Good morning! And welcome back. I'm happy to report that our spreadsheet is now fully up to date.

Over the last year, we have covered:

- 665 different companies

- 300 companies have been covered at least three times

- 112 companies have been covered at least five times

Serica Energy (LON:SQZ) gets the prize for receiving the most coverage, having been discussed 14 times!

In total, there have been 1,865 company updates since records began on 5th November 2024. We couldn't do it without your excellent comments, constructive criticism and encouragement - thank you!

Spreadsheet accompanying this report: link (last updated to: 31st October).

Today's report is finished, thank you.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

Intertek (LON:ITRK) (£7.8bn | SR76) | Costa Rican testing business Suplilab, described as a market leader in food safety and medical device testing. 2024 rev £3.1m. | ||

Unite (LON:UTG) (£2.8bn | SR56) | Empiric’s occupancy is slightly below Unite’s assumptions, while its rental growth is in line. Unite is currently acquiring Empiric. | PINK | |

Kosmos Energy (LON:KOS) (£571m | SR27) | Net production +3% at 65.5k boepd vs Q2. Rev $311m, opex $148m, capex $67m. | ||

Empiric Student Property (LON:ESP) (£517m | SR37) | 25/26 YTD occupancy 89%. LFL rent +4.5%, in line. Delivery of FY occupancy target “will be challenging”, due to fewer Chinese students. | PINK | |

Capita (LON:CPI) (£358m | SR68) | Customer services and technical support for Samsung UK, extending 14yr partnership. | ||

Anglo Asian Mining (LON:AAZ) (£246m | SR55) | Contract to sell copper concentrate to Trafigura, including $25m prepayment facility. Has now received govt licences to operate a processing plant at Demirli. | ||

Winvia Entertainment (LON:WVIA) (£205m | New Listing) | “Technology-led entertainment business”, with presence in UK Prize Draw (BOTB and Click Competitions) and Romanian online gaming markets. Raised £40m in placing. | No view - new listing (Roland) This is not a sector I tend to study closely, but gaming-related businesses have sometimes proved strong investments. Debt appears to be minimal across the combined group, removing one potential concern. Personally, I will wait for Winvia to publish its first set of accounts as a listed business before taking a view. But for investors with an interest in this sector, I can see that this IPO might be worth a closer look. | |

Optima Health (LON:OPT) (£175m | SR62) | H1 rev +17%, approx £59m (in line with exps). Net debt £4.7m. Continues to believe it is “well positioned for growth in FY26”. | AMBER (Graham) [no section below] This is a pensions administrator that provides SIPPs and SSAS’s, so it’s logical that it would buy up this book of business from AJ Bell (LON:AJB). Investacc only listed last year and we’ve not looked at it before; it was floated by the private equity group Marwyn who still own 60% of INAC. You might recognise their name from AdvancedAdvT (LON:ADVT) where they are a 15% shareholder. Meanwhile, INAC is run by Executive Chairman Mark Hodges, previously CEO of Aviva UK and of Centrica’s consumer division. INAC’s StockReport is currently a sea of red but the historic numbers (to FY June 2024 only) are not too relevant in my view, and there aren’t any earnings forecasts either. So I would keep an open mind. The shares are up 50% since IPO, so the market must like what it has seen so far. | |

M&C Saatchi (LON:SAA) (£166m | SR55) | The offer from Brave Bison (LON:BBSN) "fundamentally undervalues" the division which is a core element of SAA’s growth plans. No discussions are ongoing. See below. | AMBER/GREEN (Graham) I'm happy to raise our stance on SAA as acquisition interest from a company in the sector suggests that its own shares might have become too cheap now (P/E ratio c. 7x). | |

InvestAcc (LON:INAC) (£88m | SR18) | Buys pension administration client books: AJ Bell's Platinum SIPP and SSAS business. Initial consideration £17.5m plus £1m of shares. Defcon of up to £6.5m in the first half of 2026. “The Acquisition represents a material increase in the scale of the Group, and we look forward to welcoming over 3,400 new customers, 46 employees, and new relationships with more than 200 financial advisers.” | AMBER (Graham) [no section below] This is a pensions administrator that provides SIPPs and SSAS’s, so it’s logical that it would buy up this book of business from AJ Bell (LON:AJB). Investacc only listed last year and we’ve not looked at it before; it was floated by the private equity group Marwyn who still own 60% of INAC. You might recognise their name from AdvancedAdvT (LON:ADVT) where they are a 15% shareholder. Meanwhile, INAC is run by Executive Chairman Mark Hodges, previously CEO of Aviva UK and of Centrica’s consumer division. INAC’s StockReport is currently a sea of red but the historic numbers (to FY June 2024 only) are not too relevant in my view, and there aren’t any earnings forecasts either. So I would keep an open mind. The shares are up 50% since IPO, so the market must like what it has seen so far. | |

