Good morning!

Today's report is now finished (12.30). Please feel free to leave any additional requests in the comments if there's something you'd like us to look at, and we'll try to cover some of them later this week if time permits. Have a good afternoon.

Explanatory notes

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day. We usually avoid the smallest, and most speculative companies, although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We have a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Add your own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing. Links:

Daily Stock Market Report: records from 5/11/2024 (format: Google Sheet).

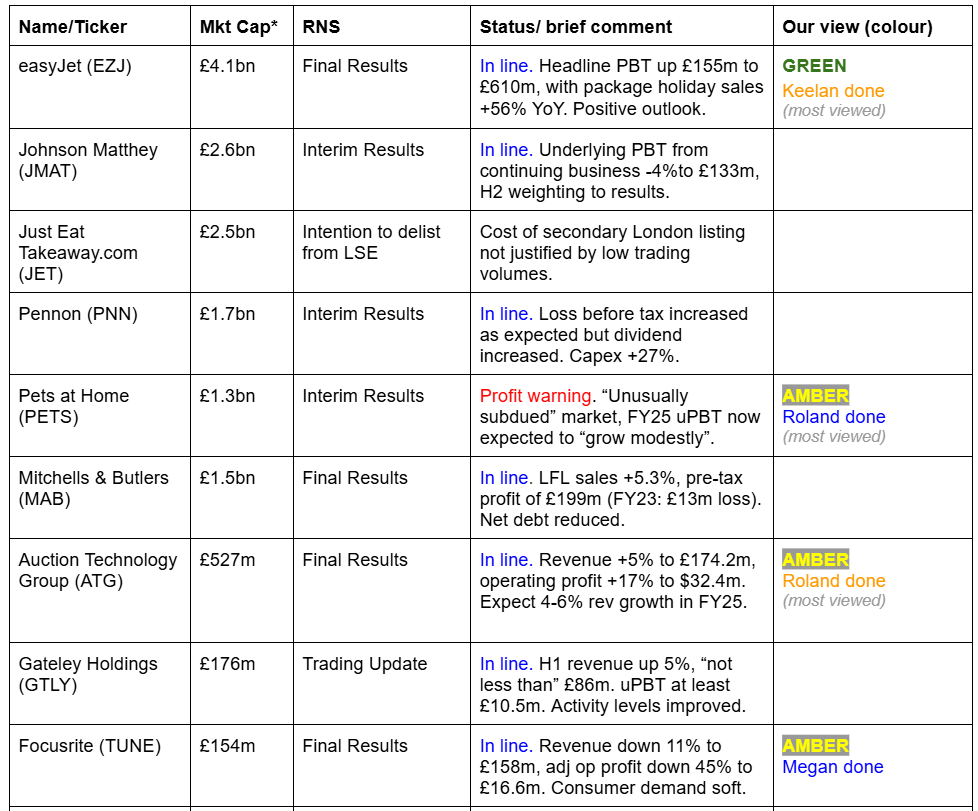

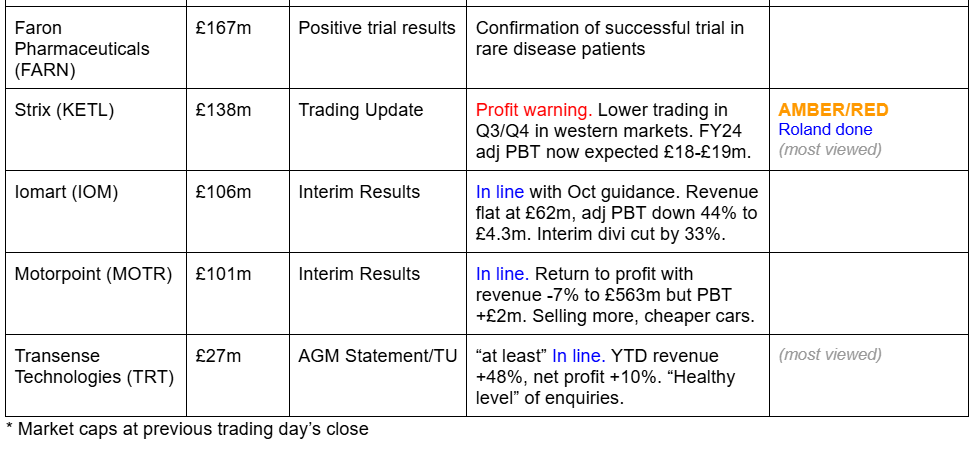

Companies reporting

Summaries

Strix (LON:KETL) - down 9% to 55p (£128m) - Trading update - Roland - AMBER/RED

Another profit warning from the kettle controls manufacturer translates to a near-30% cut to 2024 earnings forecasts. While I can see potential in some elements of this business, I’m wary about the indebted balance sheet and unsure about the broader outlook.

Pets at Home (LON:PETS) - down 10% to 248p (£1.1bn) - Interim Results - Roland - AMBER

The pet and vet group has cut profit guidance for FY25, saying that subdued market conditions are continuing for longer than expected. However, underlying pre-tax profit is still expected to increase “modestly”. I can see some value here, but also several possible headwinds, so remain neutral.

easyJet (LON:EZJ) - up 1% to 545p (£4.1bn) - Final results - Keelan - GREEN

easyJet delivered robust FY2024 results this morning, with headline profit before tax rising 34% to £610 million, driven by a 56% profit surge in its Holidays division. The company is capitalising on fleet efficiencies and growth in package holidays. The company's dividend hike, growing cash pile and optimistic outlook put it in strong standing for 2025.

Auction Technology (LON:ATG) - up 17% to 515p (£627m) - Final Results - Roland - AMBER

Today’s results suggest trading could be strengthening into the new financial year. However, shares in this online auction software group don’t look obviously cheap to me and the balance sheet is not especially strong. At least one broker has trimmed FY25 forecasts following today’s numbers. I remain neutral.

Short sections

Halfords (LON:HFD)

Up 15% yesterday to 147p (£283m) - Interim Results - Megan - No colour

