Good morning,

A few bits to cover today.

- Redcentric (LON:RCN)

- Alpha Financial Markets Consulting (LON:AFM) - dropped this one, as not interesting enough!

- Tricorn (LON:TCN)

- Vertu Motors (LON:VTU)

- Volution (LON:FAN)

- Codemasters Group (LON:CDM)

Redcentric (LON:RCN)

- Share price: 85.9p (-0.1%)

- No. of shares: 149 million

- Market cap: £128 million

This is a simple one: trading in line with expectations.

Redcentric is a managed IT services provider that offers the IT/Cloud services you'd expect from a mid-sized group.

Net debt is light, at £16.5 million - no major surprise, then, to see that RCN is paying out dividends and also buying back £2 million of its own shares.

Net debt has declined over the past year despite dividend payments and "an acceleration of network and infrastructure capital expenditure in the period."

While reported net income has been nothing to write home about in recent years, if this company hits its forecasts from now on then it will offer decent value at current levels.

Tricorn (LON:TCN)

- Share price: 11.2p (-38%)

- No. of shares: 34 million

- Market cap: £4 million

I'm not going to bother covering Alpha Financial Markets Consulting (LON:AFM), which was in the original list.

Let's move on and see if this announcement from Tricorn is worth looking at.

Paul covered the company in April. His summary opinion was:

It's difficult to get excited about this - a small engineering group, with a bit too much debt, is not going to attract a high rating.

Deary me.

Today's announcement is a nasty one. Let me put the problems in bullet form:

- USA demand "broadly in line with expectations"

- USA margins are down, due to tariffs on Chinese imports. Tricorn phrases this elegantly, saying there is a "lag" between the imposition of these tariffs and its negotiation of higher prices with its own customers.

- UK demand "slowed significantly", with H1 revenues down 12%.

The upshot is that revenue will be "slightly lower than expectations" and 7% lower than H1 last year. PBT will take the hit of lower revenues and lower margins. Full-year results will be materially lower than expectations:

There is a strong pipeline of opportunities and the Board continues to evaluate the impact of new business inload and the extent to which this can offset the impact of weaker underlying market conditions. However, the Board now anticipates that full year results will be materially lower than market expectations.

My view

Stocko shows a net income forecast for the current year of £1.03 million, off revenues of £23 million. With lower revenues and margins, is it safe to assume that the company will publish a loss?

Like Paul, I see few attractions to this share. But then, I tend to steer clear of nano-caps and companies in this sector.

When I reviewed it in June last year, I thought it was worth looking into, despite the debt load (£3.3 million at year-end) and patchy track record. But this update suggests not.

I'm struggling to find anything of interest, but let's plough on and see if there is anything more interesting in the next set of announcements.

Vertu Motors (LON:VTU)

- Share price: 33.2p (+2%)

- No. of shares: 369 million

- Market cap: £122.5 million

A (trailing) EV/EBITDA multiple of less than 3x would normally be of interest to a value investor.

And financial results at Vertu remain excellent, with free cash flow of £14.6 million from PBT of £16.1 million. That's in just six months!

The profit number is a slight deterioration compared to the prior year, but VTU's valuation is evidently pricing in a collapse, and these results are far from a collapse.

The risk is that the valuation is correct and this turns into another Pendragon (LON:PDG), seeing its profitability disappear in the face of a terrible new car market.

Vertu's new vehicle sales to the retail market were down by just over 10% in H1, on a like-for-like basis.

Let's check the outlook section. The company is on track to meet expectations.

Key points from the outlook:

- September like-for-like new vehicle unit sales to retail are down 1.6%

- used car sales and service revenues still growing on a like-for-like basis

- overall profitability in September is up compared to the prior year.

The company also mentions the impact of Sterling with respect to manufacturer margins and price changes to consumers.

While I do think that Sterling weakness should only be a short-term issue for Vertu (in the sense that price changes will be passed on to consumers and Vertu should retain its small margin), it's hard to be optimistic about overall prospects for the new car market.

And this general weakness in sales means that the company's prospects are dull, at least in the short-term.

However, is this more than fully priced in? Quite possibly.

If it were possible to buy a car dealership ETF, which included a basket of stocks like this, I'd be tempted to pick up a few. Those which survive the potentially imminent recession could prove to be great investments over a 5-year holding period.

I also note that this company bought back 2% of its shares during H1.

The trigger for me to actually go ahead and take a stake in one of these dealerships might be something like a material share buyback. If we wake up one morning and see that 20%+ of the shares in one of these companies are being retired, that could be the signal for me me to get involved.

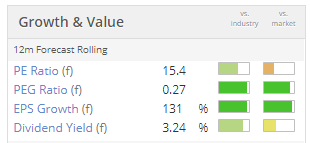

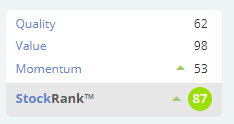

StockRanks love it. Quantitatively, its story checks out:

Volution (LON:FAN)

- Share price: 171p (+1%)

- No. of shares: 198 million

- Market cap: £339 million

This is "a leading supplier of ventilation products to the residential and commercial construction markets", i.e. another stock which is unlikely to light up the bulletin boards any time soon.

It reports organic revenue growth of 3.5% at constant currency - not bad.

Combine that with growth via acquisition and currency movements, and you get total revenue growth of 14.6%.

On an adjusted basis, this feeds through to growth in operating profit of 13.3%.

Remarkably, this feeds through to growth in statutory PBT of 38%.

The reason is that the accounts have cleaned up a bit, with much fewer adjustments for 2019.

Last year, the company included £5 million of factory relocation costs within the adjustments. This year, only £1.5 million of such costs were included.

Net debt is significant at £74.6 million. The company reckons this is 1.6x EBITDA, which is not a very scary multiple.

Net cash from operations during the year was £32 million. If acquisition activity was dialled down for a while, it looks like the company would be able repay significant chunks of the debt.

Working on margins

I appreciate management's focus on margins:

Whilst there is an inevitable margin dilution as we acquire companies with a lower margin, we are also conscious that there has been a reduction in our underlying margin over the last two years.... We have taken action to ensure that operating margin improvement is the key focus for management and employees of the business over the coming years and we have also updated our strategy to now include a sharp focus on Operational Excellence. We believe that the Group has the potential to increase adjusted operating margins back to a level of 20% over the medium term.

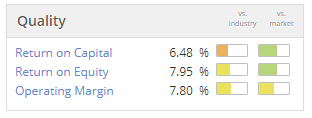

But if we check the "official" metrics, ew see that the company's quality scores are distinctly average at present:

It's true that the "underlying" operating margin is much better than this, but we should be cautious about accepting that at face value.

By far the largest adjustment relatess to the amortisation of acquired intangibles: £15.4 million this year, and £14.7 million last year.

If we ignore this charge, we risk treating the company as if its acquisitions were free - which of course they weren't! So it's important to be careful about that.

My view - I don't have a strong opinion on this one. It's cheap on a PE basis, but it looks to be average as far as quality is concerned. The balance sheet has negative tangible equity, another reason for caution.

Codemasters Group (LON:CDM)

- Share price: 213p (+0.2%)

- No. of shares: 140 million

- Market cap: £298 million

This trading update is in line with expectations.

Newsreaders and broadcasters are supposed to make the news sound "sensational". Unfortunately, I can't patch up the fact that today's company news was terribly dull, at least from my perspective. Let's hope for a better day tomorrow.

Cheers,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.