Good morning, it's Paul here!

Graham has passed me the reins for the rest of this week, and all of next week.

Jack Brumby articles

I had a smashing lunch with Jack recently, totally unaware that he was about to join the Stockopedia editorial team! Jack is part of the brilliant (and highly amusing!) team at Langton Capital, which focuses on the hospitality & leisure sector.

The Langton daily email newsletter is an essential read, very highly recommended, if you don't already subscribe (it's free).

Here is the link to Jack's 3 thoughtful articles on Stockopedia, in case you hadn't spotted them already.

Victoria (VCP) meeting

I've been offered a meeting with Victoria this Thursday afternoon. As I happened to be in London already, I've accepted. This should be a useful opportunity to talk through, and ask questions, about the recent aborted bond issue. The company is keen to put across their view of things, and clear up any remaining questions or issues.

I like to be a conduit between private investors and companies, so am happy to throw it over to you. Therefore, if you wish to submit a question for me to ask Victoria management, then please leave your question(s) in the comments section below. I will then report back, hopefully with answers, some time after the meeting.

It's important to give companies a right of reply, I think. Although after the couple of clarification RNSs, I think most of the confusion has already been cleared up.

Persimmon (LON:PSN)

I am very pleased to see that Persimmon has sacked its grotesquely overpaid CEO, Jeff Fairburn, giving this reason;

... the Board believes that the distraction around his remuneration from the 2012 LTIP scheme continues to have a negative impact on the reputation of the business and consequently on Jeff's ability to continue in his role.

If you recall, a badly designed LTIP scheme ended up paying obscene amounts to Directors, with the CEO getting something like £100m. He reduced this to about £75m, but it's still left such an appalling legacy that clearly his position was untenable.

This is executive greed at its worst, and is incredibly socially divisive. If ordinary folk are struggling to pay their rent, imagine how it makes people feel, to hear on the news that this man has personally enriched himself to an unimaginable & unjustified extent? Plus, he didn't really earn the money at all! He just happened to be in the right place, at the right time, when the Government inflated the housing market with its Help To Buy scheme.

People in the City need to understand, that if this kind of thing continues, we're going to end up with a Corbyn Government that will legislate to stop this stuff. Maybe that's necessary, since the excesses have become so ridiculous that something needs to be done.

NEDs, major shareholders, and brokers, need to review every executive bonus, or incentive scheme of whatever kind, to ensure that out-sized payouts are not repeated. I question the entire basis for bonuses & LTIPs for people who are already paid large basic salaries. I don't think they particularly improve company performance. Indeed, incentive schemes can often introduce danger, to take excessive risks (e.g. from debt-fuelled acquisitions). It's pure greed, and in most cases these schemes just pay out when the economy happens to go in the right direction, not because management were especially skillful.

The only exceptions, are where key management are totally indispensable. That does happen from time to time, but not very often.

The City needs to really get its act together on this, or the matter is likely to be taken out of your hands by a future reforming Government. It's probably time that something was done, as things have spiralled ridiculously out of control. I'm sick of seeing not particularly good management plundering the companies they run. This is a widespread problem.

Q3 trading statement - reads positively. Sales and forward orders, are up on last year.

Note that the company talks of resilient consumer confidence! That's rather different from what many retailers have been saying. As I've mentioned here before, the consumer confidence monthly reports show that people are positive (on balance) about their personal finances. That's to be expected since we have full employment, and rising real wages.

The negative perception is because of the current political uncertainty over Brexit. Hence why consumers (according to the monthly GFK reports) are simultaneously positive about their personal finances, but very negative about the economy as a whole.

Anyway, people are clearly still enthusiastic to buy houses, so things can't be as bad as most journalists like to tell us they are.

Another point to consider is that retailers are having a tough time because business is slipping away online, and there is widespread over-capacity. That's not a sign of weak consumer demand, although it's often wrongly portrayed in that way. Business is just being spread more thinly.

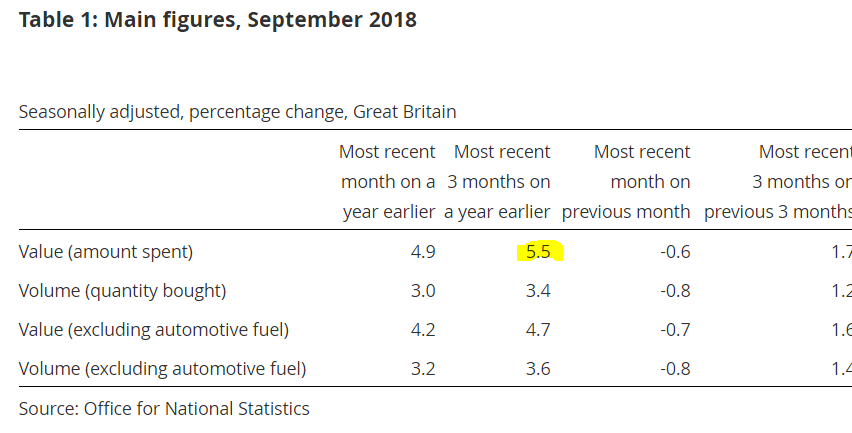

As you can see from the table below, overall retail sales are growing strongly. So much for supposedly soft consumer demand!

