Good morning!

There's a comment below, "Should we consider shorting MKS?"

My answer (subject to the usual disclaimer: no advice) is a resounding yes!

It has many of the features of an attractive short:

- legacy, disrupted (not disruptive) business model

- shrinking revenues

- not much evidence of any economic/competitive moat

- low margin

- capital intensive

- financially geared (financial net debt £1.6 billion, plus lease liabilities)

Bar skimming the headlines, I haven't studied its results in detail today. But if I was looking for another short candidate, this stock would be my immediate focus. For now, my shorting energies are dedicated elsewhere.

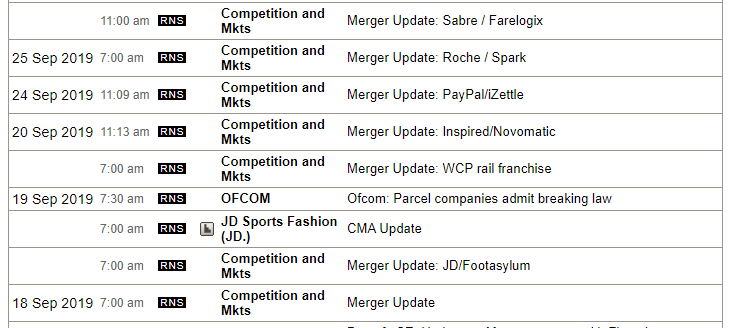

Competition & Markets Authority

An update on a minor matter.

On September 17th, I wrote to the CMA and asked them to put more information in their RNS headlines, to help speed up my work and the work of everyone else who checks the RNS feed every day.

I was informed that the team responsible for scheduling RNS updates had been forwarded my message.

It turns out that they implemented my suggestion from September 19th:

Thank you, CMA!

So which small-caps am I going to look at today?

Provisional list:

- Park (LON:PARK)

- Innovaderma (LON:IDP)

- Seeing Machines (LON:SEE)

- Frontier Developments (LON:FDEV)

- Connect (LON:CNCT)

Park (LON:PARK)

- Share price: 52.18p (+2%)

- No. of shares: 186 million

- Market cap: £97 million

Appreciate Group PLC - Change of Company Name and TIDM

Please note that I have a long position in PARK (or "APP").

This might win the award for "silly RNS of the day".

I've not yet heard anybody on the message boards or elsewhere say anything positive about this name change. Therefore, the contrarian in me wants to defend it. But "Appreciate Group" is a bit of a strange one, isn't it?

Imagine if Berkshire Hathaway ($BRK) (disclosure: long) had changed its name to "Compounding PlC". Would it make me want to own it more - not at all! The name of the PLC doesn't matter to me at all.

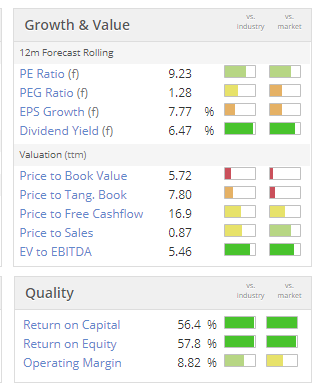

This has been a difficult holding, and I have been tempted to give up on it, but the value and quality metrics remain too attractive for me to walk away from:

Their mystery new product should have its launch date announced over the next few months.

I'm looking forward to that, and to the core gift card business maintaining its value and proving that it deserves a better valuation than this. Technology and marketing investment will "suppress" profitability in the current financial year, but hopefully we will then get the desired bounce back in company performance.

Innovaderma (LON:IDP)

- Share price: 72.05p (-9%)

- No. of shares: 14.5 million

- Market cap: £10 million

I've covered this one many times before - see the archives.

It's trading in line with expectations.

Checking an intraday chart, I see that the share price fell before the AGM. So I can rule out the possibility that something said at the AGM provoked someone to get out in a hurry!

This update reads quite well:

- revenues +38% in first four months of the financial year

- Boots increasing shelf space for Roots. It has already rolled out Skinny Tan.

- Multiple distribution agreements for Prolong.

I've found a possible reason for the share price fall: what sounds like a delay in material revenues from a new skin-care category:

"...the Company expects revenue contribution from this brand will be more keenly felt in FY 2021 as the brand establishes itself. We believe this has the potential to disrupt a large category which has received little innovation in recent years and presents a significant opportunity for us to cross-sell to our large self-tanning DTC customer base."

FY 2021 begins in July 2020.

In the previous update, Innovaderma said:

The new products will be provided with prominent shelf spacing from Superdrug and sold via the Company's DTC platform in the first quarter of calendar 2020

My view

The possible delay is not a big problem, in my view.

This share has been tempting me for a while, but I've stayed away for a variety of reasons:

- not understanding the rationale for IDP to have a portfolio of products in different categories at this early stage of its development

- noticing bad online reviews for some of its products

- I'm already heavily invested in Creightons (LON:CRL), and don't feel like I need more stock in this category.

