Hello again!

Wrapping it up there for now, thanks everyone.

Spreadsheet accompanying this report: link (last updated to: 5th November).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

BAE Systems (LON:BA.) (£54bn | SR81) | H2 trading in line with exps. No material impact yet from US shutdown, but could delay payments prior to year end. YTD order intake of £27bn, FY25 outlook in line with previous guidance. | ||

Experian (LON:EXPN) (£32bn | SR45) | Rev +12%, with 8% organic growth. Adj op profit +15% to $1,145m. FY26 outlook: expect rev +11%, at top end of prior guidance, with margins up by 0.3% to 0.5%. | ||

SSE (LON:SSE) (£22bn | SR75) | Raising £2bn in a placing to support a £33bn investment plan to FY30. Expected to deliver 7-9% EPS CAGR to 225-250p in FY30. H1: adj EPS -29% to 36.1p, in line with exps. | AMBER (Roland) Today’s results show a sharp drop in H1 profits due to lower power prices and poor wind conditions. But the real news today is the company’s plan to spend £33bn over the next five years, funded through a mix of cash flow, borrowing, disposals and today’s £2bn placing. Having crunched the numbers, it seems SSE is allocating £39bn to this programme – with much of the balance required to maintain above-inflation dividend growth throughout the five-year period. This seems like poor capital allocation to me – and an expensive way to fund shareholder returns. But with eight investment banks involved in today’s £2bn placing, I can’t help feeling that the City is in charge here and may be eyeing up the fees that will be on offer as SSE borrows double-digit billions over the next five years. | |

Taylor Wimpey (LON:TW.) (£3.8bn | SR70) | Seeing a softer market in H2 due to Budget uncertainty, with sales rate of 0.63 (FY24: 0.71). Underlying pricing “broadly flat”. Continue to expect FY25 op profit in line with guidance (c.£424m). | ||

Volex (LON:VLX) (£689m | SR85) | Rev +12.7%, adj PBT +29% to $48.5m. Data Centre sales +80%. Margins at upper end of target range, FY expectations unchanged. | AMBER/GREEN (Roland) Strong growth in seemingly higher margin EV and Data Centre markets provided a welcome boost to profit margins in H1, offsetting weakness in consumer and medical markets. While I’m a little wary about the increase in debt in H1 – without any acquisitions – I remain broadly positive about management and the trading outlook at this business. I don’t see any reason to change my previous view today. | |

Avon Technologies (LON:AVON) (£577m | SR67) | Order intake -3.6%, order book +16.7% to $262.8m. Rev +14%, adj PBT +38% to $35m. FY26 guidance: expect high single-digit rev growth & 14-16% op margin. | AMBER/GREEN (Graham) Strong results although I don't fully go along with the adjusted earnings figures and I note that meaningful amounts of cash have gone to pension deficit recovery payments and the LTIP. While I am happy to upgrade our stance on this, I would be very quick to switch back to neutral on any disappointment. This is consistent with it being a “High Flyer” (high momentum, low value): these punchy stocks can be more vulnerable to setbacks, and I don’t know if I’d have the conviction to hold this one for the long-term. | |

Marshalls (LON:MSLH) (£435m | SR55) | 10mo rev +2% to £548m. Landscaping stabilising, w/ Building & Roofing +5% YTD. Net debt £155m. FY25 expectations unchanged. | AMBER/RED (Roland) [no section below] After three profit warnings this year, the building supplies company has issued an in line statement. During the four months to 31 October, the company says Landscaping revenue was flat, with Building Products +4% and Roofing Products -3%. The latter fall appears to be due to an unspecified mix of tough comparators for solar and lower sales of roof tiles. The main negative for me is that net debt remains higher than I’d like, at £155m ex-leases. This is broadly unchanged from H1 but suggests leverage remains c.1.8x EBITDA – above the company’s historic target range of 0.5x-1.5x. I don’t think this level of borrowing is likely to become an existential issue, but I think finance costs could be a drag on earnings and dividend capacity until revenue starts to recover and deliver some operating leverage. Marshall’s share price has now fallen by c.75% in five years and the stock trades on less than eight times 10-year average earnings (CAPE 10y). Forecasts are for a modest recovery in profits next year and I think it’s possible we’ll see some improvement in activity once November’s Budget has passed. From a cyclical perspective I think a neutral view might be warranted here, but the stock’s low MomentumRank, leverage and subdued profitability means I’m going to leave my previous AMBER/RED view unchanged for a little longer. | |

