Good morning from Paul & Graham. Today's report is now finished, we got through nearly everything on the agenda, it's a nice feeling when that happens!

Agenda

Paul's Section:

Oxford Metrics (LON:OMG) - FY 9/2022 results from yesterday don't look particularly good, but under the surface something interesting seems to be happening here - strong demand, and a big increase in order book, plus delayed orders (supply chain) suggest a much better year is likely for FY 9/2023. Over half the market cap is a huge net cash pile, from a remarkable deal disposing of Yotta. Overall, I think this share looks very interesting, and is still reasonably priced. It gets a thumbs up from me. Over to you - OMG looks worth a closer look.

Musicmagpie (LON:MMAG) [quick comment] - a series of profit warnings, collapsing earnings forecasts, and rising debt, led me to regard MMAG as uninvestable here in Sept. Shares have bounced strongly (in % terms) from the lows, so is there hope of a recovery, or is it a dead cat bounce? Today it says trading for FY 11/2022 has been in line with expectations. But bear in mind expectations have been lowered from 7.5p EPS to -0.1p EPS. Net debt is £8.2m (better than expected) out of a £30m facility. Record Black Friday sales, and it talks up the prospects for its mobile phone rental offering. I remain unconvinced this is a viable business model, but at least trading is not getting any worse. £28m mkt cap looks (mag)pie in the sky to me! [no section below]. EDIT: note that even the house broker doesn't think it will generate any PBT in the next two years.

Moonpig (LON:MOON) - We warned readers here in Sept that Moonpig looked to have overpaid for a large, debt-financed acquisition. That's very much confirmed by today's interim results, which show how the balance sheet has been wrecked by this acquisition, leaving a vulnerable consumer discretionary business that's facing tightening demand, and with a mountain of debt to service. Risk;reward looks poor to me, so I'd steer clear of this one for the foreseeable future.

Naked Wines (LON:WINE) - Interesting interim results, seem to show some progress has been made. The main problem is wildly excessive inventories, which have peaked at over £200m. It's taken a £8m hit against those (adjusted out of the headline numbers, of course!), but I worry such an extensive wine lake could have other nasties lurking in it. It's also spending customers' cash, which I don't like, it should be ring-fenced. I discuss the bull & bear points below, and think this share could go either way, so am neutral.

Redde Northgate (LON:REDD) [quick comment] - Interim numbers look fine to me. It presents more conservative underlying numbers (which seem to strip out the unusual profits on disposals from temporarily high vehicle residual values), alongside statutory numbers. There’s also an important section on timing differences re residual value/depreciation changes, that seems to be pulling in some extra profit this year. That’s probably why next year’s forecasts are down (45.8p vs 49.1p). Full year outlook is good - “modestly above market expectations”. My view - the value investment case looks good - fwd PER of 7.9, divi yield of 6.0%, nicely asset backed too with P/TBV of only 1.26. Don’t worry about the debt, as it owns £1.1bn in vehicles, which is much more than the debt. Thumbs up from me. (no section below)

Quiz (LON:QUIZ) [quick comment] - good interim figures out today. H1 profit of £1.8m, on almost £50m revenues. Very strong gross margin at 61.6%. Excellent balance sheet, with £9.2m net cash (down to £7.8m as of yesterday - normal fluctuation, not a concern). Current trading - weak in Oct, better in Nov. FY outlook - at least in line with market expectations. My view - great to see the business fully recovered from the pandemic, and profitable again. Still looks cheap to me. (no section below)

Graham's Section:

SDI (LON:SDI) (£166m) - these interim results have disappointed the market, although there is no change to revenue and adj. operating profit forecasts. What has changed is interest rates, and a higher interest bill will take a small bite out of SDI’s adj. net profits this year and probably next year, too. Net debt has risen to a level that is unusually high for SDI, but the company maintains that its balance sheet is “unstretched” (i.e. it has a low net debt/EBITDA multiple) and that it can carry on with further acquisitions. Unfortunately, organic revenue growth has fallen to just 3.8% and looks like it remains vulnerable, due to an ongoing reliance on some Covid-related sales. I agree with sellers today who have helped to push this to a more modest PE multiple. SDI still has the ingredients of a high-quality compounder but without organic growth I would be wary of overpaying for it.

