Good morning!

All done for now - cheers!

Today's Agenda is under construction.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

Centrica (LON:CNA) (£7.8bn) | Two nuclear power stations in which Centrica has a 20% share. Electricity for an additional year. | ||

Ithaca Energy (LON:ITH) (£3.9bn) | Gross proceeds of £106m, 3% of issued share capital. Placing price 213.75p (yday’s close: 237.5p). | AMBER/GREEN (Roland) [no section below] Ithaca’s former private owner Delek Group and Italian oil major ENI have trimmed their holdings, raising £106m. Ithaca shares spiked after its interim results on 20 August, so it looks like these two shareholders decided to capitalise on this liquidity. While the discount may seem a little large for a £3.9bn FTSE 250 stock, Delek and ENI still control over 80% of Ithaca shares after this 3% sale, so liquidity is a bit more limited than for some comparable-sized companies. Such large shareholders can only sell when the going is good, so I don’t see anything sinister about this disposal. My view on Ithaca remains unchanged today – for investors with an interest in this sector, I think it could be worth a closer look. | |

Plus500 (LON:PLUS) (£2.1bn) | Clearing membership enables PLUS to expand futures business to new territories and customers. | GREEN (Graham) Another prestigious clearing membership has been achieved, in a move that further embeds Plus500 within the financial infrastructure of the US and Europe. I’m staying GREEN on this as this move marks further progress and another upgrade in its capabilities. It trades at a P/E multiple of 10x: not bad for the best-performing UK stock over some timeframes. | |

Oxford Nanopore Technologies (LON:ONT) (£1.78bn) | Revenue +28% (cc). LBITDA £48m, loss £71m. Cash £337m. Guidance unchanged. | ||

Uniphar (LON:UPR) (£909m) | Rev +8.6% (cc). PBT +22% (€28.7m). Net debt €198m. Confident of delivering exps. | ||

Everplay (LON:EVPL) (£592m) | Rev -10%. Adj. PBT +2% (£20m). FY2025 adj. EBITDA to be slightly ahead of current exps. | AMBER/GREEN (Graham) These shares have appreciated in price by 50% since I looked at them last. The bull these has played out and the stock is now in "High Flyer" territory. It passes six bullish stock screens, with half of these being Momentum screens. Today's results, despite offering "slightly ahead" guidance, strike me as being rather mixed, and the company does not currently have a permanent CEO. On this basis, I think it's sensible to moderate my stance by one notch: I'm still positive, but not as outright enthusiastic as I was before! | |

Johnson Service (LON:JSG) (£548m) | Rev +5.5%. Adj. PBT +15.8% (£25m). Further £25m buyback. Adj. op profit to be in line. | ||

Custodian Property Income Reit (LON:CREI) (£351m) | Avg rental uplift 13.5%. 1.5p divi fully covered by EPRA EPS, implying 7.9% yield. NAV 96.7p. | ||

Intuitive Investments (LON:IIG) (£217m) | Nationwide distribution of TEAM CHINA merch at Easy Joy online store, under Lucky Joy brand. | ||

Integrated Diagnostics Holdings (LON:IDHC) (£208m) | Rev +42% (revenue per test +29%). Adj. EBITDA +78%. Outlook: rev growth >30%. | ||

Ecora Resources (LON:ECOR) (£183m) | The sold subsidiary has 2% net smelter return royalty. $16.5m cash upfront, $3.5m contingent. | ||

Avingtrans (LON:AVG) (£151m) | US subsidiary wins two contracts from long-term existing customer. Rev weighted towards FY27. | ||

Beeks Financial Cloud (LON:BKS) (£146m) | Purchased small stake in Swiss network technology firm, will deploy ÜberNIC in data centres. | ||