Fuller Smith & Turner (LON:FSTA) (£335m | SR60) | Rev +6.9%, with LFL sales +4.6%. Adj PBT +28% to £22.5m. Strong momentum continued into H2, Christmas bookings +16% YoY. | ||

Franchise Brands (LON:FRAN) (£246m | SR46) | Q3 trading “resilient”, albeit some weakness in construction and plant hire sectors. FY25 adj EBITDA to be in line with exps. | AMBER/RED (Graham) [no section below] This had a profit warning in July (at its interim results), when EBITDA expectations were cut by over 10%. I was hoping that I might be able to upgrade my stance on FRAN today, but I cannot, as broker Dowgate have today cut (or "trimmed") their 2026 forecasts. The revenue forecast has been cut by £2m (now suggesting year-on-year growth of just 4%) and the adjusted PBT forecast shifts lower from £28m to £26.2m. It's doubly frustrating as there is little indication that this might have occurred in today's RNS - a reminder to me of the importance of checking broker notes whenever I can, before drawing conclusions from an RNS! The RNS does mention that discretionary spending has been held back in the construction and plant hire sectors, impacting Pirtek (hydraulic hose repair and replacement business), which has instead relied on its essential services. This is the reason cited by Dowgate for their revisions to the 2026 numbers. Other businesses in the FRAN family - Metro Rod, Filta, etc. - seem to be doing fine. Shareholders won't be panicking but for me, the sogginess of forecasts and muted growth are enough to keep me cautious in the short-term. I do still intend to be neutral (or even positive) on this when both demand, and forecasts, show signs of strengthening again. | |

Seeing Machines (LON:SEE) (£195m | SR20) | Q1 FY26 Quarterly KPIs & Guardian order from US-based multinational | Q1 hardware sales 368 units (Q4: 2,536). “Some slippage” in Q1 sales. “We remain on track to achieve our cashflow break-even run rate target by the end of this calendar year." New order to initially supply and support 1,100 units by Dec 2025. | |

Genel Energy (LON:GENL) (£171m | SR34) | Net cash $135m. Near term objectives include restart of exports and maximisation of production at Tawke and Peshkabir fields (Iraq). | ||

Motorpoint (LON:MOTR) (£130m | SR56) | Revenue +15%, PBT +80% (£3.6m). Outperformed the wider used car market. “Strong momentum has continued into H2”. | ||

Castings (LON:CGS) (£102m | SR57) | H1 revenue £87.6m (H1 last year: £89.2m), PBT £5m in line with expectations. Demand schedules reflect lower heavy truck build rates at OEMs. “Assuming no material further reduction”, the outlook is in line with expectations. | ||

Ten Lifestyle (LON:TENG) (£49m | SR37) | Net revenue +4.5%, adjusted EBITDA £13.2m at constant FX (2024: £12.8m). Trading since year end has been in line with expectations (adj. EBITDA forecast £15.5m). | ||

Time Finance (LON:TIME) (£45m | SR92) | £230m lending portfolio, up 6% since May, up 12% year-on-year. Secured lending >86% of total. Confidence that FY26 will be at least in line with expectations. | GREEN (Graham) [no section below] No reason to change my positive stance after a strong update that shows continued progress with the lending portfolio and continued progress with the composition of that lending portfolio in the categories which the company has prioritised. So far there is no evidence of any deterioration in credit quality, and valuation continues to appear attractive. | |

MicroSalt (LON:SALT) (£30m | SR2) | Initial order $50k, projected 2026 volume c. $500k. MicroSalt “expects to be integrated into the Daiya Foods portfolio of product lines. | ||

London BTC (LON:BTC) (£12m | SR1) | Holds 85 BTC. Over 1,000 Bitcoin miners. Total assets exceeding £8m. H1 operating loss £1.2m. |