Brave Bison (LON:BBSN) (£83m | SR57) | Submitted a non-binding proposal to buy M+C Saatchi Performance for enterprise value of £50m from M&C Saatchi (LON:SAA). See above. | AMBER/GREEN (Graham) Leaving our stance on BBSN unchanged due to strong business momentum, although shareholders might need to watch out for dilution from upcoming M&A activity. | |

Synectics (LON:SNX) (£51m | SR89) | 5-year contract. Bus Eireann to deploy Synectics' real-time cloud services across the existing fleet. Synectics has been working with Bus Eireann since 2004, so this extends a long-term relationship. | AMBER/GREEN (Roland) [no section below] This is a win for Synectics’ systems integration business, Ocular, which supplies a mix of own and third-party products. Ocular is much lower margin than the company’s other division, Synectics Systems (which sells proprietary tech through partners). I estimate the trailing 12-month operating margin for Ocular at 7.1%. Based on this, I reckon today’s contract could contribute c.£130k of operating profit over five years (£26k/yr). So while this is still a useful contract win, it’s arguably not that material for a business generating >£5m of annual operating profit. Of course, it’s possible that the mix of products sold under this contract will be higher margin – we don’t know. There’s no update to broker forecasts today and I would not expect a contract of this size and duration to have any material impact on forecasts – in my view it’s probably priced in to existing expectations. Synectics’ recent full-year trading update looked fine to me and I think the valuation remains affordable, on a forward P/E of 10. I am not sure this contract win really justifies an RNS, but I’m happy to leave our broadly positive view on this business unchanged today. | |

EnSilica (LON:ENSI) (£42m | SR27) | Six ASIC design/supply contract wins are on track. New definition and feasibility study contracts worth >£1.6m in revenue. | ||

Renalytix (LON:RENX) (£36m | SR11) | Revenue +30% ($3m). Operating loss $17.2m (previous year: $30.5m). $3.2m of share-based payments. Going concern warning. Cash on hand of $3.6m (June 2025) and $9m raised in September 2025. “We may be required to raise additional funding within the next 12 months and engage in significant cost cutting measures if required to extend the cash runway.” $4m of convertible debt is being converted at 9.5p per share, reducing the long-term debt outstanding to £3.1m as of October 2025. | RED (Graham) [no section below] This “precision medicine diagnostics company” has been a loss-making, cash-burning diluter since inception in 2018. The top-line growth achieved in FY June 2025 offers some hope to investors, and cost-cutting means that operating loss has nearly halved, but the scale of its administrative expenses ($18.4m) are still rather frightening in comparison to its revenues. Regardless of the merits of its technologies, the financials here are clearly unsustainable. If I was a shareholder here, I think that one element that would particularly bother me would be stock-based compensation of $3.2m in FY 2025 (previous year: stock-based compensation of $1.1m). While stock-based compensation does at least preserve the life of the company, which would struggle to pay these amounts in cash, I am stunned to see that the value of stock-based bonuses exceeds the revenues of the company. This is very rare! And to my eyes, an important red flag for a stock which already looks like a highly dubious investment. | |

Fusion Antibodies (LON:FAB) (£15m | SR17) | OptiMAL® successful with smaller peptide targets: will enable Fusion to propose its use for a wider range of targets. | ||

Croma Security Solutions (LON:CSSG) (£11m | SR73) | Revenue +10%, EBITDA +10% (£1.17m), cash £4.3m. Trading in FY26 is on track. | AMBER (Roland) I am cautiously optimistic about Croma’s strategy of acting as a consolidator in the highly-fragmented locksmith market, then using this position to leverage higher-margin fire and security system sales. However, I’m a little concerned by the lack of recent acquisition activity and the weak profitability (at a group level). While the strong balance sheet provides scope for acquisitions and a margin of safety, my feeling is that growth needs to improve to justify both the valuation and the growing cost base. The growth needed could come from acquisitions, but today’s forecasts from Zeus imply that earnings upgrades will need to reach c.50% simply to match FY25 profit levels. For this reason, I’m staying neutral for now. |

