Good morning!

Meteorological Autumn has begun and, as usual, we expect a vast quantity of interim results statements to rain down on us this month!

All done for now, cheers!

Spreadsheet accompanying this report: link (last updated to: 11th August).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

Great Portland Estates (LON:GPE) (£1.24bn) | Acquired long leasehold in The Gable, WC1, for £18m (£409/sq ft). Net yield 6.4%, will refurbish. | ||

Kainos (LON:KNOS) (£851m) | After “solid Q4 2025”, expect FY26 rev at upper end of forecasts with adj PBT in line (f/c: £66.4m) | AMBER/GREEN (Roland) While today’s update is not an earnings upgrade, the tone and content of the commentary do suggest improving momentum and a likely return to growth for this IT services group. The valuation doesn’t seem unreasonable to me on a forward P/E of 16, especially given the strong net cash position. I think it’s fair to upgrade our view by one notch to reflect the seemingly more positive outlook. | |

Genuit (LON:GEN) (£840m) | Commercial ventilation provider, focused on UK education sector. Paid £55.6m (12x FY25E EBITDA) | ||

Domino's Pizza (LON:DOM) (£771m) | SP +8% | AMBER/RED (Roland) [no section below] Investors have cheered Domino’s decision to splurge £20m on buybacks just weeks after the stock slumped on a profit warning. In accounting terms, the market may be correct – my sums suggest this buyback could generate a c.12% effective return at current share prices. Broker EPS estimates have been notched 2% higher today, accordingly. As always with this business, my concern remains that the balance sheet looks poor to me, with negative book value and more debt than I would like to see. Today’s update suggests year-end leverage will now be 2.3x EBITDA. That’s probably affordable for Domino’s, but profits are expected to fall for the third consecutive year in 2025. In this situation I would prefer to see the experienced CEO focusing on operational improvements and deleveraging, rather than debt-funded financial engineering. With the stock trading at 10-year lows on a P/E of 11, I acknowledge that Domino’s could be cheap. However, I’m going to leave our view unchanged today as there’s no new information on trading. | |

Craneware (LON:CRW) (£758m) | New $100m/3yr facility on lower rates. Also initiated $284.2m proposed reduction of capital. | ||

Supreme (LON:SUP) (£211m) | Paid £1.65m for brand + up to £3m for inventory/defcon. Revenue previously peaked at £8m. | AMBER/GREEN (Graham) This may be a controversial stance seeing as Supreme is heavily involved in vaping distribution and it has a majority shareholder (the CEO). But on valuation and business prospects, I like the outlook for shareholders here. I tend to be a fan of very small, bolt-on acquisitions, and Supreme are using them both to diversify away from vaping and to increase their access to retailers. I like what they're doing. The shares trade at a P/E of about 10x. | |

Gateley (Holdings) (LON:GTLY) (£170m) | Paying up to £9m for “boutique IP firm” w/ rev £4.7m, adj PBT £1.4m. Consideration 75/25 cash/shares. | ||

Team Internet (LON:TIG) (£152m) | Rev -36% to $263.9m | AMBER/RED (Roland) [no section below] | |

Activeops (LON:AOM) (£130m) | Previous termination by EMEIA ControliQ customer is now fully reversed with contract renewed. | ||

Dialight (LON:DIA) (£87m) | SP -7% Confident of meeting PBT exps (FY 3/2026). Cautious on sales outlook. Demand remains soft. Adjusted PBT forecast is $5.7m (£4.2m). | RED (Graham) [no section below] Some curious wording, with the Board saying “they are confident of meeting market expectation” but this applies to PBT only, not to revenues, and it sounds like revenues are under quite a bit of pressure. I was RED on this when I reviewed it last year. Full-year results published in June (for FY March 2025) showed the company making heavy losses, thanks to £21.6m of “non-underlying items”, which are primarily to do with a legal battle against a former manufacturing partner. These results also included another “going concern warning”, due to the risk of breaching bank covenants. Net debt was $17.8m. With a poor-sounding update today, I think RED remains the correct call here, from a risk point of view. Note that high-risk shares can still perform extremely well - these shares are in fact up by over 70% since I reviewed them last year. But I wouldn’t sleep soundly owning this stock. | |

Journeo (LON:JNEO) (£68m) | Variation to £10m First Bus UK agreement. Add’l £3.5m. Option to extend by further two years. | GREEN (Roland) [no section below] Another week, another contract win for this transport systems provider. In this case, a £10m deal agreed with First Bus’s London unit in May has been extended by a further £3.5m to include the provision of the company’s latest 5G vehicle gateway, digital CCTV and digital wing mirrors and field service maintenance. Once again, there’s no detail on the financial impact of this deal, but I’m happy to remain positive, given apparent strong momentum here and a very reasonable cash-adjusted FY25E P/E of 14. Journeo’s interim results are due later in September, which should give us the chance for a more in-depth review of this situation. | |

MTI Wireless Edge (LON:MWE) (£43m) | Order from existing customer for construction and delivery of integrated shelters. Approx $1.1m. | ||

Eenergy (LON:EAAS) (£23m) | Great British Energy Solar Partnership Midlands Lot 1: solar PV systems for schools. | ||

