Good morning! It's the last day of Q3. As expected, a large number of companies are posting results on deadline day.

Signing out for today, cheers! We will try to catch up on missed stories later in the week.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

Legal & General (LON:LGEN) (£13.6bn) | Outgoing CFO informed the Board of his decision to stand down. New CFO is CEO of L&G’s Institutional Retirement business. | ||

3i Infrastructure (LON:3IN) (£3.28bn) | On track to exceed return target for the half year. On track to deliver FY26 dividend target. | ||

Assura (LON:AGR) (£1.53bn) | LfL increase of 5.6% on first half rent reviews. £250m development pipeline over next two years. | ||

Elementis (LON:ELM) (£927m) | Outgoing CFO retires after nine years. Replacement is CFO of Learning Technologies Group. | ||

A G Barr (LON:BAG) (£760m) | Full year profit expectations reconfirmed. H1 revenue +3.1%, adj. PBT +20.1% (£35.2m). | ||

Close Brothers (LON:CBG) (£747m) | Op loss £122m, adj. op profit (continuing) £144m. Motor finance provision unchanged. More clarity needed for dividend reinstatement. | ||

Boku (LON:BOKU) (£677m) | Rev +34%, op profit $11.9m (H1 last year: $0.4m loss). Own cash $87.3m. Full year adj. EBITDA to be in line with consensus. | ||

Serica Energy (LON:SQZ) (£671m) | Acquires Prax Upstream for $25.6m, Prax is 100% owner and operator of the Lancaster field and owns 40% of Greater Laggan Area, a 10% interest in the Catcher Field, and a 5.21% interest in the Golden Eagle Area Development. Adds 11.0mmboe 2P reserves and 7.9k boepd production. Takes on $350-$400m decomm costs, mostly in 2030s. | AMBER (Mark) | |

PayPoint (LON:PAY) (£467m) | Strategic Investment in Collect+ by International Distribution Services | SP +11% IDS to take a 49% ownership, with an investment of £43.9 million, valuing the Collect+ business at £90 million. Paid out to shareholders as a 50p special dividend. | GREEN (Graham) [no section below] This is a watchlist stock for me, and we've been AMBER/GREEN on it in this report (e.g. here and here). I'm going to upgrade it to fully GREEN today on the back of another very nice piece of news which validates the worth of Collect+ (one of PayPoint's many business lines!), deepens the strategic relationship with Royal Mail, and immediately results in a 50p special dividend for PayPoint shareholders. For a more cautious perspective, see Roland's coverage here. From my perspective, this is an overlooked financial stock: management have proven themselves to be savvy operators and have achieved some very interesting partnerships with much larger entities: Amazon, Lloyds Bank, Royal Mail. They do carry some leverage but I think they can afford to. They are returning £90m to shareholders in the current financial year. |

Card Factory (LON:CARD) (£372m) | SP -4% | GREEN (Graham) [no section below] There is no updated broker note up on Research Tree yet. Singer did update in early September, with upgraded forecasts as follows: FY January 26 revenue £596m, adj. PBT £71m; FY January 2027 revenue £650.5m, adj. PBT £79.4m. EPS is seen at 15.2p in the current financial year, then rising to 17p. So there’s a very cheap earnings multiple at work, although with the potential for some adjustments to muddy the waters. Today’s accounts are unclean, with the following items: £1.7m of costs to acquire Funky Pigeon (reasonable in my view), £0.6m amortisation (probably also reasonable), and losses of £3.4m tied to FX derivatives. I would not be inclined to allow these losses to be adjusted out, as I think the effects of hedging transactions should be counted. In the big picture, however, there is a £70-80m PBT opportunity here and the headline is that expectations remain unchanged for the time being. We’ve been GREEN on this and I’m going to leave that alone today. Personally, this is not the type of stock that would find its way into my portfolio or watchlist, as I view cards/party supplies as a particularly commoditised industry and a dangerous niche within the retail sector for investors. I also note that CARD is moderately financially leveraged (£79m) and also of course leveraged through leases (£121m). But it’s cheap, it has made a nice acquisition, and there is every chance that it can rerate higher from the current level. | |

Asos (LON:ASC) (£350m) | SP -6% FY25: adj. EBITDA +60%, expected to be towards the lower end of the £130-150m guided range. Revenue is “slightly below” consensus estimates. Gross profit margins up 350bps. Profit per order up by c. 30%, and a modest free cash inflow, “ahead of broadly neutral guidance”. Confident in achieving FY26 adj. EBITDA and FCF in line with forecasts. | BLACK (RED) (Graham) [no section below] We’ve been RED on this and our lack of faith is rewarded with a profit warning, adj. EBITDA set to come in at the lower end of the guided range for FY August. This update is really all about strategy, with the company saying that it has addressed legacy issues, rebuilt its commercial model, and has now moved on to re-engage powerfully with customers. I applaud management for attempting to fix what went wrong, raising margins and profit per order, but a quick glimpse at the StockReport reminds me that the company is forecast to remain loss-making for the foreseeable future. Net debt excluding leases was £276m at the end of H1 - this still looks very financially hazardous to me. | |

