Good morning!

I probably won't have time for reader requests today. The reason being that the dentist needs to reverse years of neglect of my teeth, with some repairs. It's nothing serious, but more a time issue, in that I'll be out all afternoon.

To get you started, here's a link to yesterday's report. I wrote loads more sections in the afternoon, so it now covers 13 companies in total.

Upbeat comments & results are out today from the UK's largest housebuilder, Barratt Developments (LON:BDEV) . It's outside the remit of this small caps report, but given the importance of housing to our overall economy, I always like to quickly read the commentary & glance at the numbers for major housebuilders. Barratt's CEO sounds positive about the outlook;

The Group starts the new financial year in a good position with a strong balance sheet, healthy forward sales and robust consumer demand supported by a positive mortgage environment."

So, cheap mortgages and Help To Buy are keeping the new house market healthy, it seems. For how long though? Nobody knows. It's strikes me as a crazy market, where cheap debt is fuelling Barratt's 17.7% operating profit margin.

Housebuilder shares seem to have come down quite a bit this year, and offer amazing (but probably unsustainable, longer term) dividend yields.

Somero Enterprises Inc (LON:SOM)

Share price: 391.5p (up 1.7% today, at 08:32)

No. shares: 56.3m

Market cap: £220.4m

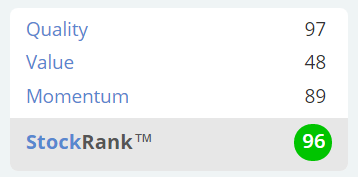

This US-headquartered company is the world leader in laser-guided concrete screeding machines. It's long been a favourite stock of ours here at Stockopedia - both with the SCVR, and also a consistently high StockRank (see below). My view is that, if human small cap specialists like it, and the Stockopedia algorithms do as well, then we've probably got a decent chance of getting it right! So far we have been right, although nobody knows what the future holds.

Interview with management - your questions please!

I have arranged to interview management on the telephone this Friday, and will publish the audio recording on my website. As usual, I am crowd-sourcing the questions from you, dear readers!

So please let me have any questions that you would like me to ask. Just leave them in the comments section to today's report. Keep them brief, and to the point please! (NB. I do not usually charge a fee for my interviews, as I like to keep them independent. I do not currently hold shares in Somero).

Interim results - These are good numbers, and I like the presentation too. In particular, starting off the announcement with this clear statement below is incredibly helpful during the time-pressured 7-8am slot, when we have to read & digest announcements from lots of companies;

Somero Enterprises, Inc. is pleased to report its interim results for the six months ended June 30, 2018, which are in line with management expectations.

Making it clear at the beginning of the announcement, that the company has traded in line with expectations, makes life so much easier. It means that I can ignore the figures, and just need to have a quick look at the outlook comments, then can safely park it to one side to look at later, once the 7-8am rush is over. Very helpful - I wish all companies would report in this way.

Key points (remember these are just for H1);

- Revenues up 6% to $45m

- Diluted adjusted EPS in H1 is up 20% to 18 US cents = 14.1p

- Full year forecast from house broker is confirmed unchanged today (note is on Research Tree) at 37.7 US cents = 29.4p = PER of 13.3

- Net cash of $20.7m

- Interim dividend doubled to 5.5 US cents (note that UK investors may be asked to fill in a simple form for tax purposes) - this is a one-off re-balancing, to pay a greater proportion in the interim divi vs final divi. The forecast yield is just under 5%

- Upbeat commentary, in particular on new product development

- Outlook - healthy markets, and confirms full year market expectations

- China - market penetration minimal to date. Has recently appointed a Sales Director for China

- Balance sheet - excellent, with a current ratio of 4.66 - very strong indeed, no worries here at all

- Cashflow statement is lovely - profits reliably turn into cash, and there's little capex. Pretty much ideal really

My opinion - this is one of my favourite companies, and management teams. It was a pleasure to interview them in Jan 2016, here (audio & transcript). The share price has tripled since then.

So I'm really looking forward to interviewing them again this Friday.

The valuation is far from demanding - a PER of only 13, for a cash-rich company, paying a 5% dividend yield, and reporting a good outlook, looks great value to me. The only reason I don't currently hold this share personally, is because I've concentrated my portfolio into Sosandar (LON:SOS) which seemed to me to have bigger (albeit riskier) upside potential.