Flat sales and slight decline in underlying pre-tax profits were enough to send shares in beleaguered motoring and cycling retail group Halfords (LON:HFD) up 15% yesterday. Expectations are low for the company, which has had to warn of the fallout from weakening market conditions twice this year. Prior to this interim results announcement, shares had fallen to record lows. Consensus earnings forecasts for the year to March 2025 are now just over 9p, down from 19p at the start of the year.

Let’s be clear, these interim results are not good. The company reported a loss of market share in both its autocentre tyres and retail motoring divisions and only a miniscule gain in a severely weakening cycling market. Pre-tax profits from continuing operations were down 17% and it takes some heavy and rather confusing adjusting to help the company report only a 2% decline in what management calls ‘underlying’ pre-tax profits.

And H1 is the profitable half of the year. In the coming months the company will have to stomach additional freight charges, while the rollout of new ‘Fusion’ stores will force the temporary closure of some Autocentres, at an estimated £1m cost to revenue.

The company has also confirmed that the national insurance and minimum wage hikes announced in the budget will add £23m of additional labour costs in FY26 alone. That’s equivalent to about 40% of net profits. A spokesperson for the company confirmed the rather large figure for a company that employs about 12.5k staff and noted that unlike some other retailers, Halfords’ financial year aligns with the tax year so staff cost increases will have a full year impact.

Megan’s view

I can offer a consumer perspective on Halfords because as an investor this is not one for me. I am a very keen cyclist and I like to spend money on cycling gear or gadgets or trinkets for my bike. My bikes also need quite a lot of care and get taken into a shop about once a year for a general service - which normally ends up costing more than I would like (and often more than I spend on servicing my car). But I have only ever bought one thing from Halfords bike shop - my Boardman bike.

The problem Halfords has is that even consumers like me are not loyal. Both bike and car maintenance are hugely fragmented markets and customers are more likely to take their vehicles into shops that are convenient for them. In the retail space, they’re also competing with companies that have fantastic online offerings - Wiggle, for example, which is owned by Frasers.

As a consumer, I can’t see how management can halt the downward trajectory at Halfords without a major overhaul of the strategy.

