Good afternoon/evening/morning, it's Paul here.

What a beautiful surge in temperature this week, which I have enjoyed very much, and hope you have too!

Hopefully I shall be able to report back to you shortly on a private matter, which has caused me immense anxiety. It concerns a guarantee I gave (foolishly) to a friend's pubs. I never imagined that the PG would actually kick in. It has. Hopefully it should get sorted out at some point.

Here in Bournemouth there was a terrible accident, some time ago, when a Red Arrows pilot tragically lost his life, in a display crash. Local children were invited to design a memorial. A local artist then took it further.

I spent 10 minutes today, just taking some time to ponder what a beautiful memorial it was to the Red Arrows pilot, called Jon Egging. Here it is - isn't this magnificient?

You can't see it in this picture, but there are coloured glass bubbles in the exhaust trails of each plane.

It's incredibly moving, when you see the memorial, with the light shining brightly through the coloured glass bubbles in the exhaust trails, on a vividly sunny day such as today.

There was another plaque nearby, which commemorated a Spitfire pilot, who also lost his life, when his plane crashed in the vicinity during the Battle of Britain.

Anyway, I think we have a busy day on the horizon - it's results from Gear4Music (in which I have a long position) - a costly growth stock, which institutions seem to want to buy.

Also, I think results from Zytronic (LON:ZYT) are out in the morning.

I'll be taking my time to amble through things. Graham has got a heavy cold, so you'll have to put up with me for the rest of the week! I'll do my best, we'll see what happens lol.

Book recommendation

I start lots of books, but rarely finish them. This is why I rarely trouble you with book recommendations.

Occasionally, maybe once per year, I'm gripped - and enjoy a book so much, that I don't want to put it down.

For me, such a book, the book of 2018, has been "Return To Go", written by Jim Slater, in 1977 - this was just after his business career went from a supreme high, to a degree of difficulties - along with everyone else - did you know that the stock market fell an astonishing 75% in that 1974 bear market? The banks almost collapsed. Anyone who thinks 2008 was unique, is wrong - 1974 was actually quite a lot worse.

I was only 6 years old, so cannot vouch for that myself! Although I do recall the power cuts, and our living room being illuminated only with candles. Mum occasionally had to warm up tins of spaghetti hoops with a little blue camping-gaz stove, in the darkness. It seems bizarre now, but things really were pretty awful in the energy crisis & 3-day week of 1974.

Thatcher sorted out things later, from 1979. That is why I like her so much - as I saw everything gradually get better (in the south) when she took control. The number of working days lost due to strikes, fell to become almost insignificant. Britain went from being the "sick man of Europe", into something resembling an enterprise economy.

Of course, if you worked in heavy industry, in the North, then you would have a different view - blaming her for structural changes that were actually inevitable & long overdue.

Anyway, "Return To Go" is a riveting account of the rise & fall of Slater Walker, during the easy credit days of the buffoon Heath's Government.

For many of us, it was Jim Slater's wonderful book, "The Zulu Principle", which whet our appetite for investing. It certainly was for me - concentrating on small caps, as a specialism, has served me very well.

Can I just also say, that older books which are perhaps obscure, can sometimes be the most fascinating. I don't like revisionism. I'd rather hear history from people who lived it, and remember it vividly, and recently.