Ocean Wilsons Holdings (LON:OCN) (£317m) | Investment portfolio returned 5.1% gross, 4.6% net in H1. | PINK (proposed all-share merger with Hansa Investment Company) | |

Niox (LON:NIOX) (£307m) | Rev +21% at constant FX. Adj. EBITDA +30% (£9.2m). “Comfortably in line with revenue & adj. EBITDA consensus exps.” | ||

Big Technologies (LON:BIG) (£247m) | Strong underlying trading but FX headwinds and margin mix to impact revenues (c. 5%) and EBITDA (c. 10%). | BLACK | |

Avacta (LON:AVCT) (£210m) | £12m outflow from operations, £9m inflow from sale of Launch Diagnostics. Raised equity to fund quarterly bond payments. | ||

Animalcare (LON:ANCR) (£162m) | Full year results to be in line with expectations. H1 revenues +20.8% at constant FX, underlying PAT £6.7m (H1 last year: £3.5m). | AMBER/GREEN (Graham) Pretty good results and I get the chance to interview management. Organic growth is fairly low but the company is investing heavily in R&D, with increased R&D results in lower EPS forecasts for the next few years. This is not a profit warning, according to the company and its brokers - instead, it's a sign of ambition and confidence in their growth potential. I'm happy to give this an upgrade by one notch as I think the earnings multiple is modest, if you assumed R&D spending was set to zero. As is ordinarily the case with pharma stocks, it then becomes something of a bet on R&D success prospects. | |

Savannah Energy (LON:SAVE) (£126m) | H1 2025 and full-year 2024 report to be published on 10th October. SAVE’s shares to remain suspended until both published. | ||

Strix (LON:KETL) (£106m) | H1 Revenue -9% to £60.5m, EBITDA -18% to £13.7m, PBT -22% to £6.1m, EPS -41% to 1.7p, Net debt flat to £68.8m. Trading for the 15 months to 31 March 2026 to be in line with management expectations. | ||

Invinity Energy Systems (LON:IES) (£104m) | H1 revenue & grant income £2m. £20m order book drives H2 weighting. H1 operating loss £10.2m. Net cash £18.7m. | ||

Jadestone Energy (LON:JSE) (£102m) | H1 Revenues +23% to $228.3m, EBITDAX +67% to $101m, PBT $32.8m (24H1: $31.1m loss), Net debt $108m (31 Aug net debt $53.5m after $62.5m received post period end). Production guidance unchanged. | AMBER/GREEN (Mark - I hold) | |

Eurasia Mining (LON:EUA) (£91.5m) | West Kytlim mine in position to significantly step up production, while NKT licence has been extended to allow time to apply for a production permit. | ||

KEFI Gold and Copper (LON:KEFI) (£90.7m) | Significant progress made with Tulu Kapi Gold Project. On schedule to begin full development programme in October. | ||

Journeo (LON:JNEO) (£82.3m) | £1.1m purchase orders from Worcestershire County Council. | ||

Watkin Jones (LON:WJG) (£76.7m) | Sale of new c. 784 bed student accommodation in Glasgow to JV entity owned 5% by WJG. | ||

Venture Life (LON:VLG) (£70.4m) | Additional investments to underpin growth. Confident in meeting management expectations for 17-month period to May 2026. | ||

Agronomics (LON:ANIC) (£63.6m) | Portfolio company Clean Food acquires the assets of Algal Omega 3 Ltd. Immediate access to 1 million litres of fermentation capacity. | ||

Zephyr Energy (LON:ZPHR) (£63m) | H1 revenue -54% to $6.3m, due to lower production and lower commodity prices, revenue expected to increase in H2. H1 LAT $13m. Cash $5.8m (24H1: $1.1m). | ||

HSS Hire (LON:HSS) (£62.6m) | Likely to be suspended from trading for not producing audited accounts. “...actively advancing a range of promising commercial and strategic initiatives focused on long term value creation…” | ||

Enwell Energy (LON:ENW) (£62.5m) | H1 revenue -86% to $3.4m due to suspension of production, Op Profit -95% to $1.0m, Cash $100.7m (24H1: $93.7m). Continuing to pursue legal proceedings to challenge the suspension orders. | ||

Hemogenyx Pharmaceuticals (LON:HEMO) (£62.3m) | H1 LBT £5.0m (24H1: £2.8m LBT), £227k cash after raising £2.2m. Further £2.2m raised post period end. | ||

1Spatial (LON:SPA) (£53.5m) | EA includes annual enterprise licences of US$1.5m representing a 50% increase in licence revenue on FY25. | ||

Ferro-Alloy Resources (LON:FAR) (£46.9m) | H1 Revenue +19% to $2.5m, LBT $3.5m (24H1 $4.0m loss), Net debt $16.7m (24H1: $9.9m net debt). Awaiting the imminent publication of the feasibility study for the Balasausqandiq project. | ||

Billington Holdings (LON:BILN) (£43.3m) | H1 Revenue -28% to £41.8m, EBITDA -50% to £2.68m, PBT -64% to £1.67m, Net Cash £18.7m (24H1: £21.9m), FY25 results below market expectations, FY26 in line with market expectations. |