Graham's Section

Avon Technologies (LON:AVON)

Up 6% to £19.80 (£597m) - Preliminary Results - Graham - AMBER/GREEN

This defence stock focuses on respiratory protection gear and helmets

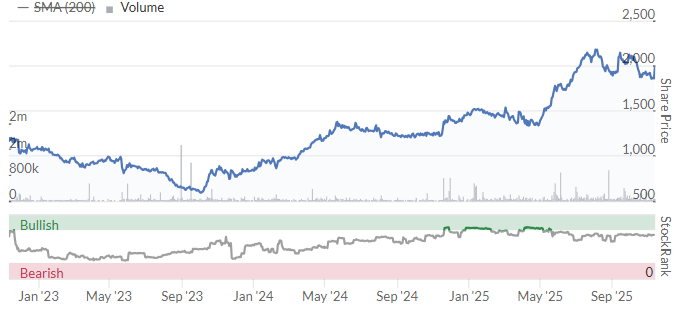

It is still trading at less than half of its Covid-era peak, but it has had an excellent run in the last few years:

While this is a UK-headquartered company, Avon Protection Systems is in Michigan and Team Wendy is in Ohio.

Let’s quickly summarise these full-year results:

Revenue +14% ($314m)

Adjusted PBT +38% ($35m)

Net debt rises to $50.1m.

Unfortunately, the actual, unadjusted PBT is only $13m.

First two questions: 1) why did net debt rise despite the company’s profitability, and 2) why the large gap between adjusted and actual PBT?

1) The company says that the increase in net debt “is primarily due to increased receivables from Team Wendy's DoW shipments in Q4, which have now unwound”.

I’d like to verify this myself from the financial statements if possible, and I do find a negative “working capital” item for $11.7m.

However, there are various other items that could increase net debt, even after that item:

Pension deficit payments $6m (the pension liability isn’t counted in the net debt liability

Capex $8m (matches the depreciation charge, nothing unusual here)

Dividends $7m.

Purchase of own shares for LTIP (employee bonuses) $9m.

Let me be clear: the leverage being used by AVON is not a major concern for me - its leverage multiple is less than 1x. But I always think it’s worth a second look whenever net debt rises at profitable companies: I like to know where the cash flow is being spent.

In this case, the answer is: capex (totally normal), but also the pension deficit, dividends and buying shares for the company’s LTIP.

Fortunately, the net deficit in the pension scheme is described as being just $13.8m as of September 2025.

I do think that the amount spent on the LTIP is rather large and something that shareholders need to be aware of.

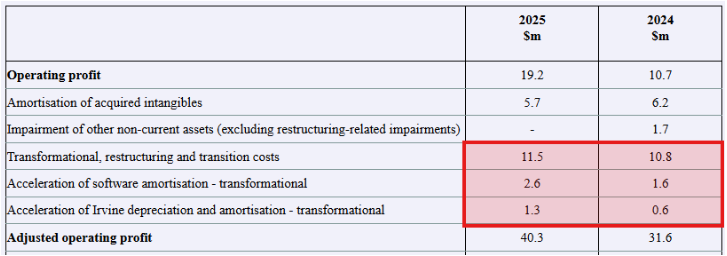

2) Now let’s check the quality of earnings.

PBT is $13.1m, and this rises to $34.9m after adjustments.

Last year was similar: PBT was $2.3m, rising to $25.3m after adjustments!

And unfortunately, the adjustments are not merely accounting fictions that the company wishes us to look past. In most cases, they are real costs in my view. And they’ve been very large for two years, compared to operating profits:

Fortunately, “most of the previously announced transformation initiatives are now complete”, although spending was higher than planned in FY25.

Projects include: “footprint optimisation” (targeting a 50% improvement in revenue per square foot), “operational excellence” (faster inventory turn, higher productivity), “functional excellence” (HR team, SAP systems, etc.) and “commercial optimisation”.

FY26 will see $6m of transformation costs, and will finish at the end of 2026 (the calendar year, presumably - the financial year ends in September).