XP Factory (LON:XPF) (£17m) | March 2025 results. Rev +19%. 3 new Escape Hunt sites. Adj. op profit £3.5m. Cautiously optimistic re: meeting expectations. Net debt £4.8m (March 2024: net cash £0.1m). Outlook: recent openings trading in line or ahead of expectations. Unseasonal weather impacted Q1. Q2 has rebounded with 8.6% LfL growth at Escape Hunt, 0.2% LfL growth at Boom. | AMBER/RED (Graham) [no section below] The owner of Boom Battle Bars and Escape Hunt reports another statutory loss, consistent with its track record. I tend to be harsh on leisure businesses (restaurants, cinemas, and the like) that trumpet adjusted EBITDA despite depreciation being one of their heaviest and most important charges (£3.8m this year for XPF). Revenue is up 19% with increasing scale; more meaningful are the 3.2% like-for-like growth at Escape Hunt and the 2.3% like-for-like growth at Boom. With increased labour costs working against the company, I fear that faster LfL growth is needed than it’s currently achieving. On the balance sheet, tangible equity is zero. I think the market is pricing this correctly by keeping it firmly in nano-cap territory for the time being. | |

Satsuma Technology (LON:SATS) (£13m) | Quarterly results (to August) plus restated quarterlies to May. Revenue ≈£0. £169m raised. | RED (Graham) [no section below) The key point here is that the convertible loan note has a conversion price of 1p per share, vs. current share price 2.4p). It seems to me that investors at the current share price are asking for big trouble, as logic dictates that the share count should explode. | |

Chill Brands (LON:CHLL) (£11m) | Primary distribution partner in UK for RELX vape company (not RELX plc!). | ||

Abingdon Health (LON:ABDX) (£10m) | Successful establishment of activities at Madison, WI with five development projects underway. |

Graham's Section

Supreme (LON:SUP)

Up 2% to 183p (£218m) - Acquisition of 1001 carpet care brand - Graham - AMBER/GREEN

An interesting little deal for Supreme:

...the acquisition of the trade and intellectual property of 1001, the iconic carpet care brand trusted by consumers for decades ("1001") for a fixed consideration of £1.65 million (including £0.35 million of deferred consideration) from the US-based WD-40 Company. The transaction also provides for the purchase of inventory at book value, with additional contingent consideration, associated with future sales growth, up to a maximum of £3 million.

Supreme is perhaps most well known for its vaping brands, but it has a range of activities and brands beyond that.

88vape

Typhoo Tea

Battle Bites - protein bars

Millions & Millions - vitamins

Elfbar vape distribution

Duracall/Panasonic battery distribution

See here (external link) for the complete list.

While I'm generally cautious when it comes to M&A, I have no issue when it comes to small, bolt-on acquisitions like this.

At its last full-year results, Supreme reported net cash (excluding leases) of £1.2m - a modest figure, but PBT was over £30m. In the current financial year, PBT is forecast to reduce only slightly. So current profits should easily pay for today’s acquisition many times over.

The strategic rationale sounds smart to me:

This acquisition is fully aligned with Supreme's M&A strategy, strengthening its portfolio of everyday essential consumer goods. With Supreme's vertically integrated platform and distribution network spanning 40,000 retail outlets, 1001 presents a compelling opportunity to accelerate growth at minimal incremental cost….

Expansion of Supreme's portfolio with another well-recognised consumer brand

Immediate earnings enhancement

Access to new retail customers, including Aldi

Longer-term potential to develop 1001 into a broader household cleaning brand, a high-growth category particularly within the discount retail channel

Estimates: we are told that 1001’s revenues for FY August 2025 are expected to be c. £4.5m. It looks like Equity Development have left their estimates unchanged for now: for FY March 2026, they forecast revenue of £240m (+4%) and adjusted earnings per share of 19.5p (down 5%).

Graham’s view

This reminds me very much of the Typhoo Tea acquisition - that was another well-liked old British consumer brand, bought up by Supreme at a modest price (£10m). This is even smaller than that, but the motivation looks similar.

The big picture for Supreme is that it is grappling with the ban on single-use vapes. That ban has been in place for a few months now, and my understanding is that the vape industry has moved on to rechargeable and refillable systems that are in line with new regulations. Supreme sells 88vape, Lost Mary, Elf Bar and other vape brands that are compliant with the new rules.

While noting that Roland was AMBER on this in July, I would tend to have quite a bullish view on smoking/vaping as an investment category (please note that I own BATS). Therefore, I’m inclined to be moderately positive on Supreme at this valuation:

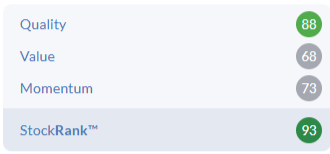

I also note a StockRank of 93 (and it’s a Super Stock):

When it comes to management, I would have a positive view of their M&A strategy, as deals like that announced today (and Typhoo Tea) strike me as opportunistic, interesting, and quite low-risk.