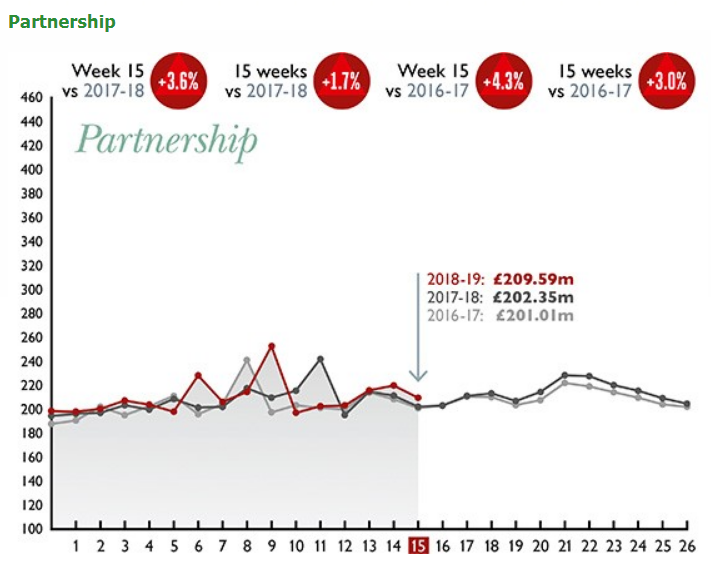

John Lewis Sales Figures

It's quite interesting to read the weekly updates published by the John Lewis Partnership. This provides a good gauge of retail sentiment, and performance, with read-across to many other companies.

You can sign up for a weekly email update here, which is worthwhile for people brave or foolish enough to invest in retailers! The nice weather will certainly be helping retail sales.

As mentioned before, I'm much more optimistic about the UK consumer than most commentators & investors. This is based on the fact that average wage rises have now risen above (falling) inflation. The annualised impact of weaker sterling is now reversing, and sterling is now somewhat stronger than the prior year comparatives. This is positive because it means inflation should reduce - I believe we could be looking at near-zero inflation this time next year.

This view was bolstered by optimistic recent outlook comments from Next (LON:NXT) (which is my largest personal shareholding at the moment), and looks strikingly good value to me.

As you can see above, JLP seems to be trading reasonably well, no doubt assisted by pleasant weather in recent weeks.

We do of course have to be terribly careful in picking retail shares - as some, like Carpetright (LON:CPR) , Mothercare (LON:MTC) , are already in financial difficulties. Debenhams (LON:DEB) looks very vulnerable too.

I'm only interested in retailers which;

- Have short leases, hence the ability to exit from loss-making sites,

- Are successfully transitioning to online sales (which must be a fairly high % of total sales)

- Strong balance sheets, enabling them to avoid dilutive fundraisings

- Ideally also with some hidden additional value - e.g. licensing/royalty profit stream, valuable properties, etc.

- Unique product, designed in-house - not re-selling other peoples' products

- Some kind of niche product/service that can't be easily replicated

That list should help avoid the banana skins littered around the sector, and might help find a bargain or two.

Sprue Aegis (LON:SPRP)

Share price: 97.5p (down 26.4% today, at 12:36)

No. shares: 45.9m

Market cap: £44.8m

Sprue (AIM: SPRP), one of Europe's leading developers and suppliers of home safety products announces its audited final results for the year ended 31 December 2017.

It's mostly smoke alarms that this company sells.

The reason the 2017 accounts are so late, is because of a dispute with a key supplier. As regulars here will know, I've been sceptical about this company for a while. This is down to its accident-prone nature, with a series of problems that have hurt investor sentiment badly;

I like candlestick charts, as the large red bars correspond with bad news, thus flagging it more clearly than on a conventional chart. Look how many big red bars there are in the last 3 years with this company!

I reported here on 10 May 2018, on a settlement agreement which Sprue had reached with BRK. The share price responded positively to that announcement, as embattled investors thought that maybe it was time to emerge from their bunkers.

With the share price down 26% today, then clearly the figures and/or outlook comments today have displeased investors. Let's have a look.

The P&L figures don't look too bad, in the context of the company only being valued now at £44.8m.

Revenue down 4.9% to £54.3m

Pre-exceptional adjusted operating profit up 114% to £4.7m

The exceptional charge of £3.8m relates to the BRK settlement, and was pre-announced last week, so that's not a surprise. I think it's fair to say that this is indeed exceptional, so can be ignored if we're trying to ascertain the underlying trading position.

