Good morning!

Incredible drama in the footy last night - well done England.

In terms of the markets today, it’s holiday season in the US so watch out if you are trading any US instruments.

Stocks of primary interest today are:

- Distil (LON:DIS) - trading update

- Topps Tiles (LON:TPT) - trading update

- Churchill China (LON:CHH) - trading update

- Staffline (LON:STAF) - trading update

- Nektan (LON:NKTN) - trading update

Distil (LON:DIS)

- Share price: 2.2p (+2%)

- No. of shares: 502 million

- Market cap: £11 million

(Please note that I currently own shares in Distil.)

I've been making some trades for my personal portfolio this morning.

As a consequence, I now own a starter position in Distil, having been encouraged by its trading update today.

Distil is a stock I've been covering regularly in this report since last year - see the archives. I've generally said nice things about it and thought the valuation wasn't too bad. So on the back of today's update, I thought I would finally put my money where my mouth is.

The company owns some premium spirits brands, of which the most important is RedLeg Spiced Rum. This is stocked by Tesco and is available through a variety of other channels (£20.50 for 700 ml).

Today's trading update is in line with expectations.

Q1 revenues (April to June) are up by 27%, and volumes up by 21%.

Since Easter fell in April last year, and in March this year, the company provides us with additional info:

To remove this phasing imbalance, we are also providing the unaudited six-month performance figures to 30 June 2018; year on year revenues increased 28% and volumes increased 27% over this six-month period.

On this six-month basis, the volume increase approximately matches the revenue increase. I think the six-month basis is the more meaningful approach.

The Executive Chairman remarks that "the gin and rum markets remain buoyant". As I've noted before, this segment of the alcohol industry appears to be far more vibrant these days versus beer/lager.

My rationale

As a value-oriented investor, I don't usually pay up in advance for growth. I usually steer away from early-stage companies.

I don't consider Distil to be extraordinarily risky or the shares to be extraordinarily expensive.

It achieved breakeven in FY 2017, and broke into a small profit in FY 2018.

Operating profit in FY 2018 amounted to £157k, which was after spending £465k on advertising and promotions.

So one way of looking at it is that that the company made £622k, before advertising and promotions.

Of course, it would not have made so much operating profit, if it had not spent so much on advertising. So I admit that this is an optimistic way of looking at the figures.

But let's suppose that revenue growth for FY 2019 proves to be 28%, in line with today's update, and margins stay constant at 58%.

The company would then have £1.5 million of gross profits.

Non-advertising expenses stayed flat in FY 2018, as compared with FY 2017. I will (optimistically) assume that they stay constant again in FY 2019. It's possible that spend will increase on product development and other things.

If non-advertising expenses do stay constant, that would leave Distil with £950k in operating profit for FY 2019, before advertising-related expenses.

If it ploughed all of that back into advertising, perhaps we could get another large growth in revenue in FY 2020, leading to a virtuous cycle of ever-increasing brand recognition?

Balance sheet: It finished FY 2018 with £1 million in cash and no borrowings. So I don't expect that it will raise additional funds, unless investors want to help it accelerate advertising spend. For now, it looks like it can fund its own modest advertising campaigns, using gross profits.

Valuation: On an ex-cash basis, using the March 2018 cash balance, the company is currently valued at £10 million which is about 10.5x the pre-tax profits I think Distil could make this year, excluding advertising spend, if it keeps up the 28% growth rate.

As you can see, there are quite a few assumptions involved, that will probably turn out to be false. But that 10.5x multiple looks like a reasonable entry point to me.

Revenue growth last year was 23%. So you could argue that 28% is a blip, or that the company's progress is accelerating. Brokers are forecasting 24% growth.

This is riskier than my normal style, that's for sure. There is a fair chance that the brands will ultimately fail to gain traction. If they do succeed, I would expect investors to be richly rewarded.

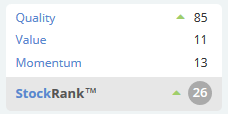

The warnings from the Stocko algorithms are clear: it is considered highly speculative and has a below-average StockRank. I take some comfort from the fact that Quality and the overall Rank are moving in the right direction:

PS: Another piece of evidence used in my decision-making was that RedLeg enjoys generally favourable online reviews. See examples here and here and here.

Topps Tiles (LON:TPT)

- Share price: 62.25p (-1%)

- No. of shares: 196 million

- Market cap: £122 million

Topps Tiles Plc (the "Group"), the UK's largest tile specialist, announces a trading update for the 13 week period ending 1 July 2018.

Like-for-like revenues are down 2.3%, "reflective of a weaker consumer environment". TPT thinks it is outperforming the overall tile market.

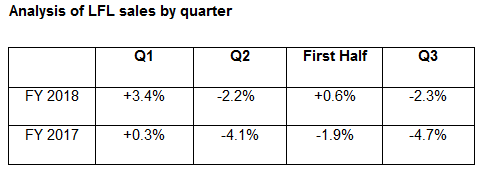

Like-for-like sales were actually worse last year:

Things can get a bit messy when we start talking about the second derivative of sales, but maybe there is a glimmer of hope in that the FY 2018 like-for-likes are all better than their FY 2017 equivalents?

The company is busy launching new ranges, investing in its stores and and expanding its sales efforts to commercial clients.

Shares are nice and cheap, as you would expect:

See Paul's commentary in May, for further insights.