Alumasc (LON:ALU) (£121m) | FY25 rev +13%, adj PBT +9% to £14.2m. FY26 “likely to be H2 weighted” due overseas sales. | AMBER/GREEN (Roland) [no section below] There are plenty of reasons why a construction materials group might be reporting disappointing results at the moment – but Alumasc is still doing well. Today’s results are in line with market forecasts, with profits up in all three operating divisions. Operating margins were respectable at 12%, but this extends a two-year decline from the 14% high seen in FY22. Management says that lower margins are due to a higher proportion of overseas sales. This factor is also expected to result in an H2 weighting to profits in FY26. This may not be a problem, but profits have historically been quite equally weighted across the year. When combined with the company’s mention of “short-term volatility” and “medium term growth drivers”, I wonder if there’s a slightly increased risk that results could fall below expectations this year. Broker FY26 forecasts are largely unchanged today and the stock’s P/E of 11 seems fair to me. I’m happy to maintain Mark’s moderately positive view from July, but I don’t see this as a compelling opportunity right now. | |

Severfield (LON:SFR) (£96m) | FY26 exps unchanged with significant H2 weighting. UK/EU order book £420m at 1 Sept. | ||

Michelmersh Brick Holdings (LON:MBH) (£91m) | PW: PBT -29.3% to £2.9m. UK stronger, EU “very challenging”. FY25 to be “broadly” flat vs FY24. | BLACK (AMBER/RED) (Roland) A disappointing set of results, flagging up a combination of market headwinds and one-off company problems. H2 should be stronger, but full-year performance is no longer expected to show any growth relative to 2024. That’s a big downgrade from previous expectations for earnings growth of c.25%. I’ve previously been a fan of this business, in part due to its very experienced leadership. The new CEO/CFO team lacks industry experience and appears to be taking over at a difficult time. If macro conditions improve then we could see a good recovery, but I think there’s still some risk of further downgrades. I’m less positive about Michelmersh than I was and am happy to stay on the sidelines for now. | |

Audioboom (LON:BOOM) (£81m) | All key operational elements now integrated, including ad marketplace, inventory & sales. | ||

Journeo (LON:JNEO) (£71m) | Total consideration of £12.7m for critical infrastructure protection firm that specialises in high security fencing and CCTV for utility sites and similar. Valuation: 9.3x FY25 PBT. | AMBER/GREEN (Roland) | |

Fiinu (LON:BANK) (£65m) | Will raise £1.4m by placing 9.4m shares at 15p. 50% premium to 6 Aug subscription. | ||

Tialis Essential IT (LON:TIA) (£17m) | £50m/5yr framework contract from existing customer. Improves revenue visibility for next year. | ||

Defence Holdings (LON:ALRT) (£13m) | Defence Technologies brand will provide “sovereign AI capabilities” Two MoD applications underway. |

Graham's Section

Plus500 (LON:PLUS)

Down 1% to £29.58 (£2.1bn) - New Strategic Membership with ICE Clear Europe - Graham - GREEN

Plus500 has come a long way from the days when I disparagingly referred to it as a “bucket shop”. Over the years it has grown, expanded and achieved an impressive degree of licensure in a wide range of geographies.

This trend continues today with a new clearing membership at ICE Clear Europe, part of the Intercontinental Exchange (ICE).

ICE is a financial giant responsible for many of the world’s largest exchanges, including the NYSE.

This is what clearing membership at ICE will mean for Plus500:

This clearing membership enables the Group to strategically expand its futures business to new territories and customers, further scaling its clearing services to cover a broader range of futures products across multiple asset classes, offering customers a more seamless trading experience.

“Clearing membership” means the ability to settle trades for other institutions - it’s an important and, in a financial context, a prestigious responsibility.

Plus500 already had clearing membership with ICE Clear US:

Building on the Group's existing clearing membership with ICE Clear US, obtained earlier this year, this additional clearing membership further enhances Plus500's industry-leading infrastructure, optimises cost efficiencies and unlocks opportunities to cater to a wider, more diversified B2B customer base through an enhanced clearing offering.

