Good morning! After a busy but somewhat mixed week for company news, lets see what the RNS feed has in store for us.

The agenda is now complete. It's a bit quieter today!

Update 12.45: that's all for this week, see you on Monday.

Spreadsheet accompanying this report: link (last updated to: 5th September).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

MHP SE (LON:MHPC) (£443m) | Lower impact from Ukraine war than H1 2024. Rev +10%, op profit -29% to $136m. Leverage 2.3x | ||

Big Technologies (LON:BIG) (£271m) | New allegations of “forgery and deliberate falsification of documents” are made by the company against its former CEO Sara Murray. We are told these could have “material adverse implications” for the ongoing Buddi litigation. An update on the group’s financial situation and any potential impact from this news is promised by the end of September 2025. | AMBER/RED (Roland) My general approach in situations where companies face significant legal risks is to avoid them altogether. I have no way of evaluating this situation; it is completely outside the normal run of business. The fact that Ms Murray owns almost 27% of Big stock only further complicates the situation. However, I do recognise that the company seems to be trading comfortably and has an extremely strong balance sheet, with net cash of £95m reported at the end of June 2025. In this context, the valuation could be quite reasonable, while the cash pile might allow the group to resolve the legal proceedings without equity losses. To reflect this, I’ve held back from taking a fully negative view today. However, even if I was far more optimistic than I am, I would not consider investing until the company’s promised financial update is published at the end of this month. | |

B.P. Marsh & Partners (LON:BPM) (£248m) | BPM is investing to support its existing US-based investee XPT Group with the launch of the XPT Producer platform. This will be used to incubate new insurance producers (i.e. revenue-generating new hires). BPM will take a 35% equity stake in XPT Producer for a nominal $3,500 and will provide loan funding of up to $12.5m over two years. This will carry an interest rate of SOFR +6.5%, with a minimum rate of 10%. | GREEN (Roland) [no section below] Today’s new investment shows BPM using its strong balance sheet to support the growth of existing investee XPT Group - a business that we can assume the company knows very well. The loan part of today’s deal looks likely to generate a satisfactory return in most normal circumstances, while the large equity stake – acquired for a nominal cost – is effectively an option that could provide a big payoff if XPT Producer becomes successful. To me, this looks like a typically savvy investment from BPM. This specialist insurance investor has an excellent long-term record and a very strong balance sheet, with £74m of net cash reported at 31 January. With the shares continuing to trade at a 20%+ discount to NAV, I think the valuation looks reasonable and am happy to maintain Graham’s previous positive view. | |

Roadside Real Estate (LON:ROAD) (£79m) | Sold commercial property business for £12m. These properties are being sold to Tarncourt Properties, which is a business controlled by Roadside CEO Charles Dickson and his family. After repaying external debt, net proceeds of £4.7m will be used to repay debt owed to Tarncourt. | AMBER/RED (Roland) [no section below] Roadside has an ambition to build a £250m property portfolio, but as far as I can see owns very little property right now and has minimal revenue. Net debt will remain at c.£14m after this disposal, all of which appears to be owed to Tarncourt and Charles Dickson. The joker in the pack appears to be a 48% holding in Cambridge Sleep Sciences, which Roadside has an option to sell for “not less than” £48m during certain periods from Sept ‘26 to Sept ‘27. However, even if this goes ahead, I’d guess that a chunk of the proceeds will be used to repay debt held by Tarncourt/Dickson. Unless I’ve missed something in this initial review, I can’t help feeling that the £80m market cap (2.5x book value) is overly generous for a business with net debt and no trading profits. I am also discouraged by the level of related party activity here. Stockopedia rates this as a Momentum Trap and I agree. I can't get any higher than AMBER/RED here. | |

Gemfields (LON:GEM) (£68m) | Auction rev $32m, 100% of lots sold w/ avg price $160.78/carat (+41% versus Nov 24 auction). | ||

Volvere (LON:VLE) (£46m) | Rev +7.1%, pre-tax profit +32.7% to £2.88m. NAVps £18.25 (+6% vs Dec 24). Net cash: £28m. | AMBER/GREEN (Roland) A strong set of results showing respectable revenue growth and much-improved margins at subsidiary Shire Foods. My sums suggest that Shire is generating attractive returns and is probably undervalued on a standalone basis. However, management shows no inclination to sell and is considering organic investment in Shire, while remaining open to acquisitions. In this scenario I think Volvere’s huge cash pile is likely to continue acting as a drag on the stock’s valuation, potentially slowing future returns. However, I can’t fault the performance of Shire Foods or the strength and inherent value in the balance sheet, so I’m leaving our moderately positive view unchanged today. | |