BLACK/AMBER (Mark - I hold) | |

Novacyt SA (LON:NCYT) (£29.8m) | H1 Revenue +2% to £9.8m, LBITDA £4.1m (24H1: £5.0m LBITDA), Cash £23.7m (24H1:£30.5m). | ||

MicroSalt (LON:SALT) (£27.8m) | H1 revenue $0.8m (24H1; $0.2m), Net loss $1.9m (24H1; $2.8m), Cash $0.9m following $2.9m fundraise (24H1 $0.3m). | ||

Clean Power Hydrogen (LON:CPH2) (£24.8m) | H1 LBT £3.7m (24H1: £2.7m), Cash £1.8m after £6.1m raise in January, £7.4m raise post period end. | ||

Solvonis Therapeutics (LON:SVNS) (£24.3m) | H1 LBT £1.6m (24H1: £0.5m LBT), Cash £1.7m (24H1: £27k LBT) following £2m fundraise. | ||

Emmerson (LON:EML) (£23.9m) | H1 LBT £1.3m (24H1: £1.6m), Cash £0.6m (24H1: £2.3m). Litigation ongoing. | ||

Mast Energy Developments (LON:MAST) (£20.3m) | JV Agreement signed with Carbon Zero Markets. | ||

Rome Resources (LON:RMR) (£20.1m) | LBT £578k (24h1 £214k LBT), Net cash £1.1m (24H1: £1.8m net debt) after £8.3m placing. | ||

Symphony Environmental Technologies (LON:SYM) (£16.5m) | H1 Revenue -15% to £2.93m, Op Loss £0.37m (24H1: £0.42m), Net debt £1.43m (31 Dec: £2.69m net debt) after £2.25m fundraise. | ||

Tan Delta Systems (LON:TAND) (£16.1m) | H1 Revenue -29% to £0.5m, LBT £0.8m (24H1: 0.5m LBT), net cash £2.0m (24H1: £3.6m). | ||

Cloudbreak Discovery (LON:CDL) (£16.1m) | Five nuggets recovered with metal detectors. | ||

Tortilla Mexican Grill (LON:MEX) (£15.5m) | SP -8% | BLACK (RED) (Graham) [no section below] Another share where our lack of faith has, so far at least, turned out to be justified. Today's strategic highlights include focus on UK "profitability", defined as Adjusted EBITDA (pre-IFRS 16). But the UK business remained marginally loss-making (£0.3m), and the group as a whole posts a £2.3m loss. A debt facility with Santander has been enlarged; net debt excluding leases has increased to £9.8m. Along similar lines, the balance sheet is in the red even before we exclude the value of intangibles. Anything is possible in business, but I'd be highly surprised if this one worked out well for investors. | |

Tissue Regenix (LON:TRX) (£15m) | H1 Revenue -6% to $13.8m, Adj EBITDA -78% to $0.2m, Net debt $9.3m (24H1: $7.9m net debt). | ||

Argo Blockchain (LON:ARB) (£13.7m) | H1 Revenue -78% to $6.3m, Net loss $8.1m (24H1: $38m loss), cash $1.7m. | ||

Cadence Minerals (LON:KDNC) (£12.8m) | Funding Secured for Cadence's Participation in the Azteca Plant Offtake via Equity Subscription of £2.16 million; Directors Subscription of £0.18 million and Retail Offer to raise up to £0.2 million. | ||

EMV Capital (LON:EMVC) (£12.6m) | H1 Revenue -9% to £1.1m, Loss £1.5m (24H1: £1.8m loss), Net assets -6% to £13.6m. Cash £0.5m (24H1: £1.0m). | ||

Genincode (LON:GENI) (£12m) | H1 Revenues +15% to £1.6m, Adj LBITDA flat at £2.0m, Cash £2.44m (24H1: £1.11m) following £3.7m net raise. Revenue for the full year is likely to be lower than expected. | ||

Switch Metals (LON:SWT) (£11.8m) | LBT £1.0m (24H1: LBT £0.18m) In total over 400 tonnes of samples have been collected on schedule and on budget from a total of 369 pits, for a cumulative total depth of 1,609 metres. Samples from these holes contain various quantities of heavy minerals, including tantalum. | BLACK | |

Futura Medical (LON:FUM) (£11.7m) | H1 Revenue -86% to £1.0m, LBT £6.6m (24H1: £1.0m PBT), Cash £3.7m (24H1: £3.9m). Expects revenues for FY 2025 to be materially below expectations. | BLACK | |

Oracle Power (LON:ORCP) (£11.5m) | MEGA Resources will fully-fund the operations with Project Owners to receive 50% of the profit. | ||

Bow Street (LON:BOW) (£11.1m) | H1 Revenue -21% to £15.1m, Adj EBITDA -37% to £1.2m, Op Loss £0.2m (24H1: £0.6m profit), Net cash excl leases £2.4m (24H1: £2.2m). £10.1m raised post period end. | ||

Kelso group (LON:KLSO) (£10.7m) | 30 Jun NAV £9.2m, “As of today's date, The Works and NCC are Kelso's largest holdings, each at 23% of the investments, with THG at 21%, Selkirk at 20%, and Angling Direct at 14%.” | ||

Airea (LON:AIEA) (£9.5m) | Revenue +6% to £9.82m, u/l Op Profit +31% to £0.63m, Net cash flat at £1.3m, advanced negotiations to divest £4.1m of investment property. Made an encouraging start to the third quarter. No interim dividend. |

Graham's Section

Animalcare (LON:ANCR)

Up 4% to 243.9p (£168m) - Interim Results - Graham - AMBER/GREEN

I had the chance to interview management here this morning, an opportunity which I took.