Ah, I think I've found a reason why the share price has fallen sharply today;

Sales in the four months to 30 April 2018 are approximately 20 per cent. lower than in 2017, primarily because of lower sales into Germany due mainly to overstocking.

Whilst the Board believes that manufacturing Sprue's products at Flex, Poland, plus the investment into technology building blocks will open up growth opportunities, and is the right move for the Group strategically, in the short term, this has impacted the Group's trading as management has been focused on the transition plan, and latterly, on settling the dispute with BRK amicably.

So it's another profit warning basically.

With disruption from the transition to the new FireAngel range, new product introductions and lower than anticipated sales into Germany in H1 2018 due mainly to overstocking, the Board expects that the Group will report an operating loss for H1 2018.

In addition, the Group's sales and operating profit for the full year are likely to be significantly below the most recent market expectations.

The Company's 2018 results will be more heavily weighted towards H2 than has been the case in recent years as we install new FireAngel retail ranges, potential new sales emerge and sales into Germany are expected to recover.

Oh dear, that's pretty lousy then. Will shareholders once again be giving SPRP the benefit of the doubt? Patience must have worn very thin, even for bulls in this stock.

If you treat this year as a one-off, then there could be a recovery in 2019;

However, the Board expects the Company's operating results to improve significantly in 2019 and beyond when there is no BRK distribution fee to pay and, as expected, sales increase into newly emerging channel opportunities and recover in the Group's key market, Germany, together with sales growth in UK Retail and UK Trade."

Dividends - there is no final divi for 2017.

Balance sheet - this is the crux for me. The company had big cash balances in the past, and paid decent divis. If its balance sheet remains strong throughout this period of turbulence, then it might make a decent recovery play.

Overall, the balance sheet looks alright to me.

NAV: £27.0m. Deducting intangible assets get us to;

NTAV: £13.8m

Current ratio: 1.77 - which is strong. However, both inventories and receivables look too high. The company mentions problems with customers paying more slowly, hence this is sucking in cashflow.

Cashflow statement - looks poor, not just in 2017, but also prior year. In both years operating activities generated a negative cashflow. There was then the cost of significant capex - £5.0m in 2017, and £4.3m in 2016, about half of which was intangible assets (e.g. product development costs).

The total reduction in cash was £8.5m in 2016, and £11.1m in 2017. This has resulted in the company burning through a £22.4m cash pile at the start of 2016, with only £3.3m left at end 2017. That's very worrying.

The trouble is, with more capex planned for 2018 (on tooling at the new Polish manufacturer), and the monthly payments to BRK, the cash burn looks set to continue.

Going concern note - I'm worried by the going concern note in today's announcement, which flags up various risks. It concludes;

Consequently, at the date of this report, the Directors have a reasonable expectation that the Group and Parent Company have adequate resources to continue in business for the foreseeable future. Accordingly, the financial statements have been prepared on the going concern basis.

That's all very well, but given how unreliable this company has been in the past, I'm not minded to put any reliance on management assurances.

My opinion - I think things are looking quite precarious here, potentially.

It's now loss-making, and has heavy cash outflows expected this year too.

Therefore, the business looks to be dependent on its bank facility. To have demolished a big cash pile in 2 years, is very worrying.

The FD left suddenly in Mar 2018, which again points towards all not being well.

I think there are enough red flags here, to make the share uninvestable as far as I'm concerned. It could be a decent turnaround in 2019, but there's a risk it might not survive long enough to achieve that, if the cash burn continues at its prodigious existing rate.

Cenkos Securities (LON:CNKS)

Share price: 110p (up 5.3% today, at 13:51)

No. shares: 55.3m

Market cap: £60.8m

(at the time of writing, I hold a long position in this share)

AGM Statement (trading update)

- Disappointing Q1

- Fee income has improved (in Q2, presumably)

- Pipeline also improving

- More optimistic on full year outlook

- Capital position has improved, through asset disposals

My opinion - I don't normally invest in financials, but this broker has looked strikingly cheap for some time. The balance sheet is also very strong.