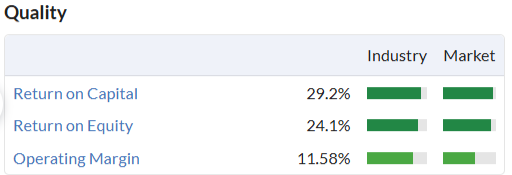

Supreme has earned excellent quality metrics over the years, which I think helps to prove that it’s more than just your standard low-margin distributor. I think of it more as a brand owner, although its pure distribution activities have also been highly profitable:

The CEO behind the strategy is a 56% shareholder. I didn’t realise that he owned so much of it, but I did expect him to own a large percentage - that’s consistent with an ambitious but low-risk M&A strategy.

Some people will want to stay away from any stock with a majority shareholder, and others (for good reasons) will avoid the vaping category. But on valuation and its prospects, I have to say that I like the outlook for shareholders here. So I'm upgrading our stance by one notch. The main risk is that vaping profits will be volatile, and there is vulnerability to any future regulatory changes. But as things stand, it seem to me that the industry is successfully navigating the changes announced so far.

Roland's Section

Kainos (LON:KNOS)

Up 18% to 836p (£988m) - Roland - Trading Statement - AMBER/GREEN

Today’s half-year update from this IT services provider guides investors to expect revenue at the upper end of forecasts for the year ending 31 March 2026 (FY26). Profit forecasts for FY26 have been left in line for now, perhaps opening the door for an upgrade if momentum remains strong.

The market has given this news a resounding thumbs up.

Let’s take a look at the main points from today’s update;

Following a strong sales performance in Q4 2025, Kainos delivered “further sequential improvement” in H1, creating “opportunities for further operating progress” during the rest of the year;

Kainos is recruiting additional staff and ramping up use of contractors to support new projects across all three of its operating divisions.

A brief summary of highlights is provided for each of these divisions.

Workday Products (add-ons to the Workday (NSQ:WDAY) system): “strong growth”, passing $100m annualised recurring revenue (ARR) in July. Working with partners including Diageo on a new Pay Transparency product. This is due to launch in Q3 to support the EU Pay Transparency Directive that comes into force in June 2026;

Workday Services: Kainos is a specialist in deploying Workday’s Finance, HR and Planning products and expects to report a return to growth during the current year, “driven by improved results in our core European and North American markets”

Digital Services (in house software products developed for clients): “secured several significant programmes” including new contracts with the Home Office, NHS England and the Driver and Vehicle Standards Agency. Also seeing strong revenue growth in North America, but performance in the commercial sector during H1 remained “muted and below prior-year levels”.

Outlook & Estimates: today’s update provides fairly clear guidance as it includes details of current consensus forecasts – this is very helpful for investors trying to digest RNS updates efficiently and should be standard practice, in my view.

Kainos says FY26 revenue is expected to be at the upper end of expectations, while adjusted pre-tax profit is expected to be in line with current consensus forecasts. This gives us the following guidance:

Revenue: at the upper end of £378-393.4m

Adjusted pre-tax profit: current consensus is £66.4m

There’s also an updated note available from broker Canaccord Genuity on Research Tree today - many thanks. CG’s analysts have left their FY26 estimates unchanged for earnings of 51.1p per share.

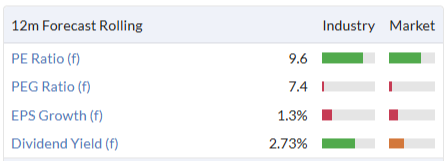

That puts Kainos on a current year forecast P/E of 16 at the time of writing.

Roland’s view

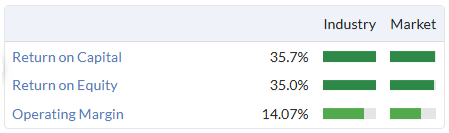

Kainos reported net cash of £134m at the end of March and the group’s CEO is a 5% shareholder. When paired with the group’s impressive quality metrics, this is enough to make me think it might be an above-average business:

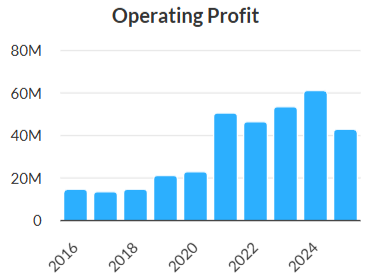

Profit growth since the 2016 IPO has been strong, albeit inconsistent:

Kainos benefited from exceptional growth in healthcare revenue during the pandemic and this has subsequently normalised. However, today’s update strikes a confident note. I think it could be a sign that the business is now returning to a more normal growth trend.

Graham and I have taken a neutral (AMBER) view on this IT services and technology group on three occasions since last November’s profit warning:

Today’s update has triggered a double-digit share price gain, but I think it’s worth remembering that profit expectations are unchanged today – this isn’t a big upgrade.

Even so, I think the tone of today’s update provides some reassurance that last year’s profit warning is firmly in the rear-view mirror. I’m also impressed by the group’s seemingly strong presence in the UK public sector – an area where IT spending seems likely to increase.

While I note Stockopedia’s Falling Star styling, I think we could soon see this improve if Kainos continues to display positive momentum. I’m going to tentatively upgrade our view to AMBER/GREEN today.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.