First let’s take a look at some H1 headlines:

Revenue +18.5% to £43.8m (higher at constant exchange rates)

Adj. EBITDA +39.5% (£9.2m)

Randlab (acquisition we discussed here) makes a “significant contribution”.

Organic growth of 1.3% “reflecting resilience in varied end-market conditions”.

The end result is a reported profit after tax of £3.3m (last year’s £5.1m result was boosted by a disposal).

On an “underlying” basis, profit after tax from continuing operations is £6.7m (H1 last year: £3.5m).

The main adjustment which gives rise to that figure is amortisation and impairment (£2.9m). I’m fine with this, if we also write intangibles on the balance sheet down to zero.

There are also “restructuring costs” (£0.5m) and “acquisition and integration costs” (£1.1m).

I’m a bit more measured when it comes to allowing these types of adjustments - it might be prudent to allow half of them.

So I’d prudently estimate the underlying profit after tax from continuing operations at around £6m, give or take.

Estimates: thanks to Singer for publishing on this. They have left their forecasts unchanged, except for the impact of increased R&D: an extra £0.3m this year (£3.8m total R&D), an extra £1.7m next year (£5.4m total R&D), and an extra £1.8m the following year, in 2027 (£5.6m total R&D).

For 2026 this means a 12% cut to the EPS forecast, to 13.4p.

For 2027 this means an 11% cut to the EPS forecast, to 13.9p.

For the current year, they expect EPS of 14.2p.

So increased R&D will mean lower EPS for the next few years. Singer says that increased R&D is in line with management’s ambition to “build a potentially transformational portfolio of new products”.

Management interview

I had the opportunity to speak with CEO Jennifer Winter and CFO Chris Brewster this morning, so many thanks to them for taking the time to speak with me.

Product overview: I asked about ANCR’s two main brands, Plaqtiv+ and Daxocox, where they own the relevant IP.

Plaqtiv+ is a non-prescription brand that breaks down dental biofilm (plaque). CAGR there is expected at 20%+.

Doxocox is a weekly prescription drug that treats dog osteoarthritis. Animalcare is looking to build it out in a variety of ways: it will be used in response to more indications, it is being expanded internationally, and through partnership agreements. The CAGR is c. 30%.

Higher R&D: management do not see today’s change in forecasts as a downgrade, but as a sign of the company’s confidence in its growth. Looking at the products in the pipeline, “we (i.e. Animalcare) know them well”, and some of them are low-risk. There are two early assets where the probability of success is less than 50%, but the potential reward is huge.

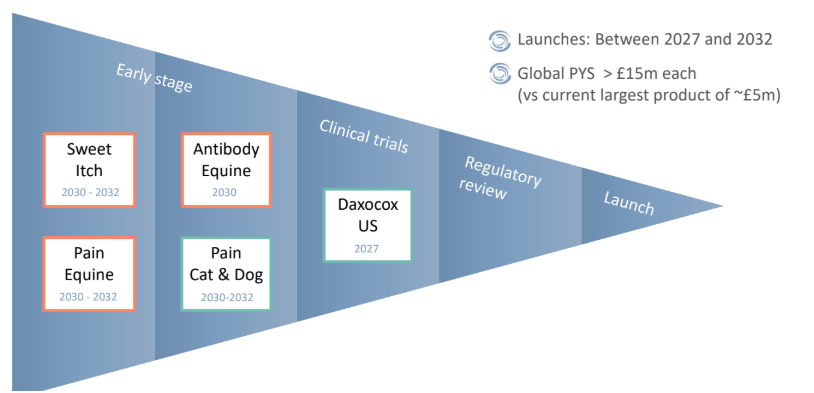

I’ll post a slide from this morning’s slide deck:

As noted in the above slide, the annual revenue opportunity is seen as at least £15m in each of these opportunities, whereas the largest existing product has revenues of c. £5m.

This is seen as attractive relative to M&A, where typical multiples are 5x revenues and 10-12x earnings.

M&A: on the subject of M&A, management informed me that they are always thinking about it. Their Head of M&A is always travelling in search of new opportunities. What they look for in targets: good revenues and EBITDA, and a pipeline, which is difficult to find.

They hope to use M&A to expand geographically, e.g. in France which is currently a gap for them. They could also do much more in Asia-Pac. And smaller bolt-ons would be welcome, too.

Graham’s view

Many thanks again to Jennifer Winter and Chris Brewster for chatting with me this morning.

In P/E multiple terms, the stock is now trading at 18x next year’s earnings. That’s due to the increased share price and the EPS forecast cut.

However, EPS is unlikely to stay still: I asked management what their key takeaway for investors was today, and they said that they were positioned for growth - which I can believe, given the increased R&D investment.

The difficult question for me is how to value the annual R&D expense of £5-6m.

I would guess that the existing business (without any R&D) is probably worth around 12x earnings.