MS International (LON:MSI) (£61m) - excellent H1 results from this very quiet, family-controlled group of businesses. Even after nearly 30 years of consecutive dividends to its shareholders, MSI’s cash balance (£24m) remains formidable as a percentage of its market cap. Today’s strong results (PBT of £3.5m) were achieved without any contribution from the company’s Defence division, which will hopefully be able to make meaningful profits in the years ahead with the help of a large US Navy contract. I love finding quirky businesses like this which quietly do a good job for their shareholders. MSI gets the thumbs up from me.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Oxford Metrics (LON:OMG)

101p (up 12% yesterday)

£131m

Oxford Metrics plc (LSE: OMG), the smart sensing software company servicing life sciences, entertainment and engineering markets, announces preliminary results for the financial year ended 30 September 2022.

- Year of strategic progress with disposal of Yotta -

- Record order book underpins more than half FY23 revenue expectation -

- Overall strong demand picture provides encouraging momentum into new year

FY 9/2022 key numbers don’t look particularly remarkable -

Revenue up 5% to £28.8m

Adj PBT down 36% to £2.6m

Adj basic EPS 2.55p down 7% (and giving a PER of 40x hardly a bargain at first sight)

Dividend of 2.5p (up 25%), giving a yield of 2.5% (note there is only a final divi, no interim divis, and a flurry of special divis were paid in 2015).

As you can see below, the longer term track record doesn’t really show much progress over the last six years -

.

So what’s all the excitement about?! Onto the positives -

Net cash pile of £67.7m, which is 52% of the market cap, which mostly arose from a stunning deal to dispose of its Yotta subsidiary for £52m. This also was the main contribution towards the statutory profit of £47m for FY 9/2022, a one-off.

Delayed orders due to supply chain saw £3.5m of orders deferred into next year, which on a high gross margin (it’s 68% overall), might have hurt FY 9/2022 profit by about £2m perhaps, and that could be recouped in FY 9/2023, if supply chains normalise maybe?

Finance income of £305k in FY 9/2022 could increase considerably now, e.g. a 3% interest receivable rate on the £67.7m cash pile could see c.£2.0m in finance income this new year.

Huge increase in order book looks very interesting - up 307% to £24.0m, which looks nearly comparable with revenues for the whole of FY 9/2022 (£28.8m).

My main questions are -

Q1. What are they going to do with the cash pile? It’s c. half the market cap, so highly material.

Progressive suggest that management are looking at acquisitions, but finding price expectations still too high. Very sensible! So it sounds as if they’re likely to sit on the cash, until the right opportunity is found - I’d say that’s ideal, as there’s less chance of them making a horrible mistake. Also management has already proven its skill in acquisitions & disposals. The deal with Yotta was barn-storming, as it looked a waste of time, yet they sold it for £52m! So these people clearly know how to do favourable deals.

Q2. What’s caused the huge increase in order book, and is this likely to continue? If so, we might be witnessing one of those rare, but lovely situations where companies see a step change in demand upwards, which can be very lucrative.

A note from Progressive (i.e. effectively from OMG, just indirectly) says that customers are more willing to place orders now, to ensure supply. Hence this suggests maybe some front-loading of demand, that could ease in future, possibly? Even so, the massive increase in order book speaks for itself - clearly OMG has products that are in strong demand, which I like a lot.

Forecasts - Progressive has pencilled in a hefty 28% rise in revenues to £36.9m in FY 9/2023, and the commentary says this does not include catching up with delayed orders, hence there could be upside on this number. The tone of the note suggests forecasts are more likely to be raised, than reduced, which I like. Although it is increasing overheads in some areas, to develop the business.

Adj PBT is expected to go up from £2.6m to £5.9m, and it sounds like there’s upside potential on that number too. If achieved, that would be 4.1p adj EPS.

Tax charges are lowered by R&D tax credits.

Valuation - the obvious way to value OMG, is the £131m market cap, less the £68m cash pile, giving a cash adjusted market cap (or EV) of £63m.

If it hits forecasts of £5.9m+ PBT his year, then that looks an attractive valuation, a PER of about 12 (I’ve assumed half the normal corp tax rate, at 13%, to allow for tax credits).