CEO comment:

"We are extremely pleased to secure our membership of ICE Clear Europe, which complements our existing ICE Clear US membership. As we continue to evolve into a provider of global market infrastructure, clearing memberships remain a key pillar of Plus500's growth strategy for our global futures business, and this new membership will further expand our clearing capabilities across multiple asset classes in European markets…

Graham’s view

I treat Plus500 with much more respect these days than I did before. I still think that Plus500’s retail customers are, on average, less experienced than the retail customers of other trading platforms, and I still think that I was right to be cautious about Plus500’s risk management practices.

But there is no denying that whatever risks Plus500 took in the past (and possibly still takes today?), it has generated enormous wealth for its shareholders - it is the best performing UK stock over some timeframes, giving shareholders the holy trinity of share price appreciation, large buybacks and dividends.

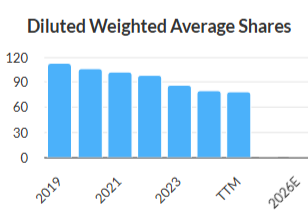

The share count continues to decline:

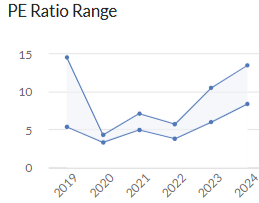

Today it trades at a P/E multiple of 10x. I think it’s uncommon for the market to allow it to trade much higher than that.

I’m staying GREEN on this, as I have done quite a while now. Please see my analysis of its recent interim results for more.

Everplay (LON:EVPL)

Down 1% to 400.1p (£555m) - Half Year Results - Graham - AMBER/GREEN

everplay group plc, a leading global independent ("indie") developer and publisher of premium video games, working simulation games and children's edutainment apps is pleased to announce its unaudited results for the six months ended 30 June 2025 ("H1 2025" or the "period").

Everplay is the new name for “Team17”, which was most famous for making Worms, but its new name is designed to let us know that it’s in a new era now.

Most revenues are from third-party IP, but its own IP still contributed 35% of H1 revenues.

Also worth mentioning that the majority of its revenue is actually from its back catalogue (140 titles), not from new releases.

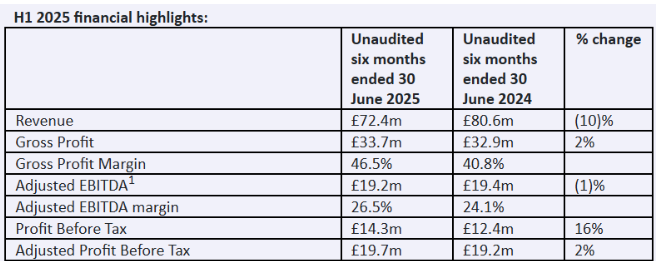

The overall half-year results are as follows: revenues down, but profits up.

The revenue decline is attributed to various causes - timing of license revenues, fewer physically distributed sales, and a strong prior year performance of the back catalogue.

As an “indie” developer, it is less reliant on the strong performance of any particular title (in contrast with something like Frontier Developments (LON:FDEV)). It has both a large back catalogue and a steady stream of new titles.

In H1 alone we have four new titles, and another three are scheduled in H2. That’s at the “Team17” division only - there is also a German games publisher and a publisher of children’s apps.

The German publisher (“astragon”) saw a particularly sharp 35% revenue decline in H1, but we are told that its release schedule is set to favour H2 over H1.

CEO position: their CEO left rather abruptly in May, and the search for a successor continues. Frank Sagnier is Interim Executive Chair.

Outlook: adjusted EBITDA to be slightly ahead of current market expectations, those expectations being revenues of £173.6m and adj. EBITDA of £46.9m. It’s interesting that the share price is slightly down despite this positive guidance. Maybe the market is disappointed to learn that no CEO is expected until next year?

The main thrust of the outlook statement is positive:

The Group has continued to perform well to date in H2 2025, driven by the strong performance of the new releases launched in H1 and to date in H2, as well as ongoing back catalogue momentum.

New release revenues are expected to be significantly higher in H2 2025 relative to H1 2025, following the launch of new titles including Date Everything!, LEGO® Bluey™ and Firefighting Simulator: Ignite, along with the full launch of Sworn and the first dedicated products for Switch 2. In total, we expect around 10 new games to be released over the course of 2025 (GN note: that’s across all divisions).

