

The market has not recovered as quickly as expected and short-term growth remains uncertain, despite the decisive result in December's General Election.

The timing of UK investment in major infrastructure projects is still not clear and certain manufacturing, automotive and rail sectors continue to be impacted by a lack of confidence. In addition, there is continued uncertainty surrounding IR35.

At least the company is still profitable. The lowered profit forecast of £6m (down from £10m) is still not bad for a company valued at only £29m market cap.

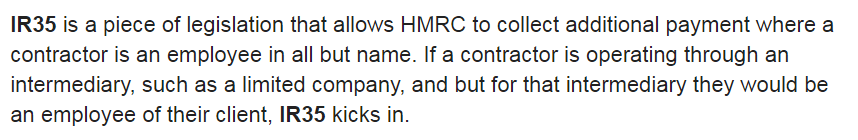

IR35 - I goggled this to see what it's about, and it rings a bell from reports on the TV news. This is what google says;

That sounds potentially bad for staffing agencies. I'm no expert on tax matters any more, because it's all become so complicated, and there have been so many changes since my CFO days in the 1990s. That was before the internet, where instead I had to rummage in my paper copy of Tolleys to find answers to tax issues. Does anyone else remember those loose leaf tax guides, where a bundle of update pages arrived by post each month, and had to be manually inserted into a special over-sized lever arch folder! If you mis-filed anything, it was lost forever, hence why I always did the filing myself, instead of delegating it!

I think the tax advantage of classifying someone as a contractor instead of an employee is that the employer avoids employers NICs of 13.8% - a substantial saving. Plus it makes hiring/firing simple, with no tribunal costs, etc. From the contractors point of view, the saving is on employees NICs, which can be avoided by setting the salary from their personal services company a whisker above the lower limit, then paying themselves mainly through dividends (which don't incur NIC). Put that together, and HMRC is losing a ton of money through NIC avoidance. It's amazing they haven't clamped down on it more vigorously before.

Tight labour market - we've also had something of a jobs miracle in the UK in recent years, with very high levels of employment, creating labour shortages in some sectors. This has made some companies more keen to employ directly, in order to retain good people, rather than use temporary staff through an agency. Staffline (LON:STAF) mentioned this point in one of their profit warnings.

My opinion - the sector headwinds look horrible, hence I'm feeling that it's probably best to steer clear altogether.

The forward PER last night, before the profit warning, was only 4.27 - this is usually not value, it's a warning sign that the market has correctly identified that the forecasts are too high, and the company is performing badly.

Note that Gattaca stopped paying dividends in 2018, after years of paying arguably over-generous divis.

Profitability here is dropping like a stone, which makes me wonder if historic levels of profit are ever likely to be recouped? Given the headwinds mentioned above, I suspect probably not.

Recruiters do have the advantage of being able to cut costs, e.g. reducing staff, and paying staff on variable commission linked to fees earned from clients, making it flexible.

Overall, I don't see any appeal to this share. It probably shouldn't be stock market listed, what's the point of a listing now that its heyday is gone, and possibly unlikely to return?

Quixant (LON:QXT)

Share price: 162p (down 21% at 10:36)

No. shares: 66.4m

Market cap: £107.6m

Trading update (profit warning)

Quixant (AIM: QXT), a leading provider of innovative, highly engineered technology products principally for the global gaming and broadcast industries, today provides an update on trading for the year ended 31 December 2019.

Profit warning - well done to the company & its advisers (Alma PR & finncap) for giving us specific revenue & (more importantly) profit figures;

The Board expects to report revenue for the year of $92.3m and adjusted profit before tax of $10.7m.

The majority of the shortfall against expected revenue has been experienced in the Gaming Division which has had a consequential impact on profit.

Unfortunately, they did not include a footnote in the RNS to give us the now defunct market expectations. I'm surprised at this, as another finncap client which reported yesterday, Sopheon (LON:SPE) , included a link to the finncap update note. The good news is that finncap has its own research portal, or everything is in one place on Research Tree, both of which I find incredibly helpful.

Revised figures - finncap reduces profit & EPS for 2019 by 11% - not a disaster, but coming at the end of the year, not great either. It's a 5% revenue miss, hence with operational gearing, the impact is greater on profit. EPS of 13.9p is a PER of 11.7

Rather more concerning, is that the 2020 forecast has come down a lot, by 32% to 15.4p (12/2020 forecast PER of 10.5). That looks cheap, but will the revised numbers be achieved in 2020?

Outlook comments are a mixed bag, but I like the comment about growth in 2021 at the end;

"The previously announced softness in demand from several of our gaming customers has continued for a longer period and been slightly more pronounced than previously anticipated.

This has impacted our financial performance in the Gaming Division over the second half of the year.

We are confident in delivering healthy growth in 2020, however, the recent softness has led to having a more conservative view on the level of growth and we are reviewing costs in line with this lower revenue expectation.

We have initial orders for significant new business which we believe will contribute to sustained growth into 2021.

There is also talk of lower margin products going end-of-life at Densitron, a previously independent listed company which Quixant acquired.

Balance sheet - it claims to have a strong balance sheet, so of course I had to check, as so often such claims are false. In this case I'm happy to confirm that the company is being truthful - it does have a good strong balance sheet,

Net cash is reported today as being $16.2m at 31 Dec 2019, up from $12.4m 6 months earlier. Note that it reports in US dollars.

My opinion - this share looks good value. However, given that it's struggling to maintain profitability, and lowering expectations for the second time in 6 months, then there's a question mark over performance.

