Good morning!

There is plenty of juicy news for us to digest today.

- Crusader Resources (LON:CAS)

- Spaceandpeople (LON:SAL)

- Aukett Swanke (LON:AUK)

- Cloudcall (LON:CALL)

- Begbies Traynor (LON:BEG)

- Yu (LON:YU.)

- Best Of The Best (LON:BOTB)

- Taptica International (LON:TAP)

Crusader Resources (LON:CAS) - this little gold exploration company is seeking to cancel its AIM admission. It was listed only in April 2018, and was suspended as soon as October.

Is this a record in terms of speed to failure? It's a shame that this kind of junk is still floating around.

Spaceandpeople (LON:SAL)

- Share price: 16p (unch.)

- No. of shares: 19.5 million

- Market cap: £3 million

Significant Property Opportunity

Spaceandpeople had a trading update only yesterday, but is back again with another update. It has commenced a tie-up with Hammerson (LON:HMSO) to provide retail experiences and (on an exclusive basis) its "Mobile Promotions Kiosks" at Hammerson properties.

No numbers are given - all we know is that it's a multi-year contract. The company has made plenty of announcements like this before. While it's hardly bad news, my assumption is that this announcement does not mean a dramatic change in the company's fortunes.

Aukett Swanke (LON:AUK)

- Share price: 0.95p (-27%)

- No. of shares: 165 million

- Market cap: £1.5million

Another stock that is deep in "why are you even listed?" territory.

You might equally be asking "why are you even writing about it?"

This is a stock where I lost a significant amount of money, having been attracted by a superficially cheap valuation several years ago. I learned several lessons from it, so I'm intrigued to see the eventual fate of the company.

It turns out that FY 2018 results from this architectural group are a disaster and yet they could have been even worse, if the company's management of its costs and its cash balance had not saved it.

- Revenue is down by another 22% to £14.4 million. It is down by over 30% in two years.

- The total loss is £2.5 million.

- Net cash was £157k at September 2018, but the company acknowledges that it used its overdraft throughout the year.

Outlook - expecting a better outcome and "a positive result" in 2019, but cautious.

My view

The numbers now look very frightening to me.

- Balance sheet equity reduces from £6.6 million to £4.2 million. Tangible equity reduces from £3.3 million to £1.2 million.

- Receivables turnover is only 2x, implying that it took Aukett about six months to get paid on average. This figure has deteriorated since last year. Massive receivables book of £6 million.

- As has been pointed out by a bear over on the LSE board, the company's cash balance for September 2018 adds up to 3 days' worth of last year's expenses.

The travesty is that everything was made worse by a poorly-timed expansion. Aukett spent a couple of million pounds (more than its current market cap) buying up practises in the UAE in 2015/2016.

Its Middle East segment has produced a £1.2 million loss in 2018, adding insult to injury. All of the cash that has been burned in the Middle East could have been returned to shareholders or used to shore up the core UK operations.

Also worth noting that the CFO handed in her resignation in September. There is no sign yet that a successor has been found.

While a turnaround is still possible, I'm glad I'm not betting on it. I took a painful loss but at a share price that was still multiples of the current level. Unless things change very soon, it looks like this company is going to run out of road, at least as far as existing equity holders are concerned.

If you want to know why I'm now allergic to professional services companies, particularly those with an acquisition-led growth strategy, this company is a good place to start!

Cloudcall (LON:CALL)

- Share price: 113.5p (+3.7%)

- No. of shares: 24 million

- Market cap: £27 million

Paul covered this recently, when he attended Cloudcall's Capital Markets Day.

Cloudcall is a software business that provides a solution to integrate telephone systems with a client's CRM (customer relationship management) software.

The company has never made a profit and is set to remain unprofitable until at least 2020, according to official forecasts. And the StockRank is a meagre 6, i.e. it is a Sucker Stock. It qualifies for two short-selling screens and has seen its share count rise again and again over the years, with another increase today.

There is nothing wrong with investing in early-stage and unprofitable companies, so long as you do enough due diligence to convince yourself that it can overcome the inherent statistical unlikelihood of success (like Paul has, in this case).

