Good morning, it's Paul here, suitably refreshed after my sickie yesterday (thanks for covering, Graham).

Well, what a roller-coaster it's been of late. My view is that markets in the USA just got too expensive, and needed to correct. I don't see any particular read-across for UK small caps. Actually, it's felt quite bearish in UK small caps for several months now, with many shares having fallen considerably from previous highs.

I'm reviewing the debris of recent market moves, to see if there are any bargains on offer. Sometimes when people panic sell, they sell off good things, too cheaply. My hedging strategy worked very well, which was a relief. It's great to have some short positions generating profits in a market downturn, because that gives you peace of mind that you won't become a forced seller. So you can keep a clear head whilst all around are panicking.

Anyway, a correction from excessive levels, and a bit of fear coming back into the market, is a very good thing, in my view. Markets that just rise inexorably, without a pullback, are crashes in the making. I think it's important to remember that bear markets don't just happen randomly - they are caused by the market anticipating economic slowdowns/recessions, and hence reduced corporate earnings. With the world economy now doing well, almost everywhere, these seem very good conditions for businesses. Sure, there's a bit of fear over Brexit, and probably more fear about a Corbyn Government, here in the UK. Jacking up Corporation Tax to 26% (as their first move upwards, probably to be followed by further rises), that would make a dent in UK company earnings. That would hit share prices across the board here. So it's a big worry.

I can't think of a worse time to consider increasing Corporation Tax, than when Brexit uncertainty is probably already making some companies consider whether to stay in the UK or not. Our low taxes, and flexible employment laws, plus a population who speak English as their first language, are big attractions for companies to stay in the UK. So I fear that a Corbyn Government would be absolutely disastrous for the UK economy. In a globalised economy, you can't tax the rich - they just move their money somewhere else, to avoid being taxed. Or they just leave, with their money, and we get precisely zero in tax revenues from them. So there are lots of schoolboy policy errors already evident with Corbyn. Maybe a new generation has to experience Socialism in practice, to become as fearful of it as my generation (and older) are?

Anyway, on to today's small company results / trading updates.

Warpaint (LON:W7L)

Price: 212.5p (up 2.4% today)

No. shares: 76.75m

Market cap: £163.1m

Warpaint London PLC (AIM: W7L), the specialist supplier of colour cosmetics and owner of the W7 brand, is pleased to announce the following trading update for the year ended 31 December 2017.

This looks to be a satisfactory performance:

The Group continued to perform well during 2017 and the Board confirms that it expects to report results in line with management expectations for the financial year.

I understand why companies use the phrase "management expectations" during the year - because analysts usually don't produce forecasts for partial years. However, when reporting on a full year, I think companies should refer to "market expectations", not "management expectations". Also, companies should always include a footnote, to say what they believe market expectations are. Or provide the range of broker forecasts, where they differ significantly. This is becoming much more important, now that MiFID II has considerably restricted the ability of private investors to access research.

Forecasts - there's an update from one broker, available on Research Tree, which I'm just having a look at now. They forecast 10.2p EPS for 2017, which puts the shares on a PER of 20.8,which looks fully priced to me.

However, the 2018 broker forecast is for EPS to rise to 13.1p, which if achieved, would drop the PER to 15.5 - much more attractive.

Acquisition - is going well so far;

The integration of Retra, acquired in November 2017, has been completed and the Retra business is performing well...

The company issued 11.16m new shares in a placing, priced at 190p, in Nov 2017, to fund the acquisition of Retra. Checking back to the details given late last year, Retra looks to have been acquired at a relatively cheap multiple of earnings;

Retra recorded profit before tax of £2.3 million on sales of £17.5 million in the year to 31 December 2016.

The Acquisition is expected to be immediately earnings enhancing before anticipated (but not quantified) synergies

Although a word of caution when interpreting the accounts of private companies - Directors often draw de minimis salaries, and instead pay themselves mainly through dividends. So that tends to inflate PBT, which would then need to be adjusted down to reflect the payroll costs of Directors once the company is acquired by a listed group.

I always like to see a clear logic for acquisitions, and this one seems to tick the right boxes. Warpaint says that the acquisition will give it access to new suppliers, customers, and markets. Warpaint seems to have paid a sensible price too, so it all looks good.

Outlook - sounds positive;

"We are very pleased with the performance of the Group in 2017. Retra has integrated well with the rest of the Group and we are already seeing new opportunities and synergies from the combination.

"2018 has started well and we look forward to the future with confidence."