Graham's Section

Brave Bison (LON:BBSN) / M&C Saatchi (LON:SAA)

BBSN down 2% to 79.50p (£81m) - Response to Press Speculation - AMBER/GREEN

SAA up 3% to 140.44p (£172m) - AMBER/GREEN

One announcement from each of these companies today.

Brave Bison admits that it made a proposal to acquire M+C Saatchi Performance for a £50m enterprise value (i.e. assuming no cash and no debt carried over).

M+C Saatchi Performance calls itself “the growth marketing agency for digitally-driven brands”.

Rationale for the proposal:

The intention of the Company would be to combine MCSP with Brave Bison's existing performance marketing operations to form a scaled digital media challenger to the global marketing networks. The combined business would be one of the largest independent performance marketing companies outside the US, with a market-leading presence in UK and APAC with no substantial regional overlap.

They were willing to pay nearly twice last year’s revenue (£50m is nearly twice the 2024 revenues of M&C’s Media Division), or six times forecast adjusted EBITDA (£8m).

It’s an optimistic RNS, which even outlines how Brave Bison intends to fund the acquisition - a bank facility for £25m and a place of new shares.

Response: the response from M&C Saatchi pours cold water all over the plan.

The Board is of the view that the Offer fundamentally undervalues the Division and does not reflect the future prospects for the Division which forms a core element of the Company's growth plans; as such no discussions are ongoing.

This gives a very different impression compared to the Brave Bison RNS, which made it seem that the takeover was still possible!

Graham’s view: I can’t blame Brave Bison for being ambitious with their M&A activity. They do already have a small net debt position (see our previous coverage) and it makes sense that they would need to raise additional equity to pull off a £50m takeover. Clearly there is no lack of hunger for more deals - their last acquisition was in September.

Looking at their possible offer for MSCP, it was perhaps reasonable when viewed as a multiple of sales - their own shares trade at a P/S multiple of c. 2x, similar to what they offered for MSCP.

However, in terms of the EBITDA multiple, maybe they did lowball their offer. Their own shares trade at about 13x forecast EBITDA, about double the EBITDA multiple they offered for MSCP.

Perhaps after a period of very strong share price performance (BBSN shares have doubled over the past year, while Saatchi’s shares have retreated), they opportunistically thought this was a good chance to offer their shares as currency to a struggling peer? Saatchi’s valuation in the market is quite poor at the moment.