Graham’s view

I have mixed feelings about today’s results - overall, it’s solid, but there is little to get overly excited about.

I will point out that the adj. EBITDA figure (£19.2m) converts to nearly £20m of adj. PBT - this is an example of a company where I don’t get too excited and upset about the use of EBITDA.

If we want to be really strict, the actual PBT is only £14.3m. But I’m comfortable with the adj. PBT figure.

Cash and cash equivalents are an impressive £59.5m, so it should be very secure from a balance sheet point of view.

These shares have increased in price by nearly 50% since I analysed the company in March.

I was GREEN on it then. I think that with the valuation having increased rather dramatically over the last six months, I can now moderate my view on this back to AMBER/GREEN.

It was trading at 10.6x earnings then, whereas it is now trading at 15.6x.

The bull thesis has played out - it was too cheap then, and the stock is now perhaps up with events. But I still like this company and I’m happy to remain somewhat positive on it - if I was holding it, I’d probably not be in any rush to sell, unless there was some urgent need for the cash!

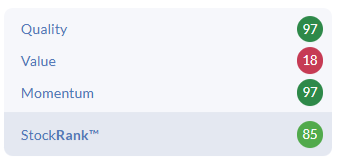

I note that the share passes six bullish stock screens, but half of these are to do with momentum. It’s truly a “High Flyer” now: the type of stock where some investors might already be planning their exits.

Roland's Section

Michelmersh Brick Holdings (LON:MBH)

Down 9% to 89p (£85m) - Roland - Half Year Results - BLACK (AMBER/RED)

After rival UK brick producer Forterra recently upgraded its 2025 profit guidance, I was cautiously optimistic today’s results from premium brick specialist Michelmersh might also bring good news.

Unfortunately that’s not the case – Michelmersh has issued a profit warning today. Brokers covering the stock have cut their 2025 earnings estimates by 15%-20%.

Let’s take a look.

H1 results summary: a mixed picture

Today’s half-year figures show revenue flatlining and a sharp fall in profit in H1, alongside a big reduction in net cash. To some extent this might have been expected; we knew that significant capex and manufacturing shutdowns were planned in H1 as Michelmersh upgraded several key plants.

However, the commentary in today’s results makes it clear that combination of delays and continuing difficult market conditions mean performance was below expectations.

Revenue up 1.1% to £35.8m

Pre-tax profit -29.3% to £2.9m

Earnings per share -26.7% to 2.47p

Net cash down £1.5m (Dec 24: £6.0m)

Interim dividend held at 1.6p per share

Trading commentary: a mix of company-specific and broader market conditions seem to have weighted on H1 performance and expectations for the remainder of the year.

Shutdowns at the Michelmersh and Florens (Belgium) factories completed on schedule, with orders despatched from inventory and no impact on expected sales

A shutdown at Carlton overran by two weeks due to delays in the manufacture of a key piece of tooling. As a result, manufacturing and despatches fall below expectations. Management says this was the “the most significant drag on H1 profit”

However, pricing Industry conditions remain difficult with “highly competitive” pricing during the first half of the year as mothballed industry production capacity was brought back online, leading to elevated inventories across the sector

Michelmersh says UK brick despatch volumes are still around 25% below 2022 peak levels, but that its focus on premium products is allowing to outperform the market:

Order intake ahead of normalised manufacturing volumes in H1, underpinning a balanced order book profile for the start of H2

Even so, my feeling is that profit margins may have come under pressure to secure these orders:

Highly competitive pricing environment mitigated by a continued focus on collaboration with customers to support stable average selling prices

Belgium: this business only accounts for around 5% of sales, but demand seems to have fallen off a cliff since 2022. Brick demand is said to be 40% below 2022 levels and the company reports a further 20% fall in housing permits during the first half of the year.

As a result, production at Florens is being suspended during the third quarter, with the intention of resuming production in Q4. When combined with the maintenance shutdown in Jan/Feb, this will mean Florens has been non-producing for nearly half of 2025.