So hopefully we’ll see cleaner accounts next year. But I do want to be clear that FY24 and FY25 accounts are far from clean, in my view, and I would be careful about assuming that these costs deserve to be adjusted out.

Some of the company’s successes:

Mask deliveries to Australian defence forces

NATO contracts for masks, boots and gloves

US law enforcement helmets up 15%

Department of War orders for combat helmets

Forward-looking indicators: the order book is up 16.7% year-on-year, to $262m, with total orders received during the year down only slightly (3.5%). Business is thriving.

CEO comment:

"Nearly two years ago, we set bold ambitions for the business, which could only be achieved by significant change. This year, in particular, required enormous tenacity and dedication from our employees. That effort is paying off. Adjusted EPS has grown by over 100% since 2023, the balance sheet now provides a strong foundation and strategic optionality, and we've launched several exciting new products which will support future growth.

Outlook:

We are ahead of the targets we set for 2027. Revenue growth has outpaced original guidance, operating margins are approaching our target range, ROIC is already above our 2027 goal, cash conversion remains consistently strong, and leverage remains below our target range.

We are firmly on track to meet or exceed our key targets in FY26 and confident in sustaining improved returns over the long term, with further initiatives underway to support continued margin expansion into FY27…

With the following official guidance:

High-single-digit revenue growth

Adjusted operating profit margin within our target 14-16% range

More than 60% decrease in transformation expenses at c.$6m

Cash conversion of over 80% before transformational costs

Graham’s view

I am going to upgrade our stance on this to AMBER/GREEN as I am impressed by the company’s overall progress and financial performance. It does appear to have nice underlying business momentum behind it, with no shortage of demand right now.

However, this does come with certain disclaimers:

I don’t believe the adjusted profit figures. It’s very important to me that future years show cleaner accounts, with lower adjustments, now that the transformation projects are finishing.

In a similar vein, I think the LTIP spending has been quite high and detracts from the soundness of the financial performance. I have no issues with capex spending, the dividend or pension deficit recovery, but the LTIP does stand out to me.

The balance sheet is ok: tangible net assets of about $50m, and some net debt. It’s not very strong, but it’s fine.

I don’t know if the strong demand for helmets and related gear, e.g. from NATO, could be vulnerable to weakness any time soon.

So while I am happy to upgrade our stance on this, I would be very quick to switch back to neutral on any disappointment. This is consistent with it being a “High Flyer” (high momentum, low value): these punchy stocks can be more vulnerable to setbacks, and I don’t know if I’d have the conviction to hold this one for the long-term.

I do tend be sceptical of this one, e.g. I was AMBER/RED on it in January (at a share price of £15), and I think my co-writers generally share my caution. But for now, it’s looking good.

Time Finance (LON:TIME)

Up 4% to 50.4p (£45m) - Loan Book Update - Graham - GREEN

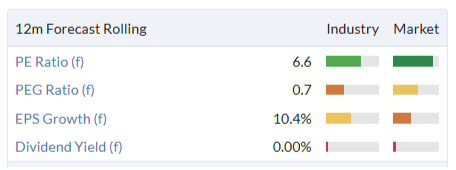

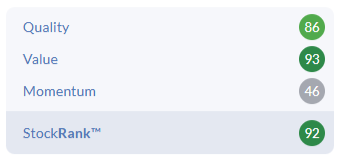

I’ve been positive on this one for a while, as I like cheap financial stocks and I like the growth profile at TIME. And did I mention it’s cheap (ValueRank is 93):

Today’s update confirms continued growth of the lending book, now at £230m (up 12% year-on-year).

TIME notes that it has reached various all-time highs. I do tend to ignore it when companies say they have reached all-time highs in various metrics - that is what investors are always looking for, and it’s not very unusual! But TIME’s growth has genuinely been quite good:

Lending book at FY May 2024: £201m

At FY May 2025: £217m

Now: £230m.

An important feature of the growth is that it has been accompanied by a change in mix: they have prioritised invoice finance and “hard” asset finance.

They helpfully describe the difference between “hard” and “soft” asset finance on their website, here.