If retailers are complaining about soft demand, it's because their competitors (maybe online) are fulfilling customer demand. Not because there's a lack of demand. Hence why it only makes sense to buy retailer shares, if they have a successful online strategy.

EDIT - there is also an update from another housebuilder today, Redrow (LON:RDW) . It is trading in line with expectations, although it cautions that the London property market is "subdued", due to excessive Stamp Duty & Brexit concerns.

BOTB

Share price: 236p (up 6.3% today, at 09:15)

No. shares: 10.1m

Market cap: £23.8m

(at the time of writing, I hold a long position in this share)

Best of the Best PLC, (LSE: BOTB) the online organiser of weekly competitions to win cars and other lifestyle prizes...

Today we are provided with a positive update;

... is pleased to announce that trading for the six months ended 31 October 2018 has been encouraging, with revenues and profits before tax generated tracking ahead of market expectations for the current financial year.

Broker update - there's a note out this morning from the house broker. It raises forecast profit for FY 04/2019 by 14%, to £1.6m.

In EPS terms, the latest forecast is 13.5p, giving a PER of 17.5 - the cheapest it's been in quite a while. That's a good price, for a decently growing, profitable, online business, in my opinion. There is now only 1 remaining physical location - the business used to be best known for operating from airport concourses. It's now migrated almost completely online.

The problem is getting hold of shares, as it's highly illiquid.

CEO interview - I interviewed William Hindmarch, BOTB's CEO recently, here's the link to the audio.

My opinion - as the house broker points out today, the falling share price is inconsistent with improving performance & rising profit forecasts.

Unusually, BOTB has been a very generous dividend payer in recent years, including some lovely special dividends.

The increase in Remote Gaming Duty may have spooked some investors. The company sounds unconcerned about this today, saying it will take steps (unspecified) to mitigate the tax rise. As FinnCap points out, historically the company has navigated regulatory & tax changes well, so this doesn't seem cause for alarm.

This share sits comfortably in the "hold forever" part of my portfolio. I see considerably long-term potential here. I'll try to persuade the company to come along to Mello London, to meet hundreds of serious investors that are attending, including lots of readers of these reports.

Fulham Shore (LON:FUL)

Share price: 11.75p (up 9.3% today, at 11:38)

No. shares: 571.4m

Market cap: £67.1m

(at the time of writing, I hold a long position in this share)

Fulham Shore is a restaurant group with 2 main brands - Franco Manca pizzerias, and The Real Greek. Its Chairman is the experienced restaurateur, David Page - which is part of the appeal of this share.

I agree with MrContrarian, who posts his informative & pithy updates every working day here in the comments section. Incidentally, can I join with several readers, who thank him for posting his early morning thoughts - it's excellent stuff, and often helps give me a steer as to what companies to look at in more depth later in the day.

MrC reckons that today's update from FUL is "positive sounding, but useless". I agree, for the following reasons. It says;

Fulham Shore has had a successful first six months of the financial year with turnover and customer numbers across both of our restaurant businesses ahead of the same period last year...

Of course turnover & customer numbers are up, because they've opened lots of new sites! So this comment is too vague to be of any use. What we really need to know, is what the LFL performance has been, for existing sites? There's no mention of that.

I suppose the use of the phrase "successful first six months" implies that trading must be good. Why not make it more specific though?

Store roll out - expansion was previously quite rapid. Given very tough market conditions in the casual dining sector (due to massive over-supply), the roll out of new sites has sensibly been curtailed;

We continue to search out well located sites for our two successful businesses in order to proceed with our prudent expansion programme.

I like this. Debt levels had got a little higher than I would have liked. So a prudent expansion programme is sensible. Waiting is also likely to deliver better property deals on new leases too, as many High Streets thin out, and end up with desperate landlords, eager to fill empty units with quality leisure operators.

My opinion - many investors follow the herd, and say to me that they would never invest in casual dining companies, given how tough that sector is. I think that's a mistake. The point is that, even in tough market conditions, the best operators do well.

I see Franco Manca & The Real Greek as being popular formats, with an everyday good value pricing policy. They're not perfect formats (the Franco Manca menu is awful - far too limited choice of pizzas), but they're distinctive & the food is good quality, and good value. Sites are often smallish, with a policy of filling them, and hence getting a decent amount of turnover from modest fixed overheads.