One Health (LON:OHGR) (£36m) | Trading for FY26 YTD “remains strong and in-line with management expectations.” Planning permission for a new hub in Lincolnshire has been received and site preparations are now underway. | AMBER (Roland) [no section below] Consensus forecasts suggest adjusted earnings of 13.6p per share for FY26, broadly in line with the 13.8p reported for FY25. Turnover is also expected to be relatively flat this year at this business, which provides NHS-funded medical procedures. Investment in a new surgical hub is now underway and a return to growth is expected in FY27. While I have no serious concerns, the stock’s current valuation on 18x rolling forecast earnings looks high enough to me for a business with fairly average growth and quality metrics. I'm staying neutral ahead of October’s half-year results. | |

Tialis Essential IT (LON:TIA) (£20m) | Acquiring 50% stake in MXLG Acquisitions for £7.15m in new TIA shares at 75p. Related party deal. | ||

GSTechnologies (LON:GST) (£18m) | Completed integration of Bake crypto platform. FY rev +90% to $3.0m, net loss $2.3m. Cash $4m. | ||

Argo Blockchain (LON:ARB) (£12m) | CFO Jim MacCallum terminated “with immediate effect”. | ||

Angle (LON:AGL) (£12m) | CEO and FD have agreed to step down from the board following shareholder discussions. |

Roland's Section

Big Technologies (LON:BIG)

Down -12% to 81p (£239m) - Roland - Litigation Update - AMBER/RED

Big Technologies plc (AIM: BIG), a leading provider of electronic monitoring solutions, today provides an update on further very serious matters that have come to light regarding the conduct of Sara Murray and persons associated with her (the "New Developments").

This business specialises in providing electronic monitoring (i.e. tagging) for criminal justice and care sectors. However, trading this year has been overshadowed by allegations relating to former CEO Sara Murray, who continues to control a 26.7% shareholding in Big Technologies.

According to previous updates from the company, Ms Murray failed to disclose various relevant commercial interests at the time of Big’s IPO and may have provided “untrue information” to the company and in court filings.

New allegations: today the company has shared further “very serious matters that have come to light regarding the conduct of Sara Murray and others”.

This statement from management suggest the company is trying to get ahead of any counterclaims from Ms Murray and control the narrative – understandably:

Given the nature and seriousness of these New Developments, which centre on forgery or deliberate falsification of significant documents by Sara Murray, the Company has concluded that it is appropriate to provide specific details of some of the principal forgeries and falsifications. The Company is taking this step so that there is no room for doubt about the severity of, and responsibility for the implications of, these matters, and also so that any statements that Sara Murray may make on the subject or other matters relating to the Company, whether privately to shareholders or publicly, can be understood and assessed against the background of the clear, specific and detailed facts that the Company is disclosing today.

These new allegations are said to have “material adverse implications for the Company’s position in the Buddi Litigation”.

Buddi is a business that was founded by Sara Murray to provide GPS tracking devices for children. It was acquired by Big in 2018 and provided the basis for the company’s current products.

Today’s RNS goes into considerable detail, but I’m not going to try and unravel and repeat the details of these new allegations here. I would strongly recommend that anyone interested reads the RNS directly themselves.

Outlook: the company has promised a further update by the end of this month, including a financial update:

The Company is in the process of assessing the financial impact (if any) of the developments announced today and intends to provide an update with its interim results for the six months ended 30 June 2025, which are expected to be published on or by 30 September 2025.

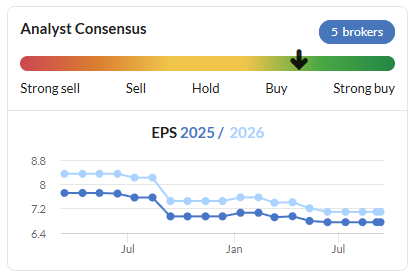

For what it’s worth, broker estimates have remained fairly stable this year:

Roland’s view

The impact of today’s news on Big’s share price has been relatively modest:

Personally, I have no way of quantifying the likely impact or potential outcome of this ongoing litigation. My general approach in such situations is to view them as uninvestable. I cannot understand or measure these risks, which are completely outside the normal run of business.

I would not consider an investment in Big Technologies while these issues remain unresolved.

However, I can see a more bullish counter-argument here that I’ll outline briefly, in order to prevent a more balanced view:

In its delayed 2024 results (published May 25), Big reported a net cash position of £94m and a relatively stable set of trading results.

A more recent update in July confirmed revenues remained stable during H1 2025 and reported adjusted EBITDA of £12.5m on revenue of £24.8m – a 50% EBITDA margin. The net cash position had also improved slightly to £94.9m at the end of June 2025.

Big Technologies appears to be trading profitably with a very strong balance sheet. An investor who has a strong understanding of the underlying business and a bullish view on growth prospects might speculate that the group’s net cash position will cover costs and any damages associated with the ongoing legal action.

