Good morning from Roland and Graham!

Today's report is now finished (10.30am). See you tomorrow!

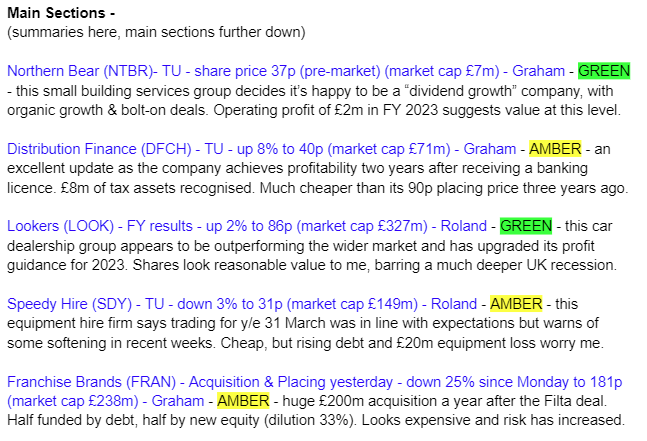

Other companies reporting today -

- Hilton Foods (HFG) - FY results/CEO £622m

- Airea (AIEA) - FY results £15m

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Graham's Section

Northern Bear (LON:NTBR)

- Share price: 37p (pre-market)

- Market cap: £7m

I covered this building services group in some detail at its full-year results last year. Unfortunately the share price has gone backwards since then, and it’s now below our £10m cut-off. So I’ll try to keep these comments brief.

I do still want to cover this one though, because it has shown signs in the past of being a better-than-average micro-cap. However, in recent years it has written down the goodwill associated with some acquisitions, and this has impacted its official results:

Since 2020, Northern Bear’s Chairman has been the Canadian investor Jeff Baryshnik, who has a 25% stake in the company.

When the company declined to pay a dividend last year, and said that it was studying larger acquisitions than it had made before, I assumed that Mr. Baryshnik had aggressive plans for the business. But today’s update strikes a different tone:

After a review of strategy and dividend policy, the Board is pleased to report that the Group will pursue a dividend growth strategy supported by the organic progress of the Group's businesses and, to the extent accretive, bolt-on acquisitions.

There will be a 4p ordinary dividend plus a special dividend of 1p for FY March 2023. Not bad on a 37p share price! (last night’s close).

Trading update:

…the Group has traded ahead of the prior year's results except for a provision at our Northern Bear Building Services Limited subsidiary, anticipated to be in the range of £500-£750k, to account for certain unprofitable contracts. The Board expects that operating profit for FY23, stated before amortisation, one-off costs, and other adjustments (in the format used in prior years' results, "adjusted operating profit") should exceed £2.75 million (or £2.0-£2.25 million of reported operating profit net of the provision)...

So we again have c. £2m of operating profit, or £2.75m if you’re willing to look past a few mishaps.

The company guides for a net cash position at year-end, but reminds us that this position changes dramatically throughout the year.

My view

I’ve noted many times before that this sector tends to be accident-prone, and the “certain unprofitable contracts” mentioned above are another reminder of this. It’s a low-margin, labour-intensive and highly competitive industry.

But having said all that, I still think these shares are interesting. I’m actually relieved that they are going for organic growth with bolt-on acquisitions, and dividend payments, rather than more aggressive plans. At a £7m market cap, I think investors should be more than happy with £2m of operating profit - no need to take extra risks to earn more than that!

Distribution Finance Capital Holdings (LON:DFCH)

- Share price: 40p (+8%)

- Market cap: £71m

It has been three years since we last mentioned this one, and it has achieved bank status since then.

It helps a variety of sectors by funding the purchase of goods from manufacturers to dealers, e.g. trucks, trailers and caravans.

Today’s update sounds excellent:

…the Board is pleased to confirm that it expects to announce full year results for the year ended 31 December 2022 that materially exceed management expectations, predominantly due to increased net interest income and effective cost management. The Group now expects to report a maiden full year profit before tax of not less than £1m.

As an added bonus, the company has losses that it can offset against future profits, so it will be able to recognise an £8m tax asset in its accounts.

Other nuggets included in this update:

Loan book up 15% since year-end to £505m

100 new dealers were added. It now has 1,079 active dealers.

My view

The 40p share price has piqued my interest - this initially listed at 90p when it demerged from Trufin (LON:TRU) .

I’ve just quickly checked the interim report. Tangible net assets as of June 2022 were c. £85m in a highly geared balance sheet (total assets over £400m).

I’ll stay neutral for now, but this one could be worth studying in further detail as a new, already- profitable bank in a niche sector. Let’s hope that it doesn’t turn into another PCF!

Unlike PCF, this one does not have a majority shareholder who is based offshore. My initial impressions are that governance is better here - the Board and management can be reviewed here.

