What is factor investing?

What drives stock returns? It's a puzzle that most individual investors never seem to figure out. By picking stocks on gut feel or a promising story, we tend to play the market like a lottery. But lottery stocks have lottery outcomes. While some win big, many lose.

Yet, the drivers of investment returns are an open secret. A hundred years of research, practice, and academic science have proven that certain quantifiable characteristics, or ‘factors’, can deliver market-beating returns.

Such factors can include measures of company size, profitability, valuation and share price strength. A factor is most useful if you can sort the market by that characteristic (e.g. the P/E Ratio) and find that the stocks at one extreme (cheapest) reliably outperform those at the other (most expensive). If so, you can build a portfolio of stocks that rank best for these kinds of traits, in the hope of market-beating returns.

As Andrew Ang, the Head of Factor Strategies at BlackRock, has put it: "Factors are the language of investing that everyone should be speaking".

Which factors work?

While investment fads come and go, certain factors have outperformed persistently over many decades and across different sectors and regions.[1] And while there is still a little disagreement, in stock markets the following five factors are generally recognised as being most enduring and most investable:

Quality - profitable stocks beat unprofitable stocks.

Value - cheap stocks beat expensive stocks.

Momentum - improving stocks beat deteriorating ones.

Size - small stocks beat large stocks.

Volatility - low-volatility stocks beat high-volatility stocks.

Market-beating performance

The most powerful factor driving any stock is the market itself. When the stock market is rising, it creates a rising tide that lifts all boats. As Bill O'Neil once said, "at least 50% of the whole game is the general market".[2] Of course, if you are happy to earn average returns, you can just go and buy the entire market using passive index-tracker funds. This is adequate for many investors.

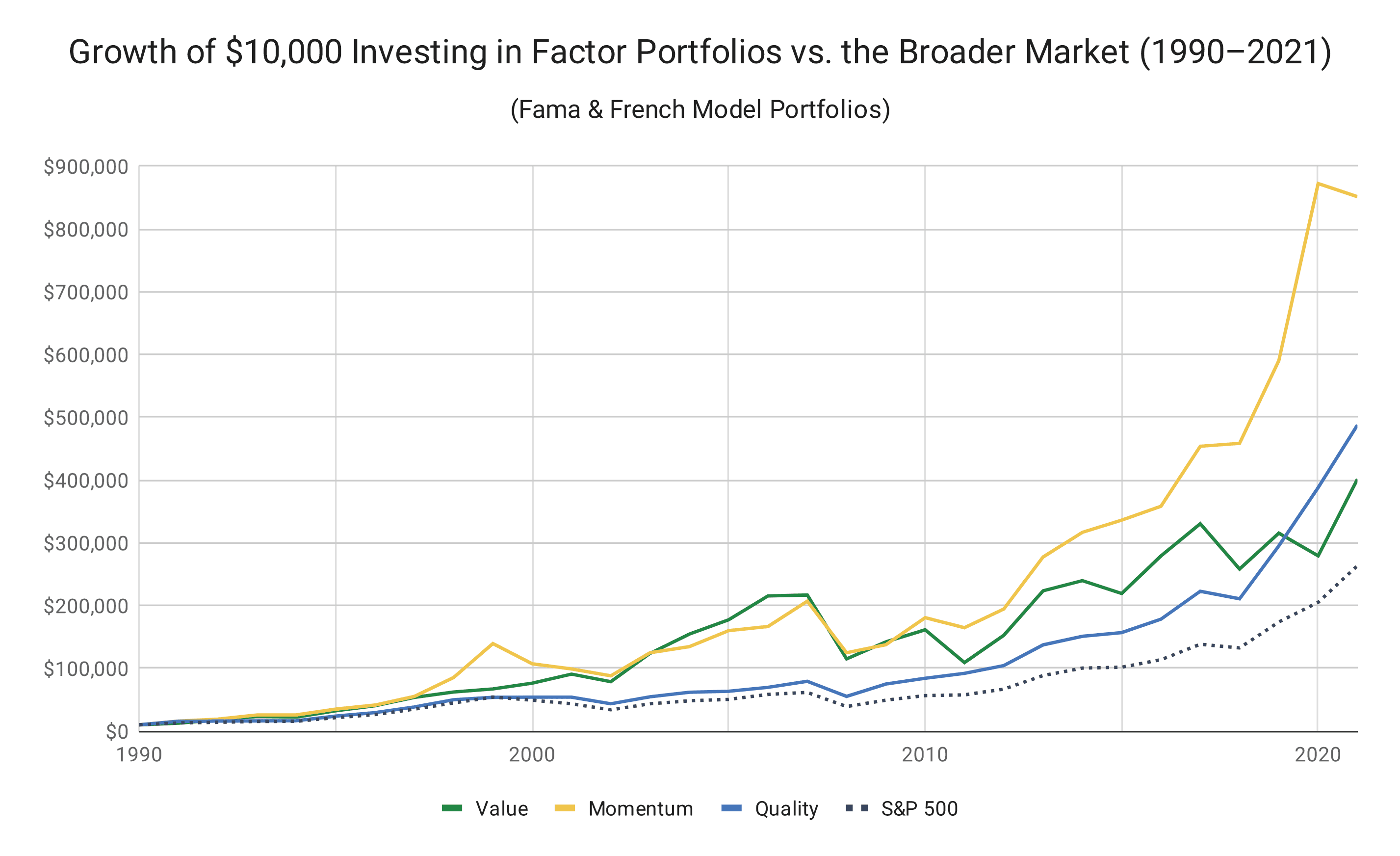

But as you've got this far, you may well be interested in earning more than the market return. And as the following chart shows, you can find those returns by picking stocks that rank well for factors. Over the three decades since 1990, the returns to the top 10% of US stocks ranked for quality, value and momentum factors have significantly outperformed the market.[3]