Earnings are erratic, but the company pays out hefty dividends in the good years.

It's a nice share to tuck away for income, which is why I hold it. Every now and then a whacking great dividend appears in my account. In the last 6 years, it has paid out 65.5p in divis - for a share which you can buy now at 110p.

I was worried about the risk of the company de-listing, if the valuation remains this low. Graham's article yesterday on de-listing risk, was I think excellent, and a timely reminder. In the case of Cenkos, I doubt it would de-list, because the listing serves the purpose of allowing staff to cash in their share options & sell them into a market. That continuous selling could be why the share price remains so depressed, maybe?

Its profits are highly erratic, because the big years are due to one-off large flotations. Even so, it seems a very attractively-priced share to me, if future business is good. Today's update seems reassuring, and seems to be pointing generally towards more buoyant stock market sentiment. It looks as if this bull market could continue.

Gear4Music (LON:G4M)

Share price: 717p (down 1.2% today, at 14:35)

No. shares: 20.87m

Market cap: £149.6m

(at the time of writing, I hold a long position in this share)

Gear4music (Holdings) plc, ("Gear4music" or "the Group") (LSE: G4M), the largest UK based online retailer of musical instruments and music equipment, today announces its unaudited financial results for the 12 months ended 28 February 2018.

Why is this company valued at almost £150m, when its profits are small, and have fallen year-on-year? The reason is that it's all about top line growth. This is effectively a period of land-grab, where in various product areas, a small number of dominant players are emerging. Obviously the big one is Amazon. Then in fashion (in the UK), we have ASOS (LON:ASC) and Boohoo.Com (LON:BOO) and surprisingly perhaps, also Next (LON:NXT) . Then there are lots of other brands, many of which are likely to fall by the wayside in the future.

As regards musical instrument eCommerce, the dominant European player is called Thomann. However, Gear4Music appears to be making considerable progress, in Europe as well as in the UK.

G4M has a low gross margin of only 25.4% (down from 27.0% last year), but its average order value is high, at £127 (up 3%). So the way I look at it, the gross profit is £32.26 per order - a respectable figure.

The company and its advisers have managed investor expectations very well, in my view. We were told some time ago to expect flattish profits this year. This is because the company is concentrating on driving growth, which requires some up-front costs (e.g. initial losses from new distribution hubs in Germany & Sweden). The company then sees a benefit from that investment, because it can better manage deliveries, and provide next-day deliveries.

There is also the issue that some brands (e.g. guitars) require that distributors have a physical showroom in every country. So opening a distribution hub in Germany moved G4M up the pecking order.

The other reason that short term profitability doesn't really matter, is that marketing spend is the key driver of sales growth. Once sufficient scale has been achieved, then marketing naturally falls as a percentage of revenues, which in turn drives up the future profit margin. This is also the main barrier to new entrants achieving scale - they can't afford to spend the big marketing bucks which creates scale.

I'm printing off the full results statement now, and will read it thoroughly outside - OK that's at least partly an excuse to sit in the sun for a while! More later....

Having read the full results now, here are a few key points;

- Strong revenue growth +43% to £80.1m

- Distribution capacity is being increased to handle £150m annual future sales

- Profitability in 02/2018 fell by 25% to £1.96m, but this was flagged in advance, and isn't a concern in my view

- Market share is only small - estimated at 6% of UK market, and 1% of European market - so plenty of growth potential - this company should continue to grow strongly for years to come, in my view - which is why the shares look expensive, based on current profitability

- Own-brand products are just over a quarter of total sales. These tend to be higher margin.

- Marketing spend is £6.7m, or 8.3% of revenues. As the business grows, then this percentage should eventually fall, thus boosting profits. I like the fact that, in a recession say, marketing spending could be switched off, or reduced. It's discretionary, which is a very attractive feature of eCommerce business models.