Let’s put it this way: if management instead fixed R&D at zero, I think that adj. PBT next year would be around £18m next year (instead of the £12.5m forecast).

Applying tax and dividing by the share count, I get EPS of 19.5p.

At that rate of earnings, the current P/E would be 12.8x.

This seems like a good way to value the company: value it on the basis of zero R&D (e.g. 12x), and then adjust your view higher or lower depending on whether or not you think that R&D is likely to add value.

I’m willing to go along with the idea that R&D is going to add value, so a higher earnings multiple than 12x makes sense to me.

I can’t come up with a precise measurement of what it’s worth, but I think AMBER/GREEN is a reasonable stance for me to take today.

Mark's Section

Billington Holdings (LON:BILN)

Down 18% at 268p - Interim Results and Board Change - Mark (I hold) - AMBER

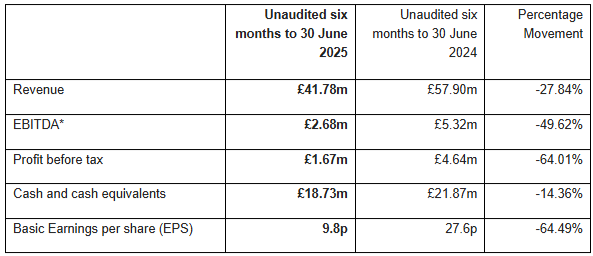

First up for me, on what I am dubbing BLACK Tuesday is one of my holdings, structural steel specialist Billington. These interims are rather lacklustre:

It is a cautionary tale as to why order books are not everything. They say:

…the Group has been successful during the period in securing a number of significant contracts that have further increased in magnitude and has a healthy order book spanning multiple market sectors.

However, in the absence of specific performance milestones, the company recognises revenue when they deliver to the customer. So, delays to customer delivery schedules cause significant drops in revenue:

Billington Structures faced a challenging first half of the year, with significant pricing pressure, contract delays and deferments and subdued demand.

This can be seen in WIP, which is at a similar level to last year, and up significantly on the year end, despite lower revenue:

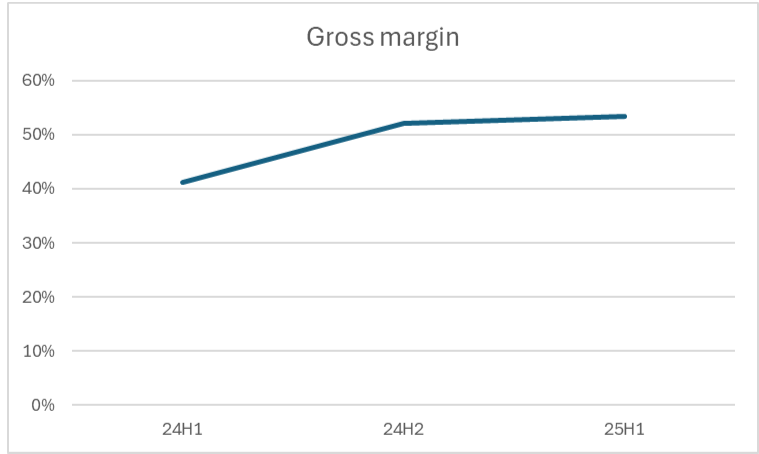

They also flag challenges with pricing power. The majority of structural steel suppliers are privately owned and in tough times they will reduce pricing in order to win business and keep their operations busy. While this may be part of the story as to why Billington have lower revenues, there is little sign of them having to compete only on price. Their Gross Margin on materials only has actually increased in H1 this year:

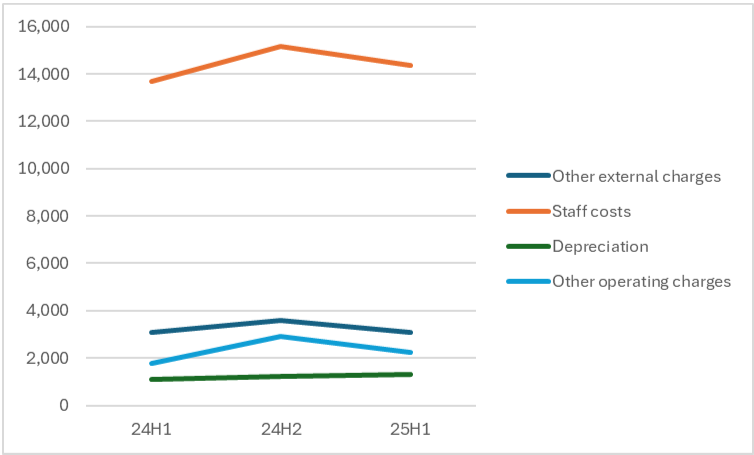

And costs are largely flat:

