Good morning and welcome to Friday's report!

The agenda is now complete.

Update: 10.15: it's a quiet news day today so I am wrapping up the report there. Graham will be back with you next week.

Spreadsheet accompanying this report: link (last updated to: 5th September).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

Vodafone (LON:VOD) (£20.3bn) | Vodafone and Digi Romania have entered into an agreement to purchase assets worth €30 million from Telekom Romania. | ||

Investec (LON:INVP) (£5.3bn) | H1 2026 trading shows earnings are broadly in line with last year, with headline earnings per share expected to come in around 35.2-38p. Share buyback programme ongoing and steady progress in both the South African and UK markets, despite macroeconomic challenges. | ||

IG group (LON:IGG) (£3.8bn) | Acquisition of Independent Reserve / Update on Revised Customer Metrics | IG acquires Australia’s Independent Reserve for A$178m, or £86.8m to accelerate Asia-Pacific crypto expansion. / IG Group revises customer metrics from Q12026 onwards, introducing funded customers and aligning active and first trade definitions across products. Trading update confirmed for release on 25th Sept. | GREEN (Roland - I hold) Today’s acquisition looks expensive upfront at 5x trailing sales and 18x EBITDA. However, Independent Reserve does seem to have some attractive characteristics, in particular a very high revenue per customer figure. If recent growth can be maintained this could prove to be a value-additive deal, but I don’t have any way to judge how likely this is. Fortunately this purchase is comfortably affordable for IG and we know from recent results that the group has had good momentum this year. I am going to leave our positive view unchanged today ahead of a trading update later this month. |

Kainos (LON:KNOS) (£1.06bn) | Kainos acquires Canadian consultancy Davis Pierrynowski, expanding Digital Services in Canada. Adds 120 staff to support digital transformation across healthcare, government and community organisations. | ||

Spire Healthcare (LON:SPI) (£872m) | Confirms has engaged Rothschild & Co as adviser and has begun a process to hold preliminary discussions “with a number of parties” relating to a range of possible options, including a sale of the company. | PINK (AMBER) (Roland) [no section below] In today’s statement, Spire’s management complains that the operational progress being made by the company and the value of its “freehold property and well invested asset base” are “not yet reflected by the market in full”. In other words, they think the share price is too low. Checking the latest accounts shows freehold property with a book value of c.£640m, which management says is valued at “<£1.4bn” – quite possible if the property is held at cost on the balance sheet. This looks significant relative to the market cap of c.£850m. However, as a business Spire seems to have very average profitability, with return on capital employed of just 6.4% on a trailing 12-month basis. Return on assets is c.1% according to the StockReport. I’d suggest this low profitability may be one reason why the share price isn’t higher. Operating margins are under 10% and it doesn’t seem like Spire is generating much value from its properties. The other potential concern for me is debt. Net bank debt was £357m (2.2x EBITDA) at the end of June and the group also had £915m of lease liabilities. The debt was agreed in Feb 22 and is currently being refinanced (so presumably interest rates will rise). The balance sheet also shows a net lease liability of c.£270m, perhaps suggesting that some of Spire’s properties are loss making. Given that finance costs accounted for 68% of operating profit in H1, I think group’s overall debt and lease obligations could continue to limit profitability and cash generation unless margins improve. Spire’s earnings are forecast to rise sharply in 2026, so perhaps management is right to hope for a re-rating. However, until there’s more evidence of this, my feeling is that the business looks quite fairly valued. We’ll have to see what the market thinks, but I’m going to echo the StockRanks and take a neutral view today. | |

Close Brothers (LON:CBG) (£748m) | FY25 results delayed by 7 days to 30 Sept due to request for additional audit time. | ||

Henry Boot (LON:BOOT) (£264m) | Developing Duxford AvTech site to develop low and zero carbon aircraft technology at IWM Duxford | ||

Concurrent Technologies (LON:CNC) (£192m) | Provision of design services to major US contractor over 2025/26. First time selling design services. | AMBER/GREEN (Keelan) Concurrent Technologies has secured a $5.25m US defence design contract, marking its first move into outsourced design services and strengthening ties with a major US prime. This comes on the back of a record £4m UK contract and the launch of Bragi, its first AI-focused GPU, earlier this month. Broker Cavendish sees further upside, but keeps its price target at 256p. While the shares look a bit pricey at around 30x earnings, execution has been impressive, and the pipeline suggests there could be more to come, which is why I’m giving it an AMBER/GREEN rating. | |