My opinion - this looks very interesting, and it gets a thumbs up from me on a quick review.

Outlook comments also sound positive, yet the valuation is still reasonable.

I think this share could do very well, if demand continues to be buoyant.

So I’ll hand it over to you, for more detailed research - well worth a closer look in my view.

.

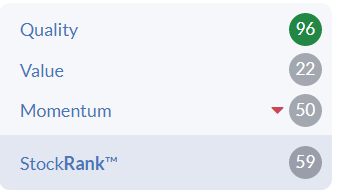

Note the StockRank is upper-middling. This is an interesting one, in that I don't think the Stockopedia computers would necessarily know that 52% of the market cap is now net cash. So paradoxically, when the FY 9/2022 figures feed through into the data, we might even see the quality score fall, since it would look as if things like ROCE had fallen. So it might be a situation where man can do better than machine?!

For the same reason, I think we can ignore the value score, because that also probably won't know that half the market cap is net cash.

Moonpig (LON:MOON)

123p (down 19% at 08:42)

Market cap £419m

This is one of the day’s largest % fallers, so we need to take a look at what’s happened.

I last looked at MOON here on 21 Sept 2022, concluding that it had overpaid for a big acquisition, and taken on too much debt, at the wrong point in the cycle.

H1 results to 10/2022 (for FY 4/2023) don’t look great -

H1 revenue flat at £143m

Adj PBT down 22% to £18.9m

Disruption from Royal Mail strikes.

Outlook comments say trading has become “progressively more challenging” in Oct & Nov.

Revenue guidance for FY 4/2023 now £320m (but annoyingly doesn’t say what previous guidance was). Stockopedia shows £343m forecast.

Guidance for EBITDA unchanged, due to “actions taken” - looks like cost-cutting, especially marketing spend.

Expecting gearing to reduce in H2, to between 1.9x and 2.0x EBITDA by 4/2023.

Net debt now too high for me, at £208.8m, was £113m a year ago. Of this £19.8m is lease liabilities, so net bank debt is £189m.

Bank covenant is 3.5x EBITDA (from April 2023 until Jan 2026)

The company recognises debt is too high, and it sounds like there won’t be any divis -

Our short-term priority is deleveraging.

Finance costs of £5.8m in H1 uses up 39% of operating profit, so funding the debt pile is definitely an issue. Note 13 gives detail of interest rate hedges.

Going concern note - the company gives itself a clean bill of health here, which surprises me. There again, online businesses do have a flexible cost base, and can reduce marketing spending very easily. Although that could result in a downward spiral of falling revenues & eventually profits.

Balance sheet - was bad before the big acquisition, and now looks absolutely dreadful.

NAV is negative at £(57)m, but that includes £213m of intangible assets, mostly goodwill on acquisitions (and similar, they call it something else now). The big acquisition seemed to have negative NAV of £(47)m, so has made MOON’s balance sheet a lot worse, on top of the goodwill. Writing off all intangible assets, gives NTAV of an alarmingly negative £(270)m. Although with little in the way of inventories or receivables, you could argue that it doesn’t need a strong balance sheet.

Note 8 shows that it also capitalised £6.66m of internal payroll costs relating to IT development in H1 - hence EBITDA is not meaningful.

Trade payables have shot up, with note 12 showing a new payable of £49.3m (zero in the prior year comps) called “Merchant accrual”. The commentary explains what this is - being the money owed to providers of experiences, where MOON has received the voucher cash up-front -

The merchant accrual balance acquired upon business combination with the Experiences segment was £61.2m. A payables balance is recognised when a gift experience is sold to a consumer, to reflect the expected future liability to the merchant; this balance is settled through the remittance of cash to the merchant following redemption of the voucher by the recipient.

My opinion - this looks a bit of a mess to me. It’s quite clear now that, as I previously thought, the big acquisition of Experiences was a terrible mistake. It seems to have added little profit/cashflow, but come at a massive cost, funded through debt, which is now too high.

Management seemed oblivious to the consumer downturn, and that its products don’t get much more discretionary, so are likely to suffer when consumers curtail discretionary spending.

Demand is softening, so it’s maintaining EBITDA by cutting marketing spending - which I imagine would itself then cause revenues to fall.