A contrarian’s view

From an investment perspective, Halfords is certainly a contrarian pick and it’s marked as such by our StockRank Styles.

Both its forecast earnings and dividend yield around 6%, which is tempting if those forecasts are achieved. Margins are wafer thin, but there has been a little improvement at the gross level in these numbers. The opportunity presented by the ‘fusion store’ concept could provide further support to the margins. The balance sheet is nothing to write home about, but it’s fine, with net gearing at a modest 57%.

If the company can continue the pattern of delivering against its expectations without another warning, its shares might have been oversold. But with market conditions still very weak and big staff costs coming down the line, the current forecasts could still be a bit too optimistic.

Ab Dynamics (LON:ABDP)

Up 2% yesterday to 2069p (£466m) - Final Results - Megan - GREEN

Since its searing pre-pandemic highs, Ab Dynamics (LON:ABDP) has paid the price of its US tech stock-like valuation. Its price to earnings multiple rarely falls below 30x, which means the car testing company must deliver phenomenally impressive numbers consistently to prevent punishment. And because it is somewhat at the mercy of the automobile industry, it has been punished a number of times in the last few years.

There hasn’t been much to complain about in the year to August 2024. Revenues rose 10% to £111m and adjusted operating margins were almost 2 percentage points higher than the previous year at 18.2%. Like many companies, AB Dynamics does insist on stripping out amortisation of acquired intangibles from its underlying profit figures. When they’re included, operating profits were flat and margins slightly down at 11.5%.

But adjustments in the income statement can be forgiven when the cash flow statement is so impressive. Cash inflows from operating activities rose 39% to £26.9m, equivalent to 109% of operating profits. The company’s net cash position is now £28.3m, even after £17m of acquisitions completed in the year.

Acquisitions have proved both a blessing and a curse for AB Dynamics which, under the tenure of its founder Antony Best, grew largely organically with whopping margins. Acquisitions made in the last few years have supported sales growth (revenues have risen at a compound annual rate of 22% over the last five years), but come at a cost to the company’s quality metrics. Operating margins have fallen from an average of more than 20% prior to the pandemic, to 12% in the last five years. Return on capital employed, which also always used to average 20%, now hovers closer to 10%. That puts the mega-valuation ratios harder to justify.

Still, it’s hard to deny that the acquisition strategy has been the right one. AB Dynamics now has a global presence in the vehicle testing and simulation market, which puts it far better positioned to benefit from the rollout of electric vehicles and autonomous cars. It also could make it a takeover target itself.

Megan’s view

I have struggled with AB Dynamics’ diminishing quality metrics, which haven’t been justified by growth while the global car industry remains challenged by supply chain disruption. But this year, the company might have turned a corner. As acquisitions become more embedded into the company and costs can come out, margins could recover.

Earnings forecasts have also been ticking up this year, which could be a positive precursor to a change in momentum.

With a valuation like this, AB Dynamics is a risk - we know what happens when it fails to deliver and it has to deliver big to achieve any material share price rise. But I have belief in renewed growth at this former high flyer and am going with green.

Telecom Plus (LON:TEP)

Up 2% yesterday to 1800p (£1.4bn) - Interim Results - Megan - GREEN

Every time I look at financial results from Telecom Plus (LON:TEP), I think that I really should become a customer. This is a business which delivers fantastic service to its customers, making it easy for them to pay utility bills and delivering them long term cost savings.

Retaining customers for as long as possible is a good business strategy. It’s cheaper to upsell new services to existing customers than it is to win new ones and so when revenue per customer rises, margins also benefit.

In the first six months of the 2025 financial year, Telecom Plus welcomed almost 66,000 new customers, sending total customer numbers up 13% to 1.08m. The table below shows the breakdown of customers across all of the company’s services. Note the rise in three of the four core services. Insurance services numbers were temporarily down while the company made a decision to renew its licences on four insurance products.

Revenues declined in the first half of the year owing to falling energy prices, but as this resulted in a greater proportion from higher margin non-energy businesses, gross profits were slightly up on the previous year. Operating and administrative costs were largely in check, despite the material inflows of new customers. The company has pencilled in £3m of additional staff costs from the national insurance changes due to come into effect next year.