My opinion - I'm quite tempted to have a nibble here - the group seems to be trading well, and the price (based on 2018 estimates) looks fair. The acquisition of Retra should increase earnings in 2018, but that will be diluted by the increased number of shares in issue.

Overall then, I think this could be worth a closer look.

Reach4Entertainment LON:R4E

Share price: 1.9p (down 7.3% today)

No. shares: 1,004.1m

Market cap: £19.1m

r4e, the transatlantic media and entertainment marketing company, is pleased to provide a trading update for the year ended 31 December 2017...

I've kept this share vaguely on my radar, after discussing it with Nigel Wray at last year's UK Investor Show. He owns 19.2% of the company, and I think was instrumental in the refinancing done a little while back, where some debt was paid off at a discount, which seemed a clever deal. Prior to that, the company was basically insolvent, so the equity had little to no value prior to the restructuring.

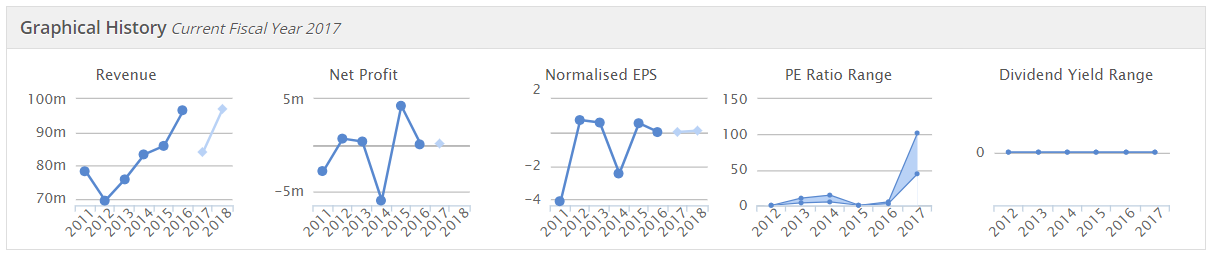

The company track record of trading has been lacklustre, Looking at the graph below, the big one-off profit was due to gains from the debt restructuring & haircut, so it wasn't trading profits;

When you see big turnover (much is pass-through revenues), but little to no profit, you have to question whether the business model is viable? The shares seem to be mainly of interest as a potential turnaround, under new management. I like situations of this kind - where new, better management might be able to strip out unnecessary costs, and drive new business wins & new products. The gains from a successful turnaround, based on a bombed-out share price, can potentially be excellent.

The trouble is, that many attempted turnarounds simply don't work - Flybe (LON:FLYB) and Mothercare (LON:MTC) spring to mind, where they seem to be running to stand still.

Update today - 2017 trading performance looks to be slightly below expectations;

The Company is expected to achieve Adjusted EBITDA* broadly in line with market expectations for the 12 months to 31 December 2017 and in line with current market expectations for 2018.

Given that 2018 has only just started, it seems odd to be mentioning performance against expectations this early in the year. Perhaps the company has good visibility of bookings? Even so, I'm wary of an update this early in the new year.

Strategy update - there's some interesting commentary about the group's revised strategy. It seems to be wanting to broaden out into new markets, and geographies. This may involve more acquisitions. A fundraising of £5.5m was done in Dec 2017.

I see that Michael Grade became Chairman last year.

Cost-cutting - has been done, which explains why the group is more confident about 2018 performance;

At the end of 2017, the Company made a number of changes to the business, including a staff restructure, benefiting the underlying ongoing cost base.

These factors are expected to contribute to improved Group profitability in 2018 in line with current market expectations of Adjusted EBITDA*.

My opinion - I'm not yet convinced by this turnaround. To my mind, expanding into new areas, because you can't really make any money from existing ones, isn't attractive as an investment proposition. However, time will tell if the turnaround is good, or not. At least it's properly financed now.

I would have thought that the bank is likely to be supportive, re the Q3 2017 covenant breach, particularly as a £5.5m placing was done recently, in Dec 2017. Although I've checked the last balance sheet, and it was very weak. So adding in the £5.5m recent placing, the balance sheet would still be fairly weak, but not disastrously so.

Overall, it's not for me, but could be worth keeping an eye on, if the turnaround does start to work.