However, on the back of today's update, and noticing how cheap the stock remains, I've done a little bit of extra digging.

I now have a few extra reasons to be cautious about this share - this may be old news to some of you, but here we go.

- In September last year, the Executive Chairman sold 1 million shares at 150.6p. In May 2018, he sold 775,000 shares at 132p.

- Offsetting these purchases, some of the directors made pathetically small purchases of shares, which look as if they were purely for show.

- On a more serious note, I see that the company has a habit of capitalising its product development costs.

In 2019, the company capitalised £884k of product development spending and purchase of intangibles. If you check the final results (in particular Note 25), there is no evidence of any amortisation. Profit before tax was £1.4 million, but it would only have been £500k if they had expensed their product development costs and purchase of intangibles.

Red flag: curious, I pulled out the company's annual report for 2019.

On page 37, the company says that it capitalises "separately identifiable direct costs incurred in the creation of customer lists... costs have been recognised with the specific task of customer acquisition".

In Note 12 on page 46, customer lists are shown with a value of £2.2 million. These are basically marketing costs which the company has chosen not to recognise as expenses during the period when they were incurred. This is highly suspect, in my view.

On top of that, there are another £580k in product development costs which have been recognised as assets rather than expensed.

Hat-tip to the message board users who pointed me in the right direction, noting that the company's reported earnings were questionable. I'll certainly be staying away from this share for the time being.

Seeing Machines (LON:SEE)

- Share price: 4.65p (+0.5%)

- No. of shares: 3365 million

- Market cap: £156 million

Seeing Machines Limited (AIM: SEE, "Seeing Machines" or the "Company"), the advanced computer vision technology company that designs AI-powered operator monitoring systems to improve transport safety, provides a business update ahead of its Capital Markets Day being held in London today.

I understand very little in this complex RNS, but the bottom line is that the CEO thinks his company can make it to profitability. Although if you read his statement carefully, it's not exactly clear if the latest developments will be enough:

...we believe the outcome of our negotiations with our manufacturing partner, coupled with the strong momentum across the Fleet business and the strengthening relationships with distributors and other partners, will improve the division's profitability and cash flow, and will also help fund the Company through to profitability.

Based on its financials, this stock is very high up the risk spectrum. There is also an inherent valuation risk since it's a play on the "hot" autonomous vehicle theme, and a geographical difficulty for UK investors, since it's headquartered in Australia.

Frontier Developments (LON:FDEV)

- Share price: £11.70 (+4.5%)

- No. of shares: 39 million

- Market cap: £455 million

Planet Zoo Launch, Frontier Publishing Update, CMD

Planet Zoo is out now, and it looks amazing! Here's the trailer.

In other news, FDEV is working to launch development partnerships with other companies, on games that are already "at various stages of development". This initiative is expected to be "a material contributor to the group in years to come".

My view: while I don't fully understand the high valuation attached to this share, I like what they do! Their games look so attractive - in this clip, you can see someone driving a jeep through a dinosaur park in Jurassic World Evolution.

Connect (LON:CNCT)

- Share price: 29p (-1.4%)

- No. of shares: 248 million

- Market cap: £72 million

Directorate and Executive Changes

The Group CEO has stepped down, and the CEO of subsidiary Smiths News steps up to become interim CEO.

And the value-destroying acquisition of Tuffnells (bought for well over £100 million in 2014) might be reversed:

While the Group has made significant progress against many of its recovery targets the underperformance of Tuffnells has materially impacted our overall performance and, as a consequence, we have fallen short in our ambition for stakeholders. We are therefore implementing a strategic review of Tuffnells to determine both the further actions required for a sustainable recovery and, more widely, to assess its future role and prospects in the Group.

Excluding Tuffnells, the core Smiths News business generated an adjusted operating profit for the year of £43.6 million (up from £38.9 million in the prior year).

Volumes and revenues from newspaper and magazine deliveries were down, but the loss was more than offset by cost-cutting.

Net debt ended the year at £74 million (1.9x EBITDA), before the sale and leaseback of some properties. Excluding the benefit of those sale and leasebacks, the enterprise value implied by the current share price is £146 million.

Outlook

The new year hasn't started particularly well:

Sales in Smiths News have started the year a little slowly but we are confident that performance will be brought back on track over the remainder of the year. In Tuffnells, trading in the year to date is more difficult than anticipated but is expected to stabilise in H2.

My view

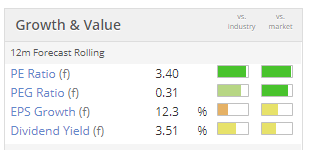

Logistics is a difficult sector, but there is an obvious bull case that can be made for this share.

If Tuffnells can be sold or shut down without creating a huge loss, and if Smiths News continues to do ok, then the shares are probably too cheap at the current levels.

Investors have little to no interest in the declining newspaper trade, so you get valuations like this:

All done for today, thanks all! Paul will be taking care of things tomorrow.

Cheers,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.