After completing a £10m buyback scheme in the second half of FY2024, management has decided to revert its material cash generation back to the payment of dividends. The interim dividend was confirmed at 37p, but shareholders will receive an annual dividend of 94p, which is a 13% improvement on last year. At their current price, the shares are yielding 5.2%.

Megan’s view

Telecom Plus is an under-the-radar company which rarely causes controversy, but delivers pretty consistently for its shareholders. It’s unspectacular and not especially good value. A comment from a reader yesterday said that they had bought the stock at just 103p in 2003 - I can’t see the company replicating that kind of performance over the next 20 years. But I can see it continuing to pay reliable dividends and return its material cash profits to its shareholders. For long term income investors, I think this is green.

Focusrite (LON:TUNE)

Up 2% to 265p (£153m) - Final Results - Megan - AMBER

As forecast back in the summer, profits at audio products company Focusrite (LON:TUNE) fell materially in the year to August 2024.

Adjusted EBITDA (the company’s preferred figure of profitability) was 34% lower than the previous financial year at £25.2m. That’s in line with the guidance delivered during the summer’s profit warning, but below the £27m-£30m forecasts set out at the start of the year.

Adding back in the £8.6m of ongoing amortisation and depreciation, underlying operating profits were 45% lower at £16.6m.

A further £5.5m was booked as non-underlying amortisation and the company took a £5.3m impairment charge on the goodwill value of its Sequential acquisition. Focusrite bought the US-based synthesiser specialist in 2021, but with demand for higher priced products now lower than it was when the acquisition completed, the company’s growth trajectory is less than expected.

Reported operating profits were just £5.7m and the company reported earnings of just 4.5p, down from 38.4p last year and a 2021 high of more than 50p.

So what’s gone wrong at Focusrite - a former gem of London’s junior market?

The main issue is that market conditions have altered dramatically since the wonderful highs of the pandemic - when amateur musicians clamoured for music making equipment during the tedious lows of lockdown. This was reflected by the 19% decline in sales from the content creation business in FY2024. Acquisitions and investments made during that period are also not delivering against the expectations set out at the time.

The smaller business division - Audio Reproduction, which delivers sound systems for venues - remains in growth mode everywhere other than America. Acquisitions made in this division in recent years have bolstered its overall contribution so that it now makes up just under a third of overall revenue. This has also improved the company’s diversity of end markets.

Megan’s view

Looking at the numbers alone, it’s hard to get excited by Focusrite. Sales have fallen, margins narrowed, earnings missed, debt widened and return on capital declined.

The company is still cash generative, but as profits have fallen so sharply those cash inflows aren’t as impressive as they once were.

I am happy to stick with the numbers on this one and not get tempted by the price to earnings ratio of 14x, which is materially lower than the company’s history.

But for those who like a story stock, it is worth taking note of the company’s continued investment in new products which should help stimulate some better growth in the coming years. There is also the fact that the company’s founder Phil Dudderidge (who was the drummer in Led Zeppelin) remains the company’s chairman and its major shareholder, with just under a third of the business.

Amber for me, because I am trying to be disciplined (and story stocks don’t tend to deliver for shareholders). But there are things to like.

Roland's section

Strix (LON:KETL)

Down 8% to 55p (£128m) - Trading update - Roland - AMBER/RED

Bad news for holders of this leading manufacturer of kettle controls – it’s another profit warning. According to today’s update, the improvement in sales seen during the first half of the year (see our comments here) was a false dawn, driven by Strix’s customers restocking their pipelines.

Underlying consumer demand has remained weak and the company says that it experienced “relatively lower trading” in Q3 and (so far) in Q4. Demand has been especially weak in regulated markets such as western Europe and the US, where the company sells its highest-margin kettle controls.

Updated guidance: as a result of this weaker performance in H2, Strix now expected to report 2024 adjusted pre-tax profit between £18m and £19m.