Franchise Brands (LON:FRAN)

- Share price: 181p (down 25% since Monday)

- Market cap: £238m

This share has seen a big reaction to an announcement on Monday night regarding a proposed acquisition, and the placing associated with it. The share price is now around the placing price, which is to be expected.

The target is “Hydraulic Authority I Limited, the owner of Pirtek Europe, an established European provider of on-site hydraulic hose replacement and associated services”.

And the price is enormous: £200m for the business plus an additional £12m for various adjustments.

For context, the acquisition of commercial kitchen services company Filta last year seemed like a big deal at the time (and it was!). That deal was valued at £50m.

In July 2022, FRAN said:

"In the near term, we are focussed on integration to capitalise on the opportunities the (Filta) acquisition presents.”

I can’t have been the only one who thought that FRAN was going to take some time to digest Filta and focus on organic growth for a while!

The new Pirtek deal is financed by:

Bank debt of £110m

A minimum of £110m in new equity, of which £90m to be raised via a placing at 180p.

As announced yesterday, the company managed to raise nearly £92m in the placing (gross), so the total new equity is £114m.

New shares represent 33% of the enlarged share capital. That’s very serious dilution for anyone who didn’t take part in the fundraising, but let’s think about the rationale.

Pirtek is a van-based business providing essential services - exactly the type of thing that FRAN wants to own.

It had system sales of £164m and adjusted EBITDA of £15m in 2022 (both figures unaudited).

It operates in eight countries, including the UK, “with the right to operate in an additional eight European countries”.

The logic behind the deal is as follows:

The Acquisition is highly complementary to the Group's existing businesses and, by expanding its operations to ten countries, will significantly advance the Board's aim to create a market leading international B2B multi-brand franchisor in the UK, Europe and North America.

The Board believes that the size and diversification of the Enlarged Group will provide greater resilience in the services provided, customer base, end markets and franchise networks and geographically.

Pirtek Europe's established overhead will provide a low-cost platform from which to launch the Group's current brands into new markets where Pirtek operates currently.

Etc., etc.

Forecast revenues for the enlarged group are £155m in 2023 and £168m in 2024 (pro forma basis).

My view

I’m going to have to take a neutral view on this stock this morning, with some very mixed feelings.

On the one hand I’ve always said that I like the franchising business model.

But with this stock, we now have a leveraged balance sheet thanks to the Pirtek deal. And I can’t say that it sounds like very good value. They are paying £200m+ for a company that earned an unaudited adjusted EBITDA of £15m last year: the bottom line is likely to be much, much smaller than that figure.

Of course the deal is predicated on synergies between Pirtek and the existing businesses. However, if the management of Franchise Brands are happy to issue 63 million shares at 180p (there were only 130 million shares outstanding as of last week), then it would be a reach for me to think that the shares were worth much more than 180p at the company’s current stage of development.

I thought that FRAN would take more time to digest Filta, generate some healthy profits, and then recycle its cash flow into its next deal. Instead, they are shooting for the moon: it might work out, but risk levels have definitely gone up a notch.

Roland's Section

Lookers (LON:LOOK)

Share price: 85p (pre-open)

Market cap: £327m

Strong growth momentum leading to higher profit expectations for 2023

Car dealership group Lookers has issued a solid set of numbers for 2022 and upgraded its guidance for 2023 profits. Earnings were previously expected to fall sharply this year as supply shortages eased.

It now seems that this reduction will be smaller than previously expected, continuing a trend that’s seen several upgraded to 2022 forecasts since last summer:

Lookers has had some problems in recent years, but appears to be performing well now and may not be unreasonably valued. Let’s take a look at today’s results.

Financial highlights

Earnings peaked in 2021, when new car shortages were at their worst. Lookers’ 2022 results reflect this, with a reduction in profit margins compared to the prior year:

Revenue: up 6% to £4,300.9m

Underlying pre-tax profit: down 8% to £82.7m

Statutory pre-tax profit: down 6.2% to £84.4m

Underlying earnings earnings per share: down 9.3% to 18.2p

Dividend: up 20% to 3.0p per share

Net cash: up £63.5m to £66.5m

Operating margin: 2.5% (2021: 2.8%)

Return on capital employed: 16.4%

I can’t really see anything to be worried about here.

The dividend gives a useful 4% yield and while retailing cars is a low-margin business, Lookers appears to be generating attractive returns on its assets, with ROCE of 16%. That’s at the upper end of the range of comparable listed rivals.

Free cash flow: Cash generation for the year was strong, with free cash flow of c.£55m. However, most of this seems to have come from favourable working capital movements and disposals, so I suspect cash generation might be slightly weaker this year.

Adjustments: Looking through the accounting notes, the adjusting items in this year’s results mainly relate to the proceeds of property sales and the costs of site closures. So I think it’s probably useful to adjust these out in assessing the performance of the core trading business.