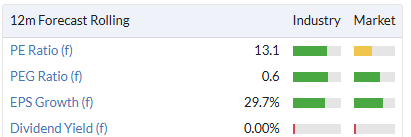

In such a scenario, Stockopedia’s valuation metrics suggest the shares might not be too expensive at current levels:

However, the algorithms' Falling Star rating may provide some pause for thought and suggests a more cautious view:

To reflect Big’s profitable trading and very large net cash position, I’ve held back from being fully negative and have taken an AMBER/RED view today, ahead of the company’s promised financial update later this month.

Even so, I would consider this a high risk and speculative situation until there’s some clarity on the likely outcome of legal proceedings.

Volvere (LON:VLE)

Up 2% to 2,130p (£47m) - Roland - Half-year Report - AMBER/GREEN

Graham usually covers this unusual “growth and turnaround investment company” and most recently reviewed its full-year results in May.

Today we have a solid set of half-year results from Volvere, whose sole investment and subsidiary is Shire Foods. This food producer makes pies and pastries and supplies Aldi, among others.

Here are the headline numbers from today’s half-year results, which cover the six months to 30 June:

Revenue up 7% to £23.8m

Pre-tax profit up 32.7% to £2.9m

Net assets up 12.8% to £43.5m (£18.25 per share)

Cash and available-for-sale investments up 31.7% to £32.0m

Net profit attributable to shareholders up 21.8% to £1,772m (80.4p per share)

Cash levels were boosted by £563k of interest income and Volvere’s £4m share of a £5m dividend paid by Shire Foods (which is 20%-owned by its employees).

Shire Foods - investing for growth?

Shire’s revenue growth in the first half of the year was held back by the loss of “a low margin product, which ceased supply in 2025”. However, it looks like this may have helped to improve profit margins – Shire’s pre-tax profit margin rose to 11.5% (H1 24: 8.8%).

Management also flag up several recent wins:

Extended product supply into “two of our major customers”

“Won several new lines with a fuel station food-to-go customer whose emphasis is on quality and category innovation”

This year has seen the largest number of new product launches “in memory”, most of which will take place in H2

To reflect and build on the opportunities in the market, the company is currently considering whether to Invest in a second site to increase manufacturing capacity. Management says this would probably involve moving existing on-site storage to a new location nearby to free up additional space for manufacturing onsite.

This upfront investment could ultimately allow Shire to become more vertically integrated and “undertake certain activities our … supply chains currently perform for us at a direct cost”.

Investment to secure lower operating costs and growth capacity seems sensible, if it can yield satisfactory returns.

Profitability: last year’s subsidiary accounts for Shire Foods show the company generating a 28% return on capital employed. I estimate the trailing 12-month figure (to 30 June 2025) may have risen to c.40%, given the increase in H1 profits reported today.

If investment to expand Shire Foods can generate further double-digit returns, then it would make sense for Volvere to use some of its sizeable cash pile in this way. After all, the returns on cash are only ever going to be in low single digits.

Outlook

The company reiterates comments made in May that the UK food sector, as a whole, is facing higher labour costs.

Cost increases are said to have continued into Q2 and Q3, affecting gross margins. The company says it is mitigating these where possible through revised terms with customers and hopes to see this feed through to results over the remainder of the year.

However, Shire Foods “will most probably not see the level of profit growth that we have seen in previous years”.

This outlook comment seems to support my feeling that the increase in profit margins seen in H1 may partly have been driven by the loss of a low-margin, higher-volume product that is no longer diluting the company’s overall margins.

Valuation: no forecasts or broker coverage is available for Volvere, but my sums suggest today’s results leave the shares trading on 11x trailing 12-month earnings – not especially expensive.

However, stripping out net cash from Volere’s market cap suggests to me that the market may be valuing Shire Foods on as little as four times earnings – surely too cheap?

Roland’s view

Today’s commentary seems to make it clear that the company has no plans to liquidate and is still hoping to make further acquisitions:

The focus of the Board is on the long-term value growth of the Group. To that end, we continue to review acquisitions that we think would be strategically complementary to Shire Foods as well as looking at step-change investments in Shire itself over the next two years. In parallel with this, we continue to review potential investments in other sectors, in line with our investing strategy.

Although the shares are now trading slightly above net asset value, my sums suggest Volvere could still be cheap when net cash is stripped out of the market cap.

For example, applying a multiple of eight times trailing earnings to Volvere’s 80% share of Shire would suggest a value of £34m. Adding £32m of cash and investments to this would imply a market cap of £66m or c.£30 per share – nearly 50% above the current price.

However, realising this value might not be easy if Volvere’s board decide to continue owning and developing Shire Foods. The level of cash on the balance sheet acts as a substantial drag on overall returns and is probably holding back the valuation.

I know that not all subscribers will agree with me, but I would be more inclined to take an interest here if Volvere abandoned its periodic share buybacks and instead started distributing cash through dividends, in order to provide a tangible return for patient long-term shareholders who don't want to sell. A £2m annual payout would be easily affordable and provide a useful 4% yield.

Graham was AMBER/GREEN on Volvere in May. I don’t see any reason to change this view today.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.