Sadly, Strix’s management did not include previous expectations for comparison in today’s RNS. Fortunately, two updated notes are available on Research Tree today. With thanks to both Zeus and Equity Development, we can see that today’s update corresponds to a big drop in expectations:

Zeus: pre-tax profit cut from £23.6m to £17.5m (-25.7%)

Equity Development: pre-tax profit cut from £23.7m to £17.6m (-25.7%)

These new estimates drop out to give 2024 eps forecasts of 6.5p and 6.2p per share respectively. That’s a cut of around 28% from previous estimates of c.8.8p.

Both brokers are now forecasting broadly flat performances for 2025.

This extends a run of downgrades this year and means earnings forecasts for Strix have now halved over the last 12 months:

Dividend & Net debt: in its half-year results management said net debt/EBITDA leverage was expected to fall to 1.5x before the end of 2025. Today’s update doesn’t mention this target but confirms that “latest reported net debt leverage” is 2x EBITDA.

Significant cost cutting efforts are said to be underway to protect the balance sheet against a backdrop of weaker trading.

This level of leverage is said to be within covenant limits and does not appear an immediate cause for concern. But I think it’s still a bit too high, for a small cap that appears to be struggling to recapture past levels of profitability.

As a result, I do not understand management’s decision (reiterated today) to press ahead with the reinstatement of the final dividend for 2024, which I estimate will cost c.£3.2m.

Given that Strix's cash interest costs appear to be running at c.£8m annualised, I would have thought it far more prudent to use any surplus cash to reduce debt until trading stabilises.

Roland’s view

I was struck by a statistic in this morning’s ED note saying that Strix’s core kettle controls market is still trading 20% below peak 2019 sales levels.

I’m not sure what lies behind such a big drop in sales. While kettle controls are obviously a mature market (we all have one already), periodic replacements are necessary. One possibility perhaps is that consumers are delaying discretionary replacements (i.e. they are no longer replacing kettles that aren’t faulty) or else switching to hot water taps.

If the latter is true, then hopefully Strix’s higher-margin Billi divisions, which sells “hot water dispensing” products, should continue to do well. The half-year results already suggest that Billi is becoming as important as kettle controls in terms of profit contribution:

I think this is worth watching. But for now, I’m inclined to remain cautious on the investment prospects here. It’s not clear to me when (or if) the kettle controls market will start to recover.

In the meantime, I think the group’s elevated level of debt increases the risk of holding the shares.

Strix shares have been weak since the interim results, perhaps pricing in a further downgrade. However, with the stock trading on 10x earnings and a flat outlook for next year, I’m not convinced the shares are obviously cheap right now. I’m going to maintain our AMBER/RED stance on this one.

Pets at Home (LON:PETS)

Down 10% to 248p (£1.1bn) - Interim Results - Roland - AMBER

Oh dear. Even Brits’ spending on pet care appears to have come under pressure this year. This has prompted a profit warning from Pets at Home, which has a 24% share of the £7bn UK pet care market.

we are operating in an unusually subdued pet retail market which we now expect to continue through H2.

As a result, the company now only expects modest growth in underlying pre-tax profit in FY25. Previous consensus cited by the company in May was for a figure of £144m. That would have been a 9% increase from the FY24 uPBT result of £132m.

Still, modest growth in this environment is not necessarily a disaster.

Today’s profit warning has left PETS stock trading at levels last seen during the 2020 market crash. Is value emerging here, or are there too many risks? Let’s take a look.

Interim results summary: today’s figures cover the 28 weeks to 10 October 2024. The financial highlights for the half year are actually okay, showing a decent recovery in profits from last year’s depressed levels:

Revenue up 1.9% to £789m, with LFL +1.6%

Vet group revenue +18.6%

Retail revenue +0.1% - “resilient against a declining retail market”

Underlying pre-tax profit up 14.1% to £54.5m

Net debt exc leases of £8.3m (FY24: net cash £8.8m)

The company says the rollout of its new digital platform has seen app sales almost double, vindicating a period of investment in IT. Similarly, a new distribution is also said to be working well, supporting “near record” availability in stores and greater automation of ecommerce.

Pets at Home’s business model is built around offering a full vertical range of pet services to owners, with benefits for loyalty and a seamless in-store/online offer. The company’s loyalty club offer seems to resonate with many customers and membership rose by 3% to 8.1m consumers in H1.