Outlook

No further maintenance shutdowns are planned for the second half of the year and management expects to report a stronger H2 performance. However, industry headwinds combined with the impact of the Carlton delays in H1 and the planned shutdown in Belgium mean that full-year results are now expected to be “broadly in line” with FY24.

To put this in context, earnings were previously expected to rise by around 25% this year.

With thanks to brokers Canaccord Genuity and Cavendish, updated earnings estimates are available on Research Tree today. These show reductions of 16-22% in FY25 EPS estimates and similar cuts for 2026:

EPS estimates | Cavendish | Canaccord Genuity |

FY25 | 8.5 (prev. 10.1p) | 7.6p (prev. 9.8p) |

FY26 | 10.1p (prev. 11.4p) | 8.9p (prev. 11.0p) |

Cavendish appears to be a little more bullish than CG. Averaging these two estimates gives a FY25 EPS estimate of 8.1p, 16% below the 9.7p consensus figure shown on Stockopedia ahead of these results.

After this morning’s (relatively modest) share price fall, that leaves MBH shares trading on a forward P/E of 11 with a possible 5%+ dividend yield.

Boardroom changes: another point I think is worth mentioning are the changes taking place in Michelmersh’s boardroom from today.

As planned, chief executive Peter Sharp stands down today and will become the company’s “industry advisor”. He’s replaced by former CFO Ryan Mahoney, who has been with the firm for around four years.

Alongside this, Michelmersh has also announced its new CFO today, Rachel Warren. She joins from logistics group Wincanton, after a career mostly spent with IAG.

What strikes me about these changes is that the company no longer has any top execs with in-depth experience of the brick industry; for both Mahoney and Warren, Michelmersh is their first job in this sector.

In contrast, Peter Sharp and former co-CEO Frank Hanna both had 30-40 years of experience in the UK brick sector.

Brick production is an intensely cyclical and capital-intensive business. I can’t help feeling that long experience might be valuable in senior leadership roles. Perhaps this explains Peter Sharp’s move to the newly-created role of industry advisor.

Roland’s view

Mark picked up some negative vibes when he covered Michelmersh’s trading update in May, noting that “pricing pressure makes it sound like hard work” to hit forecasts. Sure enough, forecasts have been cut sharply today.

I still think Michelmersh is fundamentally a decent business with good recovery potential when industry conditions improve. It’s clear that at least some of the H1 weakness was due to one-off delays at Carlton. There shouldn’t be any more issues of this kind in H2.

However, my confidence in this business is a little lower than it was, in part due to the lack of in-depth industry experience in the C-suite.

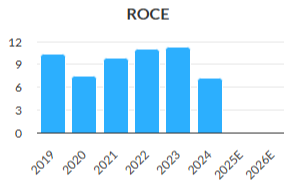

I’d also note that Michelmersh’s returns on capital are only just high enough to be of interest, in my view. The StockReport shows an average ROCE of 9.5% since 2019:

Michelmersh is now trading below its book value of £94m and still has a net cash balance. The company has a well-invested production base with no major capex planned and the ability to increase output. I’d expect cash generation to improve in H2, as well.

Given the one-off nature of much of the H1 profit shortfall, the shares could be cheap at current levels. Higher production would also be likely to support positive operating leverage and improved margins.

However, I can’t ignore the lacklustre industry outlook and evident pressure on pricing. I would imagine that 2026 forecasts still carry some uncertainty at this point.

Given our knowledge that further periods of weakness often follow an initial profit warning, I’m going to downgrade our view by one notch to AMBER/RED today.

Journeo (LON:JNEO)

Up 5% to 438p (£73m) - Roland - Acquisition of Crime and Fire Defence Systems - AMBER/GREEN

We seem to have commented on transport systems provider Journeo frequently recently – most recently yesterday, when the company announced a contract extension in its core market of bus operators.