Hard assets: vehicles, plant/engineering machinery, manufacturing equipment, agricultural and forestry equipment.

Soft assets: lower value and depreciate faster. Computer hardware/software, office furniture, electronics, etc.

Invoice finance and hard asset finance together make up 86% of the lending portfolio now, up from 83% at the full-year results and 52% five years ago.

And there’s a nice little trading update to go with this:

This ongoing positive lending book growth provides the Board with increased confidence that Group financial performance for FY 2025/26 will be at least in line with current market expectations.

Graham’s view

Naturally, I have no reason to change my positive view on TIME after this update.

I wouldn’t be positive on the stock if I thought they were sacrificing credit quality to achieve growth, but so far there has been little evidence of that.

At the Q1 update, write-offs were unchanged at 1% of the average lending book, and arrears were unchanged at 5% (both KPIs being compared to a year earlier).

And remember that their strategy is all about focusing on sectors with strong, tangible security.

I’ll keep watching the credit metrics of course, but as things stand I remain a believer in this one.

The StockRanks concur:

Roland's Section

SSE (LON:SSE)

Up 11% at 2,184p (£24bn) - Interim Results, Proposed Placing & Strategic Update - Roland - AMBER

Today’s half-year results show a sharp fall in H1 profits due to lower power prices and adverse wind conditions, but are said to be in line, with full-year expectations unchanged. I’m not going to look at these numbers in any detail, as I don’t think they are the main story today.

What is more interesting, in my view, are the spending and capital allocation plans SSE has announced today. I think these are worth a look – especially as the market has reacted very favourably, sending the shares to new record highs:

A transformational £33bn five-year investment plan announced separately today will see a significant increase in the Group's exposure to UK electricity networks, driving long-term value creation with attractive regulatory asset value and earnings growth.

It’s been clear for a while that electricity network operators in the UK and other developed markets are facing big spending requirements. In many cases, they need to upgrade dated grids to cope with increased electricity demand and the more distributed nature of renewable power generation.

A recurring complaint from renewable operators and businesses trying to reduce their carbon footprint is the difficulty (and delay) in getting new grid connections. In many cases these take years to secure.

Last year we saw National Grid go big with a £7bn rights issue to help fund a £60bn investment plan to upgrade its UK electricity networks.

Today, SSE has followed suit, unveiling plans to invest £33bn in its networks and operations by 2030. This appears to be an expansion of the company’s previous plan to invest £17.5bn by 2027.

Within this, £27bn will be invested in the company’s regulated asset base – its SSEN Transmission business (£22bn of spending) and SSEN Distribution (£5bn).

Alongside this, there will be smaller investments in renewables (£4bn) and other generation activities (£2bn).

Management expects the resulting increase in regulated assets and generating capacity will support adjusted EPS growth of 7%-9% annualised over the period, implying possible earnings of 225-250p per share for the year ending March 2030.

As part of this increased spending plan, SSE is tapping investors for cash, with a £2bn placing. While this may seem like a lot of cash, I can’t help feeling that it’s not likely to make a big contribution – especially when the company’s dividend plans are taken into consideration.

I understand that UK utility investors like their dividends – and in general I share this view. But today’s plans suggest a circular movement of money that doesn’t necessarily seem like an optimum way to allocate capital, in my view.

Where’s the cash coming from?

£33bn is a lot of money, even for a FTSE 100 utility. Helpfully, SSE has provided a simple breakdown of where the cash for this spending is expected to come from:

c.£21bn from operational cash flow

c..£14bn from an increase in adjusted net debt, with this increase being smaller than the expected increase in regulatory assets. Net debt is expected to stay below 4.5x throughout the plan (!)

c.£2bn equity placing

c.£2bn “targeted asset rotations” - e.g. disposals

Where’s the cash going?

The eagle-eyed among you will note that the list above gives a total of around £39bn – or £6bn more than the £33bn spending plan.

So where’s the extra £6bn going?

Dividends: most of this extra cash seems likely to be handed back to shareholders over the next five years.