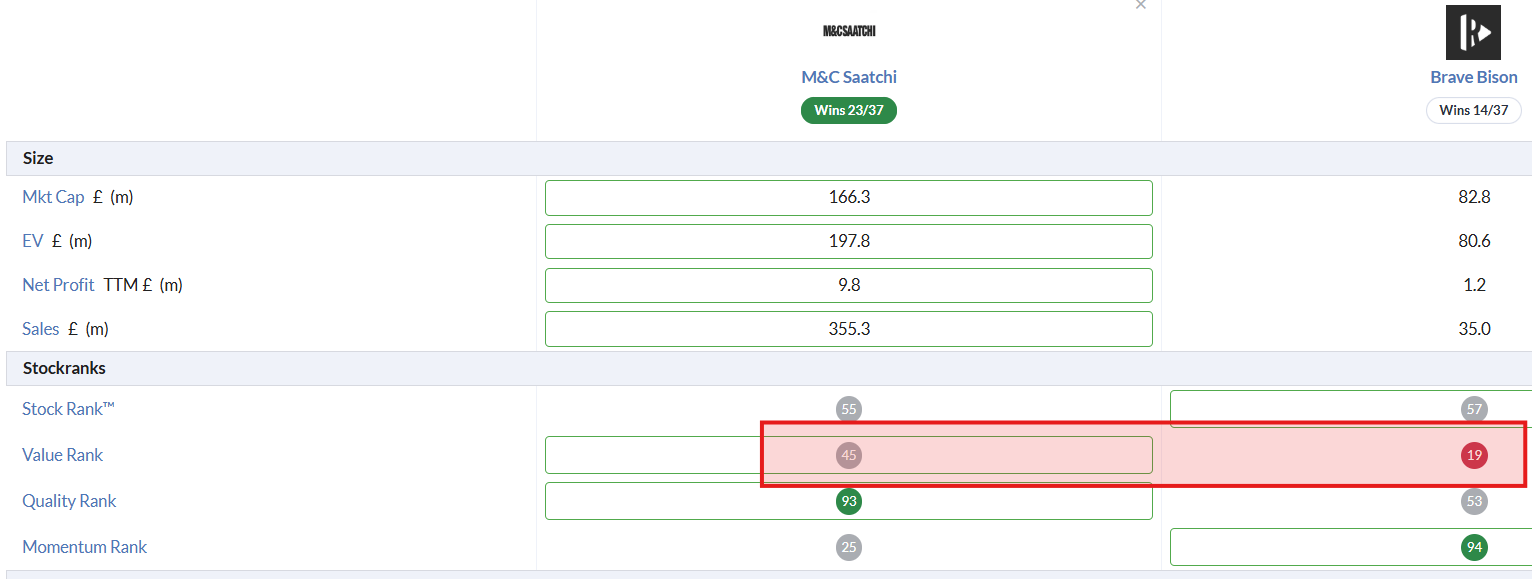

A comparison of the two companies using Stockopedia’s “compare” tool confirms that Saatchi shares are much cheaper than BBSN.

We’ve been AMBER/GREEN on BBSN, and AMBER on SAA.

One slight worry for Brave Bison shareholders might be that management are apparently keen to issue more shares for acquisitions at this level, and might be willing to issue a substantial number of them. It could be a sign that management think their shares are fully valued here? At 11x forecast earnings, I do think that BBSN’s valuation is probably about as high as makes sense for a company in this sector, although it has justified that valuation with strong performance.

Today I’m going to leave our stance on BBSN unchanged, but I’m going to raise our stance on SAA, as acquisition interest from other companies suggests that its own valuation has perhaps become too cheap now.

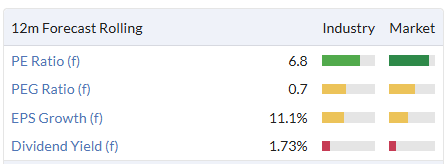

SAA's valuation metrics:

Roland's Section

Croma Security Solutions (LON:CSSG)

Up 2% to 82p (£11.3m) - Final Results y/e 30 June 2025 - Roland - AMBER

AIM-listed Croma describes itself as an “innovation and services-focused security solutions provider”. But I think we can more easily understand this business through its two operating divisions, Croma Locksmiths and Croma Fire and Security (alarm systems).

It’s a small business, but companies that provide essential everyday services and aim to grow through bolt-on acquisitions can sometimes become very successful investments over time. This appears to be Croma’s strategy, according to CEO and 27% shareholder Roberto Fiorentino:

Our strategy of acquiring family-owned locksmith businesses and integrating them into our network of security centres continues to drive profitability and increase our scale.

Today’s results and show a mix of acquisitive and organic revenue growth, with a decent increase in profitability and cash generation:

Revenue up 10% to £9.63m, reflecting acquisitions plus organic growth of 5%;

EBITDA up 10.4% to £1.17m

Pre-tax profit up 3.5% to £825k

Earnings per share up 44.8% to 5.72p

Net cash of £4.33m (FY24: £2.14m)

Dividend of 2.4p per share

(The sharp increase in EPS this year reflects a significant reduction in the tax charge, due to a prior year adjustment. This isn’t explained in today’s results, but broker forecasts suggest the situation will normalise this year.)

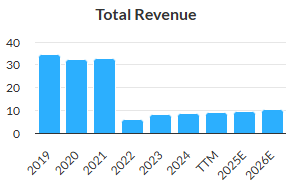

For some background, Croma’s current strategy dates back to 2023, when the group sold its Vigilant “manned guarding business” for £6.5m, to focus solely on building a national network of security centres. Proceeds from this sale are being received in 10 quarterly installments, starting from 31 March 2024 and completing in June next year.