Today’s news is a little different. Journeo has announced a significant acquisition that appears to be targeting a new business sector. The company will pay up to £12.7m to acquire Critical Fire and Defence Systems Limted:

CFDS specialise in protection of Critical National Infrastructure sites including utilities and high security industrial and commercial applications. CFDS provide a range of solutions to enhance security infrastructure including cutting-edge access control systems, complex perimeter intrusion detection, and high-performance thermal, infra-red and visual surveillance systems.

About CFDS: looking at the CFDS website and its latest accounts, its main specialist market appears to be the gas utility sector, for which it provides high-security fencing and surveillance solutions.

Here’s a summary of the last three years’ financial results for CFDS:

Y/E 30 April | Revenue | Pre-Tax Profit |

2025 | £17.3m | £1.4m |

2024 | £12.1m | £0.5m |

2023 | £13.6m | £2.0m |

These figures suggest growth hasn’t been entirely consistent – my impression from a quick review of the CFDS accounts is that the business may have suffered some growing pains and one-off project issues in FY24, in particular.

Recruitment and retention of skilled staff is also mentioned as a significant challenge.

Journeo + CFDS - a good fit? Journeo says CFDS will add to its capabilities in providing critical solutions across markets such as public transport and infrastructure, including “major railway stations, international airports and nuclear power generation facilities".

CEO Russ Singleton says the acquisition is a logical addition:

This acquisition aligns with our strategy of taking our core capabilities into adjacent markets and strengthens our offering and broadens our reach.

Valuation & Financials: Journeo will pay up to £12.7m for CFDS, with the payment structured in three parts:

£10.7m initial cash consolidation

£2m in deferred cash payments repayable after 12 and 24 months

£1m in new JNEO shares with a minimum 24-month holding period

CFDS is expected to have over £1m cash on completion, hence the total consideration is £12.7m.

Based on the CFDS FY25 accounts, Journeo is paying a multiple of just over nine times pre-tax profit.

This does not seem excessive to me, assuming the run-rate of revenue and profitability CFDS achieved last year is sustainable.

Naturally, we don’t know anything about the CFDS order book or longer-term outlook. However, demand for infrastructure security and surveillance seems likely to be evergreen and growing, in my view, so I don’t see this as a major concern.

Revised FY25 & FY26 estimates: today’s update helpfully provides details of the expected financial contribution CFDS will make during the remainder of Journeo’s current financial year, which ends on 31 December:

Revenue: £4m

Pre-tax profit: £0.4m

FY25: Previous market expectations were for group revenue of £52m and adjusted PBT of £5.2m. Adding the CFDS contribution gives us new revenue and PBT guidance of £56m and £5.6m respectively.

Broker Cavendish has translated this into a FY25 EPS estimate of 26.5p, an increase of 6%.

FY26: Journeo expects CFDS to contribute £17m of revenue and £1.4m of adjusted PBT in FY26, in addition to existing expectations of £55m and £5.8m. This gives us new revenue and PBT guidance of £72m and £7.2m.

Management says this guidance is “prudently allowing” for integration costs. However, what strikes me is that Journeo expects CFDS’s performance in 2026 to be flat relative to its FY25 performance. For whatever reason, the growth delivered by CFDS last year isn’t expected to repeat next year.

Cavendish has increased FY26 EPS estimates by 20% to 33.2p as a result.

Roland’s view

This is quite a large acquisition for a company of Journeo’s size. The acquisition consideration is nearly 20% of the group’s market cap and CFDS will add over 30% to group revenues.

Journeo shares are up by 5% at the time of writing, reflecting this morning’s FY25 EPS upgrade. That suggests investors are not yet pricing in any further gains from cross-selling, synergies or improved market reach.

I am inclined to take a neutral view on this acquisition as well. I can see that it has the potential to provide adjacent services to some of Journeo’s current offerings, but I can’t help feeling that there is only limited overlap.

In addition, integrating large acquisitions always carries some risk and I would be interested to understand why no further growth is being forecast for CFDS over the next 18 months.

On balance, I’m going to downgrade our view by one notch to AMBER/GREEN today.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.