Today’s plans include confirmation that the company will target 5-10% annual dividend growth through to 2029/30, from an “unaltered 64.2 pence 2024/25 baseline”.

Applying a minimum 5% growth rate to last year’s dividend suggests to me that this year’s payout alone will cost around £770m – so around 40% of today’s placing will be returned to shareholders in the next 12 months.

Over the duration of the plan, I estimate around £4.3bn will be paid out as dividends (assuming a minimum 5% growth rate). Increasing the dividend growth rate to 10% suggests c.£4.7bn might be returned to shareholders.

City fees and debt costs? As for the remaining c.£1.5bn of unallocated spending in the list above, I would hazard a guess that most will be accounted for by additional debt costs and fees for City advisors.

For example, today’s placing involves no fewer than eight investment banks, in addition to SSE’s advisor Rothschild & Co. (National Grid only used two banks in last year’s £7bn rights issue.)

SSE will need to borrow double-digit billions over the next five years – I imagine there will be some nice paydays for the banks that can arrange this funding.

Roland’s view

I am fully supportive of SSE’s plan to upgrade and improve its asset base. I suspect some of the spending has been prompted by regulatory requirements and is perhaps overdue.

However, I can’t see how maintaining above-inflation dividend growth throughout a period of elevated investment can make sense, in terms of capital allocation.

This is especially true given the existing high level of leverage in the business (between 3.5x and 4.0x EBITDA).

SSE is effectively using the proceeds of the placing and any disposals to fund its dividend – or alternatively, will be using additional borrowing to support the payout. In either case, it’s an expensive way to fund shareholder returns.

To me, this plan smacks of financial engineering led by expensive City advisors, rather than owner-focused management.

I would argue that a truly responsible, owner-focused way to approach this situation would be to cut the dividend while the spending is underway, and then pay more generous dividends from improved earnings in the future.

Valuation: with the shares now trading close to 2,200p, SSE is already effectively trading on a P/E of 9-10x FY30 forecast earnings, based on today’s FY30 EPS guidance of 225-250p per share. That seems quite high enough to me, for a utility stock.

In addition, today’s share price gains have pushed the current-year dividend yield down to under 3%.

I don’t see much value in the stock at this level and would not personally be keen on investing in a company that’s planning to use increased leverage to support dividend growth.

However, I’m not sure I can justify an outright negative view on this business, which will remain structurally important and should continue to benefit from good visibility on regulated cash flows.

For all of these reasons, I’m going to take a neutral view on SSE today.

Volex (LON:VLX)

Up 13% at 421p (£777m) - Half-Year Report - Roland - AMBER/GREEN

This specialist manufacturer of “critical power and data transmission products” (industrial wiring) has announced some boardroom changes today alongside its results.

Former executive chairman Nat Rothschild is stepping into a dedicated chief executive role, while the board will now be led by newly appointed non-executive chair Dave Webster. Mr Webster appears to have extensive leadership experience in this sector and looks a well-qualified appointment.

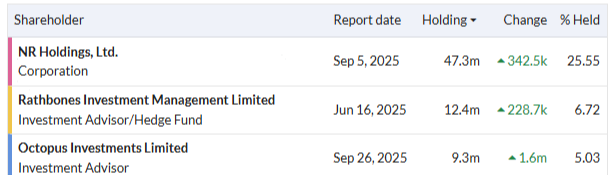

I don’t know if this shift to adopt corporate governance best practice might signify that a possible move to the Main Market is being considered, or whether it’s just a reflection of Volex’s growing size and complexity. It seems a broadly positive development to me, especially when we remember that Nat Rothschild owns more than 25% of Volex shares so remains well-aligned with shareholders.

Turning to the results, today’s numbers confirm the trends reported in October’s half-year update (which I covered here) and highlight Volex’s growing exposure to the high-growth AI data centre market.

H1 results summary

Today’s results and outlook are in line with expectations. I don’t want to repeat too much of my commentary from October, but I do think it’s worth taking a closer look at some of the financial details from today’s results.