New pet registrations with the company’s Vet Group remained “robust” at 18k signups a week.

Pets’ hybrid vet/retail model supports much higher operating margins than a pure retailer would be likely to command. The half-year results show an operating margin of 7.6%, up from 5.4% for the same period last year. This is still below past highs, but is at least trending in the right direction again:

Cash generation is generally reasonably good, too, in my view. These half-year results show free cash flow of £33.8m. The company says this represents 61% of underlying pre-tax profit. Personally, I think a more useful metric is that this free cash flow gives 90% conversion from reported after-tax profit of £37.6m.

In general, I often find that reported profits are a closer match to free cash flow than adjusted figures, hence my general preference for reported profits.

Updated FY26 guidance: Pets at Home’s H1 performance was clearly an improvement on last year. Unfortunately this rate of improvement isn’t expected to continue in H2.

The company says “pet retail market growth has been subdued for longer than we anticipated” and believes this situation will persist through the remainder of the current financial year (y/e March 25).

However, capex plans have been cut by £5m to £55m and management expects free cash flow performance to be relatively stronger for the full year.

The company says it continues to expect that pet market growth will return to its long-term rate over time, supporting a return to profit growth:

we are confident that market growth will improve in future, supported by long established and unchanged structural growth trends and a stable but higher pet population. As growth returns to historical long-term averages of c4% (c3% Retail and c5% Vets) in future we would expect to deliver revenue and profit growth in line with our medium-term ambition

Outlook: the consensus trend chart shows us that analysts’ estimates have been trending lower for most of the year:

I don’t have access to any updated forecasts today, so we’ll have to wait for new consensus estimates to trickle through to the StockReport.

However, based on uPBT guidance, I think it’s reasonable to expect underlying earnings to be similar to last year’s figure of 20.7p per share.

Assuming a figure of 21p per share leaves PETS shares trading on a P/E under 12. Dividend forecasts also suggest a possible 5.5% dividend yield, still covered by earnings.

Roland’s view

At face value, I think Pets at Home could be decent value at current levels. The balance sheet seems fine to me and the company’s whopping 24% market share ought to mean that it remains a strong competitor in the future.

However, there are a few factors that concern me.

Growth timing: the post-pandemic decline in profits may still be ongoing. Certainly, the market has not yet returned to growth.

Regulatory risk: the Competition and Markets Authority’s investigation into the big pet care chains is ongoing. We don’t know what the outcome might be, or if it will have any impact on the profitability of PETS vet business.

The Vet segment generated two-thirds of H1 profit. In my view, it’s really the engine that drives PETS superior profitability and potential attraction as an investment.

Budget impact: planned increases to National Insurance and the minimum wage are expected to cost PETS £18m in FY26.

The timing of PETS’ financial year means that like Halfords (see above), the FY26 results will include a full year’s impact from these changes, rather than a partial year as for some other retailers.

Conclusion: on balance, I’m going to stay neutral on Pets at Home for now. While there are several aspects of this business I like, I can also see the potential for further headwinds. AMBER.

Auction Technology (LON:ATG)

Up 17% to 515p (£627m) - Final Results - Roland - AMBER

This online auction software group owns a range of online marketplace websites and also provides a white label service used by many auctioneers. We’ve covered ATG a number of times over the last year, most recently in October when Graham took a neutral stance following the group’s full-year trading update.

Today’s full-year accounts should not theoretically have contained too many surprises, given the recent update. But Auction Technology’s share price is up strongly this morning, suggesting the market has found something to like.

Final results summary: today’s results cover the year to 30 September 2024. Looking at the numbers, my feeling is that the rally we’ve seen today may be more of a relief rally than an upgrade.

Full-year revenue rose by 5% (2% organic) to $174.2m, while operating profit was 17% higher at $32.4m.

This dropped through to a 3% fall in adjusted earnings, to 38.6 cents per share (FY23: 39.8c). However, this FY24 result appears to be slightly ahead of Stockopedia’s consensus figure of 35.9 cents, perhaps giving some investors confidence that momentum is returning.