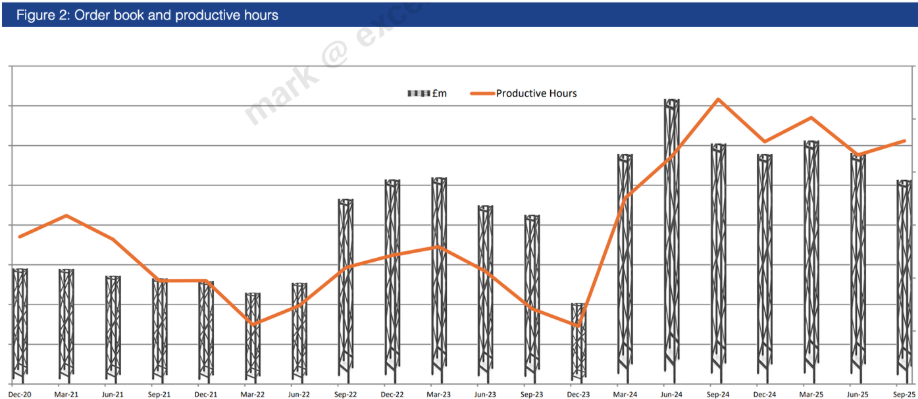

The issue is that those costs are the same on much lower revenue. The company also points out that it is productive hours that matter as much as order book value, saying that “H1 2025 productive hours increased by 5.4% compared to H1 2024.”

Given the graphics, it looks like their broker, Cavendish, have been given a sneak-peek at this afternoon’s investor presentation, which backs up this trend for improving productivity:

The big downside, though, is that there is no significant recovery predicted for revenue for the rest of the year:

With the Group now undertaking a smaller number of larger contracts, the timing of their deliveries and the resultant profit recognition, will have a more material impact on the Group's results in a particular period. The programmed delivery of a number of contracts has experienced client led delays and as a result the Group expects to recognise margin later than previously forecast, with profit previously expected to be recognised in 2025 now expected to be recognised in 2026. It is therefore expected that the results for the year ended 31 December 2025 will be below market expectations, with uncertainty remaining over the precise timing of profit recognition on certain contracts.

Cavendish quantifies this for us, and it is a huge downgrade to FY25 numbers. They reduce FY25 Revenue from £115m to £92.5m which takes a whopping 52% out of PBT for the year. This comes on top of the downgrade earlier in the year which took 15% out of revenue and 27% out of FY EPS. Overall this year 2025E EPS has gone from 55.5p down to 18.8p. It is perhaps unsurprising that the shares have halved in value this year.

However, there are signs that these issues (at least in their severity) are short term in nature. The company also says that FY26 remains in line with expectations, which are for £125m in revenue and 44.8p EPS. We must really consider this to be a downgrade here too, as this will benefit from the delayed revenue recognition from FY25. However, there will undoubtedly be contracts that are in the order book that were originally planned to book revenue in 2026 that are pushed into 2027. The key point is that this appears to be a demand shift to the future, with the inability to fill the short term with acceptably priced contracts to make up for this, rather than a fundamental shift in their competitive position within the industry.

Cash & Cash Flow:

The company has always been conservatively run, as the lack of the word adjusted or its usual synonyms in these results attests:

This extends to the balance sheet where they tend to hold significant cash balances:

The Group continues to enjoy a strong cash balance, with cash and cash equivalents of £18.73 million as at 30 June 2025 (31 December 2024: £21.70 million and 30 June 2024: £21.87 million). Post period end, on 1 July 2025, £3.3 million was utilised for the 2024 dividend declared earlier in the year.

That makes the current pro-forma cash balance around £15.4m, or around 40% of the current market cap. The reduced cash balance has mainly been about working capital flows. Net working capital excl. Cash has risen to £6.7m at 30th June compared to £2.6m at the same time last year, and £5.8m at the year end. The 24H1 position always looked temporary, but the current build up perhaps leaves some room for normalisation to lower levels. In the short term, the delays to revenue recognition and payment for WIP have Cavendish reducing their cash forecast to £16.3m. However, this rises to £21.5m by the end of 2026 due to profitable trading and more normal working capital requirements.

Over the past few years they have had a policy of investing in improving their operational efficiency. This is coming to an end, but they have also slowed this in H2 this year in response to weaker market conditions:

The Group is now in the final year of its planned five-year capital investment and modernisation programme, but we are mindful of the current subdued economic environment and therefore it is likely the remaining elements of capital equipment will be replaced in 2026. It is therefore expected that capital expenditure will be approximately £3.25 million in 2025, with £2.15 million of this year's expenditure being invested in the first half.

Once this is over, this should boost free cash flow further. On top of this, it looks like they may be making progress on accessing the £1.8m pension surplus.

Where I am most disappointed is in their use of this cash. Cavendish have them reducing their FY dividend payout in line with earnings, and while I understand the desire to always pay a covered dividend, with the cash balance and the downturn expected to be short term, surely it would be better to maintain this, even if they have a year uncovered.

They have done well in the past buying businesses out of administration, and perhaps they feel the current short-term delay cycle will lead to distressed competitors or adjacent businesses that can be acquired on the cheap. However, their own shares now trade at 0.75xTBV. It seems hard to imagine that they will find a profitable business on similar metrics, and you have to wonder if they wouldn’t be better off just buying back their own shares.