Providing security guards is a relatively high revenue, low margin activity, so this explains the company’s revenue history:

To get a better understanding of Croma’s current performance, I think it’s worth digging down one level to look at the segmental results:

Croma Locksmiths

Revenue +10% to £5.62m

Operating profit +3.6% to £747k

This business serves residential and commercial customers. Two new centres were added last year and the locksmith business operated from 18 centres at the end of the financial year (30 June). However, this total has since fallen to 16 centres, following the consolidation of two centres in Peterborough and two in Southampton.

It’s also worth noting that acquisition activity was below the management’s target of three to five deals per year.

The company provides a useful summary of its strategy in this business:

The security centres are all former locksmith stores and have been converted into a network, servicing not only local communities but also national accounts. Larger commercial customers within this division encompass a broad range of industries including travel, leisure, utilities, housing associations, student housing, healthcare and defence.

Looking across the main customer sectors, retail, facilities management, housing associations, healthcare and utilities are said to have generated the most activity last year.

According to management, one important aspect of this business is that it provides a “natural gateway” to the group’s Fire & Security services, which typically attract a higher share of customer spend:

Typically, corporate security spend allocates around 20% to locksmith services and 80% to Fire & Security, a dynamic that positions us well for cross-selling opportunities.

This division generated a segmental operating margin of 13.3% last year (FY24: 14.2%). Helpfully, the company also provides a breakdown of segmental assets, allowing me to see that the Locksmith division generated a 10% pre-tax return on net assets (FY24: 14.7%).

This level of profitability seems reasonable to me for a business of this kind, but the decline in profitability last year is not ideal. From what I can see, this is due to costs rising faster than pricing. Administrative costs rose by 12.3% to £1.2m last year – presumably due to higher wage/NI costs.

The Locksmith depreciation and amortisation charge also rose sharply, climbing by 32% to £368k. While this is a non-cash item, it does reflect previous capital expenditure and acquisition spending, so I think it’s a relevant consideration for a business whose model is built on acquisitions.

Croma Fire & Security

Revenue up 8% to £4.09m

Operating profit up 9.4% to £606k

Croma Fire and Security provides a full range of electronic security solutions and services to commercial and individual customers and has strong commercial relationships across the public health and hospitality sectors.

This business operates from four regional locations across England, “as usual benefiting from the support and lead generation from our Locksmiths network”.

New Industrial doors products were introduced this year and the company expanded its relationship with the AJAX intruder alarm business.

Work is also underway to complete a software upgrade to the divisional computer systems. This has already been completed in the Locksmith business and is expected to deliver a range of benefits, including standardising quotations, tracking time on projects and improving data collection.

Profitability in this division was a little stronger than in Locksmiths, with an operating margin of 14.8% (FY24: 14.6%) and pre-tax return on net assets of 18.8% (FY24: 31.9%). The sharp fall in return on assets reflects a £1.4m increase in segment assets to £4.2m last year. I’m not entirely sure what drove this relatively large increase

Outlook

There’s no specific outlook guidance in today’s results, but Mr Fiorentino sounds upbeat and seems to suggest we could soon see an increase in acquisition activity:

We have started the new financial year well, and with a very strong pipeline of acquisition opportunities lined-up and close to completion, we expect these new stores, as they are acquired and integrated into the business, will drive a step-up in Group revenues.

Fortunately, I have access to an updated broker note from Zeus on Research Tree – many thanks.

The broker has left its FY26 forecasts unchanged today but notes that “our forecasts assume no contribution from future acquisitions and are very likely to be upgraded as acquisitions are announced”.

That seems reasonable to me, given that we are already in the fifth month of Croma’s FY26 financial year.

Zeus FY26E forecasts are very similar to the consensus figures shown on the StockReport, with adjusted earnings (excluding any future acquisitions) expected to fall sharply this year:

FY25 actual Revenue / EP:S £9.6m / 5.72p

FY26E Revenue £10.2m

FY26E EPS: 3.9p

Zeus’s estimates suggest the forecast fall in earnings this year will be driven mainly by a further significant increase in overheads, paired with a return to a more normal tax charge after this year’s reduction.

I assume the increase in overheads partly reflects the annualisation of higher employment costs following April’s increase to the minimum wage and NI. Zeus also notes that the company is currently investing in senior leadership to support the rollup strategy; it looks like Croma may be adding headcount in an effort to get its acquisition strategy back on track.