Reassuringly, net debt fell by $26.5m to $114.7m last year, reflecting flat overheads and free cash flow of $23.9m. This demonstrates an excellent near-100% conversion from reported net profit of $24.2m.

No dividend has been proposed for FY24.

Profitability: Today’s results give an operating margin of 18.5%, up from 16.7% in FY23. That’s a respectable margin, but my sums suggest these profits only give a sub-par return on capital employed of 4%. This is due to the presence of $589m of goodwill and £244m of other intangibles on the balance sheet – I assume these are largely a legacy of past acquisitions.

As we’ve been discussing in the comments today, I don’t believe in ignoring these items. In general, they represent past capital allocation decisions by management. This is a personal choice, but it makes sense to me that we should judge profits relative to these past investments.

Operating performance: moving on, I find that it’s often useful to look at key operating metrics for businesses of this kind, as well as financials.

ATG listed 23.8m lots last year (+7%) and facilitated more than 88,000 auctions (+2%) and 390m web sessions (+16%).

The company says it has improved its differentiation and growth potential with the launch of a white label solution auctioneers can use, while still being able to list their items on ATG’s own marketplace websites.

A key metric for this business is gross merchandise value (GMV), on which most auctioneers levy a percentage fee.

ATG says that GMV fell by 11% last year, but improved as the year progressed with H2 GMV down by only 4%.

GMV is said to have turned positive in the first eight weeks of the current year, driven by a recovery in revenue from Industrial & Commercial sales.

However, the fall in GMV last year relative to the increase in lot numbers tells me that there was a fall in the average value of items sold, which isn’t ideal.

More positively, ATG’s take rate (% of GMV) improved last year, rising from 3.6% to 4.2% last year. This improvement was driven by improved take-up of value-added services such as shipping, payments and digital marketing. Such services now represent 24% of group revenue.

However, without further research I’m not sure how the company’s core auction lot fees have changed. Providing these add-on services carries costs too, after all.

Outlook: the words from the company sound positive. Trading in the first eight weeks of FY25 is said to have shown positive momentum.

For the FY25 full year, the company expects revenue growth of 4%-6% and adjusted EBITDA margin of 45%-46% (FY24: 46%).

However, these estimates do not appear sufficient to support previous broker forecasts in the market.

In a new note today, broker Cavendish has cut its FY25 earnings estimate by 8%, from 43.2 cents to 39.6 cents per share.

If this estimate proves accurate, then it would leave ATG’s earnings effectively flat for the third consecutive year:

This revised estimate prices the shares on a FY25 P/E of 16.4 after this morning’s gains. That doesn’t seem obviously cheap to me, given the slow growth.

Roland’s view

I have some familiarity with this kind of business through having used such services in a past life. Many (most?) bricks-and-mortar auctioneers now depend heavily on online auction tools to drive a significant proportion of their sales.

Instinctively, I would say that this ought to be a decent business to own, cash generative and able to deliver incremental growth.

However, I can’t ignore some of my concerns. I’m not familiar with the competitive landscape here and I don’t know how many serious rivals ATG has, who might threaten either margins or market share.

Past acquisitions have laden the balance sheet with intangibles and a reasonable amount of debt. While debt leverage of 1.4x EBITDA doesn’t seem excessive, interest costs totalled $12.5m last year. That’s more than a third of operating profit.

The company’s former private equity owner also seems intent on selling, having disposed of a 5% stake earlier this year. However, TA Associates remains the largest shareholder with 12%, so there could still be an overhang here that will drag on the share price:

The shares themselves have been in a long-running decline that might not be easily overcome. Stockopedia styles the stock as a Falling Star in an additional warning, although I note the StockRank has improved (slightly) this year:

I think there could be a decent business here, but based on the evidence of these results the shares are not cheap enough to tempt me in. I’m going to maintain our view at AMBER.