I am inclined to think that retailers such as this are fairly priced. If you can see the consumer environment recovering and are willing to take a chance on that, then they are worth investigating further.

Churchill China (LON:CHH)

- Share price: 1085p (+11%)

- No. of shares: 11 million

- Market cap: £119 million

This is a quality share I should probably have bought by now, but have never quite managed to find a space for it in my portfolio.

It makes tabletop products and distributes them around the world (not just to China!)

The stock qualifies for no less than three of Stockopedia's quantitative screens:

- Piotroski F-Score (Quality Investing)

- Dividend Achievers (Income Investing)

- T Rowe Price Screen (Growth Investing)

Today's update is short and sweet, upgrading expectations for the full year:

We have continued to make good progress against our strategic objectives. In the first six months of the year we have achieved better than expected levels of growth in Europe, reflecting our investment in market and product development. We now anticipate trading performance will be ahead of our earlier expectations for the full year.

I can see a PBT forecast for FY 2018 of £8.2 million, representing a 9% increase on FY 2017.

I guess this is now headed for at least a 12% increase or thereabouts?

Churchill retains heavy ownership and involvement by a group of family members. And like many family businesses, it enjoys fantastic stewardship. Senior management have shown strong loyalty to the business.

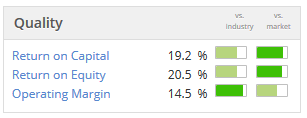

There is basically nothing that I dislike about this company. See the quality metrics:

It trades at an above-average valuation, as you would expect, with a forecast P/E ratio in the region of 16x. That seems to me a very fair price to pay.

Staffline (LON:STAF)

- Share price: 978.5p (+5%)

- No. of shares: 28 million

- Market cap: £273 million

Interim Pre-Close Trading Update

Staffline (AIM: STAF), the Recruitment and Training organisation, is pleased to provide the following update on trading for the six months ended 30 June 2018.

Trading is in line with expectations.

Statements of confidence and of success in relation to Staffline's acquisitions appear to have boosted the share price today.

This remains attractively cheap, along with many other shares in the recruitment industry.

When it comes to executive recruitment, they are all basically doing the same thing, with differences only in the industries they serve.

Staffline is different, as it sources large numbers of skilled, blue-collar workers, rather than small numbers of executives. According to its website, it provides up to 52,000 workers per day to 1,500 clients across the UK and Ireland.

This arguably puts it in a safer position as compared with the executive recruiters, due to its sheer scale. It is the biggest recruiter in the UK.

It also has a great track record of growth and has generally treated shareholders well (paying a strongly rising dividend stream and making helpful presentations and disclosures).

Worth looking into.

Nektan (LON:NKTN)

- Share price: 24p (+20%)

- No. of shares: 47.4 million

- Market cap: £11 million

Nektan plc (AIM: NKTN), an international B2B and white label gaming software and services provider, announces its trading and business update for the three months and year ended 30 June 2018 (Q4 FY18 and FY18).

This has only been covered once before in the SCVR. That was by Paul, in December 2016.

He described it as "basically insolvent", with the share price at 28.5p.

Fast forward 18 months and although the share price hasn't fallen very much, compared to then, the share count has almost doubled. That's a lot of dilution for shareholders to swallow.

The rising share count is thanks to a combination of normal equity fundraising plus the conversion of Loan Notes to equity.

What it does

Nektan is "one of the managed casino solution providers of choice in the UK", operating a large network of casino brands. Its proposition to brand owners is as follows:

Nektan manages the entire gaming operation on behalf of its partners, allowing Operators to focus solely on marketing the product to players.

The company reports the entire net gaming revenue from casino operations on its income statements.

It then deducts "marketing, partner and affiliate costs", i.e. the revenue share attributable to its partners, the commissions due to affiliates, etc.

Today's results show a 48% increase in net gaming revenues for FY 2018, following a 37% increase in Q4 (versus Q4 in FY 2017). I understand this to be organic growth.

It looks set to expand internationally:

The Company is now operating with a total of 113 brands from 55 partners. The Group has a strong pipeline of new brands from both existing and new partners to be launched during the current quarter with growth expected from the UK as well as internationally, the latter being an important part of Nektan's strategy going forward.

Nektan also has B2B and "on-premise gaming" divisions. These look small but may have some potential - I don't know.

The interim CEO is very bullish, describing Nektan as a "global technology company", that will build on its momentum in the year ahead.

It has a habit of releasing its results as late as possible, which is a shame. The quarterly updates are helpful, but then investors have to wait until December to get the results for the year ending June. Perhaps the process could be sped up this year?

The numbers

There are no forecasts available for this company. Things have mostly not worked out for it, or for its investors, since its 2014 IPO at 236p.

Interim results to December 2017 showed an operating loss of £3.2 million.

At the time, the company had £9.7 million of convertible loan notes and accrued interest outstanding, plus a couple of million of shareholder loans.

Net assets were negative £10 million, or negative £16 million if you discount the value of intangible assets. Cash was just £700k.

I'm intrigued as to whether the underlying business might have bright prospects. The growth rate in managed gaming solutions is superb.

The problem is that the balance sheet is simply too thin. I'll keep my eye on developments here, but it doesn't look particularly investable with its current financial structure. It needs more equity and less debt.

All done - thank you for dropping by!

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.