Before buying this share, I'd want to understand in detail what makes it tick. It reminds me a bit of Zytronic (LON:ZYT) - which makes good margins on niche products. However, performance is dependent on long-running contracts, and hence customer orders can be lumpy. End of life products are also an issue for ZYT.

Overall, I think it might be worth a closer look, as the valuation is now looking attractive. So this is more of interest to value investors, than growth investors, I would say.

Empresaria (LON:EMR)

Share price: 54p (down 4%, at 11:56)

No. shares: 49.0m

Market cap: £26.5m

Empresaria (AIM: EMR), the global specialist staffing group, today provides a trading update for the financial year ended 31 December 2019 ahead of announcing its full year results on Wednesday 18 March 2020.

Another staffing group, with the distinction from Gattaca above, that Empresaria has a spread of international businesses - very odd for such a tiny market cap company. They seem to operate largely independently. This portfolio approach of operating businesses does however give some protection against regulatory or operational problems in any one country impacting the group too much. It also gives flexibility, Empresaria could potentially sell subsidiaries, if it needed to raise cash, to say reduce gearing in an economic downturn.

Today's update is in line;

The Board confirms that it expects the Group to deliver results in line with current market expectations for the financial year ended 31 December 2019...

Adjusted profit before tax is anticipated to be in line with market expectations at £9.3m (2018: £11.4m)...

Great, well done to Alma PR & Arden, for including the figure of what market expectations are. That saves time, and adds clarity, for people reading the RNS - many thanks!

The adjusted profit figure of £9.3m looks great considering the market cap is only £26.5m, but does exclude (unquantified) restructuring costs.

Given the sector headwinds mentioned before, and some interesting reader comments below, it's difficult to avoid the conclusion that profits here might continue falling.

My opinion - I don't want any exposure to this sector, so even though the share price looks amazingly cheap, I'll give it a miss for now.

Of the 2 recruiters mentioned today, Empresaria would be my preference, if forced to buy one of the two, due to its higher profits, lower earnings multiple, and geographic spread. Although I've never been particularly happy with EMR's balance sheet & debt position. Let's move on.

Shorter sections now, as I've covered the more interesting smaller companies reporting today. For the avoidance of doubt, I try to focus my time on profit warnings, and out-performance announcements. So the biggest price movers, usually. Then whatever is left can have shorter sections, due to time constraints.

Pendragon (LON:PDG)

Share price: 11.3p (down 2% today, at 14:41)

No. shares: 1,396.9m

Market cap: £157.8m

This is for the year ended 31 Dec 2019.

There's something wrong with this car dealers, but I can't remember what it is? Do any readers remember what it might be? Possibly a mis-selling, or some other investigation? Google to the rescue, yes it seems that there is an FCA investigation into Pendragon, and Lookers, about car finance selling. I try not to invest in anything where there is anything like that going on, as it creates unquantifiable risk.

Going through the announcement, I don't really have anything much to add from MrC's snapshot first thing, in the comments section (thanks again for these MrC, they're brilliant!).

Accordingly, the Group's underlying profit before tax for FY19 is expected to be around the bottom end of current expectations. However, the Board remains confident that the improvement in performance during the second-half puts the business on a much stronger footing as we enter 2020.

There's no footnote as to what market expectations are in the RNS. Checking on Stockopedia, it's forecast to be loss-making (post-tax) at -£10.0m for 2019. So a lousy performance, despite the chirpy narrative today about H2 having improved.

Pendragon seems to be taking self-help measures, such as closing 22 under-performing branches, cost control, and better managing inventories.

My opinion - there is a possible case for looking at car dealers as a contrarian value investment. They've been up against some unusual negative factors - e.g. confused Govt policy on diesel that resulted in a sharp fall in sales - buyers might hold off until policy is resolved. There's also electric cars to think about - in terms of pent-up demand, with lots of new models starting to hit the market.

Final point, is that I see consumer confidence being likely to improve strongly in 2020, due to the end of political chaos, and the 6.2% increase to minimum wage coming in April, which is likely to have a domino effect as higher paid employees seek to maintain differentials over low paid colleagues.

If Pendragon can return to previous levels of profits, then the shares now would look extremely cheap. I don't know how likely that is, and the FCA thing worries me, so I'll give it a wide berth for now.

I wonder about sector consolidation presenting opportunities maybe? I've been wondering about that for a while, and nothing has happened yet.

Renew Holdings (LON:RNWH)

Engineering services group - Q1 (Oct-Dec 2019) trading update is in line with expectations. Also;

- Order book up 14% year-on-year, at £651m

- Net debt & cash generation in line with Board's expectations

My view - I was impressed with the P&L performance when reviewing the last full year results here. That article also explained why I don't like the risk here, because it has a worryingly thin balance sheet. That may not matter when it's trading well, but means there's no financial cushion if anything were to go wrong - which it often does in this sector.

So far so good though, management seems to have done a great job in navigating through these risks.

SCS (LON:SCS)

Trading update - 26 weeks to 25 Jan 2020.

In line with expectations. Pleasing to see that LFL sales have returned to growth in the last 9 weeks (peak trading period), at +1.2%. That's tons better than -7.1% decline in LFL sales in first 17 weeks. Which makes me wonder why performance is only in line, and not above expectations? Maybe they had to drop prices (and hence profit margin) to drive sales?

Long-serving CEO has handed in his notice. Sounds amicable, so no particular worry there.

My view - I like this share, and it's on my possible purchases list. It's one of the few retailers that is weathering the storm reasonably well, and is reasonably-priced when you take into account a lovely strong balance sheet.

I imagine improving consumer confidence should enable it to improve performance in 2020. Quite good I think.

All done for today.

Best wishes, Paul,

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.