This isn't the type of thing I'd invest in, because I have no idea if the Cloudcall solution is better than the alternatives. For example, if I type "integrate telephony CRM" into Google, there are a lot of products which claim to do this.

Bullhorn, which is Cloudcall's key CRM partner, also partners with and promotes three other telephony integrations. Why would we want to invest in Cloudcall, rather than one of the other integrations? That's the sort of question I'd be asking, if I was researching this in further detail.

Begbies Traynor (LON:BEG)

- Share price: 58.6p (+0.7%)

- No. of shares: 110 million

- Market cap: £65 million

Latest Red Flag Alert Report for Q4 2018

This insolvency practitioner updates with the latest insolvency statistics:

- The number of businesses in "significant" financial distress increases 3% quarter-on-quarter to 481,000

- "Real estate and Property" is the hardest hit sector, up 7% quarter-on-quarter.

- Retail gets away lightly, only up 2% quarter-on-quarter.

- Begbies describes Q4 as a "winter of discontent".

Interesting theory on the retail sector:

While the number of retailers in significant distress only increased slowly year on year since Q4 2017, we expect that this is due to heavy discounting giving retailers more cash and delaying their entry into danger. The industry should be braced for a tough start to 2019.

They specifically mention Next (LON:NXT) (in which I have a long position) as an example of a retailer with quality product and a good online and offline offering, meaning that it can thrive even though overall conditions are difficult.

Doesn't it feel like the great rebalancing of the economy has yet to occur? I suspect there is still scope for a windfall of business to come in the direction of Begbies in the next few years. Its revenues are still significantly below the peak of 2009-2011.

Yu (LON:YU.)

- Share price: 155p (+130%)

- No. of shares: 16 million

- Market cap: £25 million

Trading Update and Change of Auditor

Hot on the heels of yesterday's update from Utilitywise (LON:UTW) is an update from Yu Group.

- guidance for the adjusted pre-tax loss in 2018 is unchanged at £7.35 - £7.85 million, on revenues of £80 million

- contracted revenue of £85 million for 2019

- net cash £14.6 million

- new auditors hired after the scandal which revealed its accounts to be misleading

CEO comment

Whilst we are being more selective and prudent in relation to our growth, we are securing new business at a reasonable margin. With a strong balance sheet and a focussed and dedicated workforce, I remain confident in the underlying business....

My view

I would treat this with a lot of caution. SME energy supply is a problematic sector and we still don't have a very good picture of what happened in terms of the misstatement of this company's accounts. We do know that it was unprofitable in 2018, to an extent that completely wipes out the small profit it made in 2017.

Even if it does manage to get back on track, it going to grow at a much slower pace than was previously forecast.

There is a case to be made that this was already in the price when it was trading at a discount to net cash - that is an understandable point of view. But it is now trading at a significant premium to cash.

Checking the bulletin boards and social media, I see that the stock has caught the attention of what seems to be hundreds of people. The combination of an optimistic update and a very limited free float (less than 50% of shares) has helped to more than double the share price today.

Nice quick gains if you can get it! But I would not be hanging around for the after-party.

Best Of The Best (LON:BOTB)

- Share price: 305p (+39%)

- No. of shares: 10 million

- Market cap: £31 million

A nice clear company description at the top of this report:

Best of the Best plc runs competitions online to win cars and other prizes.

There is one remaining physical location - at Birmingham airport.

Indeed, I made a point of allowing myself to be approached by one of the salesmen at this site when I was there after Mello Derby last year.

The car looked great but the salesman's lines were rather uninspiring and canned. I guess they were pretty much what you would expect when someone is standing there all day trying to get strangers to buy raffle tickets. I wouldn't want his job!

The company is still focused on cars through its online channels and you can see the list of stunning cars up for grabs on its website.

Great H1 results:

- revenues +28.5% to £7.1 million

- adjusted PBT +14.7% to £1.1 million

The company appears to have cracked the online marketing problem - no easy task. Congratulations are due.

There was also exceptional income of £2.5 million (£4.5 million in, £2 milllion out) arising from tax issues. Great news.