Life Science Reit (LON:LABS) (£139m) | Following review and sale process is planning a managed wind-down over 12-18 months. | ||

Skillcast (LON:SKL) (£51m) | Rev +43% to £529k, Q1 26 rev +143%. Op loss reduced to £6.1m. £328k cash at 31 March. | ||

Insig Ai (LON:INSG) (£29m) | Rev +43% to £529k, Q1 26 rev +143%. Op loss reduced to £6.1m. £328k cash at 31 March. | ||

Futura Medical (LON:FUM) (£27m) | FY25 rev to be materially below exps, at £1.3-1.4m. Eroxon sales below exps, $2.5m payment from Haleon delayed as patent claim not yet approved. £2.7m cash expected to provide working capital to Jan 26. Exploring funding options and carrying out “significant restructuring”. | RED (Roland) [no section below] The company is warning that it only has sufficient cash until January 2026 – and even this is “subject to a number of variables”. It's also trying to raise funds. It’s an automatic RED from me, as it looks like there’s a significant risk to equity here. | |

Predator Oil & Gas Holdings (LON:PRD) (£23m) | Report and Interim Financial Statements for the 6 months to 30 June 2025 | First oil revenue of £66k in Trinidad. H1 net loss £1.6m, cash balance £2.6m. | |

GEO Exploration (LON:GEO) (£20m) | Drill hole JUD001 complete at 810m. Expect assay results in Q4 2025. JUD002 now underway. |

Roland's Section

IG group (LON:IGG)

Down 1% at 1.094p (£3.8bn) - Acquisition of Independent Reserve - Roland - GREEN

(At the time of publication, Roland had a long position in IGG.)

IG is acquiring Independent Reserve, “a leading cryptocurrency exchange based in Australia”.

The total consideration for the deal is A$178m (£86.8m).

In fairness, I don’t know that much about crypto and I have never heard of Independent Reserve. But my first impression is that this is a relatively expensive purchase, priced on the hope that Independent Reserve’s recent rapid growth can continue.

Here are some key metrics we are given about the company being acquired:

Independent Reserve has strong growth momentum, with revenue in the 12-months ending 30 June 2025 of A$35.3m (£17.7m), increasing 88% on the previous fiscal year and representing a CAGR of 70% over the prior two years. Approximately 76% of revenue was generated in Australia and 24% in Singapore. EBITDA in the 12-months ending 30 June 2025 was A$9.9m (£5.0m).

Based on this, today’s purchase price represents 5x FY25 revenue and 18x FY25 EBITDA.

Naturally, these figures could rise if revenue growth continues at a CAGR of 70%, but how likely is this? I cannot say.

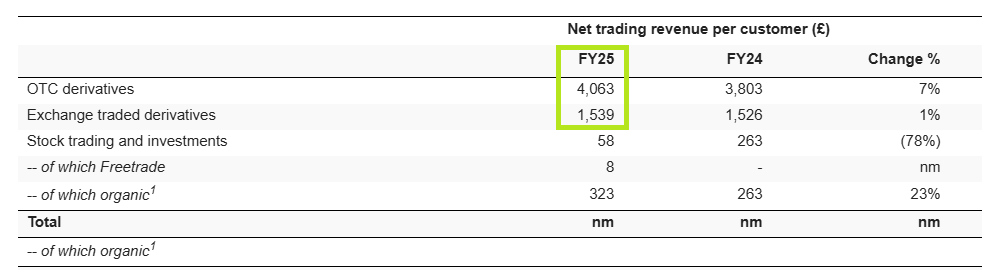

We’re told that Independent Reserve had c,11,600 active monthly customers during the 12 months to 30 June. This implies each contributed just over $3,000 of revenue during the year – that’s potentially attractive and is comparable with the revenue per customer generated from the group’s core OTC derivatives (spread bet/CFD) and options trading (exchange-traded derivative) customers:

Purchase terms:

Fortunately, IG does seem to have engineered some caution into the payment structure for this acquisition.

Initial acquisition of 70% of Independent Reserve for £53.4m

Additional payment of £7.3m is contingent on FY26 performance

Call option to buy remaining 30% stake with a valuation based on performance in FY27 and FY28

In the meantime, the current leadership team and employees will remain, owning the the outstanding 30% stake and presumably motivating them to continue growing the business:

The leadership team and employees will remain with Independent Reserve, and retain a collective 30% shareholding at completion, bringing strong crypto-native expertise to lead future propositions at IG.