In happier times, and with little to no debt, MOON would look a good business. But in tough times now, with a mountain of debt on its very weak balance sheet, I think MOON looks vulnerable.

Is it likely to go bust? If things get really bad, with an extended recession, it cannot be ruled out. If the business shrinks, and has to chase its own tail by reducing marketing spending, then it’s possible a downward spiral could emerge, with the debt mountain then becoming an existential problem, requiring a big equity fund raise.

Even in the upside case, where everything turns out fine, with debt reducing over time, shareholders probably won’t get any divis for several years.

For me therefore, risk:reward looks poor, and any ideas I had of buying this share for a recovery are off the table completely for the time being. I can see why people are ditching the share in the market today, that looks entirely logical to me. Why take the risk?

The poor fundamentals suggest that sub-100p could just be a matter of time.

This one is another disastrous, over-priced 2021 float. No wonder the IPO market is dead now, after all those fund managers got stuffed with things like this.

.

Naked Wines (LON:WINE)

100p (up 3% at 10:55)

Market cap £74m

Naked Wines is the larger of the two listed wine subscription services (the other being Virgin Wines UK (LON:VINO) ). It’s a bit of a special situation, where it ran into various problems, which I won’t repeat (it’s all in our archive here), and the issue now is whether the turnaround actions are working or not?

H1 figures (26 weeks to 26 Sept 2022) -

Revenues up 4% to £165.8m

Adj PBT has improved to £4.6m (H1 LY: £1.7m)

Statutory PBT is a £(215)k loss.

Adjustments of £4.8m include a £7.9m provision (cost) to write-down the value of US inventories. See note 4 for more detail on other adjustments.

Improved adj PBT has been achieved by slashing advertising costs by 44% to £10.0m (saving £7.9m) - but as with Moonpig above, will this have a negative impact on future sales? It stands to reason that it would, otherwise the implication is that advertising/marketing spend is just wasted money.

Current trading -

Currently, we are trading profitably in line with our expectations over the key holiday quarter and reconfirm our revised guidance for FY23 shared in October.

Profit guidance - is adj EBIT of £9-13m for FY 3/2023

Balance Sheet - has been boosted nicely by favourable currency translation of about £17m (see reserves section of BS), with NAV now £127.3m - note this is well above the market cap. Deducting £37.2m intangible assets gives us a still-healthy NTAV of £90.1m.

The stand-out item is the gigantic inventories figure of £209m. The company has said before that it plans on de-stocking. To put this into context, H1 cost of sales was £93.3m. So inventories of £209m is over 13 months of sales. I appreciate that selling wine might involve storing, or advance purchasing, but even so this is clearly a wine lake that is way above what it should be. Given than a provision of almost £8m was booked in H1 (against wines that will have to be sold below cost), I suspect that might not be the last provision needed against excessive inventories. When problems like this emerge, they tend to leak out gradually, with the first hit not being the last. Sometimes they can be much, much worse than anyone imagined, which is why excessive inventories is such a big risk.

Cash is down to £41.6m, and there’s a new term loan of £18.7m, so net cash is £22.9m. Sounds OK, but it’s not, because WINE is holding £87.7m of customer’s cash (that’s what the “Deferred Angel and other income” liabilities represent. So basically, WINE has spent the customer’s cash, to a large extent. That’s not illegal, but it strikes me as unethical. Note that small competitor VINO keeps customer cash in a separate trust account, which is much better.

My opinion - the main issue is that WINE needs to dig itself out of the big hole of its own making - buying up loads more wine than it should have done.

My main worry is that the wines it holds in excessive inventories could be wines that customers don’t like. Therefore de-stocking may not be as simple as the commentary implies.

This share could go either way.

Bull case - if it successfully reduces inventories (which need to roughly halve, I think), and achieves the guidance for improved profits, then I could see this share maybe doubling or more.

Bear case - that the massive inventories could contain a lot of poor wines that it can’t sell, leading to more write–offs, and erosion of the balance sheet. If forecasts are not achieved, and customers drift away because of reduced marketing spend, then the cash could run out (as customers withdraw it), leading to potential solvency problems.

Overall, I think it looks fairly evenly balanced, and could go either way.

It's hardly issued any new shares in recent years, so theoretically there could be good upside on the share price from here. Although the bull market pandemic valuation was nuts.