On my site visits, staff have been motivated & charming - that's at about 3 different sites. The company pays adult minimum wage to all staff, not just the over 25's, and staff keep the tips. This makes an amazing difference. A lot of the Franco Manca staff are Italians. So sometimes you almost feel as if you're gate-crashing an Italian house party, when eating your pizza! The "No Logo" beers are excellent, and good value. It's a great format basically.

Meanwhile the share price has roughly halved since last summer, to reflect tough market conditions. That's fine by me, I was happy to buy the shares some time ago at a much more attractive price.

Some people may not like the accounting adjustments, although in my view they're fine.

The current share price looks about right to me. Longer term, I see potentially good upside here, so it's a core long-term holding for me. There are no dividends yet, as it's focusing cashflow on expansion.

Note that the sector is not altogether dead. Restaurant (LON:RTN) recently announced a hare-brained scheme to buy Wagamama at far too high a valuation, in my view. That could well flop. However it does show that the best operators in the restaurant sector are potential bid targets.

It is likely to take years for the weaker operators to exit the sector, but that process is already underway. There should therefore be a lot more business to go around, in years to come, for the operators that can still thrive in a tough market. I see FUL as being that type of business. So there's not necessarily much immediate upside on the share price, but I reckon it's likely to be a long-term winner.

Lookers (LON:LOOK)

Share price: 98.5p (up less than 1% today, at 13:01)

No. shares: 392.0m

Market cap: £386.1m

Lookers plc, ("Lookers" or "the Group"), one of the leading UK motor retail and aftersales service groups, issues its trading update for the period ended 30 September 2018.

This sector looks very interesting at the moment. Share prices have been hit by short term supply issues, connected with manufacturers' failure to meet new emissions standards in time. Those supply issues now seem to be getting resolved. So there could be a buying opportunity, possibly? Brexit also weighs on things, so if you think that UK-EU trade is likely to be affected significantly by Brexit, then probably best move on to the next section!

As with the positive update above from housebuilder Persimmon (LON:PSN) , car dealership Lookers is also today reporting solid trading. So a pattern seems to be emerging here that consumers are perfectly happy about making big ticket purchases. That's not what the media has been telling us, is it, with the daily dose of doom & gloom on the television news.

Lookers says;

Trading was positive in the third quarter, against strong comparatives, with an encouraging result during the important month of September and with full year expectations unchanged...

Interestingly, Lookers says that it was able to increase margins when supply was short in September;

Against this background, we are pleased to report a very respectable result for the important month of September, despite the challenges in the supply of new cars.

We were able to mitigate the effect of the reduced volumes in the market and take advantage of this short supply by improving our margins on new cars across the quarter as a whole.

This is very interesting, as it could well have read-across for any Brexit-related disruption. If dealers can mitigate supply problems by jacking up prices, then there's probably nothing much to worry about. The dirt cheap valuations in this sector therefore look appealing to me.

Used cars - sounds good;

The used car market continues to be buoyant and values have remained stable and predictable in the period.

Used cars contributed 27% of total gross profit and are an important and successful part of our business, delivering additional growth in both volumes and gross profit.

Aftersales - also performing well, and it's highly significant, at 42% of total gross profit.

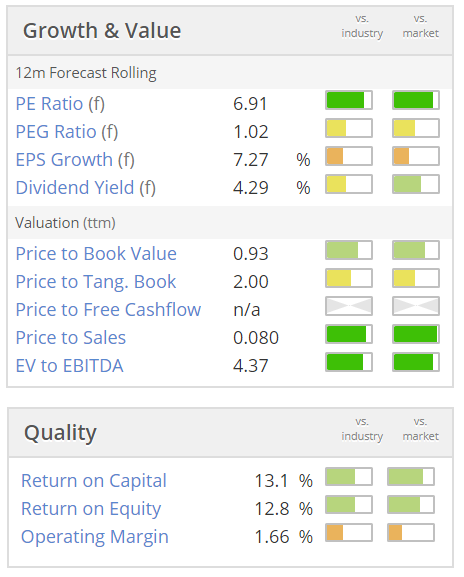

My opinion - this looks worthy of a closer look. The company has today confirmed full year market expectations. Yet look at how low the valuation is;

There's quite a nice dividend yield there too, and good tangible asset backing.

Overall - I think there could be some good buying opportunities in this sector right now, after sharp recent share price falls. It's proving more resilient than some investors might have imagined.

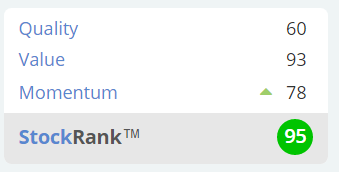

Stockopedia likes it too, with a high StockRank, and "Super Stock" classification.

That's it for today - nothing else on the RNS interested me.

See you tomorrow!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.