Staying on the issue of tax, the company's margins will be under some pressure as remote gaming duty (RGD) will increase from 15% to 21% on its "Spot the Ball" competition:

This will directly impact our operating margins going forward and represents a significantly increased tax burden, when combined with material sums of irrecoverable VAT on our cost base that we are also now absorbing.

Outlook - confident. Will try to mitigate the RGD problem.

Tender offer - a weird tender offer is announced at 485p. Why not buy back shares at the current share price? This is the official explanation:

In determining the level of return of value, the Board has taken into consideration its aim of improving the Company's earnings per share, as well as targeting a more efficient capital structure through returning excess balance sheet cash to Shareholders.

A tender offer at the current share price would boost EPS even more (since it would reduce the share count more) while returning the same amount of cash to shareholders. So this explanation doesn't tell me why they choose to execute the offer at 485p.

I'm worried it might have something to do with the possibility that some shareholders might fail to send their instructions in time. To the extent that anyone fails to send their instructions, those who do send their instructions will be able to sell more shares at the ridiculous price of 485p. This will mean a wealth transfer from those who don't send their instructions, to those who do.

I'd like to think that the explanation is more benign than this, and of course I presume that it is, but I can't think of anything else right now. Nothing can surprise me on AIM after the recent shenanigans at Thalassa Holdings (LON:THAL).

BOTB's free float is very small (only 17% according to Stocko) and the shares are horribly illiquid. Taking more stock out of the market is only going to make this worse. So I would tread carefully, even if the underlying business is performing very well.

Taptica International (LON:TAP)

- Share price: 192.5p (+15%)

- No. of shares: 68.5 million

- Market cap: £132 million

We get clarity today on the deal which caused Taptica to suspend its share buyback: it is thinking about joining forces with RhythmOne (LON:RTHM).

RhythmOne is another AIM stock that has had more than its fair share of controversy over the years. It's a US-based video/online advertising company and was previously known as Blinkx, back when a Harvard professor made serious allegations against it.

RhythmOne has been talking about doing a share buyback of its own for years, but hasn't got around to doing one yet. Not doing buybacks is something that Taptica and RhythmOne have in common!

At its most recent H1 results, RhythmOne said that its Board had at last approved a $10 million buyback, but they've since been distracted by the Taptica talks.

From a Taptica point of view, it is telling its shareholders that their company has a similar value to RhythmOne: after the merger, they would be left with 50.1% of the combined entity.

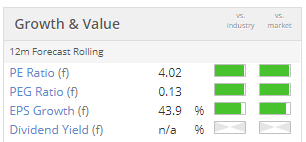

Despite producing annual losses since 2015, RhythmOne is officially forecast to generate $42.5 million of pre-tax income in 2019, and so is allegedly trading at a P/E ratio of 4x.

It's a unique situation: two companies trading at a P/E ratio of 4x are trying to merge, when they could be buying back their own shares right now instead. Or they could be buying each other's shares. Either way, they could be using their cash to exploit the extreme undervalution, but they prefer not to, for now.

Ever since the controversy back in 2014/2015, I have viewed RhythmOne catiously. A potential merger with Taptica, where I am also very cautious, and in these circumstances when both of their shares prices are at silly levels, makes me doubly cautious. I could be wrong, but the bad smell surrounding Taptica appears to be getting worse. Good luck to anyone who is involved - I fear that you might need it.

Staffline (LON:STAF)

- Share price: 670p (-33%, suspended)

- No. of shares: 28 million

- Market cap: £187 million

Delay to publication of results

Suspension - Staffline Group plc

This recruitment group announced first thing that the publication of its results would be delayed, offering no reason why and prompting a huge slide in the share price as shareholders wondered what on earth was going on.

Then at 3:50pm, the shares were suspended, "pending an announcement".

There is hardly any point in ringing the Nomad at this point. Hopefully we get some information tomorrow morning.

A shame that there weren't many good companies reporting today, but it can't be helped.

If today's report demonstrates anything, I guess it's the extreme danger that is so often associated with small-cap investing.

Paul will be with you tomorrow.

Safe travels,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.