Graham’s Section:

SDI (LON:SDI)

Share price: 161.5p (-6.65%)

Market cap: £166m

This is “the AIM quoted Group focused on the design and manufacture of scientific and technology products for use in digital imaging and sensing and control applications”. I tend to think of it as a smaller version of Judges Scientific (LON:JDG) or a much smaller version of Halma (LON:HLMA) .

Let’s look at the interim results for the period to October 2022.

Firstly, the outlook for the full year is in line with expectations.

However, these market expectations only relate to sales of £66.3m and adjusted operating profit of £12.8m. The estimates for adjusted PBT and adjusted EPS have marginally reduced, both for this year and for next year.

H1 headlines:

- Revenue +28% to £31.7m.

- Adj. operating profit +19% to £6.9m.

- Reported operating profit +7.7% to £5.6m.

Nearly all of the growth is the result of acquisitions, with only 3.8% organic (Judges Scientific did better at its interims, reporting 7% organic revenue growth for the H1 period to June). SDI says that this H1 period is up against “stronger comparatives” compared to last year.

Acquisitions - four companies have been acquired during the calendar year so far.

I spoke to the company’s new CFO at Mello last month and asked whether the company might outgrow their existing acquisition strategy soon, and need to start acquiring larger companies. The response was that the current strategy would remain viable for several years.

Looking at the acquisitions so far this year, their price tags have been (net of cash acquired): £13m, £4.2m, £7.7m, £4.9m. So the company is still working at the very small end of the spectrum.

Trading - mixed comments on trading, including that “demand from OEM customers was more variable this half year than the equivalent period last year”, and supply chain issues continue to pose difficulties across all of SDI’s businesses.

In better news for the company, “inflationary cost increases have, in general, been passed on to customers where possible and gross margins have generally held”. I would hope and expect that SDI would have the pricing power to enable it to do that.

Revenues - are being boosted by large orders received by ATIK relating to cameras for PCR machines. These orders were received from a particular customer and they will be completed during H2. SDI has “no visibility” of future orders from this customer.

It sounds like organic revenue growth is going to remain challenging at SDI. Covid gave rise to “revenue and profit fluctuations which have not fully settled yet”, and if the PCR-related orders are finished soon, then I’m not sure that SDI will be able to make up the difference with other activities.

Profits - margins have reduced due to the acquired businesses having lower margins than the group as a whole.

It may also be important to note that “most of our power and heat costs are fixed until Q1 2023” - so there could be a vulnerability in H1 next year.

Net debt - rises to £15.4m, from a net cash position six months previously. Headroom on the bank facility is a further £6m, with possibly an additional £5m available on top of that.

Outlook

The COVID 19 related orders at Atik will complete this financial year, as has been previously communicated. The weighting of these camera deliveries are skewed to the first half of the year. SDI Group continues to execute on its business model, adding two quality businesses to our portfolio and maintaining growth. A higher interest rate environment will lead to a small increase in interest rate expense in the second half. We look forward to delivering a full year trading performance in line with market expectations.

My view

The market has reacted negatively to this statement, although it doesn’t appear to contain very much that is new.

It does contain the news that interest costs are increasing (but is this really news?).

Accordingly, the company’s broker has increased their estimate of SDI’s interest cost for the current year by £0.4m. They trim the adjusted net profit forecast from £10m to £9.7m. They also make a tiny downward adjustment to next year’s adjusted net profit forecast (£9.9m).

My guess is that investors are disappointed to see confirmation that organic growth is at such a low level (3.8%), despite inflation being passed onto customers. This implies that volumes are down organically.

I also read overnight that China is planning to reduce the amount of PCR testing it does. If PCR is finished as a mainstream pandemic tool, then ATIK’s PCR-related orders might also be finished, and achieving organic growth might be even harder for SDI next year.

What all of this says to me is that SDI can reasonably be valued on an ex-growth basis. Sure, this might just be a temporary blip due to the recessionary conditions. But does it make sense to pay a growth company valuation for a company that isn’t growing and that now has a net debt position to manage? I don’t think so.

With the company trading at a PER of nearly 18x last night, I can understand why the shares have come off this morning.