Valuation:

0.75x TBV seems cheap to me for a conservatively run business that is still profitable, but going through a weak patch. However things don’t look as good on near-term earnings. With the shares currently around 279p to buy, that's 14.8x forward earnings. However, that falls to 8.7x if we cash adjust it based on the current cash balance, or 8.3x on the year end estimate from Cavendish. This falls to 6.2x on FY26 EPS estimates, and 3.5x cash adjusting on this year’s cash estimate, or 2.5x if you take the 2026 year end estimate and assume they also get to access the pension surplus next year. This puts it amongst the cheapest UK stocks on forward earnings, IF these estimates are reasonable.

Management changes:

When a profits warning is accompanied by a management change, you normally expect that it is one of the C-suite falling on their sword. In this case it looks more benign:

…Trevor Taylor, the Company's Chief Financial Officer, has been appointed to the new Board role of Chief Operating Officer, effective from 1 October 2025. Dave Jones, currently Finance Director - Group Companies, will join the Board as Chief Financial Officer, from 1 October 2025 after successfully leading the operational finance function at Billington since 2019.

I think this possibly backs up the idea that the current malaise is a function of wider market conditions and that there have been no major missteps by management in the eyes of the board.

Mark’s view

While I understand the market reaction this morning to a clear disappointment and big downgrade to near-term EPS, I think this may be a case where the very low momentum has taken the share price below fair value:

If the company gets anywhere close to the current FY26 EPS forecasts they will be one of the cheapest stocks on the UK market despite have a long-term history of profitable growth and good capital allocation. I think the now discount to TBV means this has fallen too far.

Roland was prescient when he downgraded this to AMBER/RED following the previous profits warning, saying “However, this negative momentum could persist for a while, so I’ve downgraded my previous view to moderately negative.” There is still the risk that a further warning could be on the way, and many investors will want to wait for the Momentum Rank to turn up, but given that this is so cheap and the cash balance starts to protect the downside from these levels, I have to nudge this up to AMBER.

Serica Energy (LON:SQZ)

Up 11% at 190.8p - Acquisition of UK North Sea asset portfolio - Mark - AMBER

This announcement shows the type of deals that can still be done in a rather depressing North Sea Oil Sector. It is a rather confusing situation:

…a sale and purchase agreement to acquire 100% of the issued share capital of Prax Upstream Limited ('Prax Upstream') from Prax Exploration & Production Plc (in Administration) (the 'Acquisition'). Prax Upstream holds a 100% interest in, and is the operator of, the Lancaster field. In addition, Prax Upstream is party to separate executed sale and purchase agreements with TotalEnergies and ONE-Dyas for the purchase of certain assets ('Existing SPAs').

Prax got itself into trouble after taking on a large debt load in 2021 to buy the Lindsey oil refinery from TotalEnergies. "Material irregularities" were discovered in June 2025 within a crucial £783 million securitization loan facility, which was the main source of the group's working capital. Administrators were called when the company defaulted on money owed to Glencore, who triggered security clauses leading to the seizure of refined oil products and feedstocks.

Serica are only taking the upstream assets, including some from Total and ONE-Dyas, which are:

a 40% operated interest in the Greater Laggan Area ('GLA'), a 10% interest in the Catcher Field, a 5.21% interest in the Golden Eagle Area Development ('GEAD') and a 100% interest in the Lancaster field.

This is the impact on production:

A more diverse and robust production portfolio, with H1 2025 production of 7,900 boepd associated with the Existing SPAs and 5,900 boepd from the Lancaster field (expected to cease production in H2 2026)

They are only paying $25.6m, and indeed seem to be being paid to own the assets by completion!

Upon completion, Serica will pay an aggregate upfront consideration of $25.6 million and will receive payments totalling an estimated c.$100 million reflecting interim post-tax cashflows between the economic dates of each transaction and estimated completion dates

This seems a phenomenal deal, and it is no doubt helped by a lack of competition in UK O&G due to increased government regulation and taxation. However, the company is also taking on the decommissioning costs. So while they get significant near-term cash flows, they are also committing to spending large amounts in the future:

Near-term decommissioning costs relate largely to the plugging and abandonment of two wells at Lancaster, forecast to cost c.$60 million

- Catcher and GEAD decommisioning is set to occur towards the end of the decade, at an estimated net cost of c.$90 million

- Decommissioning at GLA is not currently planned until well into the 2030s, with net post-tax costs potentially in the range of $200 to $250 million. As operator, Serica expects to work with partners to pursue opportunities to extend the productive life of the facilities through increasing production and securing third party throughput

I make that $350-400m, although with only $60m of that in 2026, the NPV will be much lower. And perhaps the biggest advantage is that they also get a load of further tax losses (which also helps explains the complexity of the deal structure.)

Mark’s view

This looks a great deal, although acquiring mature assets from financially struggling companies isn’t without risk, as Serica have found out with the maintenance issues on their current non-operated assets! Roland downgrades this to AMBER after issues with yet another problem with the Triton FPSO. Although this still looks cheap on earnings and dividends, I think I’ll leave it the same until it is clear these new assets have bedded in without any issues being found.

Jadestone Energy (LON:JSE)

Up 5% at 19.8p - 2025 Half Year Results - Mark (I hold) - AMBER/GREEN

In case investors needed another cautionary tale about acquiring aging producing assets, this company provides one. They acquired the Stag field offshore Western Australia in 2016 and Montara in the Timor Sea in 2018, with the aim of extending the lifetime of these. They were relatively successful with this and for a number of years these were the cash cows that enabled them to acquire and develop newer and better located assets, including the Akatara gas field that they developed and went into production last year.