Somero certainly looks a great value/GARP share. Although we do have to consider the cyclicality. Sales and profits tend to be very cyclical. Its biggest market (the USA) is doing well, after the stimulus from Trump's tax cuts. That should benefit Somero in a lower tax charge, although I note that H1 2018 sees a 22.4% tax charge, up from 20.2% last H1.

Overall then, all looks pretty good to me.

QUIZ (LON:QUIZ)

Share price: 165.5p (down 1.2% today, at 10:19)

No. shares: 124.2m

Market cap: £205.6m

Quiz calls itself a "the omni-channel fast fashion brand" - so it sells clothes in shops, and online (through its own, and third party websites). The point of difference with Quiz, is that its womenswear is mainly special occasion wear. Although looking at its website, the product range seems to have broadened somewhat since I last looked, so the point of difference isn't quite so clear now.

I met management at the float in July 2017, and was very impressed - they're experienced rag traders, so struck me as safe hands. With hindsight, the float probably over-valued the shares a bit, but the market has done a good job in the last year, finding a share price level which I think looks about right at the moment.

The current financial year ends on 31 Mar 2019. So the update today covers roughly 5 months.

Key points;

- On track to deliver market expectations for the full year

- Board is pleased with performance (especially over the summer)

- Continued growth in all channels - but no figures provided

- UK stores & concessions have performed well (this is about half the business, by revenues)

- House of Fraser administration exposure is small, at only £0.4m

Online sales - this bit is key to the valuation, in my view. When it last reported to the market, Quiz showed exceptionally strong online growth. This was for y/e 31 Mar 2018. Over that period, online sales grew 158% to £30.6m.

This rapid online growth is the main reason that Quiz shares command a growth company PER of 21.8 times forecast FY 03/2019 earnings. If it was just physical stores, then in the current environment I don't think anybody would be interested in the shares unless the PER was about 10-12 perhaps.

Online revenues were only 26% of total Quiz revenues in FY 03/2018, so not a particularly big part of the overall mix, although growing fast. For comparison, you could buy Next (LON:NXT) shares (I don't currently hold any NXT, for the avoidance of doubt) on a PER of half Quiz's, and yet get a business which sells a considerably greater proportion of its product online - about half.

I think last year's online growth rate at Quiz might have been somewhat flattered by logistical problems it had the year before, thus making the comparatives soft.

Today's statement also suggests that last year's online surge had another one-off benefit;

In line with our strategy and as anticipated, we are now generating stronger growth through QUIZ's own websites compared to third-party websites, which experienced exceptional growth last year following the launch of partnerships with Zalando and Next.

This, combined with the fact that today's announcement does not give any figures for current online growth this year, suggests to me that the growth rate of total online sales has probably slowed down considerably from last year's 158%. Obviously that rate of growth can't be maintained as any business grows, but we need to know the figure, which was conspicuously absent from today's RNS. If online growth was still stellar, then they would have provided the figure today!

Outlook - This sounds reasonable overall, but with a seed of doubt in the first few words;

Despite an uncertain trading environment, we believe that the Group, underpinned by the strength of the QUIZ brand as well as its flexible, omni-channel model, remains well positioned for continued strong growth.

At this stage, and with important trading periods in the second half of the financial year still to come, the Board remains confident that QUIZ is on track to deliver market expectations for the full year.

My opinion - Given the above points, I'm feeling more cautious about online growth for Quiz. Hence I've decided not to buy any. I had been considering a purchase recently, on the back of previously very rapid online growth, and a possible upward re-rating if such stellar growth continued.

Looking at the product, and branding, it doesn't look special to me. In a crowded marketplace, I think it needs to be more distinctive.

That said, the company is trading in line with expectations, and growing in all channels (UK, overseas, and online), so it does deserve a premium rating. Taking everything into account, I think the current rating of around 20 is fair. Priced about right, is my conclusion. As always, that's just my personal opinion - Mr Market might disagree, and take the shares up or down - I have no idea what the share price will do, and am not trying to predict that. I'm just giving an opinion on the current valuation.