Keelan's section

easyJet (LON:EZJ)

Up 1% to 545p (£4.1bn) - Final results - Keelan - GREEN

(Disclosure: Keelan has a long position in easyJet)

It was easyJet’s turn to publish some excellent full-year 2024 results this morning after IAG and Jet2 led the way with their respective updates earlier this month. Headline profit before tax rose 34% from 2023, reaching £610 million, a level slightly above the company’s prior guidance range of £590-£595 million for the year.

A large factor driving this growth in profitability is easyJet’s Holiday’s division. The division has seen a dramatic 56% increase in profit before tax, contributing £190 million in profits overall. The holidays division now covers more than 80 destinations across Europe and North Africa, with a collection of more than 5,000 hotels to choose from. Its rapid expansion has surpassed most expectations, with easyJet now forecasting a further 25% growth in its customer base next year.

The Holidays division is a key differentiator from its struggling low-cost peers, Ryanair and Wizz Air. Selling holiday packages is a far more profitable activity than simply selling plane seats. Incoming CEO, Kenton Jarvis, commented the following on the Holiday’s division strength:

"The outlook for easyJet is positive and travel remains a firm priority with consumers who value our low fares, unrivalled network and friendly service. The airline will continue to grow, particularly on popular longer leisure routes like North Africa and the Canaries and we plan to take 25% more customers away on package holidays, as easyJet holidays continues to thrive. I am looking forward to taking over the controls of this fantastic business in the new year and we still have a lot to go for as we progress towards our ambitious targets."

The fact that easyJet’s fleet is entirely Airbus has also benefited the business. Companies relying on Boeing aircraft orders are experiencing notable delays, a problem easyJet is not struggling with.

Whilst its peers are scrambling for additional seats and more fuel-efficient planes, easyJet has reliably secured its growth plans. A further 9 aircraft deliveries are expected next year, reaching a total fleet size of 356. The delivery of the new Airbus A320 neo aircraft this year helped save the company £25 million from cost efficiencies. easyJet is clearly becoming a leaner business.

Source: easyJet FY2024 annual report

However, it appears that overall costs did increase by 14% last year, though, it appears most of this can be explained by the higher capacity and the expansion of easyJet holidays. Indeed, the headline Cost Per Seat (CPS, excluding fuel) experienced a marginal increase of 1% on 2023.

For FY2024, the company has produced a commendable return on capital employed of 16%. Provided there aren’t any significant operational disruptions next year, profitability could yet improve further, especially as fuel prices are expected to fall. You’ll see the profitability metrics and Quality Rank improve as the results feed through to the StockReport page tomorrow.

Moving to the balance sheet, the company is steadily building its cash resources now. easyJet’s cash pile grew from £41 million in 2023 to £181 million this year. This opens up the possibility of improved shareholder returns in the future. Broker Jefferies certainly thinks so, with a price target of 680p:

“We see a re-rating opportunity as easyJet benefits from a growing package holiday business, fleet renewal and self help opportunities through optimising winter trading and ancillary revenues.

The strong balance sheet and net cash position leaves room for upside to dividends in the next two years.”

Keelan’s view

There’s a lot to like from the results today, despite the muted response from the market. easyJet’s outlook for 2025 is optimistic, it’s firmly on track to achieve its medium-term target of £1 billion in annual profits and its Holidays division is defying all expectations.

Travel demand remains resilient, and as long as we don’t see any deterioration in the geopolitical environment or another global pandemic, easyJet is now in a good place to take advantage after fixing up its post-Covid balance sheet.

Whilst the share price momentum hasn’t really picked up compared to IAG or Jet2, the broker revisions in the coming days may offer some hope. Most notes have been positive so far this morning, and whilst the company didn’t provide clear visibility for FY2025, it’s likely to come in well above the £522 million currently forecast

A promising snippet I picked up on was that the winter losses are expected to fall. The company is adding more winter destinations to its Holidays offering, thereby reducing the impacts of its winter seasonality. This is especially important as this period erodes a significant chunk of the group’s profits each year. In H2 2024, the company achieved a record £960 million in profits, but the winter losses meant the total for the year fell to £610 million.

Any meaningful progress in reducing winter losses is likely to be well-received by the markets next year. In the meantime, investors can take solace in the fact that the dividend has been hiked from 4.5p to 12.1p.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.