Crypto progress:

IG says this acquisition complements the progress it has made with its crypto offering in the UK and US under CEO Breon Corcoran.

UK:

In the UK, the Group launched spot crypto trading in May 2025, becoming the first UK-listed company to provide the product to retail investors. Launched in partnership with Uphold, the offering includes 35 coins and is fully integrated across the IG platform and IG Invest app.

US:

In the US, tastytrade has expanded its product range to 23 coins and enabled stablecoin account funding for investors across multiple blockchain networks. This innovative funding method allows tastytrade customers around the world to fund their brokerage accounts with stablecoins, 24/7/365, powered by Zero Hash, the leading on-chain infrastructure provider.

Roland’s view

I think IG can easily afford this purchase and it could be a logical addition to its offering. Crypto appears to have become a mainstream asset class, especially for speculative traders.

I take some reassurance from the high revenue per customer and existing profitability of Independent Reserve.

However, there’s no doubt this deal could turn out to be quite expensive, if Independent Reserve’s growth slows for any reason – or if market conditions change.

Graham was GREEN on IG Group when he reviewed its full-year results in July and covered the company in more depth in a Stock Pitch article last week.

Obviously I am biased as a long-term shareholder, but I am also a fan of this business, which is currently benefiting from strong market conditions thanks to the elevated volatility that’s been seen this year.

I don’t see any reason to change Graham’s positive view today – with a trading update due on 25 September, I think it makes more sense to wait until then to consider refreshing our view.

Keelan's Section

Concurrent Technologies (LON:CNC)

Up 1.68% at 225.7p - $5.25m US defence contract secured - Keelan - AMBER/GREEN

Concurrent Technologies is a UK-based designer and manufacturer of embedded computer systems, supplying mission-critical computing platforms to defence, aerospace, and industrial clients. Whether it’s powering sensor systems, drones or complex communications gear, its systems are designed to work flawlessly in critical conditions.

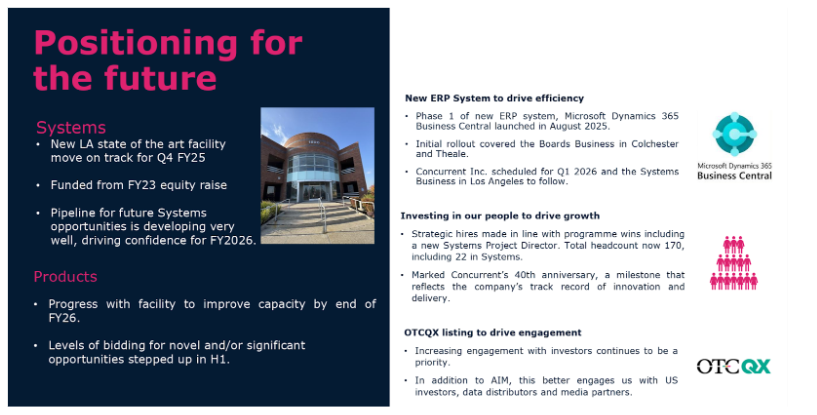

Source: Concurrent Technologies H1 2025 Results presentation

The company announced this morning that it has just secured a $5.25 million design services contract with a major US defence customer. This is a significant win for the business. It’s the first time the customer has outsourced the design of one of its own computing products, and the first time Concurrent will be delivering a fully external design service. The contract runs through 2025 and 2026, and it's a clear sign that the relationship with this US prime contractor has deepened.

This deal reflects trust and also a strategic shift. More and more defence primes are outsourcing hardware development to focus on their core systems and software. Concurrent is now well placed to benefit from that emerging trend, especially as a principal member of the SOSA (Sensor Open Systems Architecture) consortium, which is helping standardise these types of platforms.

CEO, Miles Adcock, commented on the update: "We are well positioned to benefit from the growing trend of outsourced hardware development, and this contract provides a valuable opportunity to assess the potential of design services as a future line of business."

The announcement comes after a busy month for Concurrent, having delivered strong H1 results earlier this month.

Broker Cavendish, which acts as house broker, described the contract as a “substantial new area of business”, but kept its price target at 256p, implying a further 13.2% upside from current levels. The broker does expect the company to now beat current market forecasts, though, and says forecast risk is now very much to the upside.