The headline numbers look strong and highlight a useful increase in margins. All the growth was organic in this period, as Volex hasn’t made any acquisitions recently:

Revenue up 12.7% to $583.9m

Operating profit up 27.3% to $46.6m

Operating margin: 8.0% (H1 25: 7.1%)

Adjusted EPS up 29.6% to 19.7c per share

Interim dividend up 6.7% to 1.6p per share

Net debt exc leases rose to $151.2m (FY25: $127.4m)

Segmental results: October’s trading update highlighted the directional trends in each of Volex’s five market segments, but we get actual sales numbers today:

Electric Vehicles: up 13.1% to $89.9m;

Consumer Electricals: down 6.3% to $125.6m;

Medical: down 9.9% to $76.1m;

Complex Industrial Technology: up 48.2% to $155.5m, thanks to an 80% increase in Data Centre sales. These now reflect 55% of revenue in this sector, presumably being driven by the global AI rollout;

Off-Highway: up 20.1% to $136.8m, boosted by one-off revenue from a defence vehicle programme that won’t repeat in H2

Trading across the group is mixed, but the growth in EV and Data Centre sales appears to be generating higher-margin revenue at attractive growth rates. If Volex has positioned itself in the right place at the right time for these markets, then I can imagine we could see significant further growth.

Net debt: One point that may be worth highlighting is the increase in net debt, which largely reflects some big cash outflows during H1. These were needed to support the growth of the business, but were quite sizeable:

Working capital outflow of $32.4m

Net capital expenditure of $21.3m

Net interest payments of $14.3m

The company says that Data Centre sales “operate through a hub model” which results in longer cash conversion cycles. I’m not sure exactly what the hub model means – perhaps that Volex is selling through a systems integrator or middleman of some kind?

While I don’t see leverage as a significant concern here, I wouldn’t really expect net debt to rise all that much further in the absence of any acquisitions or major expansion projects.

Cash flow & Profitability: free cash flow was poor during H1, with an inflow of just $4.8m. However, management says working capital is expected to be broadly flat in H2, supporting stronger cash generation. I think that’s something to watch for the full year.

I am reassured by the improving overall profitability of this relatively capital-intensive business. My sums suggest a trailing 12-month return on capital employed of 13.9%, slightly ahead of the FY25 figure shown on Stockopedia of 13.8%. I’d hope that this figure will improve in H2 if working capital levels stabilise at this year’s higher level of profit.

Outlook

Trading so far in the second half of the year is said to be “solid”, with H2 revenue expected to be “broadly consistent” with H1 (i.e. perhaps slightly below).

Trading in the second half-to-date has been solid, with activity levels broadly maintaining the strong performance of the first half, although comparatives are more demanding. The Group expects second-half revenues to be broadly in line with the first half, reflecting stable trading across most end-markets.

Today’s results confirm that H1 benefited from a one-off defence project, so this doesn’t seem unreasonable.

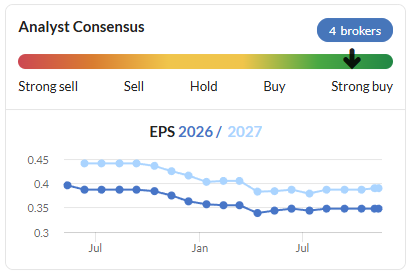

Looking ahead, full-year expectations are unchanged, once again. It’s worth noting that despite positive trading in H1, earnings estimates have remained largely unchanged following April’s tariff adjustment:

I don’t have access to any broker notes today, so I’m not sure if there have been any changes to external forecasts today – perhaps, given the 10%+ share price movement. We’ll have to watch for any changes to the consensus chart above over the next week or two.

Roland’s view

I’m relieved to see I’ve been AMBER/GREEN on Volex since June. As things stand, I have no complaints about the company’s performance and no serious concerns about its accounts.

While many of the markets in which it operates are cyclical, areas of weakness such as consumer goods are currently being offset by stronger EV and Data Centre demand.

The main caveat I’d add is that this remains a relatively capital-intensive manufacturing business, so I’m unsure how much further profitability will improve. The StockRanks view this as a High Flyer and that seems fair to me, despite the seemingly modest forward P/E of 13.

I’m happy to maintain my moderately positive view today

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.