At the last-seen price of 82p, this prices Croma on 21x FY26E earnings with a possible 2.9% dividend yield.

Roland’s view

I haven’t looked at Croma properly before and my initial impression is mixed. The company seems to have a sensible strategy and benefits from a very strong net cash position, thanks to the continued quarterly instalments from the Vigilant sale. I can see the potential for it to become a larger business.

However, the long-term performance of the stock has been uninspiring, and I also have a couple of potential concerns.

The pace of acquisitions has clearly fallen behind the company’s target level, both last year and so far in FY26. We’re more than a third of the way through the current financial year and Croma hasn’t yet made a single purchase.

I’d be interested to know why acquisitions are running behind schedule – is it due to disagreements on pricing, a lack of suitable businesses to buy, or simply a lack of internal capacity to complete deals?

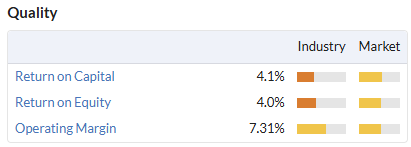

The other point I’d make is that profitability is also a little lower than I’d like to see. I calculate a FY25 operating margin of 6.2% and return on capital employed (excluding net cash) of 4.9%. These are similar figures to last year:

Admittedly, 35% of the current market cap is covered by net cash. That provides a significant margin of safety and gives Croma’s management plenty of dry powder for acquisitions.

However, while the stock is only trading slightly above its tangible book value of 76p per share, I would argue that this level of profitability doesn’t really justify a stronger valuation.

Looking at the valuation relative to earnings suggests a similar conclusion. Given the modest level of organic growth, my feeling is that the current P/E of >20 is only really justified by hopes of stronger earnings growth in the future.

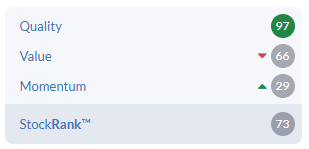

Prior to today’s results, the StockRanks viewed this as a Contrarian stock with strong quality and value credentials, but weaker momentum:

This largely reflects my own view, so my choice lies between AMBER and AMBER/GREEN today.

I would like to be able to go AMBER/GREEN, but I’m a little concerned by the group’s rising cost base and seemingly limited expectations for organic growth.

Even if acquisitions go ahead as planned, current FY26 EPS forecasts will need to be upgraded by c.50% to rise above FY25 earnings.

It’s possible that I’m being too cautious, but I’m going to take a neutral view today, in the hope that we’ll be able to turn positive in the future when growth expectations improve. AMBER.

Winvia Entertainment (LON:WVIA)

No view - new listing (Roland) This is not a sector I tend to study closely, but gaming-related businesses have sometimes proved strong investments. Debt appears to be minimal across the combined group, removing one potential concern. Personally, I will wait for Winvia to publish its first set of accounts as a listed business before taking a view. But for investors with an interest in this sector, I can see that this IPO might be worth a closer look.

First of all, it’s great to see a business with meaningful size and profitability being floated on AIM, after the steady outflow of companies seen over the last year or two. However, a large part of this 'new' business will already be familiar to many UK private investors – Winvia is the renamed owner of the Best of the Best prize draw business!

BOTB was a standalone UK-listed company until it was taken private by well-known investor Teddy Sagi in 2023. Since then, Mr Sagi has added some Romanian gaming assets (“Crowd Group”) to the company and renamed the combined business as Winvia. Following today’s listing, he will remain the controlling shareholder, with a 69.5% holding.

For anyone interested in investing, I would recommend reading the Admission Document (available on Winvia’s website) for a fuller overview of the business. I don’t have time for an in-depth review today, but the pro forma accounts provided show the combined business generated net revenue of £138m in 2024, with a pre-tax profit of £7m. That suggests quite low margin, but closer inspection suggests the BOTB business remains quite profitable, while the Romanian business was actually loss making last year.

This is not a sector I tend to study closely, but gaming-related businesses have sometimes proved strong investments. Debt appears to be minimal across the combined group, removing one potential concern. Personally, I will wait for Winvia to publish its first set of accounts as a listed business before taking a view. But for investors with an interest in this sector, I can see that this IPO might be worth a closer look.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.