Pension deficit: It’s also worth noting that Lookers has a pension deficit that required a £14.2m contribution last year. This year’s payment will be £13.6m.These are material amounts for a business of this size, but the scheme is undergoing its triennial review at the moment. So it’s likely that payments will change from 2024 onwards.

Operational/market commentary

New vehicles: The order book for the year ahead is said to be robust. At the end of Q1, Lookers had 18,000 vehicles on order for retail customers and 24,000 vehicles for fleets.

Lookers says that it outperformed the market last year with a reduction in new car volumes of 1.1%, versus a UK market total of 2.0%.

New car supply levels are now said to be returning to more normal levels, after heavy disruption. The UK market is expected to see 2.1m new car and van registrations this year, compared to 1.9m in 2022.

Used vehicles: used vehicle volumes fell by 4.9% last year, but again the firm outperformed the wider market, where volumes fell by 8.5%.

Strong margins are expected to continue into 2023, as supply of used vehicles remains limited.

Aftersales: Lookers is continuing to focus on customer retention to drive profits in this higher-margin business.

I think it’s only a slight exaggeration to say that the main purpose of selling cars seems to be to secure the aftersales revenue they generate! The profit breakdown below shows that aftersales generates more gross profit than either new or used car retailing for Lookers.

Outlook

Management says that underlying pre-tax profit during the first quarter was ahead of the same period in 2022. However, they warn of continued inflationary pressures and risks to consumer confidence.

Profit for the full year should now be higher than expected, but frustratingly management doesn't provide any specific guidance on how this updated guidance compares to current consensus estimates.

My view

It was always obvious that car dealers’ profits would have to ease back from the record levels seen in 2021. However, Lookers (and most rivals) seem to be handling the cyclical shift successfully, so far at least.

Lookers also seems to have fixed the management and governance issues it suffered before the pandemic. There’s a notable emphasis on risk management and other governance areas in the results.

The shares don’t look expensive to me on seven times forecast earnings and the share price is also supported by a property portfolio that’s said to be worth £290m (versus a market cap of £327m).

On balance, I think Lookers is executing well and in good financial health. The short-term risks facing the business mostly seem to relate to macro factors outside management’s control.

Investors who are reasonably optimistic about the outlook for the UK economy might find an opportunity here. I’m cautiously positive, although I’d probably lack the conviction to buy.

Speedy Hire (LON:SDY)

Share price: 32p (-3% at 09.40)

Market cap: £149m

… we enter FY2024 with confidence.

Equipment hire group Speedy Hire embarrassed itself in February when the company admitted it had lost around £20m of equipment – nearly 10% of the total book value of its hire equipment assets.

Today’s year-end trading update covers the 12 months to 31 March. Fortunately, it does not reveal any further cringe moments for the company.

With the shares trading at possible bargain levels and offering a forecast yield of 7%, is this business worth considering as a contrarian buy?

22/23 trading update: lost equipment aside, Speedy Hire seems to have traded reasonably well last year.

Revenue for the full year is expected to be 14% higher, which is slightly ahead of consensus forecasts for 12% shown in Stockopedia. Customer rate increases were successfully applied to offset the impact of inflation.

Adjusted pre-tax profit for the year is expected to be in line with the Board’s expectations.

Unfortunately the company doesn’t confirm what these are, but we can probably assume they’ll be reflected by current consensus forecasts. That would price Speedy Hire stock on just six times forecast earnings:

Net debt: Speedy Hire expects to report net debt of less than £94m at the end of the year, excluding lease liabilities.

Equipment hire businesses tend to carry a reasonable amount of debt to fund their hire fleets. I estimate this figure is around half the value of Speedy Hire’s hire fleet, after the expected write-off relating to the missing items.

As a rule of thumb, I tend to look for debt to be no more than 50% of the value of hire equipment. So this falls within my risk tolerance, just.

However, Speedy Hire’s net debt has risen from just £67.5m over the last year – an increase of £26.5m. This increase appears to be directly linked to the £30m share buyback completed over the last year. I consider this a poor use of capital, given the uncertain macro outlook.

Current year trading: the company says there has been “some softening of demand in recent weeks”, but that its pipeline of new business remains strong.

On balance, management expects to report revenue growth this year.

Cost-cutting initiatives are underway, including depot consolidations. These measures are expected to cost £6.6m and generate benefits “in the region of £5m per annum”.

An update on the missing equipment will be provided with the full-year results in June. Reassuringly, a further asset count at the end of March “did not identify the need for an increase in existing provisions”.

My view

Speedy Hire has a mixed track record as a listing company, but the shares do seem reasonably valued at current levels.

After a series of broker downgrades last year, forecasts have recently turned up, but profit growth this year is expected to be minimal:

However, I’m slightly concerned by the increase in debt last year, especially as it’s resulted from buybacks, rather than investment in the business.

I’m also concerned about the wider management controls and culture within the group, given the asset loss reported in February.

I think Speedy Hire shares might offer value at current levels. But it’s too speculative and low quality for me.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.