While Jadestone have managed to extend the life of Stag, the retirement of its FPSO in 2020 means that they have had to use tankers for direct offloading, upping the cost considerably. At Montara, the FPSO experienced multiple shutdowns for repairs, maintenance, and regulatory inspections after leaks were found in one of the tanks. It became clear that life-of-field costs at both Montara and Stag would be higher than anticipated due to rising repair and maintenance expenses. What were significant assets were, at least for a time, liabilities.

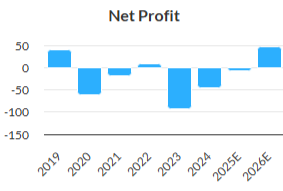

The impact of this can be seen on the profits:

And even more severely on the share price:

What attracted me here was that this had become pretty much the most hated company in a hated sector. On top of the issues with Stag and Montara, the company took on debt to develop the Akatara gas field, adding to the risk. Plus, it seems that some institutions have been keen sellers for ESG rather than valuation reasons.

The scale of the dislike can be measured by the current £102m market cap. These results give us up to date production figures:

Record production of 20,368 boe/d (H1 2024: 16,867 boe/d) from a diversified production base, representing 21% growth year-on-year, underpinned by a strong performance from Akatara.

This is in the middle of their guidance range, which was upgraded in July. Bear in mind that Serica reviewed above has a 29-32boepd guidance range for 2025, some 50% above Jadestone. However, Serica is valued at £671m some 6.6x larger despite operating in a higher tax and lower oil price environment.

Of course, there are many factors that I am not including here such as reserves, production growth, cost environment, oil vs gas mix. And of course a fair comparison would be on an EV basis, which would make the multiple less severe. Still, it shows how hated Jadestone is. None of that matters if it is hated for good reason. However, a new management team is largely in place with a mandate to focus on operational performance rather than deal-making and their initial efforts appear to be helping:

l Profit after tax of US$32.8 million (H1 2024 loss after tax of US$31.1 million).

l Revenues (post-hedging) of US$228.3 million (H1 2024: US$185.1 million), up 23% year-on-year.

l Adjusted unit operating costs of US$24.70/boe (H1 2024: US$31.72/boe), down 22% year-on-year, driven by a focus on cost control across the Group.

With 6c EPS this is the first profit for some time. Mere mortals such as us can’t see the broker coverage, so it is hard to tell for certain. However, it seems to me that the consensus for a FY loss in Stockopedia now looks behind the curve. However, positive EPS hasn’t yet led to positive cash flow as the costs of developing Akatara have been significant and there was a cost overrun at an infill well to extend Montara’s life:

Net debt at 30 June 2025 of US$107.7 million, reflecting cash balances of US$59.0 million and drawn debt of US$166.7 million. The Group received cash proceeds of US$62.5 million in July 2025 from June 2025 Montara and Stag liftings.

With this sort of company, when oil is delivered and paid can make a big difference, and it is also worth noting they received $39m for selling a non-core asset in the period. Most importantly net debt continues to be well within their $200 Reserves Based Lending facilities:

Net debt at 31 August 2025 was US$53.5 million, reflecting cash balances of US$113.3 million and drawn debt of US$166.7 million.

They keep their guidance for $270-360m of free cash flow generation before debt interest costs which would more than cover the debt.

Trade payables are up, but not hugely suggesting that these figures have largely included payments for the Skua well costs. They suggest they may have capacity for further acquisitions, but personally, I’d rather they paid down debt and considered buybacks as a higher priority.

One of the reasons that the shares have done so poorly recently is that Baillie Gifford have been selling, but with them effectively out of what was a 7% position in the company, this overhang looks to have cleared. One of the recent buyers is long-term supporter of the company, Tryus Capital. However, they are now approaching the limit of what they can own without triggering a mandatory offer:

One of the risks is that they may trigger that offer, but at a level that longer-term shareholders would be unhappy with.

The other risk remains further issues at Montara. It seems that this is still on the regulator’s radar, even if they consider any currently required work to be immaterial for cost guidance:

In September 2025, NOPSEMA issued a General Direction requiring Jadestone to revise its policies and approach to the hull integrity management of the Montara Venture FPSO, and commission an independent review and verification that the Group's hull integrity management approach aligns with common industry practice and sound integrity management principles. The safety of Jadestone's people and assets is a priority for the Group, and Jadestone will fully comply with the General Direction. Many of the tasks necessary to meet the General Direction's requirements had previously been identified by the Group's new leadership team, with work already underway to address them. The Group expects that any incremental activity required to comply with the General Direction will not have a meaningful operational impact, nor will it have an impact on the Group's operating cost guidance, which remains unchanged.

Mark’s view

The shares are up around 5% today, but given the first positive results for quite some time, it appears that this may (finally) be the start of some positive momentum in financial performance. If it is, then it looks cheap on EV/production multiples even compared to a lowly rated sector because of what appears due to price-insensitive selling.They just have to prove those Montara maintenance and cost issues are finally behind them. However, I think there is enough in today’s results for us to take a slightly more positive view of AMBER/GREEN.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.