Good, that's got the more detailed part of today's report out of the way.

Next, I'll take a briefer look at some other companies.

Kainos (LON:KNOS)

Share price: 409p (up 12% today, at 11:43)

No. shares: 120.1m

Market cap: £491.2m

Kainos Group plc, a leading provider of Digital Services and Platforms, today issues a trading update for the period from 1 April 2018 to date.

A positive update - this is self-explanatory;

The Group has had a strong start to the year with the momentum seen in the second half of last year continuing into the current year. As a consequence, the Group expects the results for the year ending 31 March 2019 to be ahead of current market expectations.

More colour is given in the announcement, which you can refer to, if interested.

I can't really take if any further than that, because there are no broker forecasts on Research Tree, and the company has failed to give any indication in the RNS as to what extent the existing forecasts will be exceeded. We therefore have incomplete information, and just have to guess. Whereas presumably fund managers will get research notes. Not a level playing field, and deeply unsatisfactory, indeed unfair.

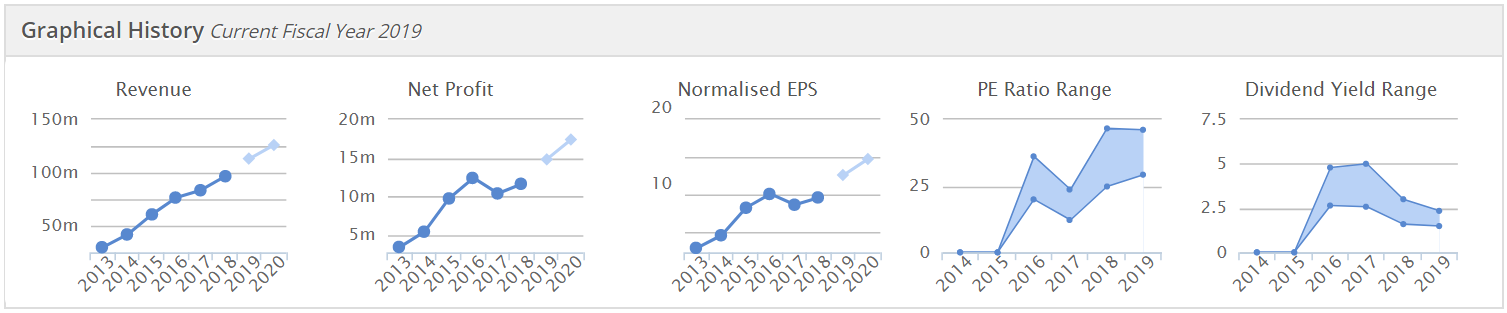

The company's track record looks superb, as you can see from the Stockopedia summary graphs;

My opinion - I can see why the shares are on a premium rating (26.9 PER, based on the old consensus forecast shown on the StockReport). The quality measures are great, the historic track record is great, and the company is clearly operating in a lucrative space - a lot of its work is for the public sector I believe.

Xaar (LON:XAR) - an innovative printing head manufacturer, that is a bit of a fallen angel. Formerly a tech star, it became too dependent on Chinese manufacturers of printed tiles - a market which seems to have waned, or encroached on by competitors.

Interim figures today are poor, but looks like that was expected, as the share price is up slightly.

Adjusted PBT in H1 is £3.2m, down 59% on H1 last year, on revenue down 39%

Net cash is interesting, at £36.8m, material to a company valued at about £150m

Interim divi reduced from 3.4p last time, to 1.0p this time - at least they're paying something

Outlook - sounds grim;

As outlined in our trading statement on 30 August, underlying trading since the end of June has been, and is expected to continue to be, below the levels previously anticipated.

Although the reception of new products has been positive, adoption of the Xaar 1201 printhead in particular has to date been significantly slower than expected, and the rate of decline in Ceramics continues to be aggressive.

The Board is reviewing the strategic options for more extensive partnering in the Printhead business.

My opinion - Xaar does at least have a fantastic balance sheet, so it won't be going bust any time soon, or at all.

I'm not interested in having a punt on the possibility that new products, which are not selling well so far, will sell in future. There is a separate announcement today talking about a contract win, but no financial details are given.

I think I can safely leave it there.

I have to leave it there for now.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.