Gattaca (LON:GATC)

Share price: 213p (down 14.8% today, at market close)

No. shares: 31.8m

Market cap: £67.7m

(I no longer hold a long position in this share)

Firstly I must thank a reader here, who challenged me (last time I wrote about it here) on why I was still holding this share, when the fundamentals seemed to be deteriorating, and Ihad just written a report saying that I suspected another profit warning might occur. I had a re-think, and decided the reader was right (telling me that I should consider selling my shares). So I ditched my shares at (from memory) about 240-260p, over several days (it's a surprisingly illiquid share). As I always say, investing is a team sport. So input from readers, particularly when challenging my views, with well-argued replies, is very helpful. Sometimes I can be so caught up in the sheer volume of daily information, and writing about it, that I can't see the wood for the trees.

Anyway, on to today's news from this staffing company,

Gattaca plc ("Gattaca" or the "Group"), the specialist Engineering and Technology (IT & Telecoms) recruitment solutions business, today provides the following pre-close Trading Update for the six months to 31 January 2018.

It's a profit warning, unfortunately, for the full year ending 31 July 2018. Note that, for anyone not familiar, "NFI" means Net Fee Income - ie revenues excluding pass-through revenue;

NFI has grown both in UK Engineering and International, tempered by continued challenges in UK Technology. PBT however, as expected, will be lower than in H1 of last year as a result of our investments in staff and support costs to deliver the increased NFI and to allow for further growth in H218.

Taking a more prudent assessment of the economic outlook, we have tempered our expectations for growth in H2 and consequently we are undertaking a review of our cost base, so as to identify savings, some of which will be achieved in H2.

Notwithstanding these savings, profits before tax excluding non-recurring costs are now expected to be in the order of 15% below the Board's previous expectations.

Not a disaster, but a 15% reduction in full year profits, when we're already half way through the year, is not good.

Forecasts - I've not yet received any updated broker forecasts. However, looking back to a commissioned research note from Equity Development, their last EPS forecast was 36.0p for 07/2018. The company is today guiding to 15% below that, so I make that 30.6p revised EPS for the current year. At 213p share price, that's a PER of only 7.0 - looks cheap, but it's looked cheap for a while, and keeps getting cheaper. Then we get a profits warning. So I'm coming round to the view that it's cheap for a reason.

EDIT (8 Feb 2018) - a note from Equity Development, with revised figures, has just hit my inbox. This is commissioned research, which is freely available to all investors via ED's website. The analyst, Paul Hill, is excellent, and a very successful small caps investor. However, he's been too optimistic on GATC.

His revised numbers come out at 29.7p EPS for 06/2018, which is slightly below the 30.6p I estimated above, but it's close enough. (End of Edit)

Net debt - updated today as follows;

We estimate our net debt position at the end of January at 37m (end July 2017 40.3m).

I don't see the net debt as a problem here. Other staffing companies also carry debt, e.g. Empresaria (LON:EMR) and banks seem happy to lend against the large debtor books of companies like this.

Dividends - once again, the market got it right here. The very high dividend yield turned out to be unsustainable. Today's update says;

In light of the revised full year expectations the Board has decided to reset the rate of dividend in order to restore a more sustainable dividend cover ratio, to enable the pay down of debt, and to reflect a more normalised yield. The Board intends to set the dividend cover at approximately 2x (2017 1x).

Increasing the dividend cover from 1x to 2x, together with reduced earnings for 2018, implies a cut in the dividend from 23p last year, to about 15p in future - which is half the revised EPS forecast mentioned above, giving 2x cover. That would still yield an attractive 7.0%. So, whilst existing shareholders will no doubt be miffed at the reduction in divis, new investors buying in after today's fall in share price would still be buying a high yield share. The reduced divis might now also, possibly, be more sustainable. Providing business doesn't continue to deteriorate. If that happened, then the company might decide to cut divis again, or stop them altogether.

EDIT 8 Feb 2018 - revised numbers from Equity Development indicate a reduced divi of only 11.5p, with cover of 2.6 times. The analyst will have spoken to the company in coming up with that figure, so I think we have to lock on to 11.5p dividends as being the most likely outcome. (End of edit)

CEO resignation - Brian Wilkinson has fallen on his sword. Probably a good idea, as the company & share price have not performed very well under his stewardship, to be blunt.

My opinion - I've lost interest in this company. It's disappointment after disappointment, and the apparently cheap valuation seems to be because the market correctly predicted problems with earnings & divis.

Maybe a new CEO could inject some razzmatazz into the company. So I might revisit the share, if the new CEO unveils an improved strategy, and has a good track record.

All done for today. See you tomorrow!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.