Over the long-term, I would still expect SDI to do fine, assuming that they don’t take on too much financial risk. They appear to be very relaxed about their cash position:

The Group has an unstretched balance sheet and has sufficient access to funds, alongside its steady cash flow, to acquire new companies and invest in our current portfolio of businesses.

I don’t understand why they would want to fly close to the sun - why not spend a year paying off the debt, bedding in the recent purchases, and then carry on with acquisitions?

I still agree with the consensus that this company is of much higher quality than your average AIM stock. The track record is very good, over many years. However, in the absence of growth I would put it at a modest valuation multiple for the time being.

MS International (LON:MSI)

Share price: 377p (+9%)

Market cap: £61m

I’ve just got off the phone with the highly knowledgeable investor Simon Hedger - who tweets at @vokdaquickstep - and has MSI as his top holding, for some extra background info on what is happening at this company.

It’s now up by over 25% since we last covered it in the SCVR in June.

It has been a rare outperformer this year, and has had an excellent few years in terms of share price performance.

This company has paid annual dividends ever since the early 1990s, and its dividends have generally increased over time. Not your average AIM stock!

It is a family-controlled business, with fewer than half of the outstanding shares trading freely. There are four operating divisions:

- Defence

- Forgings

- Petrol Station Superstructures

- Corporate Branding (link)

For more information, check out its Berkshire Hathaway-style website (I am long $BRK.B).

The company issues the bare minimum of RNS announcements, and has no broker coverage (both are indicators of a potentially good investment, in my book!).

Let’s see what we can learn from these interim results for the period ending October 2022:

- Revenue £42m (last year: £33m)

- PBT £3.5m (last year: £0.8m). No adjustments.

- Cash £24m (last year: £15.5m). No borrowings.

Now looking at each division in turn:

Defence

This division “carried substantial costs” in H1, as operations were moved into upgraded facilities in Norwich.

MSI investors are very excited about the possibility of a large US Navy contract, and have been digging into the details around this. Today’s RNS includes the following:

Pleasingly, our participation in the United States Navy's multi- phased programme of 'weapon approval procedures' with respect to our 30mm Naval Gun System, continues to progress through their comprehensive testing procedures. We are encouraged with their observations to date. A great prize, still for us to win! Our existing land and building facilities in South Carolina can be further developed, to meet any resulting defence opportunities.

I don’t think this project is officially “in the bag” but it sounds like it is very close. By all accounts, it could make a big difference to MSI in the years ahead.

Forgings - MSI’s steel forging facilities in the UK, US and Brazil “continue to operate at a high level of activity”. The challenge of rising energy costs “is being successfully managed”.

Petrol Station Superstructures - UK and Poland operations “experienced a high level of quality activity in the period”.

Corporate Branding - “good progress” as it recovers from Covid restrictions.

Outlook - gives little away. This company does not do forecasts.

We believe that we have progressed strongly and created considerable opportunities through our commitment to being bold whilst building a substantial war chest to support our continuing investment, particularly in defence. Notwithstanding, we remain vigilant, in order to react to any changing circumstances.

Interim dividend - 2p (last year: 1.75p)

My view

I defer to those who’ve put long hours into studying this one. What appear to be highly informed comments can be found in the thread below, including once again an interesting contribution from Mark (username “illiswilgig”).

This company does not promote itself at all and so investors must do their own digging and come up with their own investment thesis.

One of the quirky features of today’s results statement is that you have to dig into the footnotes to find any of the details about segmental performance. Here is the relevant table:

That’s probably a lot to take in, but the key points are:

- Defence, despite generating the largest revenue of any division, produced another H1 operating loss. This will hopefully show meaningful operating profits in the periods ahead.

- Excellent growth in revenues and profits at Forgings.

- Good performance from Superstructures, though Corporate Branding again made no contribution to H1 profits.

I will maintain my positive view on this company and this stock, despite the share price having increased materially since I last looked at it.

My reasoning is simple enough. Since I last looked at the company, it appears to have edged closer to US Navy success in its Defence division. The other divisions, in aggregate, have continued to perform very well. And the cash position has grown further: even today, after the latest share price gains, cash still covers nearly 40% of the market cap!

Given that I already had a positive view on the stock, I can’t find any reason to change my view. The share price rise is more than fully justified, in my view.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.