- Freehold property - £5.6m was spent recently on the new freehold Head Office. There is £5.2m bank loan relating to this property.

- Balance sheet looks fine, although given the high share valuation, I'd quite like to see a say £4-5m placing done, to give more headroom on cash reserves. That would only be about 3% dilution, so barely noticeable, but would provide additional balance sheet comfort & flexibility on purchasing.

- Development spending of £1.7m was capitalised.

Outlook - the company sounds confident, e.g.;

Whilst FY18 profitability reflects the investments made in our European operations and customer proposition to drive market share, we remain confident in our outlook for the new financial year.

As we continue to implement our long-term growth strategy for FY19, we expect to see ongoing strong revenue growth, alongside increasing profits and cash generation.

My opinion - the share looks priced about right to me. The market tends to value fast-growing eCommerce companies on a multiple of sales, rather than earnings. In this case, the PSR of just under 2 looks right to me. As revenues are likely to rise maybe 30-40% again this year, then that should drive share price appreciation further, given time.

The main risk is that the bull market conks out, and everyone suddenly becomes more bearish on valuations. In which case, the high ratings for growth companies could come into question. So it's more that general de-rating risk which is the issue.

As regards execution, the management team at G4M don't seem to have put a foot wrong. It's really difficult, managing any business that is growing this fast, and that needs quality management. I really rate the team here - they're exactly the type of down-to-earth, passionate entrepreneurs that I seek out. They still have a ton of skin in the game too, with the founder having a large personal shareholding.

The detailed narrative today reinforces how businesses like this are constantly changing & adapting to drive forward their customer proposition. This leaves behind older, more ponderous businesses which struggle to compete. How can any physical retailer compete, when G4M offers a staggering 44,700 product lines (not all are held in stock though, some are drop-shipped, I believe).

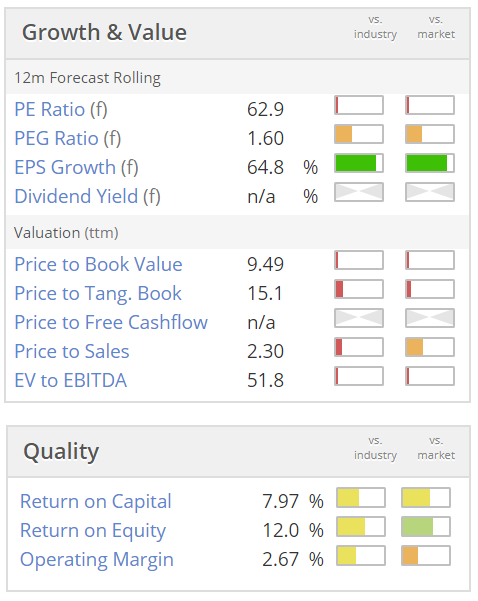

This share won't appeal to traditional value investors. These valuation metrics look pretty awful! However, that's not really what this share is about. It's a rapid organic growth share, and that drives the high valuation;

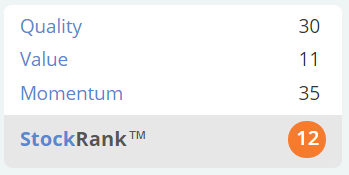

The Stockopedia algorithms don't like growth companies generally. So it's classified as a "Sucker Stock", and has a very low StockRank (see below). That doesn't particularly concern me, as I understand how the StockRank system works. It's not designed to select growth companies in particular. So I see the low StockRank as being a general warning, which I would expect to see at any fast-growing eCommerce company. It's the nature of their business models that, during the fast growth phase, profits tend to be recycled into more marketing spend. Therefore, on conventional metrics, shares like this look expensive & poor quality for a while.

Bulls of this stock are looking through the figures, and instead concentrating on the high likelihood that this will be a much bigger business, making very much greater profits, in say 5 years' time.