Moving beyond product sales

This latest contract suggests Concurrent is moving up the value chain. Rather than just selling its rugged computing hardware, it is now designing core products for major customers. That opens up potentially higher-margin work, deeper customer integration, and longer-term stickiness.

This contract could pave the way for broader revenue streams, especially as defence primes shift toward open standards and start outsourcing more of their hardware development. Concurrent has spent four years building credibility with this US customer, and this deal shows that work is starting to pay off.

This move into design services won’t replace the core products business, but it could significantly boost the company's long-term addressable market.

A strong operational year

Financially, things are already trending in the right direction. Revenue is forecast to grow from £40.3 million in 2024 to £66 million by 2028, with earnings per share climbing steadily from 6.8p to 10.2p over the same period.

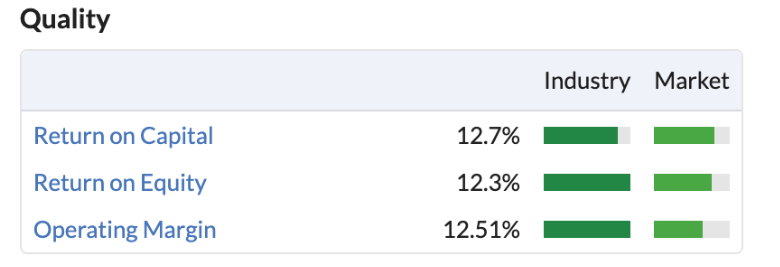

Profitability is robust, with returns on capital now at 12.7% and rising. The business remains cash generative, although free cash flow has been a little volatile due to working capital changes and investment in growth. Free cash flow is forecast to rise steadily over the next three years, reaching £6.6 million by 2028.

Momentum is firmly on the company’s side, with the company’s share price rise having outperformed the FTSE All-Share by 72.3% over the past year, and trading near 52w highs.

Valuation: pricing in growth

At around 226p, the shares trade on a forward P/E of 29.5 and an EV/EBITDA multiple of 21.7. That’s not cheap, even when compared to other UK industrial or defence names.

The current valuation is being supported by the business delivering on growth and maintaining margin progress. Should that continue, investors may be willing to look past near-term multiples, but there is a degree of execution risk here.

Recent catalysts

On top of the US contract, Concurrent has had a busy few weeks. It recently launched Bragi, its first general-purpose graphics card powered by NVIDIA’s latest Blackwell architecture (which is one of the most advanced GPU chips to date). Developed in partnership with EIZO Rugged Solutions, Bragi is designed for high-end AI and edge processing applications, plugging in directly into Concurrent’s modular systems.

Source: Concurrent Technologies H1 2025 Results presentation

At the start of September, the company also landed a £4 million UK defence contract, the largest in its domestic history.

Cavendish summed up these contract wins well in their note this morning: “This new contract follows a record 1H25 order intake of £22.3m, up 25% on 1H24 and 2H25 despite slower orders from the US market. 2H25 has already seen the group’s largest UK design win (£4m) announced on 4 September and the US market is expected to see orders accelerate throughout 2H25 following the passing of the One Big Beautiful Bill Act in July”

Keelan’s View

Concurrent seems to be firing on all cylinders. In the past month alone, it has delivered two major contract wins, a new AI-ready product, and record interim results.

The balance sheet remains solid, with no debt and healthy cash reserves. Investment in capacity continues, including an expanded UK facility at Colchester to help scale manufacturing, while the move to a larger site in California should support US growth, particularly for systems integration.

Source: Concurrent Technologies H1 2025 Results presentation

The only real hesitation I have is around valuation. At around 30 times earnings, the shares are not obviously cheap, though, for a comparable business listed in the US, I probably wouldn’t think twice. That’s the disconnect. If Concurrent keeps up this pace of innovation and contract wins, brokers may need to lift their forecasts quite soon, especially seeing as Cavendish’s 256p target already looks within reach.

There are definite echoes of Journeo (LON:JNEO) and Filtronic (LON:FTC) here, UK-based small-caps that are executing smartly in a specialist niche and steadily growing their global base and revenues with notable contract wins. For now, I’m rating this AMBER/GREEN.

The delivery from management has been excellent so far. If execution continues, and the design services side starts to show repeatable traction, this could tip into green territory.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.