Zytronic (LON:ZYT)

Share price: 411p (down 8.7% at market close today)

No. shares: 16.0m

Market cap: £65.8m

Zytronic plc, a leading specialist manufacturer of touch sensors, announces its consolidated interim results for the six months ended 31 March 2018.

Rather lacklustre, these half-year figures look.

- Revenue down 6% to £10.6m

- Basic EPS of 11.7p is down 15%

- There's usually an H2-weighting to profits, so I reckon the full year might be something between 25-27p EPS

Balance sheet still stuffed with cash - of £13.7m - or just over 85p per share - highly significant

Dividends are now paying out the bulk of earnings - which makes ZYT attractive as an income share. The cash-rich balance sheet also means that it has flexibility to continue paying decent divis, even if earnings disappoint.

Outlook - it doesn't sound as if the company is going downhill;

The second half of the year has started with some improvement in demand from the ATM market and an increased number of projects in the growing Gaming sector.

This is consistent with the improvement in trading normally experienced in the second half, and whilst growth may be suppressed compared with recent years, we expect to make good progress in developing our unique, award-winning products, particularly in the USA and Asia.

My opinion - if we assume that the company might do 26p EPS this full year, then I reckon a PER of about 12-14 looks about right - since the company can't really be seen as a growth company. That implies a share price of 312-364p, as opposed to the current share price of 411p. You could argue that the cash pile makes up the difference, so it's probably priced about right.

The Achilles Heel for this company is its reliance on lumpy, rather unpredictable customer orders, from a handful of key clients. So it's rather difficult to value.

The strong balance sheet, and much improved dividends (now yielding over 5%) are attractive. For me though, the inherent unpredictability of orders, and lack of overall growth, mean that it doesn't appeal to me very much.

I suppose there is a good case for holding the shares for the dividend income, and hoping that growth might accelerate in future - triggering a re-rating.

Here are a couple of quick comments to finish off with.

Patisserie Holdings (LON:CAKE) - excellent interim results are out today. Revenue is up 9.1%, and pre-tax profit is up 14.2%.

This tea/coffee/cakes outlet seems to be sailing through the choppy waters of town centre retailing, with complete ease. I'm perplexed as to how this can be, when so many other town centre operators are complaining of low footfall. That doesn't seem to be affecting CAKE.

The balance sheet is outstanding, and net cash has grown to £28.8m despite funding store roll outs, and (modest) divis.

This business really is a class act, which is reflected in a forecast PER of 22.4.

Accrol Group (LON:ACRL) - another placing has been announced, at 15p (a 21% discount to yesterday's closing price). This time it's set to raise £8.0m, of which £320k is coming from the Directors. There's also an open offer for existing shareholders, for another £2.0m.

I cannot understand why investors are prepared to refinance the company again, given that it has such a deeply flawed business model, as tacitly admitted today;

The Directors believe, having taken into account the net proceeds of the Placing, that the Group will have sufficient working capital for its short term requirements. However, the Board is unable to make any confirmations about the sufficiency of working capital beyond this due to the Group's working capital being highly sensitive to, amongst other things, Parent Reel pricing, foreign exchange fluctuations, the level of turnover and the pace of progress on the Group's ongoing operational restructuring.

It's completely uninvestable, as far as I'm concerned.

It will still have net debt of £25.5m, even after this placing is completed.

It's really quite shocking that a company with such a risky business model, and organisationally in a complete mess, was allowed to float on the stock market in the first place.

Lookers (LON:LOOK) - car dealers are looking very interesting right now, with fairly positive trading updates having come from several in recent weeks. Lookers today says, in relation to Q1;

Overall, trading performance in the quarter was positive with a strong result during the important month of March.

Cashflow has been boosted by £30m sales proceeds of properties which were put through sale & leaseback.

Current trading is described as "encouraging".

This looks pretty good, and the shares are worth a closer look.

That's it for today, thanks for dropping by!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.